Summary

Lending: MakerDAO implemented an increase in the debt ceiling limit of RWA 015 and RWA 007 on October 19. The current limit is 6.815 billion, and the current RWA asset size totals 3.327 billion; the Aave community launched a new proposal to introduce user aTOKEN as a voting mechanism Userocracy.

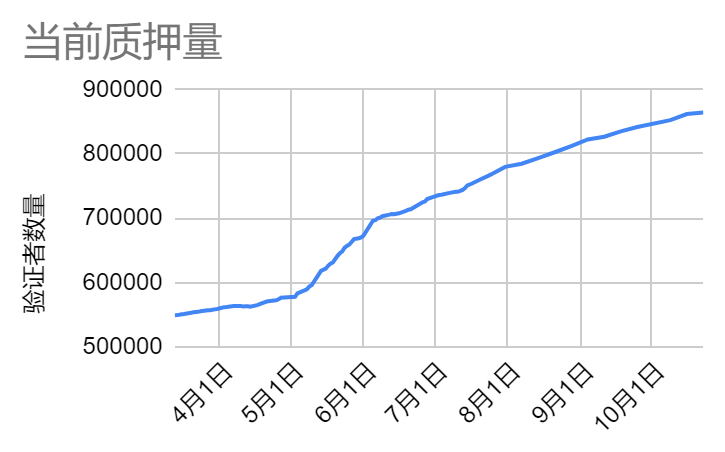

LSD: The ETH pledge rate rose to 23.22% last week, a month-on-month increase of 0.54%. Last week, 27.93 million ETH were locked in the beacon chain, corresponding to a pledge rate of 23.22%, a month-on-month increase of 0.54%; of which 864,600 active verification nodes, a month-on-month increase of 0.29%, entered the queue to be cleared for activation of verification nodes.

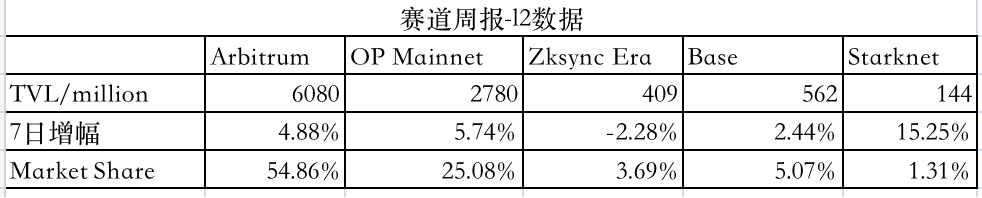

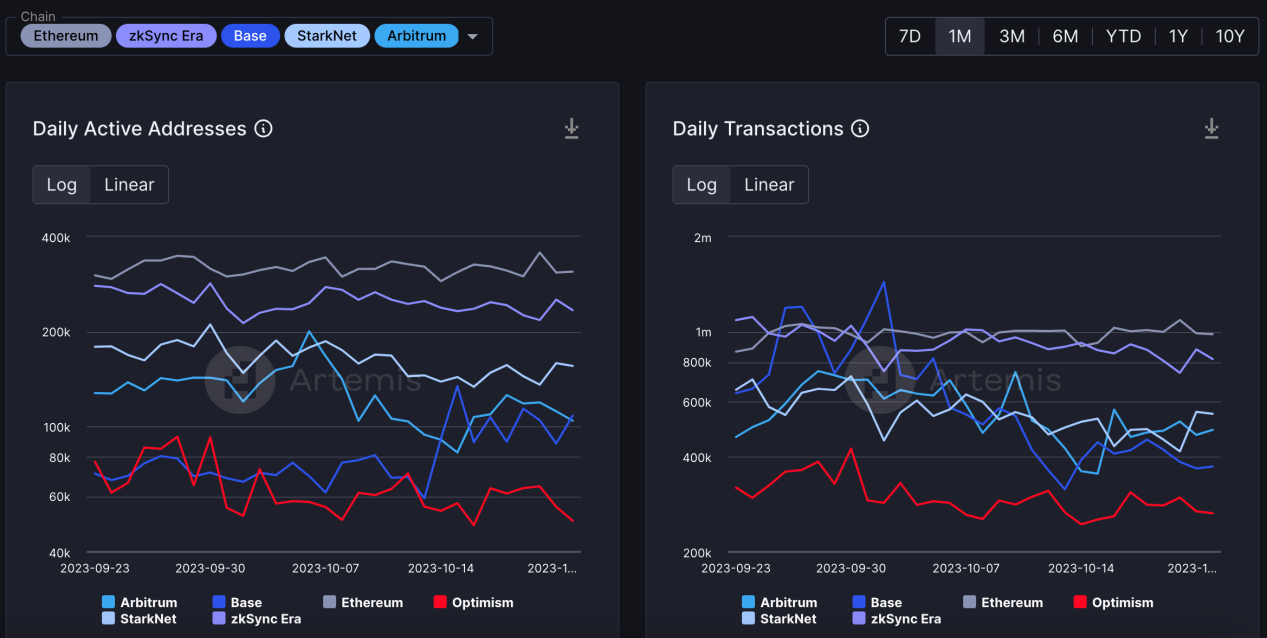

Ethereum L2: The total amount of Layer 2 TVL is US$11.09 billion, and the overall TVL has increased by 4.99% in the past 7 days. Since the launch of the Scroll mainnet, TVL has reached US$15.24 million, L2 accounts for 0.14%, and the 7-day growth rate is 1526.66%.

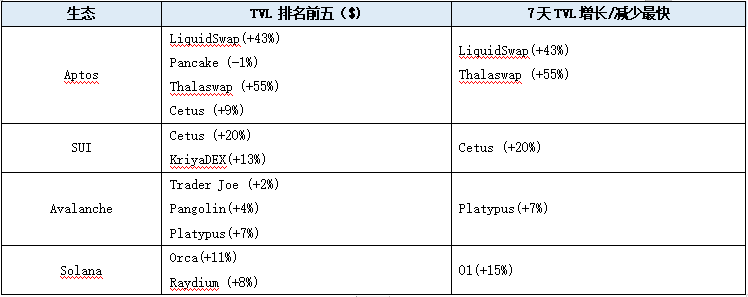

DEX:Dex combined TVL 10.92 billion,Basically the same as last week. Dex’s 24-hour trading volume is 1.57 billion, and its 7-day trading volume is 1.2 billion, an increase of 1.5 billion from last week.

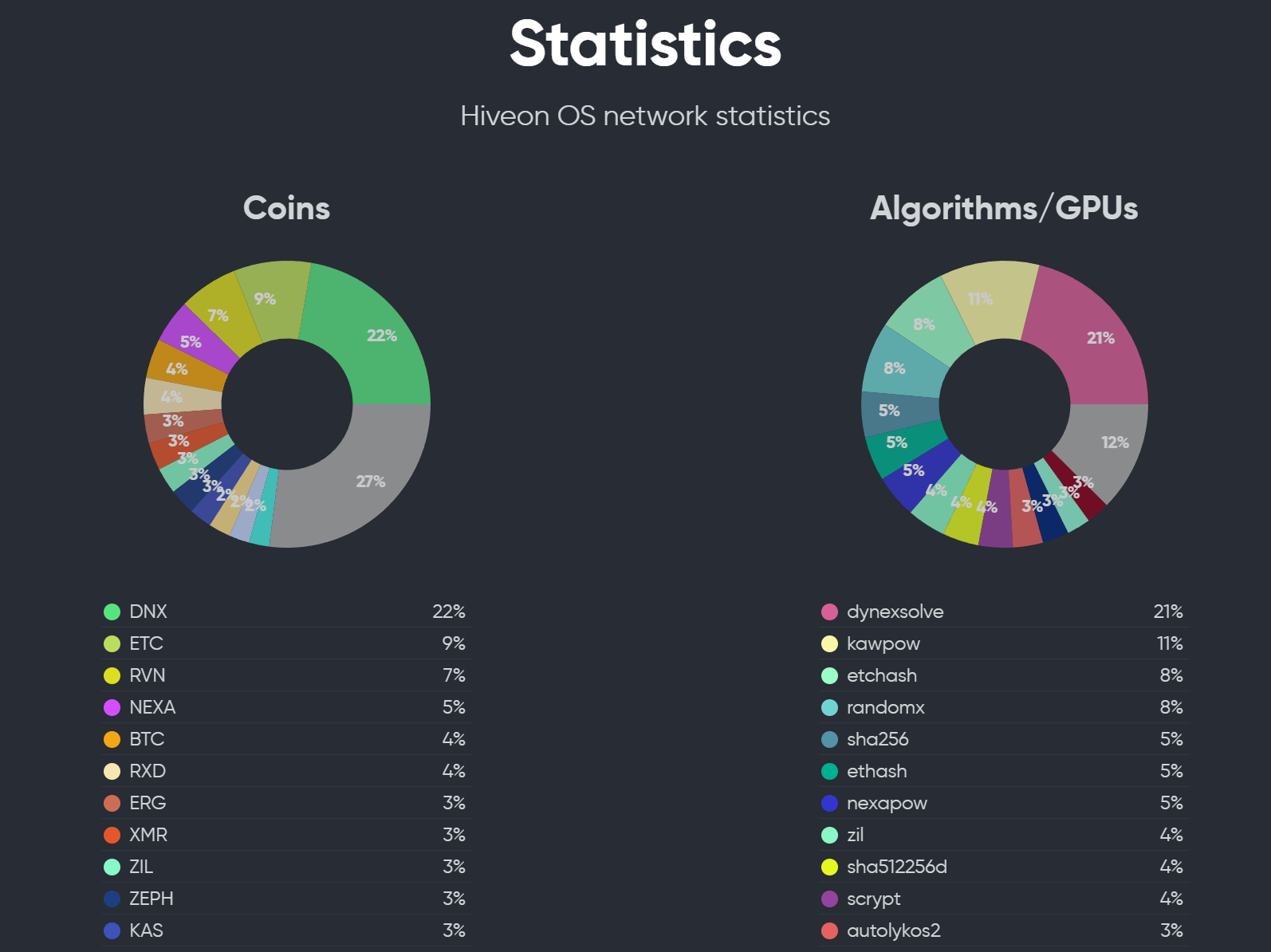

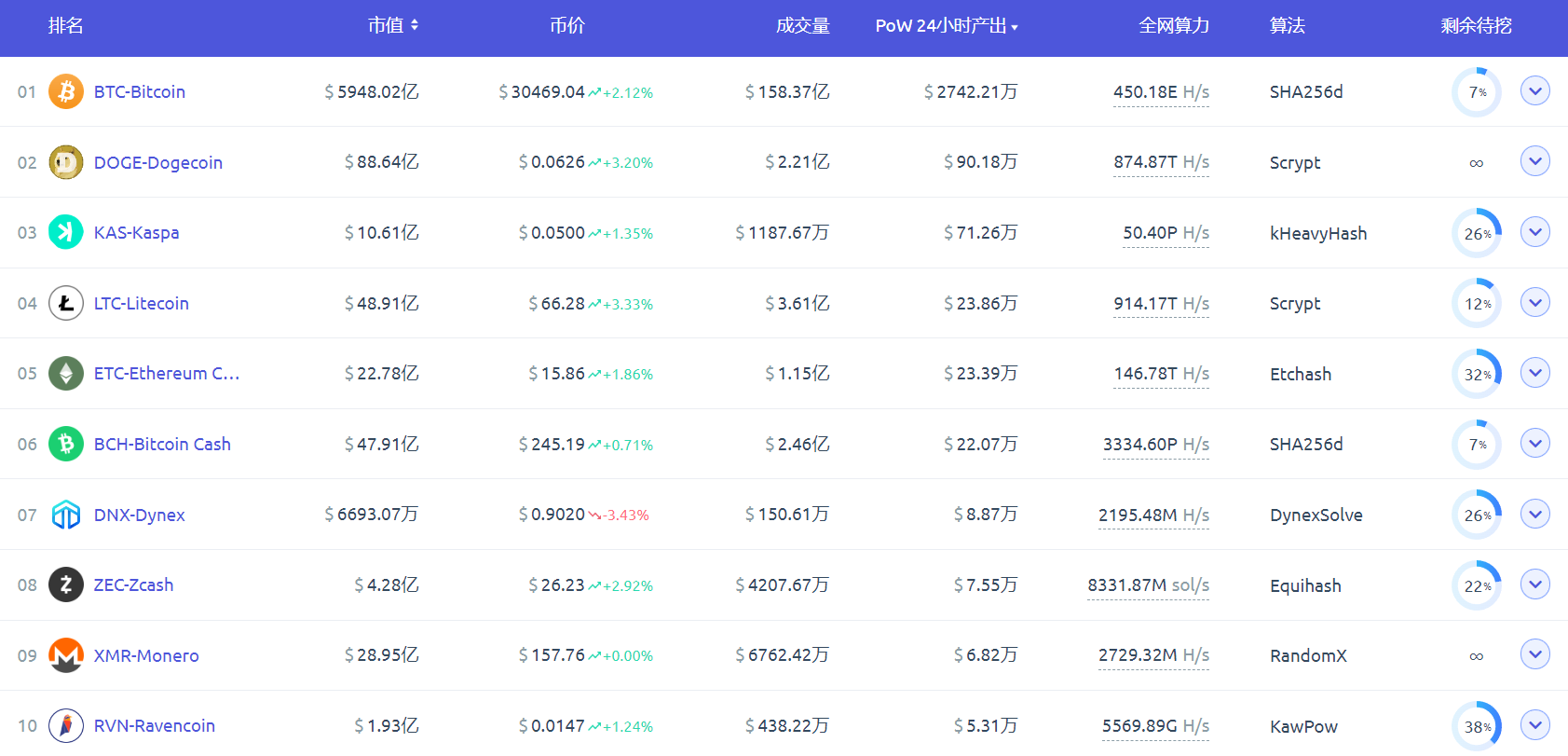

POW: BTC has risen strongly over the past week, bringing about a rise in BTC-related tokens. LTC/BCH/KAS/BSV all rose, with BSV rising the most within seven days, mainly due to Binance’s restoration of the BSV contract, which brought greater trading enthusiasm and trading volume. However, FLUX/DNX declined, and DNX experienced a larger decline and did not follow the market trend.

loan

MakerDAO

MakerDAO implemented an increase in the debt ceiling limit of RWA 015 and RWA 007 on October 19. The current limit is 6.815 billion, and the current RWA asset size totals 3.327 billion. When MakerDAO’s RWA reaches 6.8 billion, the protocol’s annual revenue is expected to be $200 million. As the RWA debt ceiling increases, the size of MakerDAO DSR also grows to $1.75 billion.

Aave

The Aave community launched a new proposal to introduce user aTOKEN as a voting mechanism Userocracy.

The proposal points out that the problem with the current Aave DAO is that Aave token holders have all the power and voting rights, while protocol users do not have any voting rights, and early Aave owners and Aave holders have too much voting power. Therefore, it is recommended to make the following modifications to DAO:

- 50% of voting rights belong to Aave token holders;

- 50% of the voting rights belong to the users, i.e. aTOKEN holders (including debt and collateral).

LSD

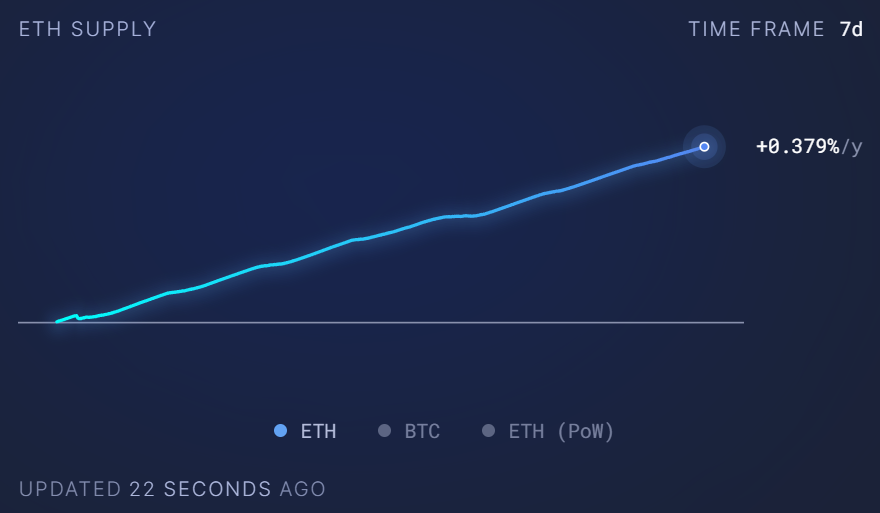

Last week, the ETH pledge rate rose to 23.22%, a month-on-month increase of 0.54%. Last week, 27.93 million ETH were locked in the beacon chain, corresponding to a pledge rate of 23.22%, a month-on-month increase of 0.54%; of which 864,600 active verification nodes, a month-on-month increase of 0.29%, entered the queue to be cleared for activation of verification nodes. This week, the ETH staking yield rebounded to 3.52%, and the annualized inflation dropped to 0.379%.

ETH staking increased by 0.54% month-on-month this week

ETH staking yield rebounded to 3.52% this week

ETH annualized inflation this week is 0.379%

Among the three major LSD protocols, in terms of price performance, LDO rose by 7.5% in the week, RPL rose by 1.3%, and FXS fell by 4.5%; from the perspective of ETH pledge volume, Lido rose by 0.22% in the week, Rocket Pool rose by 0.63%, and Frax rose by 0.22%. 0.84%. At the current stage, the ETH/BTC exchange rate has rebounded, and Defi blue chips have performed better following the rise of ETH; last week, sFRAX changed the pledge contract. The current size of sFRAX is 43.5 million, with a yield of 6.18%. Pay attention to the launch of FXB; the Rocket Pool deposit pool balance is 18,761 ETH, RPL The pledge rate is 50.61%, and the effective pledge ratio is 85.76%; SSV TVL has slightly increased to 12,960 ETH, and there is a lack of pledge capital inflow.

Ethereum L2

TVL

The total amount of Layer 2 TVL is US$11.09 billion, and the overall TVL has increased by 4.99% in the past 7 days.

Cancun upgrade

The Ethereum ACDC meeting was held on October 19th. The main contents are:

1. Release the new CL code specification The Summoning for Cancun/Deneb (Dencun) upgrade, the main changes are the mainnet KZG configuration and new invalid information rules

2. Devnet 10 is expected to be released next week, waiting for KZG in the client

ARB

Camelot, the native Dex protocol on the Arbitrum chain, received 3.09 million ARB grants and will begin distributing them in the coming weeks. The grant will be used to bring new builders to the ecosystem, support native protocols, and advance ARB adoption.

Scroll

Since the launch of the main network, Layerzero, Orbiter Finance, OKX Web3 Wallet, Bitget Wallet, etc. have announced their launch or access to the Scroll main network. The current Scroll TVL reaches US$15.24 million, L2 accounts for 0.14%, and the 7-day growth rate is 1526.66%.

On-chain activity

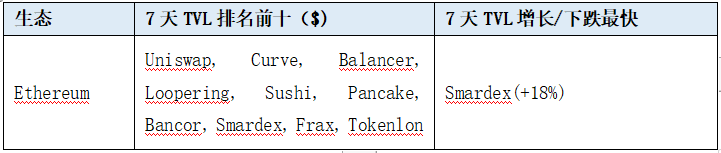

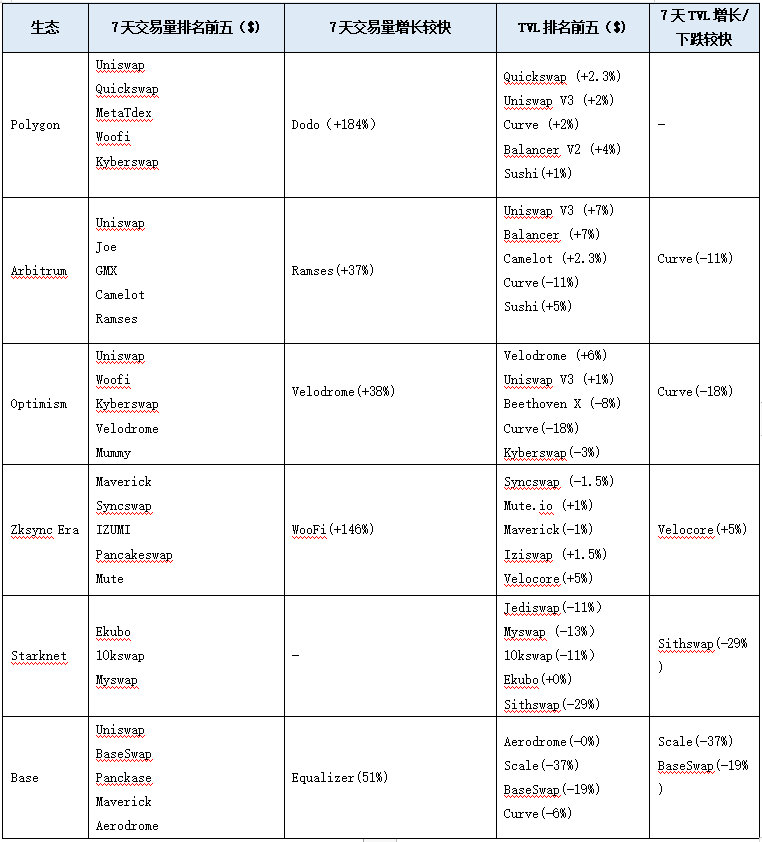

DEX

Dex combined TVL 10.92 billion,Basically the same as last week. Dex’s 24-hour trading volume is 1.57 billion, and its 7-day trading volume is 1.2 billion, an increase of 1.5 billion from last week.

Ethereum

ETH L2/sidechain

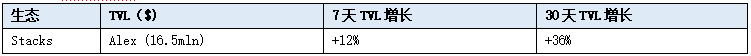

BTC L2/Sidechain

Alt L1

POW

BTC has seen a strong rally over the past week, bringing with it a rise in BTC-related tokens. LTC/BCH/KAS/BSV all rose, with BSV rising the most within seven days, mainly due to Binance’s restoration of the BSV contract, which brought greater trading enthusiasm and trading volume. However, FLUX/DNX declined, and DNX experienced a larger decline and did not follow the market trend.

24-hour output and computing power

Looking at the 24-hour product rankings, there is no change from two weeks ago. BTC is still ranked first, KAS is ranked third, LTC is ranked fourth, and DNX is ranked seventh.

DNX’s computing power has currently entered a bottleneck period, remaining at 22% without major changes. The price of DNX has fallen recently and has not followed the market. There may be two reasons: first, the previous increase was relatively large, and there is a need for a correction; second, the computing power has entered a bottleneck period, there is no new computing power, and the buying volume has decreased.