Arbitrum’s grant war has come to an end, could it become a classic case of DAO governance?

Original author: Jiang Haibo, PANews

Related Reading:

《The battle for “50 million ARB” has begun. Who among the 95 projects can stand out?》

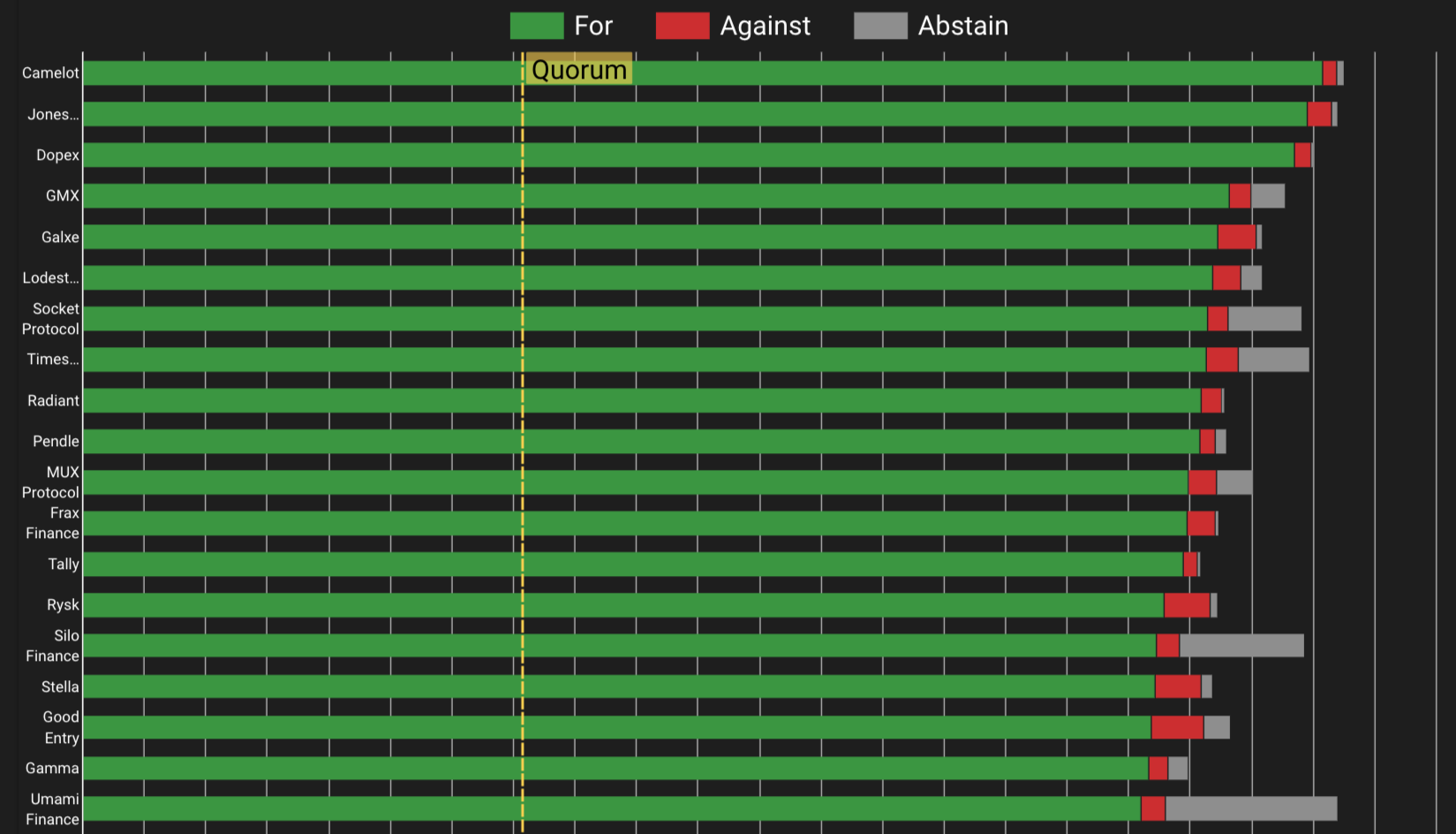

The battle for tens of millions of dollars in grants from the Arbitrum community has come to an end. Arbitrum Short-term Incentive Program on October 13 at 10 a.m.Snapshot pollAt the end of the day, a total of 57 out of 97 proposals were passed. The native projects on Arbitrum received the most support. The unsuccessful proposals were mainly projects that were not highly related to the Arbitrum ecosystem, as well as more controversial projects such as Lido. However, the number of ARB applied for by the approved proposal is 74.05 million ARB, which exceeds the 50 million limit. It needs to be screened based on the number of affirmative votes, and fewer than 57 projects may ultimately receive grants.

Organized according to raho.mevoting data(Detailed voting results can be viewed). All grant application proposals have met the requirements for the number of votes. Whether they can be passed or not is still reflected in the support rate. Judging from the results, most proposals were passed, and previous projects such as Wormhole and Gains Network were also passed due to insufficient votes.

Most supported projects: Camelot, JonesDAO, Dopex, GMX

The data shows that the projects with the most votes are Camelot, JonesDAO, Dopex, and GMX, all of which are native projects on Arbitrum. Camelot is the largest native DEX on Arbitrum, and Arbitrum is one of the most representative derivative projects. It is not surprising that the two received high votes. The data of JoneDAO and Dopex are not very ideal, with TVL of only US$14.98 million and US$2.78 million respectively, but both are early projects on Arbitrum, and both have occupied a high position on the track for a certain period of time. This also shows that native projects and early projects on Arbitrum have received more support.

Project with the most funding applications: GMX

GMX, the representative DeFi project on Arbitrum, has applied for the most funds, and TVL has long ranked Arbitrum first. GMX has applied for a total of 12 million ARB, which will stimulate liquidity and trading volume on GMX V2. After that, Gains Network applied for 7 million ARB, and Mux Protocol applied for 6 million ARB, both of which were far behind GMX. The indicators considered this time such as TVL and running time on Arbitrum are more favorable to GMX.

The most controversial project: Lido

The most controversial project was Lido, one of six projects with more than 200 million ARB in the vote and the only one that failed to pass. As one of the most well-known projects, its support rate in this round of voting has been less than 50% for a long time, and it ultimately failed. Lido hopes to use funds to stimulate the liquidity of wstETH on Arbitrum, and will also allow users to mint stETH directly on Arbitrum in the future. However, there are still many users who object. Lido applied for a 4 million ARB grant. The opponents believe that Lido did not pay incentives corresponding to the 4 million ARB on Arbitrum; for a non-Arbitrum project, 4 million ARB is too much. ; In addition, some people question that Lido poses a systemic risk to Ethereum.

Projects with fewer positive votes among the passed proposals: StakeDAO, UnshETH, Realm, etc.

Voting through Snapshot does not guarantee that you will receive a grant, as the number of ARBs applied for in this part of the proposal is 74.05 million ARBs, exceeding the limit of 50 million ARBs. Among the passed proposals, proposals with fewer votes may still not receive grants. These projects may include: StakeDAO, UnshETH, Realm, Shell Protocol, Wormhole, JOJO, etc.

The community has repeatedly called for incentive programs

Arbitrum began to decentralize after Arbitrum distributed its native token ARB. Arbitrum DAO has decision-making power on Arbitrum One and Arbitrum Nova and their underlying protocols. ARB tokens can be used to vote on governance proposals of Arbitrum DAO (you can also entrust voting rights to representatives or become representatives and accept entrustment from others) to decide Arbitrum future development. During the token distribution, the DAO treasury reserved 42.78% of the tokens, so Arbitrum has enough funds to incentivize the ecosystem.

The Arbitrum community has repeatedly called for an incentive program, and this matter has been promoted and implemented in the past two months.

Initially, team members such as Camelot, Gauntlet, GMX, Plurality Labs, and Questbook formed the Arbitrum Incentive Plan Working Group and held the first working group conference call on August 15.

September 18, Arbitrumshort term incentive plan(STIP) proposal was approved on Snapshot. Among the four options of allocating 0 ARB, 25 million ARB, 50 million ARB, and 75 million ARB, Arbitrum DAO allocated 50 million ARB tokens (this contract is US$41 million). The proposal for short-term incentives was approved and the funds will be allocated before January 31, 2024.

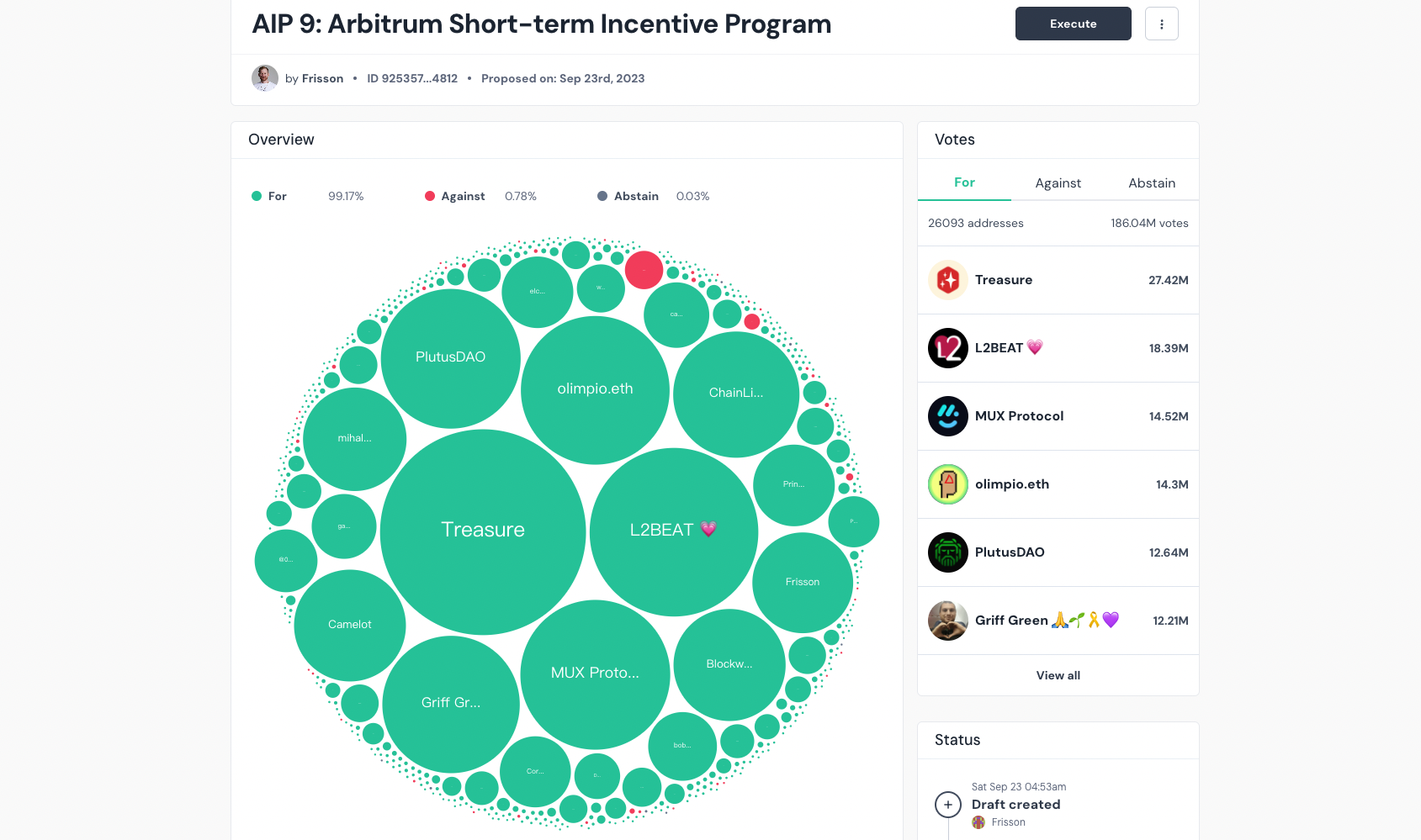

The proposal was passed in Tally on October 10On-chain voting, Arbitrum DAO will allocate 50 million ARB to the multi-signature wallet.

Proposals for individual projects applying for STIP grants will be available on October 13 at 10 a.m.SnapshotEnd voting.

The tens of millions of U.S. dollars in grants this time, with the highest amount reaching tens of millions of U.S. dollars, are considered generous among all grant programs on the blockchain. There is also an invisible battle surrounding the fight for grants. war.

Proposals on Arbitrum usually require two rounds of voting to take effect, first a poll vote on Snapshot and then an on-chain vote on Tally. But the funds for this incentive plan have been provided by aseparate proposalIt is assigned to the multi-signature address after voting on the Tally chain. The proposal, with over 99% approval, will allocate 50 million ARB to the STIP-ARB 5/9 multi-signature wallet, with signers in the multi-signature wallet acting as stewards of the grant on behalf of the DAO.

Since the funds have been allocated to the multi-signature wallet by Arbitrum DAO, it means that there is no need to vote for each project on Tally, as long as the decision is made based on the results of on-chain voting on Snapshot. Therefore, this proposal to apply for Arbitrum grants can be passed if it meets two conditions at the same time in Snapshot voting: more than 50% of the majority supports the proposal; more than 71.51 million ARBs (3% of the number of votes available) participate in the vote.

According to the Tally website, among the representatives shown in the figure below, the largest number of entrusted ARBs is the NFT and game project Treasure in the Arbutrum ecosystem, with 27.55 million ARBs. Although the data shows that the voting power of the top representatives is not much different and is relatively decentralized, since only 3% of the number of votes can be cast to pass the proposal, the requirements are not high. The top four of these representatives can achieve this by combining condition.

The ecosystem values contribution indicators such as project participation time and TVL

This short-term incentive proposal is to incentivize the use of existing Arbitrum dApps to increase indicators such as transaction volume, users, and liquidity on Arbitrum.

The working group divided the grants into 4 categories based on three conditions: time the project has been running on Arbitrum, TVL, and 30-day transaction volume. The highest tier of grants, available for more than 2 million ARB, requires both: running on Arbitrum for at least 12 months; more than $30 million in TVL on Arbitrum or $200 million in 30-day cumulative trading volume.

Participants also need to meet a series of additional conditions, such as:

Spending plans and goals must be clearly defined, and ARBs must not be converted into other assets;

Must commit to provide metrics on allocations, ARB payouts, transaction volume, TVL, unique addresses, transaction fees, etc.;

Arbitrum Foundation KYC must be completed;

Funds can only be used for incentives etc. on the Arbitrum network.

The voting for Arbitrum’s short-term incentives has ended, which can also give the project team some inspiration.

Obviously, native projects receive more support than other projects, so it is also important to prioritize a chain that is suitable for the project, such as JonesDAO and Dopex. Although the current data is not very ideal, they have also received high approval votes.

In addition to doing a good job in the project, the project party also needs to actively participate in activities in the ecosystem, such as becoming one of the multi-signature representatives that manage funds, becoming a governance representative, participating in working groups, etc. These things may help in the future. In addition, among the various indicators, TVL is still a very important indicator, which may be the main reason why GMX applied for the most ARB grants.