How do geopolitical conflicts profoundly affect the crypto world?

Original - Odaily

Author - Loopy Lu

At a time when the Palestinian-Israeli conflict is intensifying, the seemingly overhead crypto world is also difficult to escape the influence of geopolitical instability.

On the one hand, more and more Israeli projects have been affected, and on the other hand, encryption projects that comply with Sharia law have once again attracted attention.

Major events in the real world also provide a different perspective for observing the encryption market - how do geographical conflicts profoundly affect the encryption world, and how does the encryption world react on the real world?

Cryptocurrency agencies are at the center of the conflict and are being held hostage by stronger rules

The most direct impact of this war on the crypto industry is that large institutions are forced to react first.

Three groups — Hamas, the Palestinian Islamic Jihad and Lebanon’s Hezbollah — received significant amounts of money via cryptocurrency in the year before the raid, according to Israeli government seizure orders and blockchain analysis reports. Digital currency wallets linked to the Palestinian Islamic Jihad received as much as $93 million in cryptocurrency between August 2021 and June this year, according to analysis by crypto research firm Elliptic. BitOK Research reports that Hamas-linked digital currency wallets have gained approximately $41 million in a similar period.

Israeli police have frozen cryptocurrency accounts linked to the Palestinian terror group Hamas, according to a report by local Israeli outlet Calcalist. It is reported that the cyber law enforcement team of Lahav 433, a branch of the Israeli police, worked with the country’s Ministry of Defense, intelligence agencies, and cryptocurrency exchange Binance to locate the relevant accounts, and the seized funds will flow into the Israeli treasury.

After Binance assisted the Israeli police in freezing Hamas-related cryptocurrency accounts, He Yi responded to the matter, Any international organization, including any bank and trading platform, needs to cooperate when it receives inquiries about freezing. This is not Binances own slap on the forehead. It’s decided. I have no political stance. But no trading platform can refuse this law enforcement request.” Today, she further explained, “International business institutions need to follow international law enforcement principles, including almost all large international business institutions.”

This freeze caused a lot of discussion in the crypto world. An interesting observation is that previously, geopolitical turmoil often indirectly affected the crypto world by affecting the macroeconomy. As the power of encryption grows and becomes “mainstreamed,” issues related to supervision, compliance, and justice have become increasingly closely related to the encryption world.

There is no doubt that compliance will always be a step that must be taken in the crypto world.

People in the industry have also once again realized that compliance and regulatory pressure have always accompanied the development of centralized encryption institutions, and encryption exchanges and institutions have become more active in cooperating with governments and international regulatory agencies to ensure the compliance of their businesses.

In a geopolitical conflict, crypto institutions are forced to get involved, which to a certain extent shows that cryptocurrency funding channels have become part of international political issues.

The emergence of these signs illustrates the fact that the encryption world and the off-chain world are increasingly interconnected.

Many projects have been affected, especially Israel.

The strong connection between the “two worlds” extends beyond the regulatory level.

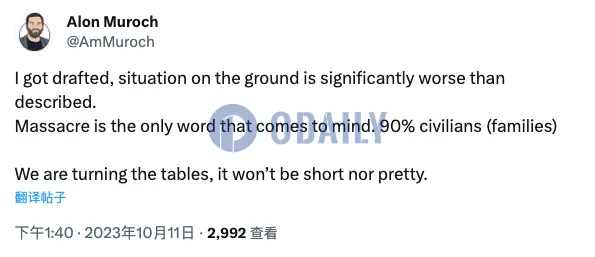

The once popular Ethereum staking infrastructure SSV Network has been extremely strongly affected. Alon Muroch, the founder of SSV, who is located in Israel, posted on The targets) are civilians. We are turning the tide, but this process will be neither short nor beautiful.

As founders are recruited, SSV’s project becomes increasingly uncertain. Ouyi OKX market shows that SSVs amplitude today is as high as 9.7%, with the lowest reaching 13.72 USDT. Prices fell rapidly after the news was announced, but now the falling prices have gradually rebounded.

The SSV is not the only Israeli-related project to be affected. Layer 2 network StarkNet is another high-profile crypto project.

StarkNet has long challenged the patience of “hair-lovers”. Users have been frequently interacting with this project in the hope of obtaining airdrops, but the airdrop plan has not yet been announced.

Founded in 2018, StarkWare (the parent company of StarkNet) is headquartered in Netanya, Israel. The uncertainty surrounding the project has also stoked concerns in the community as the Israeli-Palestinian conflict intensifies. Some community members took the opportunity to criticize.

Dune data shows that Starknet bridges TVL nearly 700,000 ETH, currently reaching 684,654 ETH, and the total number of bridged users on the chain is 1,095,635. This number ranks among the best among Layer 2 networks.

Dune data shows that the Arbitrum chain bridge TVL is 2,952,916 ETH, the Optimism bridge TVL is 623,471 ETH, the zkSync bridge TVL is 1,997,927 ETH, and the Base bridge TVL is 217,036 ETH.

In addition to the projects being directly affected, support for Israel is also being carried out in the crypto world.

Messari founder Ryan Selkis posted on the X platform that Digital Asset co-founder and CEO Yuval Rooz flew to Israel immediately after the Hamas attack to provide aid. He is raising funds for aid and is personally promoting it on the ground.

In addition, Israel’s native crypto community also stated that they have established Crypto Aid Israel, an organization that will host a multi-signature wallet jointly controlled by multiple parties. The assets will be managed by crypto custody company Fireblocks. Fireblocks stated that it has implemented a strict custody policy and teamed up with some well-known companies in the industry to be responsible for signatures, including Fireblocks, MarketAcross, Collider Ventures, CryptoJungle, and Israel Blockchain Association.

Will the crypto world become another battleground?

Natives of the crypto world are participating in this geopolitical conflict in various forms. Israeli concept coins have also become a way to express attitudes. CoinGecko market data shows that the Israeli-based NFT trading platform NFTrade platform token NFTD has experienced rapid rise in a short period of time, with a 24-hour increase of 5.9%.

How many crypto projects are there in Israel?

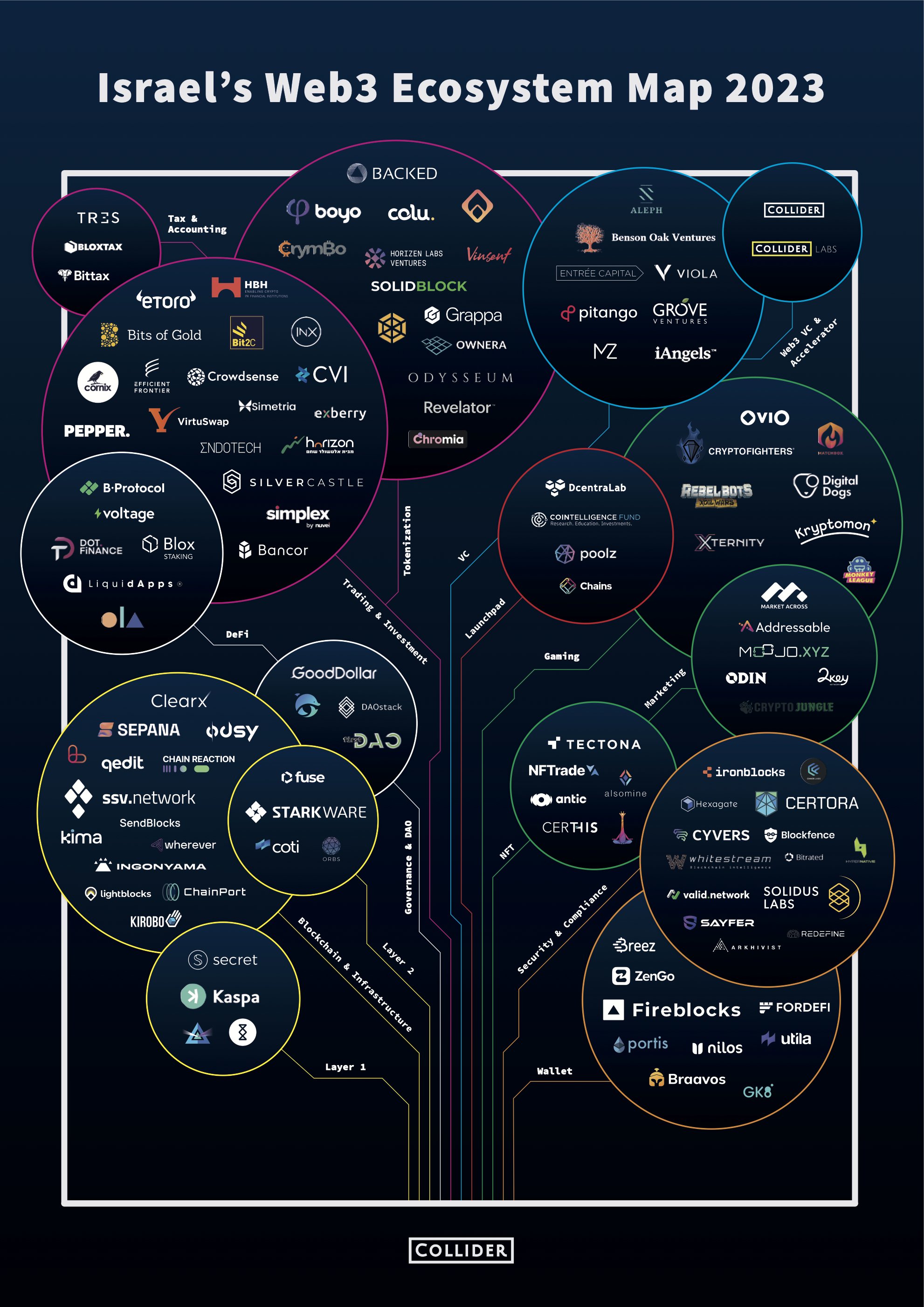

According to statistics from collider, Israeli projects cover Layer 1, Layer 2, infrastructure, NFT, DeFi and various application layer projects, etc. Covering almost all areas of the crypto industry.

Image source: collider

Among them, representative projects include Layer 2 StarkNet, Layer 1 privacy network Secret Network, blockchain IaaS platform Orbs, DEX project Bancor, etc.

existSSV founder drafted into the army? A look at noteworthy Israeli concept projects》A detailed inventory of 16 projects is provided in this article, and I will not go into details here.

What other Islamic concept encryption projects are there?

When we look away from Israel, another interesting perspective may be overlooked. As the other party in this geopolitical conflict, does the Islamic world have its own encryption projects?

The answer is yes.

“The global Islamic finance market is expected to exceed $3.69 trillion by 2024,” said Mohammed AlKaff AlHashmi, founder of Islam Coin.

The Islamic world has a unique financial model - Islamic finance. Under this model, interest is considered illegal. Participants in the financial system often distribute the fruits of growth through profit sharing. The strong financial attributes of the encryption industry have also put the legitimacy of cryptocurrency to the test.

As early as April 2018, a financial technology startup in Indonesia (the country with the largest Muslim population in the world) researched and published an article titled Is Bitcoin Halal or Halal: An Analysis of Shariah Law analysis report. The report, written by the company’s Sharia consultant, concluded after analysis that Bitcoin is normally permitted under Sharia law.

This is the earliest research we can document on cryptography and Sharia law.

Since then, institutions in the Islamic world, including the Central Bank of Bahrain, King Abdulaziz University in Saudi Arabia, and the International Shariah Institute of Islamic Finance, have conducted research on the legality of encryption technology.

Islamic Coin

At Token 2049, which is not far away from us, Islamic Coin, as one of the main sponsors, has been continuously exposed to us.

Islamic Coin is perhaps one of the most iconic cryptocurrencies in the Islamic world. Islamic Coin runs on its own HAQQ Network. The network is committed to establishing an Islamic financial ecosystem that strictly adheres to Islamic financial rules and traditional ethics. More importantly, the project also has a Shariah Committee.

In June of this year, Islamic Coin announced a $200 million investment from digital asset investment firm ABO Digital, bringing the total funding the project has received to $400 million.

Islamic Coin co-founder Mohammed AlKaff Alhashmi said Islamic Coin will conduct an ethical check on the project. Islamic Coin puts the community first and for this the ethical part of the project will be examined. First, the token does not charge interest without your knowledge. Secondly, it does not allow any negative projects to be run.

Mohammed explained that Islamic financial solutions are transparent to the Muslim community, for which Islamic Coin is designing smart contracts to facilitate Islamic lending. He also said this could create a $3 trillion market.

Currently, Islamic Coin has been listed on KuCoin.

CAIZ

CIAZ is another Islamic encryption project.

Official information shows that this is a Sharia-compliant blockchain ecosystem created in Europe to serve the global Muslim community.

From a technical point of view, CIAZ uses a hard fork version of Stellar as its own blockchain. The project released CAIZcoin and has its own CAIZchain.

The project team stated that CAIZchain will build financial products that comply with Islamic ethical standards and support functions such as payment and value storage.

But this project is too young and is far from mature. The official roadmap shows that the project is still in its first phase and its development is far from over. “Secret Product No. 2” will be announced and the CAIZ token will be released in the fourth quarter of this year.

What potential does Islamic finance have?

Although Islamic finance has already occupied a place in world finance. But the market for Islamic fintech companies remains small, according to reports from financial services firms DinarStandard and Elipses.

The market is still in its infancy, currently estimated at around $79 billion, according to the data. But the Islamic fintech market is expected to grow at an annual rate of 18%, with the top six countries being Saudi Arabia, Iran, Malaysia, the United Arab Emirates, Turkey and Indonesia, which together account for 81% of the total market size.

Back in 2018, UAE-based Adab Solutions attempted to create the world’s first Islamic Crypto Exchange (FICE), a Shariah-compliant digital currency exchange. The exchange has established a Shariah Committee, which provides input into company operations to ensure ethical compliance. But this project has long since gone dormant.

As encryption technology continues to expand, more encryption products that comply with Islamic ethics may be launched in the future.

It is reported that the Sharia Advisory Board (SAB) is an independent organization represented by internationally recognized Islamic experts. These new standards proposed by FICE will ensure an increase in the quality of exchange assets, as well as enhanced participation among Islamic cryptocurrency enthusiasts and traders.

Amid turmoil, does the “digital currency narrative” hold?

In todays turbulent global political situation, geopolitics has always been one of the focuses of much attention. It has had a profound impact on both traditional finance and encrypted finance.

In this situation, investors typically seek safe-haven assets. Since the birth of cryptocurrencies, the Bitcoin narrative has been that of the next generation of gold, with natural safe-haven properties. But as crypto adoption increases and currency prices rise, we do not see safe-haven properties from Bitcoin.

During some past geopolitical events (such as during the Russia-Ukraine war), Bitcoin did not experience significant safe-haven demand or large price increases.

It is not difficult to see from some past data that the cryptocurrency market is now more affected by capital inflows and outflows, which particularly depends on the policy impact of global central banks (especially the Federal Reserve).

Compared with the safe haven demand caused by turbulence and war, the Federal Reserve has had a greater impact on the financial market (traditional finance and encrypted finance).

Although the narrative of Bitcoin’s “digital gold” may not hold true today, the open and decentralized industry structure built by the encryption industry still provides new opportunities for cryptocurrency.

Increased uncertainty about the world situation, the rise of isolationism, and the emergence of centralized financial blockades - these factors further increase the reasons for mass adoption of an open and free crypto world.