Summary

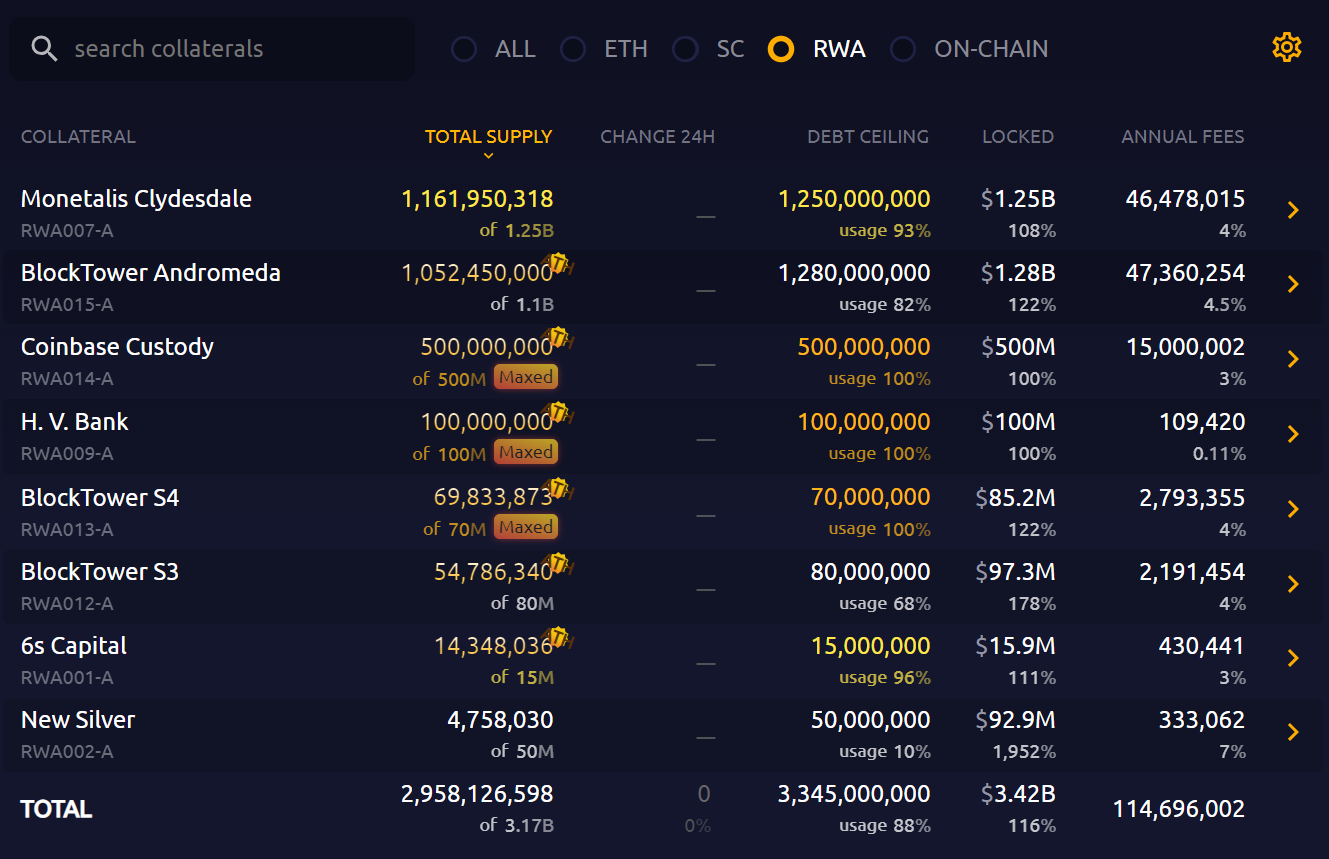

Lending: The Aave community passed the proposal to upgrade the liquidity strategy of the stablecoin GHO, and the asset size of Maker RWA continues to increase.

LSD: The ETH pledge rate rose to 22.51% last week, a month-on-month increase of 0.7%. Last week, 27.06 million ETH were locked in the beacon chain, corresponding to a pledge rate of 22.51%, a month-on-month increase of 0.7%; of which there were 819,600 active verification nodes, a month-on-month increase of 1.94%, and 22,200 queued verification nodes, a month-on-month decrease of 28.43% %. This week, the ETH staking yield dropped to 3.55%, and the annualized inflation rose to 0.285%.

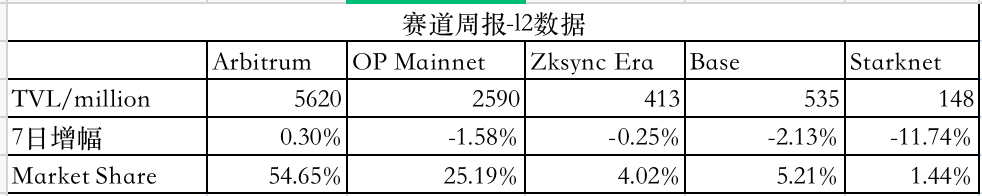

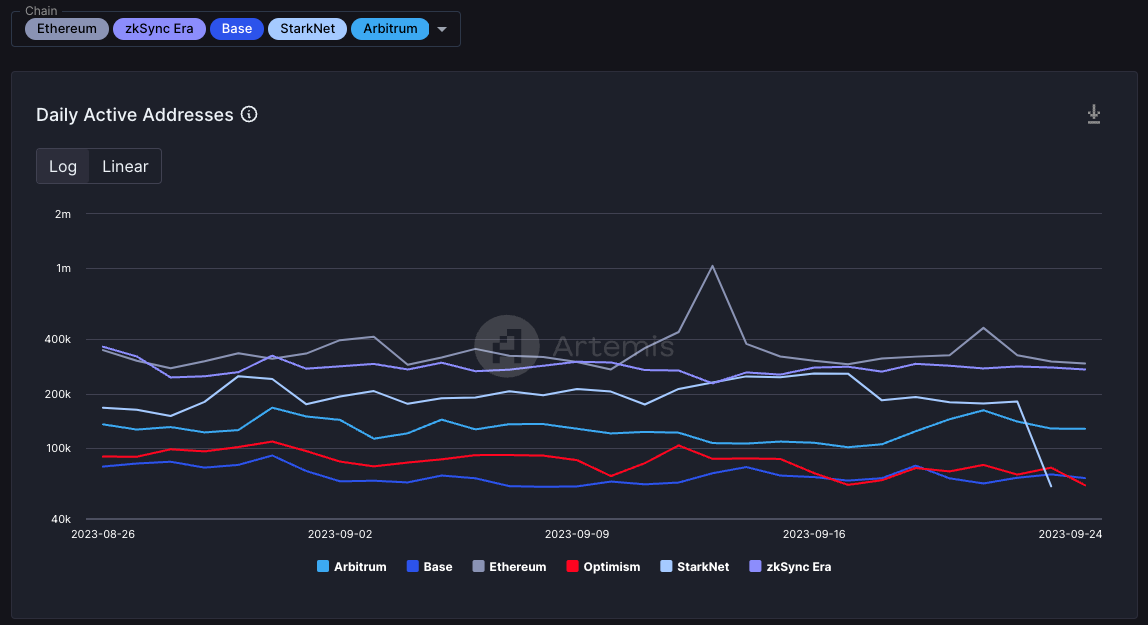

Ethereum L2: The total amount of Layer 2 TVLLayer 2 TVL rose to 10.28 billion US dollars; due to the failure of the Holesky test network to go online last week, Ethereum core developers are worried that this will delay the launch of the Cancun upgrade this year; OP announced that about 116 million have been carried out The private token sale of OP tokens has a lock-up period of two years. This week OP will usher in the regular unlocking of 24.16 million OP tokens.

DEX:Dex combined TVL 11.45 billion,A decrease of 0.27 mln from last week. Dex’s 24-hour trading volume is 970 million, and its 7-day trading volume is 9.7 2b billion, a decrease of 2.5 billion from last week. This week, the market was affected by the hawkish bias of FOMC, and the rebound momentum was relatively weak, with trading volume declining.

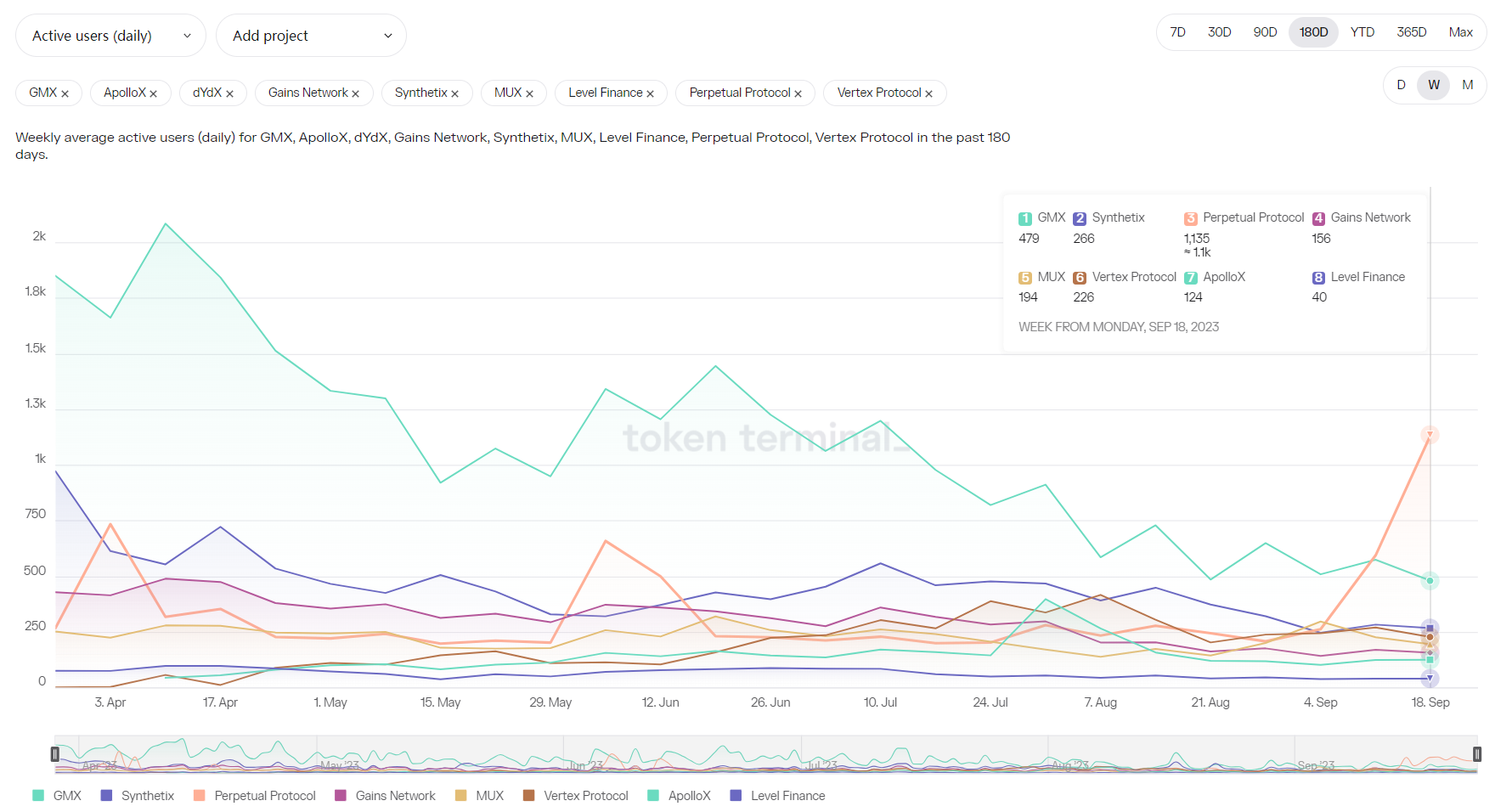

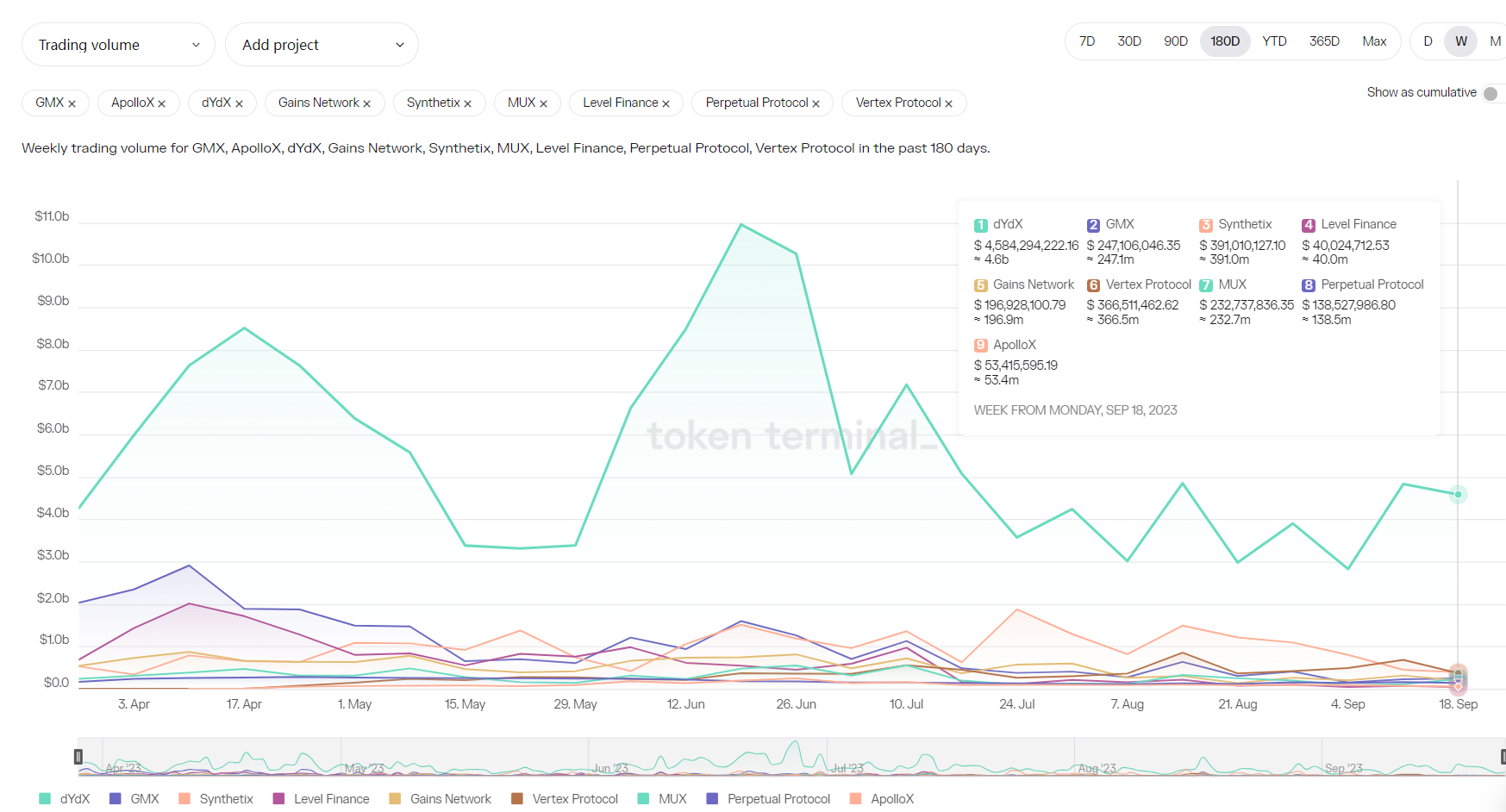

Derivatives DEX: The trading volume of major derivatives DEX in the past two weeks was US$6.9 billion and US$6.5 billion respectively, and the trading volume is still at an overall low level. DYDX accounts for most of the trading volume, especially in the past week, accounting for more than 60% of the trading volume.

loan

Aave

1) The Aave community has voted to pass the ARFC proposal on GHO Liquidity Strategy Upgrade, and the next step will be to enter the on-chain voting stage. The proposal aims to improve the peg price of the GHO token and promote diverse and comprehensive liquidity on multiple DEXs to address the challenges that arise when GHO is below $0.96.

Additionally, the strategy includes a reward budget designed to incentivize participants to provide liquidity and help increase the peg price of the GHO token. These rewards will be gradually added according to the needs of different platforms and can be updated under certain conditions.

The implementation of the liquidity strategy will be conducted by TokenLogic for liquidity analysis and monitoring, and the Liquidity Committee will execute on-chain transactions on behalf of Aave DAO.

2) Curve founder Michael Egorov has deposited 23.26 million CRV into the lending platform Silo and borrowed 3.75 million crvUSD. This action resulted in CRV TVL on Silo Llama reaching $60 million, an all-time high. Egorov then exchanges these crvUSD for USDT to repay the Aave debt.

MakerDAO

MakerDAO once again added $50 million in RWA assets through BlockTower Andromeda, which mainly invests in short-term US Treasury bonds, with an annualized interest rate of 4.5%. The current total RWA assets have reached US$2.96 billion.

LSD

Last week, the ETH pledge rate rose to 22.51%, a month-on-month increase of 0.7%. Last week, 27.06 million ETH were locked in the beacon chain, corresponding to a pledge rate of 22.51%, a month-on-month increase of 0.7%; of which there were 819,600 active verification nodes, a month-on-month increase of 1.94%, and 22,200 queued verification nodes, a month-on-month decrease of 28.43% %. This week, the ETH staking yield dropped to 3.55%, and the annualized inflation rose to 0.285%.

ETH staking increased by 0.7% month-on-month this week

ETH staking yield dropped to 3.55% this week

ETH annualized inflation this week is 0.285%

Among the three major LSD protocols, in terms of price performance, LDO fell by 3.6% in the week, RPL fell by 5.9%, and FXS rose by 4.4%; from the perspective of ETH pledge volume, Lido rose by 0.88% in the week, Rocket Pool rose by 0.72%, and Frax rose by 0.47%. The current Rocket Pool deposit pool balance is 18,057 ETH, the RPL pledge rate is 49.23%, and the effective pledge rate is 90.56%. SSV had a major correction this week, falling 7% for the week. The current TVL is 10,432 ETH, which is an increase of about 3,000 ETH compared to the 7,500 ETH before entering the third stage of the mainnet launch. The growth rate is not impressive; Frax The V3 audit has been completed, a white paper will be released in the near future, and the first treasury bond purchase is expected to be completed in early October.

Ethereum L2

TVL

Total Layer 2 TVL rises to $10.28 billion

Cancun upgrade

The 118th Ethereum Core Developers Consensus Conference (ACDC) was held on September 21. This meeting mainly discussed Devnet-9 preparations and changes to the Ethereum Consensus Layer (CL).

1. Parithosh Jayanthi, DevOps engineer of the Ethereum Foundation, said that his team will launch Devnet-9 on September 27; EL and CL client teams such as Lodestar, EthereumJS, Lighthouse and Geth have confirmed that they are ready for this testnet release (Devnet-9 is the second testnet to include the full set of code changes in the Dencun upgrade. Devnet-9 will be the first testnet to activate EIP-7514 and EIP-7516, which were implemented last week Layer conferencing added to Dencun upgrade)

2. Previously, Tim Beiko suggested launching Dencun on these test networks in the order of Holesky, Goerli, and Sepolia. However, due to the failure of Holesky to launch on September 15, it will be re-launched on September 28; Tim Beiko, the core developer of Ethereum, said that Dencun Questioning the test schedule, he said that if developers are not sure to release Dencun on the public testnet before the Ethereum Developer Devconnect in November 2023, then Dencuns mainnet activation will most likely not take place this year.

Jayanthi proposed launching Dencun on Goerli first and then on Holesky. Because Goerli is a soon-to-be-deprecated testnet, this means developers are free to experiment with modifications to the Dencun specification. Tim Beiko and Del Fante agreed to test Dencun on Goerli before Holesky, and many developers also agreed to release Dencun on the public testnet before Devconnect.

3. In addition, the developers also discussed the deployment strategy of EIP-4788, deploying trusted settings for EIP 4844 on Devnet-9, etc.

OP

1. On September 21 last week, Optimism issued a document stating that it had conducted a private token sale of approximately 116 million OP tokens, which were allocated by seven buyers for financial management purposes. These tokens have a two-year lock-up period. During the lock-up period (which will be unlocked immediately after two years of community response), buyers will be able to entrust tokens to unaffiliated third parties to participate in governance. These tokens come from the unallocated portion of the OP token pool and are part of the Foundations original working budget, accounting for 30% of the initial OP token supply. This message is intended to let the community know in advance that these are planned transactions

2. At 12 noon on September 30th this Saturday, Optimism will unlock 24.16 million OP (approximately US$30.92 million), accounting for 3.03% of the circulating supply.

ARB

1. The short-term incentive plan for the 9.11 proposal was voted on on 9.18 last week. It is planned to distribute 50 million ARB before January 31, 2024 to encourage the use of existing Arbitrum dApps. The recipients will be settled through Arbitrum time, TVL, transaction volume and other standard judgments.

2. Arbitrum Odyssey will be re-launched this week. This Odyssey will cooperate with the Web3 community activity platform Galxe for a period of 7 weeks. Complete tasks and explore 13 projects on Arbitrum One to obtain custom badges (no airdrops will be issued this time); Arbitrum New Odyssey will include the following 13 projects: GMX, Aboard, tofuNFT, Uniswap, ApeX Protocol, 1inch Network, Premia Blue, DODO, Swapr, Treasure, BattleFly DAO, handle.fi, SushiSwap

BASE

1. On September 20, Base announced the open source monitoring system Pessimism, which is designed to help support the security of all OP Stack and EVM compatible chains. Since the launch of Base, the Coinbase team has been running Pessimism internally to monitor the Base mainnet; Pessimism can detect protocol threats specific to the OP stack (withdrawal execution, failure detection) as well as general EVM blockchain events (balance execution, event emission) - Modular architecture

2. At the annual summit Mainnet 2023 hosted by Messari on September 22, Coinbase Chief Legal Officer Paul Grewal responded to “whether Base will have tokens” in an interview: “We have not completely ruled out this possibility. I think tokens may be viable at some point in the future. But right now we are not too focused on the economics of the protocol and tokenization. Regulatory clarity is also very important

On-chain activity

DEX

Dex combined TVL 11.45 billion,A decrease of 0.27 mln from last week. Dex’s 24-hour trading volume is 970 million, and its 7-day trading volume is 9.7 2b billion, a decrease of 2.5 billion from last week. This week, the market was affected by the hawkish bias of FOMC, and the rebound momentum was relatively weak, with trading volume declining.

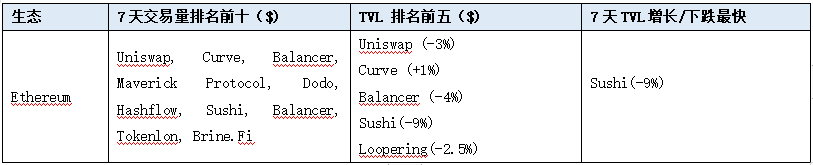

Ethereum

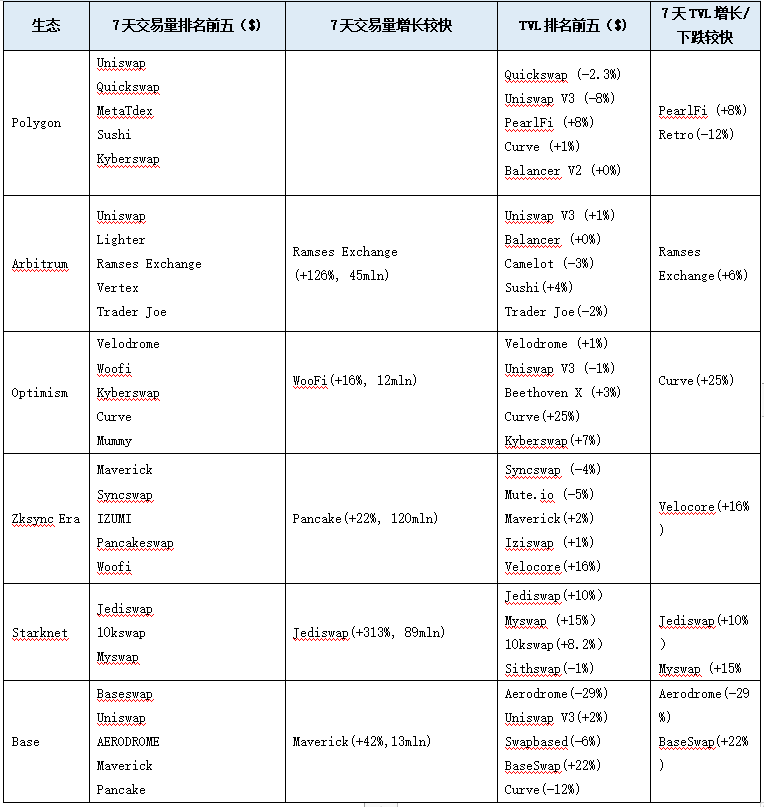

ETH L2/sidechain

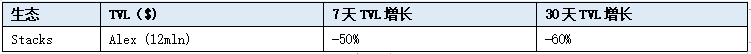

BTC L2/Sidechain

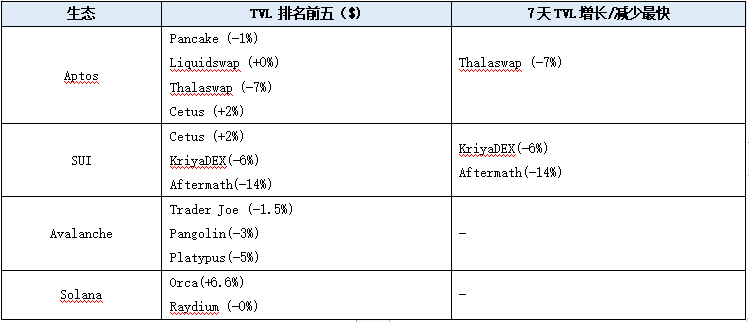

Alt L1

Derivatives DEX

The trading volume of major derivatives DEX in the past two weeks was US$6.9 billion and US$6.5 billion respectively, and the trading volume is still at an overall low level. DYDX accounts for most of the trading volume, especially in the past week, accounting for more than 60% of the trading volume.

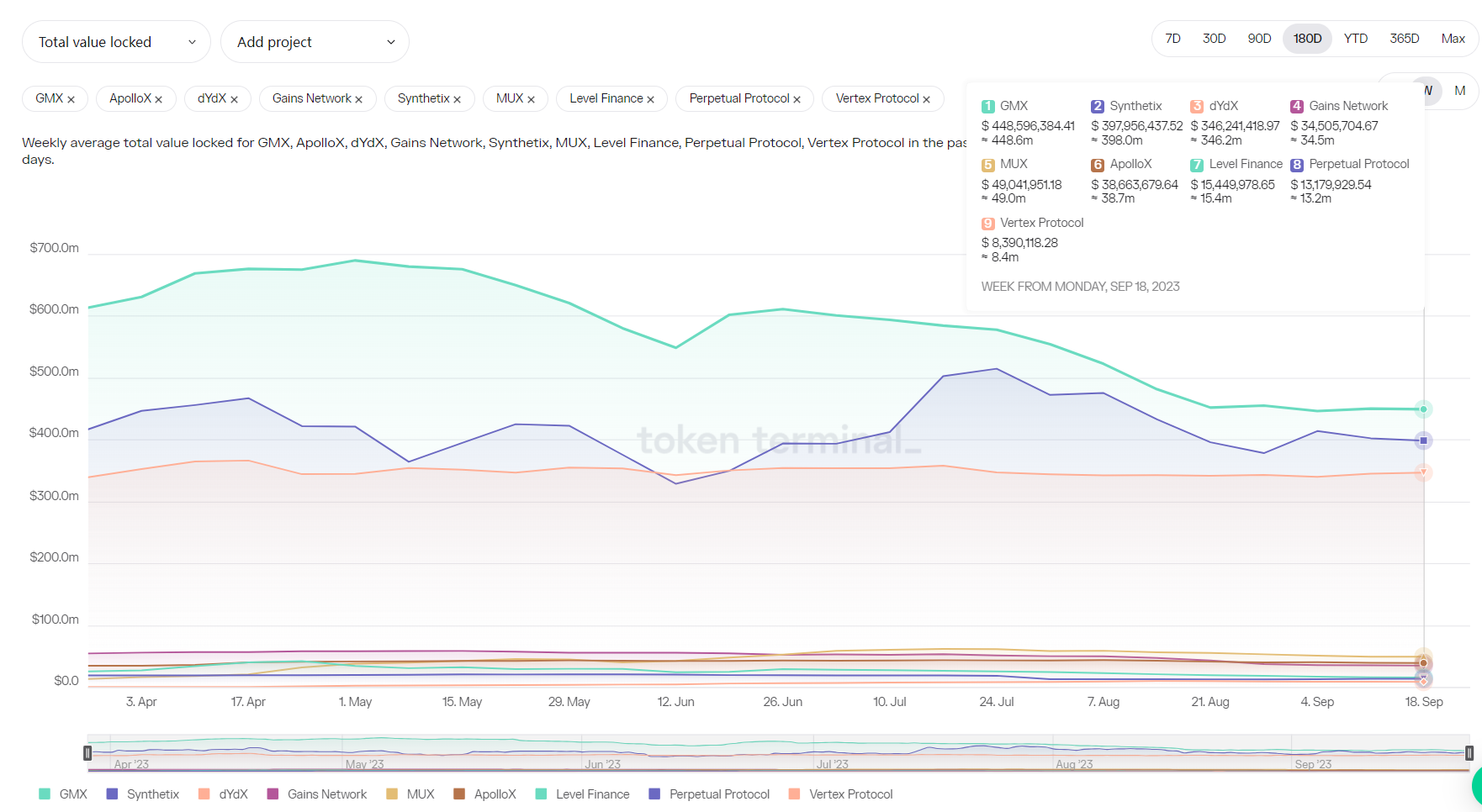

In terms of TVL, the overall TVL of the derivatives DEX track is in an outflow state, with no signs of capital inflow.

In terms of users, the number of daily active users of derivatives DEX remains at a low level overall, and the number of daily active users of major protocols has not changed significantly. In the past two weeks, the number of daily active users of the perpetual protocol has increased significantly, increasing to more than 1,000.