复盘Mixin两亿美元失窃案,谶语如何成真?

原创 | Odaily星球日报

作者 | Loopy

今日,加密世界再出大额安全事件。慢雾(SlowMist)发布安全警报称,Mixin Network 云服务商数据库于 9 月 23 日遭遇攻击,涉及金额约 2 亿美元,其中包括价值约 9448 万美元的 ETH、 2355 万美元的 DAI 和 2330 万美元的 BTC。

而这一安全事件之所以引起如此强烈的关注,更是因为曾经的币圈初代“顶流”李笑来对这一项目的站台。

2 亿美元是如何不翼而飞的?

9 月 23 日,Mixin Network 的云服务提供商数据库遭到黑客攻击。该团队表示,他们已经联系了谷歌和区块链安全公司 SlowMist 协助调查。

经初步核实,所涉资金约为 2 亿美元。Mixin Network 充提服务已暂时停止。在所有节点讨论并达成共识后,一旦漏洞得到确认和修复,这些服务将重新开放。在此期间,转账不受影响。

而 Mixin 创始人冯晓东也在今日进行了一场直播来解释这一事件。Mixin 创始人冯晓东在直播中回应称,此次受损资产中以比特币核心资产为主,BOX 和 XIN 等资产并未出现严重被盗情况,具体的攻击情况尚不能透露。

针对被盗资产,官方表示目前最多赔付 50% ,剩余部分将以债券代币形式赔付,未来官方会用利润进行回购。此外,冯晓东还表示,Mixin 还将上线新的系统用于用户资产迁移,但所能转移的资产暂时仅为用户余额的一半。

而一个备受争议的现象是,官方快速的回应不仅没有平息用户的争吵,反而让事件更添上几分悬疑的色彩——有社区用户怀疑安全事件或系监守自盗。

加密原罪:中心化

每当大规模安全事件发生,加密世界就再一次开始审视加密的愿景——去中心化。而毋庸置疑的是,几乎绝大多数的大规模安全事故都由于项目出现了极高的中心化风险。

Mixin Network 虽然是一个公链项目,但颇为离奇的是,用户缺遭受着极高的中心化风险。与 EOA 钱包不同,Mixin 并非一款去中心化钱包。该产品依靠手机号码和 PIN 码进行身份验证,由团队代用户保管私钥。在本次攻击事件发生之后我们才发现,原来其保管方式极为简单粗暴——将私钥直接保存在服务器。

这也为本次安全事件埋下了伏笔。用户并不掌握自己的加密货币,所有加密货币都由 Mixin 官方保管,这甚至不能称之为一个钱包,称呼它为“托管”或许更为准确。

Coingecko 数据显示,虽然发生了大规模安全事件,但 Mixin 的原生代币 XIN 并未受到重挫。其币价一度下跌约 8% ,目前已逐渐回升。

此外 DeFiLlama 数据显示,自攻击发生以来,Mixin 的 TVL 下降了约 3000 万美元,目前为 3.5 亿美元。

李笑来:长期投资 Mixin

2020 年初,李笑来在接受 CoinDesk 韩文版采访时,曾盛赞 Mixin 这一项目。

他公开表示,自己拥有价值约 10 亿美元的数字资产存放在冷钱包中,而所持有的主要标的是 BTC、EOS、Mixin。李笑来还强调:“成功投资的关键是坚持长期投资——所有成功的投资者都有这个相同的特质。”

但若有人真的对 Mixin 进行长期投资,恐怕却会受到这一项目的暴击。Coingecko 数据显示,XIN 代币 ATH 价格 2095 美元,现价 200 美元,已跌去超 90% 。

虽然各项公开资料均表示 Mixin 创始人为冯晓东,但对一些入圈较早的投资者来说,或许都还记得李笑来对 Mixin 的力挺。冯李二人颇为密切,由于 Mixin 与李笑来有着千丝万缕的联系,因此在提到此项目时,坊间均将其视为与李笑来个人强绑定。

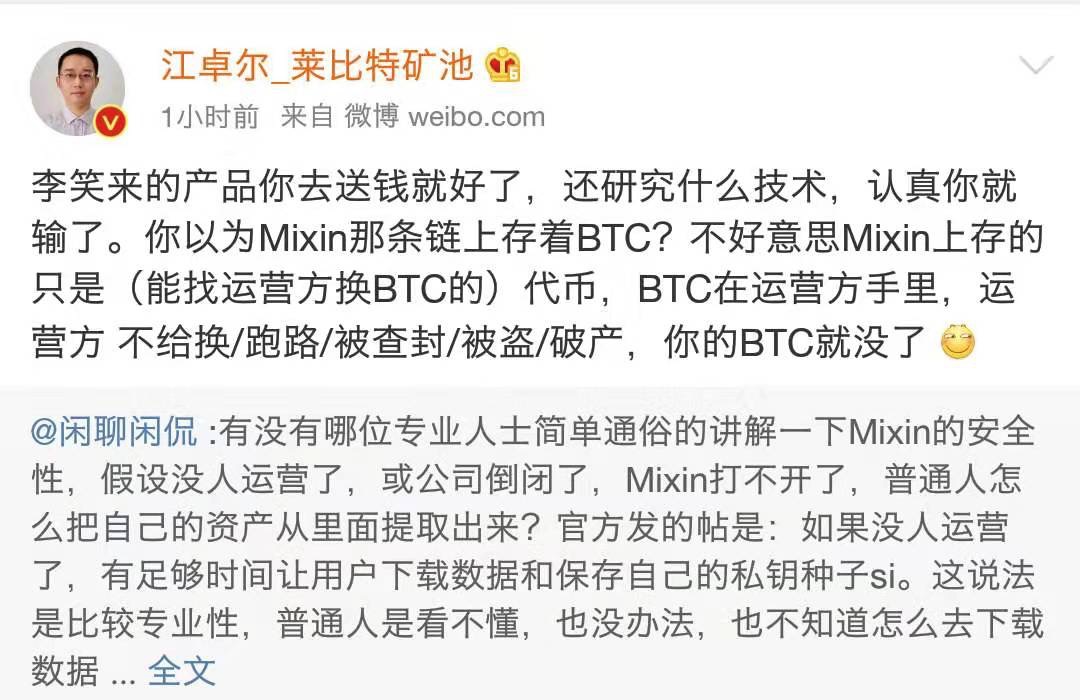

而今日 Mixin 出现安全事故之后,江卓尔一则发布于 2019 年的微博也被人们翻了出来。江卓尔曾写道,“运营方被盗,你的 BTC 就没了。”不料一语成谶。

复盘 Mixin 的历史,不难发现这并不是该产品第一次出现事故。

2020 年 3 月,Mixin 网络的两个节点 Fox.ONE、Exin 昨晚发布声明称其联合节点 SS 私钥丢失,导致联合节点中的原始资产 10000 XIN 和自 2020 年 3 月 21 日以后的所有收益均无法取出。

而Mixin 也曾因为其充满套路的签到而引发社区的质疑。在起步之初,Mixin 曾宣传“签到送比特币”。以当时价格计算,只要坚持签到 10 年,就可以获得超过 30 万元的比特币。但用户很快发现,签到门槛越来越高,他们需要邀请新用户,参与“洗脑”式答题,甚至投入资金。

结语

在 Mixin 运行不久之后,李笑来还推出了名为 B.watch 的新项目,这也被人们视为 Mixin 生态的延伸。BOX 是一个基金产品,由李笑来设计、发行。成分由三个标的构成,分别是 BTC、EOS 和 XIN。

同为李笑来“概念币”,今日 BOX 也迎来了极小幅的下跌,Coingecko 数据显示,BOX 从超过 3.1 美元最低跌至 3.02 美元。目前,BOX 的 24 小时交易量仅为约 18 万美元。

而关于 Mixin 项目还有一个有趣的事实是,Mixin 还和另一个强大的个人 IP——罗永浩——存在一定的关联。

天眼查数据显示,李笑来、Mixin 创始人冯晓东均为费格曼(北京)科技有限公司的股东。2016 年 2 月,罗永浩成为了费格曼股东,持股 4% ,并在今年 2 月退出费格曼股东行列。

罗永浩曾在 2018 年发微博表示:“曾经投入 100 多万炒币,此后再也没关心过,而这些币已经涨到了 3000 多万。”

如今,Mixin 和李笑来一样,风光不再,用户资产面临大额损失。靠营销和噱头吸收资金,以去中心化之名行中心化之实,市场的乱象,从未停止。