In-depth analysis of the LSD track: Why is Lido still considered a promising asset?

Original author: Arthur 0x

Original translation: Deep Tide TechFlow

Abstract

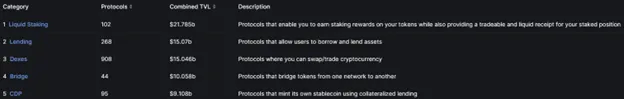

Liquid staking is one of the few protocols in the cryptocurrency space that has realized a unique product-market fit, addressing the capital efficiency problem faced by token holders in proof-of-stake (PoS) blockchains. This has resulted in the sector having the largest total value locked (TVL) in the decentralized finance (DeFi) space, with $22 billion. If the capital efficiency problem persists in PoS chains, there will continue to be long-term demand for liquid staking solutions.

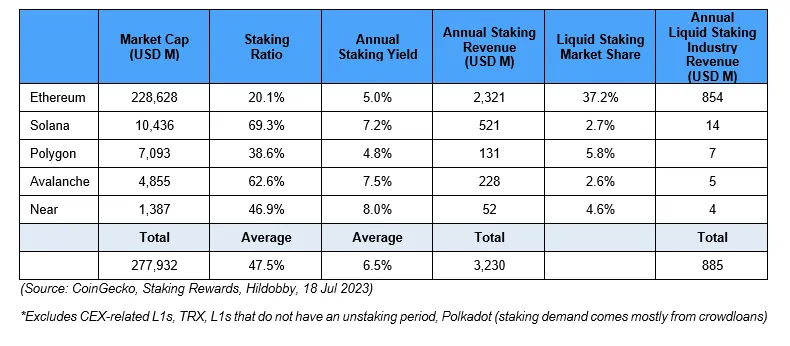

As the value of the chains served by the protocol grows, the liquid staking market also expands. Today, the top five liquid staking protocols on smart contract chains generate over $800 million in revenue annually. Additionally, due to their utility and non-volatility, the profitability of this sector is superior to other DeFi industries.

With strong network effects established around stETH, a solid track record of reliability, and the adoption of decentralized validator technology such as SSV and Obol, Lido is well positioned to capture industry growth.

In the medium term, we believe that Lido's revenue could triple, primarily due to: 1) the increase in the market value of Ethereum, 2) the increase in the Ethereum staking ratio after the Shanghai upgrade, 3) the increase in market share of decentralized liquid staking protocols, and 4) Lido's continued dominance.

Due to the ability of liquid staking protocols to address the capital efficiency problem faced by validators, they have achieved a strong product-market fit.

Today, the top smart contract chains ranked by total value locked are all running PoS or variants of PoS - such as delegated proof of stake and authorized proof of stake.

These blockchains allow users to stake their tokens in exchange for rewards that increase network security. However, staked tokens usually have a lock-up period, the length of which varies depending on the protocol and is typically a few days to a few weeks. This presents a critical issue of capital efficiency for stakers.

Liquid staking protocols have emerged to allow users to stake their tokens in exchange for a receipt token that represents their ownership of the staked asset and corresponding staking rewards. This receipt token can be freely transferred and used for DeFi activities such as trading, liquidity pools, and lending.

The most important thing is that the liquidity collateral agreement provides two key value propositions for pledgers - 1) the ability to generate income and 2) the liquidity of pledged assets, which together solve the capital efficiency problem. As a result, the liquidity collateral track has a total locked value of 22 billion USD, the highest among all tracks.

We believe that this product-market fit is unique to the liquidity collateral track - if PoS-type chains continue to be popular, capital efficiency will remain an important issue, leading to long-term demand for liquidity collateral solutions.

The liquidity collateral agreement provides a sustainable source of income for a large market.

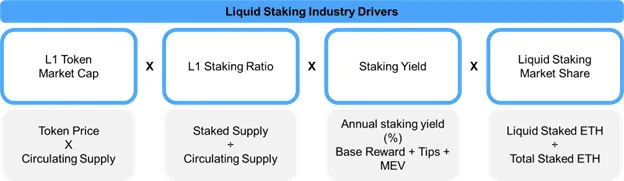

From a macro perspective, the potential size of liquidity collateral income is determined by four growth drivers: the market value of L1 tokens, the pledging ratio of L1, the pledging yield, and the market share of pledging service providers.

In summary, these drivers have created an industry that generates millions of dollars in revenue annually. Just the top five PoS smart contract platforms generate rewards of 893 million USD per year, which belong to liquidity collateral agreements.

In addition, compared to other blockchain applications, this income flow has higher quality as it is repetitive. For example, the revenue of decentralized exchanges (DEX) is cyclical and highly dependent on market conditions. Generally, during bull markets, DEX trading volume is high, while it decreases gradually during bear markets. This leads to unstable income sources at the protocol level. Unfortunately, this is also the case for many other blockchain applications - NFT market revenue decreases during NFT bear markets, and currency market revenue decreases with reduced demand for leverage. Therefore, we believe that in a volatile and fast-moving market, the stable income source of the liquidity collateral track is often overlooked.

By comparing the monthly income of Uniswap and the leading liquidity collateral track Lido, it is easy to illustrate the quality of income in this track. Uniswap's monthly income had two local peaks in May and November 2021, coinciding with the market tops of those two months. Subsequently, in the following bear market, monthly income gradually declined as trading volume and liquidity decreased.

In contrast, Lido's revenue has remained stable over the past few years, without significant fluctuations. This demonstrates the stability of equity mortgage income - as long as the blockchain continues to operate, the liquidity staking protocol will continue to generate income. We believe that one important implication of this phenomenon is that liquidity staking protocols should receive a higher valuation multiple compared to protocols with cyclical businesses.

Lido is currently the market leader in the liquidity staking field, with a total locked value close to $15 billion. In fact, it is also the DeFi protocol with the highest total locked value on the chain. Lido's ETH receipt token stETH is also the most liquid staking ETH token and has the largest composability. We are confident in Lido's ability to continue to grow and consolidate market share through the network effects it has established.

When evaluating the advantages of specific liquidity staking protocols, we also consider two additional parameters - 1) market share and 2) the ratio of rewards charged for staking. In the following sections, we will elaborate on the reasons for the growth of each driving factor and how they contribute to Lido's continued success.

1. Level 1 (L1) token market value growth

Lido will benefit from the growth of the underlying L1 chains it serves, as its total locked value (TVL) in USD is linearly correlated with the prices of these L1 tokens. Currently, Lido is actively serving three chains - Ethereum (98.9% of TVL), Polygon (0.7%), and Solana (0.4%). If these chains continue to grow, their tokens should reflect these fundamentals. Therefore, even if the TVL in token terms does not increase, Lido's TVL in USD terms will continue to expand.

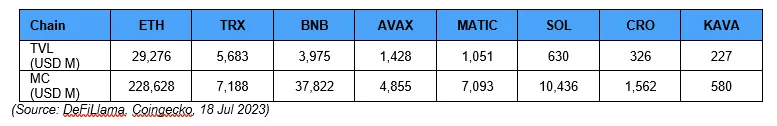

It is worth noting that Ethereum's growth has a significant impact on Lido's fundamentals. Ethereum is the largest smart contract L1 chain to date, with a market value 6 times that of BNB Chain and 23 times that of Solana. ETH also accounts for the largest share of Lido's TVL.

In this regard, we are particularly bullish on the long-term prospects of Ethereum. We have witnessed the successful implementation of major protocol upgrades such as the London upgrade (EIP-1559 - improving transaction fees and the user experience of ETH token economics), the Paris upgrade (PoS - reducing energy consumption and laying the foundation for scalability upgrades), and the Shanghai/Capella upgrade (ETH withdrawals). From an adoption standpoint, Ethereum remains the preferred platform for secure L1 DeFi activities, with applications like Aave and Uniswap enabling users to easily trade and borrow. Additionally, it continues to serve as a secure settlement layer for numerous scalability solutions, from zkRollups (Polygon zkEVM, zkSync, Starknet) to Optimistic rollups (Arbitrum, Optimism), facilitating cheap and fast transactions, and contributing to ETH transaction fees. Therefore, we believe Lido will benefit substantially from this native advantage.

Furthermore, we see Lido's multi-chain operation as a bullish option for alternative L1 chain growth. We recognize that developers and users have different needs, which can be met by other chains. From Lido's perspective, providing services for these chains is a wise approach to decentralized business.

2. L1 Staking Ratio Growth

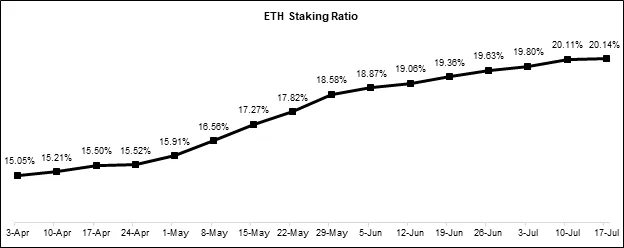

We believe the staking ratio of Ethereum will continue to rise, especially after the recent success of the Shanghai/Capella upgrade. Initially, Ethereum had a lower staking ratio compared to other PoS chains as early stakers didn't have complete assurance of the technical feasibility and withdrawal timeline of their assets when depositing ETH on the beacon chain. With the completion of the Shanghai/Capella upgrade, this risk factor has been significantly mitigated and has become a key driving factor for staking ratio growth. In fact, the staking ratio of ETH has steadily increased from around 15% during the Shanghai/Capella upgrade to approximately 20% today.

We expect the growth of the staking ratio to benefit the liquid staking space as users still face similar issues of capital efficiency despite the reduced staking risk. By converting to Lido's stETH, regular ETH holders, who constitute a majority of the ETH supply, can now enjoy the actual returns of ETH while retaining most of the on-chain composability.

3. Staking Yield Growth

We acknowledge that as the pledge ratio increases, pledge returns will be compressed under equal conditions. However, the current level of on-chain activity is comparatively lackluster compared to historical bull markets. Any increase in on-chain activity on Ethereum, such as the surge in NFT minting and decentralized trading volume, will drive up transaction fees and MEV. This will help alleviate the compression of basic rewards and contribute to the stability of Lido's income.

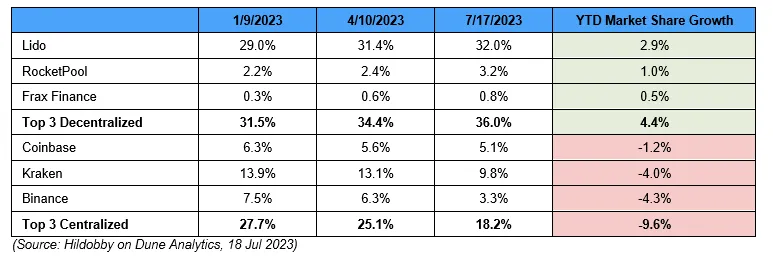

4. Growth of the Liquid Staking Market Share

We anticipate that the liquid staking sector will benefit amid increased regulatory scrutiny on pledge services provided by centralized participants. Currently, the top three centralized pledge service providers have relinquished 9.6% of the market share, which has been partly absorbed by their decentralized counterparts. It is worth noting that Lido has been the biggest beneficiary of this trend, with market share growing by 2.9%. We believe this signifies that due to the liquidity and composability of stETH in DeFi, it remains the preferred choice of most pledgers.

5. Growth of Lido's Market Share

Driven by industry momentum, we believe Lido will continue to dominate the market share, thanks to the unique network effects established around stETH. Currently, Lido holds 86% of the market share for liquid staked ETH, nearly six times more than the second-largest decentralized participant (rETH).

This is due to the power law dynamics formed around the liquidity and utility of the stETH token. stETH is the most liquid form of staked ETH derivative on DEX. On Ethereum alone, the liquidity of stETH/wstETH is approximately $700 million (paired with WETH and ETH), eight times more than rETH. Hence, it can be stated that among all alternative solutions, Lido best accomplishes the primary goal of a liquid staking protocol—providing optimal liquidity for pledgers.

With the establishment of a substantial liquidity foundation, the moat of stETH has been further strengthened as more use cases for the token are unlocked. One example is using the ETH staked in liquidity as collateral in money market protocols. Liquidity is a key parameter for assessing whether an asset is suitable as collateral, and only assets with sufficient liquidity depth can effectively handle asset liquidations. It is therefore not surprising that stETH is also the most widely used derivative of staked ETH as collateral in money market protocols.

6. Value Capture of Lido

Currently, Lido imposes a 5% fee on staking rewards, which goes directly into the DAO treasury managed by LDO token holders. This allows us to easily understand the potential income of Lido under specific parameters.

Considering all the value-driving factors of Lido, we believe there is still significant room for growth in its fundamentals in the medium term. Below, we have listed some rough numbers to illustrate the potential market opportunities for Lido.

We expect the staking ratio of Ethereum to reach 30% in the next 12 months as users start to digest the reduced risk of withdrawals.

In this scenario, staking rewards are expected to decline to around 4%.

Over time, we also believe that the liquid staking protocol can capture 50% of the market as users demand capital efficiency for their assets.

Additionally, if ETH returns to its all-time high price of $4,000 (a $500 billion market cap), this means $3 billion in annual revenue from the Ethereum liquid staking space alone.

Assuming Lido slightly increases its market share in the Ethereum liquid staking market to 90%, the annual revenue of Lido DAO could reach $135 million with a 5% fee rate.

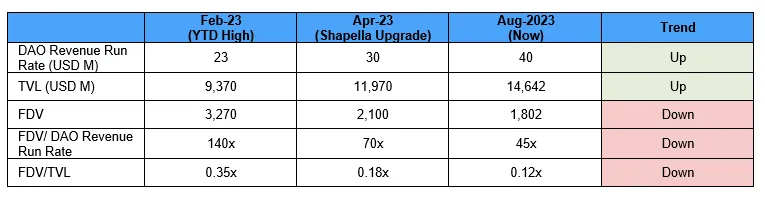

This means that at the current fully diluted valuation of $1.8 billion, the forward-looking FDV/Revenue ratio for Lido is 13.5x.

Final Thoughts

We emphasize again that we are optimistic about the prospects of the liquidity collateral field, as leading projects provide unique value propositions for the large and growing market they serve. We further outline four key driving factors supporting industry growth and provide detailed explanations on how each indicator can be further expanded.

We also discuss Lido's continued dominance in market share, driven by the strong network effect built around stETH, which is derived from the token's liquidity and combinability. If our view on mid-term growth in the industry proves accurate, we demonstrate a 5x revenue growth opportunity for Lido from here.

In the short term, the market seems to have shifted away from the initial hype surrounding Shanghai/Capella. This can be seen from the increase in Lido's total value locked (TVL) and revenue growth rate, while the valuation multiple compression. We believe that this deviation between valuation and fundamentals will not persist indefinitely, and LDO now offers some of the best risk-adjusted returns.