Original author: Jiang Haibo, PANews

Telegram trading bots have a history, and recently with the popularity of the MEME token and projects like Unibot, this field has attracted attention again.

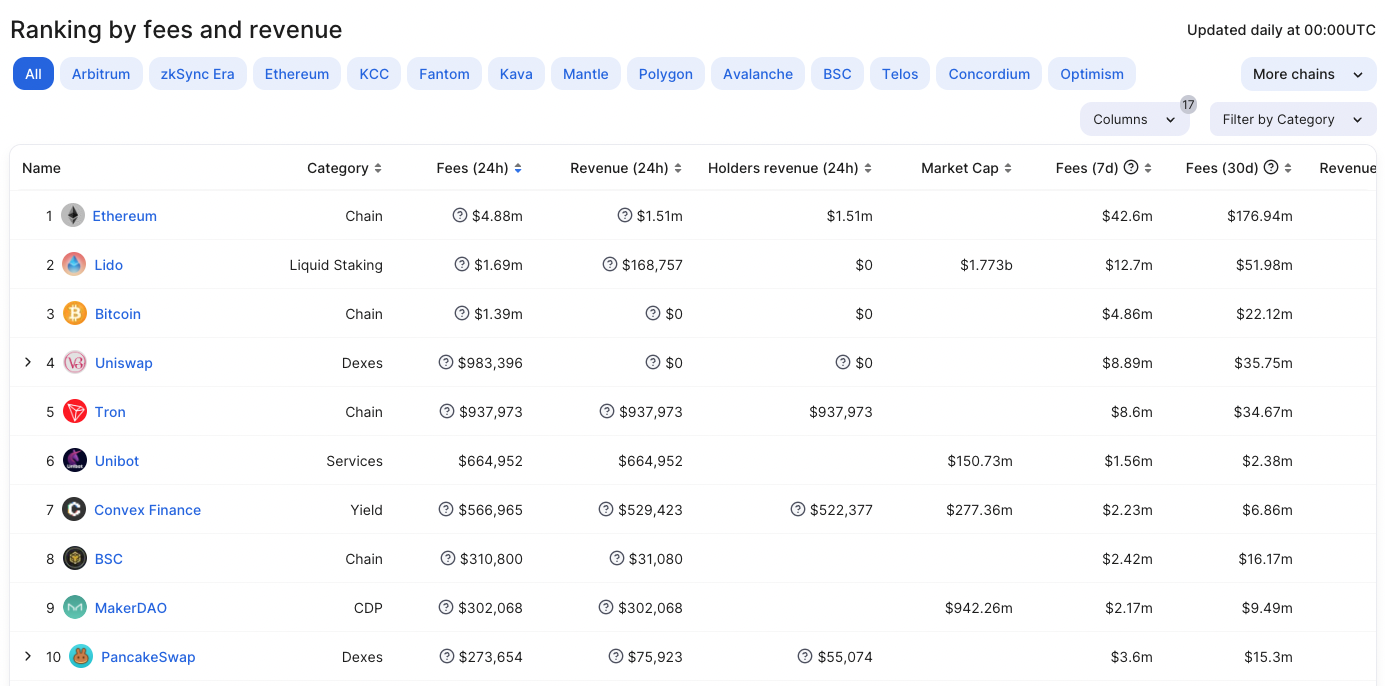

According to data from DeFiLlama, as of July 24th, among all blockchain projects, Unibot's fees generated in the past 24 hours are second only to Ethereum, Lido, Bitcoin, Uniswap, and Tron, and excluding public chain projects, it is second only to Lido and Uniswap. As Lido requires users to stake ETH to generate income, 90% of the fees are distributed to users who stake ETH, and the protocol revenue is only 10% of the fees generated; Uniswap's fees are all distributed to liquidity providers, and the protocol revenue is zero; Unibot, as a service provider, receives a proportion of the revenue relative to the fees, and its revenue of $665,000 in the past 24 hours ranks first among non-public chain projects. Based on this, Unibot distributes a portion of its revenue to holders of its native token, while Lido and Uniswap currently have no plans to distribute profits to token holders.

Unibot's Services and Pricing Mechanism

Unibot's Telegram bots complete transactions through conversations with users, and the entire process is summarized as follows:

Click "Start Trading" on Unibot's official website to initiate a trade, and a Unibot dialogue box will pop up on Telegram;

Unibot generates 3 addresses for each Telegram user;

Users can recharge Unibot addresses through wallets such as MetaMask;

Select "Buy Tokens" from the options provided in the dialogue box;

Select the wallet for the transaction and the amount to be purchased;

Enter the token address to be purchased and complete the transaction.

Compared to decentralized wallets such as MetaMask, Unibot provides a user experience that is closer to centralized products. However, security should also be taken into account during this process. The generated addresses can be replaced by refreshing, but the private key needs to be saved before that; precautions should be taken to prevent the leakage of exported and saved private keys; verify the entered address to avoid purchasing counterfeit tokens. Unibot has two ways of generating fees: transaction fees of Unibot Telegram bot and transaction taxes of the native token $UNIBOT.

Unibot charges a fee of 1% of the Unibot Telegram bot's transaction volume, of which 40% is distributed to $UNIBOT token holders, and the remaining fees are allocated to the team and referral rewards. Users can recommend others to use Unibot bot for trading, and the referrer can receive 25% of the fees paid by the referred user.

The $UNIBOT token has a 5% transaction tax, of which 1% of the transaction volume is allocated to $UNIBOT token holders, and this allocation ratio doubles during a 90-day window period.

If more than 200 $UNIBOT is sold or transferred in each reward cycle, the reward will be confiscated and returned to the reward pool.

This means that currently about 40% of the fees generated by Unibot are distributed to $UNIBOT token holders.

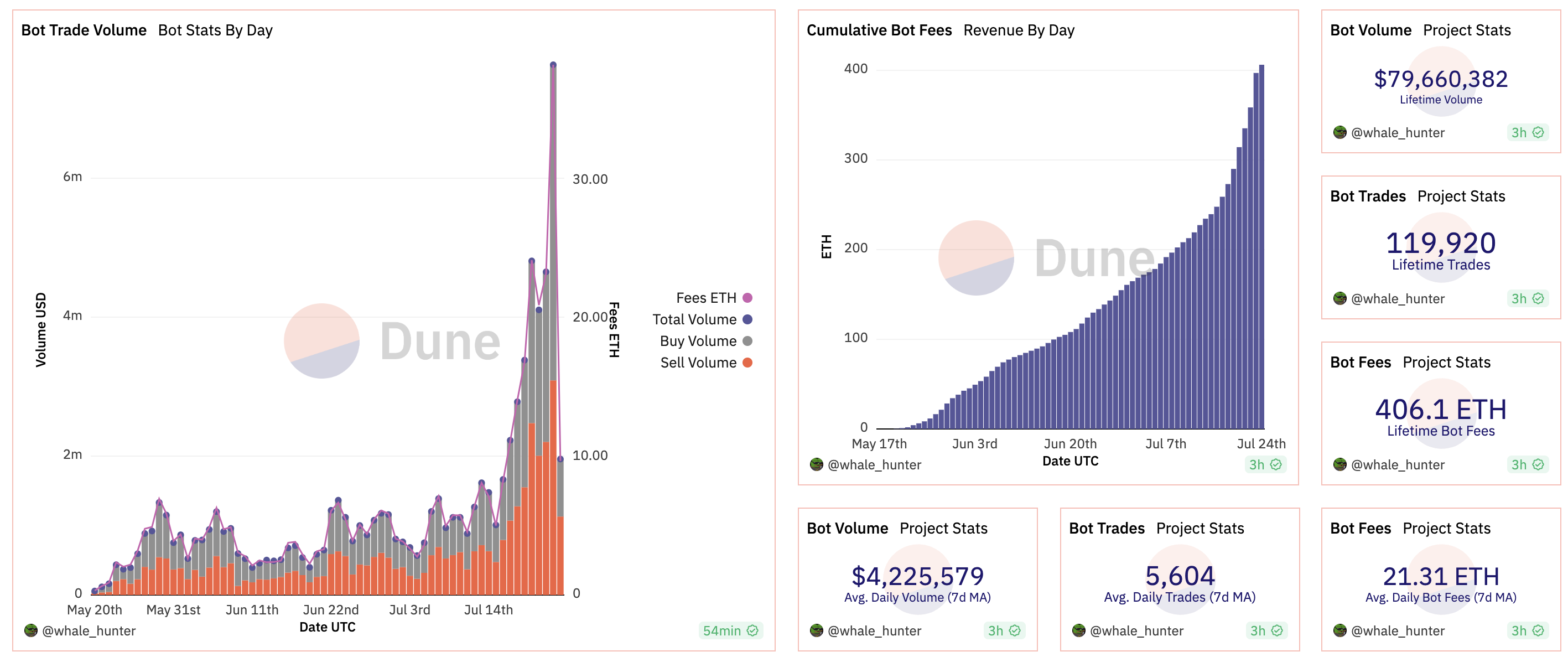

According to the Dune dashboard provided by Unibot's official website, Unibot generated a cost of 337.54 ETH on July 23rd, which is approximately $63.75 million based on the Binance closing price of $1888.73. Unlike DeFi projects like Uniswap, Unibot, being a service provider, does not need to distribute fees to liquidity providers. If the daily revenue generation remains at $63.75 million, with 40% allocated to $UNIBOT holders, based on $UNIBOT's static data of $140 million market value, the P/E ratio of $UNIBOT would only be 1.5. If Unibot's data can continue to perform well, the $UNIBOT token will be highly competitive.

Robot trading fees and $UNIBOT trading tax ratio

According to the data in Dune, as of July 23rd, all expenses in Unibot reached new highs. The total cost on July 23rd, 337.54 ETH, was 2.35 times higher than the 143.55 ETH on July 22nd, directly driving the price of $UNIBOT to $140 on July 24th.

Using the data from July 23rd as an example, the cost generated by robot trading is 38.42 ETH, with approximately 300 ETH in fees generated by $UNIBOT's trading taxes. The proportion of trading taxes is around 89%.

Before this, there were also many MEME tokens that had transaction taxes, which were used to distribute to the team, token holders, burn, or add liquidity. However, the incentive effects generated by such tokens often cannot last.

Robot Transaction Fees

The transaction fees generated by the Unibot robot belong to "real revenue", but as mentioned above, this accounts for only about 11% of the total fees. The total trading volume generated by the Unibot robot in the past was 79.66 million US dollars, with a total of approximately 120,000 transactions, accumulating a fee of 396.92 ETH.

From Dune's data, it can be seen that robot transaction fees are also on the rise. The fees on July 23 were 1.65 times higher than the previous day, but the growth rate is not as high as $UNIBOT's revenue.

Sources of Unibot's Trading Volume

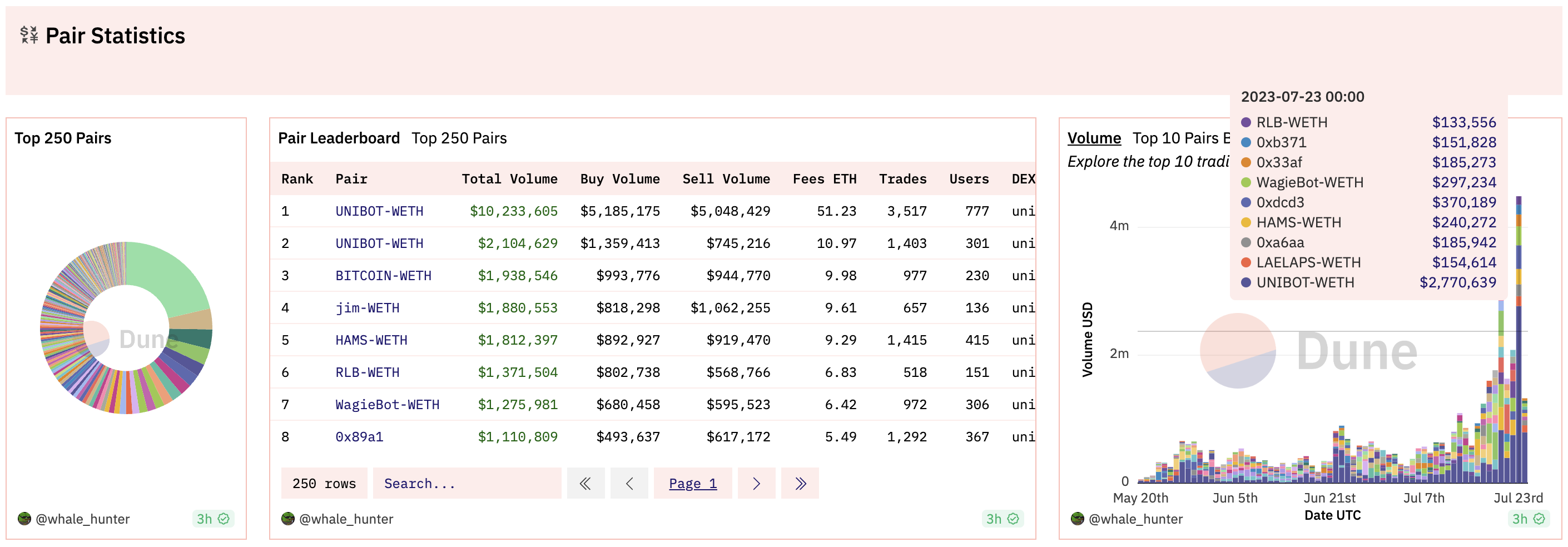

Using the data from July 23 as an example, in the top ten trading pairs by Unibot robot trading volume, the UNIBOT-WETH trading pair has an absolute advantage, being 7.5 times the volume of the second-ranked trading pair.

In the past 3 days of trading, excluding UNIBOT-WETH, 53.6% of the trading volume came from the HAMS-WETH pair. $HAMS is the token in the real version of the online hamster racing game Hamsters.gg.

In all Unibot transactions, the top tokens by trading volume also include popular tokens on Ethereum such as $BITCOIN, $jim, $RLB, and MEME coins. However, the sustainability of these tokens' popularity may be questionable.

Summary

The current static data of $UNIBOT is very attractive with a P/E ratio of only 1.5. However, approximately 89% of this comes from transaction taxes of $UNIBOT, with only about 11% coming from real profits generated by the trading bots. Typically, dividend offerings from transaction tax projects cannot be sustained in the long term.

A relatively high percentage of the trading volume of Unibot bots also comes from UNIBOT itself, in addition to projects like $BITCOIN, $jim, and $HAMS on Ethereum. This indicates that Unibot is indeed suitable for discovering popular projects, but the sustainability of the projects being traded is also a question.