Original author: Zen, PANews

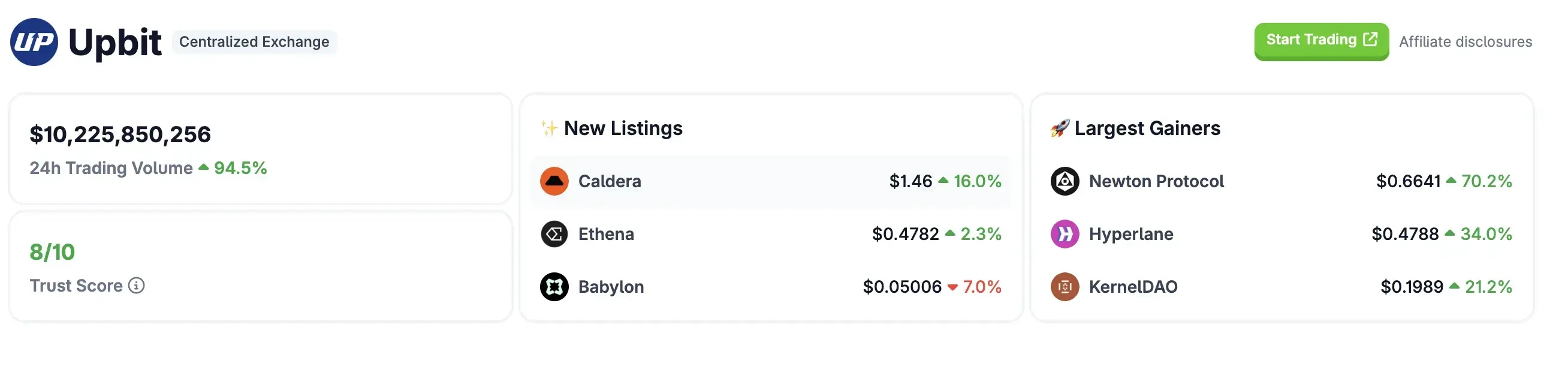

In July, the dormant Korean virtual asset market officially recovered and ushered in an explosive market with both volume and price rising. As of 8 pm on July 24, the 24-hour trading volume of Upbit, the cryptocurrency exchange with the largest market share in Korea, exceeded US$10.2 billion, an increase of 94.5%; Bithumb, the second largest market share exchange, also saw a surge, with a 24-hour trading volume exceeding US$3.2 billion, an increase of 61.5%.

Just before this wave of enthusiasm, liquidity at the bottom of the market had quietly accumulated. According to CryptoQuant data, from July 13 to 19, the stablecoin trading volume of the five major cryptocurrency exchanges in South Korea, including Upbit, Bithumb, Coinone, Cobbit, and Gopax, reached 2.226 trillion won (about 1.62 billion U.S. dollars).

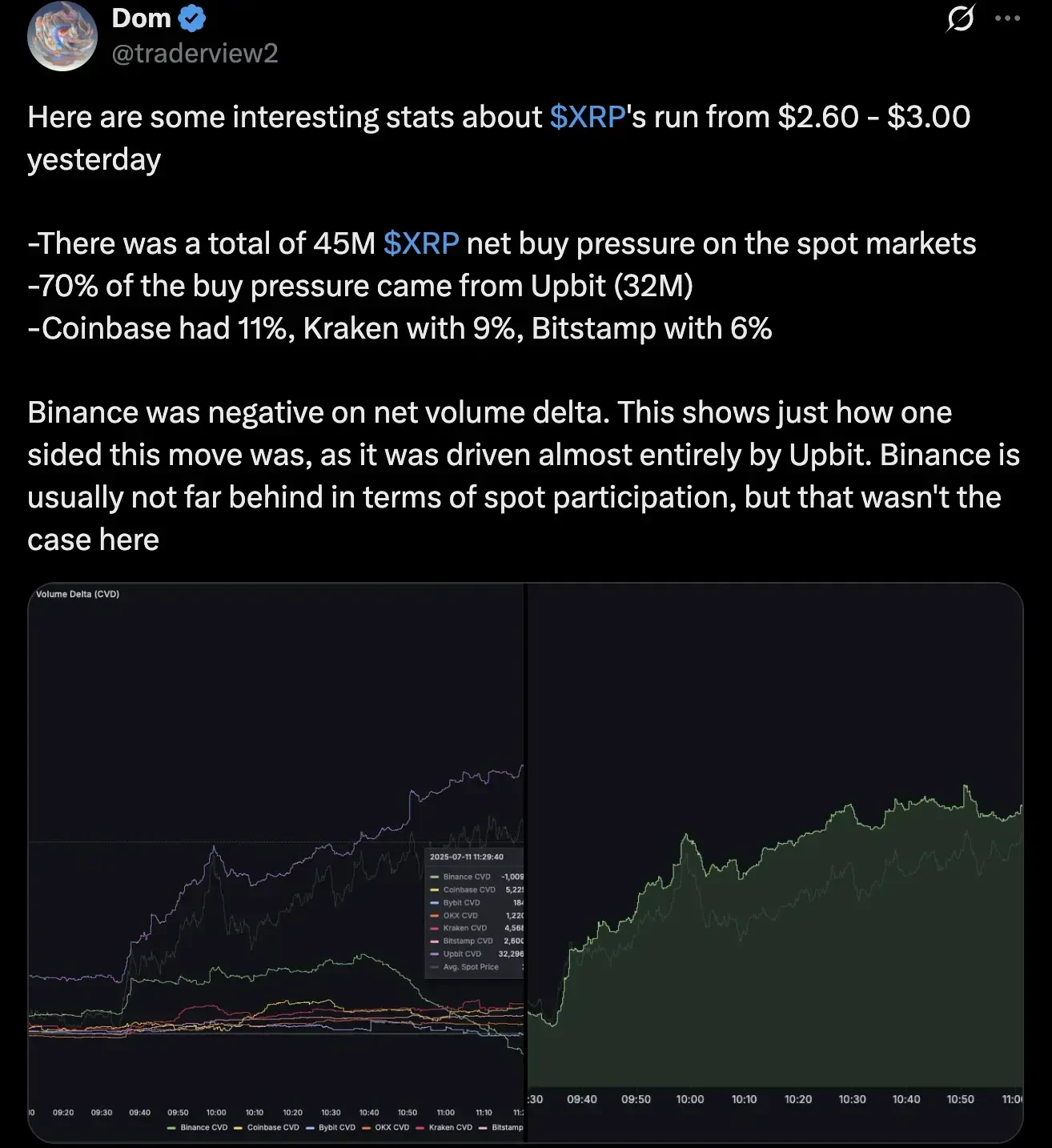

South Korean investors' high trading enthusiasm began to show when they frantically bought XRP tokens on July 11.

According to data shared by analyst Dom on the social media platform X, the token price rose from $2.60 to $3.00 within a few hours that day, with net buying pressure on XRP in the spot market totaling 45 million, of which 70% came from Upbit (32 million), Coinbase accounted for 11%, Kraken accounted for 9%, and Bitstamp accounted for 6%. This rise was almost entirely driven by South Korean buying.

XRP, which ranks just after Bitcoin and ETH in terms of total market value, is the favorite virtual asset of Korean investors, with about 15% of the world's trading volume coming from the country. The token broke through the $3.6 mark on July 18, surpassing the all-time high set on January 16 after a lapse of half a year. As of July 24, the price of XRP was about $3.16, and the 24-hour trading volume on Upbit reached $2.28 billion, ranking first among the platform's most popular assets.

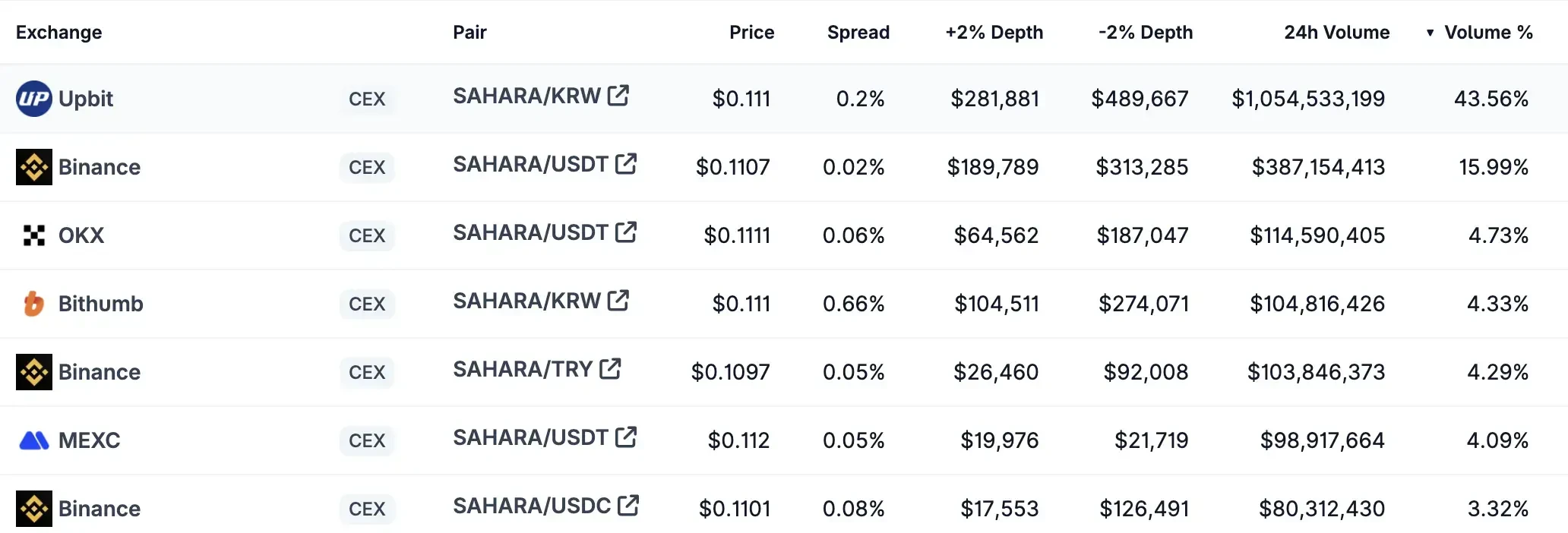

On July 23, the SAHARA token of Sahara AI, an “AI-native” full-stack blockchain platform, set off a second wave of climax. According to PANews, SAHARA’s highest daily increase was as high as 86%, ranking third in Upbit’s spot market transaction volume, accounting for 8.76% of the platform’s total transaction volume. Today, Korean investors continue to be enthusiastic about SAHARA trading. As of 8 pm on July 24, its trading volume in the past 24 hours reached US$2.3 billion, with 43.56% of spot transactions coming from Upbit and another 4.33% from Bithumb.

When the SAHARA token broke through $0.16 to reach a record high and then fell, the NEWT token of Newton Protocol, the verifiable automation layer of on-chain finance, began to take over.

NEWT was driven more by South Korean buying than SAHARA. As of 8 p.m. on July 24, the token had risen by more than 70% in 24 hours, and its trading volume in the past 24 hours reached $1.78 billion. 57.07% of the token's spot trading came from Upbit, and another 4.99% came from Bithumb. This is enough to show the concentration and explosive power of South Korean retail crypto investors.

In addition to the above-mentioned tokens, Korean crypto investors who prefer altcoins have also driven the rise of tokens such as Hyperlane, Babylon, HUMA, LISTA, MERL, etc.

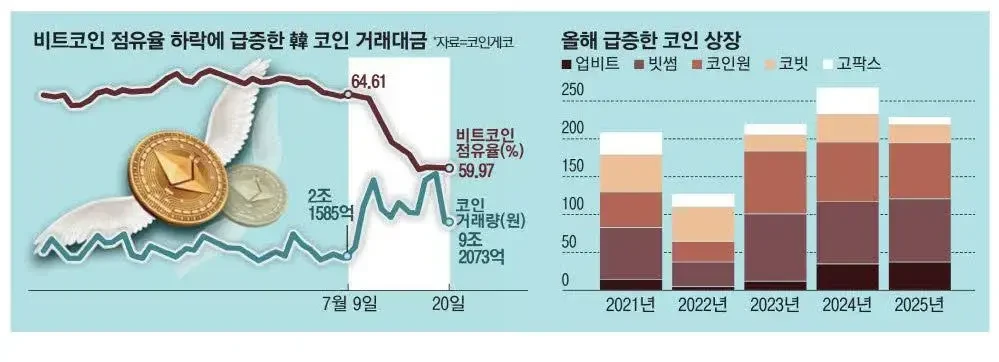

In addition, with Bitcoin reaching its historical high, ETH making a comeback, and the regulatory environment constantly improving, the pace of listing coins on Korean exchanges has also significantly accelerated.

According to the Korean media Maeil Business Newspaper, as of July 21, the five major virtual asset exchanges in South Korea, Upbit, Bithumb, Coinone, Cobbit, and GoFox, have listed a total of 229 Korean won virtual assets, accounting for 85.44% of the 268 Korean won virtual assets last year. Upbit and Bithumb have listed 37 and 84 Korean won virtual assets respectively this year, exceeding the number of listings last year (35 and 82 respectively). According to this trend, Upbit and Bithumb are likely to launch the most cryptocurrencies in the past five years this year.

This "coin listing fever" not only provides more footholds for speculative funds, but also makes the market hot spots constantly change. The intensive influx of funds and rapid rotation are also accompanied by significant volatility risks: XRP and SAHARA have experienced a short-term correction of more than 10%, and the contract liquidation orders are concentrated. If the liquidity suddenly reverses, the price will face violent fluctuations.

CryptoQuant analysts have also warned that the behavior of Korean investors will change dramatically when the altcoin boom finally arrives. Therefore, Korean investors' enthusiasm for altcoins often exceeds that of overseas markets against the backdrop of a surge in new capital inflows. Therefore, in small investments, FOMO plays a crucial role in this environment, sometimes bringing huge risks to the savings portion.

- 核心观点:韩国加密市场7月量价齐升,散户主导山寨币热潮。

- 关键要素:

- Upbit单日交易量破102亿美元,涨幅94.5%。

- XRP 70%买盘来自韩国,价格突破3.6美元。

- SAHARA、NEWT等代币涨幅超70%,韩国交易占比超40%。

- 市场影响:山寨币投机加剧,波动风险显著上升。

- 时效性标注:短期影响。