Data review of the operations of "crypto concept stock big player" Chuanmu

Original | Odaily Planet Daily ( @OdailyChina )

Author: Wenser ( @wenser 2010 )

As time enters 2025, there are only two types of KOLs still active in the crypto market: one is those who make profits or bear losses by opening contracts in a volatile market; the other is those who flexibly adjust their direction in a market with ever-changing trends and countless wind directions, and play whatever is hot. After the crypto KOL Chuanmu (@xiaomucrypto) proved his contract opening ability through activities such as the 500U real-time challenge, he has attracted a lot of market attention again in recent months through waves of crypto concept stock trading operations.

Although there are some voices in the market questioning its "using fans as exit liquidity", judging from its public operations on crypto concept stocks, the relevant entry timing and exit points still have certain reference value. In this article, Odaily Planet Daily will briefly analyze the three major investment targets mentioned and traded by Chuanmu in recent months, Circle (CRCL), Guotai Junan International and SBET, as cases for readers' reference.

Chuanmu SBET operation review: from refusing to enter the market to leaving the market with profit

On May 27, Sharplink Gaming officially announced the financing and issuance of additional shares to establish ETH reserves. Subsequently, SBET once rose to more than US$100. As a trader with a keen sense of smell, Chuanmu also paid attention to this stock at the first time and thus experienced a rather ups and downs trading journey.

The ups and downs of the "four imprisonments": from selling at a loss to making a profit of more than 1 million

On May 28, Chuanmu posted a statement saying : "This sbet cannot be bought. It has issued 69.1 million shares. On the 29th, the market value will increase from 30 million to more than 3 billion US dollars... Many people are confused." From the words, it was quite wary of "Sharplink Gaming raising its market value by issuing additional shares", but soon, it changed its mind and resolutely entered the market of crypto concept stocks such as "ETH version of Strategy".

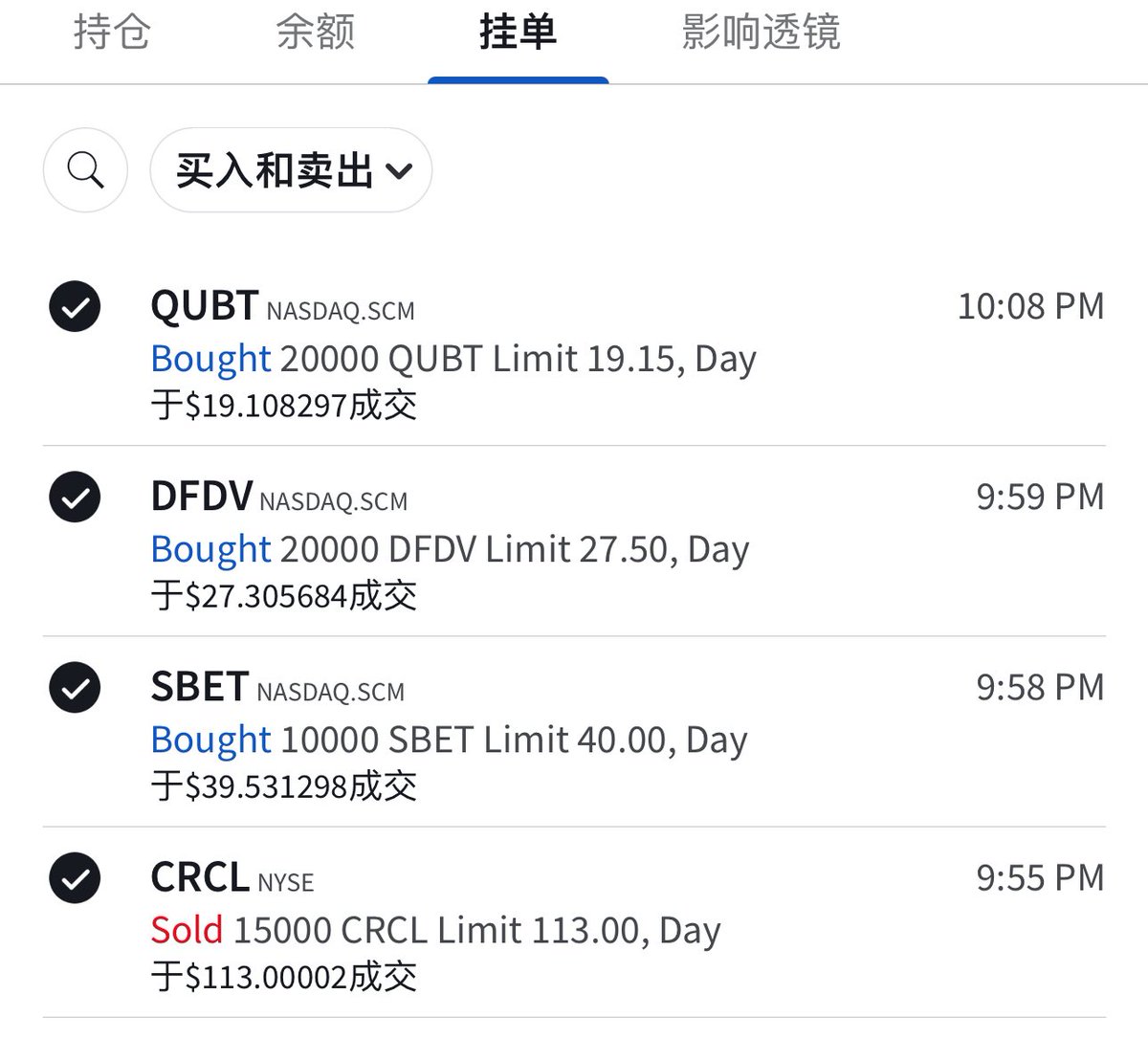

Around 10 pm on June 11, as Sharplink completed $425 million in financing and gradually bought ETH, SBET's stock price gradually stabilized, and Chuanmu no longer hesitated and bought 10,000 shares of SBET that day, with an average purchase price of about $39.5. It is worth mentioning that it also bought 20,000 shares of dfdv at an average price of $27.3 and 20,000 shares of qubt at an average price of $19.1; in addition, it also sold 15,000 shares of CRCL at an average price of $113.

Purchase records published by Chuanmu himself

And just one and a half hours later, he quickly sold part of his position : 9,000 shares of SBET at an average price of $44.5, making a profit of $45,540 on a single transaction.

Chuanmu selling record

On June 13, SBET once fell by more than 60% after the market closed. Chuanmu wrote an angry post saying : "There are really not many good people in the cryptocurrency project. The purer the cryptocurrency project, the more dangerous it is. SBET fell 60% after the market closed. This scumbag messed up eth's micro-strategy. And NM eth Lianchuang attracted a lot of cryptocurrency institutional investors. They are all fucking scumbags."

On June 17, Chuanmu made a comment in a blogger’s comment section, saying that SBET might be a project in which Dovey (Wan Hui), the founder of Primitive Capital, participated, and he dared not touch it again.

But soon, as Sharplink continued to buy ETH and once jumped to become the listed company with the largest ETH holdings, the market once again responded promptly:

On July 9, the price of SBET rebounded to around $15.35, with a 24-hour increase of more than 21%. Chuanmu posted a message saying : "Today I thought of something that might be interesting, and I was too biased before. ETH's micro-strategy may have more advantages in financing than BTC, because the pledged ETH can pay interest. It can support financing with higher interest rates, and there is no need to worry about not being able to pay the interest with a steady stream of financing. SBET may have a very big imagination, and I was biased before." Subsequently, he posted that he re-entered SBET at an average price of $15.3; later, he again purchased 40,000 shares of SBET at an average price of $17.1 .

On July 10, he posted that he had sold 50,000 shares of SBET at an average price of $186,000, leaving 100,000 shares, and threatened that "I plan to hold on to the rest, and if SBET falls, I will buy back another 50,000 shares." On July 11, he posted again to express his optimism about SBET, saying that "if ETH breaks 3,000, SBET is likely to rise to 28 yuan in one go."

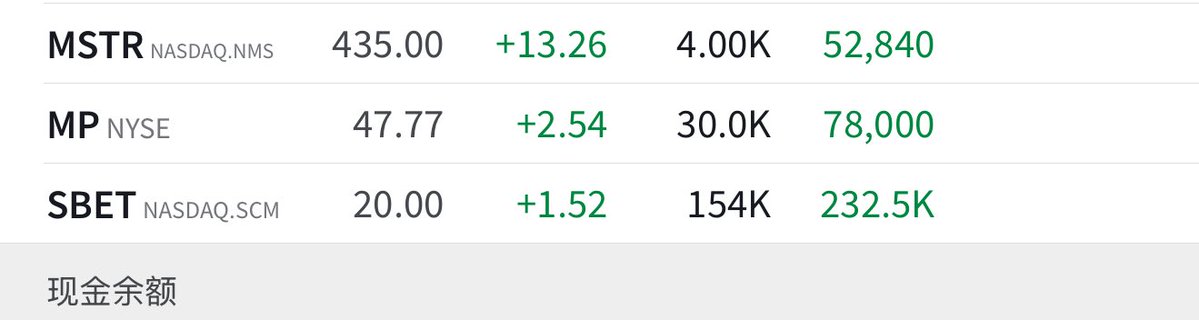

According to the tweet information at around 1 pm on July 11, Chuanmu held about 154,000 shares of SBET at that time, with a floating profit of about US$232,000; that night, he posted a message saying that he had sold all his SBET shares at an average price of US$21.5. If calculated based on 154,000 shares, his single profit was about US$465,000.

Chuanmu's holdings on July 11

Chuanmu's second clearance of SBET screenshot

But soon, the continued rise in prices verified Chuanmu's speculation that he had missed out on the opportunity. On July 14, he bought 100,000 shares of SBET again at an average price of $23.8 . On July 15, the transaction made a floating profit of about $100,000 . In the end, he liquidated SBET for the third time at an average price of $25.75 , making a profit of about $195,000 on a single transaction.

But soon, he once again had a "moment of regret" - on July 16, he once again bought 130,000 shares of SBET at a price of about US$28.3 . Soon, SBET rose to nearly US$44 before the market on July 17. Chuanmu posted a message calling it "violent", and on the other hand, he may have started his own position switching operation - from SBET to BTCS.

Of course, after Sharplink Gaming announced that it plans to raise $5 billion to continue to increase its holdings of ETH, SBET is still one of the market focuses. Chuanmu’s latest comment on SBET was a tweet on July 20. He believes that “the most conservative estimate for sbet is that after the 5 billion additional issuance, the market value will be 1/1 of the ETH holdings, (then its stock price is about) $13. A better estimate is 1.5 times, which means it will fall to $19.4. A more optimistic estimate is 2 times, which means it will fall to $25. Then, because of the continuous purchase of ETH, the flywheel will continue to rise.”

Since then, based on public information alone, it is conservatively estimated that Chuanmu’s earnings from a single SBET stock are over $800,000 to $1 million.

Chuanmu Guotai Junan operation review: bought 4 million shares and made HK$3 million in 2 days

On June 24, Guotai Junan International was approved to upgrade its license to provide virtual asset trading services. The next day, Chuanmu bravely attacked and staged a textbook "top escape" operation. It must be said that in this case, Chuanmu accurately grasped the "market sentiment trading law". Although it does not have much regularity and reproducible value, it can still be used as a trading case study.

Fast Hong Kong stock trading: only takes 2 days

On June 25, Chuanmu bought 4 million shares of Guotai Junan International (01788.HK) in two batches, with an average price of HK$2.45.

Screenshot of Chuanmu's post

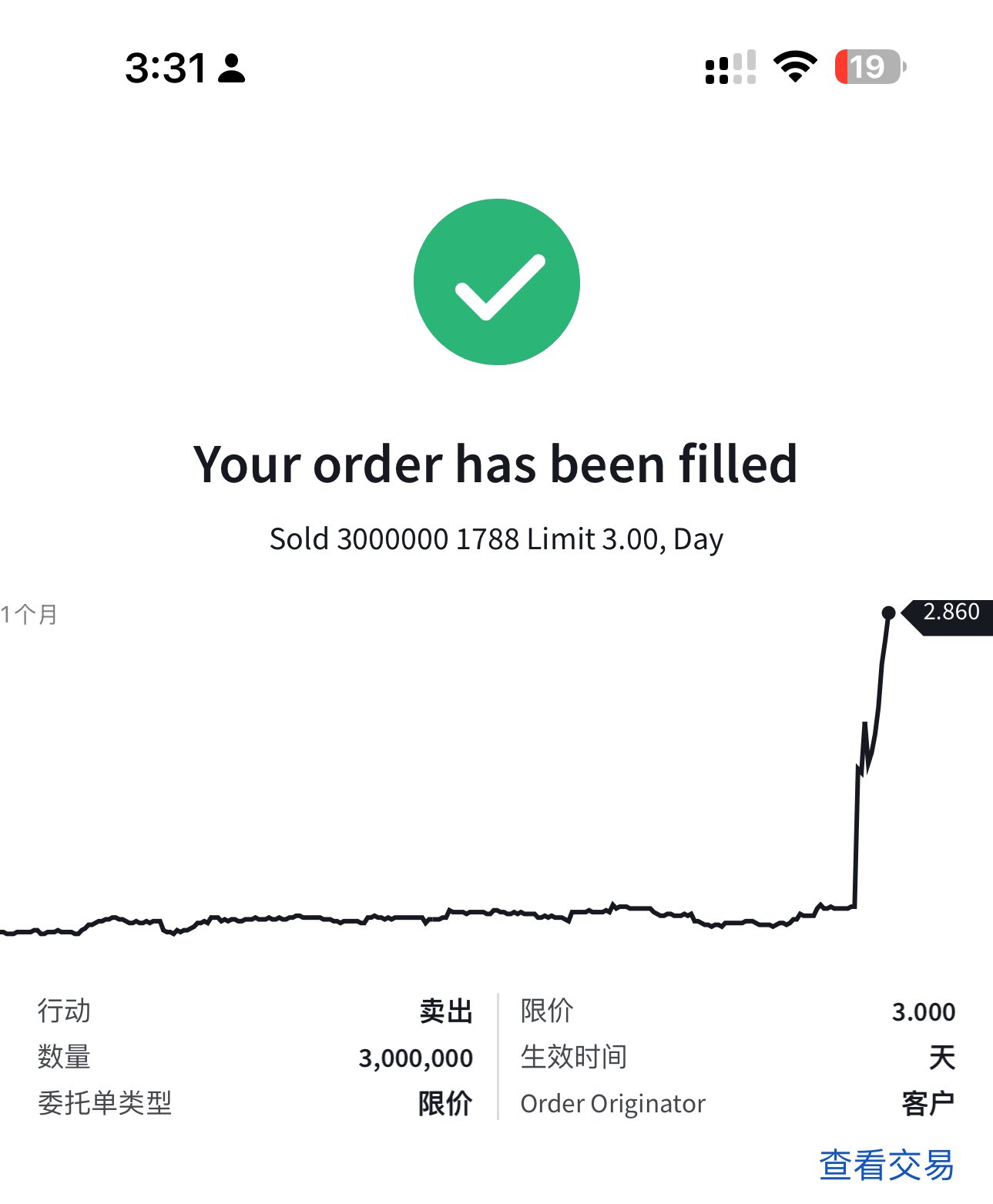

Driven by market sentiment, the price of Guotai Junan International (01788.HK) has been rising. Chuanmu sold 3 million shares at HK$3 , leaving 1 million shares. According to his own post , this transaction alone made a profit of about HK$2.5 million.

Chuanmu selling screenshot record

In addition, it is worth mentioning that as early as June 25, based on the logic of cryptocurrency brokers, Chuanmu bought 40,000 shares of Robinhood (HOOD) at US$84.4, although the stock price fell to around US$82.1 that night, resulting in a small loss.

In the end, according to his own statement , the final profit was about HK$3 million.

Chuanmu CRCL operation review: 6 transactions made over a million US dollars

In early June, Circle (CRCL), which landed on the U.S. stock market with the concept of "the first stablecoin stock", completed a terrifying increase from around US$30 to nearly US$300 in just a dozen days. During this process, Chuanmu also relied on his bold and careful operations to roam the U.S. stock market and earned millions of dollars in profits.

First trade: profit of nearly $800,000

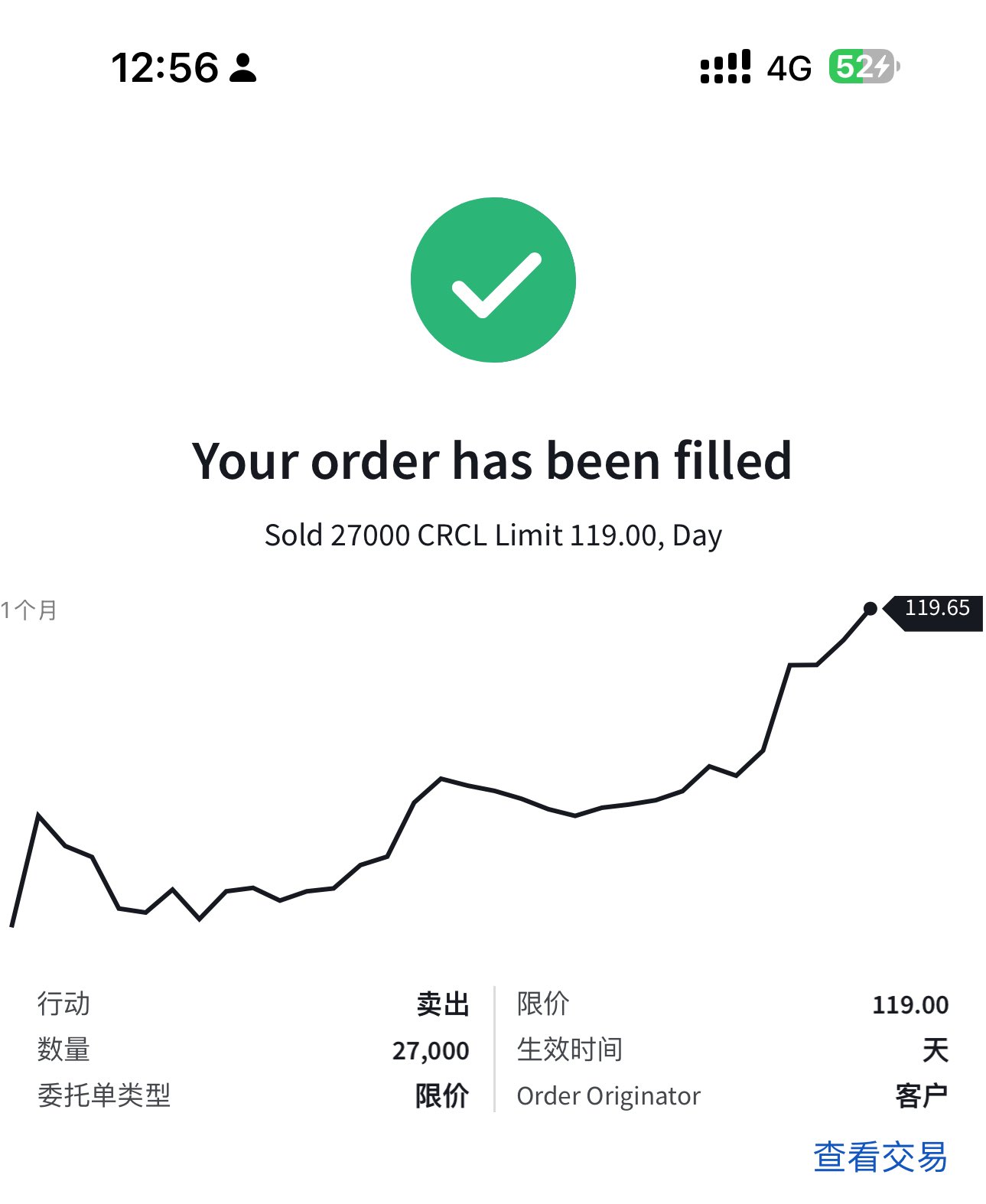

On June 6, Chuanmu chased the high price with tears in his eyes and bought 30,000 shares of CRCL at an average price of US$98 ; finally, in the early morning of June 7, he successfully sold 27,000 shares at US$119, making a profit of approximately US$700,000 .

Screenshot of Chuanmu's selling record

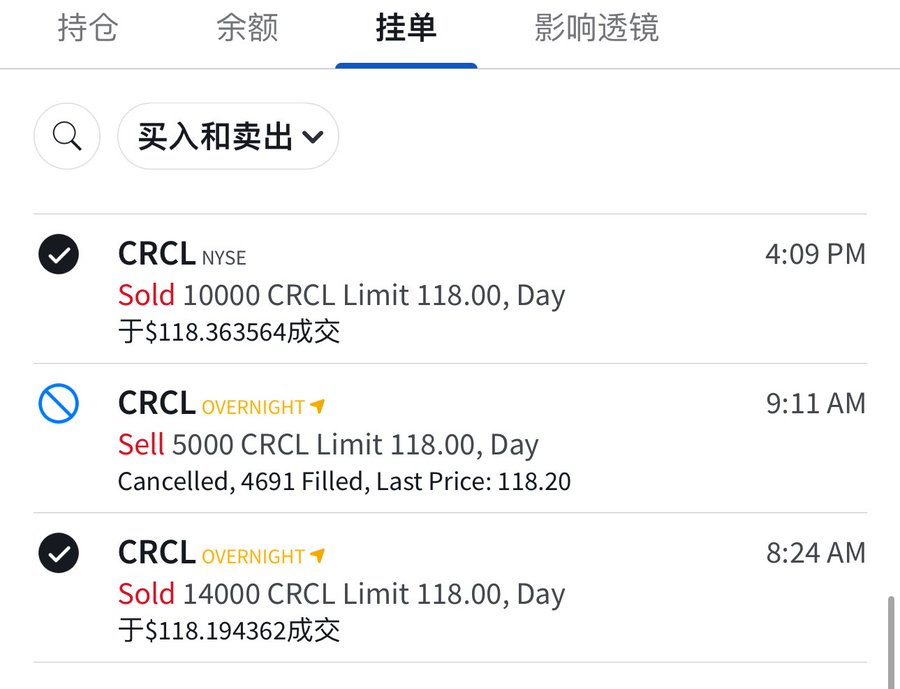

Just two hours later, Chuanmu bought back 20,000 shares of CRCL at an average price of $113.6 , and sold 18,000 shares at an average price of $118 on June 9, making a profit of about $80,000 per transaction, and still holding about 10,000 shares of CRCL . On that day, CRCL rose nearly 30%, and its share price soared to around $128 .

Second transaction: 30,000 shares of CRCL, profit over $160,000

On June 9, Chuanmu again bought 30,000 shares of CRCL at an average cost of US$111 .

On the morning of June 10, it sold 14,000 shares at an average price of $118; in the afternoon, as the price of CRCL broke through $119, it sold another 10,000 shares at $118 , leaving about 6,000 shares.

Screenshot of Chuanmu's second selling transaction

Since then, in the second transaction, Chuanmu has accumulated a profit of approximately US$168,000.

Third transaction: profit of nearly $350,000

At 9 pm on June 10, Chuanmu bought another 30,000 shares of CRCL at an average price of $108. On June 11, it sold 15,000 shares of CRCL at $113 (also mentioned above), with a single profit of about $75,000.

On June 11, he posted that he still held 25,000 shares of CRCL. Based on the share price of $118 at the time, his accumulated floating profit was approximately $405,000.

Screenshot of Chuanmu Fuying

On June 16, Chuanmu's CRCL holdings increased again to 30,000 shares, and its average holding price also rose to around US$133.5. At that time, its position had a floating profit of approximately US$208,000.

Screenshot of Chuanmu Fuying

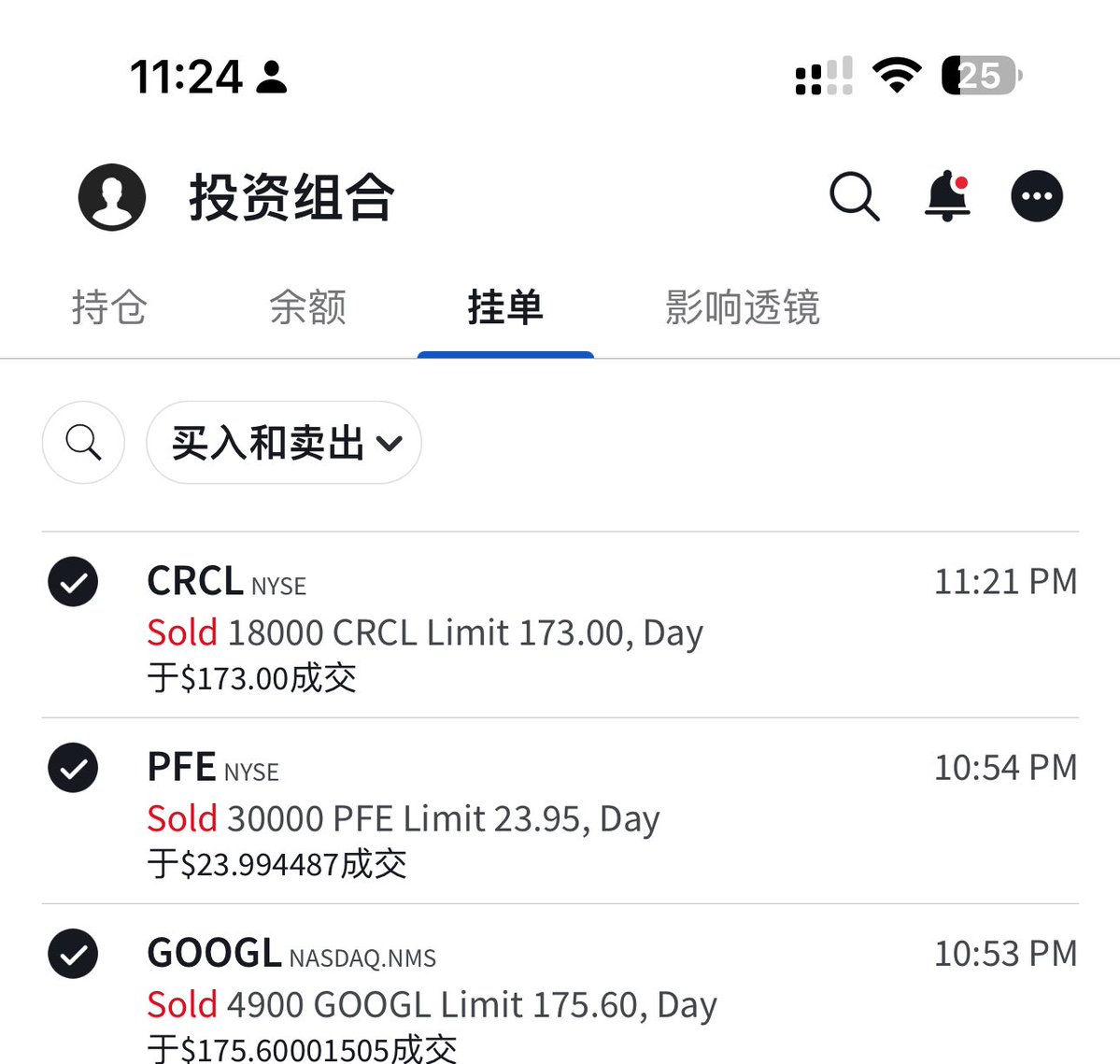

On that day, he sold 20,000 shares at an average price of $142 , and his initial profit was estimated to be nearly $170,000; the last 10,000 shares were sold at an average price of $143.5 , with a profit of about $100,000.

Fourth transaction: Profit of about $90,000

On June 18, Chuanmu himself posted again, saying that the CRCL band was getting smaller and smaller, and the position was reduced from 40,000 shares to 18,000 shares . At that time, the price of CRCL had soared from around US$140 to around US$172, and Chuanmu's position had a floating profit of about US$70,000. On the same day, he sold all 18,000 shares of CRCL at an average price of US$173 , with an estimated profit of about US$90,000.

Screenshot of Chuanmu selling

The fifth transaction: Affected by Cathie Wood’s stock crash, the loss was about $15,000

On June 25, Chuanmu again bought 15,000 shares of CRCL at an average price of $226.5 . Soon after, due to the news that Cathy Wood sold $100 million worth of Circle shares, Chuanmu liquidated its position at $225.5.

The original intention was to try to rebound the market, but due to the news of "big guys dumping the market", they had to cut their losses. In this respect, Chuanmu's situation is very similar to ours.

Screenshot of Chuanmu's clearance tweet

Sixth transaction: Profit of about $270,000 again

On July 15, after nearly 20 days, Chuanmu made a comeback and once again bought 15,000 shares of CRCL at an average price of $202 .

Buy screenshot

The next day, CRCL suddenly collapsed to around US$191, and Chuanmu cried helplessly again: "Buried alive."

But soon, CRCL rose again to $209, and Chuanmu came back to life . Subsequently, the price of CRCL soared by more than 10% to around $218 .

Finally, Chuanmu chose to sell the last 5,000 shares of CRCL at $220 . The estimated cumulative profit from this transaction is about $270,000.

Since then, after 6 transactions, Chuanmu’s total profit from CRCL stock alone is about 1.65 million US dollars.

Conclusion: If you don’t have wisdom, you must know how to follow and run.

Overall, Chuanmu's grasp of the buying and selling points of crypto concept stocks is relatively accurate. If you have a certain stock trading investment foundation, you can also use it as a reference coordinate. As the saying goes, "If you don't have wisdom, you have to follow."

However, it is worth noting that there are two problems with this type of transactional KOLs sharing information and opinions: 1. Sometimes they are limited by the speed of information dissemination or the lag in market sentiment reaction. After they build a position and buy, they release relevant information, and their fans can easily become their "takeover targets", especially in market transactions with poor liquidity. Participate with caution; 2. They are often also part of the "followers", such as Cathie Wood and well-known institutions. Sometimes they are at the end of the information flow channel, which makes them prone to chasing ups and downs. It is recommended that they enhance their own information screening and investment judgment capabilities, and do not blindly believe everything.

After all, most of the time, investing is a game of "running fast."