By: lesley@footprint.network

In June, although the encryption market rose sharply, and Bitcoin broke through 30,000 US dollars, setting a new high in currency prices in 12 months, the NFT market failed to rise at the same time, and user activities and financing were relatively flat.

NFT is no longer just a digital collectible. The attempts of many Web2 brands are gradually diversifying the application scenarios of NFT. For example, Louis Vuitton (Louis Vuitton) launched a 39,000 euro high-end"Treasure Trunk "NFT series.

Azuki, famous for its anime style, launched a new series of Azuki Elementals, which was criticized by the community, highlighting the importance of value creation and community participation to the success of NFT projects.

The data for this report comes from Footprint Analytics NFT Research page. This page provides an easy-to-use data panel, which contains the most important data indicators to understand the NFT industry, and is updated in real time. you canclick hereFind the latest information on the NFT marketplace, individual projects, funding and more.

Key Points

Crypto Market Overview

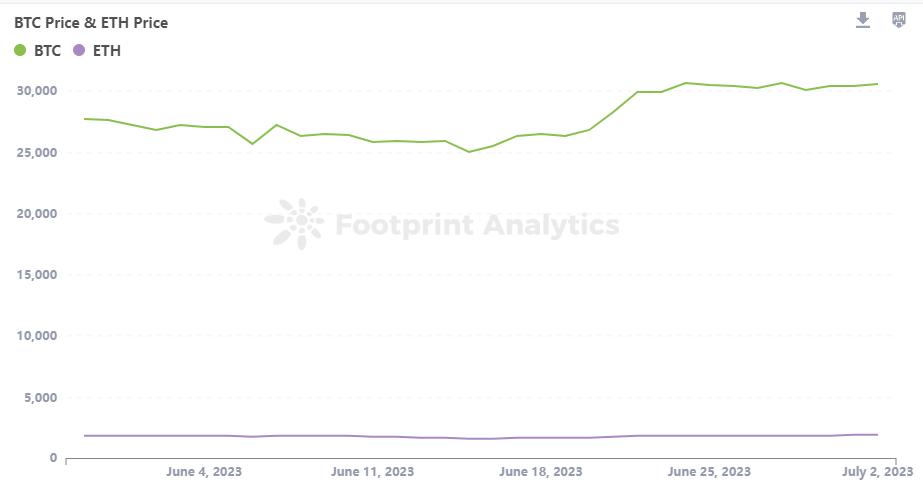

In June 2023, Bitcoin experienced ups and downs, and on June 22 it reached a 12-month high of $31.2k. In the volatile crypto market, the price of Bitcoin has maintained a continuous upward trend.

On June 22, Bitcoin unexpectedly crossed the $30,000 mark. By the end of June, Bitcoin closed at $30.4k, indicating that $30k has become a solid support point.

NFT Market Overview

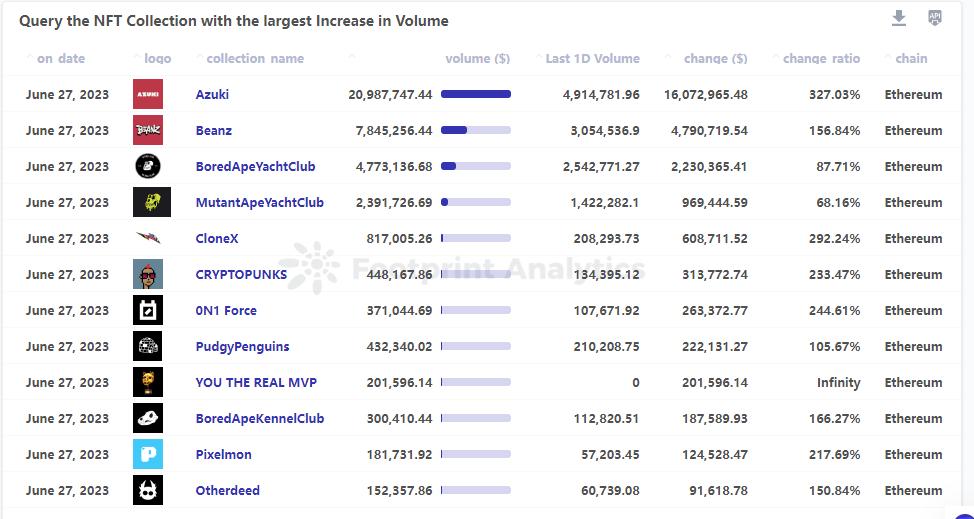

Volume hit 61.45 million on June 27, thanks in large part to Azuki, with 20 million in a single series.

NFTs are not just digital collectibles, but can help revolutionize multiple industries.

Public chain and NFT trading market

Ethereum still dominates the NFT market. In June, Ethereum’s transaction volume accounted for 97.7% of the total NFT transaction volume.

Although the BNB chain performs poorly in terms of transaction volume, its wash trade ratio (42.14%) is the highest among all chains.

Although OpenSea Pro was launched in April, data to date does not show the launch of OpenSea Pro having a significant impact on Blurs dominance in terms of transaction volume.

NFT investment and financing situation

This month, the financing market in the NFT field appears relatively deserted, with only two major financing events.

Hot of the Month: Azuki Elementals

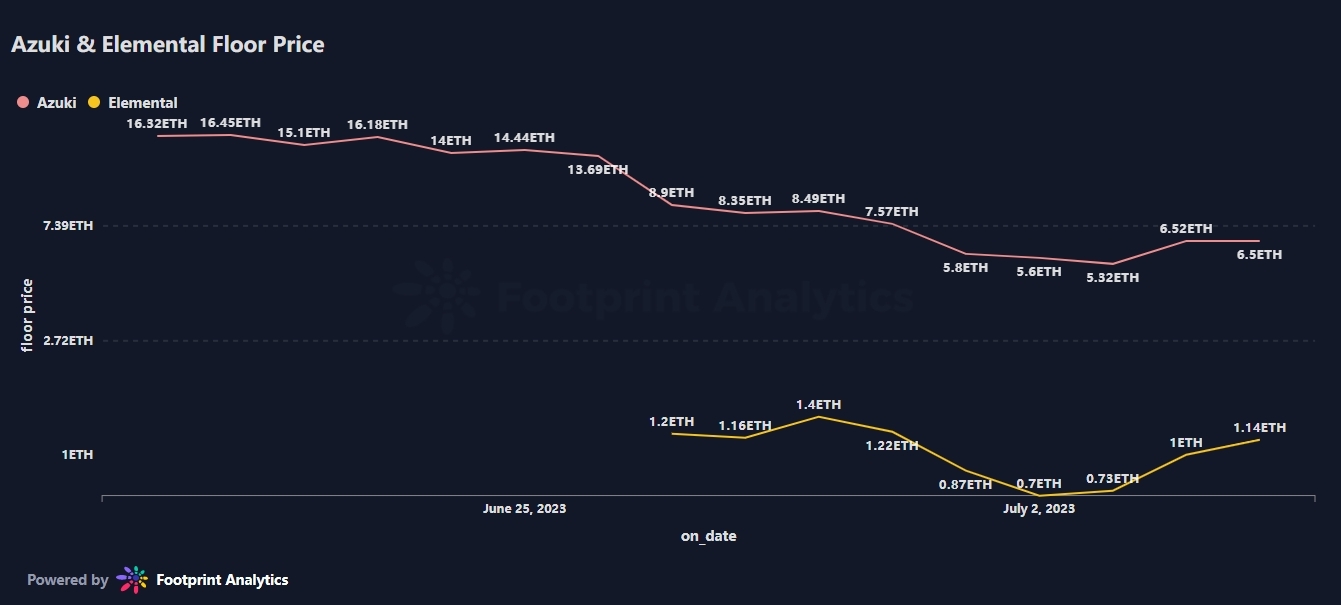

At the end of the month, the minimum selling price of Azuki had dropped sharply to 7 ETH, and the floor price of Azuki Elementals also fell below the coinage cost price of 2 ETH.

Important news

NFT work Goose sold for $6.2 million at Sothebys auction

Louis Vuitton sells limited edition NFTs to select customers, priced at 39,000 euros

BAYC #2758 will star in a Hollywood movie

Azuki team made $38 million in sales in 15 minutes

BYTE CITY pays tribute to Bruce Lee with an immersive metaverse experience

Crypto Market Overview

In early June, the U.S. Securities and Exchange Commission (SEC) ramped up its oversight efforts, filing lawsuits against Binance and Coinbase, two of the worlds largest cryptocurrency exchanges. As a result of these regulatory actions, Bitcoin price fell, falling to $24.7k.

However, on June 22, Bitcoin broke through the $30,000 mark. By the end of June, Bitcoin closed at $30.4k, indicating that $30k has become a solid support point. This stellar performance may have been fueled by positive news in the cryptocurrency space, such as Blackrocks resubmission of a bitcoin spot ETF application, which may have boosted optimism in the market.

The encryption market seems to be entering a period of consolidation, gradually being better able to face regulatory trends and market turmoil.

NFT Market Overview

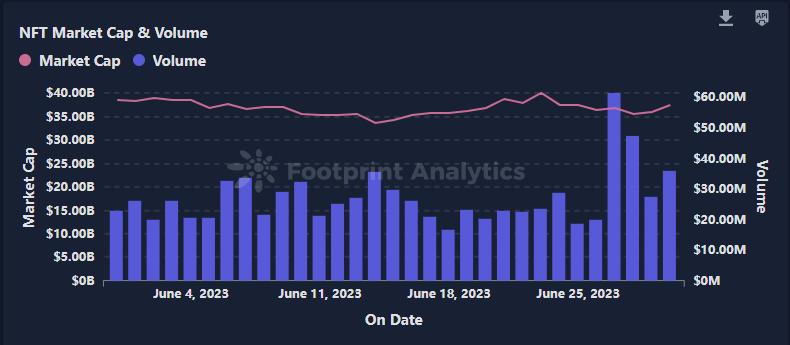

The NFT market gradually cooled down, with the market value declining slightly to $35.86 billion.

In terms of trading volume, the NFT market experienced some volatility in June. At the beginning of the month, the transaction volume was 26.2 million, dropped to a low point of 16.59 million by June 18, and rebounded to 35.86 million at the end of the month. Volume hit 61.45 million on June 27, thanks in large part to Azuki, with 20 million in a single series.

NFT Volume by Collection on June 27

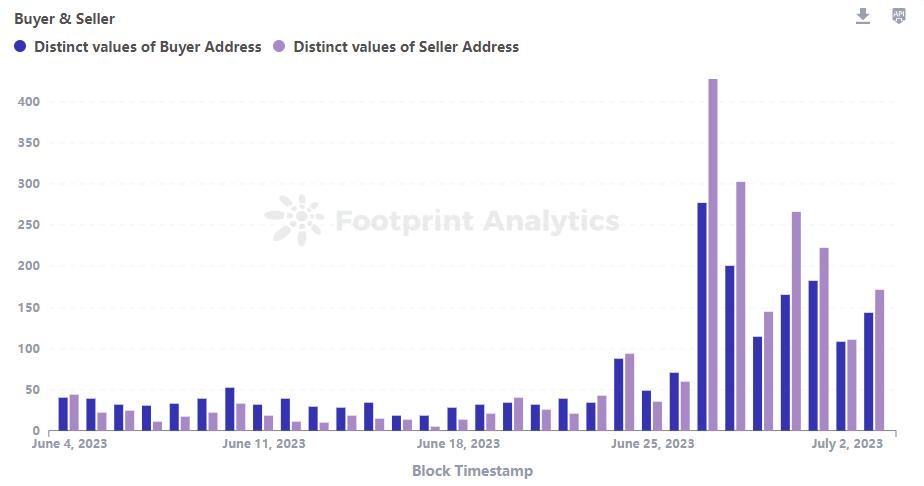

The launch of Azuki Elementals on June 28 resulted in a significant increase in transaction volume. However, there was soon a massive sell-off due to image quality issues, which also affected community sentiment towards the Azuki series. On that day, there were twice as many sellers as buyers of the Azuki range. This massive sell-off represents the markets reaction to the Azuki Elementals incident.

This surge in trading volume underscores the sensitivity of the NFT market to news and developments. In this highly volatile market, it is critical for investors to remain informed and cautious.

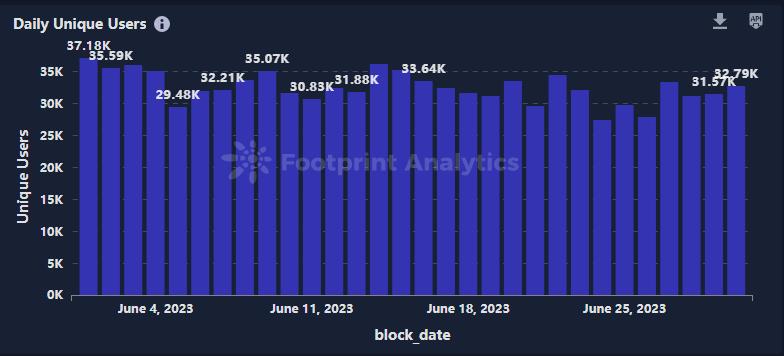

From the perspective of active users, the NFT market is relatively stable, with the number of active users remaining at around 30,000. However, over the long term, the number of active users continues to decline. In particular, current user activity is about a quarter of the peak compared to the peak on January 27 this year (129.39 k active users).

Despite the slowdown in the secondary market, there are still companies exploring and expanding its possibilities in the NFT space. For example, Louis Vuitton launched a high-end treasure chest NFT series, priced at 39,000 euros, which promoted the integration of luxury goods and digital collectibles.

A rendering from the Louis Vuitton digital Treasure Chest NFT collection

In addition, Boring Ape BAYC#2758 will star in Hollywood movies, showing the potential of NFT in content creation and intellectual property.

NFTs are not just digital collectibles, but can help revolutionize multiple industries. As more brands and industries experiment with and adopt NFTs, we can expect to see a wider range of applications and use cases beyond the traditional realm of art and collectibles. This diverse application scenario may be a key driver for the next wave of growth in the NFT market.

Public chain and NFT trading market

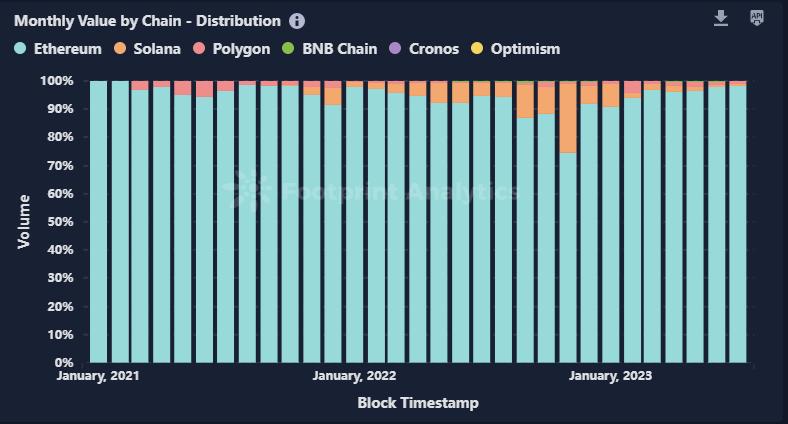

Ethereum still dominates the NFT market. In June, Ethereum’s trading volume accounted for 97.7% of total NFT trading volume, solidifying its position as the preferred platform for NFT trading. This dominance continues to rise, with Ethereum’s market share increasing slightly every month, according to 2023 data.

This trend shows that users especially rely on Ethereum for high-value transactions during the bear market. Ethereums established reputation, security, and widely recognized technical capabilities are all critical to the operation of NFT.

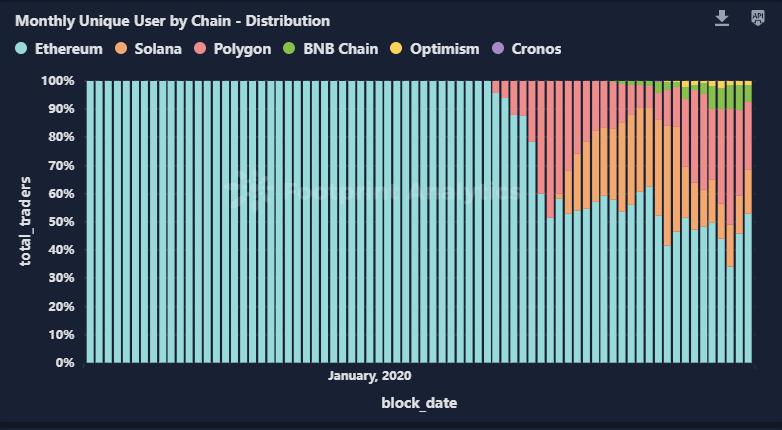

Over the past three months, Ethereum has not only maintained its dominance in NFT transactions, but its proportion of unique users has also gradually increased. Although other public chains have the advantage of low Gas Fee, most users still prefer to use Ethereum for NFT transactions.

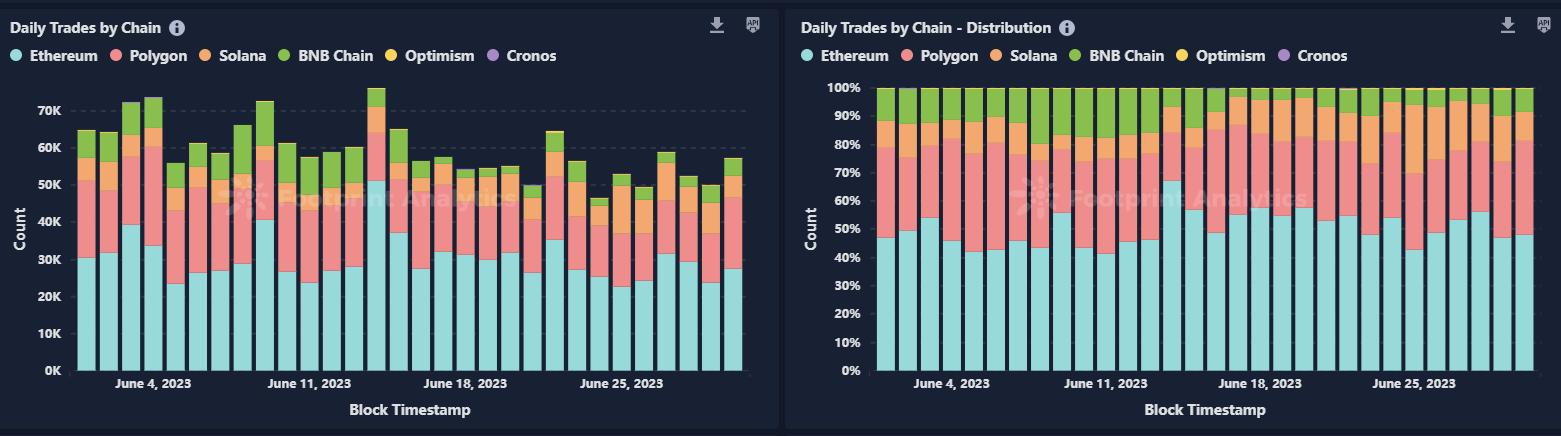

In terms of the number of transactions per day, Ethereum is still far ahead, but Polygon and Solana are not far behind, ranking second and third respectively. Ethereum accounted for 50.34% of the volume, Polygon 28.38%, and Solana 10.92%.

Although Ethereum still dominates, the high number of transactions on Polygon and Solana shows that these platforms are also the main contenders in the NFT space. Lower transaction fees and faster transaction times attract many small traders.

In June, although the BNB chain underperformed in terms of transaction volume, its wash trading ratio (42.14%) had the highest value among all chains.

Wash trading refers to traders buying and selling the same asset at the same time, artificially increasing the trading volume, which may cause people to misunderstand the market activity and liquidity of the BNB chain, thereby affecting investment decisions. This month, Pentas NFT, Alpaca Finance NFT, Binance Regular NFT, and morespecific itemsThe dish washing rate exceeds 90%.

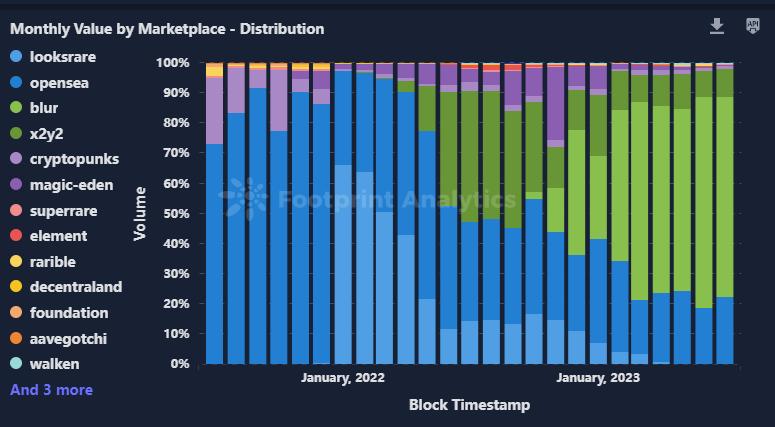

In terms of transaction volume, Blur has always dominated the market, accounting for nearly 70% of the transaction volume in June. The old NFT market OpenSea accounts for 22%. It launched OpenSea Pro in April, mainly targeting professional NFT traders. However, data to date does not show that the launch of OpenSea Pro has had a significant impact on Blurs dominance in terms of transaction volume.

However, from the perspective of both the number of transactions and the number of users, OpenSea continues to maintain its leading position with a market share of nearly 70%.

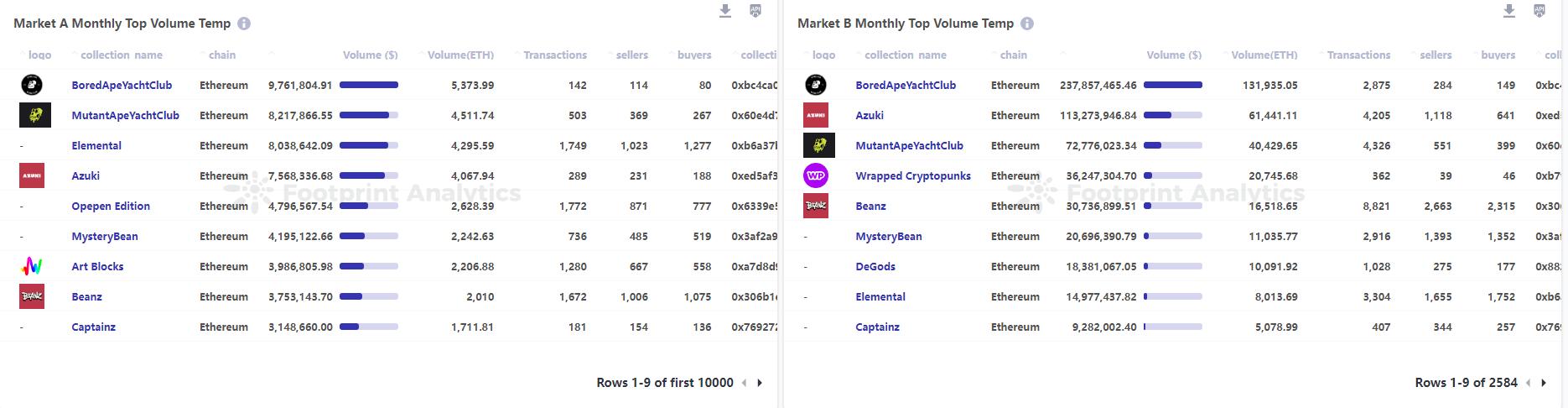

When we looked at Bored Ape Yacht Club (BAYC), the most traded NFT series on Opensea and Blur, we found surprising differences. BAYCs trading volume on Blur is 24.6 times that on OpenSea, but its number of buyers is only 1.86 times that of OpenSea. This phenomenon shows that although the transaction volume on the Blur platform is very large, the number of independent buyers participating in these transactions is relatively small.

While Blur may be the platform of choice for high-value transactions, OpenSea remains the platform of choice for many more users.

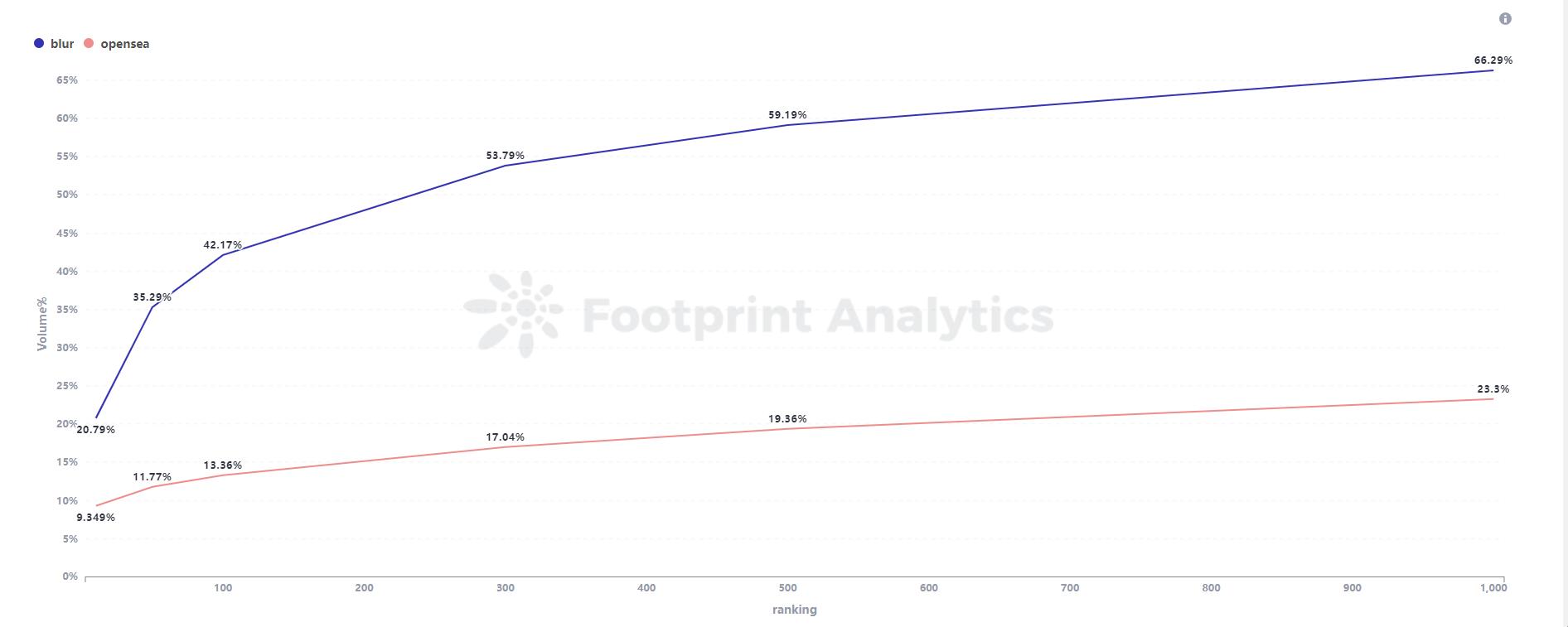

In addition, we observe that most of Blur’s transaction volume is concentrated in a relatively small number of wallet addresses. To be more precise, the transaction volume of the top 300 wallet addresses accounted for 53.79% of Blur’s total transaction volume. Relatively speaking, on the OpenSea platform, the top 300 wallets only contributed 17.04% of the transaction volume.

This data shows that on Blur, the volume of head buyers is much higher than on OpenSea, and relatively few high-volume buyers or investors are driving the majority of Blurs transaction activity.

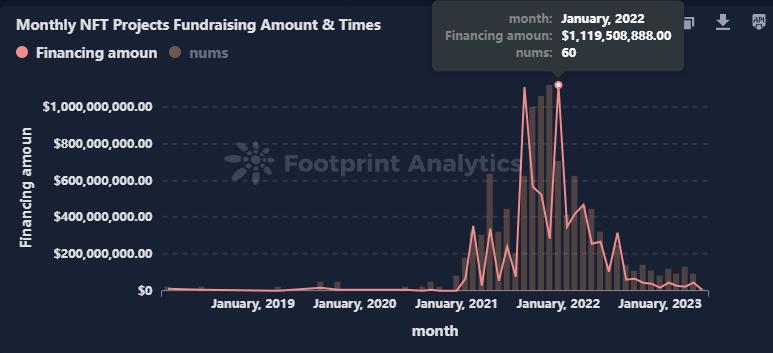

NFT investment and financing situation

This month, the financing market in the NFT field appears relatively deserted, with only two major financing events. Due to market uncertainty and regulatory issues, financing activities have dropped significantly and investors have become more cautious.

On June 14, the AI-poweredNFT data platform MnemonicCompleted a $6 million seed expansion round led by Salesforce Ventures. The funds from this round of financing will be used to expand the API suite.

At the same time, on June 28, NFT native option protocol Hook Protocol announced the completion of a US$3 million seed round of financing. The project gives traders the opportunity to benefit from rising prices on collections of NFTs, while allowing NFT holders to earn royalties on their NFTs and or sell them at a satisfying price.

On June 28, the platform of NFT native option agreementHookCompleted a $3 million seed round of financing. The project creates opportunities for traders to benefit from rising NFT asset prices, while enabling NFT holders to earn royalties and sell their NFTs at a satisfactory price.

Monthly NFT Projects Fundraising Amount & Times

Financing activity related to the NFT industry has been on a downward trend since January 2022, with investment activity in June appearing particularly sluggish.

However, even in the bear market, developers and innovators are still active, including some large Web2 companies that are optimistic about the potential of NFT, and they have combined NFT with their own brands. Insisting on innovation and construction during the market downturn reflects peoples firm belief in the potential of the NFT field and paves the way for the NFT industry to meet the next round of opportunities.

Historical experience tells us that the market always has cyclical changes. When the next bull market comes, these developers and innovators who insisted on building the foundation during the bear market are likely to trigger a new wave of innovation and investment in the NFT field.

Hot of the Month: Azuki Elementals

Azuki is a popular brand in the Metaverse, loved by fans for its unique anime art style. However, the launch of the new series Azuki Elementals quickly turned to disappointment and criticism from the community due to excessive repetition of features.

Community members initial skepticism about the Elementals series stemmed from its strong similarity to Azukis previous NFTs. However, as more NFTs are unlocked, many holders are surprised to find that their Elements are exactly the same as other holders. This is a blow to community members who expect to see new, innovative work.

In addition, various problems in the coinage process have also aroused many doubts. For example, the window period of the whitelist Mint was only ten minutes. Due to the tight time, the website traffic increased sharply until it crashed. Whats more serious is that there is no upper limit on the number of coins minted during the pre-sale stage, which allows some people to mint Elementals without limit.

At the end of the month, the lowest selling price of Azuki has dropped significantly to 7 ETH, and the floor price of Azuki Elementals has also fallen below the minting cost price of 2 ETH. The release of Elementals triggered a wave of selling, causing prices to drop sharply and sentiment to hit rock bottom.

The Azuki incident further highlights the importance of innovation and community in the NFT field. If a project is perceived as lacking innovation or fairness, it will experience a rapid decline in market confidence and value, as Azuki Elementals did.

The Footprint Community is a global, mutually supportive data community where members use visual data to work together to create communicable insights. In the Footprint community, you can get help, establish links, and exchange learning and research about blockchains such as Web 3, Metaverse, GameFi, and DeFi. With many active, diverse, and highly engaged members inspiring and supporting each other through the community, a worldwide user base has been established to contribute data, share insights, and drive community development.

Footprint Website: https://www.footprint.network

Discord: https://discord.gg/3HYaR6USM7

Twitter: https://twitter.com/Footprint_Data