XRP wins a temporary victory, what important information does the judgment reveal?

Produced by | Odaily

Author | Qin Xiaofeng

In December 2020, Ripple was sued by the U.S. SEC. After three years of arduous legal battle, Ripple finally achieved a "temporary" victory.

Tonight, a U.S. federal judge ruled that Ripple's sale of XRP tokens through exchanges and algorithm programs does not constitute an investment contract (and does not violate securities laws), but the court also supported the SEC motion that institutional sales of tokens do violate federal securities laws. Upon this news, the price of XRP surged from 0.473 USDT to 0.64 USDT, with a peak increase of over 35% within one hour.

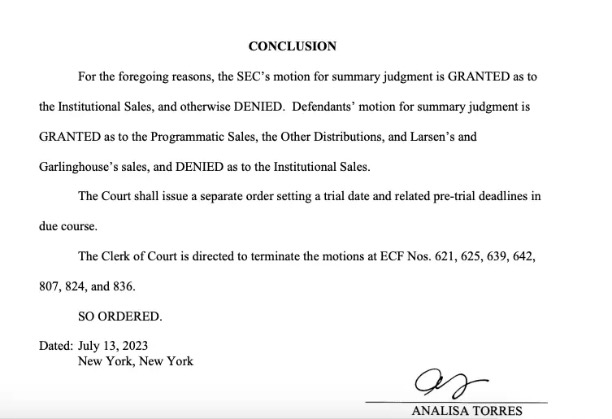

Final Conclusion

In this ruling, neither the SEC nor Ripple is a clear winner. There is currently no clear conclusion on whether XRP is considered a security. However, this news spread quickly and is seen as a positive development for the cryptocurrency market against the SEC. Especially at a time when cryptocurrency giants like Coinbase and Binance are facing SEC lawsuits, Ripple's victory is particularly inspiring. The cryptocurrency community is chanting that, with XRP's small step, it's a big step for crypto.

Odaily noticed that there are some noteworthy details in the court's judgment document.

Firstly, the court supports part of the SEC's motion, which is that Ripple's institutional token sales constituted unregistered offers and sales of investment contracts in violation of Section 5 of the Securities Act. The court made its determination based on three aspects of the Howey test:

The first step of the Howey test examines if "investment of money" is involved in the transaction; the defendant does not deny having paid money, thus the court considers this element to be established.

The second step of the Howey test, which is whether there is a "common enterprise"; the court determines that there is a common enterprise, as the records indicate the existence of an asset pool and the fate of institutional buyers is linked to the success of the enterprise and the success of other institutional buyers.

Howey TEST III, to study whether the economic reality of institutions selling Ripple leads institutional buyers to "reasonably expect profits from the entrepreneurial or managerial efforts of others". The court believes that a reasonable investor in the position of an institutional buyer would purchase XRP and expect to profit from Ripple's efforts."

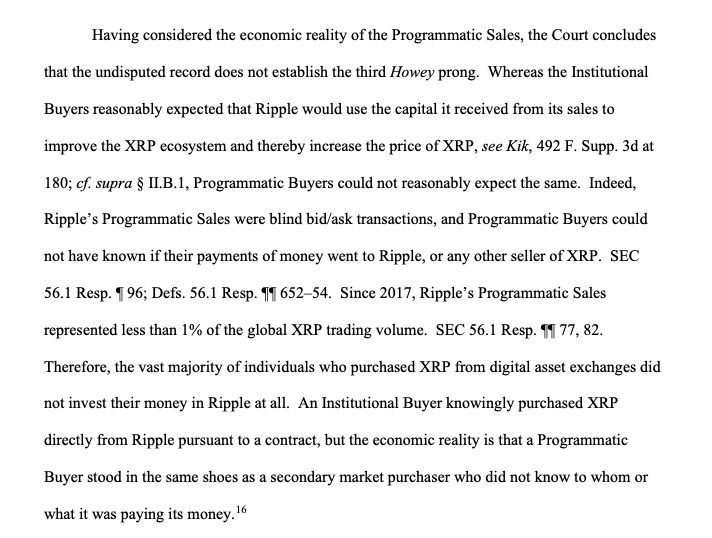

Interestingly, the reason the court ruled that Ripple's sales of XRP tokens through exchanges and programs do not constitute investment contracts is because programmatic sales do not meet the third prong of the Howey test, which is a reasonable expectation of profit.

The court found that institutional buyers reasonably expected Ripple to use the funds obtained from sales to improve the ecosystem of Ripple and thus increase the price of XRP. However, programmatic buyers cannot reasonably expect the same result. "Ripple's programmatic sales are blind transactions, and programmatic buyers do not know if their money is going to XRP or any other seller of XRP. Since 2017, Ripple's programmatic sales have accounted for less than 1% of global XRP trading volume. Therefore, the vast majority of individuals who purchase XRP from digital asset exchanges are not investing in Ripple. Institutional buyers directly purchase XRP from Ripple based on contracts, but the economic reality is that neither programmatic buyers nor buyers in the secondary market (i.e. exchanges) know who they are giving their money to."

(Regarding programmatic sales)

In the end, the court ruled that Ripple's programmatic sales of XRP did not constitute investment contracts and did not violate securities laws. The court also ruled that using XRP for investments, bounties, grants, and transfers to executives does not constitute investment contracts and does not violate securities laws.

As a culmination of the maritime legal system, the XRP ruling in the United States also provides a precedent for subsequent cases involving other cryptocurrency projects. In particular, it demonstrates that selling tokens through programs does not violate securities laws and also directly proves that token trading on exchanges does not violate securities laws. However, it is best not to sell tokens through forms such as ICO/IEO, as this may be considered as meeting the conditions for institutional sales. Odaily will continue to follow the progress of the Ripple case.