ทีม Azuki ขโมย 20,000 ETH แต่ตลาด NFT สูญเสียสภาพคล่องไป 200,000 ETH

ในขณะที่เหตุการณ์ Azuki ยังคงดำเนินต่อไป ชุมชนก็บ่น และผู้ถือระยะยาวหลายรายก็ขาย ทุบทิ้ง และจากไป ซึ่งยิ่งผลักดันความเชื่อมั่นของตลาดให้ถึงจุดต่ำสุด ผู้คนต่างพูดคุยกันอีกครั้งเกี่ยวกับการพัฒนาที่ซบเซาและนวัตกรรมที่อ่อนแอของ PFP NFT และ ผลงานซีรีส์ Azuki ตกลงไปทั่วกระดาน ขณะเดียวกัน ราคา NFT อื่นๆ ก็ไม่รอด และมูลค่าตลาดรวมของ NFT ก็ลดลงอย่างรวดเร็วภายในไม่กี่วัน

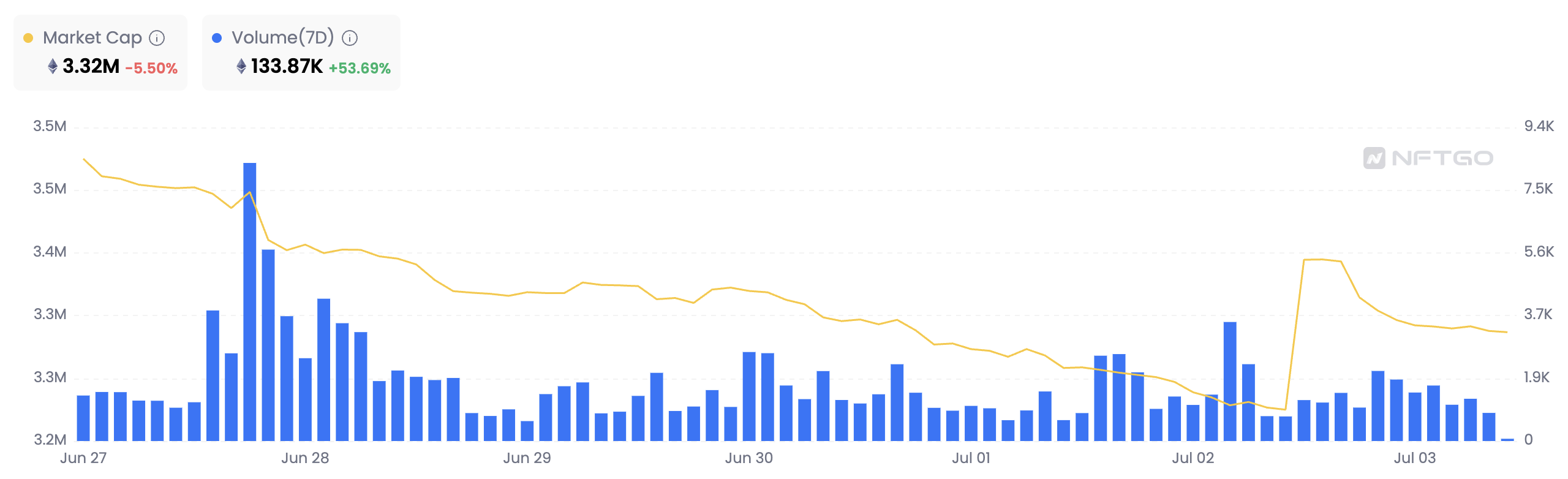

จากข้อมูลของ NFTGO ก่อนที่ Azuki จะเปิดตัวซีรีส์ Elementals (ในตอนเย็นของวันที่ 28 มิถุนายน) มูลค่าตลาดรวมของตลาด NFT อยู่ที่ประมาณ 3.474 ล้าน ETH และมูลค่าตลาดรวมของตลาด NFT ณ ขณะนี้อยู่ที่ 3.318 ล้าน ETH . เมื่อวานนี้มูลค่าตลาดรวมต่ำสุดลดลงเหลือ 3.232 ล้าน ETH เมื่อคำนวณตามมาตรฐาน ETH ลดลง 7% จากก่อนเกิดความผิดพลาด และหากคำนวณโดยใช้มาตรฐานดอลลาร์สหรัฐ ก็ลดลง 6.5%

ครั้งนี้ ทีมงาน Azuki รับ 20,000 Ethereum จากชุมชนโดยการขายภาพคร่าวๆ และภาพเล็ก ๆ แต่การดำเนินการของพวกเขาทำให้สภาพคล่องของ 200,000 Ethereum ถูกพรากไปจากตลาดทั้งหมด

ตั้งแต่เหตุการณ์ Azuki พัง ซีรีส์ NFT ของบลูชิปหลักๆ ดำเนินไปอย่างไรบ้าง? ใครโดน นั่งด้วยกัน มากที่สุด และราคาใครค่อนข้างมั่นคง? แผนภูมิด้านล่างจัดทำโดย Odaily: