1. Overall overview

secondary title

In terms of the secondary market, the current ETH price may continue to consolidate in the short term, with a support level of $1,850 and a resistance level of $1,900.

In terms of the secondary market, the current ETH price may continue to consolidate in the short term, with a support level of $1,850 and a resistance level of $1,900.

Second, the secondary market

1. Spot market

According to OKX market data, the price of ETH once rose to $1933 last week and closed at $1886 during the week, an increase of 8.6% month-on-month

ETH daily chart via OKX

The daily chart shows that the price is currently consolidating around $1,900, the lower support level is $1,850, and if it falls below, it may fall further to $1,800; the upper resistance level is $1,900.

2. Network operation

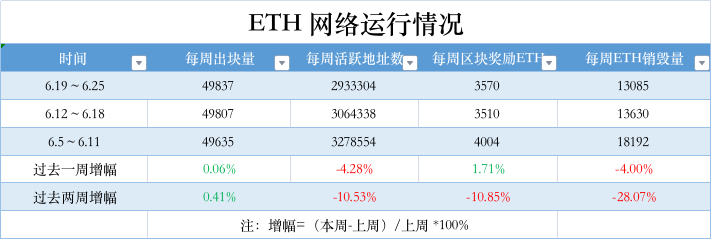

Etherscan The data shows that in the past week, the number of blocks produced on the Ethereum network was 49,837, an increase of 0.06% from the previous week; the number of active addresses per week was 2,933,304, a decrease of 4.2% from the previous week; the block reward income was 3,570 ETH, a decrease of 1.7% from the previous week; the weekly ETH The amount burned reached 13,085, a decrease of 4% month-on-month.

3. Large transaction

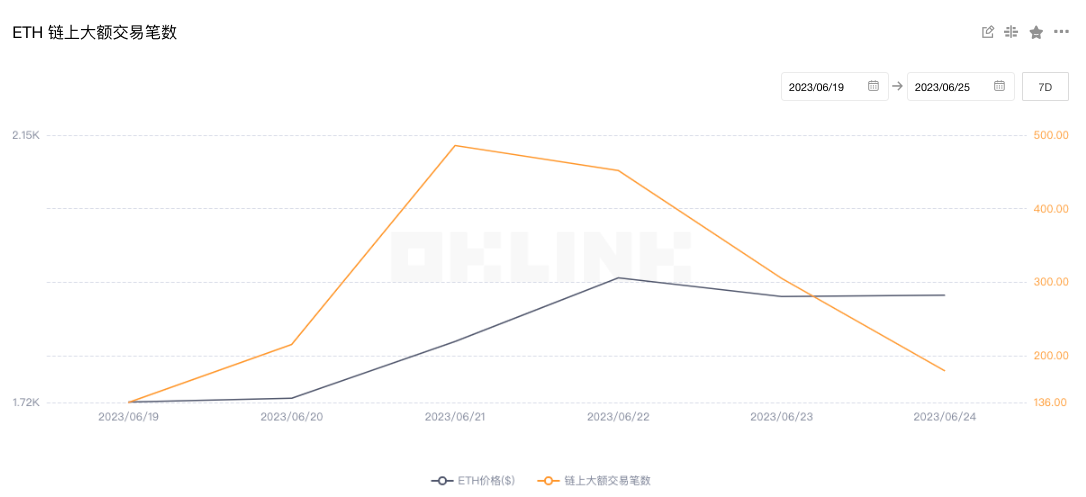

OKlink dataIt shows that the number of large-value transactions on the chain reached 1959 last week, an increase of 21.3% compared to the previous week (1614), and the trading enthusiasm of giant whales has increased significantly.

4. Rich list address

OKLink data4. Rich list address

token.unlocksOKLink data

token.unlocksOKLink data

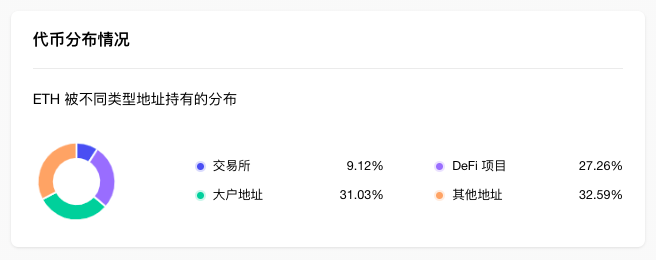

It shows that from the perspective of the distribution of ETH holding addresses, exchanges accounted for 9.12%, a decrease of 0.16% month-on-month; DeFi projects accounted for 27.26%, an increase of 0.24% month-on-month; large addresses (top 1000 addresses excluding exchanges and DeFi projects) Accounted for 31.03%, up 0.02% month-on-month; other addresses accounted for 32.59%, down 0.1% month-on-month.

DeFiLlamaThe data shows that the value of locked collateral on the chain rose from $24.7 billion to $26.52 billion last week, a month-on-month increase of 7.3%. From the perspective of individual projects, the top three lock-up values are: Lido $14.05 billion; MakerDAO $6.29 billion; Aave $4.86 billion.

3. Ecology and technology

1. Technological progress

Paradigm releases v 0.1.0 alpha version of Ethereum client Reth

2. Voice of the Community

2. Voice of the Community

(1) Ethereum developers are considering increasing the validator limit from 32 ETH to 2048 ETH

At the most recent consensus meeting of ethereum core developers on Friday, Michael Neuder, a researcher at the Ethereum Foundation and a leading proponent of the proposed change, proposed increasing the maximum validator balance per validator from 32 ETH to 2,048 ETH.

The proposal continues to be debated among the core developers, who have agreed to further discuss the implementation details of the proposal on social platforms such as ETHMagicians and Discord. (The Block)

(2) V God: Cross-chain proof is the key to realize cross-chain social recovery wallet

Vitalik Buterin, the co-founder of Ethereum, released a new article "In-Depth Discussion on Cross-L2 Reading of Wallets and Other Use Cases". The general content of the article includes:

1. To implement a cross-chain social recovery wallet, the most realistic workflow is to maintain a keystore in one location, and wallets in many locations, where the wallet either reads the keystore to update its local view of the authentication secret. key, or read the keystore during the process of verifying each transaction.

2. The key to achieving this is cross-chain proofs, and we need to optimize these proofs. ZK-SNARKs, waiting for Verkle proofs, or a custom KZG solution seem to be the best options.

3. In the long run, an aggregation protocol will be necessary to reduce costs by generating aggregation proofs to package all user-submitted operations. This may require it to be integrated into the ERC-4337 ecosystem, but may require changes to ERC-4337.

4. L2 should be optimized to minimize the latency of reading the L1 state (or at least the state root) from within L2. It is ideal that L2 directly reads L1 state and saves proof space.

6. However, the key repository should be on L1 or a high-security ZK-rollup L2. A lot of complexity can be saved on L1, but it is still likely to be too expensive in the long run, so it is more economical to keep the key repository on L2.

3. Project trends

3. Project trends

(1) Ambient Finance, a decentralized trading protocol, has been launched on the Ethereum mainnet

Ambient Finance, a decentralized trading protocol, recently announced on Twitter that it will launch the Ethereum mainnet. In the coming week, the team will release the Ambient features, philosophy and design. It is reported that Ambient Finance was originally called CrocSwap.

(2) Binance sent an email reminder to some users to "change the Ethereum network recharge address"

According to user feedback, Binance recently stated in an email sent to users that if the recharge address of the user's master account and sub-account is in the Ethereum network, its recharge address will soon expire and be replaced. Users need to reacquire the address through the Binance App website or SAPI before 15:41:45 on July 15, Beijing time; once it expires, the user's recharge to the old address will not be automatically credited.

(3) The Aave community has voted to pass the ARFC proposal of "reducing the liquidation threshold and loan-to-value ratio of CRV on Aave V2 Ethereum"

The Snapshot voting page shows that the Aave community voted to pass the ARFC proposal of "reducing the liquidation threshold (LT) and loan-to-value ratio (LTV) of CRV on Aave V2 Ethereum", with a support rate of 99.99%.

Since lowering the liquidation threshold could result in user accounts being eligible for liquidation upon approval, the team wanted to clarify the full impact to the community at each step. To minimize this impact, the proposal proposes to reach the desired setting through a series of incremental reductions, up to a 3% reduction in any given AIP, following the risk-averse framework previously approved by the community. To avoid liquidation, Chaos Labs will publicly communicate the planned revisions and list of affected accounts leading to on-chain execution.

(4) ARPA Network, a decentralized computing protocol, is launched on the Ethereum mainnet

Decentralized computing protocol ARPA Network launched on ethereum mainnet Wednesday after two months of testnet operations, developers said. According to ARPA Network developers, the network allows users to conduct blockchain activities and transactions in a privacy-preserving manner, so that on-chain actions cannot be easily traced back to a single entity or group of users. The launch allows Ethereum developers to use the ARPA Network to build and deploy Dapps such as lotteries, games, decentralized voting systems, and identity management systems, among others.

(5) Custody company Casa launches ETH vault, which will also support other Ethereum-related assets

Self-custody solutions provider Casa has launched an ETH vault again, in addition to its existing BTC vault. According to the official introduction, the Casa multi-key vault supports up to five keys for enhanced security. In a press release, Casa said it is “gathering feedback on adding support for other ETH-related assets, such as NFTs, stablecoins, and ERC-20 tokens.” (The Block)

(6) Lido opens the application for Ethereum node operators

Liquidity staking protocol Lido announced the opening of applications for Ethereum node operators. Applicants must submit applications before June 26 to be eligible for fast-track evaluation; if fast-track evaluation is not required, applications will remain open until July 14, Beijing time7 : 59. In February of this year, Lido launched the Staking Router feature, a new modular architecture designed to allow anyone (including independent stakers) to become a node operator while providing stakers with an easy stake/unstake experience.

(7) The Lido community is voting on the proposal of "stETH Grading Reward Sharing Plan"

Participants share 5% of the DAO's pledge reward share into 5 grades: 30% between 0-50,000 ETH; 35% between 50,000-150,000 ETH; 150,000-350,000 ETH 40% between 350,000 and 700,000 ETH; 45% between 350,000 and 700,000 ETH; 50% for 700,000 ETH or more.

PartyDAO, the operating team of PartyBid, an NFT group bidding platform, announced the launch of "Party - Multiplayer for Ethereum" on Twitter, allowing groups of any size to use the Ethereum platform together, including DeFi activities, collecting NFTs, participating in games, operating projects, etc. The goal of PartyBid is for people to pool their funds together to buy NFTs as a team. PartyBid's MarketWrapper contract provides a common interface to integrate different NFT auctions. According to news in June last year, PartyDAO completed a financing of US$16.4 million, led by a16z, and participated by Dragonfly Capital and Uniswap Ventures.

(9) Coinbase's market share in the ETH pledge business fell to 9.7%, reaching a nearly two-year low

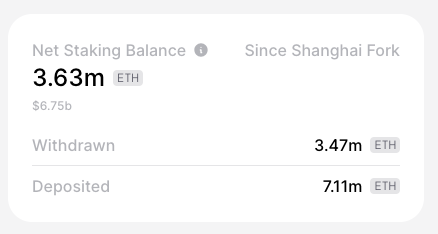

As U.S. regulators mount pressure on Coinbase's staking service, the exchange's share of ETH staking business slipped to 9.7%, the lowest since May 2021, according to 21 Shares' Dune data. Compared with the 13.6% achieved when the Ethereum Shanghai upgrade first allowed withdrawals on April 12, it has dropped significantly. Coinbase had a net outflow of $517 million (272,315 ETH) over the same period, second only to Kraken.