이 기사에서는 주목할 가치가 있는 20개의 잠재적인 프로젝트를 살펴봅니다.

원저자:slappjakke.eth,크립토 콜

원본 편집: Felix, PANews

원저자:

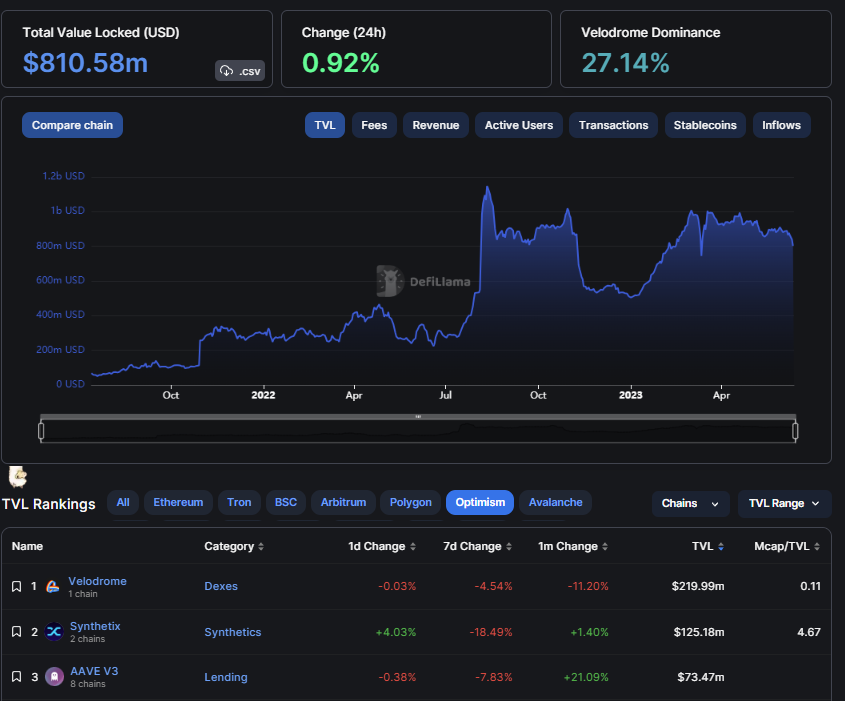

VELO

크립토 콜

ARB

시장이 하락하고 있으며, 카피 트레이딩(CT)이 만료되었습니다. 고품질 프로젝트를 천천히 비축할 때입니다. 이 기사는 암호화 KOL slappjakke.eth의 인벤토리에서 주목할 가치가 있는 상위 20개 프로젝트입니다.

STG

암호 약세 시장은 어떻게 매복합니까? 이 기사는 주목할 가치가 있는 20개의 "잠재적 주식"을 검토합니다.

JOE

Arbitrum은 레이어 2 리더이며 인상적인 생태계를 구축했습니다. Arbitrum은 강력한 사용자 끈기를 가지고 있으며 혁신적인 프로젝트는 Etherscan보다 Arbitrum에서 시작하려는 의지가 더 큽니다.

FXS

암호 약세 시장은 어떻게 매복합니까? 이 기사는 주목할 가치가 있는 20개의 "잠재적 주식"을 검토합니다.

Stargate Finance는 LayeZero 기술, 크로스 체인 브리지 및 모든 체인을 연결하는 DEX를 기반으로 하는 플래그십 프로젝트입니다. 점점 더 많은 체인이 채택됨에 따라 Stargate는 선도적인 위치에 있을 것이며 전체 체인 내러티브는 점점 더 야심차게 될 것입니다.

혁신적인 중앙 집중식 유동성 DEX인 Trader Joe's Liquidity Book은 최근 자동 풀(자동 재조정 및 수수료 합성)을 출시했습니다. Joe는 LP에 대한 높은 수수료, 스테이커에 대한 이익 공유(연이율 27%), 낮은 배출량 등의 이점이 있습니다.

Frax Finance는 혁신적인 frxETH의 출시로 LSD 시장의 많은 부분을 조용히 포착하면서 약세장 동안 계속해서 구축하고 제공했습니다. 현재 사용 가능한 제품은 다음과 같습니다.

frxETH (유동성 담보 상품)

frxETH v2

Frax v3

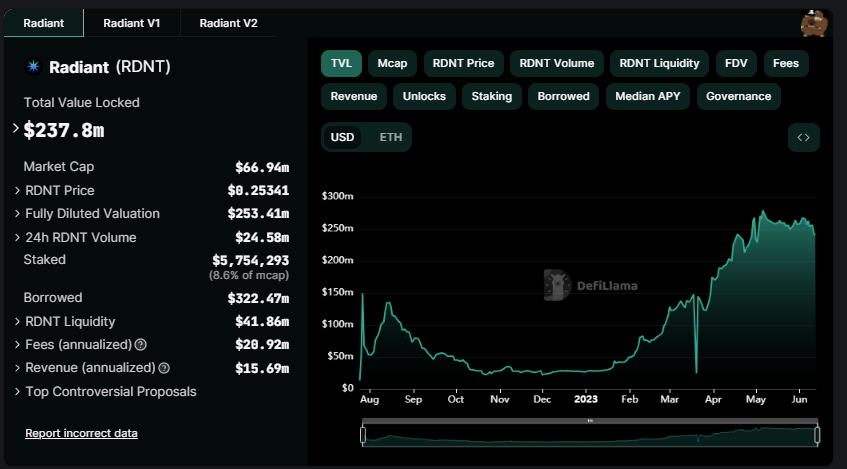

RDNT

FraxFerry(크로스체인 브리지)

PENDLE

곧:

GMX

RDNT Capital은 Arbitrum 및 Binance Smart Chain에 배포된 LayerZero 기술을 기반으로 하는 전체 체인 대출 프로토콜이며 곧 더 많은 체인이 출시될 예정입니다. 혁신적인 토큰 경제학을 통해 RDNT는 약세장에서 동적 유동성과 TVL 성장을 달성했습니다.

암호 약세 시장은 어떻게 매복합니까? 이 기사는 주목할 가치가 있는 20개의 "잠재적 주식"을 검토합니다.

GNS

Pendle은 원리금 토큰인 PT(원칙 토큰)와 Yield 토큰 YT(일드 토큰)을 분할하여 금리 스왑을 더욱 다양하게 만들고, 이 혁신적인 프로토콜은 LSD 시장 점유율을 휩쓸었습니다. 약세장 중에도 Pendle의 TVL은 여전히 상승하고 있으며 Equilibria와의 경쟁에서 더 높은 시장 점유율을 가지고 있습니다.

LYRA

GMX는 거래량과 수수료 수입이 증가하는 파생 DEX 프로토콜이며 혁신적이고 동급 최고의 토큰 경제학으로 GLP 토큰을 통해 실제 수익 내러티브를 시작했습니다.

최근 GMX의 수수료 수입이 감소하고 토큰 가격이 타격을 입은 가운데 합성 자산을 지원하는 V2 버전이 출시될 예정입니다.

THE

Gains Network는 최대 100배의 레버리지, 외환 및 기타 거래를 제공하는 분산형 파생 상품 거래 플랫폼입니다. Arbitrum이 실행된 후 Gains Network의 수수료 수입이 급증했습니다.

Lyra Finance는 AMM 기반 온체인 옵션 거래 프로토콜로, 사용자는 ETH, BTC, ARB, OP 콜 또는 풋 옵션을 매수/매도할 수 있습니다. LP Vault를 헤징하면 더 안전한 LP와 낮은 꼬리 위험이 보장됩니다.

GND

Arbitrum에 배포된 lyra Finance는 온체인 옵션 거래량을 지배합니다.

Thena는 BNBchain의 ve(3, 3) 리더로서 기능적으로 중앙 집중식 유동성을 가장 먼저 실현했으며 곧 ALPHA와 영구 거래를 실현할 것입니다. 모든 수수료는 veTHE 사물함으로 이동합니다.

LVL

Thena 팀의 제품 배송은 조밀한 로드맵과 향후 출시될 제품이 많기 때문에 빠릅니다.

rDPX

GND 프로토콜은 하이퍼 디플레이션 수익률 스테이블 코인 gmUSD 및 유니스왑 v3 CL 팜을 생성하고 있습니다.

환매, OTC 환매 및 xGND 락업으로 인해 GND 공급이 2개월 만에 25% 감소했습니다.

BTRFLY

Level Finance는 혁신적인 위험 관리 시스템을 사용하는 perp dex입니다. 최근에 막대한 수수료를 부과하고 있으며(일부 사람들은 모든 수수료가 농업 인센티브를 위한 것이라고 말합니다) 곧 Arbitrum에 제품을 배포할 계획입니다.

dopex_io는 두 개의 토큰 $DPX 및 $rDPX가 있는 분산형 옵션 프로토콜입니다.

rDPX V2는 개발 중이며, 이 버전에서는 $rDPX를 소각하여 합성 페그 자산 $dpxETH를 발행합니다(디플레이션 발생). dopex_io는 Gigabrain(암호화 산업의 개념을 깊이 이해하는 사람들) 팀이고 DAO는 자금이 풍부하고 뛰어난 Meme 유전자를 가지고 있습니다.

액체 뇌물 시장 운영자 RedactedCartel은 Curve, Convex, Frax, Balancer, Aura 생태계에서 제품을 구축하고 있으며 강력한 구축자이며 대규모 DAO 재무부를 보유하고 있으며 고품질 제품을 구축합니다.

제품 포함:

숨겨진 손 (뇌물 시장)

AURA

Pirex(자동 배합)

STX

곧:

디네로(스테이블코인)

BIT (MNT)

Aura Finance는 Balancer 생태계의 수익 집계자, 메타 거버넌스 플랫폼 및 뇌물 시장으로 veBAL의 31%를 관리하며 Arbitrum에서 곧 출시될 예정입니다.

Stacks는 Bitcoin용 L2 스마트 계약 레이어를 만들고 있습니다. Arbitrum과 Optimism이 Ethereum에 있는 것처럼 스택은 비트코인에 있습니다.

fbomb

Stacks는 새로운 합의 메커니즘인 PoX(Proof of Transfer) 합의 메커니즘을 도입했습니다. 그러나 현재 버전의 Stacks는 확인 시간이 매우 느리지만 Nakamoto 릴리스에서는 이 문제를 해결할 계획입니다.

Mantle은 30억 달러 규모의 Mantle DAO가 지원하는 이더리움에서 모듈식 레이어 2 롤업을 시작하고 빌더와 사용자를 유치하기 위한 여러 보조금과 인센티브를 제공합니다.

UNIBOT

마지막 두 프로젝트는 상대적으로 위험하므로 자신의 위험 관리에 주의를 기울이십시오.

fBomb Opera는 20개 이상의 플라이휠과 다양한 ve(3, 3) DAO의 농장이 뇌물을 주고 veNFT를 축적하는 디플레이션 농장 토큰입니다. fBomb Opera는 지속적으로 100% APR을 유지하고 시장을 잘 따릅니다.

한편, fBomb Opera는 지난 6개월 동안 공급량의 10% 이상을 소진하면서 꾸준한 소진율을 보였습니다.

Team Unibot은 사용자가 TG 채팅에 계약 주소를 붙여넣어 거래를 할 수 있는 텔레그램 봇을 만들었습니다.

그러나 안전을 위해 사용자는 새 지갑을 사용해야 하며 Team Unibot은 현재까지 천만 달러 이상을 거래했습니다.

스나이퍼 로봇