Trader Joe、Izumi、Maverick:L2头部流动性定制DEX机制分析

原文作者:Yilan,LD Capital

前言

随着 Uniswap V3许可证过期,许多集中流动性 AMM(CLMM)的分叉项目开始兴起。“Uni v3-Fi”包括 Dex(单纯的 fork V3或在V3的基础上对定价区间进行定制的不同策略模型),收益增强类协议(Gammaswap),为解决V3无常损失的 Option 类及其他协议等,本文主要介绍在V3基础上对定价区间进行了策略优化的 Dex — — Trader Joe v2、Izumi Finance 和 Maverick Protocol。

Uni V3的问题

在 Uniswap V3中,流动性是集中在特定的价格范围内的。这意味着如果资产的价格偏离了这个范围,就会出现所谓的“无常损失”(IL, Impermanent Loss)。无常损失是指相对于持有资产而言,流动性提供者在 AMM 中所遭受的损失。当价格偏离了流动性提供者所选择的价格范围时,无常损失可能会大幅增加,甚至超过原始资产的损失。

而 Uni v3的集中流动性导致的 IL 风险更大,这部分的解释涉及期权希腊字母概念中的 gamma, Gamma 是指标的价格变化相对于 Delta 值的变动速率。当 Gamma 较大时,意味着 Delta 对标的价格变动非常敏感,因此需要及时调整持仓以避免潜在损失,这被称为 Gamma 风险。在不考虑时间因素的情况下,可以说,当标的资产的波动率增大时,期权的价格也会相应增加,因为更高的波动性增加了期权实现收益的概率,因此市场对这样的期权要求更高的价格。

当资产波动率大时,gamma 风险也就越高,LP 们承受的无常损失也就越大,因此需求的对无常损失的补偿也更多。因此 AMM 可以看成是内嵌了一个永续期权市场,而 LP 则暴露在 gamma 风险之下,承受无常损失的风险来获取交易手续费或挖矿收益。

为了应对这个挑战,流动性提供者需要密切监控其提供的资产价格,并及时采取行动如撤销流动性并将资金重新分配到新的价格范围内,来减轻无常损失的影响。然而,这个过程是耗时且需要 gas 费用的,并且存在设置错误价格范围的风险。

此外,Uniswap V3还面临其他一些问题。例如,流动性集中在特定价格范围内可能导致流动性碎片化,使得交易成本增加。此外,由于资产价格变动频繁,流动性提供者需要经常进行调整和管理,这对于大规模和频繁交易的 LP 来说可能是具有挑战性的。

因此,虽然 Uniswap V3可以提供更高的费用和年化收益率,但流动性提供者需要权衡这些潜在的挑战和风险。针对 Uniswap V3存在问题的解决方案,可以分为以下几类:对无常损失的优化,对 LP 最佳做市方案的工具优化(也就是对不同风险偏好者提供多样性的添加流动性的选择方式工具),以及对 LP NFT 收益增强的策略内置优化等。

本文主要分析的是对 LP 做市方案进行优化的三个 DEX 项目:Trader Joe、Izumi、Maverick。

Trader Joe v2

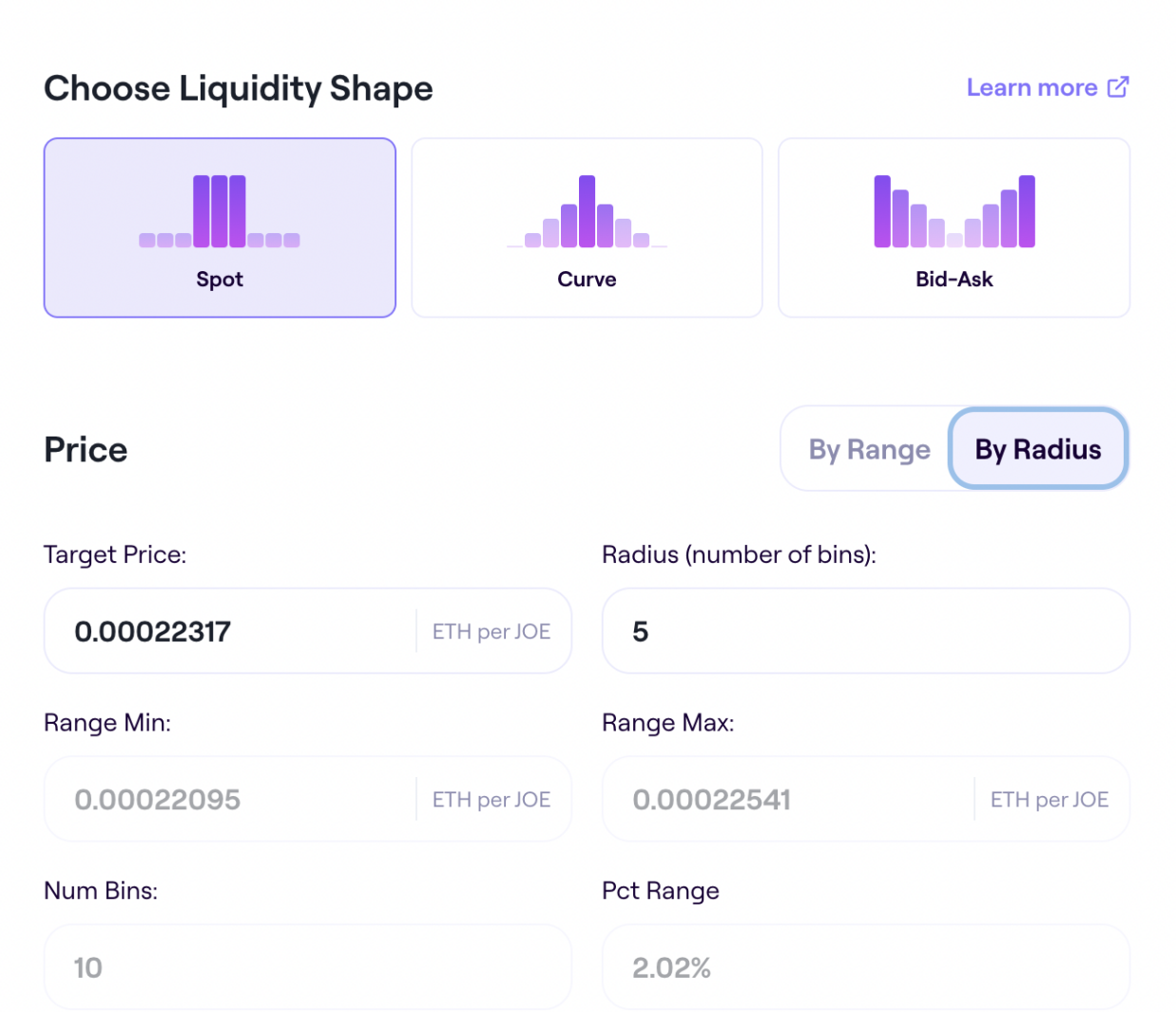

Trader Joe V2的 LB(Liquidity Book)对 Uniswap V3的最大改进是引入了“Bin”的概念并使流动性分布可策略化。“Bin”是一种价格区间,作为流动性分布的单元,在 Liquidity Book 中,流动性被划分为离散的“Bin”单元。每个 bin 内的流动性遵循固定的汇率进行兑换。允许流动性提供者将资金集中在特定的价格范围内,从而避免滑点。这意味着交易在该价格范围内可以实现零滑点的执行,提高了交易的效率和成本效益。流动性分布可策略化是指 LB Token 的半同质化属性和垂直的流动性分布方向使得 LP 可以根据一定的策略来部署自己的流动性,而不仅仅是均匀分配在 bin 上。

Trader Joe v2.1 的 Auto Pool 于 6 月开始部署,The General 是第一个将部署在 AVAX-USDC(Avalanche)和 ETH-USDC(Arbitrum)上的 Auto-Pool。The General 会自动重新平衡流动性位置,以最大化手续费收入;并对市场趋势和资产不平衡作出反应,使其能够适应大多数市场和环境。将来,The General 也会用于其他流动性池。

Auto-Pool 将累积由流动性池收取的交易费用的份额。代币可以存入收益农场(将来发布)。Auto-Pool 可以通过合作伙伴代币提供激励(将来发布)。每次重新平衡都会收取自动化费用,相当于年化利率 4.5% 。自动化费用用于支付运营成本,例如重新平衡时的 gas 费用。将来,自动化费用可能分发给 sJOE 质押者。

在不同的流动性分布的策略中进行部署,如果策略判断较为准确,也就是流动性落在选择区间的占比更多,LP 获得的奖励也就更多。此外,动态 swap 手续费使得 LP 可以根据市场波动性收取不同的费用,从而更好地管理风险和收益。

Izumi Finance

Izumi 的 AMM 使用的是 DL-AMM 算法,一种新的离散集中流动性算法,具有类似于 Uniswap V3的集中流动性做市商特征,但能够在任何固定价格上精确分布流动性,而不是一个价格范围。这使得 iZiSwap 在流动性管理方面更加可控,并且支持更多的交易方式,例如限价订单。

除了 Swap, Liquidbox 也是 Izumi Finance 的核心产品之一。LiquidBox 是一款基于 Uniswap V3 NFT LP 代币的流动性挖矿方案,通过不同的流动性激励模型来吸引流动性,让项目方能够更高效地设置交易对和流动性池,并在不同价格范围内提供不同的奖励。

这些流动性奖励模型包括:

1 )集中流动性挖矿模型(Concentrated liquidity mining model),一般与 xy=k 模型相比,特定区间的资本效率高出 50 倍以上,而集中流动性通常会增加非稳定币对的无常损失,稳定币波动区间有限,对稳定币币对较为友好。

2 )单边非永久损失挖矿模型(One-sided non-impermanent loss mining model),具体操作为,当 LP 存入 3000 个 USDC 和 3 个 ETH,izumi 通过在 Uniswap V3上(0 , 3 )价格范围内放置 3000 个 USDC 来管理,当 XYZ 价格下跌用 USDC 形成购买订单。3 个 ETH 被放置在 izumi 质押模块中以锁定流动性(质押部分不在 Uniswap V3中),在 ETH 价格上涨时不会被动出售,从而不会对项目方造成无常损失或被动抛售压力。

3 )动态范围模型(Dynamic Range model),项目旨在激励流动性提供者围绕当前价格提供有效流动性。

当用户将 Uniswap V3 LP 代币抵押到 Izumi 协议进行 Farming 时,LiquidBox 会自动判断 LP 代币的价值范围是否在项目所有者设定的流动性激励范围内,该价值范围的设定旨在确保流动性提供者在所需的价格范围内提供流动性。

这是为 Uniswap v3 LP 创造更多收益的策略,也类似于给项目方提供了一个帮助项目代币创建流动性的贿赂方式。同时存入 LP NFT 的群体基于自己对标的后市走势的判断,可以通过 fixed range、dynamic range、 one sided 的功能,进行流动性头寸的管理,在选择合适的情况下可以避免 IL。

Maverick Protocol

Maverick AMM 的自动流动性放置(ALP)机制与 Uniswap V3类似,但是重要区别是 ALP 机制可以自动实现集中流动性的动态再平衡,以使得交易滑点低于非集中式 AMM 模型,但无常损失又低于集中式 AMM 模型(单面流动性机制减少无常损失的场景)。

其关键机制是通过使用“Bin”来管理流动性。“Bin”是指价格的最小可用区间。在 Maverick 中,LP 可以选择将其流动性添加到特定的 bin 中。LP 可以选择四种不同的模式:Right 模式,Left 模式,Both 模式和 Static 模式,来决定他们的流动性随价格变动的方式。

当 LP 向 bin 中添加流动性时,LP 必须以与 bin 中现有比例相同的方式添加基础资产和报价资产。LP 将获得相应的 LP 代币,代表他们在该 bin 中的流动性份额。

在 Maverick 中,当价格发生变动时,非静态(non-static)的 bin 可以根据价格变动向右或向左移动。当一个 bin 移动到与另一个相同类型的 bin 重叠的位置时,这两个 bin 会进行合并,合并后的 bin 将获得合并前两个 bin 的流动性份额。

当 LP 想要从一个 bin 中移除流动性时,他们可以通过提供相应的 LP 代币来提取他们在该 bin 中的份额。如果 bin 是合并后的 bin,LP 需要进行递归计算,将他们的提取请求传递到合并链中的活跃 bin,并按比例从合并 bin 的流动性份额中提取资产。

总结

Trader joe v2以及v2.1 做到了三个事情: 1 )无滑点的 bin 内交易。2 )Liquidity Book 引入了动态的 swap 手续费定价,费率将应用于每个 bin 中的 swap 金额,并按比例分配给该 bin 中的流动性提供者。这样 LP 可以通过手续费来对冲在高波动率市场下的无常损失。从 AMM 内置永续期权市场的角度来看,这样的设置也是合理的,用瞬时价格波动函数为高波动性定价,也就是类似期权市场中的期权金补偿给期权卖方(LP)。3 )Auto pool 自动化重新平衡流动性位置,以最大化手续费收入。后期还会引入类似 Izumi Liquidbox 的 Farming strategy 以及项目方建池激励流动性的功能。

Izumi Finance 做到了以下三点: 1 )精确的价值范围:LiquidBox 允许项目所有者明确设置激励 LP 代币的价值范围。这意味着流动性提供者可以更加准确地了解他们所提供的流动性的价值范围,从而更好地管理风险和获得相应的奖励。2 )增强的流动性管理:LiquidBox 通过设置价值范围,使得流动性可以更好地集中在特定的价格上,而不仅仅是价格范围内。这种增强的流动性管理使得 izumi 协议更易于管理流动性,并支持更多的交易方法,如限价单。3 )不同的流动性奖励模型对项目方来说是很好的流动性管理工具。

Maverick 通过提供不同的模式来调整流动性随价格变动的方式。当价格发生变动时,bin 可以移动和合并,以保持流动性的有效性。这种机制使得 LP 能够更好地管理无常损失,并在价格变动中获得更好的收益。AMM 底层自动移动集中原生流动性、自定义集中流动性移动方向、LP 费用自动复利以及允许项目方激励特定的价格范围这几项功能,使得 Maverick AMM 为流动性提供者、DAO财库、以及项目开发团队等 DeFi 用户提供了最大化资本效率的可能以及最精准地流动性管理工具。

从数据表现来看,Maverick 过去一周 volume 为 164 mln, Trader Joe 为 308 mln, Izumi 为 54.16 mln;TVL 来看,Maverick 27.83 mln,Trader Joe 140 mln, Izumi 57 mln。相较来看,Maverick 在较低的 TVL 情况下,能够捕获更多的 volume,资金效率非常高,而大部分的交易量由1inch路由也代表 maverick 的价格发现能力更强。

与 Uniswap V3相比,Trader Joe V2、Izumi 和 Maverick 都是对集中流动性 (CLMM)模型的升级,并主要改进在于 LP 做市端。总结来看,几个协议的相同点为都引入了自定义价格区间的功能。这使得流动性提供者能够选择特定的价格范围来提供流动性。通过自定义价格区间,流动性提供者可以更精确地控制其提供的流动性,完成策略组合的建立和满足特定点位建仓需求,找到最佳的做市方案和策略。差异在于三个协议对流动性管理工具的定制程度和所在生态的发展阶段。