Research institute:Mint Ventures

Research institute:

1. Highlights of the report

1.1 Core investment logic

1.1 Core investment logic

Although the fierce competition in the Dexs track is still going on, it means that each project in the track has no strong bargaining power for traders and liquidity providers, and most projects are operating at a loss or with small profits. This kind of market The competitive situation is difficult to improve in a short time. However, due to the dual cyclicality of the encryption market and the Dexs track, projects represented by Trader Joe are still expected to outperform the market in the bull market.

1.2 Main Risks

Mainly due to fierce competition. Avalanche, the base camp market, faces ecological shrinkage and competition from Uniswap v3. Arbitrum, as the current main growth market, is still in the stage of low prices and subsidized swaps. The growth of transaction volume and handling fees is still unstable. Rely on the business volume brought by event-based projects.

1.3 Valuation

1.3 Valuation

2. Basic information of the project

2.1 Project business scope

2.1 Project business scope

Trader Joe is a comprehensive DeFi project. Its business includes spot Dex, decentralized lending (Banker Joe), NFT trading platform (Joepeg) and launchpad (Rocket Joe). Trader Joe's current trading operations span Avalanche, Arbitrum, and BNBchain. Among them, spot trading is the current core business of Trader Joe, and it is also a relatively leading business segment.

2.1.1 Spot Dex

As its current main business, Trader Joe's spot Dex business has carried out many product mechanism innovations, which are embodied in its V2 product - Liquidity Orderbook (LB for short).

The liquidity order book is actually a re-innovation of the centralized liquidity concept of Uniswap V3. In essence, it is a combination of the two mechanisms of "order book" and "liquidity pool".

LB introduces the price range unit "Bin" on the basis of concentrated liquidity, and a Bin (flow box) represents a range full of liquidity.

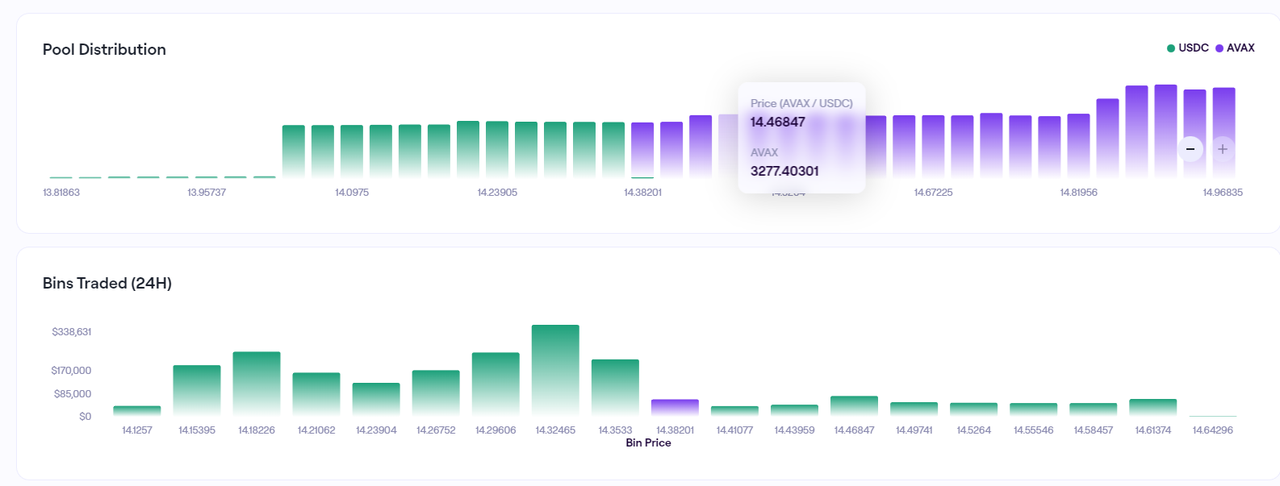

image description

Bin Distribution and Bin Trading Volume of AVAX-USDC Trading Pair on Trader Joe

Trader Joe's Bin is similar to the price of pending orders in CEX's order book matching mode, and the Bin step is the smallest unit between the prices of pending orders in CEX.

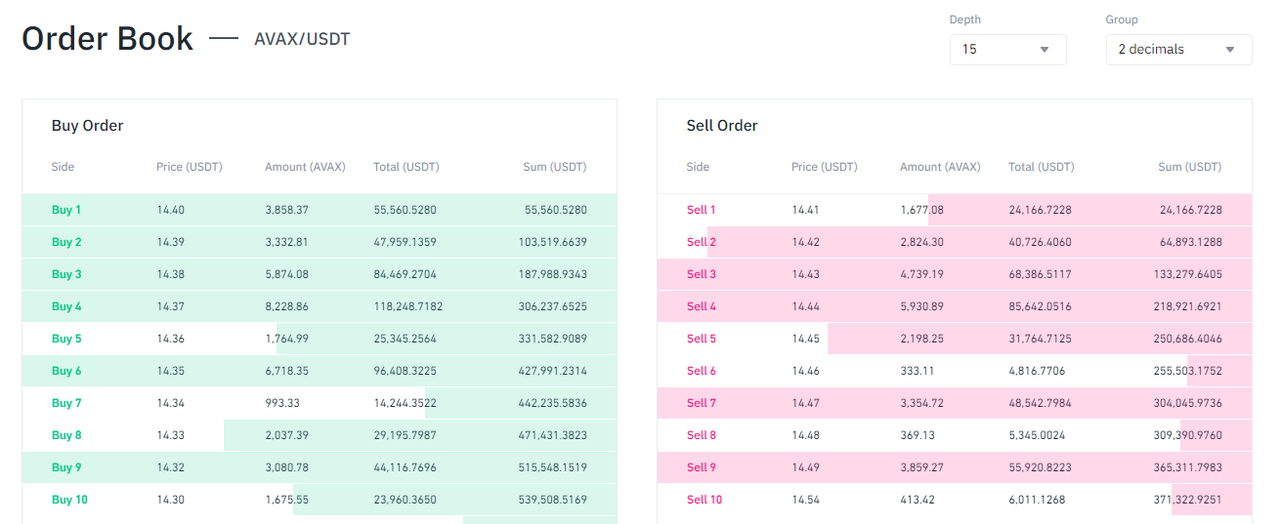

image description

Binance’s order book for the Avax-USDT pair

Therefore, Trader Joe's Dex is a custom order book with the width of the Bin as the pending order trading unit.

b. Liquidity: Bin capacity

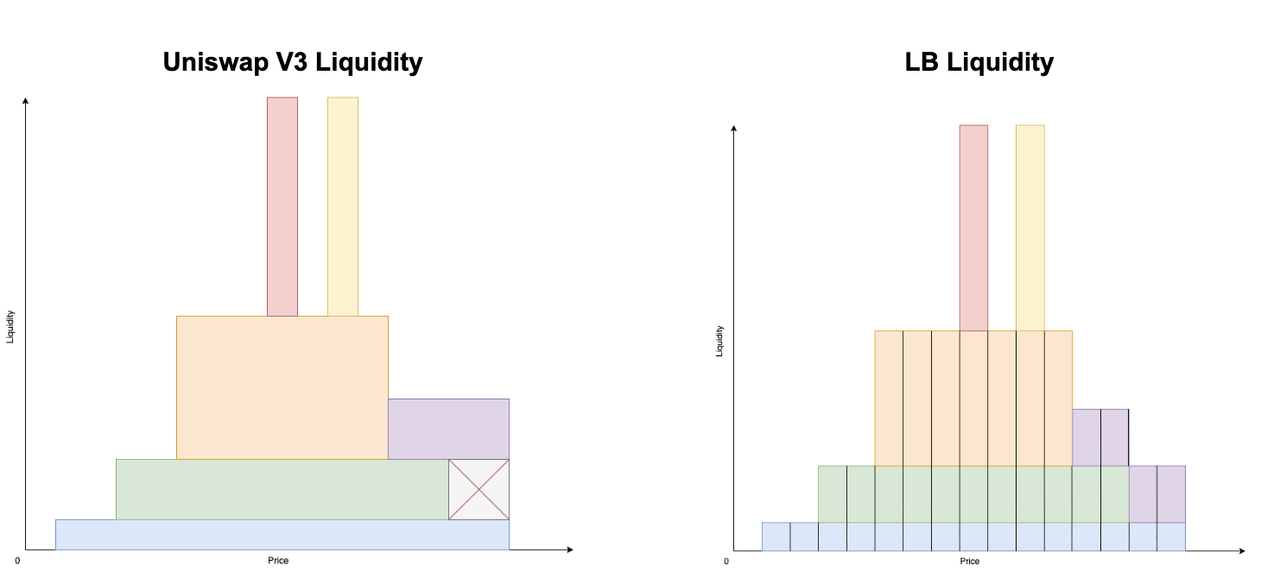

The mechanism of Uniswap V3 is to concentrate liquidity in a price range in the form of X*Y=K (constant product), while Trader Joe disperses liquidity into Bins with equal width price ranges. The flow in each Bin The property conforms to the P·X+Y=K (constant sum) equation (here P=Y/X), and each Bin is a liquidity pool, which becomes the smallest unit of liquidity management.

In simpler words, Uni v3's LP is an independent whole, based on the spanning price range and liquidity volume composition, directly stacked together; while LB splits liquidity into different The price ranges are stacked vertically, and the liquidity in the same Bin range is homogeneous.

image descriptionThe structural comparison of Uni V3 and LB liquidity, the vertical axis is liquidity, the horizontal axis is price, different color blocks represent different users,

Source: Trader Joe V2.1 Documentation

Based on Bin’s vertical aggregation of liquidity, LB’s liquidity token follows a standard similar to ERC 1155. Before introducing the characteristics of LB’s liquidity token, let’s make a brief introduction to the ERC 1155 token standard.

ERC-1155 was developed by Enjin, which solves the problem that the same token smart contract can only support homogeneous tokens (ERC 20), or can only support non-homogeneous tokens (ERC 721), ERC-1155 The token contract can support both homogeneous and non-homogeneous tokens in a token contract. In the ERC 1155 contract, each token is marked by its ID instead of the contract address standard, which means that the contract can To manage tokens with multiple IDs, there may be many homogeneous tokens under the same ID, or a single non-homogeneous token.

The most common application scenario of ERC-1155 is the game, because the game system contains a variety of homogeneous tokens and a variety of non-homogeneous tokens.

LB takes a similar approach to ERC-1155, utilizing the idea of its ID system, specifically:

The LB liquidity tokens in the same Bin are homogeneous. Homogeneous liquidity tokens can firstly reduce gas consumption, and secondly, it also provides the possibility for the calculation of handling fees in the agreement and the lightening of the complexity of the entire accounting system sex

Different Bins have different IDs, which are used to distinguish the homogeneous liquidity within different Bins

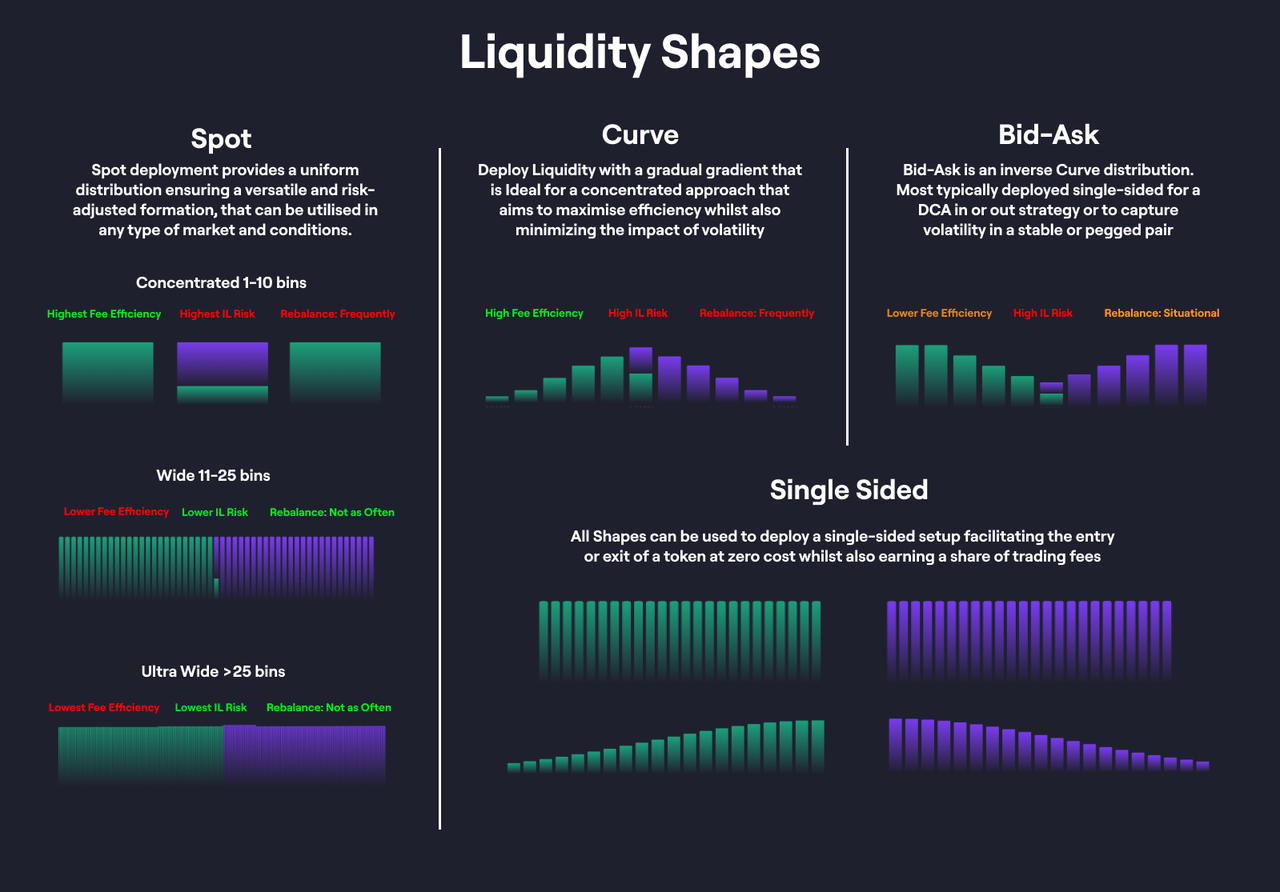

As shown in the figure below, Trader Joe provides a wealth of LP deployment options to meet user needs:

image description

Image Credit: Trader Joe Documentation

In addition to this, Trader Joe's LB features include:

Before the liquidity in the same Bin is exhausted, the price of the transaction remains unchanged, so the advantage of the transaction quotation makes it easier to capture the trading volume from the route, and of course this also magnifies the impermanent loss

A variable fee rate is introduced, that is, the greater the price volatility of the token, the higher the transaction fee rate, and the impermanent loss of LP is compensated by increasing the transaction fee income

Better composability, compared to Uni V3's LP vouchers using the ERC-721 NFT format (harder to be integrated by Defi mainly for ERC 20), the LP of the liquidity order book based on Bin uses similar to ERC-1155 In theory, this makes its LP certificates more similar to homogeneous ERC 20 tokens, so it has better composability.

c. Scenario of Liquidity Order Book

The convenient market-making and pending order strategies and easy combination based on Bin allow other projects and users to try more methods based on liquidity order books.

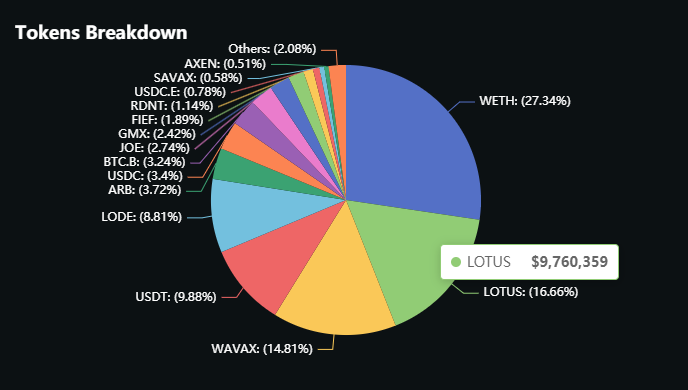

The project party's attempt

The total supply of the project token LOTUS is 30,000,000 tokens, through the Trader's JOE pool for even-scale pending order sales, the sale price of the first token in the Bin is 0.20 USD, and the last token is in the Bin The price of LOTUS is $4.2, and the ETH used by users to purchase LOTUS will be locked in the pool as liquidity. The pending order interval of LOTUS Bin is 5 Bins, and the specific distribution of pending orders is as follows:

image description

Image source: White Lotus Documentation

2. When users sell LOTUS, a 10% tax will be levied, 8% of which will be permanently destroyed to cause token deflation, and the remaining 2% will be used to reward LOTUS stakers.

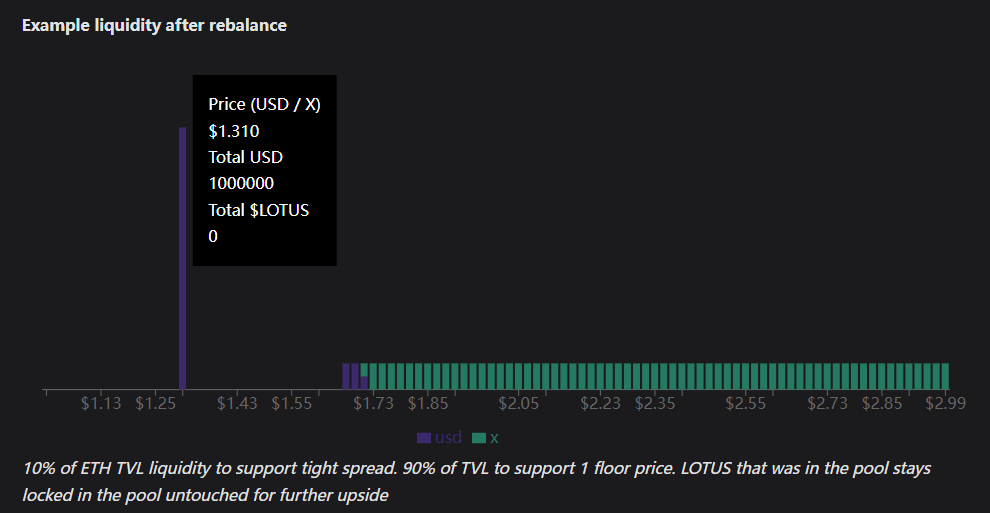

3. LOTUS has an automatic liquidity rebalancing mechanism. Every time the price moves by 5 Bins, liquidity rebalancing will be automatically performed, and the ETH liquidity in the pool will be redistributed as follows:

a. 10% of the ETH in the pool is used as "direct trading liquidity" and arranged in the Bin adjacent to the current active price, which is convenient for users to trade in the current price range.

b. The total ETH value/LOTUS is calculated as the "guaranteed floor price" of LOUTS, and the remaining 90% of ETH is concentrated in the Bin with a guaranteed floor price for pending orders. The floor price can undertake the sale of all LOTUS circulating tokens at any time.

After a certain rebalancing, the liquidity pending orders of LOTUS are as follows:

c. Under ideal circumstances, due to the limited total amount of LOTUS, LOTUS has the power to spiral upward with the token burning and reserve price increase brought about by the transaction.

However, White Lotus failed soon after its launch due to many reasons (the trading pools built by other users did not contribute handling fees and burning, the vacuum between centralized liquidity and reserve prices was too large), but the imitation disks launched after it were as follows: Jimbo and others have also adopted Trader Joe's liquidity order book as the bottom layer of their mechanism.

user practice

LB's convenient market-making experience has also received a good response on the user side. After the airdrop of ARB tokens in March this year, the transaction volume on the chain remained high. Uniswap V3, which landed on Arbitrum early, naturally obtained the largest liquidity and transaction volume, but Trader Joe also relied on LB's product experience + market-making rewards at that time Operational activities became Dex, which generated ARB's second largest transaction volume at that time, and once accounted for 45% of ETH-ARB transaction volume.

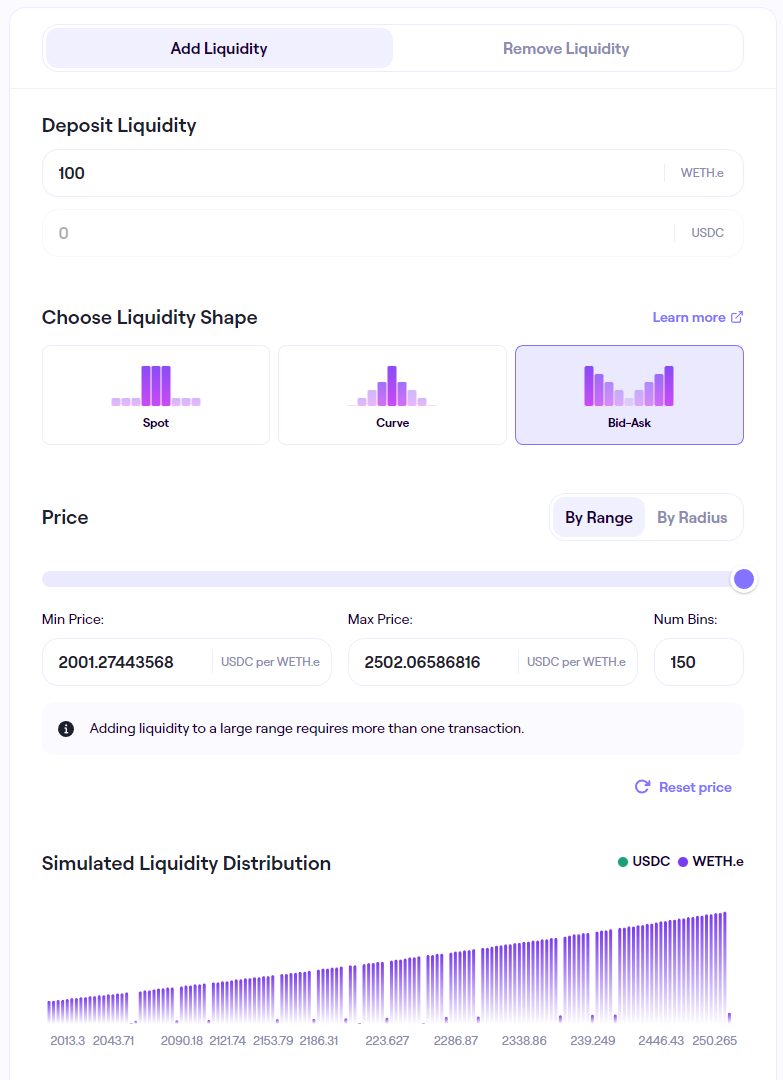

This requirement is easily realized through LB V2. We only need to deposit 100 ETH on one side, set the selling range (2000-2500), and select the Bid-Ask mode (the amount of pending selling orders increases with the price), This requirement can be easily realized.

As shown below:

As shown below:

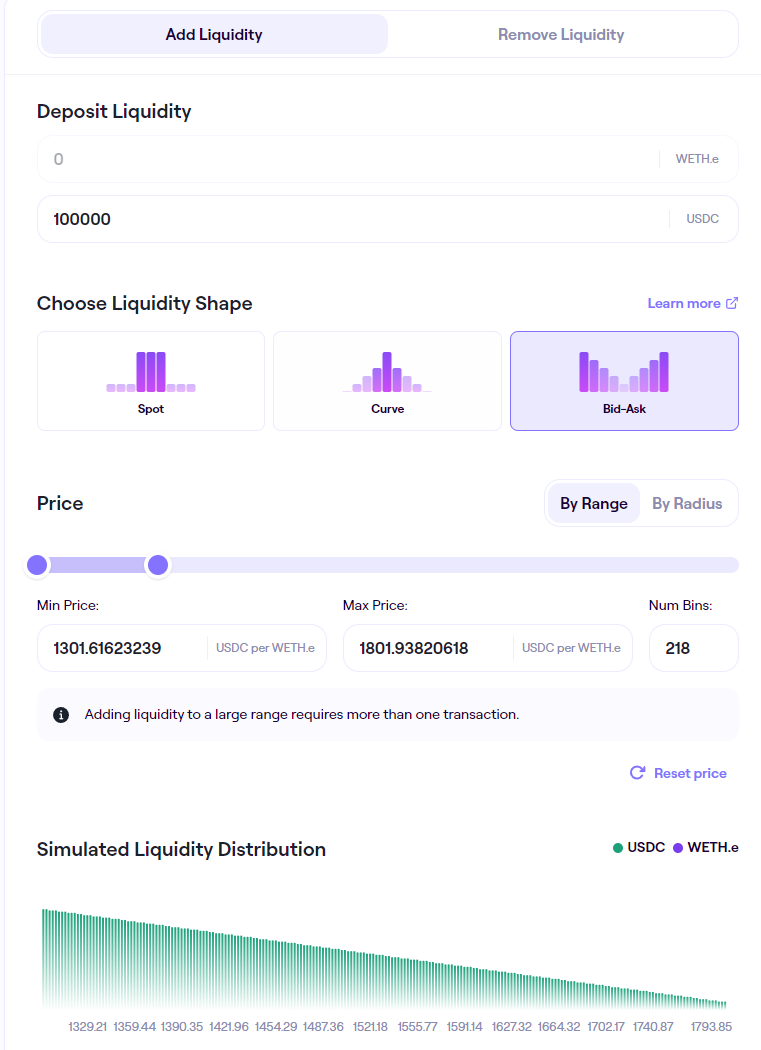

Conversely, if you want to buy 100,000 USD worth of ETH at a price of 1300-1800 USD, as the price drops, and complete all purchases around 1300, this is a variant of the Cost Averaging (DCA) position building strategy. We only need to click Deposit 100,000 USDC, set the buying range (1300-1800), and select the Bid-Ask mode. When ETH falls to this range, the position will be automatically completed, as shown in the figure below:

In general, Trader Joe's liquidity order book is based on the Bin and order book model, which lowers the management threshold for centralized liquidity on the LP side, and this convenience also provides richer trading and market-making strategies.

In addition, among the many Dex surveyed by the author, Trader Joe's product interaction experience is among the best, specifically including:

Simple and beautiful UI design and intuitive and easy-to-understand page layout, even new users are easy to use

The data dimensions of order pool and pledge amount are rich, detailed, and easy to understand. The author believes that this is very important for DeFi financial products. The real-time and transparency of business data is one of the main characteristics of DeFi products compared to TradFi, but data visualization is also important. of equal importance

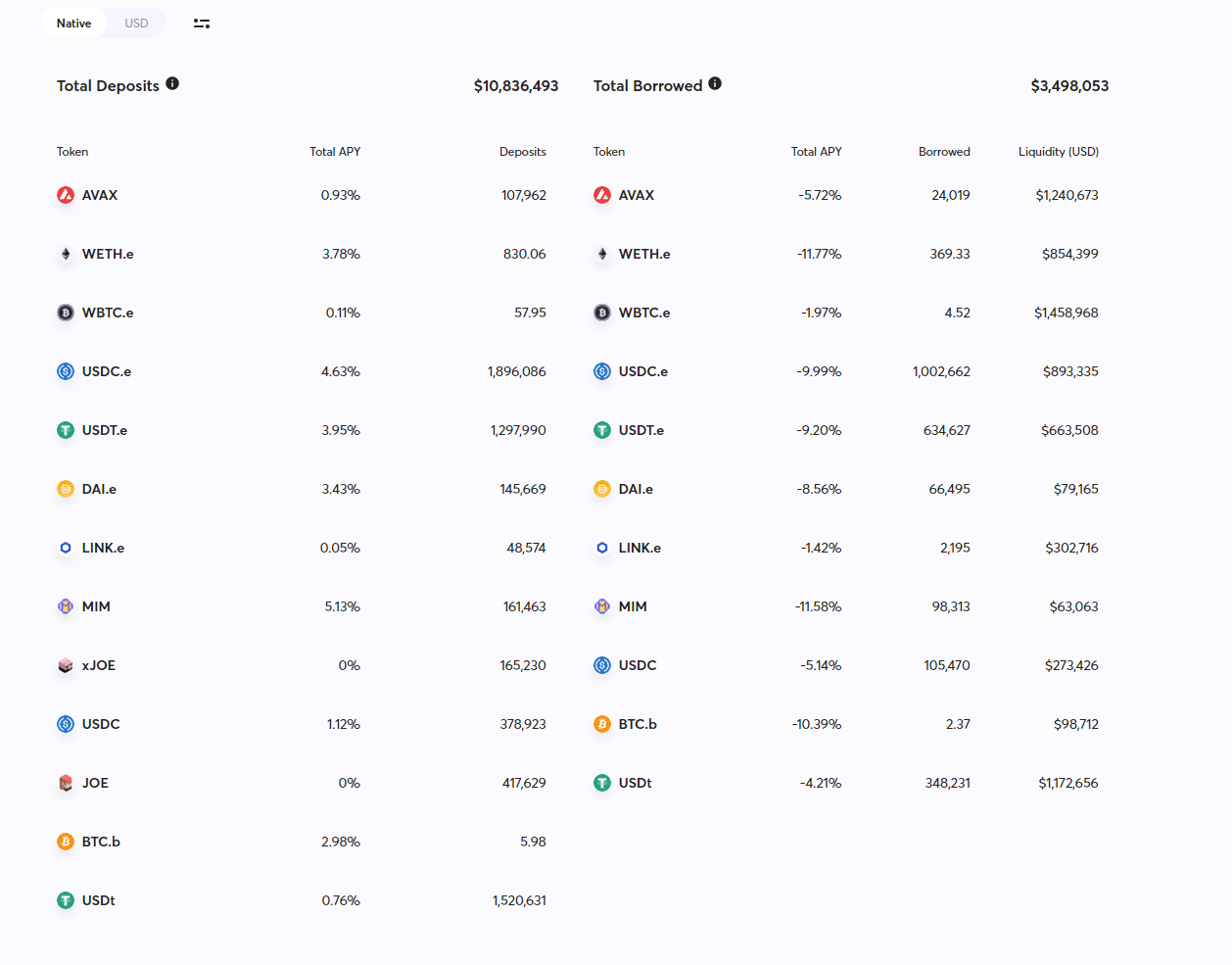

Banker Joe is a lending product released by the project party in 2021, forked from Compound and Cream. At the peak of its online business, it once had a TVL of 1 billion US dollars. However, the deposit funds of the lending business have shrunk to about 10 million US dollars. The contribution to the operation and profit of the project has been very small, and it is not currently the focus of the project's development.

image descriptionhttps://v1.traderjoexyz.com/lend

Current Banker Joe business data, source:

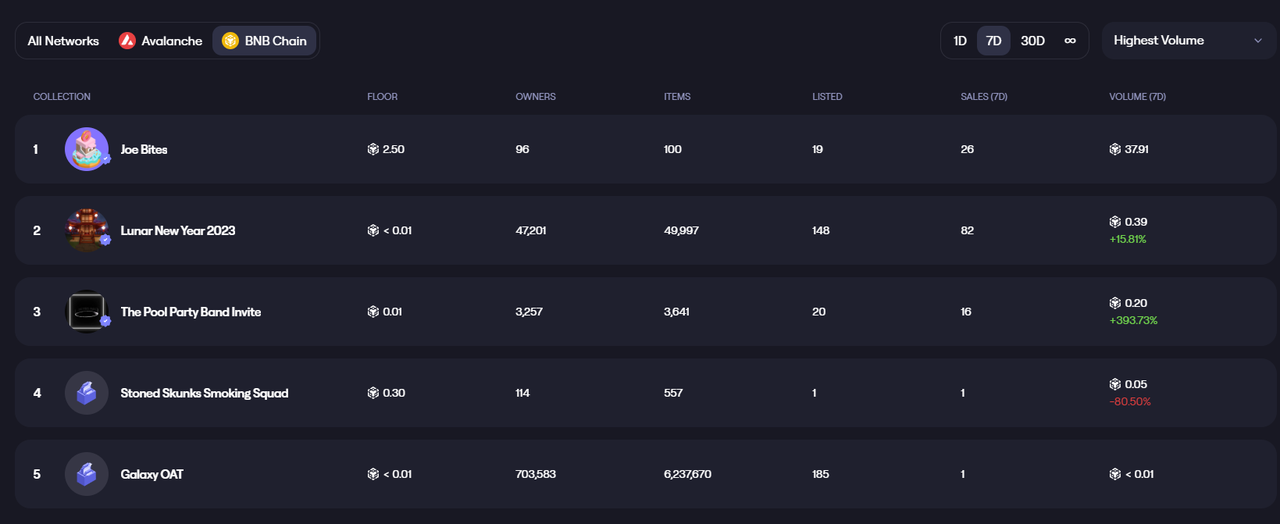

2.1.3 NFT transaction: Joepegs

Launched in April 2022, Joepegs currently supports NFT transactions on Avalanche and BNBchain, but judging from the transaction volume, the NFT transaction volume on the two chains is not high.

secondary title

2.2 Project History and Roadmap

2.2 Project History and Roadmap

The following are important events since the Trader Joe project went live, as of mid-May 2023.

On June 1, 2021, the project was officially announced, the Trader Joe contract code was open sourced in the second half of the year, and the project was officially launched at the end of June.

2021.9 Received a strategic investment of 5 million US dollars, led by Defiance Capital, GBV and Mechanism Capital, other investors include Three Arrows Capital, Coin 98 Ventures, Delphi Digital, Avalanche Foundation and Aave founder Stani Kulechov, the financing valuation is $50 million.

2021.10 The lending product Banker Joe was launched. Banker Joe forked from Compound and Cream, and used Chainlink oracles for asset quotations.

2021.10 Trader Joe and Avalanche jointly launched a liquidity mining plan worth US$20 million, each providing Joe with US$10 million and Avax with US$10 million.

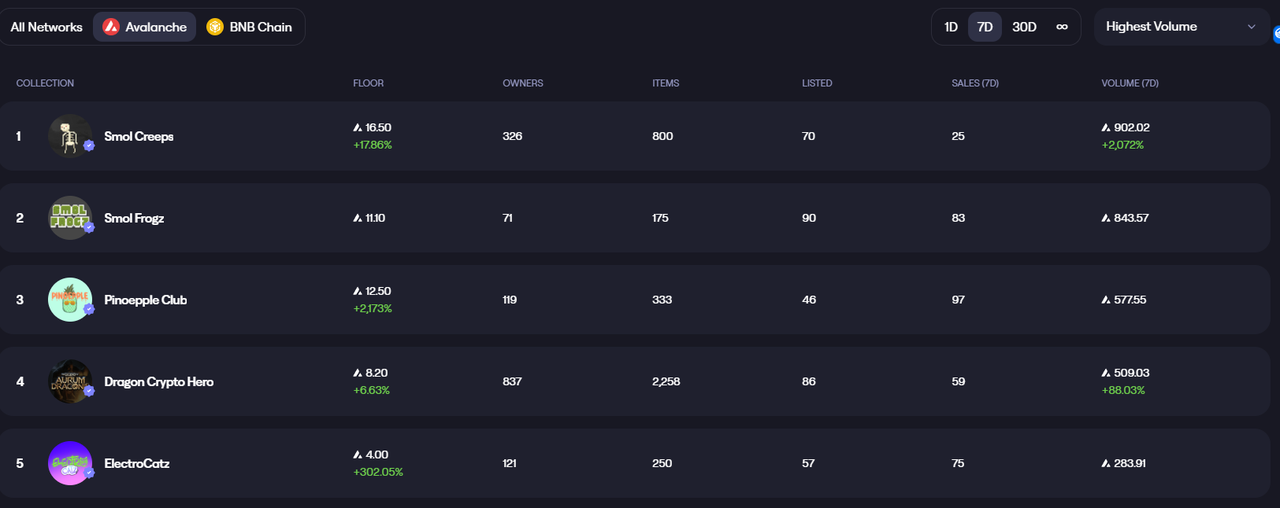

2022.1 The launchpad product **Rocket Joe will be released, and users who have pledged Joe tokens will continue to receive rJOE points as a condition for participating in the launchpad

2022.2 The economic model revision, Staking V2, is released, and the veJoe model is introduced. veJoe is generated based on Joe pledge. The longer the pledge duration, the more veJoe, and veJoe is used to accelerate the user's liquidity mining income.

2022.4 Launch the NFT trading market Joepegs.

2022.8 Release the V2 white paper and launch the Liquidity Book (liquidity book) strategy. This solution is similar to the centralized liquidity solution of Uni V3, except that "bin" is used as the unit of the price range, and a dynamic rate mechanism is introduced to increase the value of the currency. LP fee income during periods of large price fluctuations.

2022.11 Liquidity Book (V2) is officially launched.

2022.12 Trader Joe's deployment to Arbitrum.

2023.1 Announced the plan to deploy Trader Joe and Joepegs to BNBchain, and it will be completed by the end of March.

2023.1 Preview of Trader Joe V2.1 features, including liquidity order book-based incentive plan, liquidity auto-management features, limit orders, and permissionless liquidity order pools.

2023.2 Announced cooperation with Layer 0 to turn Joe into a native multi-chain token. 2023.4 Trader Joe V2.1 was officially launched.

2.3 Team situation

The Trader Joe's team remains anonymous,@cryptofishxand@0x murlocand@cryptofishxare its two co-founders. in@throwsnowballs、@PandaswapexIs a full-stack engineer with rich working experience in the Web3 field, once worked on Avalanche

Contributor to @sherpa_cash, who has also worked at Google and a decentralized derivatives exchange.@cryptofishxNot long ago, on May 13th,

He also emotionally reviewed his experience in the 2017-18 bear market on twitter. He was a doctor at the age of 30 and lost all his profits and 2/3 of the principal in the bear market. Time to learn programming and high math, and in 2 and a half years, I got 2 related degrees and entered Google, and then started Trader Joe part-time and achieved success.@cryptofishxOn May 17,

I sent a testimonial with emotion and put it on the top:

"When we first started Joe, I made a promise to myself that I would still be on the project 2 years later, because that's when most projects die. Our 2nd birthday is coming up, and I think it's very Happy to say: we're still here and building with the exact same energy as on day one."

This may be an example of the founder still maintaining a good entrepreneurial state and having a lot of affection for the project.@0x murlocAnother co-founder of Trader Joe's

There is less information disclosed. The public information only mentions that he is a full-stack engineer and product manager. Before starting a full-time business in 2021, he was the product leader of a newly listed unicorn. He has a degree in electronic engineering from a well-known university.

The author also consulted the community staff of Trader Joe on the issue of team size, and the other party said that it is inconvenient to disclose relevant information for the time being.

In the fast-changing market competition and impetuous entrepreneurial environment in the encrypted world, the diligence of the Trader Joe team is still impressive. On the one hand, it is reflected in the fact that it has tried and implemented multiple product directions in just two years (Dex, Lending, launchpad, NFT trading platform), actively follow up the trends and demands emerging in the market; more importantly, they have carried out active native mechanism innovation on the core basic disk of Dex, and the design and experimentation of economic models Also very positive (see the “Token Model” analysis section for details).

2.4 Financing and key partners

3. Business Analysis

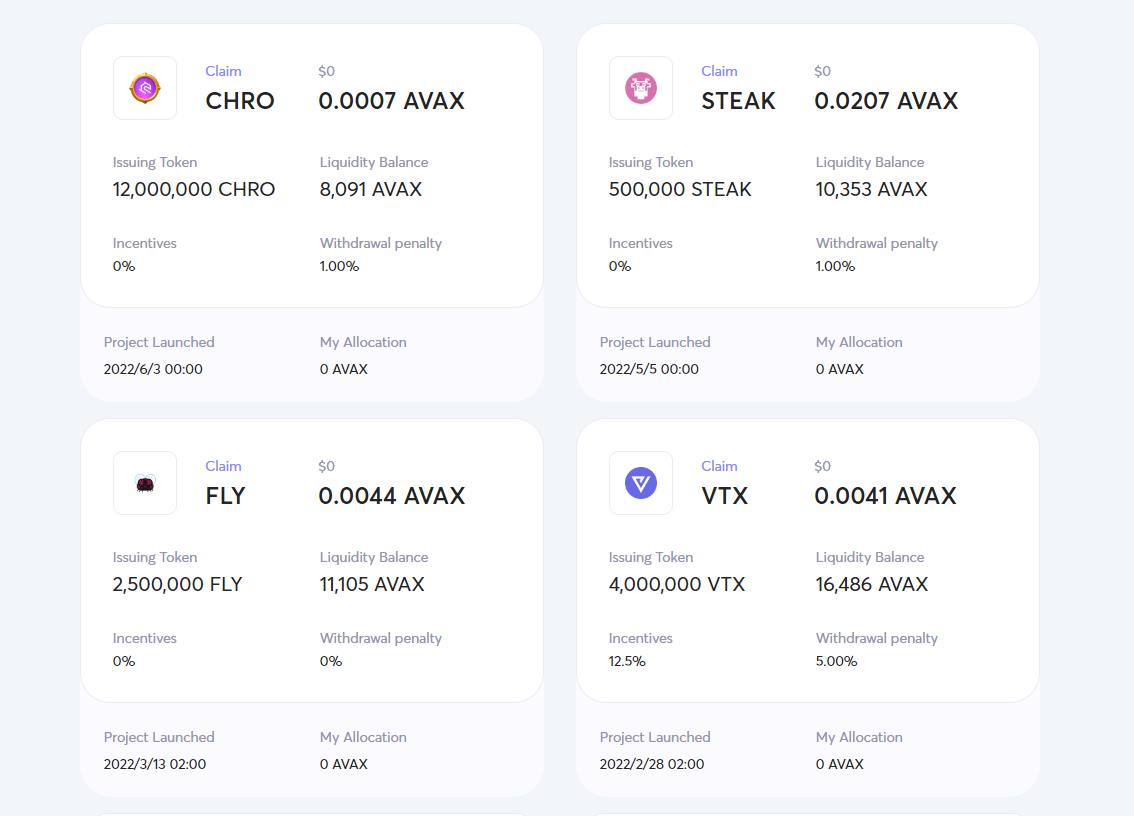

3.1 Industry space and potential

Data Sources:https://defillama.com/dexs

Data Sources:

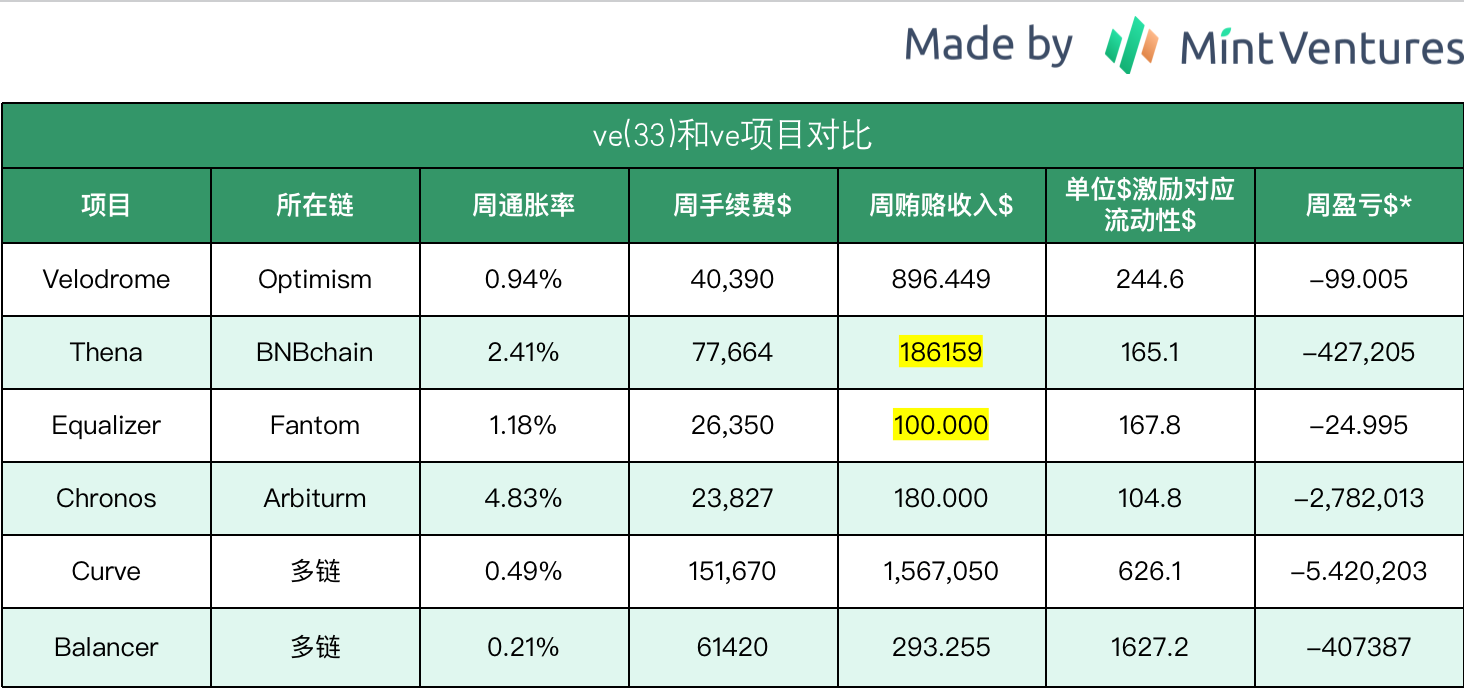

In addition to spot transactions, the business of Dexs track itself also has a liquid procurement business. Most of the representative projects operating this business adopt the ve token model (representing the Balancer project) pioneered by Curve, or further develop based on the ve model. Modified ve(3,3) model (representing project Velodrome). If you only look at the bribery revenue of the liquidity procurement business (referring to the bribery fees paid by other project parties to purchase liquidity in Dexs), you will find that this part of the income seems to be much higher than the spot transaction of Dexs, but if the ve class Dex itself Token incentives are regarded as "liquidity procurement costs", and bribe income is regarded as "liquidity sales revenue", then most of the Dex operating this business are currently at a loss (here does not consider the direct purchase of token pledges) “indirect income” from governance rights).PS: 1. The statistics and calculation time of the above data is 2023.5.5, and the data marked in yellow are estimated values. The original text comes from the Mint Ventures research report

"From Velodrome to Chronos, ve(3, 3) is back, is it a better Dex mode?"

3. Bribe revenue for Curve and Balancer, using bribe data from Votium, Hiddenhand, and Votemarket.

*[Profit and loss] here refers to income (handling fee + bribe) - liquidity emission incentive

*[Profit and loss] here refers to income (handling fee + bribe) - liquidity emission incentive

The impetus for the growth of the Dexs track, in addition to the increase in the overall asset size of the encrypted business world, also includes several key points:

The loss of users' trust in centralized institutions and the increase in the demand for asset autonomy

The composability of the DeFi ecology where Dex is located greatly improves the capital efficiency and freedom of users

Most of the native Web3 projects choose Dexs as the first stop for trading and arranging liquidity

To get out of this state, in addition to looking forward to the business growth brought about by the recovery of the encryption market, what is more important is whether Dexs can find a way to build a solid barrier and start to realize profitability.

3.2 Business Situation

3.2 Business Situation

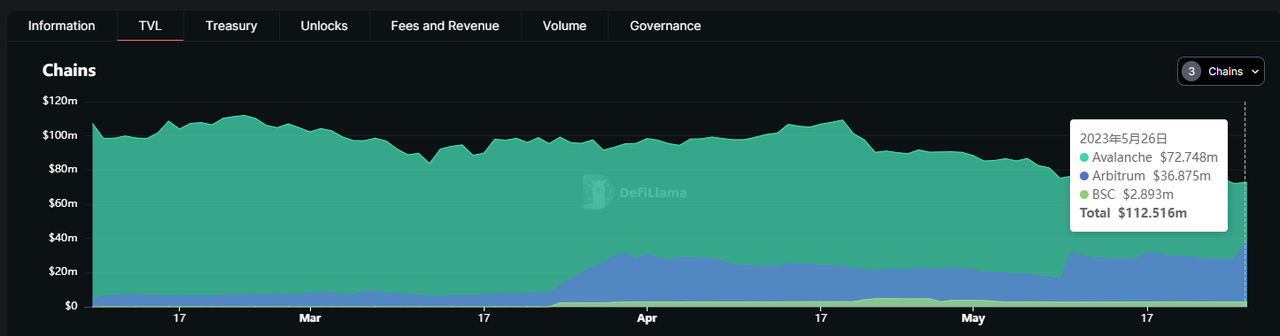

3.2.1 TVL

At the peak of Trader Joe’s last round of bull market, the TVL was as high as 2.6 billion U.S. dollars, but as the market entered a bear market, liquidity was rapidly lost. Currently, the TVL of Dex (total of V1, V2, and V2.1) is about 110 million U.S. dollars.

image descriptionhttps://defillama.com/protocol/trader-joe

Among them, Avalanche accounted for 65%, Arbitrum accounted for 33%, and BNBchain accounted for 2%. Judging from the TVL trend in the above figure, Trader Joe’s liquidity in Arbitrum continues to rise, while Avalanche’s liquidity decreases accordingly.

V1 TVL trend, data source:https://defillama.com/protocol/trader-joe

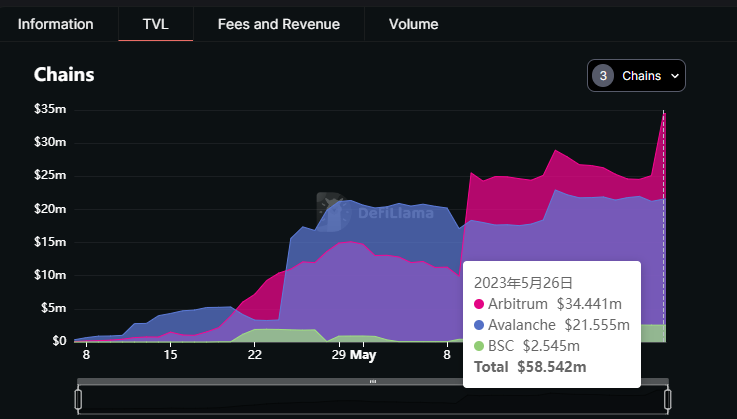

image descriptionhttps://defillama.com/protocol/trader-joe

Looking at Trader Joe's V1 and V2.1 data, you will find that V1 has been in a slow decline this year, while V2.1 has increased rapidly. The main source of the data increase is also the growth of Arbitrum's business volume.

image descriptionhttps://defillama.com/protocol/trader-joe

V2.1 TVL composition, data source:

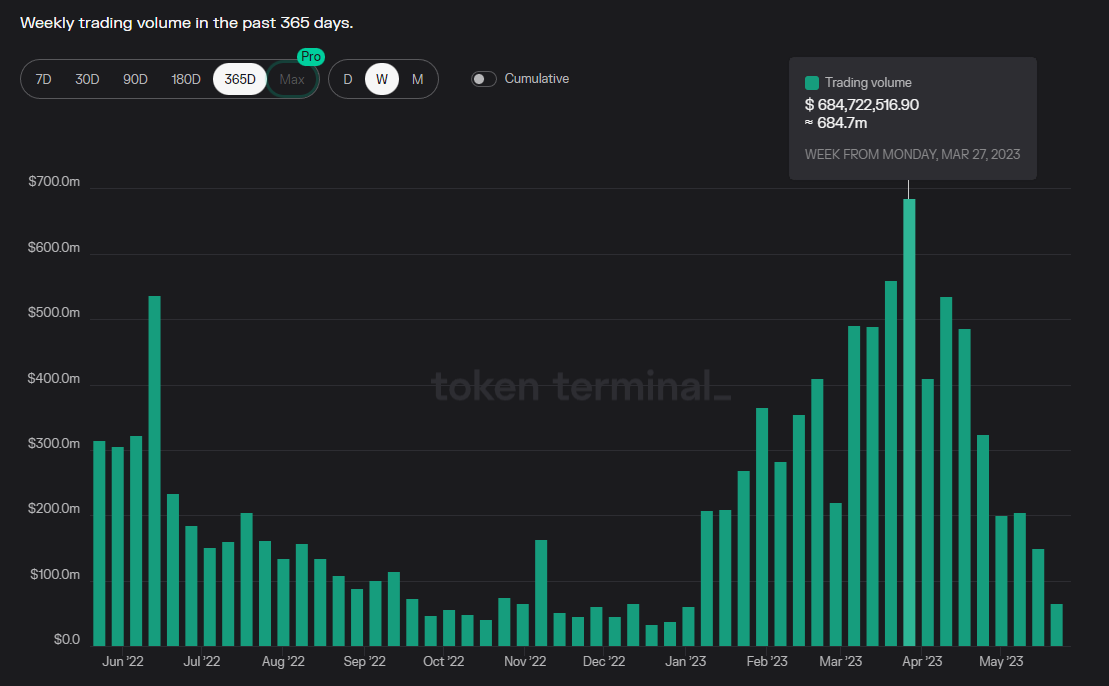

image description

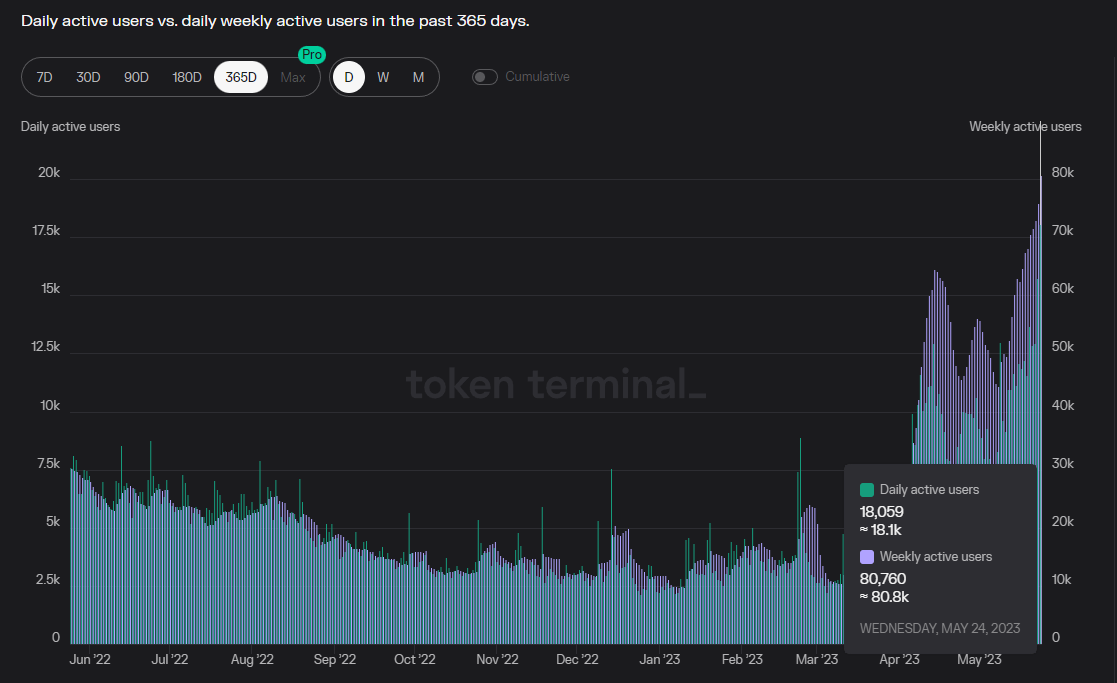

Data Sources:https://tokenterminal.com/terminal/projects/trader-joe

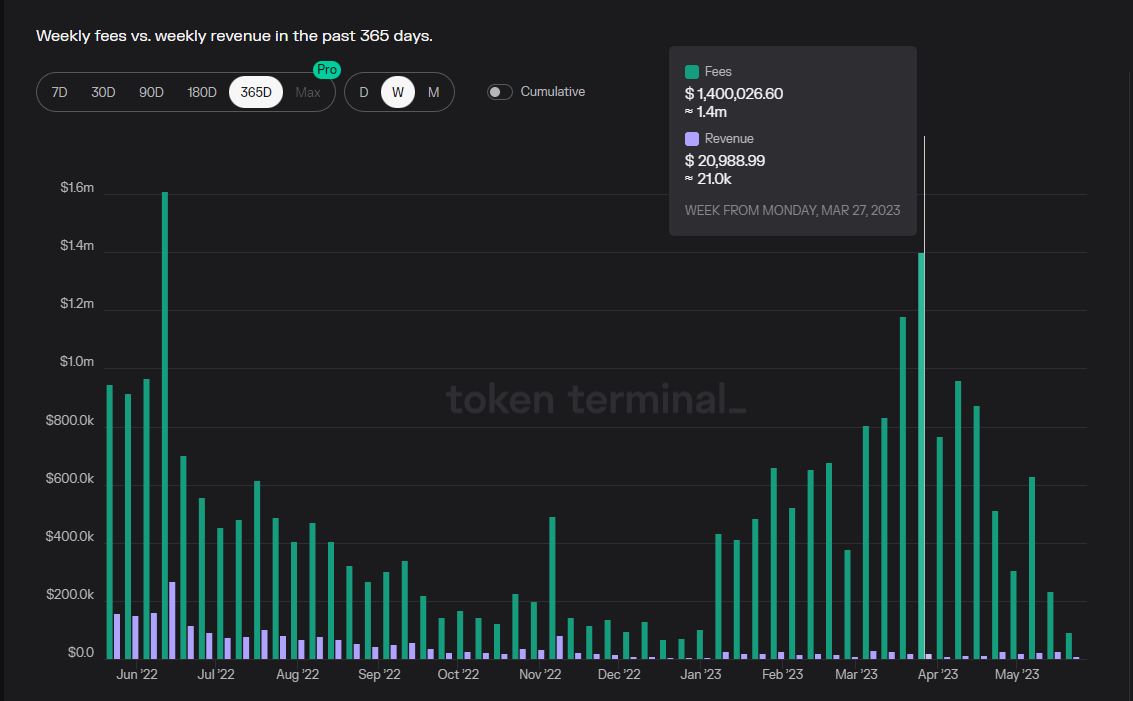

image description

Data Sources:https://tokenterminal.com/terminal/projects/trader-joe

Data Sources:

But during the same time period when trading volume returned to new highs, Trader Joe's fee income was far below the fee income at the peak last year. The weekly fee income for the week at the end of March was US$21,000, less than 1/10 of the weekly fee income of US$260,000 at the peak in June last year.

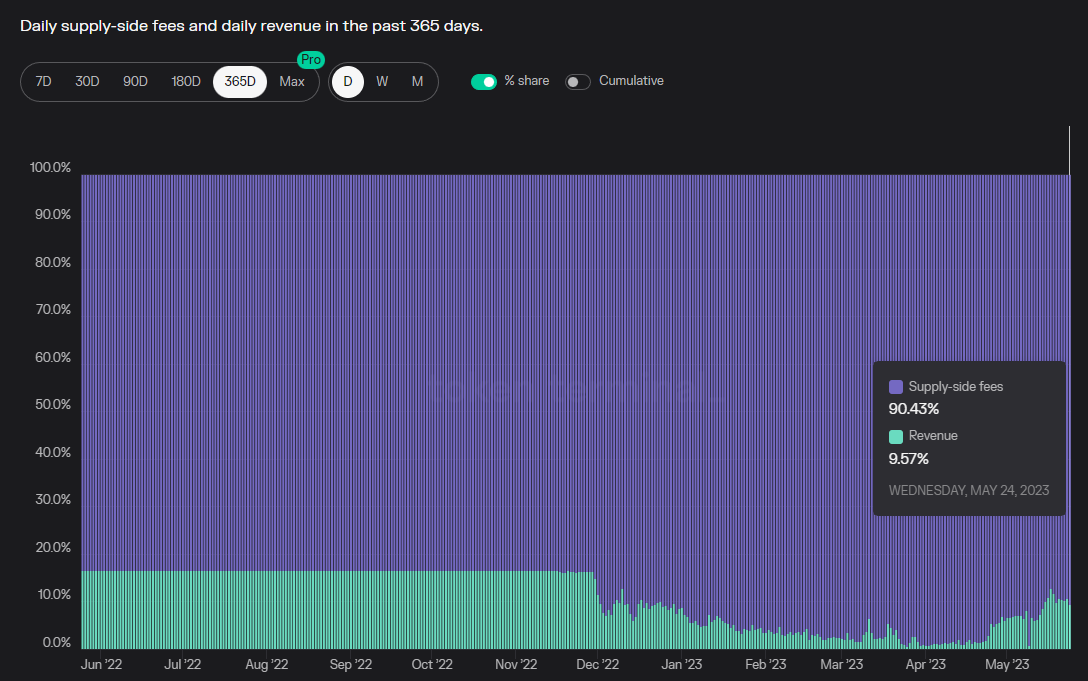

The reason for this is that since Trader Joe’s V2 was launched in November last year to April this year, Joe’s has allocated all the V2 handling fees to LPs. It was not until the recent launch of V2. To Joe's pledger. In addition, the agreement income of different agreements such as Curve = 50% * handling fee, the agreement income ratio of Trader Joe has many modes, among which:

V1: 0.05% on all transactions as protocol revenue

V2: No agreement fees are charged, all agreement fees are allocated to LPs

image description

image description

Data Sources:https://tokenterminal.com/terminal/projects/trader-joe/revenue-share

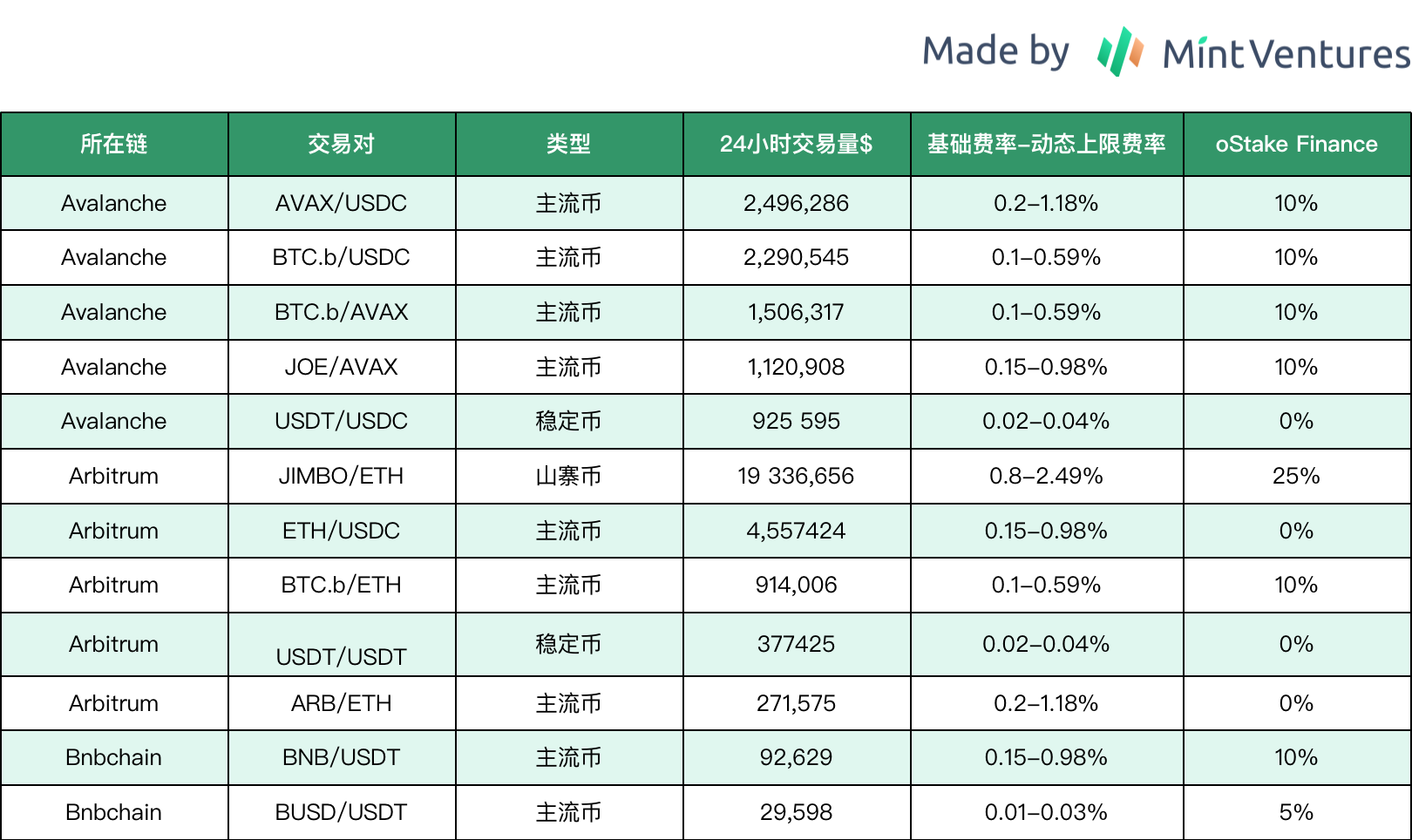

In order to have a general understanding of the protocol fee design of Trader Joe's V2.1, the author makes statistics and compares the protocol fee rates of several LB Pools with large transaction volume on the Trader Joe chain, as follows:

image description

Statistics time: 2023.5.26

From the above table, we can see that the current negotiated rate pricing strategy adopted by Trader Joe is:

Focus on developing the Arbitrum market with a strategy of reducing or waiving protocol fees

Mainstream stablecoins basically adopt a free strategy, only earning business data (transaction volume and TVL) and not making money

BNBchain business is basically negligible, so fees are charged normally

image description

Data Sources:https://tokenterminal.com/terminal/projects/trader-joe

Data Sources:

Since the deployment of V2.1, the number of active users of Trader Joe has increased significantly, reaching a new high since the birth of the protocol. Recently, the number of daily active addresses is 18,000, and the number of weekly active addresses exceeds 80,000 (Defillama data is 110,000). The number is nearly 200,000. The continuous growth of C-end users should be attributed to Trader Joe’s good product interaction experience.

3.3 Project Competition Landscape

3.3.1 Avalanche

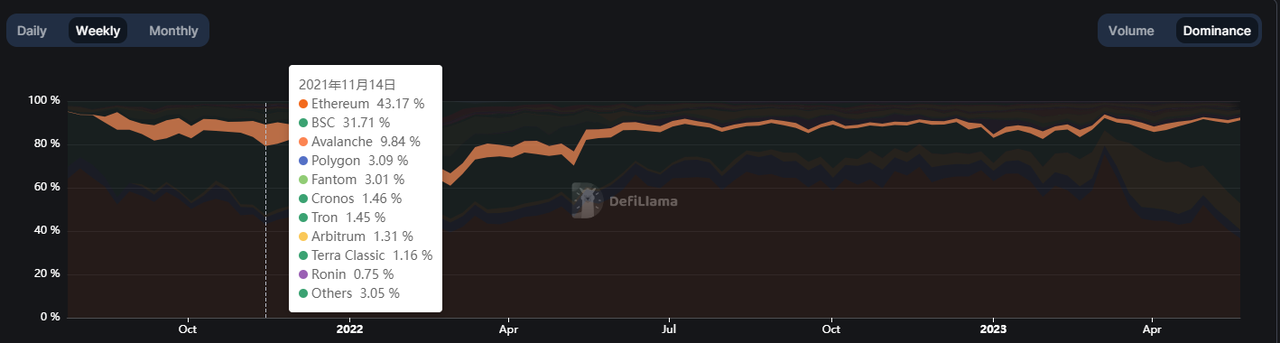

Avalanche was one of the fastest-growing L1s in the last wave of bull market. However, during the bear market, its market share in terms of TVL and trading volume continued to decline. The TVL share fell from 9.8% at the peak to the current 1.51%. The volume ratio dropped from 9.84% to the current 1.19%.

image descriptionhttps://defillama.com/dexs/chains

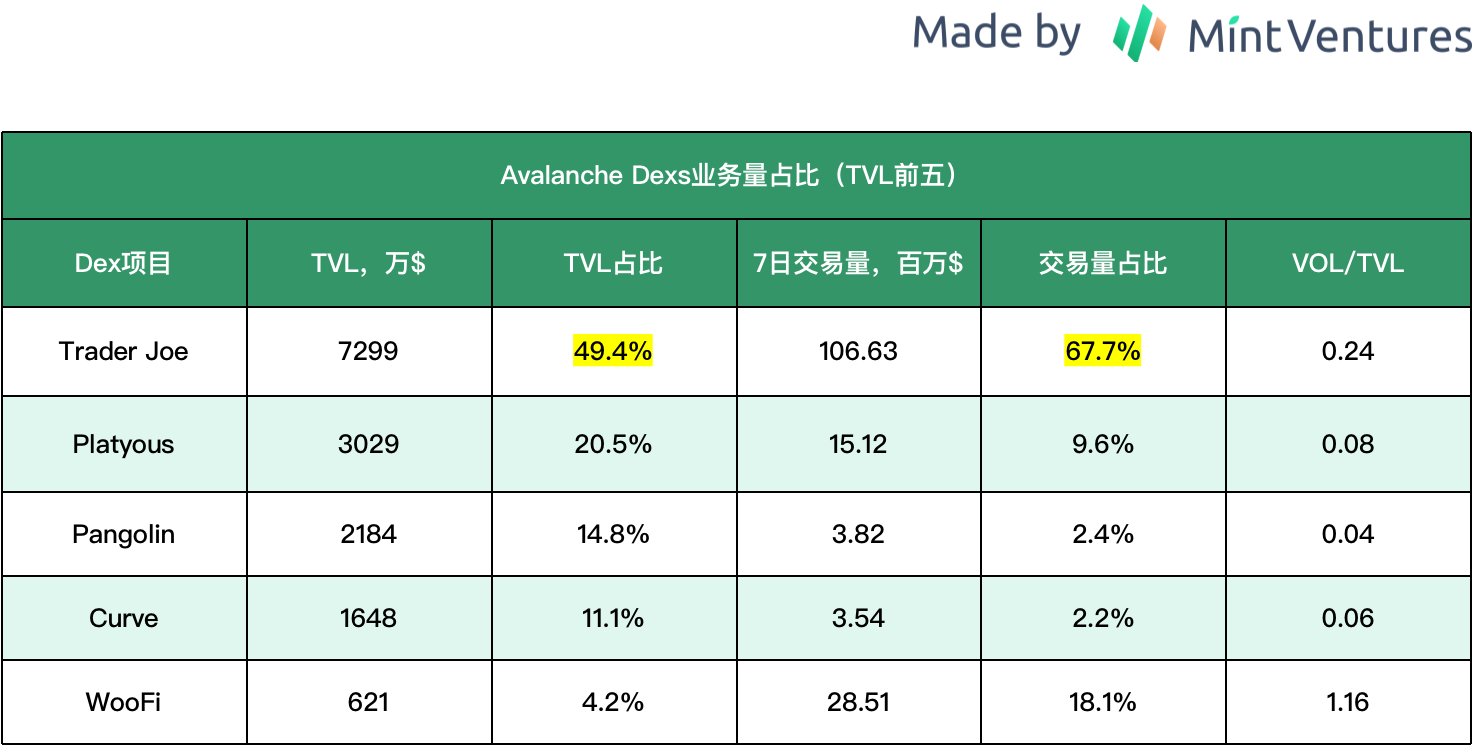

On Avalanche, Trader Joe was established and developed earlier, and has obvious advantages in both TVL and transaction volume.

image description

Data source: Defillama, PS: The calculation of the proportion is based on the total amount of the top 5. Statistical time: 2023.5.26

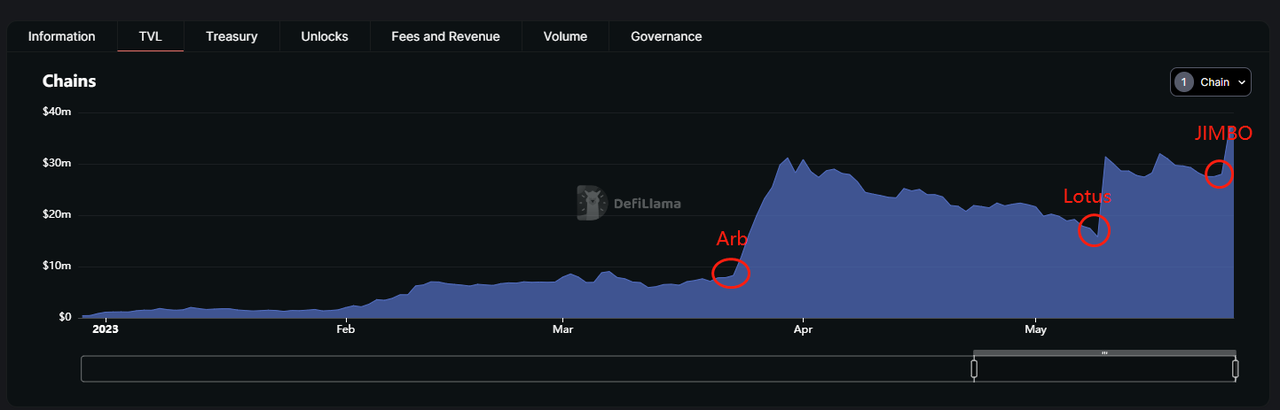

3.3.2 Arbitrum

Arbitrum is the fastest-growing L2 ecosystem in the past year, second only to BNBchain and Ethereum in terms of TVL and transaction volume (excluding Tron). A more active ecology also means more intense competition. There are many DEX projects on Arbitrum, including Uniswap V3, Curve, and Balancer, which were deployed across chains earlier, as well as native DEXs such as Camelot, Chronos, and Ramses.

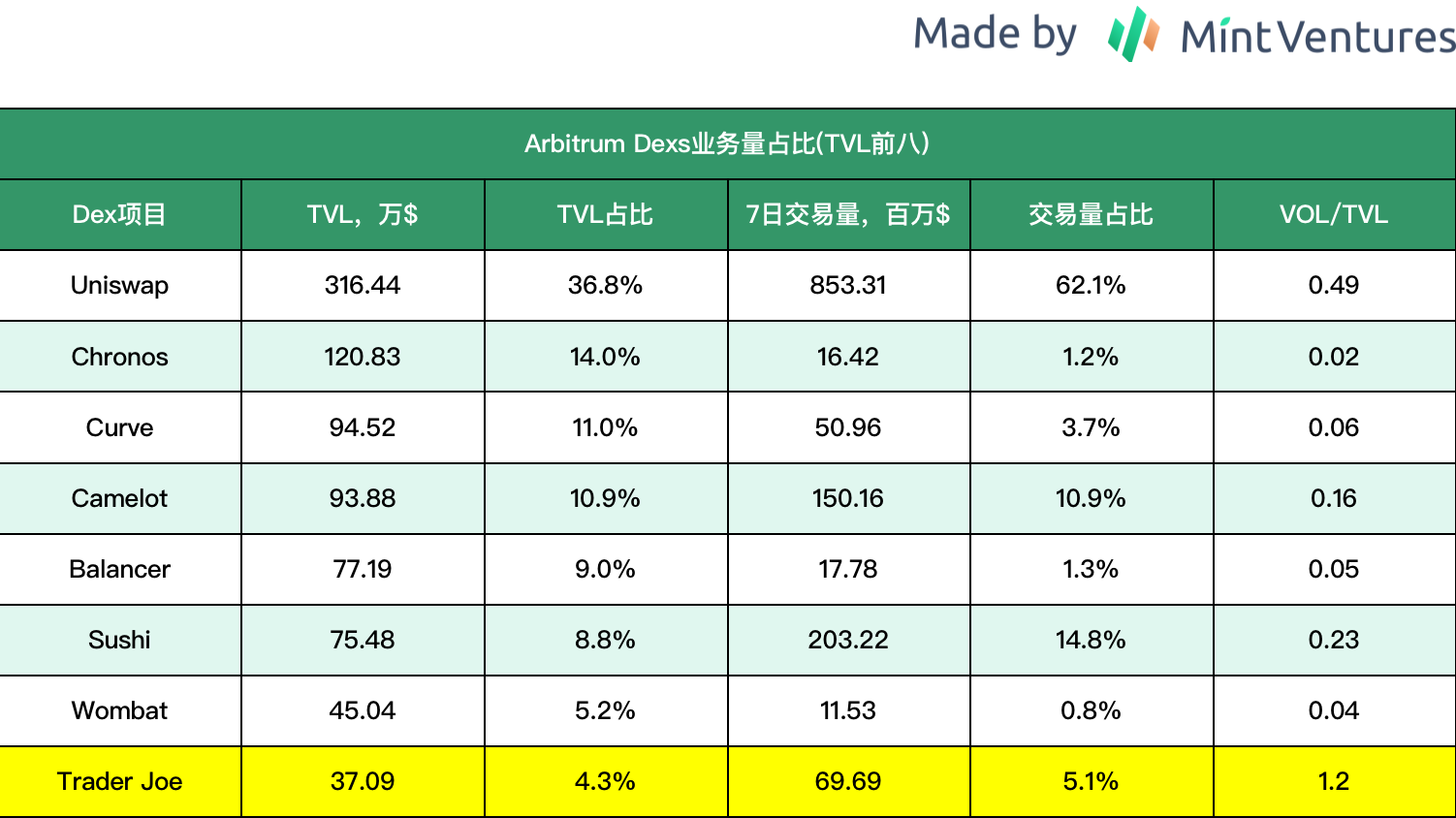

image description

Data source: Defillama, PS: The calculation of the proportion is based on the total amount of the top 8, and the statistical time: 2023.5.26

Although Trader Joe's currently ranks low on Arbitrum's liquidity, the following stats are worth noting:

Data Sources:

Data Sources:https://defillama.com/chain/Arbitrum? tvl=true

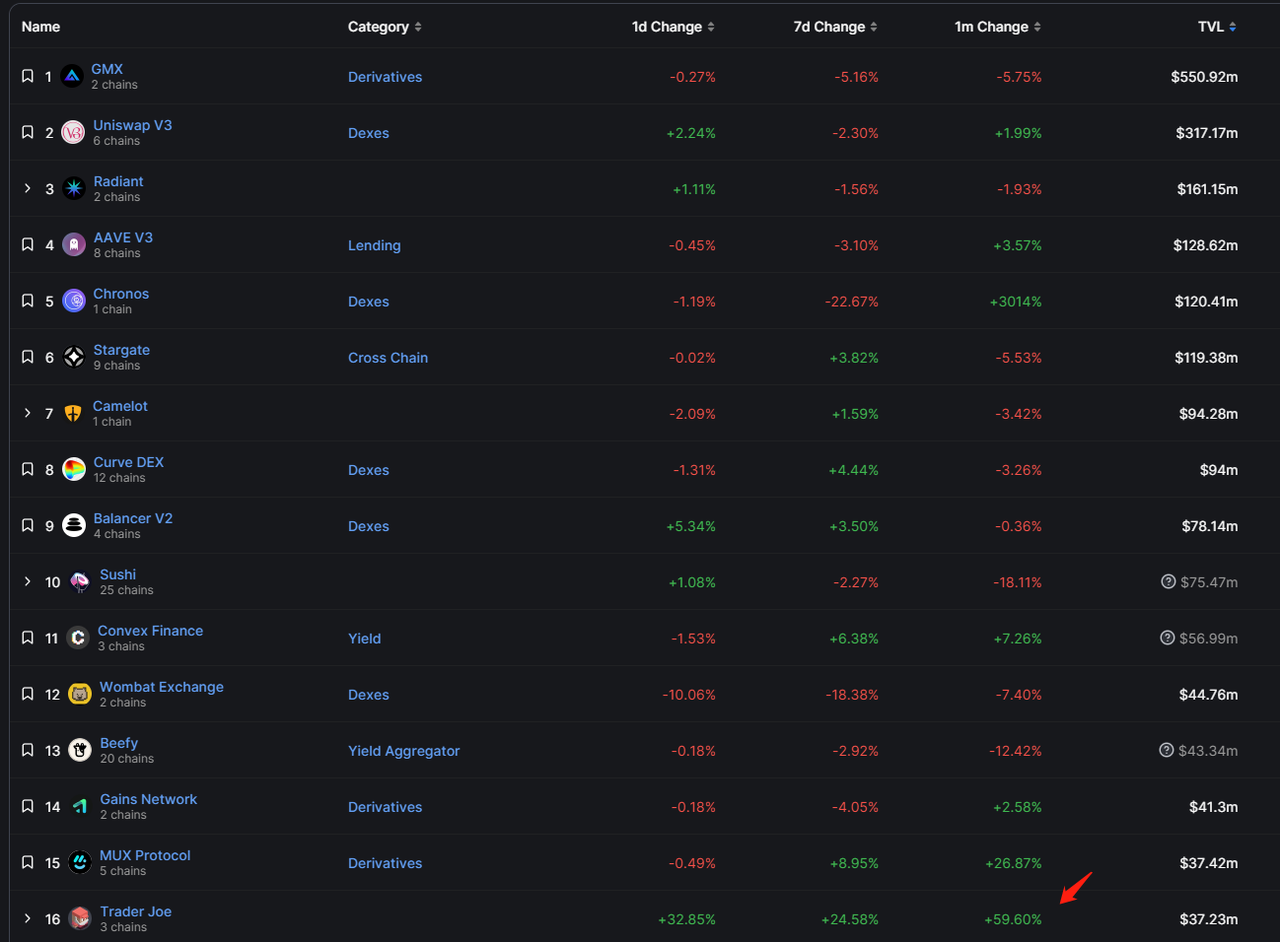

image descriptionhttps://defillama.com/protocol/trader-joe

Trader Joe's Arbitrum TVL growth trend, data source:

As for the driving force of Trader Joe’s TVL growth on Arbitrum, the author believes that the main drivers are:

The introduction of the LB mechanism is more friendly to LP, and the market-making funds + trading volume gradually increase and strengthen each other

The emergence of new assets has aroused users' enthusiasm for market making and trading (see the three red circles in the above figure for details), and Trader Joe's LB mechanism has better attracted and undertaken this part of funds and users

The first point is the basic market for growth, and the second point, as an event-driven factor, promotes the pulse-like growth of Trader Joe LB products. The three red circles in the figure above, as three driving events, have all contributed to the rapid rise of Trader Joe’s TVL and trading volume, but the logic behind them is slightly different:

a. ARB airdrop event

ARB’s airdrop on March 24 this year created a large amount of on-chain transaction volume, and the early expectation of this transaction volume also triggered a large number of users to participate in the market-making of ARB tokens, with different motivations, both promising Those who obtain service fee income through market making also hope to sell ARB or buy bottom ARB through the variant DCA average cost method while obtaining service fees through market making (for logic details, see: 2.1.1-C. Liquidity order book scene). On the one hand, Trade Joe has a more convenient market-making and pending order product experience than Uni V3, and has introduced more LPs; on the other hand, it has also increased its own Liquidity Book Rewards Program (liquidity order book reward program) The capital investment made ARB’s transaction price more dense and dynamic market-making funds appeared, which greatly reduced the transaction slippage, which allowed Trader Joe’s LB Pool to once have a transaction volume exceeding Uniswap V3 in ARB-ETH transactions (This in turn boosts the LP's market-making APR).

A week after the ARB airdrop (Epoch 3), Trader Joe provided 175,000 JOE token rewards for ARB’s LB market making LP

*The liquidity order book reward plan is a dynamic reward plan for LPs by Trader Joe, which is similar to a flexible marketing activity. The author will introduce it in the token model section.

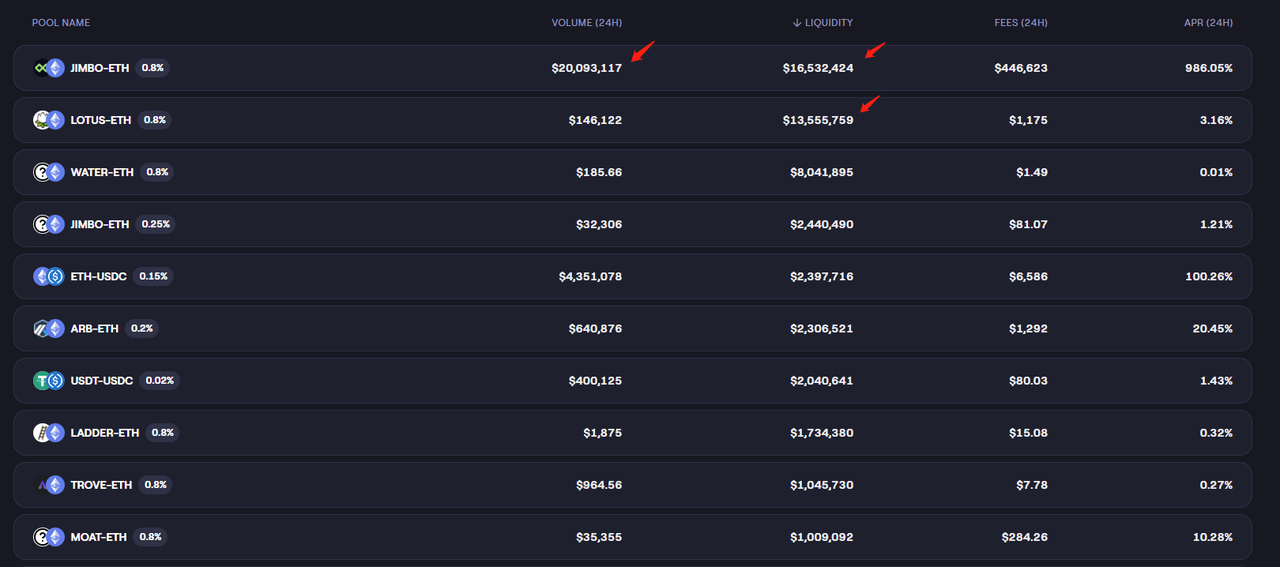

image description

Image Source:https://traderjoexyz.com/arbitrum/pool

Image Source:

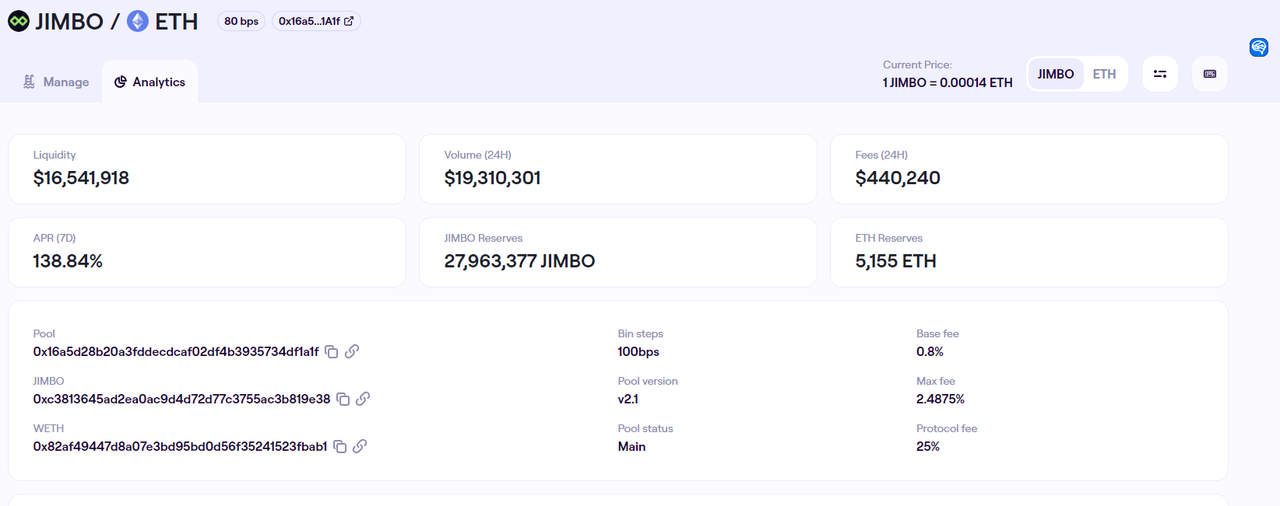

The Ponzi attributes of LOTUS and JIMBO may determine the limited life cycle of the project. The transaction volume around such projects is often pulsed and lacks good sustainability.

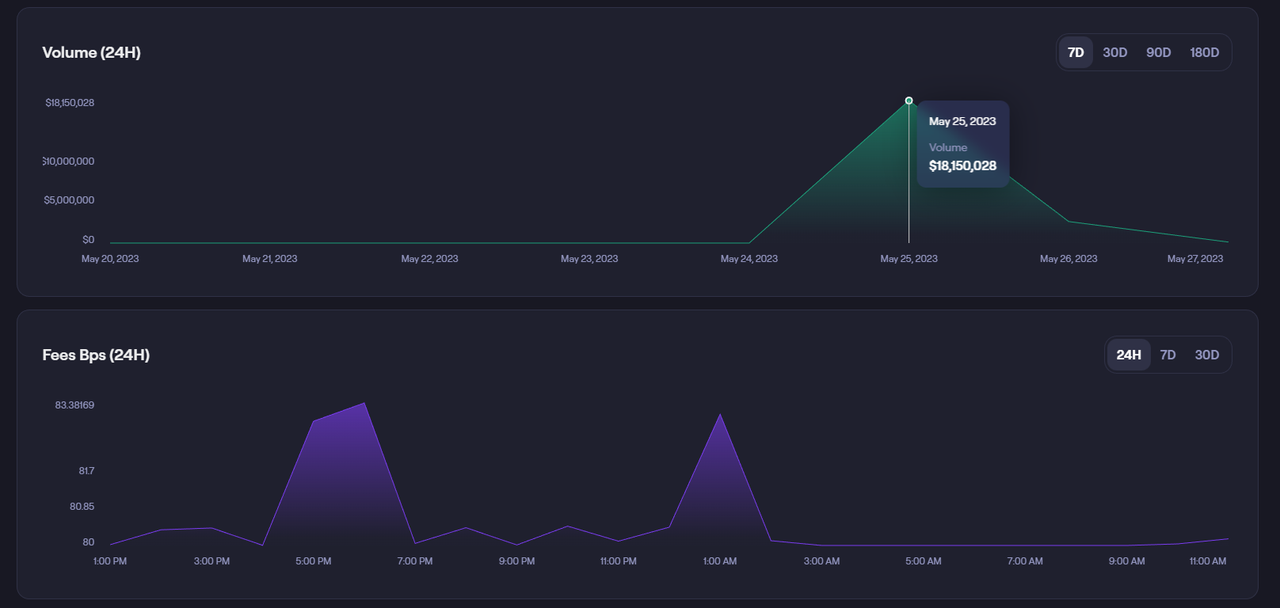

For example, the LB Pool of JIMBO V2, after the project was launched, the transaction volume reached 18 million US dollars in a single day, and quickly dropped to 2.7 million US dollars the next day.

Nevertheless, their interesting attempts based on Trader Joe's LB mechanism and good fundraising results may lead to more projects building their own liquidity based on LB or designing more imaginative gameplay, thus bringing Trader Joe More TVL and transaction volume, but the sustainability of the incremental transactions and liquidity created by these new projects remains to be seen.

3.4 Token Model Analysis

3.4.1 The total amount, distribution and release speed of tokens

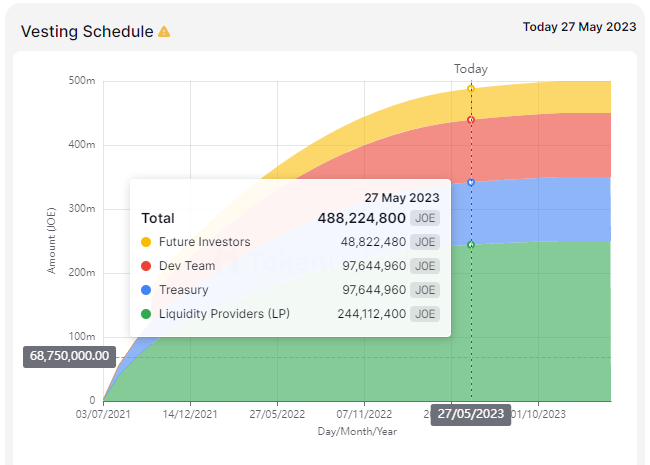

image description

Data Sources:https://token.unlocks.app/joe

Data Sources:But according toOfficial Circulating Supply Data

It is worth mentioning that, unlike most other DEX or DeFi projects that still maintain high incentive emissions, Trader Joe’s normal liquidity incentive emissions are already very low. Currently, the daily emission of JOE tokens is only 850 pieces (worth about $300), which is close to 0. After deducting the tiny emissions incentive, Trader Joe's has posted positive profits for five consecutive weeks.

image descriptionhttps://tokenterminal.com/terminal/projects/trader-joe

Trader Joe's profit chart, source:

This does not mean that Trader Joe no longer incentivizes liquidity, but that the team adopts a phased, short-cycle, and flexible incentive method around the LB mechanism, that is, the "Liquidity Book Rewards Program" (Liquidity Book Rewards Program) ", the incentive objects of this plan are LPs who make market in a specific LB Pool (for example, during the ARB airdrop period, the incentive pools are ARB-ETH and ARB-USDC). Different from the regular liquidity incentive scheme, this scheme has the following characteristics:

With the point-to-point PK system, the calculation object of points is not liquidity or trading volume, but "the market-making fee obtained by LP during the event", which means that LP needs to provide sufficient liquidity in order to obtain rewards, and at the same time It is also necessary to adjust the liquidity range in a timely and dynamic manner, so that your own liquidity can be as close as possible to the price range with intensive transactions

If you don’t engage in sunshine, if users want to get rewards, they need to ensure that their handling fees capture more than 1% of the total amount of the pool before they can participate in the distribution of rewards

The cycle is short, with weeks as the unit of activity, so that the plan can be flexibly and continuously adjusted according to market changes and hot spots, and continuously reduce the "cost-effectiveness ratio" of subsidies

In my opinion, this is a token incentive scheme based on a centralized liquidity mechanism that better balances liquidity and trading volume.

3.4.2 Token use cases

The Trader Joe team explored multiple dimensions of JOE use cases, including:

Pledge dividends: Pledge JOE for dividends and can be withdrawn at any time. The source of dividends is 0.05% of the transaction volume of the V1 AMM, and the protocol fee sharing of the V2.1 LB pool. In the early days, the pledge certificate of JOE was xJOE, the dividend token was JOE, and later changed to sJOE, and the dividend asset was USDC. Pledge dividends are currently the main pledge use of JOE.

Pledge acceleration: Pledge JOE to get veJOE, which is also available at any time. veJOE is used to accelerate (Boost) the mining income of LP of V1 AMM. The number of veJOE is related to two factors: 1. The number of pledged JOE; 2. The accumulation of pledged veJOE Duration, the cumulative duration refers to the time that the pledged JOE has not been taken out. The longer the time, the more veJOE corresponding to the pledged JOE, and the higher the reward acceleration, but once withdrawn, the veJOE will be cleared. However, when V1 AMM has fallen behind, the liquidity rewards for V1 AMM are already very meager, and veJOE is basically just a formality.

Lanuchpad Quota: Pledge JOE to obtain rJOE, and rJOE corresponds to the investment quota for participation in launchpad. However, the rJOE mechanism has been canceled in January 2023.

Participation in governance: Although JOE is the governance token of the project, the current governance authority of the project is very limited, limited to voting on the base tokens that are added to LB, and which pricing tokens are paired with the base tokens, and even LB The basic parameters of Pool are configured centrally by the team.

On the whole, the current design idea of JOE's token economic model is: 1. Actively empower the economic capabilities of tokens, so that they can capture the main business cash flow of the project, or as a participation condition for core functions; 2. Low governance decentralization: The current product development route and product parameters are still controlled by the team. Although the team has made many attempts on JOE's economic model and value capture, it is still a simple pledge dividend model without too complicated design, which may not be a bad thing.

3.5 Risk

3.5 Risk

In addition to common industry risks such as smart contract security risks, regulation, and slow development of encrypted businesses, Trader Joe’s biggest risk comes from the increasingly fierce competitive environment of Dexs.

On the one side of the Aavalanche network, the ecological growth of Aavalanche itself has stagnated and shrunk, which directly limits the growth of Trader Joe's trading volume. On the other hand, Uniswap V3 is about to be deployed to Aavalanche, which may further divert Trader Joe's trading volume.

On the Arbitrum network side, although Trader Joe’s liquidity and user volume are growing rapidly, hidden worries still exist:

At present, low or zero fee rates are adopted for the LB of many mainstream tokens. The fierce competitive environment may limit the ability of subsequent platforms to charge and increase rates

Whether it is the growth of liquidity or trading volume, it is driven by short-term events or projects with a strong Ponzi mechanism. It is doubtful whether long-term business retention and growth can be maintained. Especially the transaction volume. After the peak transaction volume brought about by the ARB airdrop, LOTUS and JIMBO issuance, we quickly observed a decline in transaction volume and transaction share.

On the BNBchain side, the current business progress is not smooth, and the growth of BNBchain itself has been very slow.

4.1 Five core questions

What operating cycle is the project in? Is it a mature stage, or an early and middle stage of development?

The Dexs track where Trader Joe is located seems to have matured, and Trader Joe's business form and products have also matured.

Does the project have a solid competitive advantage? Where does this competitive advantage come from?

Does the project have a solid competitive advantage? Where does this competitive advantage come from?

The track where Trader Joe is located is facing fierce competition. At present, none of the Dex has obvious competitive advantages, including Trader Joe of course. But Trader Joe still has more obvious strengths, including:

1. Possess a team with excellent tenacity, delivery ability, innovation ability and operation ability;

Investors and entrepreneurs are eager to participate in a track with solid barriers and strong natural monopoly, but the reality is that there are very few tracks like this in the Web3 field. In an industry with insufficient barriers, the way for all teams to survive is to continue to strive for operating efficiency, the so-called "running a marathon at a sprint speed". The "operational efficiency" here includes not only some "big things", such as the design and correction of strategies based on the market environment, the innovation of core mechanisms and products, but also small daily community operations, the execution of development work, and the speed of delivery. From the current point of view, Trader Joe is a tough team with very good operating efficiency in the Dexs blood sea competition.

Is the long-term investment logic of the project clear? Is it in line with the general trend of the industry?

The Dexs track is still the lowest infrastructure in the Web3 business world, and the track with the largest amount of funds and users. With the warming of the industry cycle, the long-term valuation of the track is still expected to recover from the current bottom.

What are the main variables in the operation of the project? Is this factor easy to quantify and measure?

It's a tough competitive situation for Dex. At the quantitative level, we can track and observe the data on the project’s liquidity, transaction volume, and profit level to confirm changes in its market share. On the qualitative level, whether there are more new projects issuing and configuring liquidity based on Trader Joe's LB is a very important business observation point.

How will the project be managed and governed? How is the DAO level?

At present, the project has only opened up very limited governance authority, and it is still far away from community-based governance.

4.2 Valuation level

4.2 Valuation level

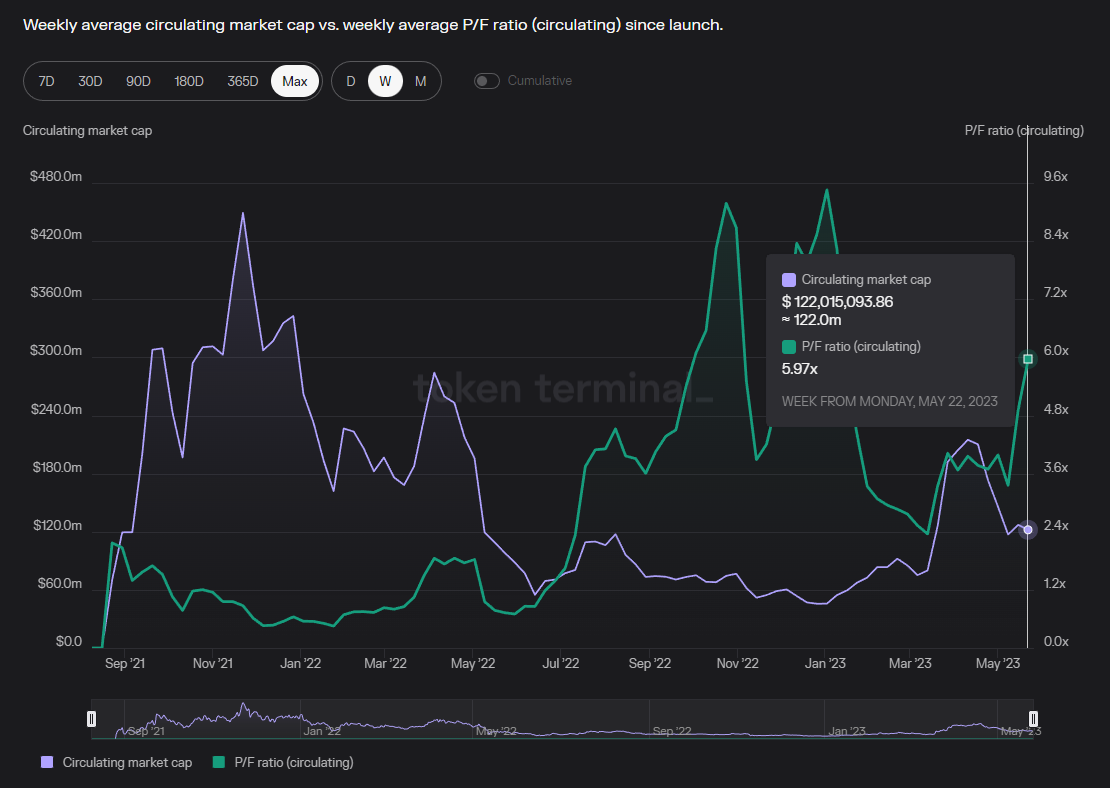

We use the vertical and horizontal comparative valuation method to observe the current valuation level of Trader Joe. The comparative valuation indicators used are the cost multiple PF (fee refers to the total cost of the transaction) and the revenue multiple PS (revenue refers to the agreement income). Due to the strong cyclicality of Dex, the reference value of the vertical valuation is not high, and it is only used as an observation, and the horizontal valuation comparison is more comparable.

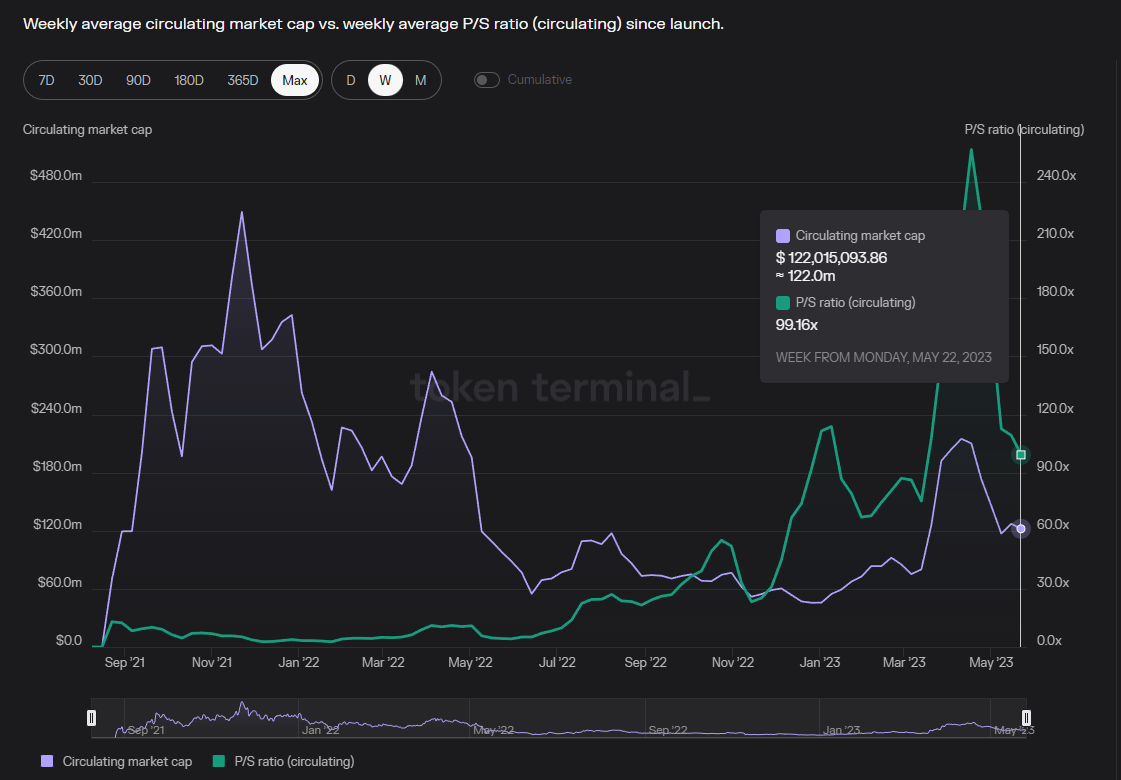

The figure below shows the trend of Trader Joe's circulating market capitalization and fee multiple (PF). We can find that the valuation level and market capitalization level of Dex are very cyclical, similar to securities companies in the traditional financial field.

image descriptionhttps://tokenterminal.com/terminal/projects/trader-joe

It is specifically reflected in the bull market cycle: the market trading volume is active, and transaction costs are rising rapidly. Although the market value is also rising at the same time, the growth rate of transaction volume is significantly higher than the speed of market value growth, which is finally reflected in the decline of PF, and the same is true for PS.

image descriptionhttps://tokenterminal.com/terminal/projects/trader-joe

PS value, time span: 2021.8-2023.5, data source:

In the bear market, the transaction volume and protocol income shrank rapidly. Although the market value also fell simultaneously, the decline was slower than the decline in income, which was finally reflected in the rapid increase in fees and income multiples.

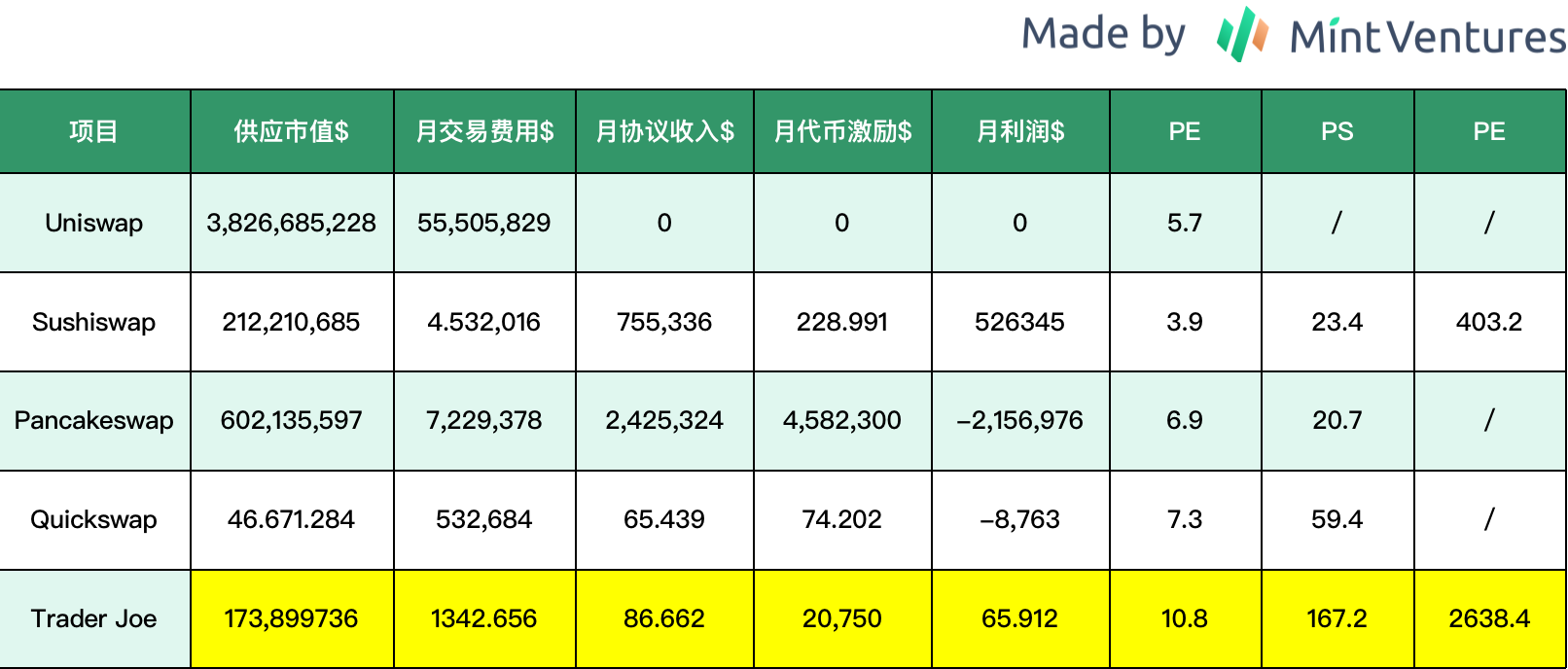

Among the many DEXs, we excluded projects such as Curve, Balancer, and Velodrome that also operate liquidity trading business in addition to trading, and chose Uniswap, Pancakeswap, Sushiswap, and Quickswap, which have more similar business models, to compare with Trader Joe.

image description

Data source: supply market value from Coingecko, fees and income from Tokenterminal, data time 2023.5.28

PS: The supply market value refers to the total market value of unlocked and released tokens, including the total amount of tokens that are unlocked but not yet in circulation, tokens in pledge and free circulation.

From the comparison of the above data, it can be seen that whether it is cost multiples, revenue multiples or profit multiples, the current market has given a relatively high valuation to Joe. This valuation premium relative to the market peers may come from the fact that Trader Joe's optimism about the resilience and innovative ability of the core team may be the expectation for the future development of the LB mechanism, and different people have different opinions.

4.3 Summary

Trader Joe's core strengths lie in its tenacity, core team with excellent delivery capabilities and innovative capabilities. Good product experience and innovation in liquidity order books have led to rapid user growth. Arbitrum is currently the main engine of its business growth.

However, the fierce competition in the Dexs track continues, which means that each project in the track has no strong bargaining power for traders and liquidity providers, and most projects are operating at a loss or with small profits. This kind of market The competitive situation is difficult to improve in a short time. However, due to the dual cyclicality of the encryption market and the Dexs track, projects represented by Trader Joe are still expected to outperform the market.

Midaswap:5. Reference content

Joe V2: Maybe what the unfinished "Uniswap V 4" should look likehttps://support.traderjoexyz.com/en/

Trader Joe's documentation:https://docs.traderjoexyz.com/

Liquidity Book documentation:https://www.coingecko.com/

Market value data:https://www.coingecko.com/

Liquidity, trading volume data:https://token.unlocks.app/