Token unlocking is imminent: WLFI’s business, background, tokens and valuation expectations

Original article by Alex Xu, Research Partner at Mint Ventures

introduction

After Circle went public, its stock price rose rapidly (but has fallen back significantly recently), and stablecoin concept stocks in global stock markets have also been extremely agitated. The US stablecoin bill "Genius Act" has passed the Senate vote and is now entering the House of Representatives. Recently, the Trump family's pure-blooded project World Liberty Financial has received news that its tokens may be unlocked and circulated in advance, which is a big news for the recent overall depressed and lacking themes in the copycat market.

So how is World Liberty Financial doing now? How is the token mechanism designed? What should be used as an anchor for valuation?

Through this article, the author will try to sort out World Liberty Financial’s business status, project background details, token mechanism, and valuation expectations from multiple dimensions, providing you with several perspectives for observing the project.

PS: This article is the author’s interim thinking up to the time of publication. It may change in the future, and the views are highly subjective. There may also be errors in facts, data, and reasoning logic. All views in this article are not investment advice. Criticism and further discussion from colleagues and readers are welcome.

WLFI Business: Product Status and Core Competitive Advantages

World Liberty Financial (WLFI) is a decentralized financial platform co-founded by the family of US President Donald Trump. Its core product is the US dollar stablecoin USD1. USD1 is a stablecoin that is 1:1 anchored to the US dollar and fully backed by cash and US Treasury reserves. World Liberty Financial also has business plans for lending (based on Aave) and Defi App, but they are not yet online.

USD1 business data

As of June 2025, the circulation of USD1 stablecoin has reached about 2.2 billion US dollars. Among them, BNBchain supplies 2.156 billion, Ethereum supplies 48 million, and Tron supplies 26,000. The scale of USD1 issued on BNBchain accounts for 97.8%, and the vast majority of USD1 is issued on BNBchain.

In terms of the number of on-chain users, BNBchain has 248,000 addresses holding coins, Ethereum has 66,000, and Tron currently has only 1.

Judging from the token holdings, 93.7% of USD1 (corresponding to 2.02 billion) on BNBchain are in two addresses of Binance, of which 1.9 billion are concentrated in one address of Binance (0xF977814e90dA44bFA03b6295A0616a897441aceC).

Looking back at the token size of USD1, we will find that the market value of USD1 was only about 130 million before May 1, 2025, but on May 1, the scale skyrocketed to 2.13 billion, an increase of nearly 2 billion US dollars overnight.

USD1 scale growth curve, source: CMC

This surge in scale actually mainly comes from the $2 billion equity investment in Binance Exchange by Abu Dhabi investment company MGX in May 2025. It chose USD1 as the payment currency in the transaction, and the current scale of USD1 tokens remaining in the Binance address is just around 2 billion.

This means:

After accepting the USD1 investment from Abu Dhabi investment company MGX, Binance did not convert it into US dollars or other stablecoins. It is currently the largest holder of USD1, accounting for 92.8% of the total size of USD1.

If the tokens generated by this transaction are excluded, USD1 is still a small-scale stablecoin with a circulation market value of only over 100 million.

This business expansion model is believed to appear repeatedly in future project development.

Business Cooperation

In terms of market expansion, WLFI has currently established cooperation with multiple institutions and agreements.

In June 2025, WLFI announced a partnership with London crypto fund Re 7 to launch USD1 stablecoin vaults on Ethereum lending protocol Euler Finance and Binance Chain staking platform Lista to expand USD1's influence in the Ethereum and BNB Chain ecosystems. Lista is the main BNB staking platform invested by Binance Labs.

In addition, Aave, the largest decentralized lending platform, has also launched a proposal to introduce USD1 into Aave's Ethereum and BNBchain markets, and the draft has been voted through.

In terms of trading platforms, USD1 has been listed on CEXs such as Binance, Bitget, Gate, and Huobi, as well as DEXs such as Uniswap and PancakeSwap.

World Liberty's Competitive Advantage

The competitive advantage of World Liberty is simple and clear: the Trump family's strong influence in the political world gives this project an inherent advantage in certain types of business development that other projects do not have. This project is also a channel for individuals, organizations and even countries that have a need for Trump in business and politics to transfer benefits that they may be willing to try.

Binance used USD1 issued by World Liberty as a funding vehicle, accepted a huge investment from Abu Dhabi investment company MGX, and held it interest-free afterwards (equivalent to helping USD1 support TVL), and quickly launched USD1, which is the best example.

However, the main risks for World Liberty token holders are threefold:

The Trump family has many channels for receiving benefits, and World Liberty may not be the one that the recipients will eventually choose (for more information about the Trump family's various money-making methods, you can read the article " THE TRUMP FAMILY'S MONEY-MAKING MACHINE" published by Bloomberg in late May this year, which is very diverse)

The WLFI token itself is decoupled from the value of the World Liberty project (described in detail in the token model section below)

After the Trump family sells the tokens, or even during the sale, they may basically abandon the heavy operation of the project and run away (refer to all the crypto assets issued by Trump in the past, from Trump tokens to various NFTs)

WLFI Background: Backers and Financing Details

Core Team Background

The core team of World Liberty Financial comes from the political and business circles, which is also the core competitiveness and source of influence of the project.

There is no doubt that the soul of the project is Donald Trump, the 45th and 47th President of the United States, and his three sons - Donald Trump Jr., Eric Trump and Barron Trump, who is only 17 years old.

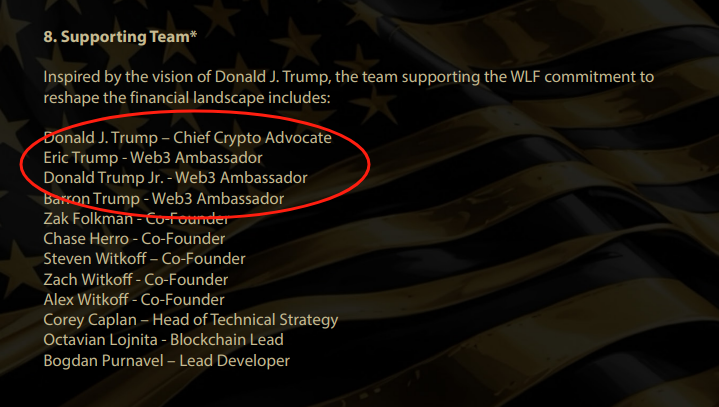

However, their "project positions" on the official website of World Liberty Financial have undergone subtle changes in the past month. In the official website introduction in mid-June, Donald Trump's position was the very fictitious "Chief Crypto Advocate", and the positions of his three sons were also very fictitious "Web3 Ambassadors."

In the project's "Golden Book," the four members of the Trump family are also defined as follows:

Despite this, Trump's four members are ranked ahead of many project co-founders.

World Liberty Financial mid-June team introduction page

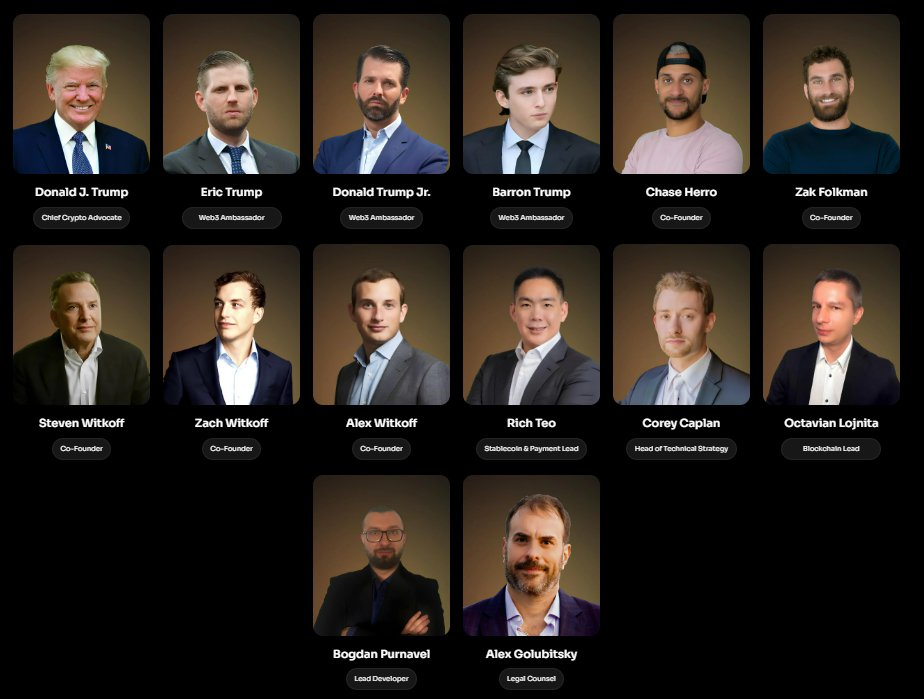

However, recently, the team's official page changed the introduction of the four people to: Trump himself - "Honorary Co-Founder", and the other three sons became Co-Founders.

World Liberty Financial mid-June team introduction page

Another tiny detail is that an almost invisible footnote "1" is added to the job descriptions of Donald Trump himself and another "Honorary Co-Founder" Steven Witkoff (whose title on the official website was also Co-Founder, but now has been changed to "Honorary Co-Founder"). The explanation of the footnote is placed at the bottom of the webpage, in small print: "Removed upon taking office." This means that once the person takes office, his "Honorary Co-Founder" will be removed.

This is a typical compliance practice aimed at preventing government officials from having conflicts of interest with companies when they assume public government positions and meeting U.S. ethical requirements that civil servants or senior government officials must sever private business ties.

But here’s the thing: Donald Trump is now a U.S. public official—the President of the United States.

In addition to the Trump family, another heavyweight in the team is Trump's long-term business partner, New York real estate tycoon Steven Witkoff, who serves as an honorary co-founder. He is the founder and chairman of the Witkoff Group. He has known Donald Trump since the 1980s. The two have long-term contacts and often play golf together. They are well-known "old friends and business partners."

Since Trump took office, Steven Witkoff has been appointed by Trump as the "U.S. Middle East Envoy", reporting directly to Trump and playing a core role in major negotiations, including those between Israel, Qatar, Russia and Ukraine. He is also Trump and Putin's "personal messenger" and has traveled to Moscow on behalf of Trump many times to meet with Russian leaders.

The Witkoff family is also actively involved in the project: his sons Zach Witkoff and Alex Witkoff are both co-founders of WLFI.

In addition to political and business celebrities, WLFI's technology and operations are mostly handled by people in the crypto industry. Zak Folkman and Chase Herro are co-founders and serial entrepreneurs in the cryptocurrency field. They founded the DeFi platform Dough Finance, but the project failed due to hacker attacks in the early stage, and their entrepreneurial experience was not successful. In the WLFI project, Folkman and Herro were initially the main controllers of the company, and then gave control to the entity controlled by the Trump family in January 2025.

Another core member, Richmond Teo, serves as the head of the stablecoin and payment department of WLFI. Richmond Teo was previously the co-founder and former CEO of Asia for Paxos, a well-known compliant stablecoin company. In addition, the team also includes blockchain practitioners such as Corey Caplan (Head of Technology Strategy) and Ryan Fang (Head of Growth), as well as traditional financial compliance experts such as Brandi Reynolds (Chief Compliance Officer).

The project also invited several consultants, such as Luke Pearson, partner of Polychain Capital, and Sandy Peng, co-founder of Ethereum's second-layer Scroll network. Sandy Peng assisted in operations during the token sale.

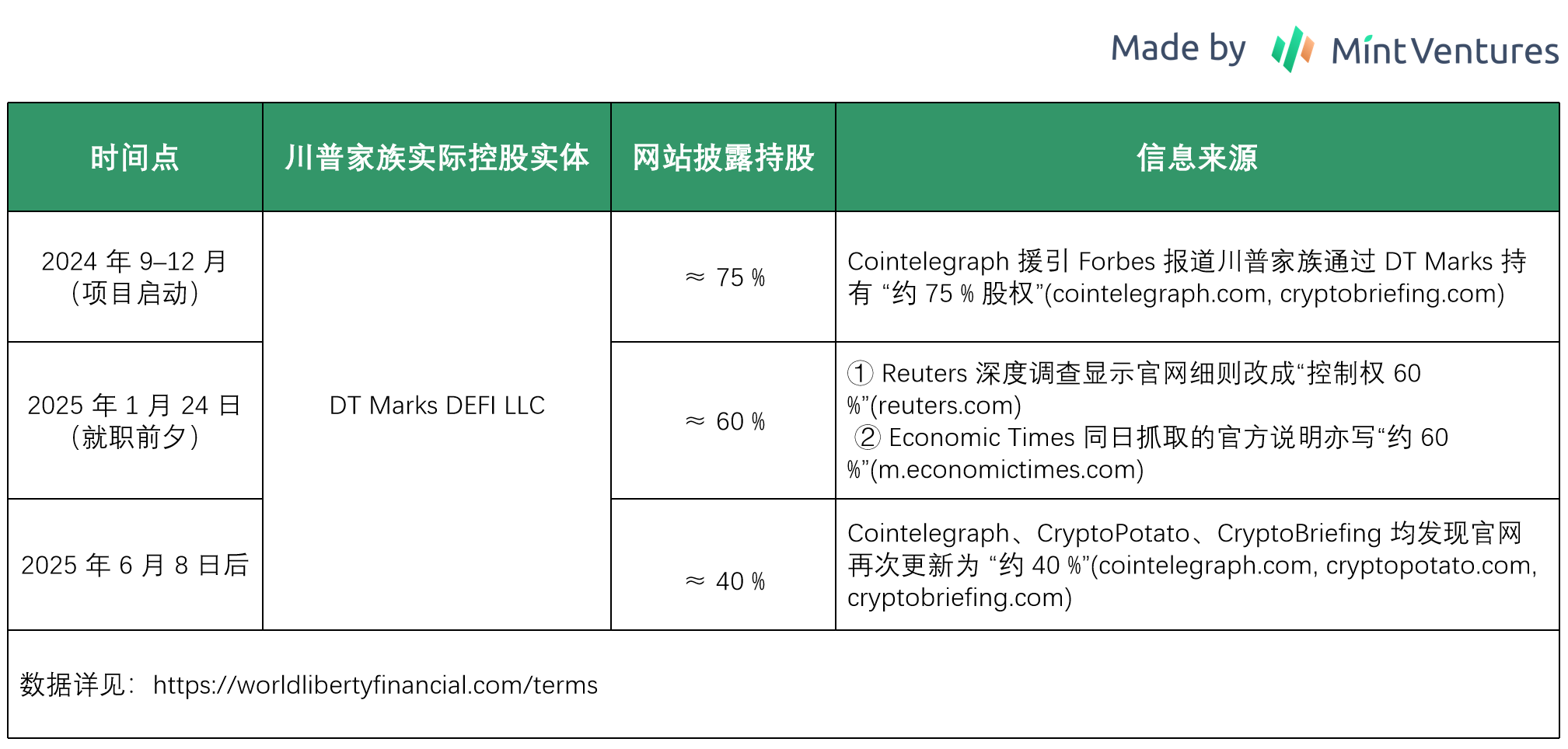

Changes in the Trump family’s equity in World Liberty Financial

In fact, the Trump family's shareholding in World Liberty Financial has been declining, and has now dropped from the initial 75% to 40%.

The decrease in equity from 75% at the beginning to 40% may have been transferred to Justin Sun, DWF Labs, and the Aqua 1 Foundation, which recently announced a $100 million investment (only speculation).

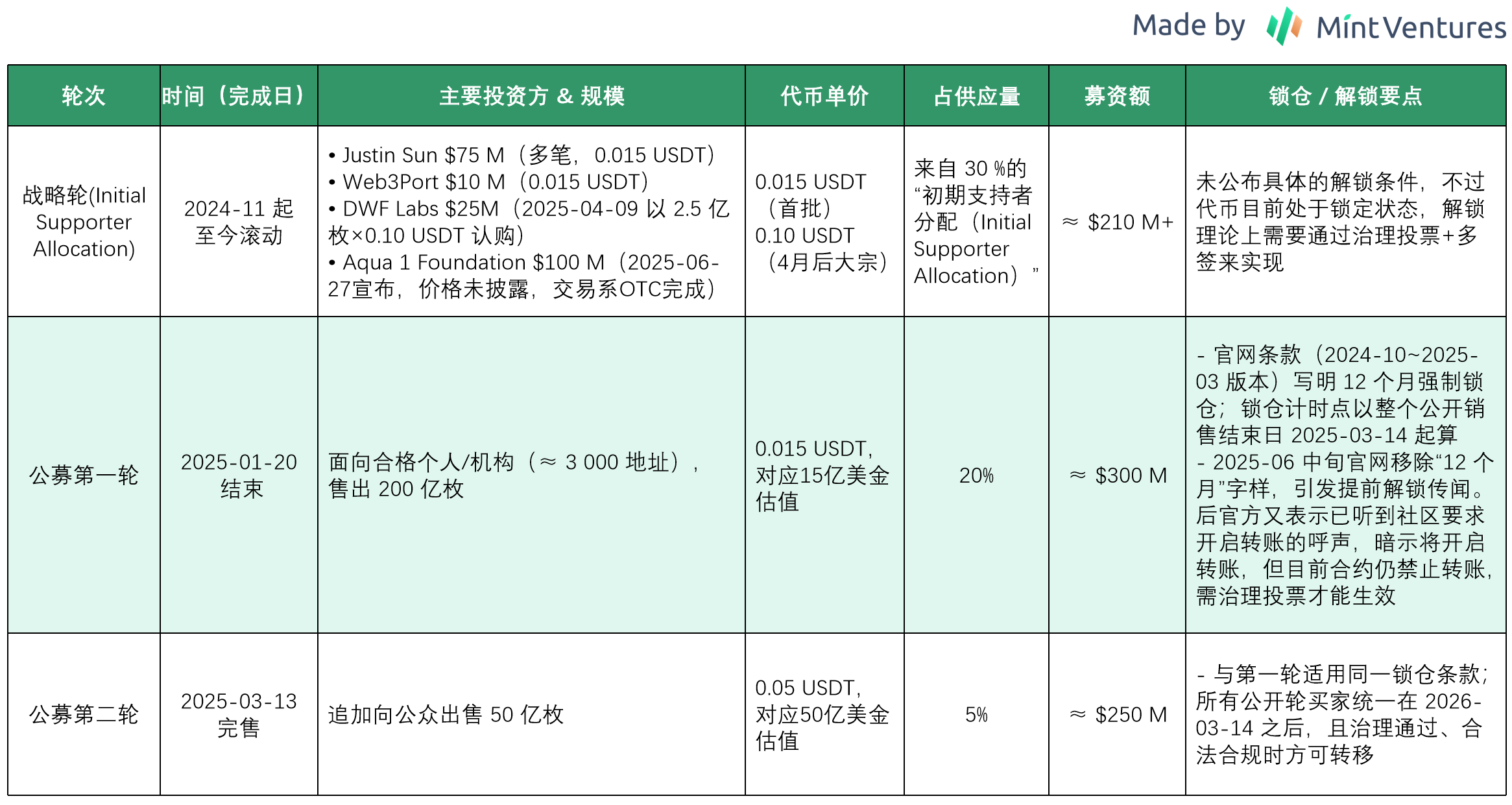

Financing history and investment institutions

Since its launch in September 2024, World Liberty Financial has raised more than US$700 million through multiple rounds of financing, and its corresponding valuation has also increased rapidly after Trump took office and issued the currency.

The author sorted out the financing situation of each round as follows:

It is worth noting that according to the project Gold Paper and website disclosures, the Trump family can obtain 75% of the net proceeds from the token sales (the subsequent resale of equity should be equivalent to the disguised resale of the token sales revenue), as well as 60% of the future business net profit (obtained from operating the stablecoin business).

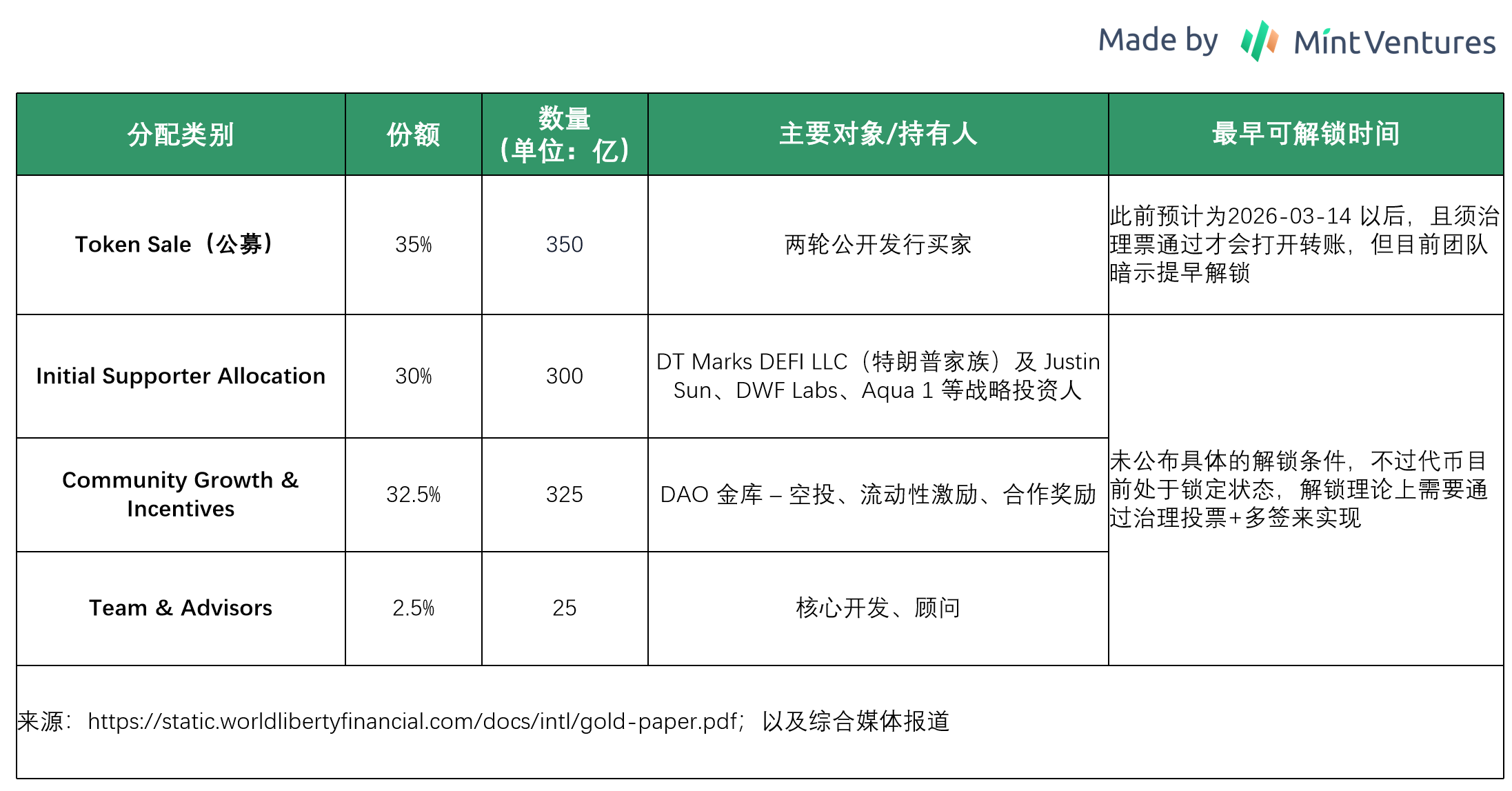

Tokens: Distribution Details, Token Functionality, and Protocol Revenue

Token Allocation and Unlock Details

The total supply of $WLFI, the governance token of the WLFI platform, is 100 billion. According to the token economic model of the official "Golden Paper", the distribution plan and unlocking plan of WLFI tokens are as follows:

It is worth noting here that the team allocated 35% of the tokens for the token sale, but currently only 25% of the public sale has been completed, and there is no answer as to how to deal with the remaining 10%.

In addition, except for the public offering part of WLFI, which has an expected lock-up period of 12 months in the additional terms, the other tokens do not have clear unlocking conditions and time, but are currently in a non-transferable state like the public offering tokens.

The ambiguity of the specific unlocking terms of the non-public offering portion of WLFI tokens has brought a high degree of uncertainty to the project.

The worst practice is that the team will unlock these tokens first and dump them in the secondary market without prior notice. A more reasonable approach is to announce the unlocking plan of the non-public offering tokens in advance before the public offering of WLFI, and unlock them in batches through formal community governance voting.

Token Function

WLFI is a pure governance token. WLFI does not have any dividend or profit rights, and does not represent equity claims in the project company. Its value mainly comes from participation in governance.

Distribution of Agreement Income

In the official gold book of WLFI, the treatment of WLFI's agreement income is described as follows:

“The initial $30 million of net protocol revenue will be deposited in a reserve controlled by a multi-signature of WLF (the Goldbook referred to the project with the abbreviation WLF at this time, and later changed to WLFI) to pay operating expenses, compensation and obligations. Net protocol revenue includes WLF revenue from all channels, including but not limited to platform usage fees, token sales proceeds, advertising revenue or other sources of income, after deducting agreed expenses and WLF’s ongoing operating reserves. The remaining net protocol revenue will be paid to entities such as DT Marks DEFILLC, Axiom Management Group, LLC WC Digital Fi LLC, which are associated with our founders and certain service providers (initial supporters). These entities have indicated to WLF that once the WLF protocol is launched, they plan to use most of the fees received to deploy the protocol.”

That is to say, the revenue of the protocol mainly belongs to the entity companies behind WLFI (although these companies have promised to use most of the fees to support the protocol), but it is clear that the WLFI token itself is not directly linked to business revenue.

Valuation: How much is WLFI worth in the long term?

Since WLFI’s core business is stablecoin, we can refer to the valuation level of its main listed competitor Circle, and use its “market value/stablecoin market value” ratio to “roughly” estimate the reasonable valuation range of WLFI tokens.

As of the end of June, the size of USDC was approximately 61.7 billion.

During the same period, Circle's market value was US$41.1 billion. If options, convertible bonds, etc. are taken into account, the approximate fully diluted market value is US$47.1 billion.

In other words, the ratio of Circle's "market value/stablecoin market value" is: 411/617 ~ 471/617 = 0.66 ~ 0.76.

If the calculation is based on the current WLFI stablecoin scale of 2.2 billion, the market value of the WLFI project is 22*0.66~0.76, the corresponding project valuation is between 1.452 billion and 1.672 billion US dollars, and the corresponding WLFI token price is 0.0145~0.0167.

Obviously, this is a figure that is difficult for WLFI investors to accept. For the first round of public offering investors, it is only close to the break-even point. People have high expectations for WLFI, and possible reasons include:

WLFI was not fully unlocked in the early stage, and its circulation market value is much smaller than FDV. WLFI can enjoy a higher premium

WLFI is in its early stages and its potential growth rate is much higher than Circle

WLFI has strong political resources and should have a "Trump premium", and a large number of projects will rush to cooperate with WLFI

The sentiment and bubbles in the crypto market are more aggressive than those in the stock market, and WLFI will enjoy a higher premium than Circle

WLFI may follow the passage of the US Genius Stablecoin Act and issue tokens to enjoy high market sentiment.

…

However, we can also put forward corresponding counter-arguments, such as:

Stablecoins are a business with extremely strong network effects. Leaders should have stronger competitive advantages and higher valuation premiums than new players (think about the comparison between the profitability of Tether, the first in the track, and Circle, the second).

WLFI project revenue has nothing to do with WLFI, and WLFI tokens lack value capture and should be significantly discounted when valued

93% of WFLI’s current stablecoin market value is supported by Binance, so the adoption is naturally low and the business volume is seriously inflated.

WLFI may be just one of the Trump family’s many “OEM licensing projects”. They will be as ruthless in selling and operating as Trump tokens and a series of Trump NFTs, and may not be able to make long-term investments.

The liquidity of the crypto market, especially altcoins, has long been exhausted. Secondary players hardly believe any story that is not supported by hard business data. Most of the new coins launched are in free fall.

…

As an investor, which side's view do you prefer? It depends on your opinion.

In my opinion, the winner of the short-term price trend of WLFI tokens after they are launched depends on the content and timing of the final passage of the Genius Act, and more importantly, whether the Trump family is willing to put WLFI in a relatively core position as a medium for interest exchange in various interest transfers and transactions. Specifically, "influential individuals, business entities, and sovereign states" actively embed USD1 (even symbolically) into their own business processes in order to obtain political and commercial interests, such as using USD1 as an investment currency (equity investment) and a settlement currency (cross-border trade).

If there is a lack of similar intensive business news after the launch, I am afraid that WLFI's position in the Trump family's business map will be worrying, as they have better revenue channels.

Let us wait and see the development of WLFI after it goes online.

So, when will the WLFI tokens be transferable?

I guess it will be after the US "Genius Act" is finally passed (it has been passed by the Senate now), then the project owners will be able to act freely, which is not far away.