RWA Weekly Report|The U.S. Senate passed Trump’s tax reform bill in a procedural vote; South Korea’s eight major banks are planning to establish a joint venture to issue a Korean won stablecoin (6.25-7.1)

Original | Odaily Planet Daily ( @OdailyChina )

Author | Ethan ( @ethanzhang_web3 )

RWA Sector Market Performance

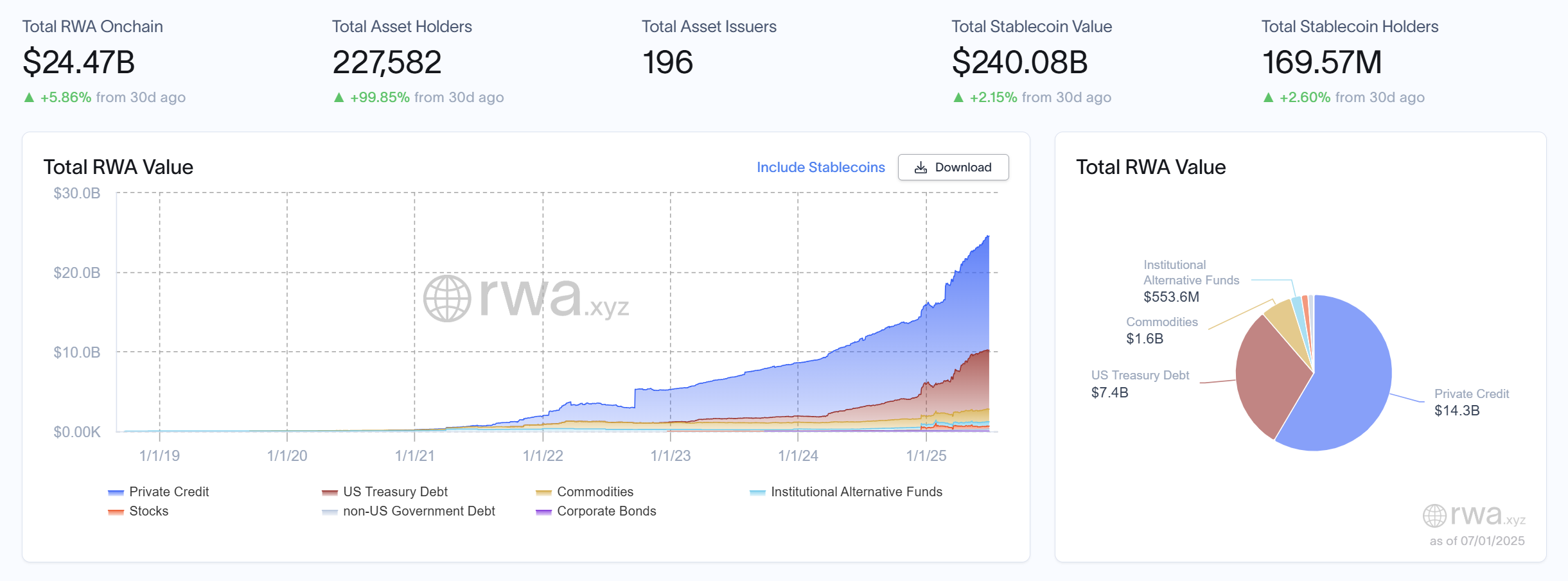

According to the latest data from RWA.xyz, as of July 1, 2025, the total value of RWA on the chain reached US$24.47 billion, an increase of 0.74% from US$24.29 billion on June 24, continuing the moderate upward trend. The number of on-chain asset holders increased from 209,678 to 227,582, with a net increase of nearly 18,000 in a single week, an increase of 8.55%. The weekly user growth rate exceeded 5% for three consecutive weeks , and market participation enthusiasm continued to heat up. The number of asset issuances increased from 194 to 196. The total value of stablecoins increased from US$238.99 billion to US$240.08 billion, an increase of 0.46%; the number of stablecoin holders also increased from 168.65 million to 169.57 million, an increase of 0.55%.

From the perspective of asset structure, private credit continues to maintain its core position in RWA assets, increasing from $14.2 billion to $14.3 billion this week. U.S. Treasury bonds remain stable, with a total value of $7.4 billion, indicating that its basic position as a "defensive asset" remains solid, and the market's demand for allocation of stable assets continues to exist. Commodity assets remain stable at $1.6 billion, with no significant changes; institutional alternative funds increased from $543 million to $553.6 million. Although the increase was limited, it shows that diversified assets continue to be favored.

What is the trend (compared to last week )?

The total market value on the chain continues to rise slightly, and user growth has accelerated significantly: total assets have risen slightly compared to last week, but what is more noteworthy is that the total number of asset holders is approaching 230,000 , indicating that RWA is attracting a wider range of market users to participate, and the ecological diffusion effect is gradually emerging; private credit and US Treasury bonds continue to form the main axis, continuing the "high yield + stable defense" structure : Private credit continues to expand as a high-yield asset, and market risk appetite remains stable; at the same time, the total value of U.S. Treasury bonds remains high, indicating that defensive allocations are still popular in the current macro environment; diversified asset portfolios have steadily increased and the structure has become more balanced : Commodities and alternative funds have maintained a growth trend, indicating that investors' strategic recognition of diversified asset portfolios and risk hedging continues to increase; the asset issuance end has expanded slightly, which may warm up for subsequent product category expansion : the number of asset issuers has increased from 194 to 196, and new protocols and new assets are about to be launched, which is expected to bring new incremental space to the on-chain asset structure.

Overall, the RWA market maintained a "stable expansion" operation rhythm this week: the market value grew slowly, the user scale expanded rapidly, and the asset category structure was stable and improved. High-yield and low-volatility assets synergistically formed the basis of allocation, and diversified assets such as commodities and alternative funds served as flexible supplements. At the same time, it is recommended to pay attention to the dynamic disclosure and structural expansion of the platform in emerging tracks such as stock assets, and make preparations for medium- and long-term layout.

Review of key events

US Senate passes Trump tax reform bill in procedural vote

On Saturday, the U.S. Senate passed a key procedural vote by a narrow margin of 51 to 49 to advance Trump's tax reform bill, increasing the likelihood that the bill will pass in the coming days. The "big and beautiful" tax and spending bill is the core agenda of Trump's second term. After several hours of delay, all Republicans except two Republicans voted in favor. The vote, which was originally scheduled for 15 minutes, lasted more than three hours as some lawmakers insisted on consulting with Republican leadership. The bill, which uses a special procedure called "budget reconciliation," allows Republicans to pass legislation with a simple majority, but they must ensure that the terms comply with Senate rules of procedure.

According to the Korean Economic Review, eight major banks in South Korea are preparing to establish a joint venture to issue a Korean won stablecoin. Participating institutions include Kookmin Bank, Shinhan Bank, Woori Bank, Nonghyup Bank, Korea Development Bank, Suhyup Bank, Citibank Korea Branch and Standard Chartered Bank Korea Branch. The project is jointly promoted by the bank, the Open Blockchain and Decentralized Identifier Association, and the Korea Financial Telecommunications and Clearing Agency, and is still discussing the underlying infrastructure.

If approved by regulators, the joint venture is expected to be officially launched at the end of this year or early next year. The project team is currently considering two issuance models: one is the trust model, which is to first place customer funds in an independent trust before issuing stablecoins; the other is the deposit token model, which directly links stablecoins to bank deposits.

According to reports, the U.S. SEC Crypto Asset Task Force held a closed-door meeting with the New York Stock Exchange on June 24 to discuss how tokenized assets can be accepted in compliance with the existing financial framework. The two sides focused on the regulatory fragmentation between traditional and crypto markets, and exchanged views on the common listing standards for traditional securities issued by blockchain and spot crypto ETFs. The talks are seen as an important signal to accelerate the listing of tokenized assets on exchanges, reflecting the willingness of regulators and mainstream markets to jointly promote compliance innovation.

Nasdaq Calypso Platform Connects to Canton Network to Support Blockchain-Based Collateral Management

Nasdaq announced that its capital markets platform Calypso has integrated the blockchain project Canton Network to achieve 24/7 automated collateral and margin management. The integration was jointly promoted by QCP, Primrose Capital Management and Digital Asset, and supports real-time capital flows and collateral allocation in multiple asset classes such as crypto derivatives, fixed income and over-the-counter derivatives. Digital Asset's Canton technology has been used by institutions such as Broadridge and Equilend to build collateral management solutions, becoming an important infrastructure in this field.

Chainlink and Mastercard Partner to Support 3 Billion Users to Purchase Cryptocurrency on-chain

Chainlink and Mastercard have reached a cooperation to allow more than 3 billion Mastercard cardholders to purchase cryptocurrencies directly through on-chain services. This integration is supported by the Chainlink cross-chain protocol, and is jointly implemented by zerohash, Swapper Finance, Shift 4 Payments, XSwap and Uniswap, connecting the traditional payment world with DeFi.

The service relies on Chainlink's secure interoperability infrastructure and Mastercard's global payment network. Users can pay with fiat currency through bank cards and finally complete the exchange of crypto assets on the chain. Zerohash provides compliant liquidity and custody support, Shift4 processes bank card payments, XSwap searches and accesses DEX liquidity such as Uniswap, and Swapper Finance integrates resources from all parties to build a unified and convenient user experience.

Chainlink co-founder Sergey Nazarov said the collaboration marks an important step in the integration of traditional finance and DeFi. Mastercard also said it will continue to explore safe and compliant on-chain payment methods to promote the wider use of crypto assets around the world. Swapper Finance, a platform powered by Chainlink, was launched today.

Grove announced the official launch of its institutional-oriented DeFi credit infrastructure protocol and received an initial capital allocation of $1 billion from the Sky ecosystem (formerly MakerDAO) to support the Anemoy AAA CLO on-chain strategy (JAAA) launched by Janus Henderson and Centrifuge. This marks the official launch of the first AAA-rated CLO strategy on the entire chain. Grove's non-custodial protocol is designed to serve as a capital channel between TradFi and DeFi, providing the protocol with accessible, compliant, high-quality credit assets. The protocol was incubated by Grove Labs, a subsidiary of Steakhouse Financial, and plans to promote the diversification of RWAs and the development of on-chain credit markets.

Midas, an on-chain asset tokenization platform, announced the launch of a new private credit product, mF-ONE, which tracks Fasanara's F-ONE fund, covering fintech receivables, SME loans, real estate mortgage credit and neutral strategies. Qualified investors can use mF-ONE as collateral in the Morpho market to borrow stablecoin liquidity provided by the USDC vault curated by Steakhouse to improve capital efficiency. The project has received support from institutions such as Stake Capital and GSR, marking the further advancement of DeFi credit tokenization.

Hot Project Dynamics

Plume Network

One sentence introduction:

Plume Network is a modular Layer 1 blockchain platform focused on the tokenization of real-world assets (RWA). It aims to transform traditional assets (such as real estate, art, equity, etc.) into digital assets through blockchain technology, lowering the investment threshold and improving asset liquidity. Plume provides a customizable framework that supports developers to build RWA-related decentralized applications (dApps) and integrate DeFi and traditional finance through its ecosystem. Plume Network emphasizes compliance and security, and is committed to providing solutions that bridge traditional finance and the crypto economy for institutional and retail investors.

Recent Updates:

On June 24, Plume Network released a new white paper outlining how it complies with the EU's regulatory framework for crypto asset markets (MiCA). The white paper was reviewed by the Netherlands Financial Markets Authority (AFM) on June 19 and registered with the European Securities and Markets Authority (ESMA) in compliance with EU Regulation 2023/1114.

On June 30, Plume announced that more than 100,000 people hold RWA assets on its platform, with a total value of more than $100 million. The asset types have expanded from government bonds to private credit and institutional funds, reflecting the diversity and growth of the Plume ecosystem.

TunaRWA (TUNA)

One sentence introduction:

TunaRWA is a Web3 project focused on tokenizing scarce natural resource rights and interests, and is committed to bringing real-world assets such as global fishing rights to the chain. The project is based on high-value fishery resources such as Australia's southern bluefin tuna, and provides users with stable income opportunities supported by physical assets through rights confirmation, leasing and smart contract dividend mechanisms. TunaRWA combines the traceability and transparency of blockchain to achieve digitalization, fragmentation and global participation in resource investment. Its native token TUNA is used for proof of rights, rent dividend distribution and community governance. TunaRWA's goal is to promote the "democratization" of investment in scarce natural resources and build a new infrastructure that connects the real economy and decentralized finance.

Previous news:

On April 28, TUNA received attention from the Hana-Zhejiang University Shanghai Advanced Research Institute Digital New Finance Joint Laboratory and will set up a special research topic. The joint laboratory was jointly established by Zhejiang University Shanghai Advanced Research Institute and Hana Finance, focusing on cutting-edge technology research such as blockchain, metaverse, big data, and asset encryption.

On May 9, according to official news, core members of TUNA appeared at BlackRock's San Francisco headquarters. Previously, BlackRock, a global asset management giant, recently announced that it had completed the on-chain mapping of $150 billion in assets, covering multiple fields such as real estate trusts and commodities. This case is regarded as a milestone in the commercialization of RWA, verifying the feasibility of the technology landing. The market speculated that the two parties may officially announce the specific cooperation plan in May. Affected by this, the TUNA token rose by 32% in a short period of time.

Related links

Sort out the latest insights and market data for the RWA sector.

" BlackRock and JPMorgan Chase are competing to lay out a full-track guide to RWA in 2025 "

This article will analyze the RWA sub-sectors with the greatest development potential and review the most representative leading projects in each field.

This article is based on the speech given by Cobo Lily Z. King on June 10, 2025 at the RWA event of Jun He Law Firm in Hong Kong for a number of securities firms, funds, stablecoin institutions and family offices on the theme of "Real World Asset Practices in an Uncertain World".