Odaily exclusive interview with Jarsy: How does "Robinhood" in the "Pre-IPO field" break the private equity investment threshold with $10?

Original | Odaily Planet Daily ( @OdailyChina )

Author | Ethan ( @ethanzhang_web3 )

Currently, the RWA track is accelerating its evolution with a vigorous momentum, and the compliance level of the industry has also been significantly improved. It is worth noting that last night Robinhood officially announced that it will launch US stock and ETF trading services based on its own Layer 2 blockchain for EU users. These assets, called "Robinhood stock tokens", will enjoy zero commissions, and holders can also receive dividends through the broker's application.

Robinhood, which is actively exploring the European and American markets, has brought more positive signals to the RWA industry. Jarsy, which is also focusing on global layout, is also making great efforts in the very novel direction of Pre-IPO tokenization. What differentiated advantages does its unique Pre-IPO tokenization layout contain? What unknown entrepreneurial narrative is hidden behind it? The breakthrough path of this emerging track is triggering the market's in-depth thinking on the digital innovation of real assets.

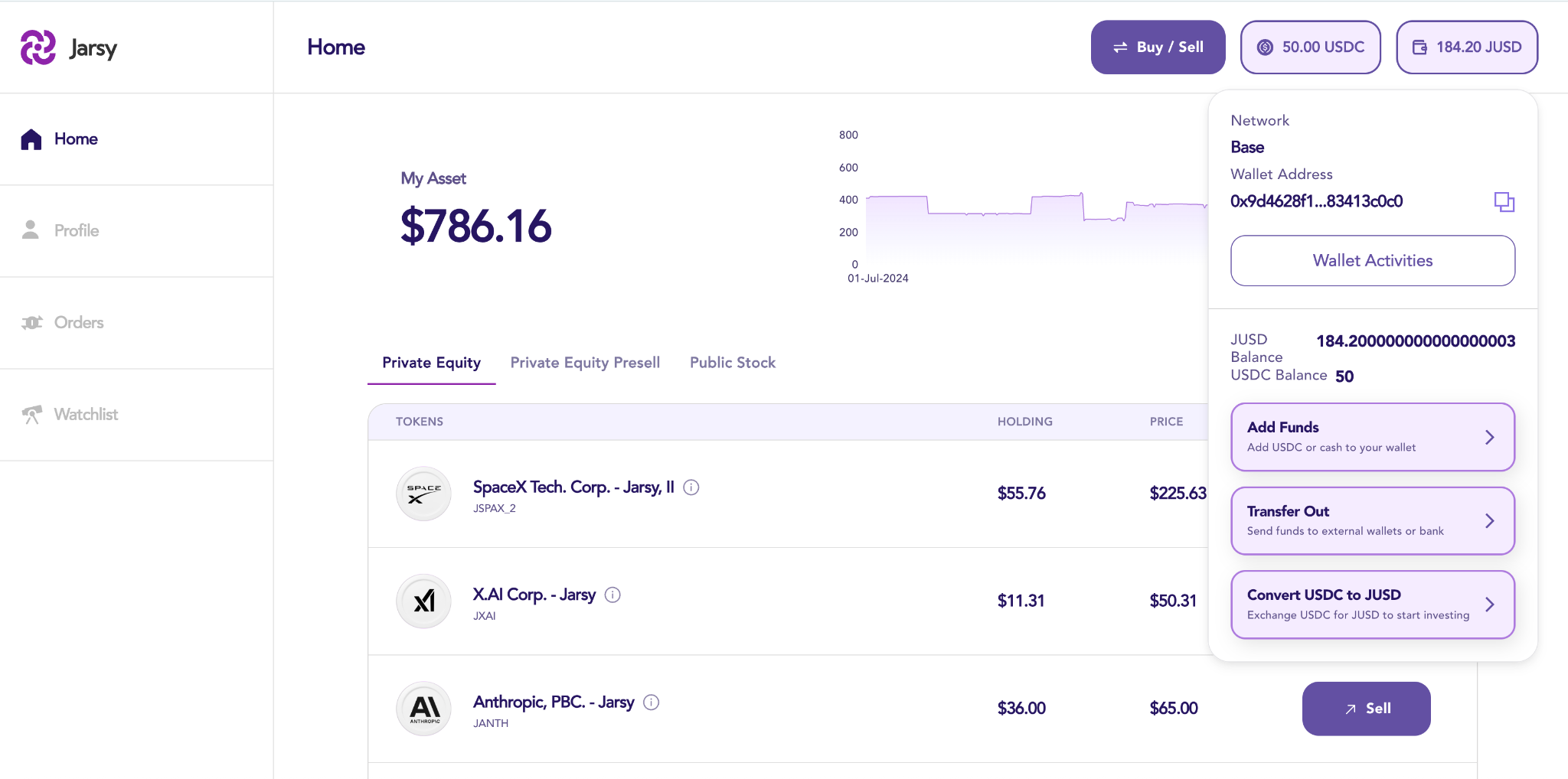

In the traditional financial system, Pre-IPO investment was once the exclusive domain of high-net-worth individuals, and the capital threshold of hundreds of thousands of dollars kept ordinary investors out. Against this backdrop, Jarsy, which is committed to "making investment popular, participating in Pre-IPO investment with as little as $10, and investment opportunities in high-growth value companies", came into being. By tokenizing the shares of high-growth private companies such as xAI, Anthropic, Stripe, etc., ordinary investors who know little about cryptocurrencies and veteran players in the crypto field can participate and enjoy the potential benefits of share investment.

Recently, Odaily Planet Daily contacted Jarsy CEO Han Qin and had an in-depth conversation with him, deeply analyzing the competitive advantages, operating mechanisms, risk management, business models and entrepreneurial philosophy of the Jarsy project. The following is an interview record, and some content has been deleted.

Odaily: I heard that you have just completed your seed round of financing, congratulations. Can you briefly introduce your financing background and project advantages?

Han Qin: Thank you for your attention. Yes, this seed round of financing is $5 million, led by Breyer Capital, and also favored by outstanding angel investors including Karman Venture, Nathan McCauley (CEO of Anchorage), and Evan Cheng (CEO of Mysten Labs) . We chose Breyer because they have led investments in excellent companies at a very early stage, such as the A rounds of Facebook and Circle; because our team all came from Uber, we chose Karman because it is a boutqiue VC funded by Uber founder Travis Kalanic and executives of Palantir, OpenAI, Anduril, ScaleAI, Anthropic, etc.

At the same time, we insist on being customer-oriented. In order to provide users with a simpler user interaction method and reduce the learning cost of non-experienced users, our team redefines and handles complex problems in blockchain technology, seamlessly connecting from login to ordering. Jarsy will charge stablecoin USDC to local cryptocurrency users and cash USD to users not related to cryptocurrency, realizing seamless cross-industry capital flow.

In addition, Jarsy asset-backed tokens are backed by 1:1 real company equity, which is held by a Delaware-registered limited liability company managed by the platform . Equity certification documents are regularly disclosed to minimize the platform's credit risk.

Odaily: What are Jarsy’s screening criteria and listing procedures for unlisted or listed companies to ensure the quality and potential of the screened and listed companies?

Han Qin: This is a very good question, and it is also a topic that users are very concerned about. Our screening logic is divided into three levels: First, in terms of industry and growth, we will focus more on high-growth tracks such as AI, aerospace, and financial technology, such as SpaceX, xAI, Anthropic, etc.; secondly, in terms of valuation health, we will give priority to late-stage unicorns. For example, Stripe has maintained revenue growth of more than 25% for 8 consecutive years; thirdly, we will do our own due diligence closed loop. Relying on Silicon Valley resources, the Jarsy team can easily interview company executives and early investors to verify the stability of the equity structure and ensure the reliability and growth potential of the investment targets.

In addition, in terms of project listing, Jarsy will clearly define economic benefit tokens, which are supported by underlying assets (such as company shares), and publish economic rights agreements for equity ownership to ensure that the entire process complies with US laws and regulations and protect the rights and interests of investors.

Odialy: What is the asset value anchoring mechanism and how to ensure investment value?

Han Qin: Jarsy works closely with private equity firms, venture capital funds and brokers to acquire shares in selected private companies. Once the shares are acquired, Jarsy will hold them through our independent limited liability company (LLC) registered in Delaware and subsequently issue asset-backed tokens that fully correspond to the number of shares held.

For the value anchoring of these platform asset-backed tokens, we base it on the company's latest tender offer (equity quotation) in each round, and on this basis, there may be a slight premium or discount in price according to the supply and demand relationship in the secondary market. This mechanism ensures that the value of the token is closely related to the company's latest valuation dynamics, and investors can also obtain the benefits brought by market valuation changes in real time. Of course, if the company sells particularly poorly in the private secondary market after the financing round, our repurchase price will be reduced accordingly.

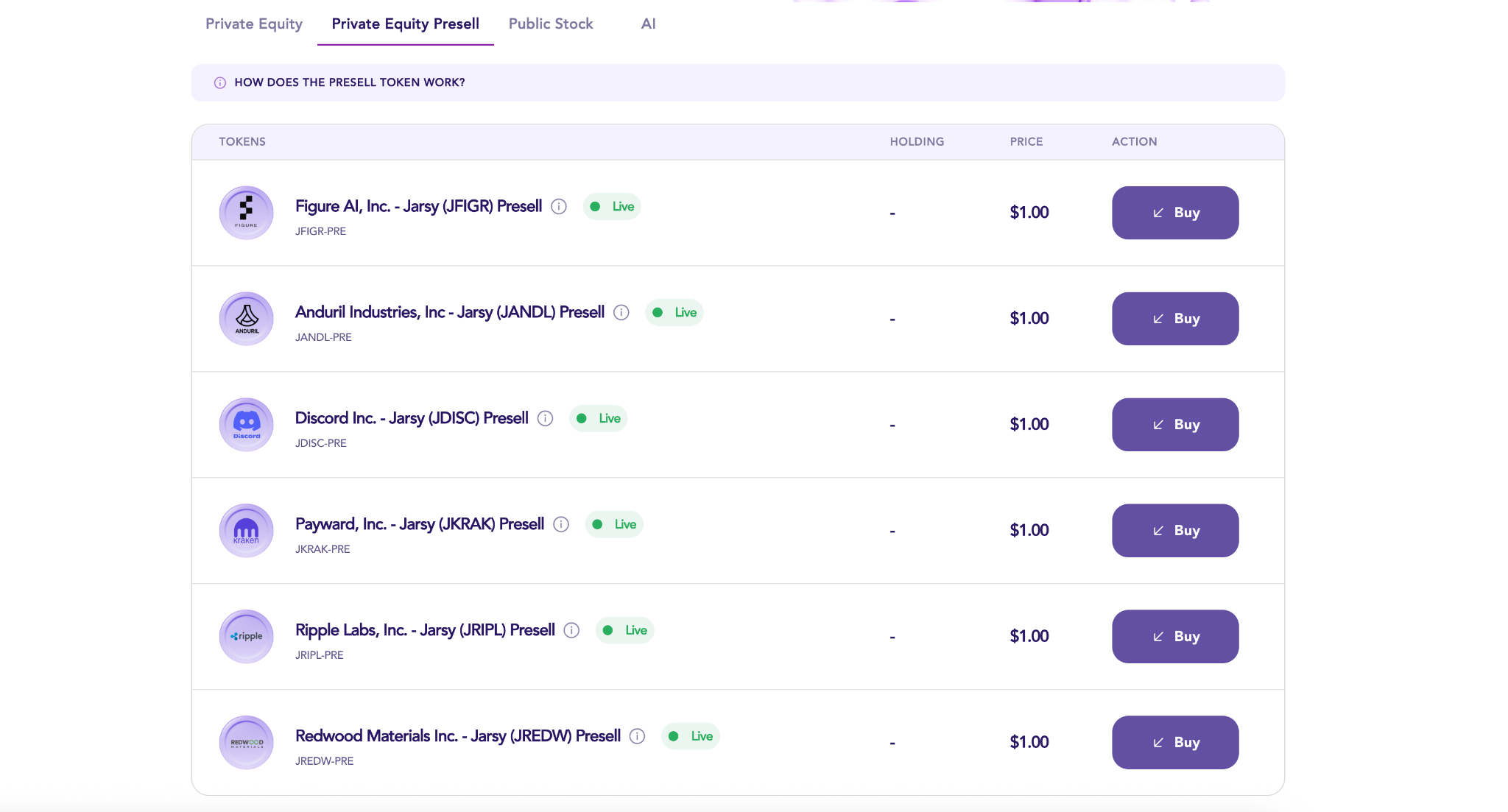

It is also worth mentioning that we have also issued Jarsy’s pre-sale tokens, which give holders priority to purchase asset-backed tokens of specific companies on the platform. Each pre-sale token is backed by $1, similar to our own stablecoin. Once Jarsy acquires the corresponding company shares and issues asset-backed tokens, these tokens will be distributed first to pre-sale token holders on a first-come, first-served basis.

During the distribution process, the pre-sale tokens are converted into asset-backed tokens at the current asset-backed token price plus the conversion cost. After all pre-sale tokens have been distributed, the remaining asset-backed tokens will be provided to other investors.

It is worth mentioning that when a user is optimistic about a pre-sale investment target and purchases the pre-sale tokens of a specific company, if the platform fails to complete the settlement within a specific time, that is, fails to purchase the company's Pre-IPO stocks in time, the Jarsy platform will refund the full amount to the user, so the user will not bear any losses if the transaction fails.

Odaily: How is Jarsy’s business model set?

Han Qin: We do not charge management fees. Jarsy's main profit model relies on one-time transaction fees, which is also our advantage over competing products. All fees incurred by users during the investment period are open and transparent. However, similar to traditional investments, there will be rare carry fees, but this fee is not Jarsy's profit, but the holding cost of some large funds for popular companies. For example, for xAI, a popular investment project on the platform, investors only incur a handling fee for a single transaction, and there are no other hidden fees, so users can retain investment returns to the greatest extent.

Odaily : Are there any restrictions for users when participating in Jarsy investment?

Han Qin: Combined with our global market positioning, Jarsy's global accessibility currently covers users in the United States, China, Singapore, Japan, South Korea, North America and other regions, and will expand to more regions in the future. Jarsy is committed to serving market users that meet regulatory requirements, requiring investors to meet the status of qualified investors, and regional users need to pass the corresponding KYC certification to ensure compliance with local regulatory requirements. In addition, due to our consideration of KYC control, the platform is not open to DeFi transactions or external secondary markets to ensure compliance and investment security.

Odaily : As an equity tokenization project, what regulatory risks will Jarsy face? How will the platform respond?

Han Qin: This issue is crucial for most companies in the crypto industry. The development of the crypto industry, including Robinhood's recent series of press conferences, is also driving the United States to provide it with clear policy bills (such as stablecoin legislation), so this is both a challenge and a once-in-a-lifetime opportunity to tokenize private investing. As a company registered in the United States, Jarsy faces regulatory challenges such as the US SEC and the EU MiCA regulations. However, because our team is rooted in Silicon Valley and has participated in the growth process of Silicon Valley giants such as Uber, we are very familiar with and good at how to make compliance arrangements before regulatory policies become clearer. We must also actively embrace and actively cooperate with supervision, and strictly implement compliance measures, such as qualified investor reviews of US users and clear definitions of token economic rights, to ensure long-term stable operations.

We believe that only by allowing regulatory authorities to see that we actively cooperate with laws and regulations can the platform continue to operate for a long time. Only a platform that can stand the test of time can gain the trust of investors.

Odaily : What are the liquidity and exit rules of Jarsy’s asset tokens? What are the regulations for the holding period?

Han Qin: This is the key to our credit value. We currently provide two exit mechanisms:

The first is that if a Pre-IPO company has already gone public, users can choose to sell the corresponding assets through the Jarsy platform to obtain an equal amount of cash.

The second is that regardless of whether it is listed or not, you can sell the tokens back to the Jarsy platform, but whether this can be sold smoothly or the pricing needs to be based on supply and demand.

Jarsy's asset-backed tokens provide holders with economic benefits related to company stocks. If the value of the token changes, users can buy or sell the token according to the new price. Jarsy will give users the corresponding amount of US dollars or USDC at the corresponding face value as economic benefit redemption. Of course, the user needs to do as much due diligence as possible before choosing which company to invest in. For the sake of compliance and simplification, the corresponding asset-backed tokens cannot be used to exchange for equivalent stocks, but can only be used to withdraw amounts. Even if the underlying asset company is listed, users cannot withdraw stocks from Jarsy.

Odaily: According to the investment process, how long does it take for investors to receive tokens from placing an order?

Han Qin: Jarsy has two main modes. One is the spot mode. It usually takes one working day from placing an order to receiving the tokens. The second mode is the pre-sale mode, which is the pre-sale token method mentioned earlier. There will be a waiting period from placing an order to receiving the tokens. You need to wait until the project funds are raised before placing an order. Of course, you will not wait indefinitely. A specific time node will be notified in advance before placing an order.

Odaily : Finally, can you talk about Jarsy’s entrepreneurial philosophy? How did the team come together to carry out the project?

Han Qin: After research, our team deeply understands the problem that the younger generation has difficulty accessing high-quality assets in an environment of high housing prices, high employment difficulties, and slowing returns in the traditional stock market. In response to these problems, there is still room for innovation in the industry. We believe that we should create high-quality investment opportunities for young people and open up channels for the general public to obtain high-quality investment opportunities through technological innovation, so as to achieve true financial freedom.

The team has worked with successful entrepreneurs such as Mark Zuckerberg and Travis Kalanick. Influenced by these entrepreneurs, rather than obtaining high returns in the short term by issuing tokens, our team would rather make a fundamentally innovative product that addresses people’s pain points and establish a long-term platform that can serve the general public. This is why our founders share the same ideals.

Of course, we are also well aware that it is not an easy road. In the past, there were competitors doing the same business, but they were only responsible for on-chain assets, without actually pledging Pre-IPO shares as assets, and simply betting on valuations. That is very unsustainable and easy to go bankrupt. From the price discovery, we encounter the problem of price opacity and the problem of easy decoupling from the underlying assets. We hope to align with Circle. As a stablecoin, Circle is 100% backed by the US dollar. The proof of reserves and the fact that it is an American company make it more compliant. So if we want to operate for a long time, we have many operational and legal and regulatory issues to overcome. This is not a project that can make quick money, but once it is scaled up, it will be a big story, and we are also looking forward to it.