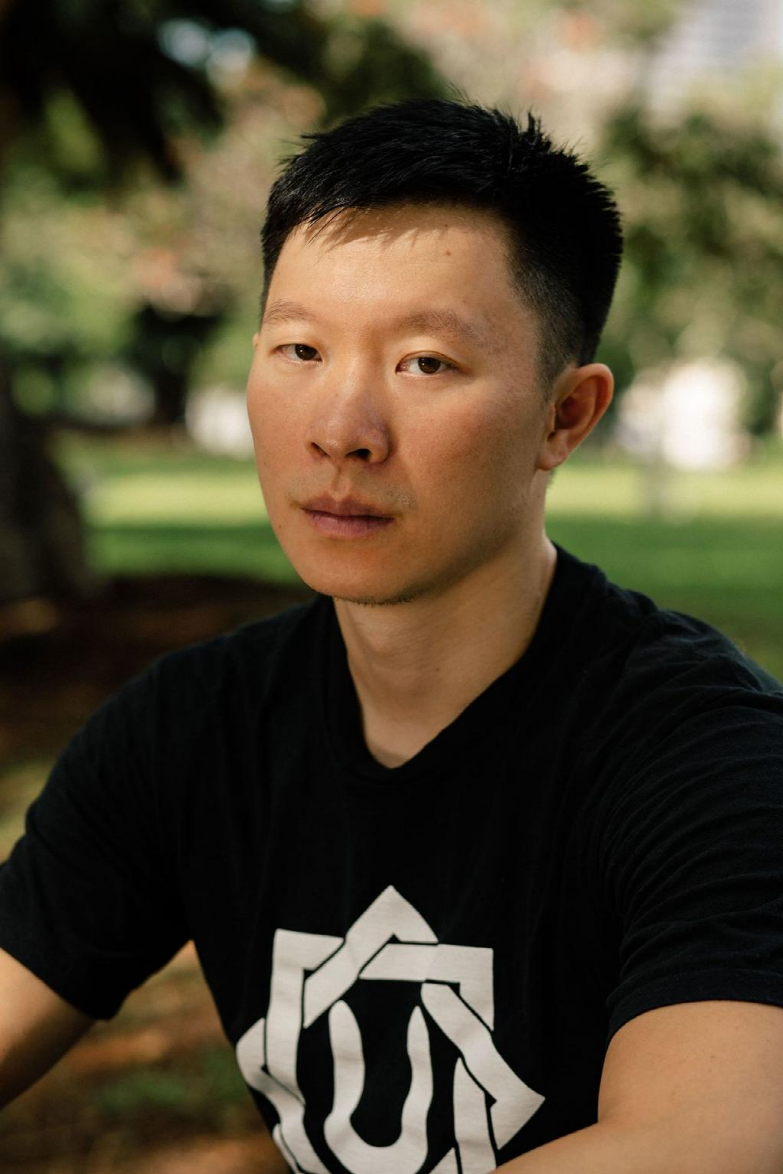

Su Zhu への Odaily 独占インタビュー: 災害後の復興と復活

6月1日、Three Arrows Capitalの創設者であるSu Zhu氏が設立した債務取引プラットフォームであるOPNXは、ガバナンスと手数料割引を備えた新しいプラットフォーム通貨OXの立ち上げと、債務取引の2つの重要な開発を続けて発表した。プラットフォームによってサポートされる初の債券市場。

副題

Q1:OXについて

Odaily:昨日の朝、OPNXは公式Twitterで新しいガバナンストークンOXを発売すると発表しました。 OPNXはツイートの中でOXの手数料割引とガバナンスの役割を紹介しました(詳細はこちらをご参照ください)このニュースレター)。 OPNX にとって OX の価値はどこにあると思いますか?そのトークンエコノミーモデルの設計思想とは何でしょうか?

Su Zhu:良い質問ですね。私たちはさまざまな理由から OX を楽しみにしています。

OPNX モデルと OX モデルを作成する前に、私たちは取引所とトレーダーが直面している歴史的問題について深く考えました。過去 10 年間、私たちはほぼすべての取引プラットフォームを使用し、仮想通貨の最高の時も最悪の時も経験してきました。したがって、私たちはこれまでの経験を活かして、OX のトークンエコノミーモデルがより公正で民主的であり、OPNX とそのユーザーが長期的に緊密なつながりを維持できるようにしたいと考えています。

私たちは、OX がこの目標を達成するために設計されたと信じています。ユーザーはOXを比例的にステーキングすることで、永続的な手数料無料の取引を実現できます。このようにして、トレーダーは、手数料のために常にポジションを消費するのではなく、ステーキングする意欲が高まる一方で、大口投資家と個人投資家の両方が約束に比例して利益を得ることができるという点でも異なります。大口投資家を優先したモデルを改善し、さらにユーザーはこれらの特典を永続的に享受できるようになり、OPNXでの取引でのみ得られる「ロイヤルティ収入」のようなものとなります。

OX の中核となるトークン経済モデルは修正される予定ですが、そうでない場合は、OX ステーカーは、非ステーキング手数料率、バーンレート、新しいコインのスクリーニングなど、提案を作成して投票することで、OPNX の中核となる変数のほとんどを変更することもできます。。これについては今後数週間以内に詳細を発表する予定です。

副題

Q2: 債券市場について

Odaily:昨夜、OPNXは正式にセルシウス債券取引を開始しました。これは、OPNXがついに独自の主要ビジネス(以前はスポットと契約のみ)を開始したことを意味します。

しかし、暗号分野のユーザーにとって、ほとんどの人はクレジット請求の概念を理解していない可能性があり、OPNX クレジット取引の開始と発展に影響を与える可能性があります。 ?

Su Zhu:「クレームのトークン化」は非常に斬新な概念です。私たちが行うことは市場の需要に応えることだけです。私たちは、市場の規模と、破産手続きに不満を抱き代替手段を探している被害者の数を考慮して、債務請求に関する解決策を構築することを選択しました。

まず理解すべきことは、債務取引は凍結資産の流動性に関係しているということです。「トークン化された請求」を選択すると、債権者にさらに多くの操作オプションが与えられます - 事前に現金化することができ、他のデリバティブ取引の担保資産として使用することもでき、保持し続けて元の請求権を保持することもできます。もちろん、破産手続きまで数年待っても大丈夫と考えてトークン化に踏み切れない債権者もいるかもしれない。 OPNX は、特に待機の機会コストが高すぎると感じる場合に、追加のオプションを提供するだけです。

潜在的な債権者の顧客にアプローチする際には、「トークン化された債権」のメリットを理解してもらう必要があります。さらに、OX による手数料割引、早期サインアップに対する手数料無料ボーナス、およびすぐに提供される素晴らしいアフィリエイト プログラムも提供します。これらに加えて、顧客が自発的にプロモーションに協力できるように、その製品に十分な利点があることを確認する必要もあります。

副題

Q3:販売者の業務について

Odaily:私の周りにもFTX事件の被害者がたくさんいますが、OPNXを通じて債権者の権利を事前に実現したい場合はどうすればよいですか?手続きが複雑になるのでしょうか?

Su Zhu:FTX は、間もなく登場する次の債券市場です。

リリースされたばかりのCeliusの場合、プロセスは非常に簡単です(詳細については、OPNX関連をご覧ください)インターフェース)。まず、顧客は OPNX に登録する必要があります。次に、OPNX のトークン化パートナーである Heimdall に請求に関する詳細情報と書類を提供する必要があります。適格性が確認されると、顧客に通知され、譲渡契約書に署名するよう求められます。債権者の権利の譲渡とトークン化のプロセス。完了すると、顧客は債権者の権利トークンを販売したり、契約の担保資産として機能したり、単に保有したりするなど、自由に運用できるようになります。

プロセス全体は迅速かつ複雑ではなく、トークン化のコストは、裁判所の手続きを経る場合に比べて微々たるものです。

FTXの債務取引は間もなく開始されるが、債権者は事前にヘイムダルの事前評価に記入できるようになったシート副題

Q4:買主の権利利益について

Odaily:OPNX 債券市場で取引される主題は「トークン化された債権」です。購入者にとって、購入した「トークン化された債権」が実際の請求権を持っていることを確認するにはどうすればよいですか?

Su Zhu:「トークン化された債権」と債権者(信託)との間の執行関係は法律によって拘束され、保護されます。副題

Q5:個人参加について

Odaily:以前、あなたはOPNXの日常業務には携わっていないと報じられていましたが、個人のTwitterには依然としてOPNXに関するコンテンツがたくさんありますが、真実はどうなのでしょうか? OPNX の運営に関する限り、スリー アローズ キャピタル事件は OPNX の開発に特別な影響を与えましたか?

Su Zhu:Kyle Davies (Three Arrows のもう一人の共同創設者) と私は、次世代の取引所とクレームをトークン化する方法についてのビジョンを持っていました。同時に、CoinFLEX も再編を図っています。私たちは Leslie Lamb 氏と Mark Lamb (CoinFLEX 共同創設者) を長年知っています。Thunder は「トークン化されたクレーム」を市場の需要に完全に満たすようにしました)、したがって彼らは自然に協力することを選択しました。

私たちは早い段階で多くのアイデアを提供し、今後も意見を提供し続けますが、OPNX を構築している 75 人のチーム自体は香港に拠点を置いています。 OX、債券取引、その他の製品がオンラインに登場したとき、私たちは彼らが挑戦的なビジョンをどのように実現したかに驚きましたが、今では彼らを全面的に信頼しています。

スリーアローズの倒産は悲劇でしたが、私たちはその運営と破産手続きから痛ましい貴重な教訓も学びました。三本の矢がなければ、FTX 後の理想的な取引所がどのようなものになるのか、また破産手続きの不透明で敵対的な性質についても洞察することができず、債権者にとって最善の結果が得られないことがよくあります。

副題

Q6: 次回の強気相場について

Odaily:現在のところ、

Su Zhu:現在のところ、私たちは現実世界の資産をトークン化することが最も興味深いことだと考えています、それは現実世界の物質的な利益を仮想通貨空間にもたらす可能性があります。 「トークン化されたクレーム」は始まりにすぎず、私たちはより実用的な結果を提供することでそれを証明したいと考えています。

これに加えて、ブロックチェーンの立ち上げコストは低下し続けるため、既存のエコシステムに対して差別化された課題が生じることになります。 Worldcoin のような新しい開発も興味深いものであり、より地域的および製品固有の市場で同様のコンセプトをエミュレートする機会が確実にあります。