Original author:21 Shares Analyst Tom Wan

Original compilation: PANews

It has been more than 10 days since the upgrade of Ethereum Shanghai. What changes have taken place on the current network? 21 Shares research analyst Tom Wan interpreted the analysis with the data, and the following statistics are as of April 22.

secondary title

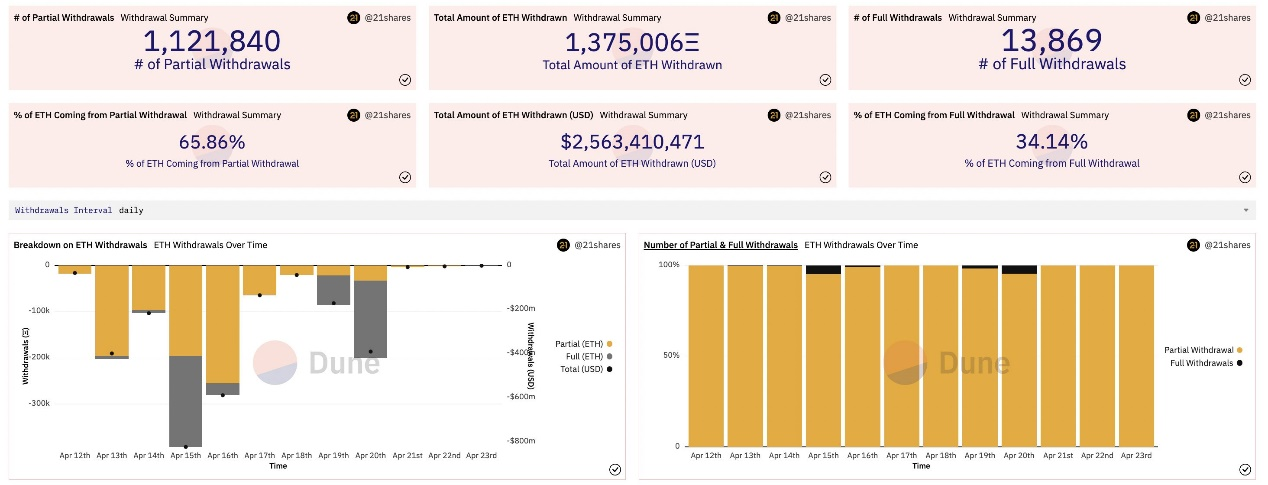

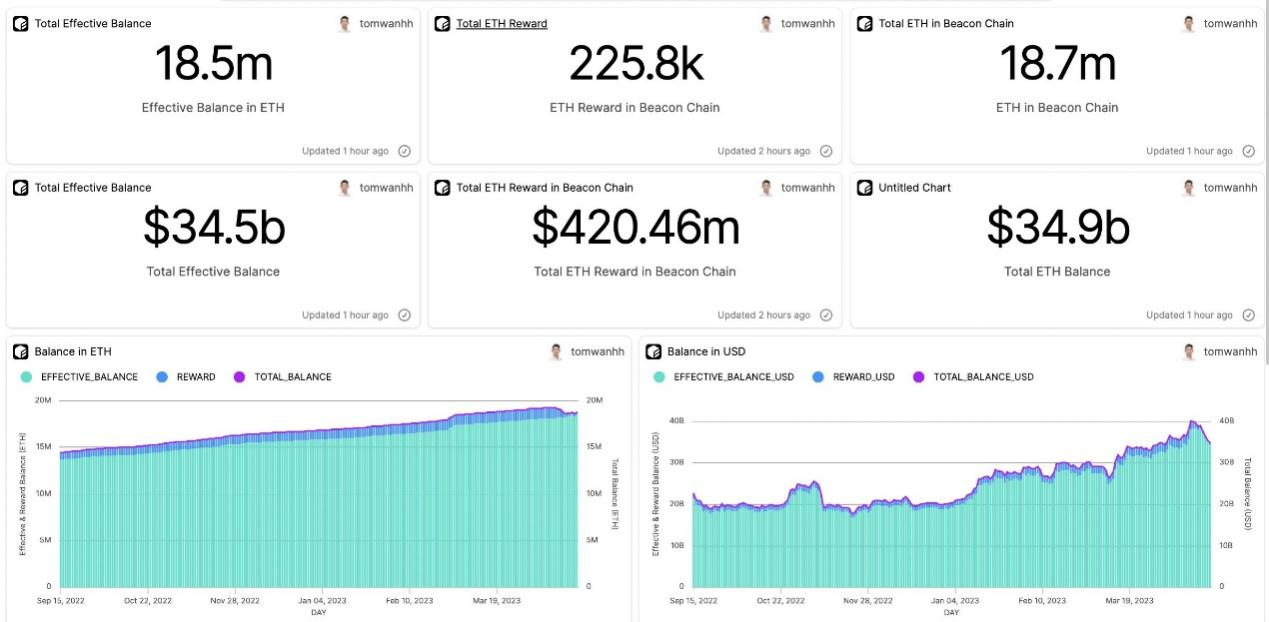

1.3 million ETH has been withdrawn, worth approximately $2.5 billion. Of these withdrawn ETH, 65.8% are staking rewards or partial withdrawals, and 34.1% are principal or full withdrawals.

secondary title

2. 10,000 Ethereum validators on the Kraken platform completely quit

Due to regulatory scrutiny, Kraken had to shut down its staking service for US citizens, as a result:

- The full withdrawal took away 333,000 ETH (accounting for 71% of the total withdrawal of Ethereum)

-The total value of ETH withdrawn by Kraken users reaches $807 million

secondary title

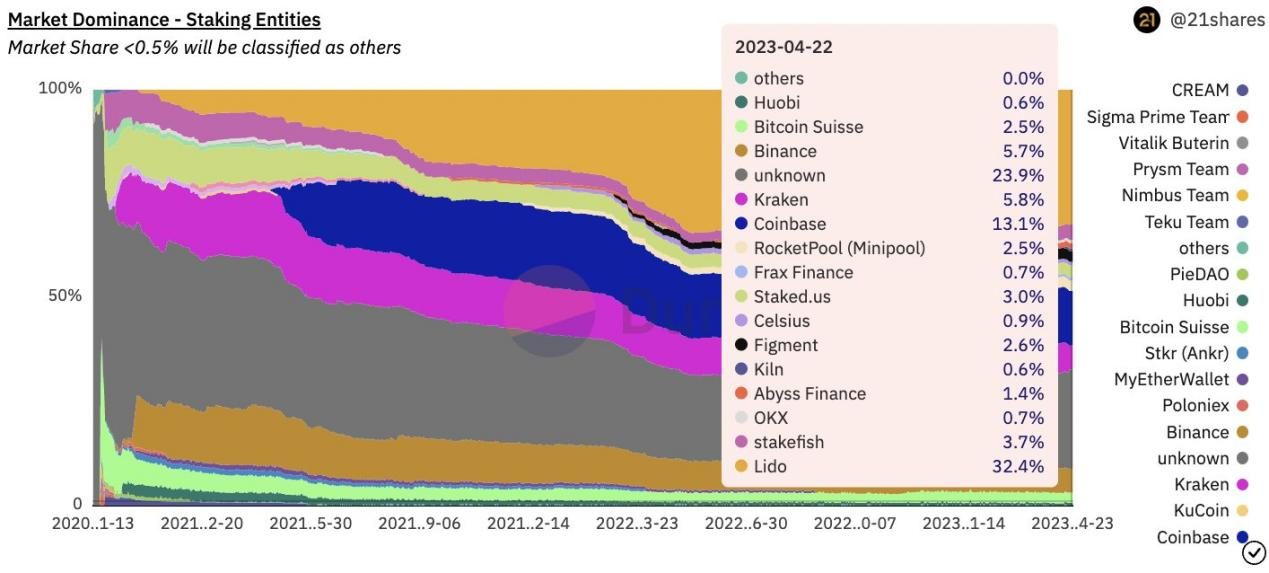

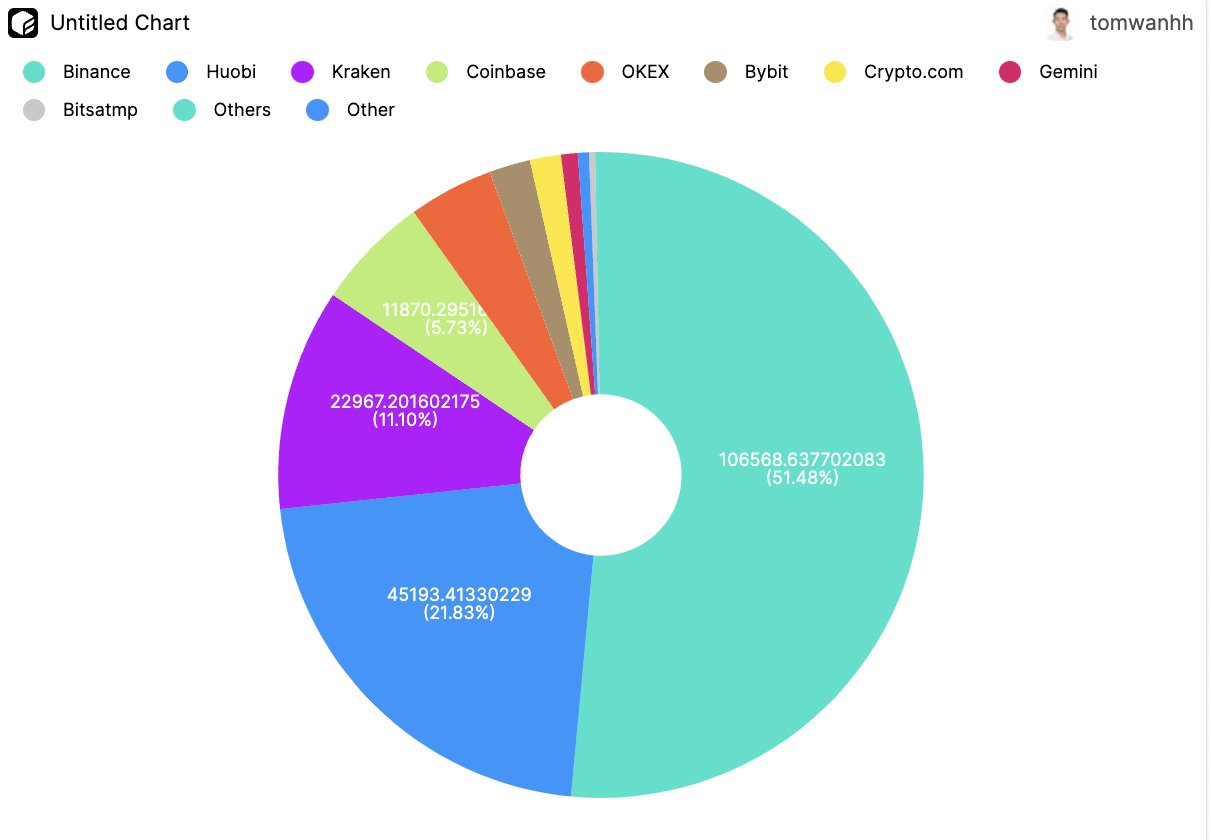

Before the Shanghai upgrade, Kraken had about 7.2% of the Ethereum staking market share, but since withdrawals started, the metric has dropped to 5.8%. Overall, CEX’s market share of Ethereum staking decreased (from 27.6% to 25.6%), but CEX’s Ethereum staking pool size increased slightly, from 13.2% to 13.7%.

secondary title

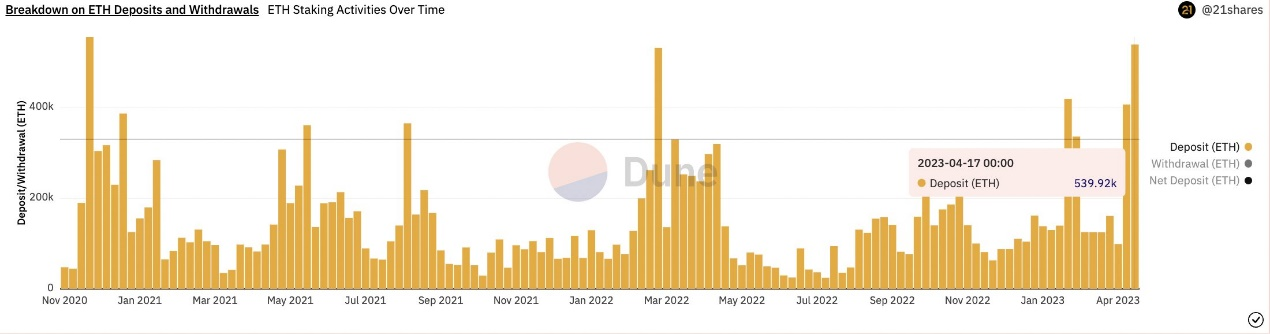

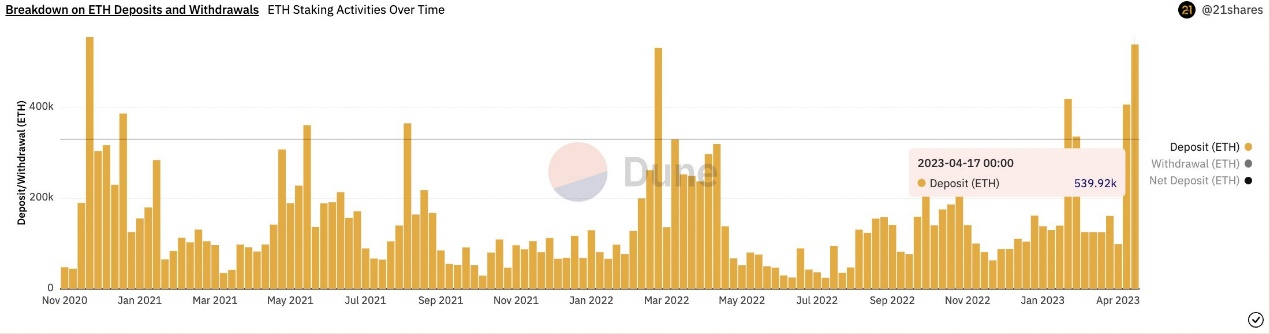

4. It is worth mentioning that a large number of institutional stakers have poured into Ethereum

A large number of institutional investors have poured into Ethereum due to the reduced liquidity risk after the Shanghai upgrade. In the past 30 days, users with large Ethereum pledge inflows include:

-Stakedfish: 90,000 ETH

-Staked: 70,000 ETH

-Klin Finance: 35,000 ETH

-Bitcoin Suisse: 17,000 ETH

secondary title

Validators must change from BLS (0x 00) to execution address (0x 01) to be eligible for payments and withdrawals, but BLStoExecutionChange is limited to 16 per block, so far there are 241.3 0x 00 Validators changed to 0x 01, 0x 01 The proportion of certificates increased from 43% to 86%.

secondary title

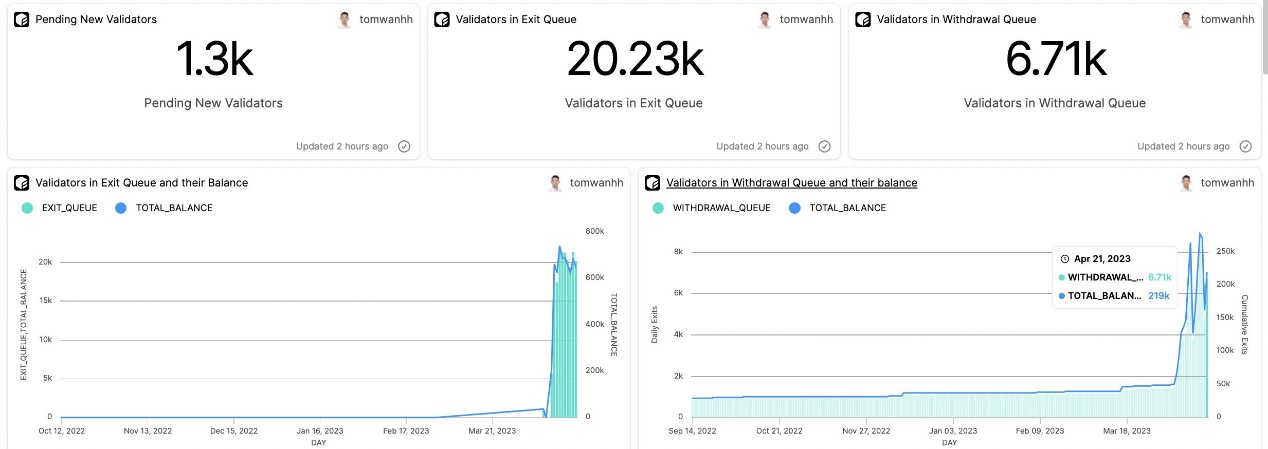

After the Shanghai upgrade, the number of active validators on the Ethereum chain decreased slightly, from 562,782 to 561,655.

secondary title

After the upgrade in Shanghai, the weekly deposit volume of Ethereum reached 539,900 ETH, setting the second largest single-week deposit record so far. The largest single-week deposit on record for inflows occurred during the week of November 23, 2020, when 556,580 ETH were deposited.

secondary title

A large influx of institutional pledgers, data interpretation What happened 10 days after the upgrade of Ethereum Shanghai?

- The total ETH balance held by the exiting validators is about 647,000.

A total of 866,000 ETH will flow out of the full withdrawal channel, and about 225,800 ETH (approximately $420 million) in the beacon chain have not yet been claimed for staking rewards.

secondary title

9. Estimated number of re-staked ETH (excluding CEX)

Based on the ETH transfer in the Ethereum blockchain address, the following indicators can be estimated:

-95,900 ETH re-staked through P2P ETH Depositor

-47,600 ETH re-staked through the beacon chain contract

-6000 ETH re-staked via Ankr

-2210 ETH re-staked through Lido Finance

secondary title

A large influx of institutional pledgers, data interpretation What happened 10 days after the upgrade of Ethereum Shanghai?

Although a large amount of ETH is sent to CEXs, not all of them are sold, and some of them may use the Ethereum staking services provided by these CEXs to earn rewards/withdrawals. Among the top CEXs that provide Ethereum staking services, Binance takes the lead. The number of ETH pledged by different CEXs is as follows:

- Binance: 107,000 ETH

-Huobi: 45,200 ETH

-Coinbase: 11,900 ETH

secondary title

1 1. In the transaction after ETH withdrawal, the USDC transaction pair is the most popular

Most ETH withdrawals do not happen on DEXs. In withdrawal transactions, the most popular trading pair is ETH/USDC. In terms of trading pairs, the top tokens for buying ETH include:

-12.5 million USDC

- $1.3 million stETH

-$856k RPL

secondary title

A large influx of institutional pledgers, data interpretation What happened 10 days after the upgrade of Ethereum Shanghai?

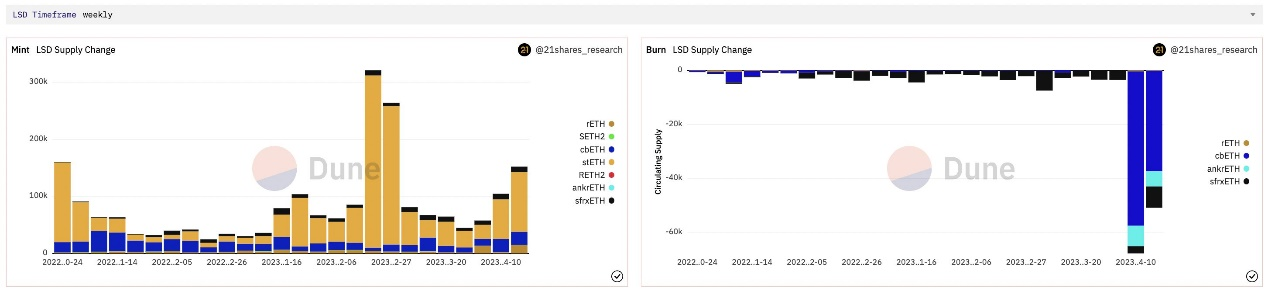

When it comes to LSD offerings, stETH seems to be the most popular, over the past 7 days:

-Lido Finance minted 104,000 stETH

-Rocket Pool minted 14,800 rETH

-Coinbase minted 22,800 cbETH

Additionally, over the past 7 days:

- The amount of cbETH destroyed is 31,700 pieces

- The amount of sftxETH destroyed is 7880 pieces