Original Author: Colin Li

secondary title

1.1 Core investment logic

In addition to ETH liquidity staking, the BNB and ATOM staking markets have begun to gain investors' attention. Among these projects, the development of pSTAKE Finance after embracing BNBchain deserves attention. If pSTAKE Finance's other public chain strategies, such as ATOM's liquidity staking service, can achieve dual-line expansion of business and ecological expansion like its BNB liquidity staking service, then pSTAKE Finance deserves to be included in investors' prudent investigation.

secondary title

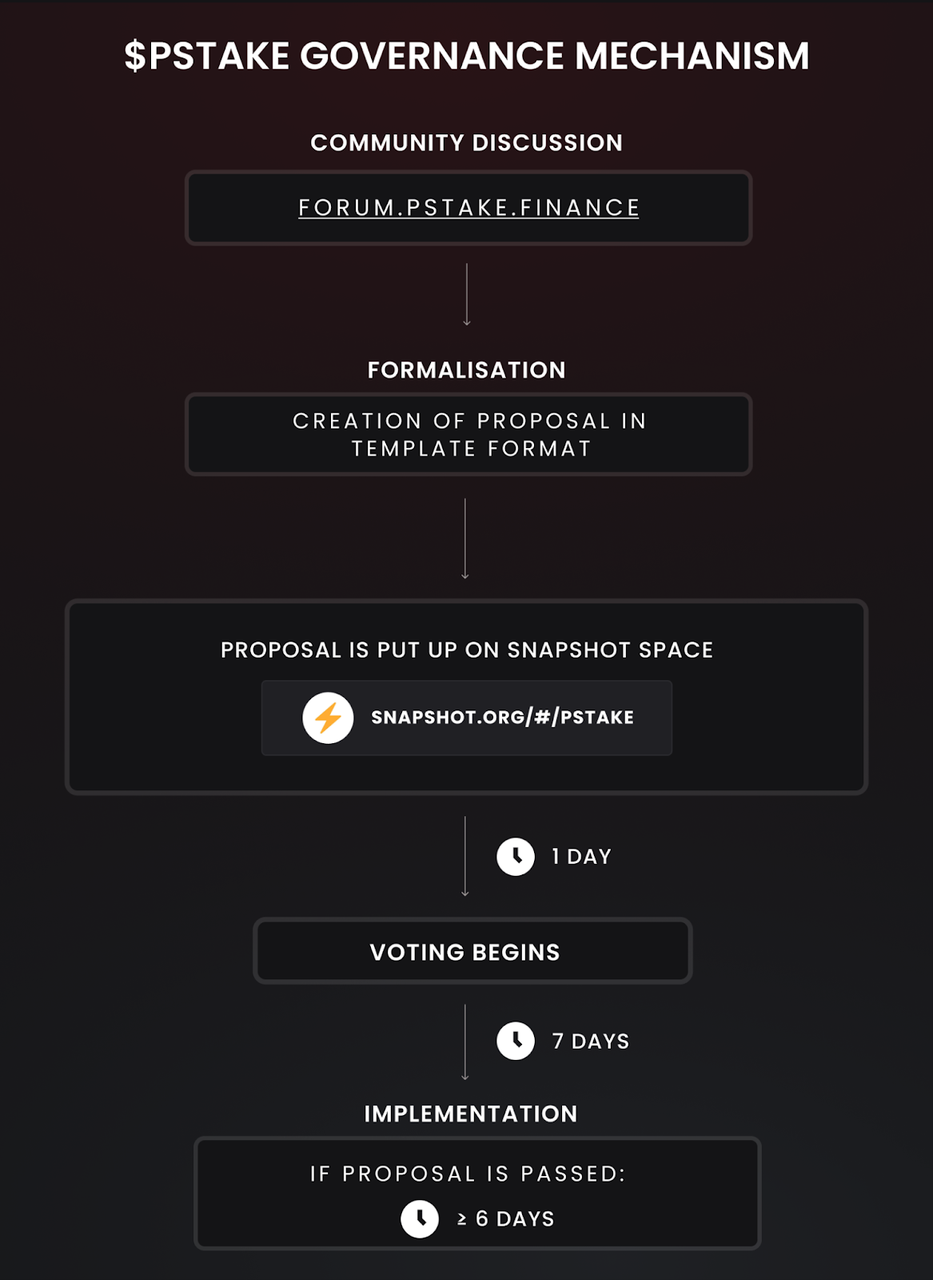

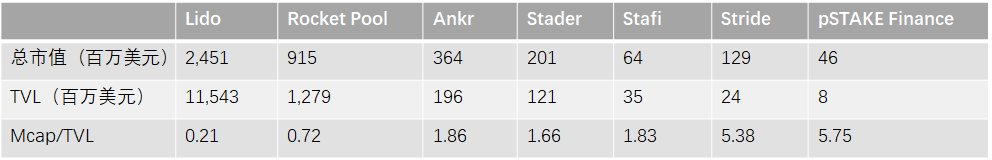

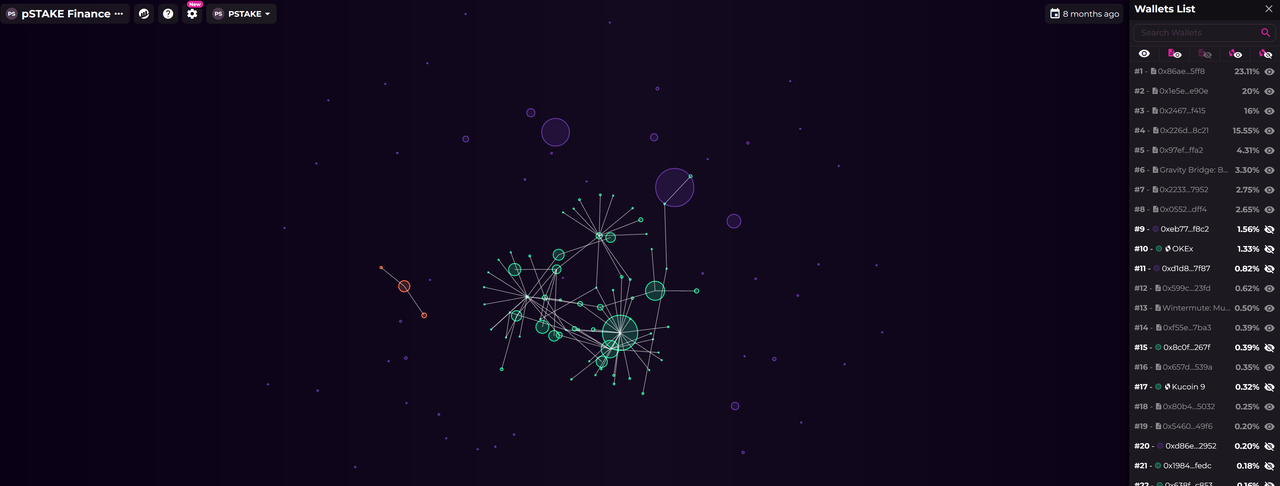

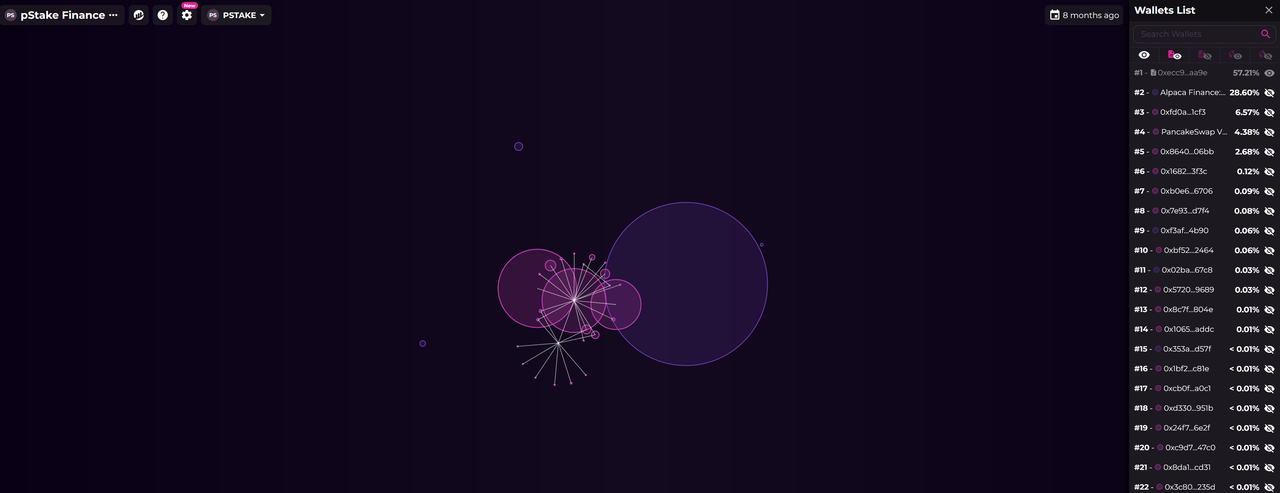

From the static valuation point of view, pSTAKE Finance is relatively expensive, which may be related to the over-concentrated distribution of PSTAKE chips: at present, more than 75% of PSTAKE chips are concentrated in a few addresses, and the circulating market value is small.

secondary title

1.3. Main risks

Public chain development risk: pSTAKE Finance is now betting on the liquidity staking business of ATOM and BNB, and the biggest beta in the future will come from the development of the public chain. Currently, the pledge ratios of BNBchain and COSMOS are relatively high, and there is limited room for growth in the future from increasing the staking ratio. In the future, it is necessary to expand other potential public chains with low pledge rates, which will test the strategic judgment of the founding team.

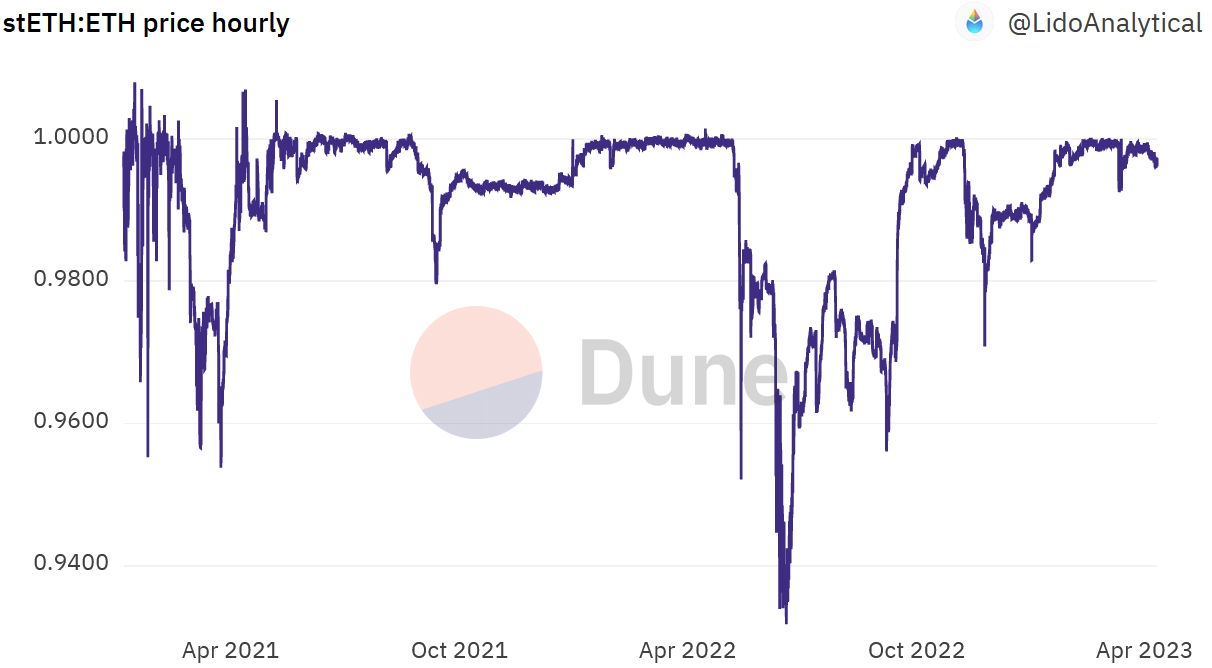

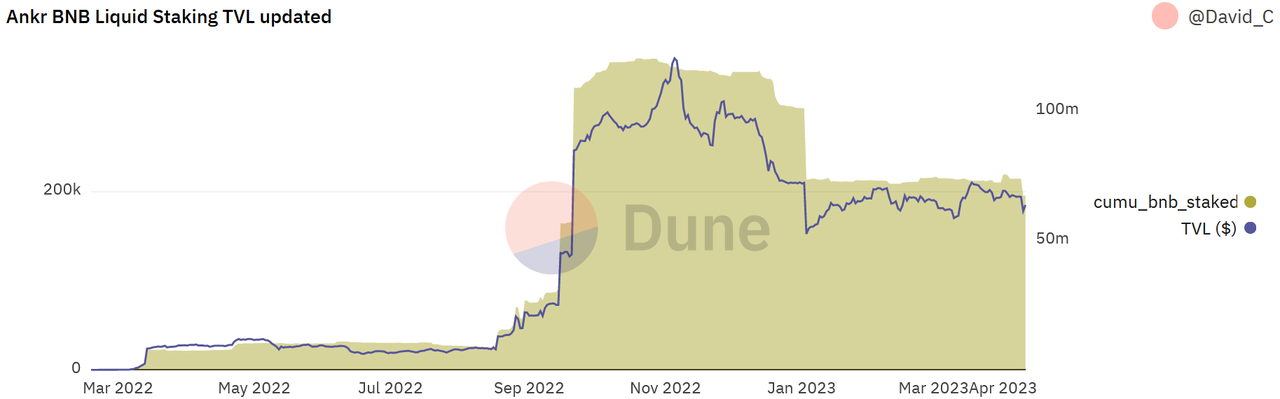

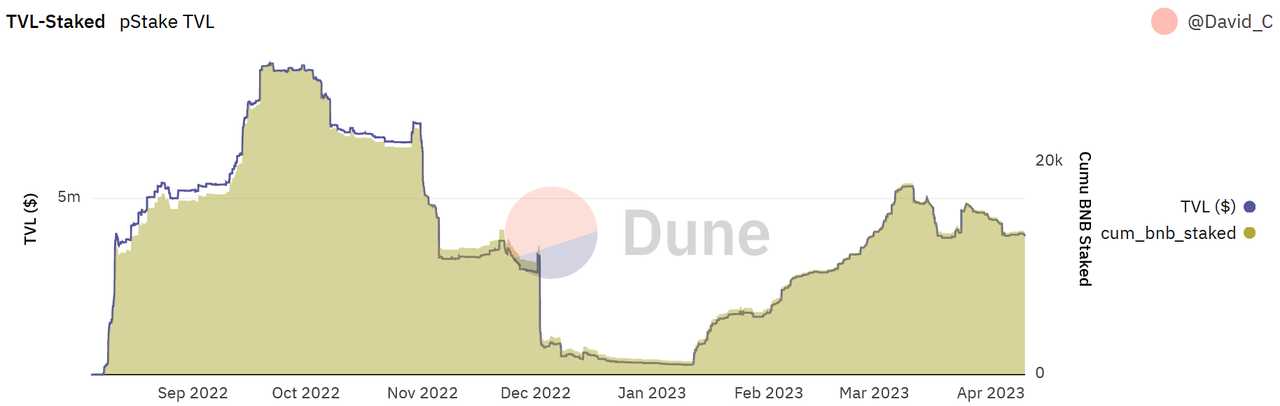

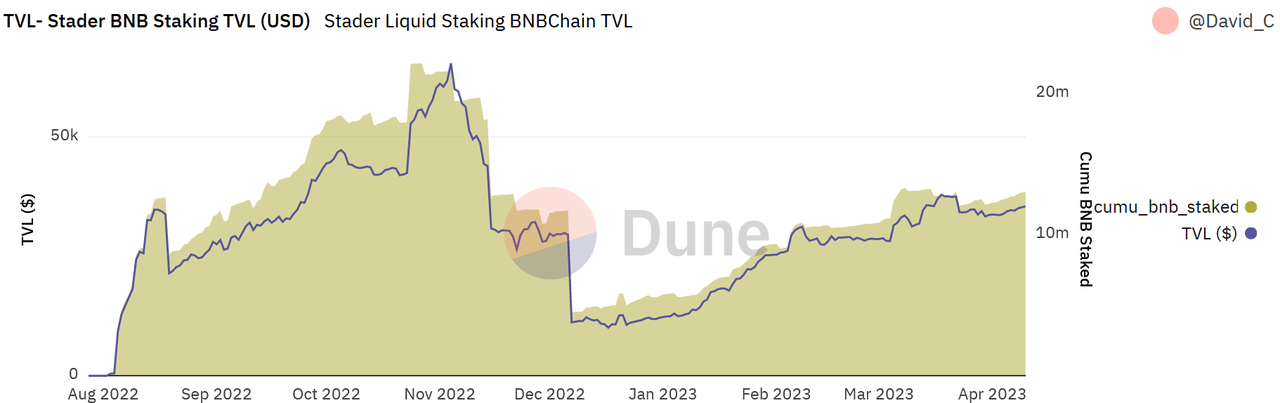

Contract risk: On December 2, 2022, Ankr's contract risk problem affected the BNB pledge track, and it has not fully recovered to the level before the incident until now. If similar incidents happen again, and pSTAKE Finance provides liquidity staking services on such a public chain, then pSTAKE Finance is likely to be impacted as well.

secondary title

2.1 Project business scope

pSTAKE Finance is a liquid staking protocol, currently focusing on the liquid staking services of Ethereum, BNBchain, and Cosmos ecology. In the future, it is expected to expand the liquidity staking business of more public chains, and expand the application scenarios of its own LSD in other DeFi.

2.2 Past Development and Roadmap

2.2 Past Development and Roadmap

pSTAKE Finance is developed by the Persistence team. Since the project was established in 2020, it has gone through the following two stages:

The first stage:

Q4 2020: Project concept finalized and MVP designed;

The first quarter of 2021: The pSTAKE Finance project was officially established, and the main business line is to provide staking services for Cosmos;

The second quarter of 2021: start airdrop and bug bounty, and conduct contract audit;

Q3 2021: pBridge (a cross-chain bridge developed by pSTAKE Finance) validators and pSTAKE validators go online;

The fourth quarter of 2021: pSTAKE Finance mainnet launch and public offering;

Q1 2022: Expand to other COSMOS chains (Terra);

The second quarter of 2022: launch ETH staking service;

second stage:

The third quarter of 2022: Launch the V2 version, promote the usage scenarios of stkToken, reach a strategic cooperation with Binance, provide liquid staking services for BNB, and officially launch in August 2022;

The fourth quarter of 2022: Promote PoS asset management, and plan to provide ATOM pledge services in the Persistence Core-1 Chain (a COSMOS-based public chain developed by the Persistence team), and provide stkATOM with more DeFi services.

2.3 Business Situation

2.3.1 Service object

The main service objects of pSTAKE Finance are users who hold POS public chain tokens. In order to provide complete pledge services and at the same time realize the security of the verification link, pSTAKE Finance uses a verifier scoring system to find verifiers who meet the requirements, and hand over the user's public chain tokens to the verifier for pledge.

Client side: Since the launch of pSTAKE Finance, it has provided pledge services for ATOM, XPRT, ETH, and BNB four public chain tokens. In the early plans, future pledge services for SOL, AVAX and other Cosmos Layer 1 public chain tokens are also included. With the advancement of the business, especially after reaching a strategic cooperation with Binance in 2022, the business focus of pSTAKE Finance will focus on the pledge services of ATOM and BNB tokens.

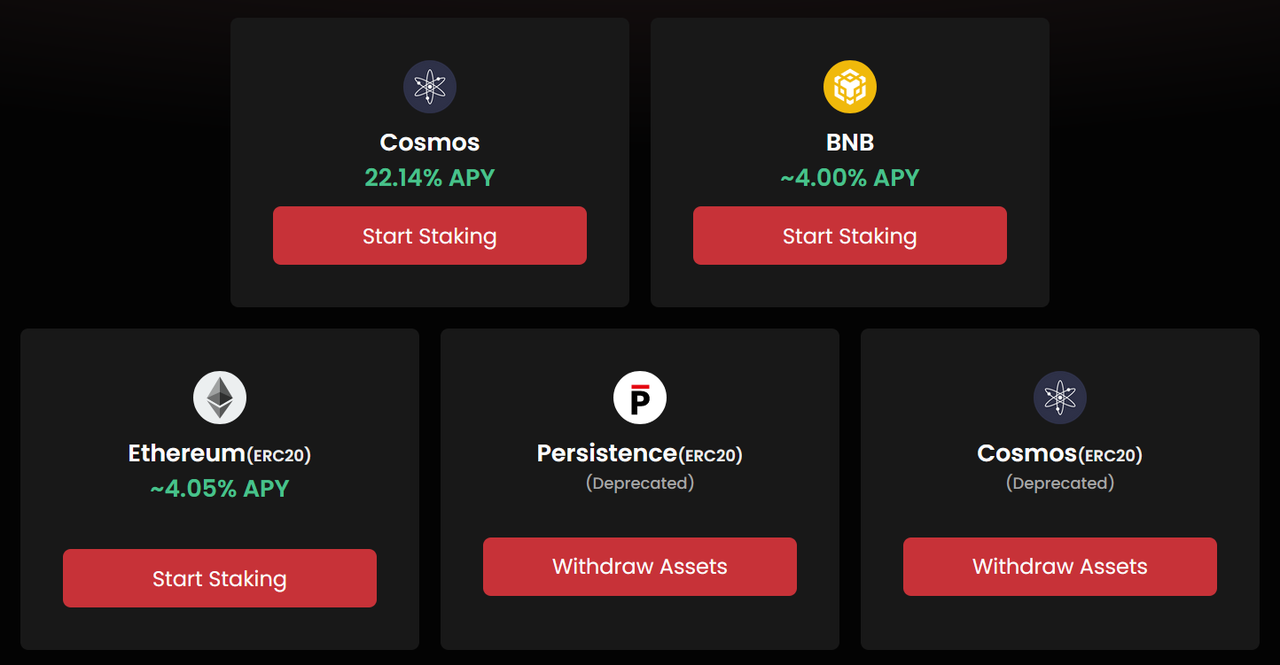

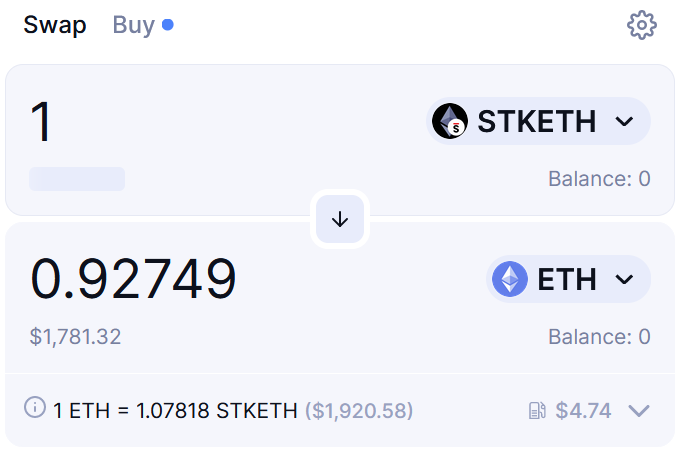

image description

source:https://app.pstake.finance/

source:

Currently, pSTAKE Finance supports the pledge service of ATOM, BNB, and ETH. Among them, stkATOM and stkXPRT are undergoing migration. In the future, the liquidity pledge service of ATOM and XPRT will be carried out on the Persistence Core-1 Chain public chain developed by pSTAKE Finance.

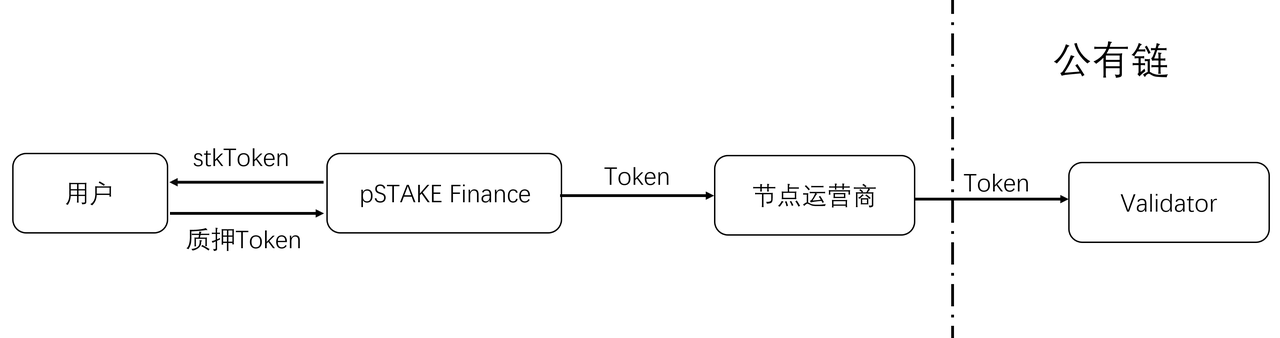

The liquidity staking business model can be simplified as the following diagram:

image description

Source: Mint Ventures

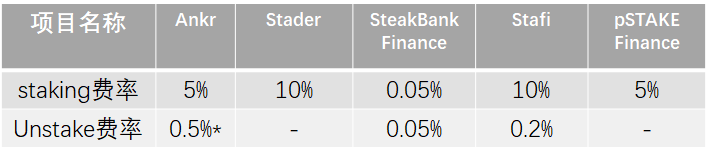

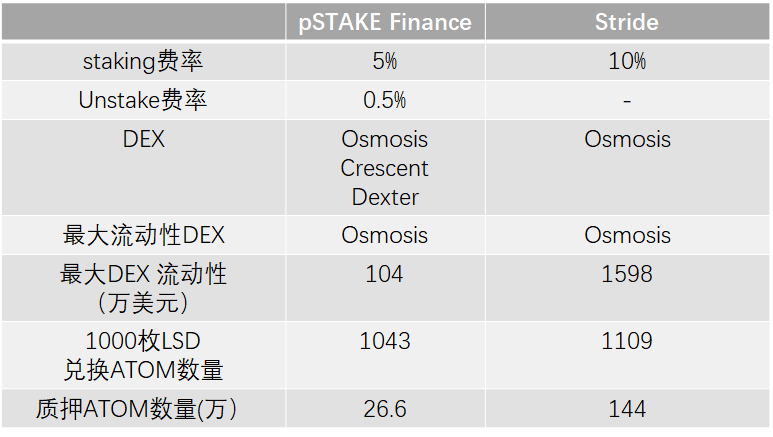

Like other LSD projects, pSTAKE Finance will charge a certain fee when providing services: Take ATOM as an example, 5% of the staking rewards users get during the staking period will be paid to pSTAKE Finance as a fee; when the user unstakes, If you want to get your pledged token quickly, there will also be a "Redeem Instantly" fee of 0.5% of the total amount.

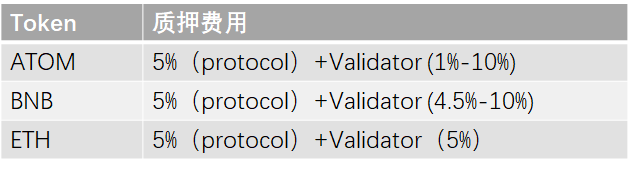

image description

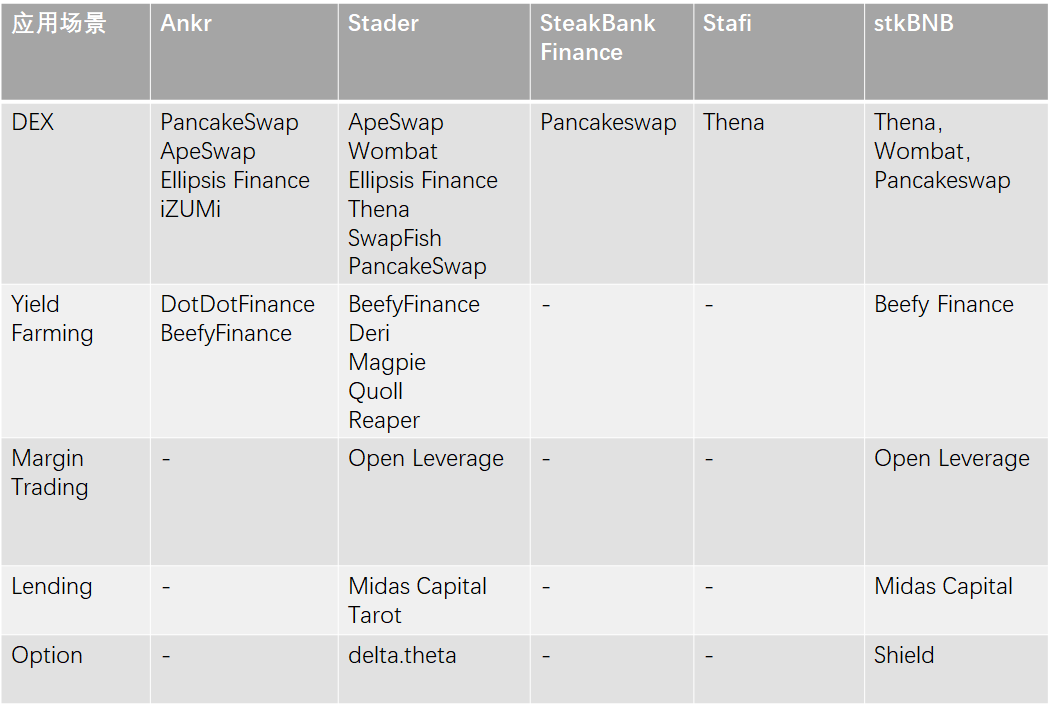

In addition to providing staking services, pSTAKE Finance also provides users with their own application scenarios for staking certificates: Take pSTAKE Finance’s BNB staking certificate stkBNB as an example. Investment, the speed of access to ecological partners is very fast. The user's stkBNB can be applied to many mainstream DeFi in the BNBchain ecosystem. For example, stkBNB can be deposited in Beefy Finance to earn extra income, or used as margin to trade in OpenLeverage, and can be deposited in Midas Captal to earn loan income wait.

image description

In contrast, the application scenario cooperation between stkATOM and stkETH is progressing slowly.

secondary title

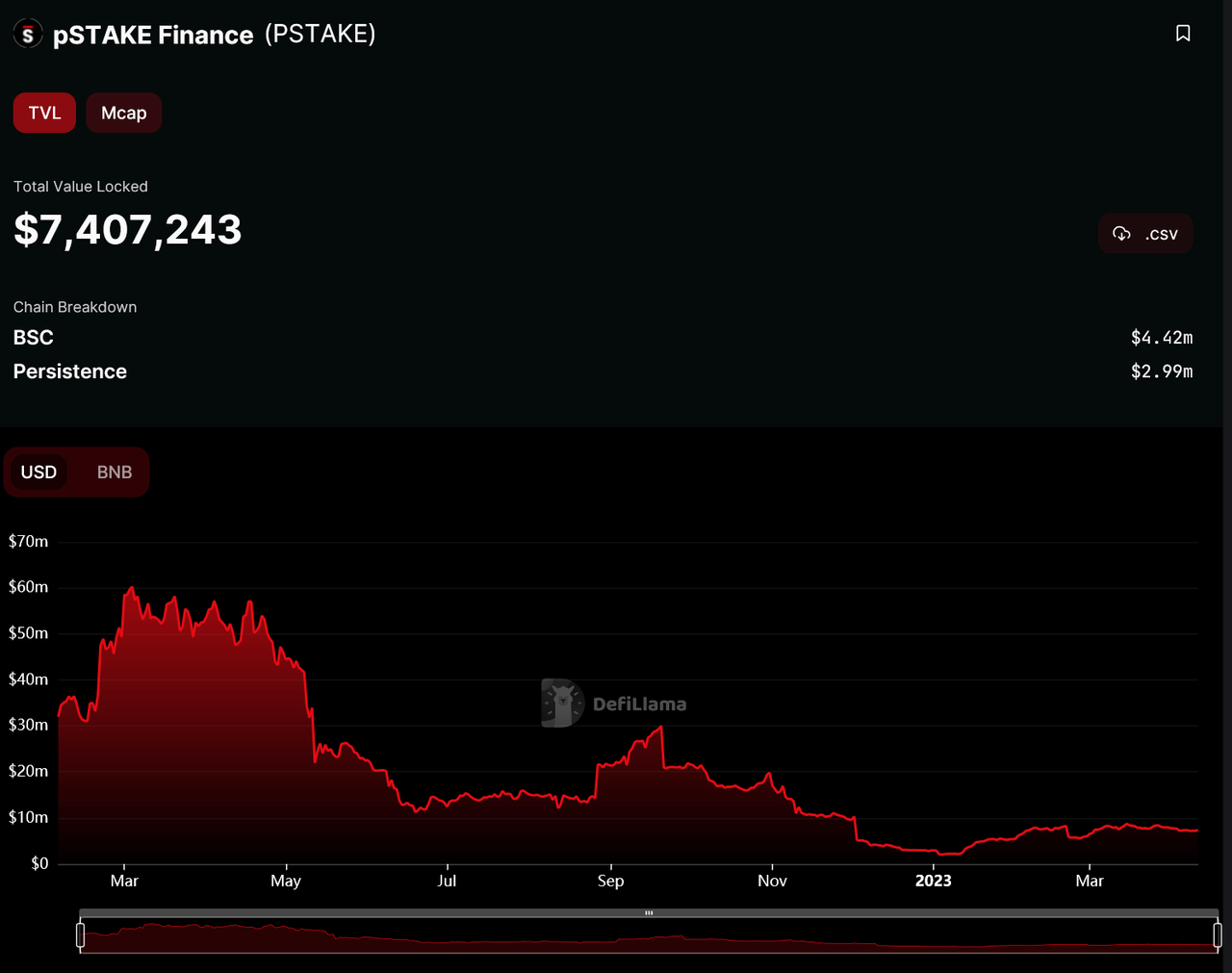

image description

source:https://defillama.com/protocol/pstake-finance

source:

The current TVL of pSTAKE Finance totals about $7.41 million, of which about 60% is BNB, 40% is ATOM, and ETH staking is almost negligible.

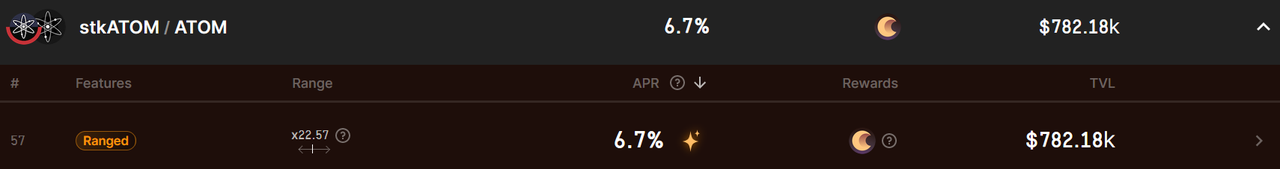

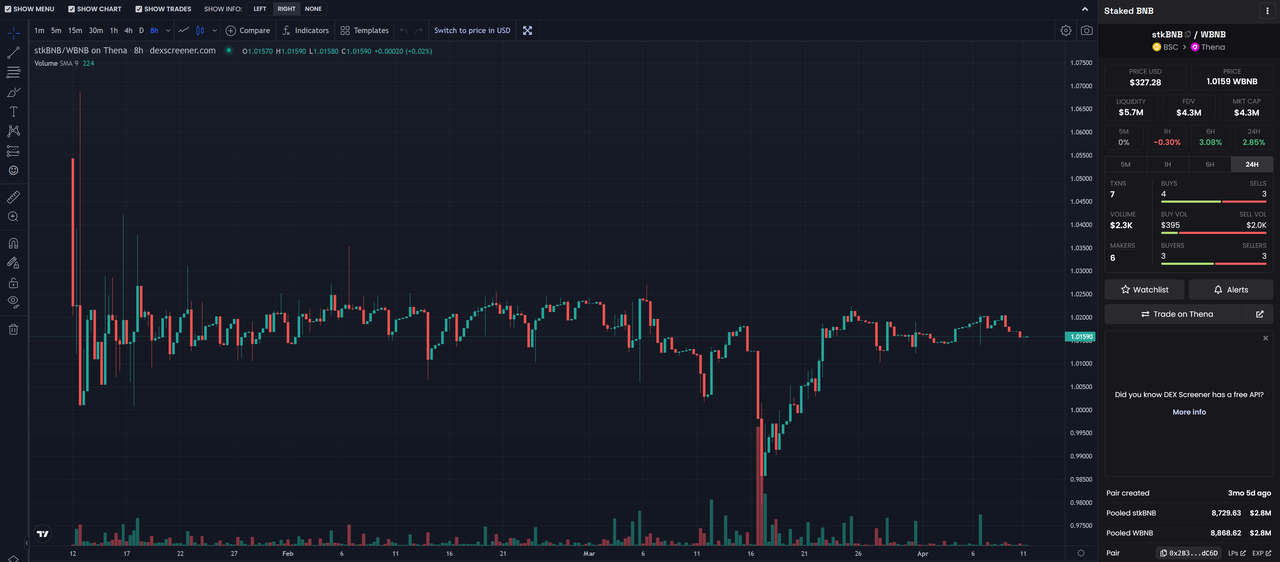

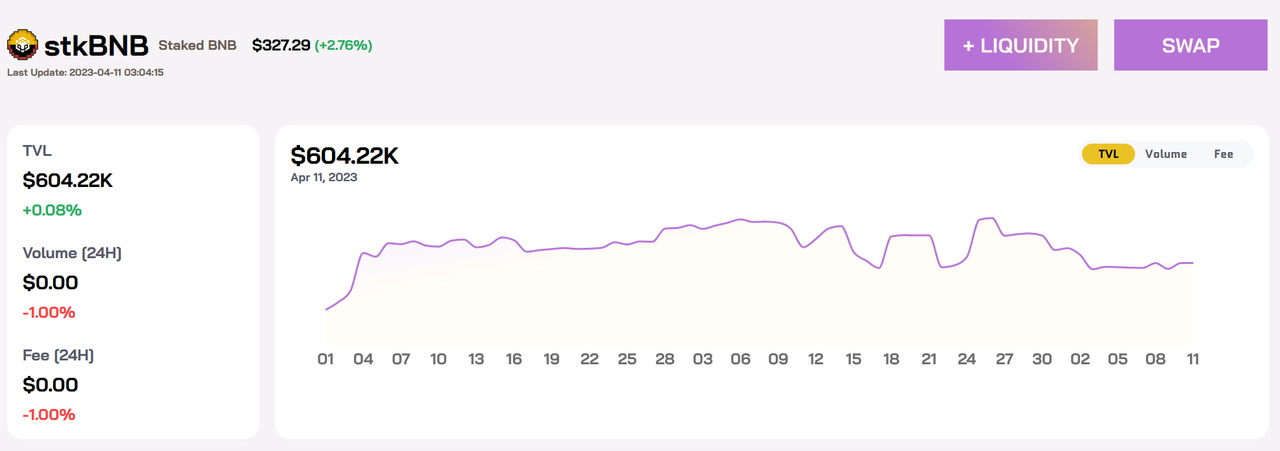

image description

source:https://info.osmosis.zone/pool/886

source:https://dexscreener.com/BNBchain/0x aa 2527 ff 1893 e 0 d 40 d 4 a 45462 3d 36 2b 79 e 8 bb 7 f 1

source:https://app.crescent.network/farm? open_modal_pool_id= 57

source:

image description

source:https://dexscreener.com/BNBchain/0x2b3510f57365aa17bff8e6360ea67c136175dc6d

source:https://dexscreener.com/BNBchain/0xaa2527ff1893e0d40d4a454623d362b79e8bb7f1

source:https://info.wombat.exchange/#/assets/0x0e202a0bcad2712d1fdeeb94ec98c58beed0679f

source:

source:

source:https://eth.pstake.finance/defi

secondary title

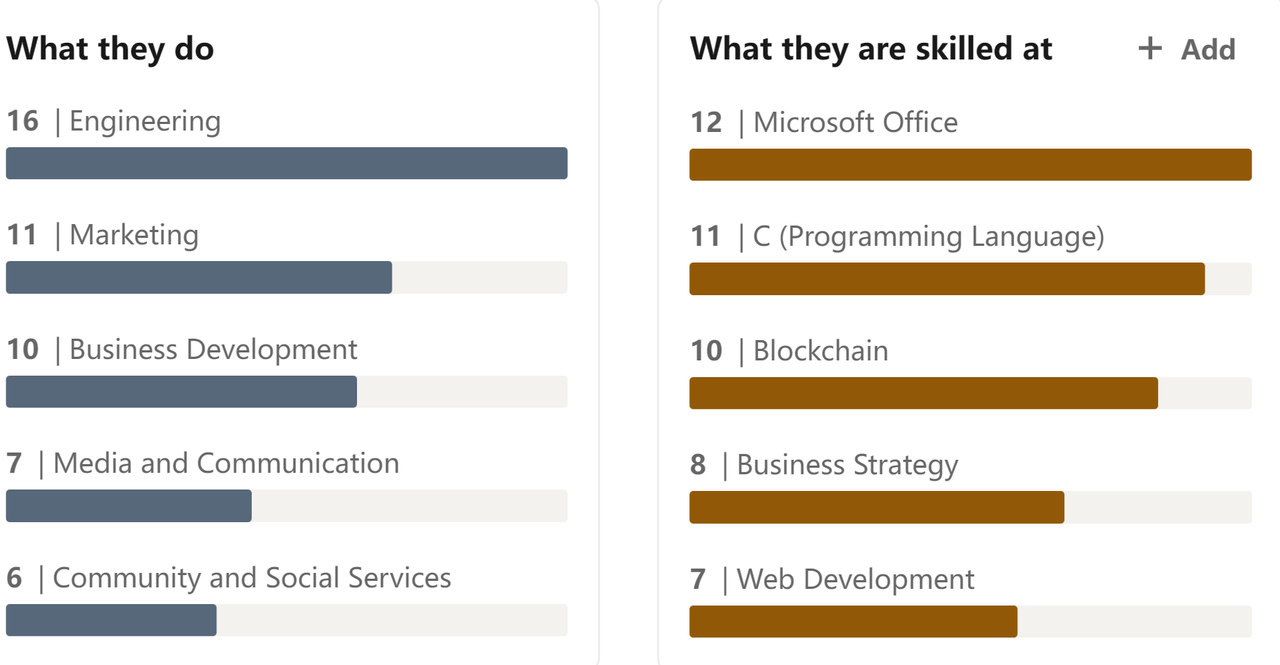

2.4 Team situation

image description

source:( 2) Persistence Labs: People | LinkedIn

image description

source:Tushar Aggarwal | LinkedIn

image description

source:https://www.linkedin.com/in/deepanshutr/

source:

Deepanshu Tripathi is the Co-Founder and CTO of Persistence and a graduate of Vellore Institute of Technology. Prior to founding Persistence, he worked as an engineer at Mahindra Comviva and later became Chief Software Architect at Comdex. In 2019, Tushar founded Persistence and served as CTO. In 2022, he founded AssetMantle, a one-stop NFT service platform.

2.4.3 Core members

Members of the main business line have rich and deep backgrounds in related fields.

Project leader: Mikhil Pandey, has been working at Persistence, successively served as market research assistant, head of strategy and business development and other positions.

secondary title

2.5 Financing situation

pSTAKE Finance has gone through two rounds of independent financing.

In November 2021, pSTAKE Finance completed a financing of US$10 million, with a valuation of US$50 million, and the sale price of the platform token PSTAKE is US$0.1 per piece. Investors include Three Arrow Capital, Sequoia India, Galaxy Digital, Defiance Capital, Coinbase Ventures, Tendermint Ventures, Kraken Ventures, Alameda Research, Sino Global Capital, and Spartan Group. Aave’s head of institutional business development Ajit Tripathi, Terra founder Do Kwon and Alpha Finance co-founder Tascha Punyaneramitdee also participated in the round.

In December 2021, pSTAKE Finance completed a financing of US$10 million on CoinList, selling 5% of the tokens. The platform token PSTAKE was sold at US$0.4 per piece, with a valuation of US$200 million.

3. Business Analysis

secondary title

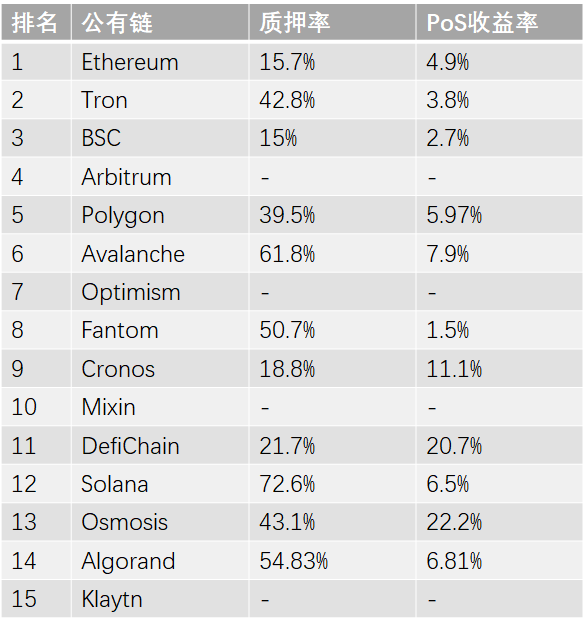

3.1 Industry space and potential

3.1.1 Classification and Market Size

For the liquid staking track, assuming that the market value remains unchanged, the staking scale of a single public chain is only related to the staking ratio (staking ratio), and the overall revenue scale of the track is also related to the PoS rate of return and service fee pumping. There is a proportional relationship. The average pledge yield of the public chain in the figure below is about 8.6%.

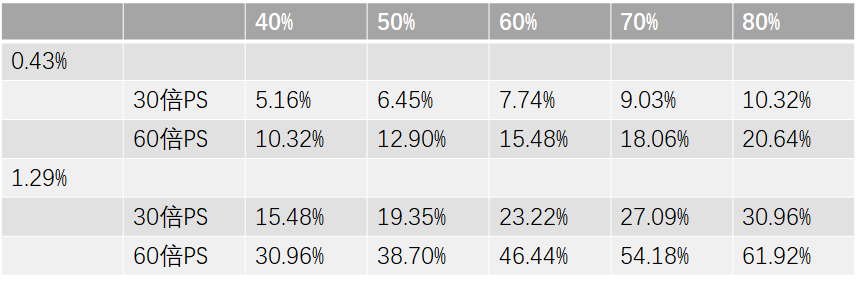

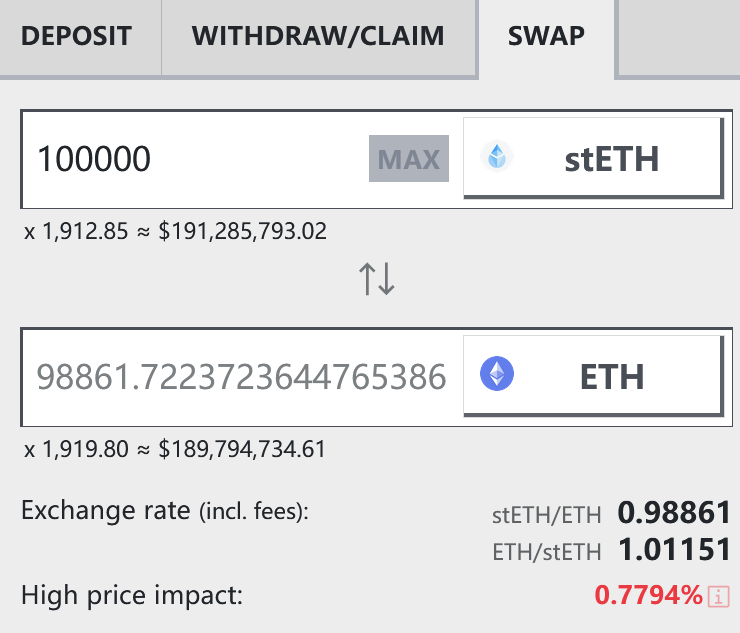

image description

Liquidity staking projects in the current market generally extract 5% -15% of the income as service fees. According to the 8.6% PoS rate of return, the total rate of return obtained by liquidation staking projects is between 0.43% -1.29%. From this, we can roughly estimate the rough relationship between liquidity staking profit and the market value of the public chain. Of course, we can also adjust the PoS rate of return for estimation.

image description

By assuming different valuation parameters—PS ratio, we can also get the data shown in the figure below.

image description

Source: Mint Ventures, data as of 11 April 2023

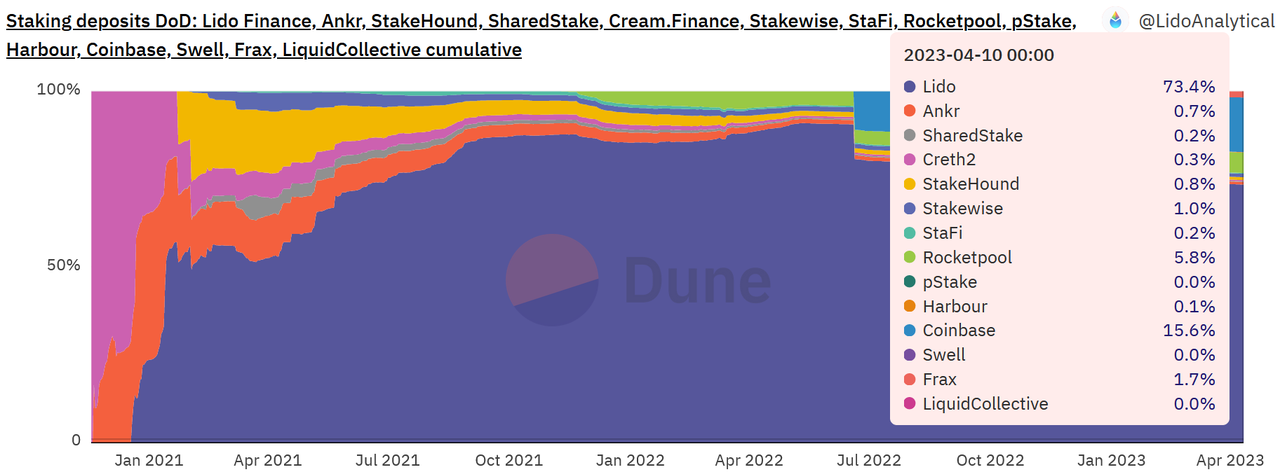

image description

source:https://dune.com/LidoAnalytical/Lido-Finance-Extended

source:

source:https://dune.com/LidoAnalytical/Lido-Finance-Extended

source:https://curve.fi/#/ethereum/pools/steth/swap

source:https://curve.fi/#/ethereum/pools/factory-crypto-91/swap

secondary title

3.2 Analysis of Token Model

3.2.1 Total amount and distribution of tokens

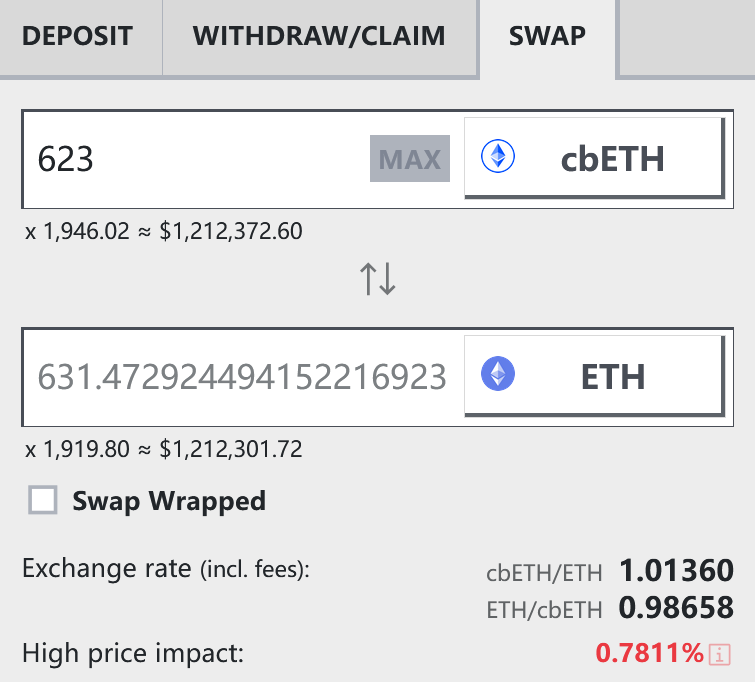

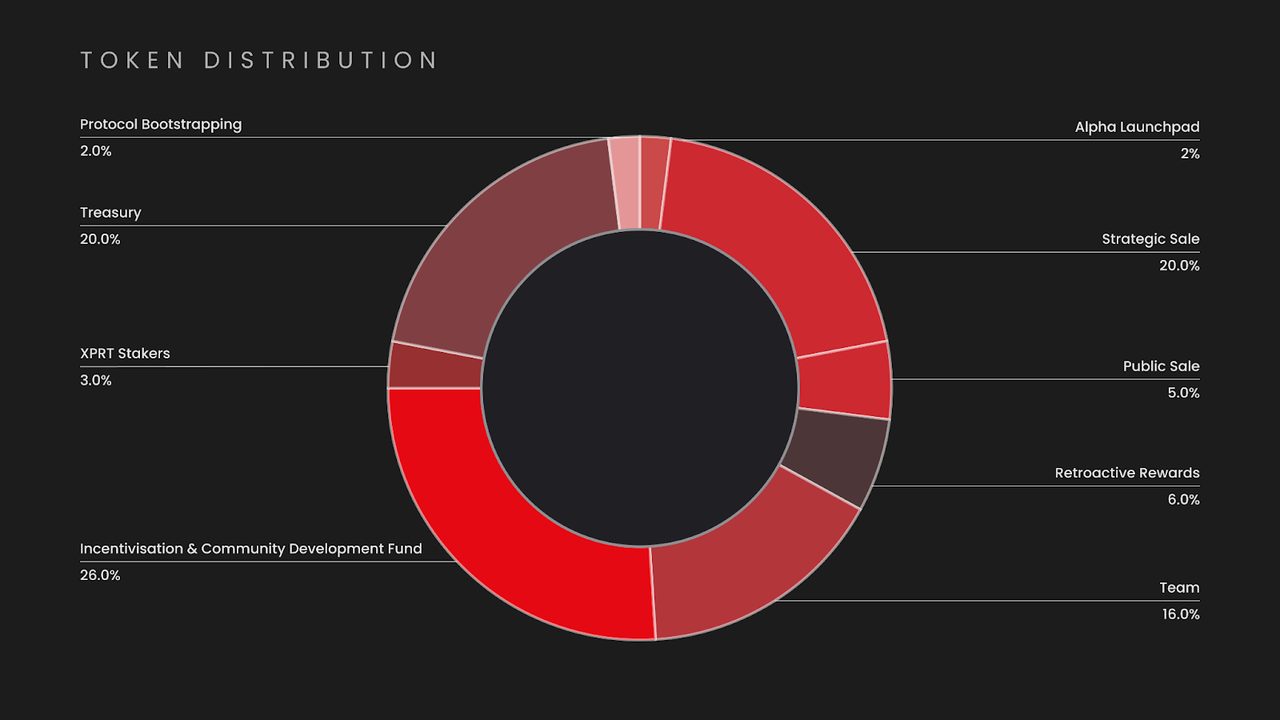

There are a total of 500 million tokens PSTAKE, which will be put into circulation in February 2022. in:

2% belongs to Alpha Launchpad, which is allocated to Alpha Finance’s pledge users and Alpha Finance (Note: It was a lending project at the beginning of its launch, but now it has become an Alpha Finance DAO, providing comprehensive services including project incubation, VC, etc.) team;

20% is a strategic sale, unlocked starting 6 months after investment and linearly unlocked over the next 12 months;

5% are public offerings on CoinList, 25% of which will be unlocked on the day of the sale, and the rest will be unlocked linearly within 6 months;

6% is a retroactive reward, which is provided to the liquidity providers of the stkATOM-ETH and stkXPRT-ETH pools. The linear unlocking will be completed within 6 months;

16% belongs to the team, which will be unlocked 18 months after the tokens start circulating in the secondary market, and will be unlocked linearly within the next 18 months;

26% belongs to the incentive and community development fund: unlocked linearly every quarter, and fully unlocked within 2 years;

3% belong to XPRT stakers, unlocked linearly quarterly within 1 year;

image description

source:https://blog.pstake.finance/2021/12/13/pstake-tokenomics/

source:https://blog.pstake.finance/2021/12/13/pstake-tokenomics/

source:

According to the above token release rules, about 55.2% of the token PSTAKE can be circulated, and all release will be completed by 2025. The average annual inflation rate in the next two years is about 35%, and the inflation rate is relatively high.

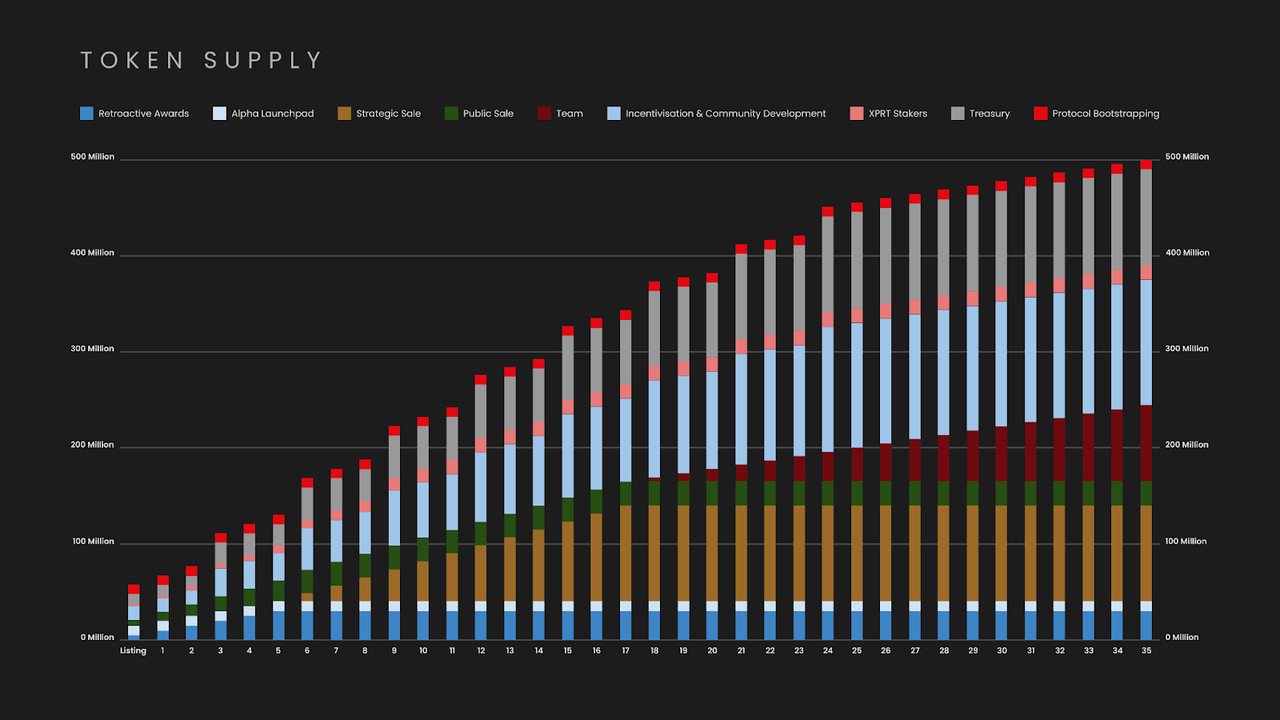

3.2.2 Token Value Capture

PSTAKE tokens only have governance functions at this stage and cannot share the revenue of the project. PSTAKE holders can participate in community governance voting, and can also pledge PSTAKE to maintain the security of the project.

3.2.3 Token core demand side

At this stage, tokens that pledge governance functions are recognized by investors may have two factors:

Directly participate in governance and influence the development direction of future projects. pSTAKE Finance stipulates that investors/institutions holding at least 250,000 PSTAKE tokens can initiate proposals in the community. This may be more attractive to investors with large capital and the ability to bring ecological support and business resources to the project. By initiating proposals and voting, large investors can influence pSTAKE Finance fees, public chain deployment strategies, ecological incentive mechanisms, etc. These strategies may increase the medium and long-term value of PSTAKE.

Similar to UNI, the value capture function of tokens may be realized through subsequent proposals. However, UNI does not necessarily have to acquire value capture or profit sharing attributes in the near future. In the stock market, stocks issued by high-growth companies do not necessarily have to pay dividends within a certain period of time. For example, Amazon’s stock has not paid dividends for a long time, but it does not affect the long-term rise of Amazon’s stock price, because the company is still in long-term rapid growth. A stage that requires a lot of investment. Therefore, PSTAKE may not have cash flow dividends in the short term, but it needs to further expand its business. Whether it is a multi-chain deployment strategy similar to Uniswap, or a multi-business line collaborative development model similar to Frax Finance, as long as the pSTAKE Finance project can pass the expansion Gaining growth, with no value capture capabilities at this stage may not be at the core of potential investors' concerns.

3.2.4 Summary of Token Model

For the problem of value capture, in the middle and late stages of the rapid growth stage of the project, pSTAKE Finance can use part of the fees for repurchases, etc., and the income earned at this stage does not necessarily have to lie in the treasury, and part of the money can be used to do so Ecological promotion, even to buy tokens of other projects that can have synergistic effects.

secondary title

3.3 Project Competition Landscape

3.3.1 Basic Market Structure & Competitors

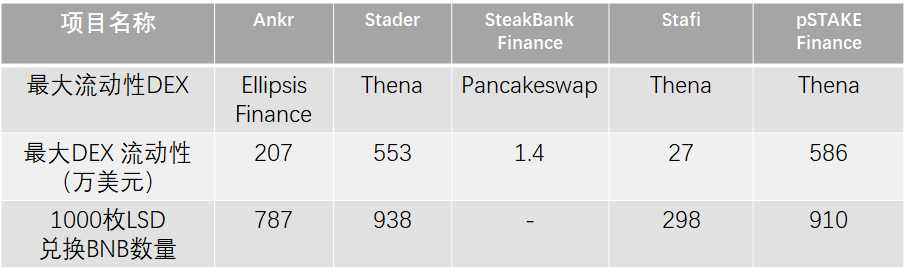

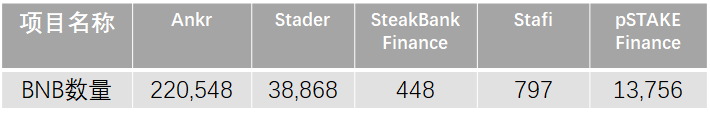

image description

Source: Project websites, Mint Ventures, data as of April 11, 2023

image description

Source: Project websites, Mint Ventures, data as of April 11, 2023

image description

Source: Project websites, Mint Ventures, data as of April 11, 2023

image description

Source: Project websites, Mint Ventures, data as of April 11, 2023

Cosmos' liquid staking markets currently mainly include Stride and pSTAKE Finance. We still observe from the above-mentioned dimensions. In contrast, the fee rate of pSTAKE Finance is low, and the depth of its depositary receipts can currently meet the needs of small and medium liquidity. In the future, with the increase in demand for ATOM liquidity pledges, at least in competition with Stride, pSTAKE Finance There is an opportunity to gradually increase market share.

image description

Source: Project websites, DeFi Llama, Mint Ventures, data as of April 11, 2023

3.3.2 Project Competitive Advantages

From the above comparison, we can find that the core competitiveness of pSTAKE Finance has been highlighted after the Binance investment:

stkBNB has a wide range of application scenarios: pSTAKE Finance has all-round support from the current BNBchain ecosystem after obtaining investment from Binance. stkBNB can almost meet most of the needs of users in on-chain financial scenarios.

These two points are also the development direction of other liquidity staking businesses such as ATOM.

secondary title

3.4 Project Risks

Combined with the problems of the liquid staking track itself, the pSTAKE Finance project mainly faces the following three types of risks:

image description

source:https://dune.com/David_C/liquid-staking-on-bnbchain

source:https://dune.com/David_C/liquid-staking-on-bnbchain

source:https://dune.com/David_C/liquid-staking-on-bnbchain

source:

secondary title

4.1 Core Issues

4.1 Core Issues

For pSTAKE Finance, the core issues that determine its value depend on the following three aspects:

The strategy chosen by the public chain: Judging from the business inflection point of rapidly expanding the BNBchain chain business after accepting Binance’s strategic investment, pSTAKE Finance chose to embrace the public chain with development potential, and the strategy of linking the ecology through capital and other channels is worthy of recognition. A similar development model can be used as a template for expanding new public chains.

4.2 Valuation level

4.2 Valuation level

image description

source:

source:https://app.bubblemaps.io/eth/token/0xfb5c6815ca3ac72ce9f5006869ae67f18bf77006

source:https://app.bubblemaps.io/BNBchain/token/0x4c882ec256823ee773b25b414d36f92ef58a7c0c

secondary title

4.3 Summary

In terms of valuation, the current window may not be the best time to buy PSTAKE. Investors need to wait for the price to fall or the fundamentals to grow rapidly before making a decision. If the ATOM-based liquidity staking business shows signs of improvement, PSTAKE may enter the investment range.

5. References

5. References

https://blog.pstake.finance/2021/11/16/pstake-raises-10 m-to-bootstrap-liquid-staking-protocol/

https://blog.pstake.finance/2021/12/10/pstake-sale-on-coinlist-step-by-step-guide/

Alpha launchpad:https://blog.pstake.finance/2021/09/13/pstake-to-launch-on-alpha-launchpad/

Retroactive Rewards:https://blog.pstake.finance/2021/10/25/introducing-retroactive-rewards-for-stktoken-liquidity-providers/>

Binance labs:https://blog.pstake.finance/2022/05/17/pstake-binance-labs-partner-to-develop-bnb-liquid-staking-solution/

Financing and token economy:

https://blog.pstake.finance/2022/12/30/pstake-2022-year-in-review/

https://blog.pstake.finance/2022/05/01/stketh-ethereum-2-0-pstakes-next-leap-forward/

Roadmap and member information:

business:https://blog.pstake.finance/2021/12/10/pstake-zero-to-one/

Provided token staking services:

https://blog.pstake.finance/2021/11/22/introducing-pstakes-validator-ecosystem/

https://blog.pstake.finance/2022/10/28/stkbnb-ecosystem-overview/

https://blog.pstake.finance/2022/02/08/expanding-the-pstake-validator-ecosystem/

validator selection:

https://blog.pstake.finance/2022/10/04/the-state-of-bnb-staking-september-2022-report/

https://blog.pstake.finance/2022/10/28/stkbnb-ecosystem-overview/

The case of the BNB chain:https://blog.pstake.finance/2021/12/10/pstake-zero-to-one/

The difference between stkToken and pToken:https://docs.pstake.finance/stkATOM_Technical_Architecture/

ATOM pledge process:https://docs.pstake.finance/stkATOM_Rewards/

ATOM staking fee:

https://twitter.com/pSTAKE_stkBNB/status/1621171480229969920

BNB staking fee:https://docs.pstake.finance/stkETH_Fees/

ETH pledge fee:

SteakBank:https://docs.steakbank.finance/tokenomics/sbf/deflationary-mechanics

Stafi:

https://twitter.com/pStakeFinance/status/1620373647474167809

BNBchain Staking Rates:

Ankr:https://www.ankr.com/staking/defi/? assets=ankrBNB&types=landing

steakbank:https://app.steakbank.finance/

stafi:https://www.stafi.io/

BNBchain cooperation ecology:

Ankr:https://ellipsis.finance/pool/0x 440 ba 409 d 402 e 25 b 95 ac 852 e 386445 af 12 e 802 a 0

Stader:https://thena.fi/liquidity/manage/0x 6 c 83 E 45 fE 3 Be 4 A 9 c 1 2B B 28 cB 5 BA 4 cD 210455 fb 55

BNBchain's largest liquidity pool: