TVLは急速に成長しており、タンジブルとUSDRの突然の出現には隠れたリスクが潜んでいる可能性がある

ステーブルコインは、ブロックチェーンの世界では避けられない話題です。アルゴリズム ステーブルコインは、ポンジの代名詞となっています。過去には、一般に安全だと信じられていた準拠ステーブルコインである USDC が、シリコン バレー銀行の破綻により、危うく損失を被りそうになりました。 Tangible は、基礎となる資産によってサポートされ、ユーザーが利益を得るのに役立つ比較的分散型のステーブルコインを設計する方法についてのアイデアを提供しました。

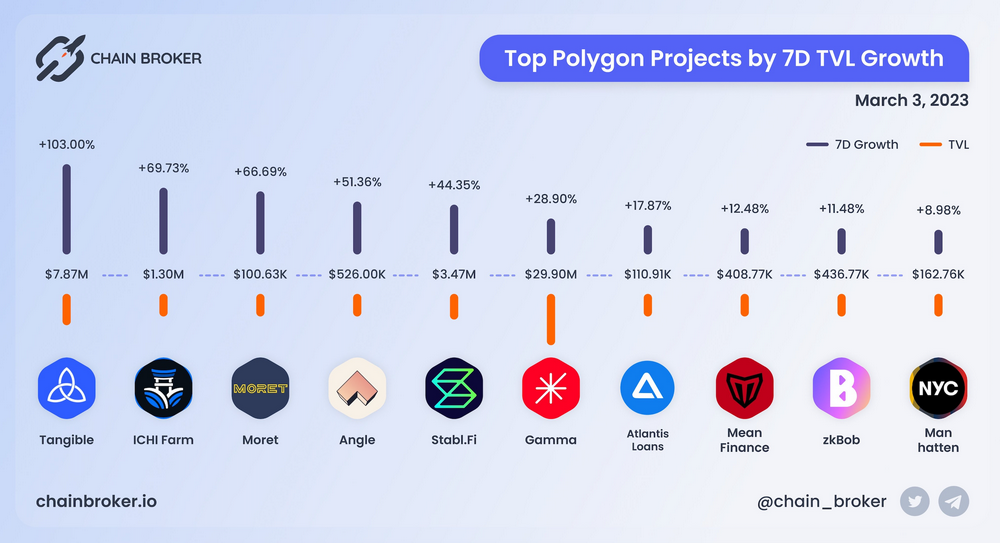

Tangible は「現実世界の資産 + ステーブルコイン」のコンセプトに焦点を当てており、Defi Llama のデータによると、3 月 15 日の時点で、TVL は先月 15.7 倍に増加しており、Polygon 上で最も急成長しているプロジェクトの 1 つとなっています。最近。急速に成長している一方で、Tangible の中核となるデータはオープンかつ透明ではなく、隠れたリスクが存在します。

USDR:高金利の預金、競輪場とテナでの多額の賄賂

流動性マイニングの機会を積極的に探しているDeFiユーザーは、非常に高い利回りのステーブルコインが最近ベロドロームとテナに登場し、これら2つのDEXのwUSDR/USDC取引ペアのAPRが通常100%にも達していることに気づくかもしれません。 Solidly の DEX からのこれら 2 つのフォークのメカニズムによれば、USDR の発行者である Tangible は、投票用の veToken を大量に保有するか、毎週賄賂を支払って veToken 保有者に自分たちに投票してもらうようにしています。

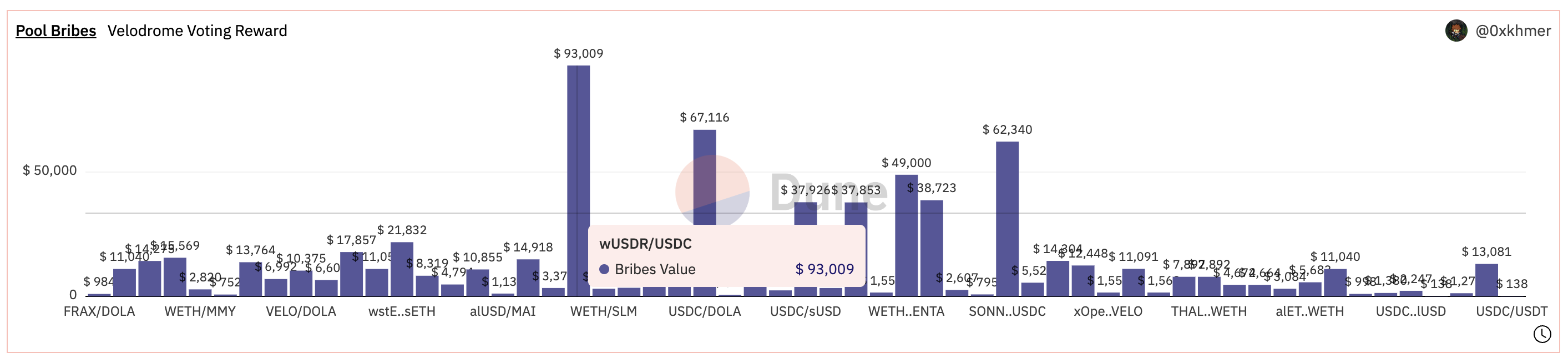

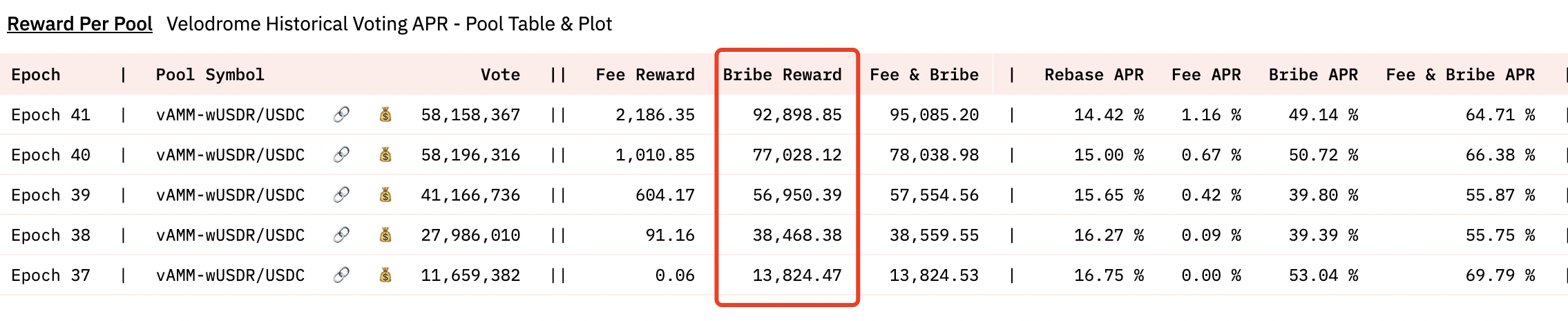

Dune@0x khmer によって編集されたダッシュボードは、wUSDR/USDC 取引ペアが現在、Optimism における DEX Velodrome への最大の賄賂であり、USDC/DOLA、SONNE/USDC および他の取引ペアを上回っていることを示しています。直近1週間の賄賂額は約9万3000ドルで、賄賂は毎週増加していた。贈収賄資金は主に安定通貨USDCまたはUSDRのパッケージ版であるWUSDRで、一部はOPです。

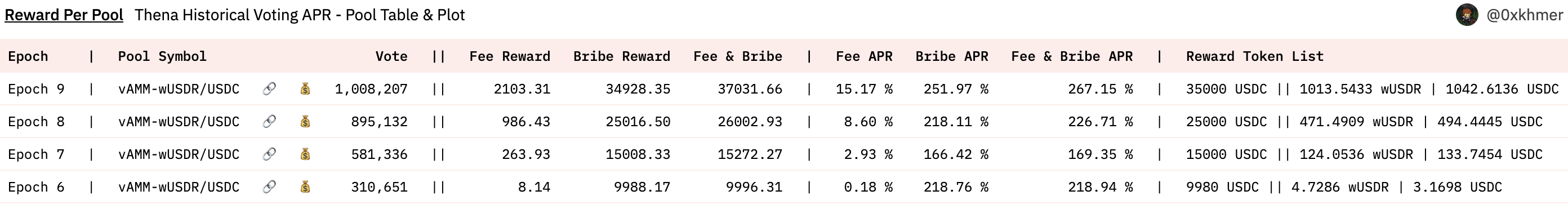

同様の状況は、BNB チェーンの Thena にも現れました。先週、wUSDR/USDC 取引ペアは Thena に 35,000 ドルの賄賂を支払いました。賄賂の額も増加し続け、すべての支払いは安定通貨の USDC を通じて行われました。」

最初のレベルのタイトル

TNFT市場

タンジブルには、TNFT(タンジブル非代替トークン、タンジブル非代替トークン)市場と安定通貨USDRの2つの主な商品があります。

Tangible を使用すると、ユーザーは暗号通貨を使用してサプライヤーから商品を購入し、Tangible が TNFT を発行して購入者に送信し、この TNFT で表される物理的なアイテムを Tangible Custody に預けることができます。 TNFT の所有者は、資産を譲渡、売却、または物理的オブジェクトと交換できます。詳細なプロセスは次のとおりです。

ユーザーはタンジブル マーケットプレイスでアイテムを閲覧して購入し、スマート コントラクトが関連アイテムの価格と手数料を処理します。

アイテムに対応するTNFTが鋳造されて購入者のウォレットに送られ、TNFTは保有または取引に使用できます。

同時に、Tangible はサプライヤー パートナーから物理的な商品を購入します。

物理的に購入したものは物理的な保管庫に発送されます。

TNFT に対応する物理的資産には、美術品、ワイン、骨董品、金の延べ棒、金の延べ棒、不動産など、流動性があまり高くない商品が含まれます。

さらに、Tangible はフラグメンテーションサービス (Tangible Fractions) も提供しており、TNFT 保有者は保有する TNFT の一部を指定価格で売却できます。たとえば、時計の価値が 100,000 ドルの場合、TNFT の保有者は時計の価値の 40% を 42,000 ドルで注文できます。

最初のレベルのタイトル

ステーブルコインUSDRの仕組み

上記のシステムに基づいて、タンジブルは安定通貨リアル米ドル(USDR)を発行し、主にトークン化された不動産トークンに投資して収益を得ています。長期的には不動産の価値は上がり続け、投資された不動産はテナントに貸し出され、その収益はリベースを通じてUSDR保有者に毎日支払われます。

USDRは通常、DAIと1:1で鋳造されますが、より少ないシェアをTangibleのネイティブトークンであるTNGBLで鋳造することもできます。 TNGBL によって鋳造できる USDR の量 = (鋳造された USDR の量 - 償還された USDR) * 10%。

USDR鋳造用の準備金のうち:

50% ~ 80% が有形不動産 NFT に投資されます。

10% ~ 50% は DAI の形で保有されます。

10%はTNGBLの形で保有。

10% -20% は、プロトコル曲線上でプロトコルが所有する流動性です。

5%~10%が保険基金です。

最初のレベルのタイトル

引き換えられない場合はどうすればよいですか?

上記から、USDRの鋳造のための準備金の少なくとも60%が不動産NFTまたは独自のTNGBLトークンに投資されていることがわかります。 Tangible はユーザーの利便性を考慮して少量の DAI を保有していますが、不動産や TNGBL の価格が下落したり、大規模投資家が撤退したいために流動性がなくなったらどうなるでしょうか?タンジブルがエグジットのために保有する流動性は十分ではないかもしれないが、プロジェクト関係者はすでにそのための方法を見つけている。

最初のレベルのタイトル

タンジブルの貸借対照表

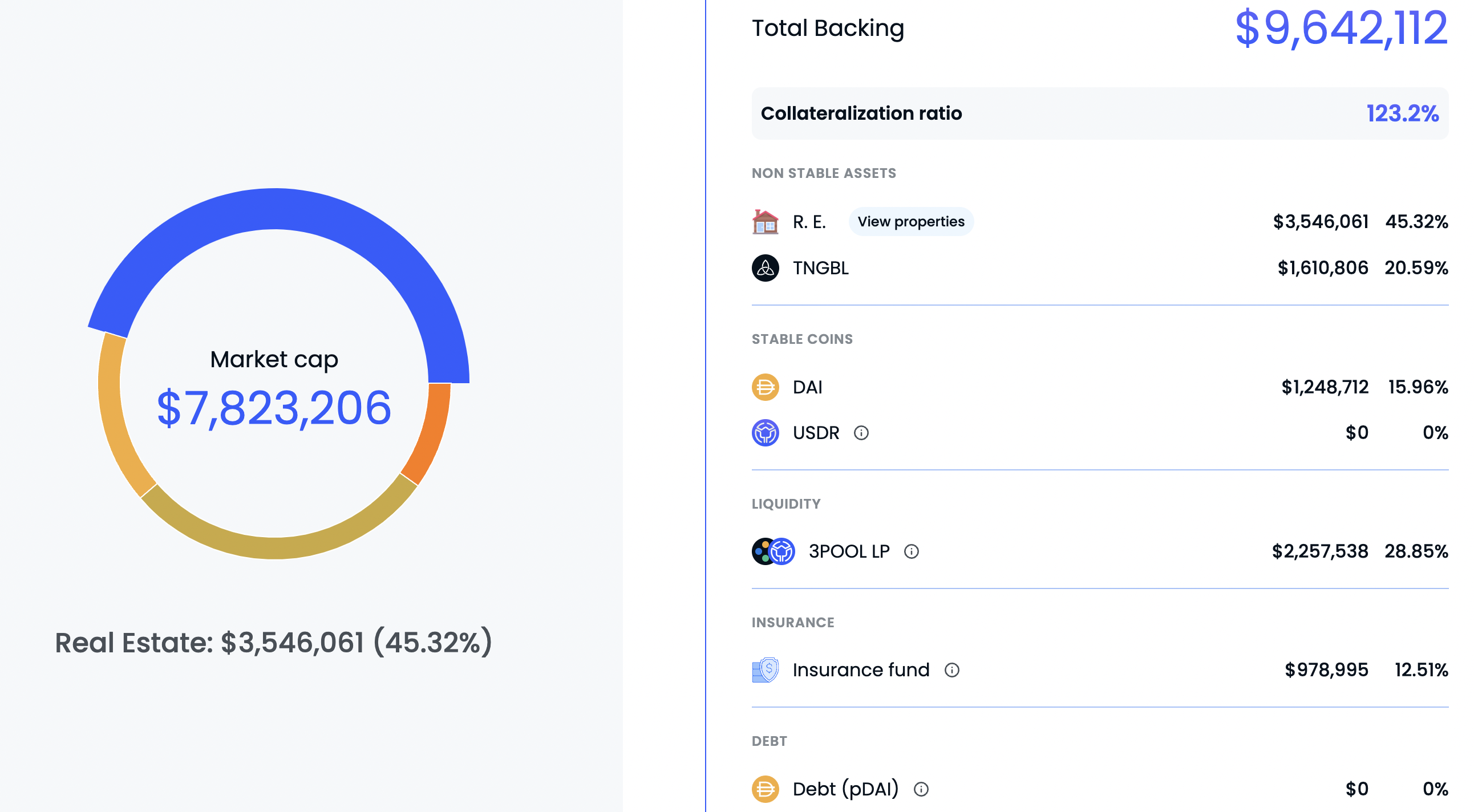

以下の図に示すように、Tangible 公式ウェブサイトのデータは、現在発行されている USDR の数が 782 万 USDR であるのに対し、協定が所有する総資産は 964 万 US ドルであることを示しています。このプロジェクトには182万ドルの余剰があるため、流動性を獲得するためにステーブルコインで毎週多額の賄賂が支払われているが、タンジブルには賄賂が利益から賄われていると主張する理由もある。

最初のレベルのタイトル

まとめと考察

USDR のステーブルコイン モデルは、ステーブルコインの設計に関する考え方を提供できます。つまり、最下層は利子を生み出す可能性のある資産を保持し、ステーブルコインの保有者は収入を得ることができ、Circle などの集中型ステーブルコイン発行者が自ら資産収入を得ることができなくなります。資金の安全性が十分に確保されている状況。

しかし、タンジブル社は強い支持を持っていない。すべての物的資産とTNFT発行権限はタンジブル・カストディによって管理されている。関係者が強力な証拠を提出する前に、このプロジェクトを通じたTNFTの購入には高いカウンターパーティ・リスクがある。プロジェクト・ダウトは可能性がある。より良い選択肢です。

流通額わずか 782 万米ドルのタンジブルは、ヴェロドロームとテナだけで毎週約 128,000 ドルの賄賂を支払っています。高いリターンを通じて DAI 1:1 で USDR を鋳造するようユーザーを引き付けるのは持続不可能である可能性があります。

また、集中化の問題により、タンジブルは「超過準備金」を達成するためにタンジブル・カストディが発行するTNFTの価格を操作することもできる。