시그널플러스 모닝뉴스 지역은행 토픽 Ⅱ

친애하는 친구, SignalPlus Daily Morning News에 오신 것을 환영합니다. 시그널플러스 모닝뉴스는 매일 거시적 시장 정보를 업데이트하고 거시적 추세에 대한 관찰과 의견을 공유합니다. 추적 및 구독에 오신 것을 환영합니다. 당사와 함께 최신 시장 동향을 따르십시오.

친애하는 친구, SignalPlus Daily Morning News에 오신 것을 환영합니다. 시그널플러스 모닝뉴스는 매일 거시적 시장 정보를 업데이트하고 거시적 추세에 대한 관찰과 의견을 공유합니다. 추적 및 구독에 오신 것을 환영합니다. 당사와 함께 최신 시장 동향을 따르십시오.

최근 뉴스:

- 서명 은행은 월요일 이 시간에 막 문을 닫았습니다.

- FDIC, 연준, Yellen 재무장관은 "모든 예금자 보호" 공동성명 발표, SVB와 Signature Bank 예금자들은 3월 13일(월) 이전에 모든 예금을 인출함.

- 납세자는 SVB와 관련된 손실에 대해 책임을 지지 않으며, FDIC 손실은 은행의 특별 평가를 통해 복구됩니다.

- 주주 및 무담보 채권자는 보호되지 않으며 고위 경영진은 해임되었습니다.

우리 의견의 핵심 사항:

- 연준은 적격 금융 기관에 1년 만기 대출을 제공하기 위해 새로운 BTFP(Bank Term Funding Program)를 신설한다고 발표했습니다. , 정부 기관 채권 및 MBS, 현재 계획은 250 억 달러입니다.

- 즉, HTM/AFS 손실에 직면한 은행들은 시장에서 자산을 매각하거나 자금을 조달하려고 시도하기보다 현재 약 5.25%의 비용으로 Fed로부터 자금을 조달할 수 있습니다.

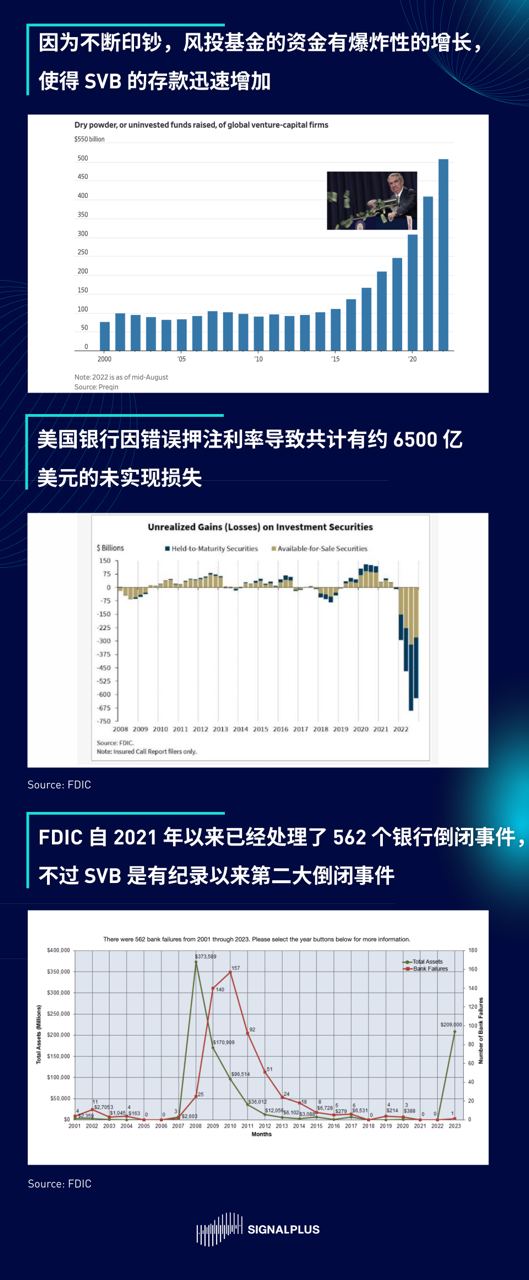

SVB 사건의 급속한 발전에 따라 관련 당국은 아시아 시간으로 월요일 아침 신속하게 행동 계획을 발표하고 FDIC 보험 상한을 취소하고 SVB 및 Signature의 모든 예금자를 전례없이 무조건 구제했습니다. 은행의 HFM/AFS 장부에서 보유한 포지션은 금융 기관이 차입 비용의 약 5%로 자금을 조달할 수 있도록 허용하는 것과 같았습니다. 마지막으로 연쇄 반응의 일부로 Silvergate, SVB 및 현재 Signature Bank가 문을 닫았고 틀림없이 모두 미국에서 규제된 암호화폐 진입로가 제거되었습니다.

아래에서 현재 상황과 상황을 요약하기 위해 최선을 다합니다.

- 글로벌 금융 위기 이후 은행 규제는 미국 은행에 엄격한 자본 준비금 요구 사항을 부과하여 주로 미국 국채, 정부 기관 채권 및 MBS를 다루는 매우 제한된 적격 채권 담보 풀에 많은 양의 예비 자금을 예치하도록 강요했습니다.

- 은행은 이러한 보유 자산을 HTM(만기 보유) 또는 AFS(매도 가능) 포트폴리오로 분류할 수 있습니다.

- 그러나 연준의 장기 양적완화와 초완화 통화정책은 금리를 제로 수준으로 끌어올렸고, SVB와 다른 은행들은 "수익률 사냥"에서 금리 위험에 내기를 걸고 고객 예금을 장기 채권에 넣도록 촉구했습니다.

- 이러한 움직임은 2010년대 대부분의 기간 동안 매우 평탄한 수익률 곡선을 만들어 스프레드 문제를 마이너스 사이클로 전환했습니다.

- 한편, SVB의 자산은 느슨한 통화 정책으로 인해 벤처 캐피털과 창업 자금이 기하급수적으로 증가하면서 경영진이 금리에 더 많은 베팅을 하게 만들었습니다.

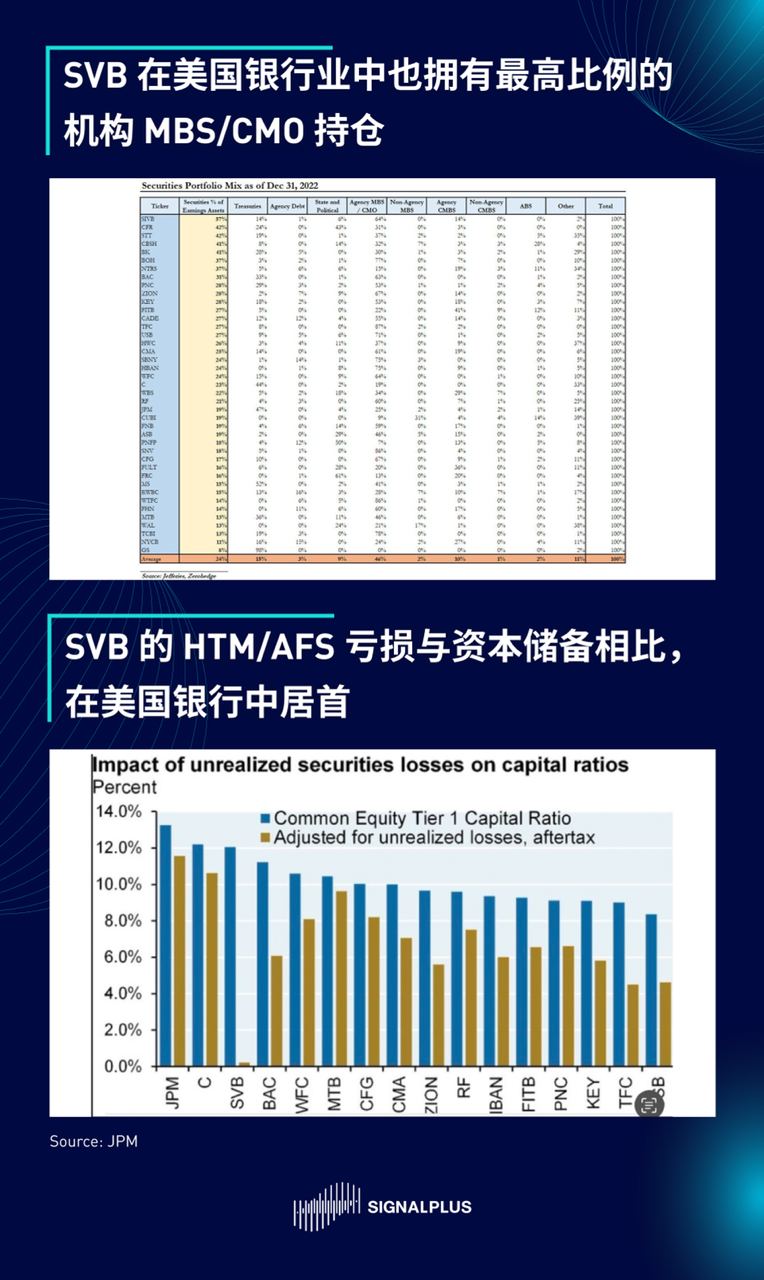

- SVB는 다른 은행과 비교하여 자산에서 증권 보유 비중이 가장 높으며 MBS 및 CMO 상품의 위험성이 가장 높습니다.

- 인플레이션은 코로나 이후 격렬하게 회복되어 지난 18개월 동안 연준과 글로벌 중앙은행의 공격적인 금리 인상으로 이어졌습니다.

- 금리 상승은 채권 가격이 금리와 반대로 움직이고, 금리가 오르고, 채권 가격이 떨어지고, 금리가 급등하고, 장기 채권 가격이 떨어지기 때문에 은행의 대차대조표(및 연준의 대차대조표)에 큰 구멍을 남깁니다. 더 많은 가을.

- Bank of America는 요율 및 듀레이션 베팅에서 총 6,500억 달러의 미실현 손실을 기록했습니다.

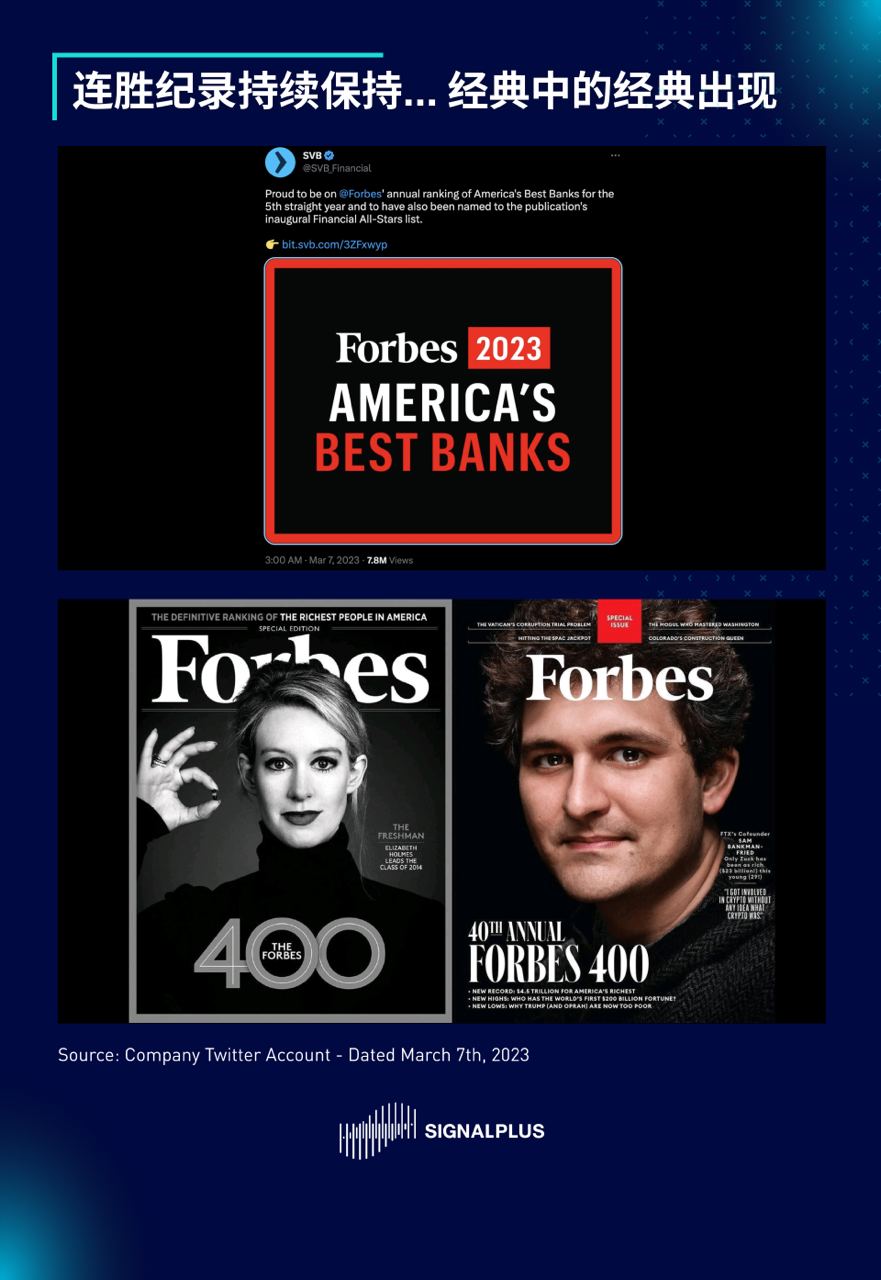

- SVB의 주식 인상과 Peter Thiel의 경고는 Silvergate의 파산이 은행 HTM/AFS의 손실 규모와 불확실성에 주목한 지 며칠 후 투자자 신뢰를 산산조각 냈습니다.

- SVB 자산의 97%(!)가 FDIC 한도인 $250,000를 초과하므로 이 은행은 결코 소매 은행이 아닙니다.

- 규제 당국은 일반적으로 그렇듯이 납세자 돈을 사용하여 잘못된 투자 결정을 내린 은행을 구제하는 도덕적 해이를 걱정하는 대신 예금자를 보호하고 체계적인 뱅크런을 중단하기 위한 계획을 48시간 이내에 작성해야 했습니다.

- 궁극적으로 FDIC/정부는 예금자를 액면가로 구제하고(모럴 해저드), Fed는 은행의 채권 손실을 충당하기 위해 1년 시장 금리 신용 한도를 제공하고, SVB의 지분과 채권 보유자는 보상을 받지 못하며, 3개의 미국 "암호화 은행"이 2주 만에 동시에 사라집니다. .

궁극적으로 도덕적 해이 문제는 제쳐두고 HTM/AFS 손실의 장기적인 문제는 여전히 해결해야 하고 이벤트는 남아 있지만 이것은 우리가 주말 동안 시스템 유동성을 위해 바랄 수 있는 최선이었습니다. 중·단기적으로 예금을 대형 은행(G-SIB)으로 옮기도록 자극했습니다.

다시 시장 반응으로 돌아가서, 지금까지 가장 큰 반응은 채권 시장이었습니다. 4분기 금리 인하, 또한 3월 회의에서 금리를 50bp 인상할 확률이 다시 10% 아래로 떨어졌고 이제 시장은 이제 연준의 급속한 금리 인상의 숨겨진 위험이 마침내 사라지기 시작했다고 믿고 있습니다. 시스템에 등장하고 연준은 조치를 중단해야 합니다.

앞을 내다보면 CPI가 상황 전개에 영향을 미치는 다음 중요한 촉매제가 될 것이 분명합니다. 그러나 우리의 기본 사례는 Powell이 3월에도 여전히 25bp 금리 인상을 유지할 것이라는 것입니다. 도트 플롯 조정의 종단 속도. 시장이 이것에 어떻게 반응할지 아직 말하기에는 너무 이르며, 향후 며칠간 주식 시장의 반응과 다가오는 인플레이션 데이터에 따라 다르지만, 우리는 여전히 위험에 대해 신중한 태도를 유지하는 것을 선호합니다. FDIC 조치는 실제로 예금자를 보호하고 은행 운영을 방지하기 위한 것으로, 주식 하락과 은행 도산으로 인해 많은 채권 손실이 기록될 예정입니다. 대형은행), 예금유출 증가 및 자본포지션 악화로 이어져 주식과 채권 등을 통한 자금조달이 필요하다.

암호화폐 측면에서 Circle은 자산의 25%가 SVB에 존재한다고 말했기 때문에 주말 동안 많은 FUD 감정을 보는 것은 놀라운 일이 아닙니다.USDC는 한때 약 0.85로 분리되었지만 현재 패리티에 가깝게 반등했습니다. ; ETH 1400 밑으로 하락 1600까지 반등했고, 지난 72시간 동안 롱과 숏 양측 모두 대규모 선물 포지션을 청산했다. 지금은 단기 변동성을 무시합시다. 이미 3개의 주요 암호화폐 및 명목화폐 채널(Silvergate, SVB, Signature)이 폐쇄되어 주류 투자자의 암호화폐 참여에 더 부정적인 영향을 미치고 Circle의 장기 투자에도 영향을 미칠 수 있습니다. 한편, 가치 저장소로서의 BTC 및 ETH의 장기적인 가치 제안은 개선되었다고 말할 수 있으며, 결국 자본이 풍부하고 완벽하게 규정을 준수하는 은행은 48시간 이내에 도산할 수 있습니다. 대체로 우리는 곤경이 끝나지 않았다고 믿고 위험 환경은 여전히 매우 불안정하며 격동의 또 다른 한 주를 맞이하면서 독자들이 최신 업데이트를 받을 수 있도록 할 것입니다.

업데이트를 즉시 받고 싶다면 Twitter 계정 @SignalPlus_Web 3 을 팔로우하거나 WeChat 그룹(소형 WeChat 도우미 추가: chillywzq), Telegram 그룹 및 Discord 커뮤니티에 가입하여 더 많은 친구들과 소통하고 교류하세요.

SignalPlus Official Links

Website: https://www.signalplus.com/