이 기사에서는 6가지 주요 비트코인 확장 솔루션의 개발 상태를 살펴봅니다.

비트코인은 가장 안전하고 탈중앙화된 블록체인 네트워크이지만 스마트 컨트랙트를 지원하지 않고 초당 약 7건의 트랜잭션만 처리하는 등의 성능 제한이 있으며 트랜잭션 확인이 최대 수십 분까지 걸릴 수 있습니다. 1월 30일 비트코인 메인넷에서 NFT 프로토콜 "Ordinals"가 런칭되었으며, 3월 2일 현재,서수에 대한 NFT 수이미 250,000이 넘었습니다.

이 움직임은 많은 논란을 불러일으켰지만, "비트코인 근본주의"는 비트코인 네트워크가 가능한 한 간단하고 안정적으로 유지되어야 한다고 믿지만, "비트코인 익스텐더"는 비트코인에 더 많은 금융 사용 사례를 가져오기를 희망합니다. 어느 쪽이든, Ordinals의 출현은 비트코인을 기반으로 한 또 다른 앱 개발의 물결을 촉발시켰습니다. 이 기사에서 PANews는 일반적인 비트코인 스케일링 솔루션의 최근 개발을 살펴볼 것입니다.

Stacks

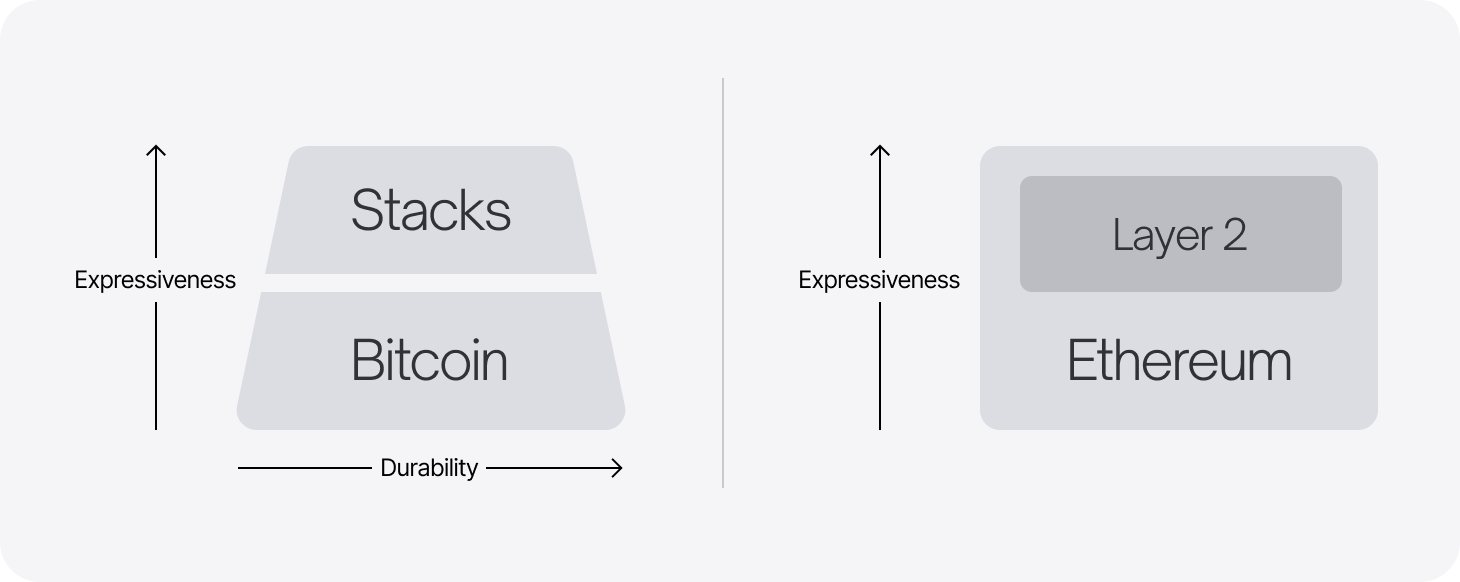

Stacks는 피라미드 형태의 스택을 채택하고 있으며, 최하층은 비트코인의 기본 결산계층, 그 다음은 스마트 계약과 프로그래밍 기능을 추가한 Stacks, 최상층은 확장성과 속도를 높이는 Hiro입니다. 자체 스마트 계약 언어인 Clarity를 사용하고 과거 거래 기록을 Bitcoin 네트워크에 기록하므로 Stacks는 Bitcoin의 레이어 2입니다(이전에는 Stacks를 레이어 1이라고도 함). 스택스는 자체 토큰 $STX를 발행합니다.$STX는 비트코인 스마트 컨트랙트의 대표자로서 최근 최고의 성과를 내는 자산 중 하나이기도 합니다.

Stacks에 구축된 현재 응용 프로그램은 여전히 주로 Arkadiko Protocol, ALEX, Stackswap, CityCoins 및 STX NFT이므로 1년 전 PANews의 통계와 변경 사항이 없으므로 여기에서 반복하지 않겠습니다.

Defi Llama의 데이터에 따르면 Stacks의 자금은 최근 30일(2월 1일~3월 2일) 동안 실제로 크게 증가했으며 TVL은 756만 달러에서 2680만 달러로 254% 증가했습니다. 그 중 DEX ALEX가 가장 큰 성장을 보였는데 TVL은 지난달 316% 증가했으며 $ALEX 가격도 2월 1일 $0.015에서 현재 $0.098로 상승했습니다.

Rootstock/RIF

Rootstock(RSK)은 비트코인의 EVM 호환 사이드체인입니다. Rootstock에서 수입을 얻을 수 있습니다. Rootstock의 기본 토큰은 거래 수수료를 지불하는 데 사용되는 비트코인 고정 코인인 Smart BTC(RBTC)입니다.

RIF(Rootstock Infrastructure, RIF)는 Rootstock에 구축된 플랫폼으로 개발자에게 도메인 이름, 저장소, 인증 등을 포함한 블록체인 인프라와 서비스를 제공하여 dApp의 개발 및 배포를 지원하는 것을 목표로 합니다. Rootstock은 RBTC 이외의 다른 토큰을 발행하지 않지만 Rootstock과 RIF는 동일한 회사인 IOV Labs에서 개발했으며 RIF는 자체 토큰 $RIF를 발행합니다.

Defi Llama에서 볼 수 있듯이 Rootstock의 TVL은 5651만 달러이지만 지난 30일 동안 3% 증가한 최근 성장은 분명하지 않습니다. 생태계에는 DEX, 대출 계약, 안정적인 통화 등의 프로젝트가 있으며 Ethereum과 같은 다른 체인의 교차 체인 자산도 사용할 수 있습니다. 하지만 Rootstock이 EVM을 지원하더라도 지난 30일 동안 생태 프로젝트의 자금이 크게 증가하지 않았습니다.

Liquid Network

Liquid Network2018년 9월 Blockstream에서 출시한 사이드 체인 기술(계층 2라고도 함)로, 비트코인 사용자에게 트랜잭션 보안 및 개인 정보 보호를 보장하면서 더 빠르고 편리한 트랜잭션 경험을 제공하는 것을 목표로 합니다. 거래소, 금융 기관 및 기타 비트코인 중심 회사를 포함하는 Liquid Joint Council에서 유지 및 관리합니다.

빠르고 저렴하며 프라이빗한 전송 기능 외에도 Liquid Network는 DeFi 애플리케이션 구축(DEX Sideswap, 대출 플랫폼 Hodl Hodl 등), 스테이블 코인 발행, 보안 토큰 발행, NFT 발행, 다중 서명 거래 등

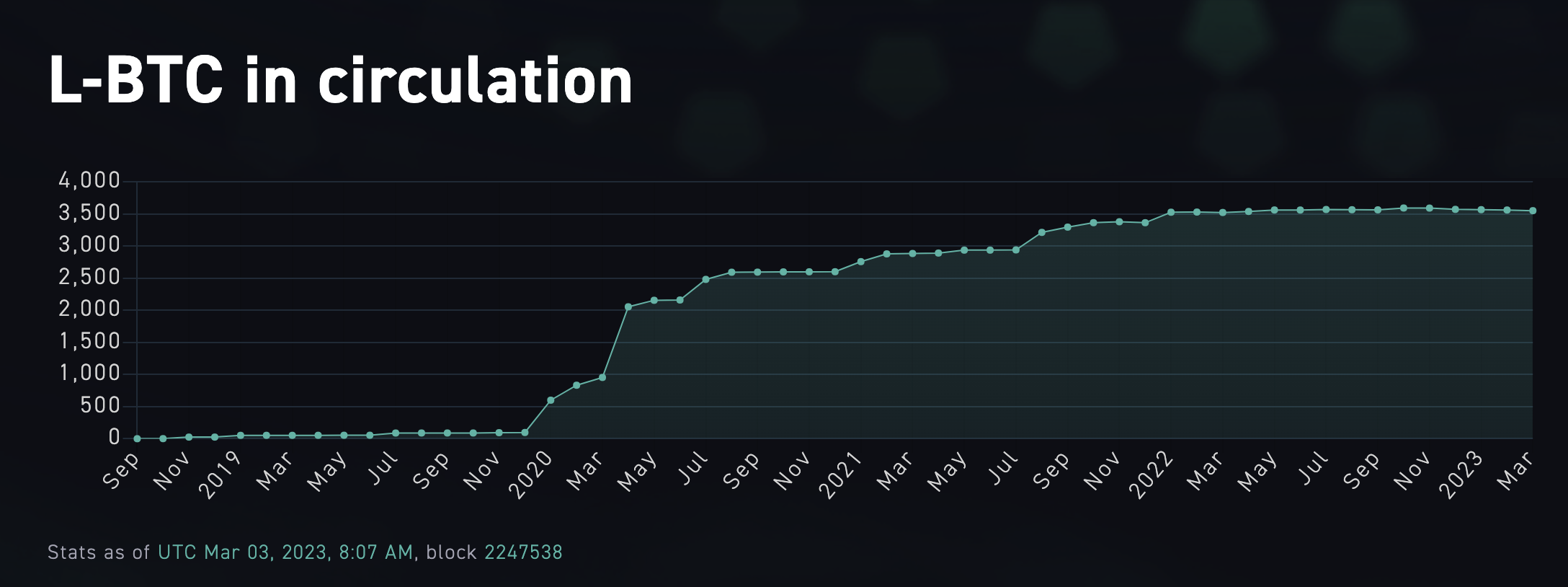

Liquid Network에서 발행된 L-BTC는 여전히 비트코인 1:1로 고정되어 있습니다.Liquid의 공식 웹 사이트에 따르면 네트워크에서 L-BTC의 순환은 최근 안정적으로 유지되어 현재 3,551개입니다.1월과 2월의 데이터는 각각 3567 및 3562 조각.

Lightning Network

비트코인 라이트닝 네트워크(Lightning Network)는 거래 당사자 간에 결제 채널을 설정하여 비트코인 거래 속도와 개인정보 보호를 개선하는 Bitcoin Layer 2 프로토콜입니다.

~에 따르면

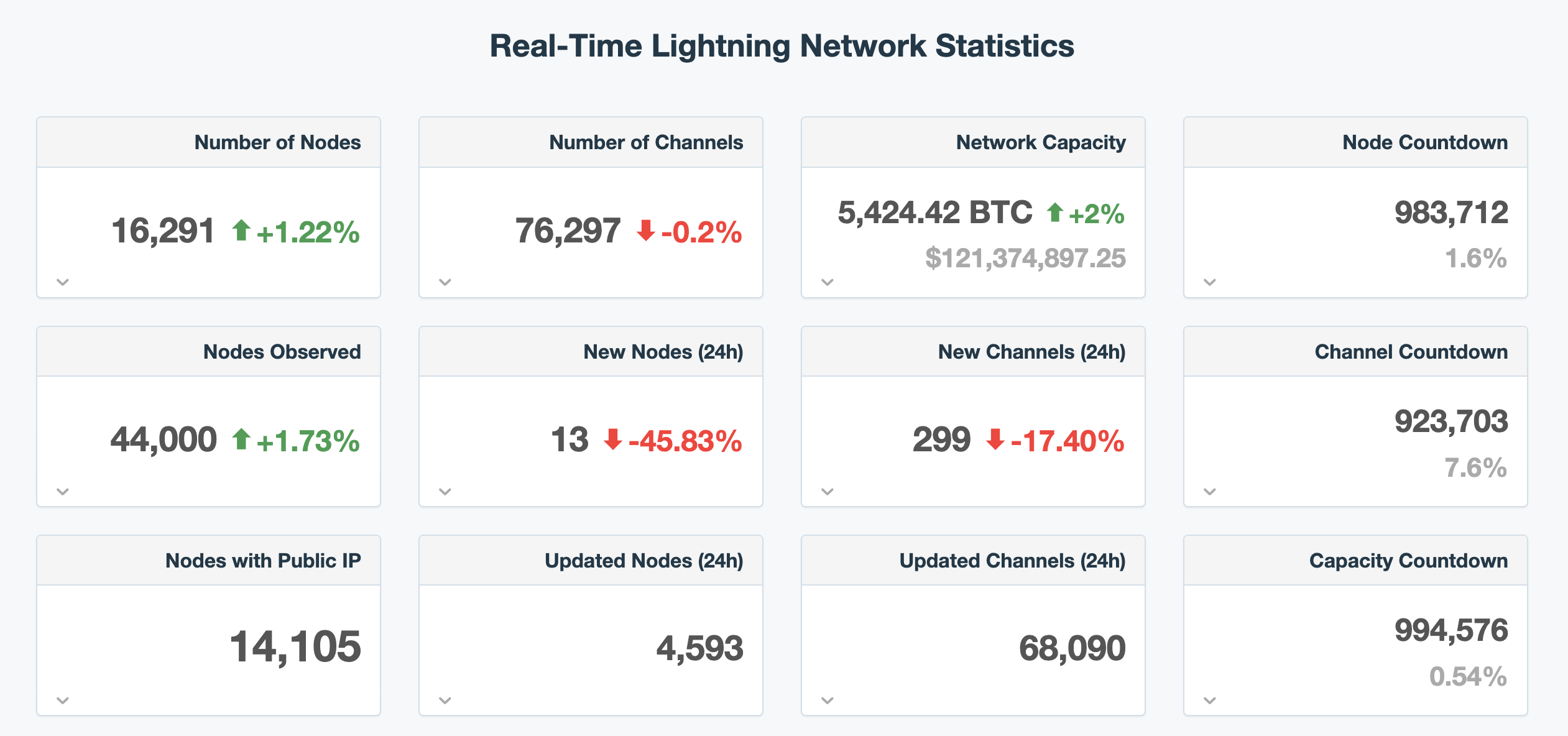

~에 따르면1 ML데이터에 따르면 라이트닝 네트워크의 현재 자금은 5424 BTC로 지난 30일 동안 2.2% 증가했으며 노드 수는 16291개, 채널 수는 76297개입니다.

Statechains

BTC의 오프체인 전송을 위한 확장 기술인 스테이트체인은 라이트닝 네트워크와 유사하지만 동일하지는 않습니다. 라이트닝 네트워크에서 자산의 이전은 채널의 소유권을 통해 이루어지지만, 스테이트체인에서는 자산의 이전이 BTC 보증금(UTXO) 개인 키(임시 키)의 소유권을 통해 이루어집니다.

스테이트체인은 먼저 예금자와 관련된 비트코인을 보유하고 있는 여러 개인 키를 가진 스테이트체인 엔터티 간에 다중 서명 지갑을 생성합니다. 개인 키 소유자는 Statechain에서 거래 기록을 생성하고 개인 키를 다른 사람에게 양도하여 비트코인 자산 양도를 실현할 수 있습니다. Statechain의 거래는 또한 모든 확인을 요구하지 않으므로 거래 속도를 높이고 처리 수수료를 줄입니다.

Statechains 기술에 대한 한 가지 솔루션은 다음과 같습니다.Commerceblock만들어진머큐리 지갑달성했습니다.

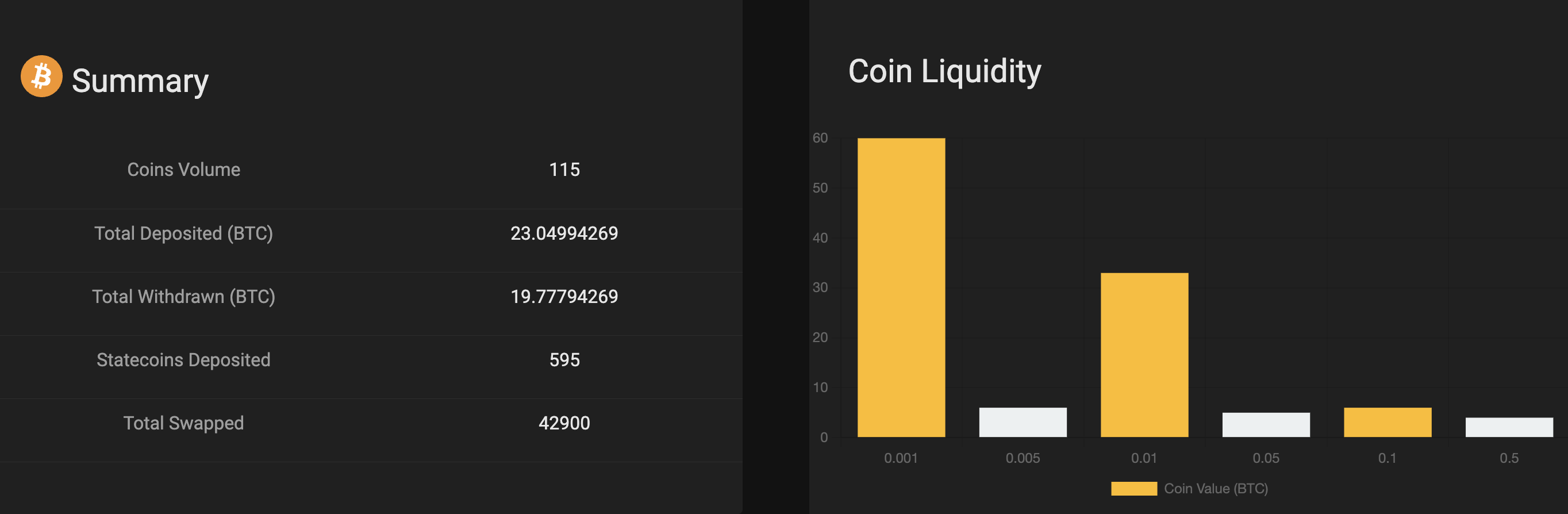

현재 Mercury 지갑의 총 입금은 23 BTC이고 총 출금은 19.8 BTC이며 응용 프로그램은 아직 적습니다. BTC의 유동성은 0.001 BTC, 0.01 BTC, 0.1 BTC 등 특정 수량이어야 하므로 충전 또는 이체 시 특정 수량만 사용할 수 있습니다.

Drivechain

Drivechain은 비트코인용 개방형 사이드체인 프로토콜로, 필요에 따라 다양한 사이드체인을 맞춤화할 수 있습니다.그것의 디자인두 개의 Bitcoin 개선 제안에서 BIP 300 "Hashrate Escrows"는 "Container UTXOs" 및 BIP 301 "Blind Mining"(Blind Mining) Merged Mining)을 통해 3-6개월의 트랜잭션 데이터를 32바이트로 압축합니다. RSK와 마찬가지로 네트워크의 보안은 공동 채굴을 통해 기존 비트코인 채굴자들에 의해 유지됩니다.

드라이브체인의 등장은 비트코인의 보안성과 탈중앙화를 유지하면서 이더리움, 지캐시, 비트코인 분기체인 등과 경쟁하고 비트코인에 더 많은 기능을 도입하기 위함이다. 기능.

2022년 12월 Drivechain 개발사Layer 2 Labs요약

요약

위의 Bitcoin 확장 솔루션 중 Stacks와 RSK가 더 일반적입니다.RSK는 EVM을 지원하고 체인 응용 프로그램에 더 많은 자금이 있지만 최근에는 Stacks에서만 빠른 데이터 성장을 보였습니다.

주로 BTC 결제에 사용되는 여러 방식 중 Lightning Network가 BTC가 가장 많음 Liquid Network는 DeFi, NFT 및 기타 사용 사례를 적극적으로 준비하고 있음 Statechains는 응용 프로그램이 제한적임 Drivechain은 다양한 사이드 체인을 사용자 정의할 수 있지만 아직 큰 규모는 보이지 않음 스케일 적용.