接盘71只BAYC,就问麻吉麻没麻?

周一,Odaily星球日报输出了一篇《面对巨鲸套利,Blur Farmer 应遵循的 8 条建议》,详细叙述了近期 NFT 巨鲸通过利用 Blur 的 Bid 功能将某 NFT 系列地板价拉高后吸引散户 Bid,再找准时机打包出售进而赚取大额收益的模式,并给予了 Blur 的散户玩家 8 条建议,防止掉入巨鲸的“套利陷阱”。

然而,就在今天,同样的套路模式,同样的巨鲸套利者,受害者却不是同一批散户,而是一直霸占 Blur 积分榜第一、最大的 BAYC 持有者之一的“麻吉大哥”黄立成。

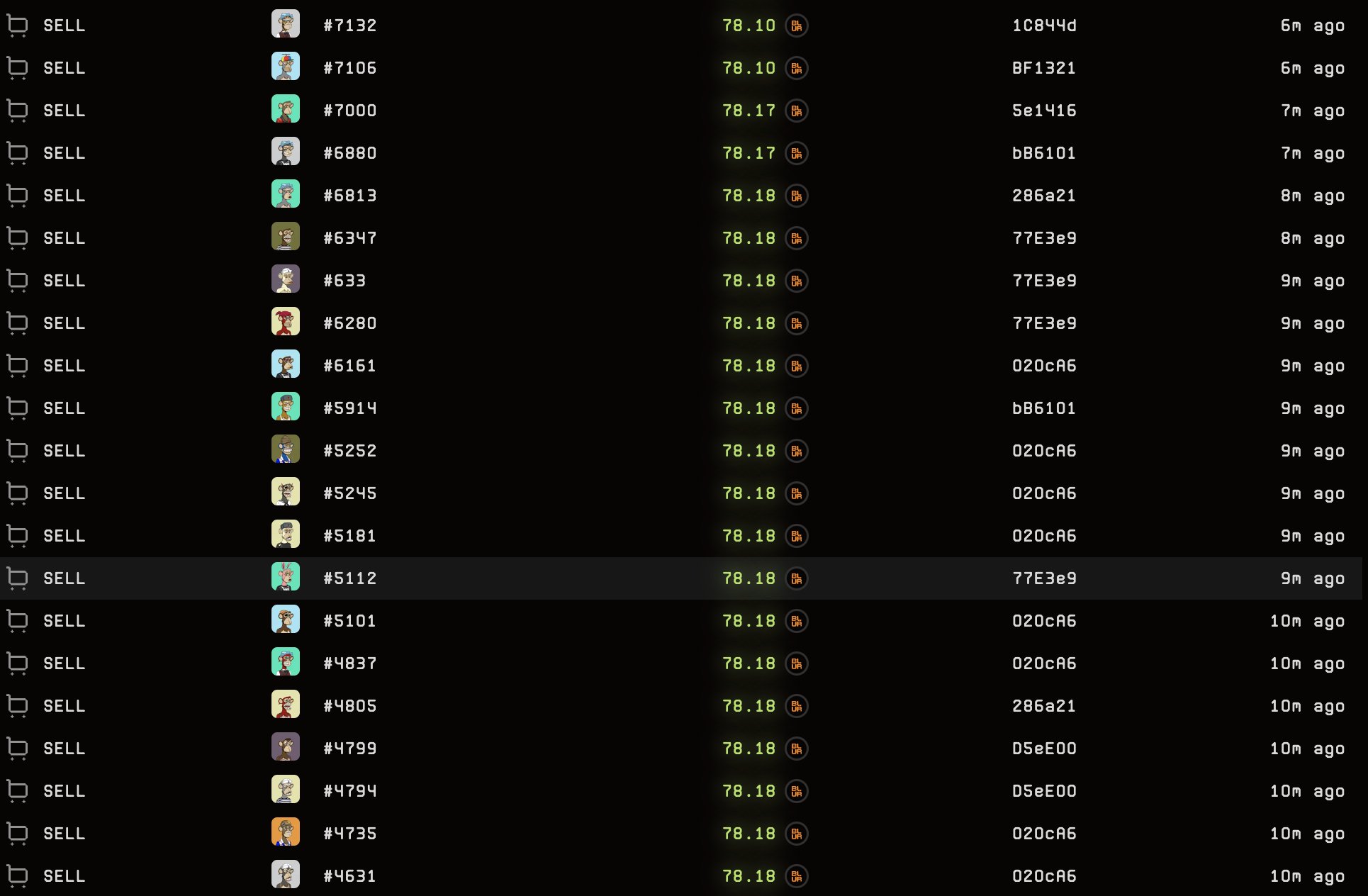

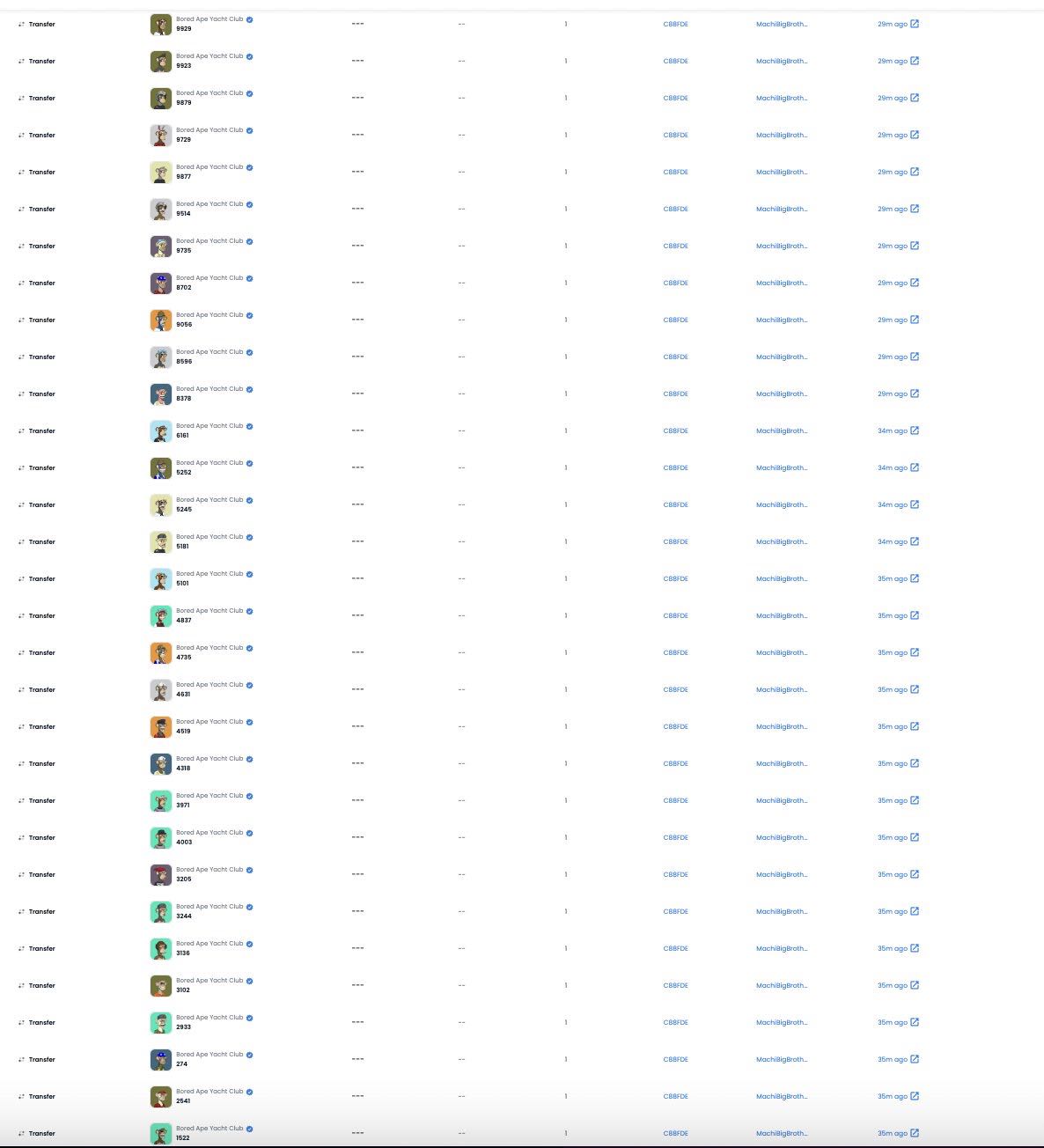

事情是这样的。今早,NFT 项目 rektguy 创始人 Mando 的地址(0xC8...36e8)在半小时内在 Blur 以约 78 ETH 的均价抛售 71 个 BAYC,以 16.3 ETH 的均价抛售 11 个 MAYC,以 15.14 ETH 的均价抛售 7 个 Azuki,附加几十个 Otherside 和 Beanz。

单从这 71 个 BAYC 来看,总价值就超 900 万美元,算是笔大额交易,即使这些 BAYC 被“空投第一季”中获得 320 万枚 Blur 的那位接住,也是一次致命的打击,何况是散户那三瓜两枣。这笔在 10 秒内成交的订单吸引了众人围观,毕竟谁不好奇会是哪个倒霉蛋呢。结果,根据链上信息以及 Blur 上的交易数据,我们发现这笔抛售交易的接盘者竟是麻吉大哥的钱包地址(0X020...5872)。

这……难道“大哥”也有失算的时候?一下接盘这么多 BAYC,网友都替他犯愁:“这得卖到猴年马月去。”不过经此一战,麻吉大哥可以将 BAYC 最大持有者之一中的“之一”去掉了,正式成为最大个人持有者。

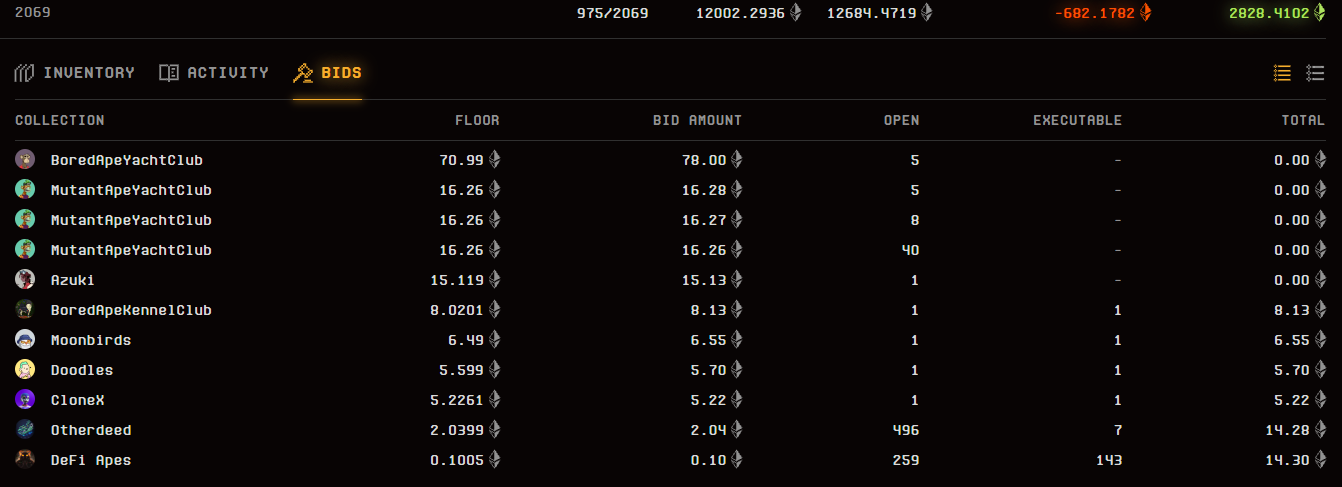

作为 NFT OG,完成过成千上万笔交易,又是 Blur 的元老级玩家,怎么就没躲过这次“阻击”?

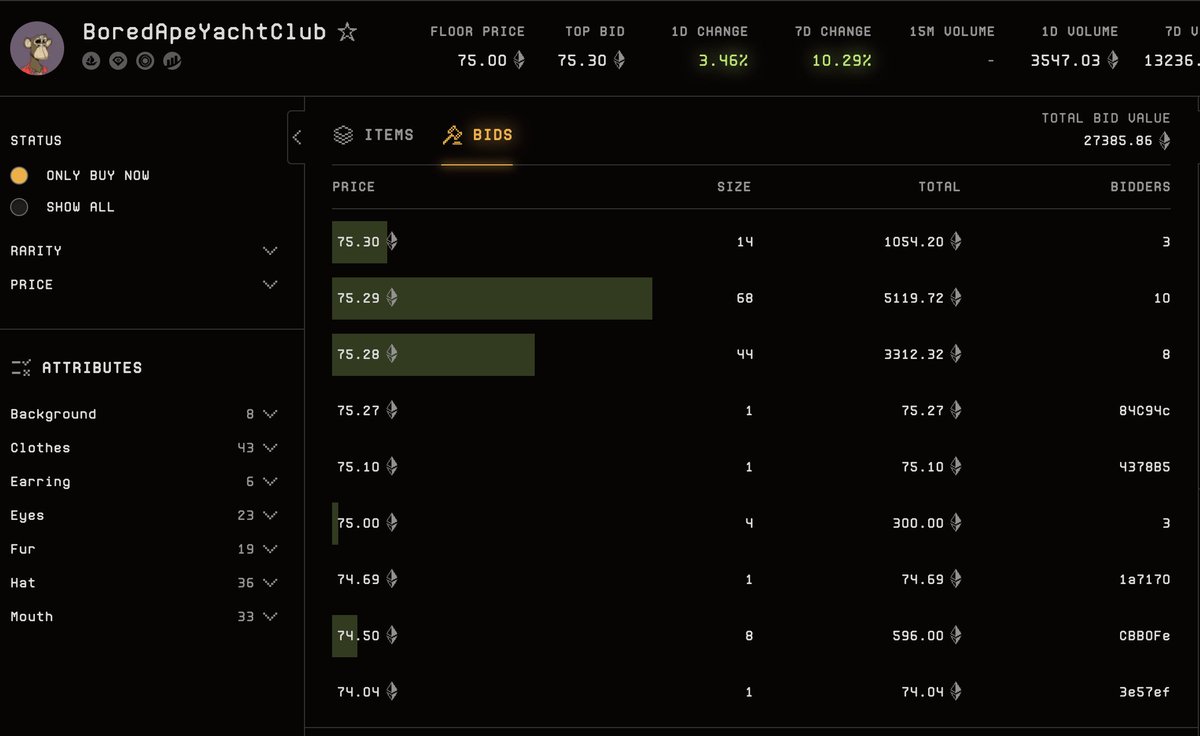

我们知道,NFT 地板价经常与 offer 价格不匹配,导致交易深度不足,这也是造成 NFT 流动性不足的主要原因。 然而 Blur Famer 正在不断利用 Bid 游戏来积赞积分以进行流动性挖掘,且最接近地板价的 Bid 最终会得到更多的积分奖励,可以让他们在后续的空投中分配到更多的代币,Blur 的这种做市激励机制可以让交易者在 Blur 上以接近地板的价格挂出 NFT,有些甚至高于地板价。这进一步创造出紧密的买卖价差,使 Blur 的地板价比其他市场上的价格低。这种方式会不断为 Blur 创造护城河,增加出价深度。

这也为 Mando 创造了最有利的条件,借机将 71 只 BAYC 全部列出,坐收百万利润,而麻吉就只剩下空空如也的钱包,Bid 资金被彻底砸空。

有趣的是,如此多的 BAYC 交易量却并没有出现太大的价格变动。如果这件事发生在几个月前,你可能会看到 BAYC 地板价因此剧烈浮动。

在第一季 Blur 空投活动中,巨鲸或许因为 Bid 赚取积分购买了大量的蓝筹 NFT。然而,在空投分配结束后,这些 NFT 或许有点“烫手山芋”的意思,暂时无利可图,这就可能会造成巨鲸利用 Blur 的流动性大量抛售的情况,虽然我们在周一紧急提醒了散户们注意这种套利手段,但却忽略了同样沉浸在「Bid to Airdrop」中的巨鲸们。

Odaily星球日报只好再次提醒大家,Blur 虽好,但千万在 Bid 前谨慎谨慎再谨慎,别做“冤大头”。