一文详解去中心化稳定币的现状与未来(上)

原文作者:SCapital

SCapital.fi 是一支抗周期的全方位区块链投资基金,业务涵盖比特币挖矿、一级市场风险投资,并深度参与基于市场/行业分析的二级市场去中心化金融活动。

引言:理想中的去中心化稳定币应当是完全透明的,非托管的,没有或只有有限的第三方控制。尽管中心化稳定币规模巨大,但无法忽视日益增加的监管压力引发的抗审查需求,并且部分中心化稳定币的资产储备的透明程度也受到质疑,这显然与加密货币的精神背道而驰。因此我们相信公开透明,完全在链上的去中心化稳定币正在变得越来越有吸引力。

Background

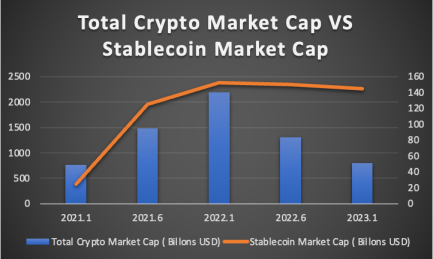

根据Statista的数据显示,稳定币总市值大约在$ 150 Billion, 约占加密货币总市值的15% 。其中USDT,USDC,BUSD分别霸榜了加密货币市值排名第3 ,5 ,7 名的位置。USDT作为CEX的主要交易对,依靠其先发优势统治着加密货币市场总交易量第一名的宝座,而USDC则是乘着2020 年DeFi Summer的东风野蛮生长,现铸币量已经接近USDT,BUSD是币安和BSC公链重要的基础设施。由此可见,稳定币在加密货币生态呈现着不可或缺的作用和地位。

从宏观角度来讲,影响稳定币增长的最大因素来自于市场的流动性,尽管2022 年美联储保持强劲的加息力度,导致整体加密货币市值较年初直接腰斩了近60% ,但稳定币的市值相较于2021 年仍然增长了约一倍,并且2022 年全年稳定在$ 150 Billion左右。相信未来随着越来越多的用户进入加密货币投资,稳定币会有更多的使用案例,会促使稳定币成为万亿市场规模的赛道。

上面提到的三个稳定币拥有共同的特点,那就是都是由链下实体私营企业(Tether,Circle和Binance)发行,并且都以1: 1 的法币维持其储备。这些中心化的稳定币,虽然规模巨大,但也面临相应的挑战。

1. 例如,USDT的储备不够透明,已经成为熊市中做空的标杆。使用储备不够透明的中心化稳定币,本质上需要相信发行方(链下实体私营企业)始终保持1: 1 的偿付能力。

2. 2022 年8 月8 日,美国财政部下属外国资产控制办公室(OFAC)宣布对加密混合器Tornado Cash实施制裁,禁令颁布后,Circle公司冻结了Tornado Cash合约地址中USDC资产。受中心化监管的稳定币,事实上无法保证永远不会冻结用户的资产,这点和加密货币的出发点显然是矛盾的。

因此,此篇报告将聚焦于去中心化稳定币。合格的去中心化稳定币应当是完全透明的,非托管的,并且没有或只有有限的第三方控制。随着中心化稳定币日益增加的监管压力和资产储备的不够透明,我们相信公开透明且完全在链上的去中心化稳定币正在变得越来越有吸引力。这里我们把去中心化稳定币分为两个大类:

1. 与法定货币1: 1 挂钩的去中心化稳定币(通常为美元)

Crypto-Collateralized Stablecoins:主要由加密货币超额抵押所生成的稳定币。典型的例子有:DAI,LUSD,crvUSD和Synthetix USD。其中DAI支持多种主流加密货币,和少量计息代币作为抵押品,而LUSD和crvUSD只支持ETH这一种抵押品,Synthetix USD的铸造主要依赖协议自身发行的SNX代币。

ibTKNs-Collateralized Stablecoin:主要由计息代币超额抵押所生成的稳定币。典型的例子有MIM, alUSD。这两种稳定币的铸造本质上解锁了ibTKNs的信用价值,将闲置资产发挥出更多的作用,并提高资本使用效率。

Part algorithm, Part crypto-collateralized Stablecoin:FRAX协议介绍了一种部分由抵押品支持、部分由算法稳定的概念,其中抵押比率我们可以看作为一种信心指数,这种灵活的调节可以有效解决超额质押导致的资本使用效率不足的问题。

2. 不与法定货币挂钩的去中心化浮动稳定币

浮动稳定币,并不挂钩美元欧元等法定货币。RAI和FLOAT,是两个有意思的尝试,它们不锚定任何法币,但追求价格的低波动率,期望成为加密世界的原生稳定币。

本篇我们会专注在与法定货币1: 1 挂钩的去中心化稳定币中两个最具代表的协议,MakerDao和Liquity,并简要讨论Curve.fi近期发行的原生稳定币crvUSD在清算机制上的创新和货币政策对稳定机制的作用。此篇文章会深度挖掘协议的基本机制,稳定机制,清算赎回机制,优劣势,以及对比分析。

Crypto-Collateralized Stablecoins

MakerDao

MakerDao是一个建立在以太坊区块链上的去中心化全球储备银行,是运行在以太坊DeFi生态系统中使用最广泛和运行时间最长的项目之一,也是TVL最大的DeFi项目。Maker协议利用了以太坊智能合约,通过超额抵押铸造出原生的去中心化稳定币DAI,与美元1: 1 挂钩。

Basic Mechanism

在MakerDao还未升级到最新版本的时候,每一个被铸造的DAI都有相应数量的ETH在MakerDao智能合约中持有。这些合约被称为抵押债务头寸(CDPs)。用户可以在CDPs中锁定ETH,新的DAI将被释放给他们以在未来换取抵押品,其中CDP中ETH的价值需要大于被释放的DAI。换句话说,CDP必须是过度抵押的。例如,如果一个用户锁定了价值1000 美元的ETH,CDP合约将铸造出价值低于1000 美元的DAI,释放DAI的数量将取决于CDP的抵押品与债务比率。用户能够借到的DAI最多为抵押品价值的66% ,这相当于150% 的抵押率。如果抵押品的价值与释放的DAI代币的价值相比低于预定的幅度,CDP的资产将被套利者清算,以保持MakerDao系统的稳定。这样一来,Maker协议确保有足够的抵押品来支持所有流通中的DAI,如果用户希望提取锁定的抵押品,则必须偿还CDP中欠下的DAI,包括与债务相关的应计稳定性费用(利息)。要做到这一点,用户需要向CDP发送所需的DAI(不能以其他加密资产)以支付债务和稳定费。

随着DeFi生态的不断发展导致对DAI需求的增长,在最新版本的MakerDao引入了Multi-Collateral DAI (MCD),因此更多的抵押资产被添加进来, MakerDao协议目前支持的抵押品多达20 多种,每种资产的抵押率以及稳定费都是由资产本身的风险指数以及MKR治理者共同决定,用户通过使用 Maker 协议来创建叫做 “Maker Vault (CDP的升级版本)"的智能合约并存入资产来生成 DAI,产生的利息费用属于Maker协议。MakerDao目前接受wBTC、LINK、Curve和Uniswap的LP代币。

Governance Token “MKR”

MKR 有三种功能:

作为治理Token,MKR持有者可以使用MKR对关于MakerDao的治理进行投票,通常被用户投票的内部参数有:抵押物价值与DAI的生成/清算比率Liquidation Ratio、清算罚款金额比率Liquidation Penalty、DSR存款利率DAI Savings Rate、拍卖机制参数(加注额度、竞标时长、加注间隔等)、哪些加密资产可以被作为抵押物以及预言机节点的挑选等。

稳定费支付功能,随着DAI在Vaults上赚取的稳定费用在Maker协议内累积,当用户在偿还 DAI 并关闭 Vaults 合约时,用户需要通过购买由 DAI 计价的 MKR 代币来偿付稳定费,系统将通过智能合约自动销毁收到的 MKR 代币。

MKR作为Maker协议的资本重组来源,通常是借款人的最后手段。在Maker协议缓冲池(Maker Buffer)中出现债务赤字时系统就会增发MKR来获取资金偿债,当Maker协议缓冲池(Maker Buffer)资金超过一定量时(MKR持有者制定)将会拍卖DAI回购MKR并销毁。

Stability Mechanism

DAI在设计上与美元1: 1 挂钩,但是DAI还是会受到市场行为影响造成一定的价差,MakerDao通过引入DAI的存款利率(DAI Saving Rate)的概念,让所有持有DAI的用户可以自动的获得储蓄收益来平衡市场供需,只需要将他们的DAI存入Maker协议的DSR合约即可,DSR合约不会对用户设置最低存款要求,用户可以随时从DSR合约中取出部分或全部的DAI。

当DAI的市场价格由于市场变化而偏离目标价格时,MKR持有者可以通过投票更改DSR来维持价格稳定。

1. 如果DAI的市场价格超过一美元,MKR持有者可以选择逐渐降低DSR,以此来减小需求,从而将DAI的市场价格降低至一美元的目标价格。

2. 如果DAI的市场价格低于1 美元,MKR持有者可以选择逐渐增加DSR,以此来刺激需求,进而将DAI的市场价格增加到一美元的目标价格。

DAI的利息由MakerDao稳定费的收益来支付,因此稳定费率的综合利率需要大于DSR。如果稳定费收益不足以覆盖DAI的DSR的总支出,则差额被记为坏账,并增发MKR以弥补差额,MKR持有者则成为了风险的承担者,如果有盈余则会放入Maker Buffer来抵御未来可能发生的风险及黑天鹅事件,但本质上通过DSR合约来稳定币价只能实现软挂钩。

Peg Stability Module(PSM)

当MakerDao引入Peg Stability Module(PSM)时,DAI拥有了一个更强大的稳定机制。在这之后,PSM成为价格稳定的最重要来源。

PSM是一个智能合约,可以让用户轻松地将USDC(Circle)、USDP(Paxos)和GUSD(Gemini)套利为DAI,反之亦然。通过PSM进行的互换总是1: 1 ,即1 个DAI总是等于1 个USDC。

如果DAI跌到1.00 美元以下,PSM给用户提供了一个无风险套利的机会,通过燃烧折价的DAI换取USDC来获利。当DAI上升到1.00 美元以上时,用户可以通过PSM将USDC换成溢价的DAI,并通过二级市场如Curve将其换回USDC,以获取差价。

诚然,MakerDao将法币支持的中心化稳定币作为DAI挂钩美元的重要机制在一定程度上牺牲了一些去中心化。但在这之后,DAI也迎来了空前的发展,PSM储备中的USDC价值超过了50 亿美元。然而,在OFAC宣布对Tornado Cash实施制裁后,埋藏在MakerDao野蛮生长中的隐患种子终于生根发芽开始反噬协议,这也导致社区开启MetaDao的救赎之路。

DAI的清算机制

若用户想要取出Vault的抵押物,Vault所有者必须部分或全额偿还所生成的 DAI,并支付 DAI未偿还期间不断累积的稳定费。稳定费只能用 DAI支付,在偿还了 DAI 并支付了稳定费之后,Vault所有者可以将部分或全部担保物退回自己的钱包。

当债务比率(Collateral-to-Debt Ratio)维持在健康状态时,系统正常运转。但如果抵押物的价值出现大幅下降导致用户生成的DAI大于Vault允许抵押物生成DAI的价值时,就会触发清算程序。在进行清算之时,用户不再需要偿还DAI ,Maker 协议会取出被清算的Vault中的担保物,并使用协议内一个基于市场的拍卖机制将其卖出。这被称为担保品拍卖(Collateral Auction),竞价成功者支付 DAI,来折价购买被清算的Vault中的担保物。通过担保物拍卖获得的 DAI 会被用来偿还Vault内的债务,其中包括清算罚金(Liquidation Penalty),清算罚金会流向Maker 缓冲金, MKR 投票者会针对不同的担保物类型设定不同的清算罚金。

如果担保物拍卖上获得的 DAI 足以清偿金库内的债务,并足够支付清算罚金,该竞拍会转换成反向担保品竞拍(Reverse Collateral Auction)尽可能地减少担保物的出售数量,剩余的担保物都会物归原主。如果担保物竞拍获得的 DAI 不足以清偿金库内的债务,亏损部分就会变成 Maker 协议的负债,由 Maker 缓冲金(Maker Buffer) 中的 DAI 偿还。如果缓冲金中没有足够的 DAI ,Maker 协议就会触发债务拍卖(Debt Auction)机制。在债务拍卖期间,系统会铸造新的 MKR(增加流通中的 MKR 量),出售给那些使用 DAI 来参与竞拍的用户,拍卖得到的 DAI 会进入 Maker 缓冲金。Maker 缓冲金可以起到缓冲的作用,避免将来因担保物竞拍不足和 DAI 存款利率上涨而导致 MKR 的增发量过大。

如果由竞拍和稳定费获得的 DAI 超过了 Maker 缓冲金的上限(由 MKR 治理设定的值),超出的部分就会通过盈余拍卖(Surplus Auction)出售。在盈余拍卖期间,投标者使用 MKR 来竞拍固定数量的 DAI ,价高者得。一旦盈余拍卖结束,Maker 协议会自动销毁拍卖所得的 MKR ,从而减少 MKR 的总供应量。

Challenges

过度抵押锚定美元抑制了资本的使用效率

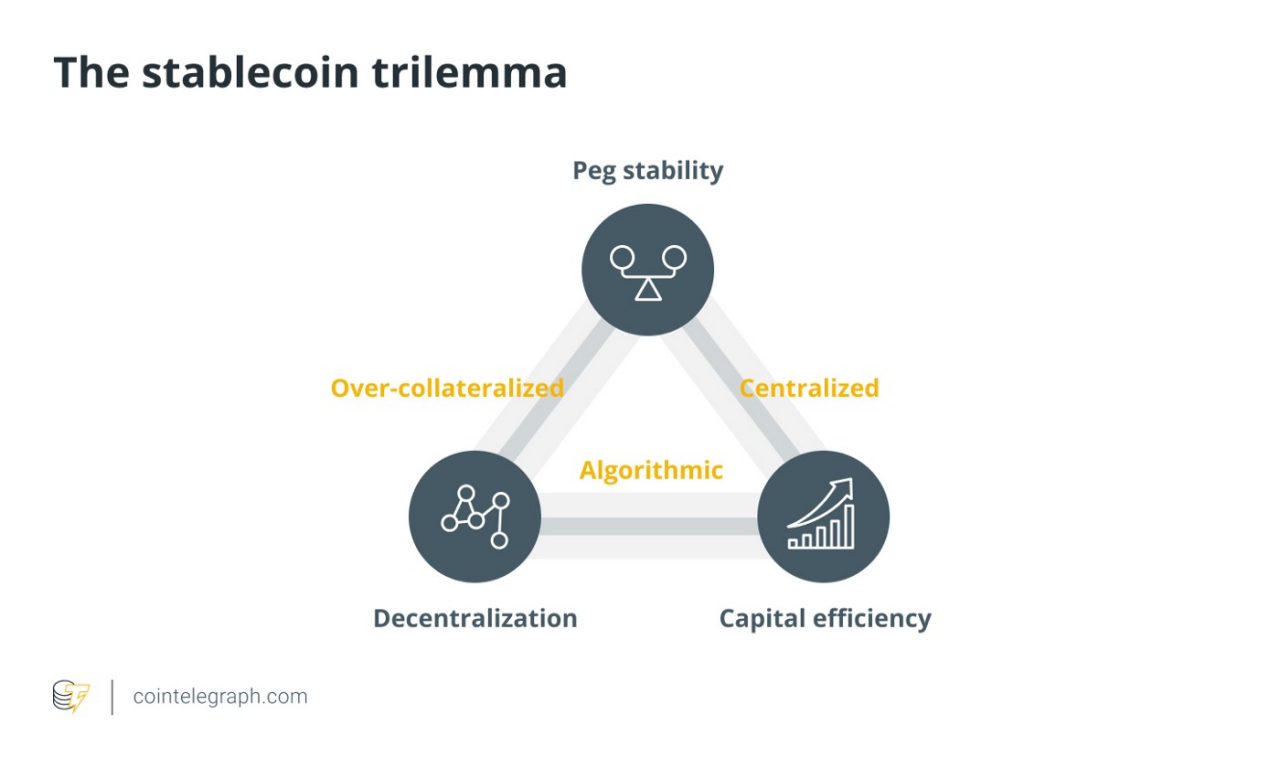

当下无论是任何稳定币都逃脱不掉 Trilemma:即Peg Stability,Decentralization,Capital Efficiency。Maker协议需要价值超过1 美元的抵押品,以建立抵押品债务头寸(Maker Vault)来铸造一个DAI。换句话说,牺牲资本利用效率从而提高稳定性,DAI的铸造意味着超过被铸造DAI的价值的抵押品在智能合约中无法流通。

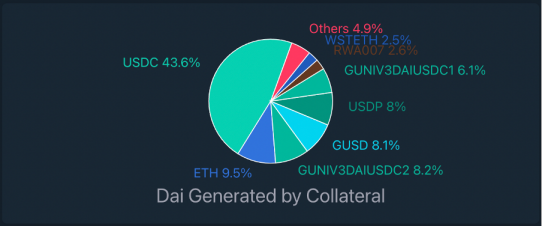

正如上文所讲,MakerDao面临的最大威胁是中心化稳定币USDC的影响

由上图可见MakerDao的整个生态系统极度依赖USDC,意味着铸造的去中心化稳定币DAI有43.6% 源于Vaults中USDC的抵押。美国财政部对Tornado Cash的制裁足以引起我们对整个DeFi生态系统是否去中心化和抗审查的思考。尽管MakerDao社区一度提出清理USDC仓位,用其他原生加密货币作为替代。但DAI与MKR能撑得起如此高的市值USDC功不可没。因此如果DAI想要实现真正的去中心化则必须权衡USDC带来的规模效应和完全去除USDC对DAI市值大幅下降的考量。

治理改革:MetaDAO

现有治理流程一方面过于复杂,制约了MakerDao开发新功能的速度;另一方面需要依靠庞大的人力参与。作为终局计划(Endgame Plan)的重要组成部分,MetaDAO就致力于加快治理进程、减少MakerDao的人力成本,隔离风险、并模块化拆分之前高度复杂的治理流程。

通过模块化的思路,将复杂的MakerDao治理拆分成一个个的小块,即一个个的MetaDAO,每个MetaDAO都可以专注于自己的任务,而不必被其它职责分心。如专注于创作的MetaDAO,将招募开发人员构建前端产品和链上功能;专注于RWA(现实世界资产)的MetaDAO将负责管理RWA Vaults。这样也能克服当前Maker治理过程的单线程问题,将治理实现了多中心,允许MetaDAO并行执行,加快治理进程。

Maker可以通过部署新的ERC 20 代币来创建新的MetaDAO。理想情况下,最终Maker Core只需支持协作MetaDAO,而具体的工作将由一个个的MetaDAO完成,减轻MakerDao的负担。部分Maker Core的成员也将重组到Meta DAO中,将MakerDao的人力成本支出减少一半。简单来说,MetaDAO 像是快速灵活的治理(Layer 2 ),而Maker Core 则是缓慢、昂贵,但安全的治理(Layer 1 )。因此,每个MetaDAO 可以承担更多的风险去尝试,并由Maker Core 提供安全性。

彼此独立的MetaDAO之间,有自己的治理代币和治理流程,每个MetaDAO都需要自己来赚取收益。按照终局计划的表述,它总共会有20 亿个MDAO代币,以Yield Farming的方式分发。其中一半会在前两年分发完毕,之后每两年奖励减半。Yield Farming分为三种类别:其中20% 分配给DAI Farming以激励DAI的需求、40% 分配给ETHDFarming以激励用Staked ETH来生成DAI、40% 分配给MKRFarming以激励积极投票治理。

实现去中心化的路径

MakerDao主要通过以下路径来增加去中心化程度,主要集中在增加去中心化抵押品的使用和用协议收入来积累协议拥有的去中心化资产上。

1 、增加ETH抵押品的使用

在Tornado Cash被美国财政部制裁之后,Maker已经通过一系列措施减少对USDC的依赖。

如提高WSTETH-B Vault的债务上限并将稳定费降至零,降低ETH-A、ETH-B、WSTETH-A、WBTC-A、WBTC-B、RENBTC-A等Vault的稳定费。

这一系列措施的出发点是希望降低其它Vault的资金费率来尽可能减少通过PSM用USDC铸造DAI的需求,但实际上效果有限,因为PSM的硬挂钩机制很大程度上是便于用户进行稳定币之间的套利。

2 、引入ETHD

ETHD的引入是为了在Maker治理的控制下拥有Staked ETH。ETHD是围绕Staked ETH的封装(类似于wstETH)。用户可以将Staked ETH封装为ETHD,也可以将ETHD赎回为Staked ETH。

简而言之,ETHD 就是一个透过「Staked ETH」来生成的新的合成资产,有助于Maker 取得更多「Staked ETH」,只有尽可能地累积Staked ETH 的抵押品,才能确保去中心化的地位。之后90% 的协议收入盈余会用来购买ETHD,并存入Protocol Controlled Vault。

3 、调整现实世界资产(RWA)的使用

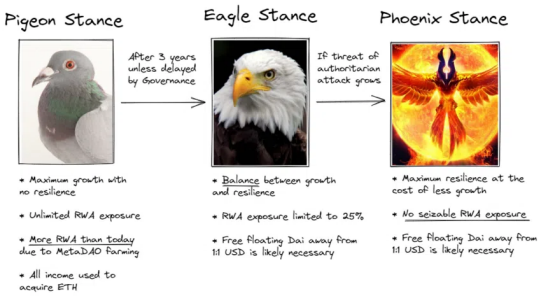

终局计划提出了3 种不同的抵押品策略,分别为鸽势阶段、鹰姿阶段、涅槃阶段,随着时间线渐进式往前发展,并根据监管的威胁逐步推进。

第一种叫做「鸽势阶段」(Pigeon Stance),基本上就是 Maker 现在的状态。在这一阶段(计划持续两年半)中,Maker 的主要任务是增加RWA专注于赚取收入并为下一阶段存储 ETH,在此期间DAI并不会脱钩一美元。

「鹰姿阶段」(Eagle Stance),DAI将根据一个负目标汇率(TR)随着时间的推移逐渐改变其价格,从 1: 1 挂钩美元转为自由浮动。该阶段会保证 Maker 对可扣押 RWA 的敞口限制在 25% 来降低风险,同时寻求业绩增长和弹性之间的平衡。

最后是「涅槃阶段」(Phoenix Stance),DAI 不再容许任何RWA,除了具有物理性韧性的RWA (不易被监管没收)。

Liquity USD

Liquity是一个去中心化,非托管的,和无需治理的借贷协议,允许用户使用ETH作为唯一抵押品提取无息贷款,贷款以LUSD(一种与美元挂钩的稳定币)支付,需要保持110% 的最低抵押率。在任何时候,它都可以按面值对基础抵押品进行赎回。

LQTY

LQTY是Liquity发行的项目代币。它用来捕获系统产生的费用收入,并用以激励早期用户和前端页面的开发者。

Trove

Trove是用户取出和维持贷款的地方,类似于其他平台的Vaults或CDPs。Troves会保持两个余额:一个是作为抵押品的资产(ETH),另一个是以LUSD计价的债务。用户可以通过增加抵押品或偿还债务来改变各自的金额。当这些余额变化时,Trove的抵押品比率也会相应的变化,用户可以在任何时候通过完全付清债务来关闭相关的Trove。

Basic Mechanism

Liquity一直被看作是MakerDao最强有力的竞争者,彼此之间也具有很多相同点,比如借贷模式都是拿一种资产来抵押作为信用担保,生成一种锚定美元的稳定币,不过Liquity实际上也有很多机制是专门针对MakerDao的痛点来设计的。

首先Liquity相比MakerDao或其他任何DeFi借贷协议的核心优势在于仅有110% 的最低抵押比率,意味着在同等ETH数量的情况下可以释放出更多的流动性,提供了更高的资本使用效率与杠杆倍数。

另一点让Liquity更具吸引力的则是无息贷款,Liquity只收取一次性的借贷费用,不需要像MakerDAO一样持续收取贷款的稳定费用,费用结构的不同使得Liquity在长期贷款方面更具成本效益。

Liquity信奉完全去中心化的精神,认为只有以ETH作为抵押物铸造出来的LUSD才是真正的去中心化稳定币。实际上MakerDao在2020 年3 月前也曾只支持ETH做为抵押物,但在312 后ETH币价的大跌加速了MakerDao支持多抵押物的上线,并开放了USDC 1: 1 兑换DAI的通道使其恢复了流动性。后来的故事我们在上文也谈到了,Maker的“改进”促使DAI在牛市的大发展,但也为其中心化的隐患埋下了种子。

Liquity并无治理投票,所有的操作都由算法自动完成,协议参数在合约部署时设置。而治理在MakerDAO中起着很大的作用,因为协议参数,如债务上限,最低抵押率都是通过投票决定的。

清算机制是任何借贷类系统稳定性的核心,MakerDao和Liquity的清算机制有着显而易见的差别。

经历了312 考验的MakerDao对清算机制进行了完善,由原来的英式拍卖模式切换到初始要价从高到低的荷兰式拍卖,但它仍为拍卖模式,时效需6 小时。并且MakerDao在发生清算时需要有足够持有DAI的用户主动参与进来。虽然MakerDao已经通过引入PSM来加强DAI的流动性,但其清算机制仍然不够高效。

Liquity能够在众多去中心化稳定币中脱颖而出,在于刚刚上线主网不久就经历了312 事件,LUSD在此期间表现亮眼,与MakerDao形成鲜明的对比,追根结底在于Liquity高效的清算机制。Liquity创新了一种自动化的清算机制,降低了MakerDao清算机制的风险。

Liquidation Mechanism

1 、稳定池机制

稳定池是维持系统偿付能力的第一道防线。它作为流动性的来源,来偿还在Trove被清算的债务,确保LUSD的总供应量始终有抵押品在背后作为支持。稳定池的资金来源于质押LUSD的用户,虽然损失了一定的流动性,但会获得LQTY代币作为激励。在另一方面,当稳定池任何Trove被清算时,与Trove的剩余债务相对应的LUSD将从稳定池的余额中被烧掉,以偿还其债务。作为交换,该Trove的全部抵押品被转移到稳定池中。换句话说,质押LUSD的用户可以获得一定数量来自系统清算产生的ETH奖励,数量多少和用户质押LUSD与池子总量LUSD的比例相关。然而,由于Troves有可能在略低于110% 的抵押品比率下被清算,因此稳定池供应商将获得相对于他们偿还的债务更多的抵押品的美元价值,这也极大吸引了一部分用户在铸造出LUSD之后并没有用于其他交易或者DeFi协议,而是直接质押在稳定池中。

2 、再分配机制

如果稳定池没有足够的流动性(LUSD被消耗殆尽时),第二道防线开启,即再分配机制。再分配机制可以将剩下的债务从清算完成的仓位重新分配到所有现有仓位。这种情况下,相比低抵押仓位,高抵押仓位会从被清算的资产中承担更多的债务并获得更多抵押品。为了为系统提供这一额外的安全层,这些较高的抵押品仓位将作为清算者获得奖励,从而从根本上得到清算后的基础抵押品。

3 、恢复模式

第三道防线侧重于应对系统性风险。Liquity 引入了一种恢复模式。如果协议的整体抵押率降到150% 以下,该模式将被触发。这样一来,系统将尝试用稳定池抵消具有最低抵押率的持仓(即使高于110 %)的头寸。此外,系统会阻止会进一步降低整体抵押率的借款人交易。新的LUSD只能通过调整现有的Troves来提高其抵押率,或者通过开设一个抵押率>= 150% 的新Trove来发行。一般来说,如果一个现有的Trove的调整降低了它的抵押率,只有当产生的整体抵押率高于150% 时,交易才会执行。

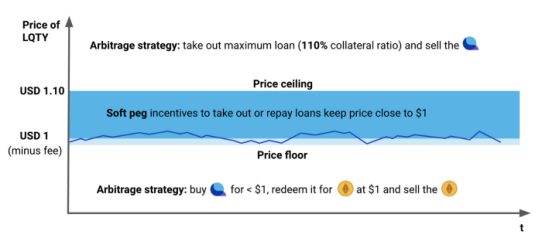

Stability Mechanism

硬挂钩机制

Liquity的核心创新之一是它的原生稳定币可以针对借款人持有的基础抵押品进行赎回。这意味着,每个LUSD的持有者都可以按面值将他们的LUSD兑换成ETH,即用100 LUSD可以得到价值100 美元的ETH。当赎回发生时,系统会用LUSD来偿还目前抵押率最低的Trove,并将相应数量的ETH从受影响的Trove转移到赎回者手中。

系统对每次赎回收取一次性费用,称为赎回费。这个费用从0% 开始,随着每次赎回而增加,如果一段时间内没有发生赎回,则会衰减到0% 。该费用确保了从价格稳定的角度来看,赎回的频率不会超过需要。

由于赎回机制的存在,投机者只要赎回得到的ETH的价值高于被赎回的LUSD的当前价值,就可以立即获得套利收益。这确保了LUSD在绝大多数情况下不会低于一美元。

软挂钩机制

LUSD价格如果高于1 美元会使借款更有吸引力(因为可以预期以1 美元或更低的利率偿还),而价格低于1 美元会激励偿还现有债务。当借入的LUSD比偿还的多时,LUSD的总供应量将增长,这应该使LUSD相对于美元贬值。相反,如果偿还的金额高于新的债务,货币供应量将萎缩,这样LUSD将升值。

一般来说,LUSD和美元之间1: 1 的汇率的长期前景将有助于稳定价格,因为用户将在他们目前的决定(购买/出售/借入/偿还等)中考虑到未来的价格变化。鉴于这种机制主要取决于对未来的假设,它只起到软挂钩的作用,并不能为价格稳定提供硬保证。

但是在实际情况中,LUSD往往高于1 美元,表明软挂钩实际上起不到足够的作用。

Challenges

Liquity支持的抵押品仅有ETH,虽然抵押率相比MakerDAO和其他DeFi借贷协议更具有优势,但是LUSD的市值也极大受限于ETH的发展。在另一方面,用户通常会将铸造出来的LUSD再抵押到稳定池来获取被清算的ETH。这样对协议的长远发展而言,LUSD并没有释放出最大的流动性,无法有效的扩散和渗透到其他DeFi协议和整个生态。

LUSD的现状类似于早期阶段的DAI,有着很好的去中心化特性,但流通量并不足够大。同时由于防止被清算需要大量的LUSD,导致市场波动时,LUSD的汇率一直高于一美元,这对稳定币来说是根本性的问题。当年DAI通过引入PSM,允许USDC和DAI的自由互换,一举解决了上述两个问题,DAI获得了空前的发展,但也带了相应的抗审查和中心化的挑战。我们拭目以待,LUSD团队会给我们带来怎么样的下一步解决方案。

crvUSD

Curve 团队在2022 年11 月2 日上线了协议原生稳定币crvUSD,本次白皮书中主要介绍了crvUSD的几个创新之处:借贷-清算自动做市商算法(LLAMMA)、PegKeeper和货币政策。

crvUSD采用了更为平滑的清算算法LLAMMA,有效解决了原有基于超额抵押稳定币在集中清算时由于流动性不足导致死亡螺旋的风险,当前crvUSD仅支持ETH作为唯一抵押品,摆脱了USDC的监管风险。

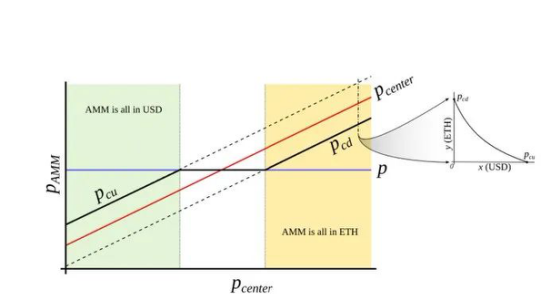

清算自动做市算法(LLAMMA)

crvUSD仍然是通过超额抵押的方式发行的,简单来说就是使用ETH铸造crvUSD的时候,自动将存入的ETH和生成crvUSD组合成LP,这些LP即与其专有的Curve的AMM池链接来代替传统的借贷和清算流程。特点在于当达到清算阈值时,清算并不是一次性发生的,而是一个持续的清算/去清算的过程,详述如下。

下图中,Pamm代表该条函数曲线的价格,Pcenter为外部预言机的价格。例如,以ETH为抵押品,借入crvUSD。当ETH的价值足够高时(黄色区域),和传统抵押借贷模式一样,抵押品并不会发生改变。当ETH价格下跌,进入清算区间后(白色区域),ETH开始随着下跌被逐渐卖出。在跌破区间后(到达绿色区域),则全部为稳定币,继续下跌不会发生变化,也和其它借贷协议相同。但是,在中间的清算区间,若ETH出现上涨,则Curve会用稳定币帮助用户重新买入ETH。若在中间的清算区间内波动,那么就会不断的重复清算和去清算的过程,不断卖出和买入ETH。

这个过程类似于在传统AMM提供流动性后来对冲无常损失,比如在Uniswap上提供ETH/USDC的流动性。当ETH上涨时,ETH被动卖出,要使自己在提供流动性过程中币本位的资金不发生剧烈变化,只能在市场上买入ETH;同样,ETH下跌时,再卖出ETH进行对冲。

因此在LLAMA 清算机制中,我们可以简单理解为反向提供流动性的Uniswap V3 ,在设定价格区间内 ETH 价格下跌时就逐步卖 ETH 买 USD。反之亦然,在价格区间上限以上抵押品全部为 ETH ,下限以下全部为 USD。

相比MakerDAO等一次性清算的借贷协议,若发生清算后市场反弹,在MakerDAO中,用户手里只剩下清算后的一点抵押品残值,而在Curve中则会在上涨过程重新买入ETH。另一点在于一旦MakerDAO触发清算流程,13% 的Liquidation Penalty是借款人的已实现损失。而在Curve团队做的压力测试中,当市场价格跌至清算阈值以下10% ,并重新上涨后,在3 天的时间窗口内,用户抵押品的损失仅1% 。

因此这种算法确实能够降低用户在极端行情下遭到清算的损失,甚至在价格回升后将损失控制在很低的范围内。

PegKeeper和货币政策

由于有足够的抵押品支撑,crvUSD的价格可以锚定为1 美元。但二级市场中价格总是波动的,此时PegKeeper就会发挥作用,是类似央行的存在。

当crvUSD的价格由于需求增加而处于锚定价格以上(ps>1 ),也就是高于1 美元时,PegKeeper可以无抵押地铸造crvUSD,并将其单边存入稳定币兑换池,使crvUSD的价格下跌。即使铸币过程没有抵押,但可以由流动性池中的流动性提供隐性抵押支持。

当crvUSD的价格低于1 美元时,PegKeeper可以撤回部分crvUSD的流动性,让价格恢复至1 美元。

PegKeeper在这个过程中等于是在高于1 美元时卖出了crvUSD,在低于1 美元时买入了crvUSD,通过套利的方式维持了crvUSD的价格稳定。

货币政策则控制着PegKeeper的债务与crvUSD供应量之间的关系。例如,当债务/供应量大于5% 时,可以改变参数,激励借款人借入并抛售稳定币,并迫使系统燃烧债务。当债务/供应量较低时,激励借款人归还贷款,使系统增加债务。

Curve团队本身控制着大量的veCRV作为投票权,能够引导crvUSD与3 pool等池间的流动性,方便crvUSD的冷启动,这是其它稳定币项目不具有的优势。因此依靠Curve先天充沛的流动性的优势下,crvUSD在DeFi生态有完美的闭环或是成功的关键。

Curve在稳定币上的布局具有战略意义,包括ETH在内的加密原生资产质押生成的稳定币,可以逐步摆脱依靠法币为背书的稳定币,增强了加密市场的抗监管能力,更重要的是为DeFi生态提供了自我造血,我们拭目以待crvUSD在下拨牛市中的表现。

关于 SCapital

SCapital 是一支抗周期的全方位区块链投资基金,业务涵盖比特币挖矿、一级市场风险投资,并深度参与基于市场/行业分析的二级市场去中心化金融活动。