Tether co-founder re-employs, creating the "second-generation stablecoin" STBL. What exactly is it?

- 核心观点:STBL推出第二代收益共享稳定币生态。

- 关键要素:

- STBL与Tether无关,由前CEO创建。

- USST稳定币由RWA抵押,YLD NFT分配收益。

- 生态旨在将发行商利润返还用户。

- 市场影响:挑战传统稳定币商业模式,促进行业创新。

- 时效性标注:中期影响。

Original | Odaily Planet Daily ( @OdailyChina )

By Wenser ( @wenser 2010 )

Last night, following the official announcement of Binance Alpha, the price of STBL, a "second-generation stablecoin and Tether-linked innovative project," skyrocketed, reaching a peak of around $0.22. This afternoon, it briefly surged over $0.30 on-chain before falling back to around $0.17. Meanwhile, Tether CEO Paolo Ardoino has recently stated , "USDT has nearly 500 million users, an average daily trading volume of approximately $45 billion, 17 million daily traders, and a 99% profit margin."

Who exactly is SBTL? Is it related to Tether's stablecoin blockchain, Stablecoin? Is Tether's co-founder true? What is the background of STBL? Odaily Planet Daily will provide a detailed introduction and brief analysis of these questions in this article.

SBTL: A "Second-Generation Stablecoin" Led by Tether's Former CEO

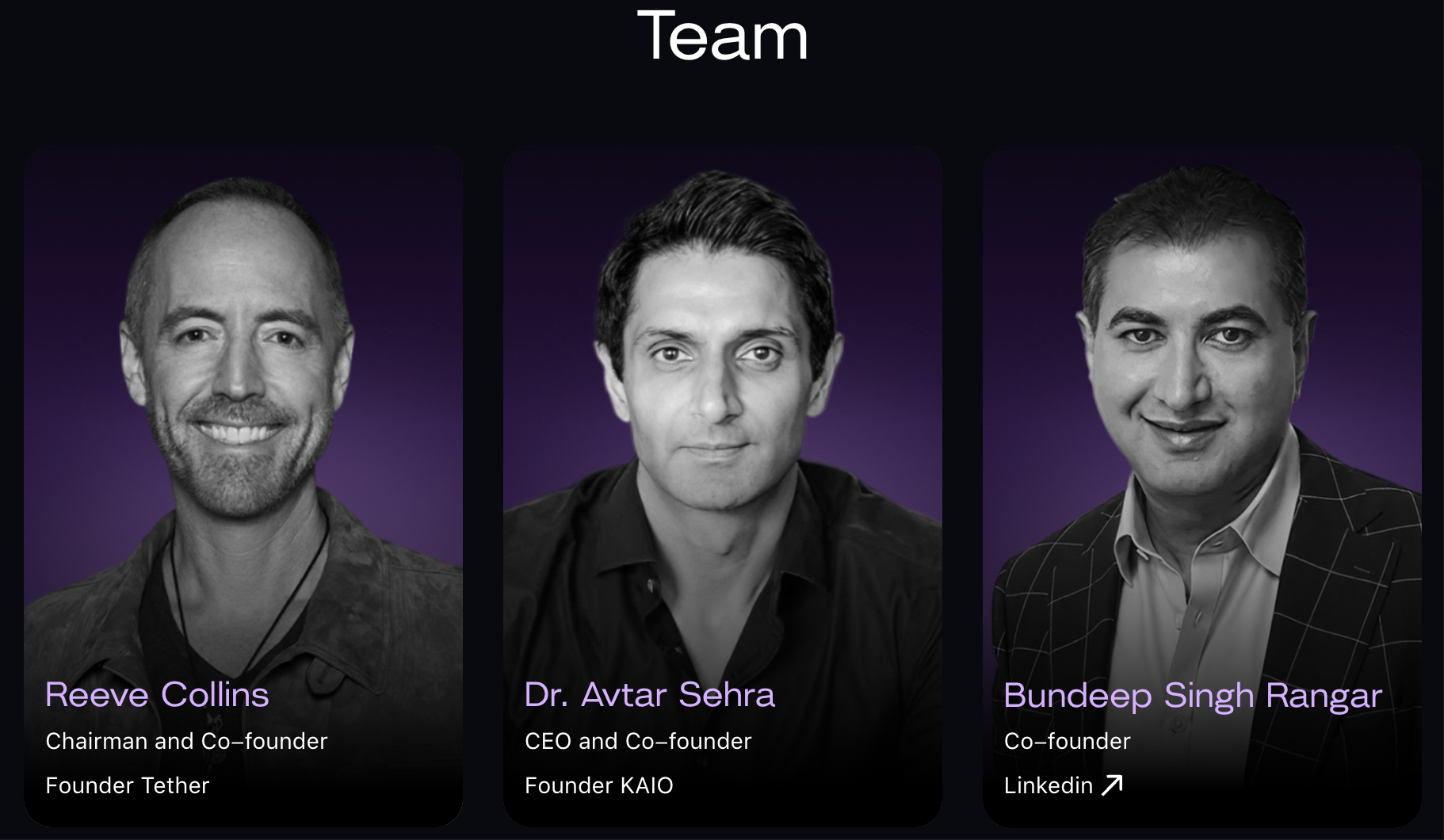

First of all, it needs to be made clear that STBL has nothing to do with the stablecoin L1 public chain Stable previously launched by Tether : the former was prepared and launched by Reeve Collins, former co-founder and CEO of Tether, president of ReserveOne, CEO of M3-Brigade Acquisition V Corp, chairman of WeFi, and Avtar Sehra, founder of KAIO. STBL is an ecological governance token, and will subsequently launch the consumer stablecoin USST and the income token YLD; the latter was launched by Tether, the issuer behind USDT, and supported by Bitfinex and USDT 0. Tether CEO Paolo Ardoino is an advisor. It uses USDT as the native gas on the chain. Users do not need to hold platform coins to initiate transactions, and P2P (peer-to-peer) USDT transfers are completely gas-free.

Therefore, unlike many users who mistakenly believe that "STBL is a new stablecoin launched by the stablecoin L1 public chain Stable", in fact, the only connection between STBL and Tether may be that its chairman and co-founder Reeve Collins participated in the operation of Realcoin (the predecessor of USDT) from 2013 to 2014, and briefly served as the CEO of the issuing company Tether.

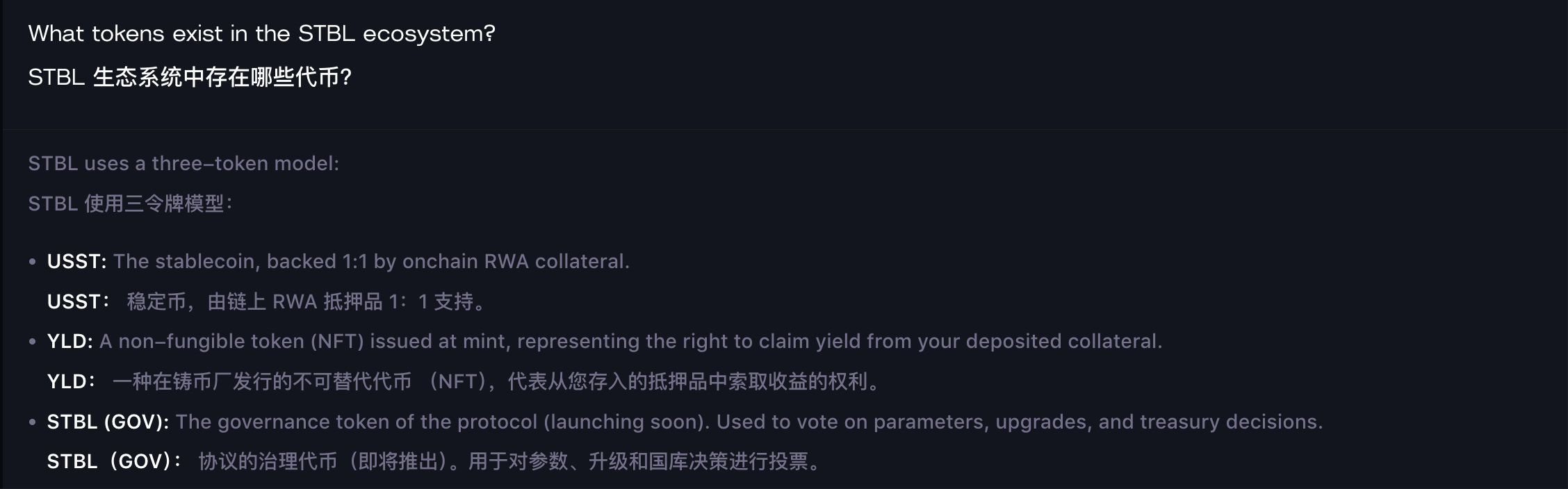

According to a long article previously published by Reeve Collins and relevant information on the STBL official website , the STBL ecosystem is mainly composed of:

- STBL is a governance token. Holders can vote on collateral types, ratios, and upgrades to ensure that STBL is secure, compliant, and community-driven. It is worth mentioning that the token is completely non-custodial.

- USST is a consumer stablecoin backed 1:1 by on-chain RWA collateral. It offers instant, over-collateralized lending with no hidden fees or lock-ups. It can be used with supported partner protocols and exchanges for trading, DeFi protocols, cross-chain bridging, and fund management. Currently supported collateral includes ONDO's USDY and OUSG, as well as BlackRock's BUIDL.

- YLD is an NFT that users can use to receive predetermined returns. It is mainly used to retain collateral returns and increase them over time.

In other words, unlike the operating model of "first-generation stablecoins" like Tether and Circle, where the issuer monopolizes the interest or income generated by the stablecoin's corresponding reserve funds, STBL uses YLD NFTs to "return these incomes to the people." Thus, if first-generation stablecoins (such as USDT and USDC) solved the problem of "how to establish a reliable digital dollar on the blockchain," then the goal of second-generation stablecoins (i.e., USST) is to financialize the dollar . Reeve's original words were: "The yield is no longer limited to the issuer's balance sheet. The principal and income are separated into two programmable cash flows."

In addition, SBTL has received support from Wave Digital Assets, an investment company headquartered in Los Angeles and registered with the US SEC. It is reported that the institution has an asset management scale of over US$1 billion. It was previously spun off from a venture capital institution with a scale of up to US$400 million and has attracted attention for its risk awareness and regulated investments.

STBL's ambition: harming issuers while benefiting many parties

At present, STBL has great ambitions, and its core lies in one sentence - the business profits generated by stablecoin issuers with the help of reserve collateral such as US Treasury bonds and gold will be distributed to users, while institutions, governments and DeFi protocols will obtain a wider range of liquid assets.

Specifically, the STBL ecosystem’s USST stablecoin and YLD NFT’s “growth flywheel” have certain benefits for different groups and roles:

- For consumers, holding USST stablecoins can ultimately contribute to the entire ecological network rather than just the interests of the issuer;

- For institutions, USST and YLD can transform idle cash assets into transparent, compliant, and income-generating assets and cash flows;

- For sovereign governments, the issuance of USST will become a major case study, which means that they can use it to produce digital stablecoins tied to their own national bonds to safeguard national sovereignty; they can also use it to release new sources of value that traditional legal tender cannot provide - that is, to achieve the preservation and appreciation of their own currencies.

- For DeFi protocols, the built-in income combinable modules of the USST and YLD systems will provide more diversified and flexible support for various businesses such as derivatives and transfers.

Summary: The future of STBL depends on the issuance of USST

While the "STBL-USST-YLD" ecosystem appears to be operating smoothly at present, the long-term price performance of STBL, the governance token, will still be primarily determined by the scale of USST issuance and the corresponding collateral interest earned. If YLD generates substantial returns, USST will undoubtedly open up a new development path for the stablecoin market—one distinct from the collateral interest-earning monopoly of Tether and Circle. However, given the current size of the stablecoin market, the issuance of USST undoubtedly faces fierce competition and an uncertain future.