Complete market review and order placement within two minutes. How does Pump.fun live streaming reshape the trading scene?

- 核心观点:Pump.fun直播机制革新,实现内容与交易闭环。

- 关键要素:

- 直播并发超Rumble,达Twitch1%。

- 动态费率激励小盘高换手。

- 单日发放创作者分成400万美元。

- 市场影响:加速注意力变现,但存活率极低。

- 时效性标注:短期影响。

Original | Odaily Planet Daily ( @OdailyChina )

Author | Ethan ( @ethanzhang_web3)

In recent days, the popularity of "Pump.fun Live Broadcast" has continued to rise.

On September 14th, co-founder Alon stated on X that the platform's concurrent live streams had surpassed Rumble, reaching a market share approaching 1% of Twitch and approximately 10% of Kick. Simultaneously, the underlying mechanism underwent a structural overhaul : Project Ascend changed creator commissions from a flat 0.05% to a dynamic rate based on market capitalization—a maximum of 0.95% for small-cap creators, falling back to 0.05% as they scale. This seamlessly connects the "attention → transaction volume → streamer income" chain. On September 16th, the PUMP platform announced that "over $4 million was distributed to creators yesterday, the majority going to first-time creators," prompting a surge in "first-time streamers" testing the waters.

Out of curiosity, I watched and participated in the entire token launch process of several livestreams. Did the stage, incentives, and content of this Pump.fun livestream truly align?

From the homepage to placing an order: a two-minute live trading session led by a "LIVE" label

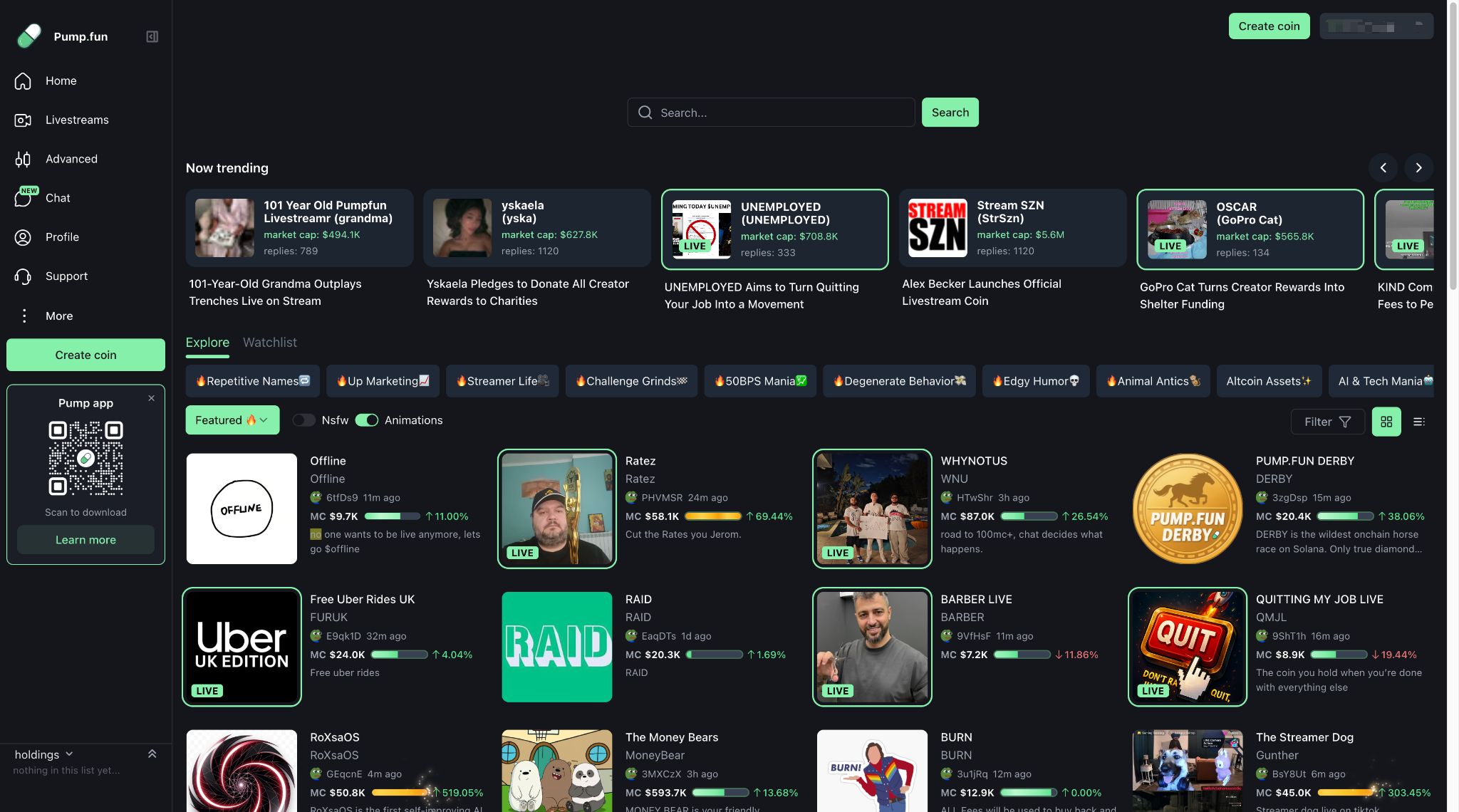

Open the Pump.fun official website, and the homepage is different from the earlier version.

The launch pad, once more of a rough-and-ready prototype, has now been fully renovated: A horizontal "Now Trending" slider appears at the top, and a bright green " LIVE " logo appears in the lower left corner of each card, distinguishing "tokens currently being livestreamed." Below this is the Explore section, organized by topic: Streamer Life , Challenge Grinds , Animal Antics , AI & Tech Mania, and more. Clicking any of these tags filters the waterfall into groups of tokens with similar themes. The left sidebar now features fixed "Home", "Livestreams", "Advanced", and "Chat," while the prominent "Create Coin" button remains in the upper right corner. The overall look and feel is more like a "livestreaming hall" than a simple launch page.

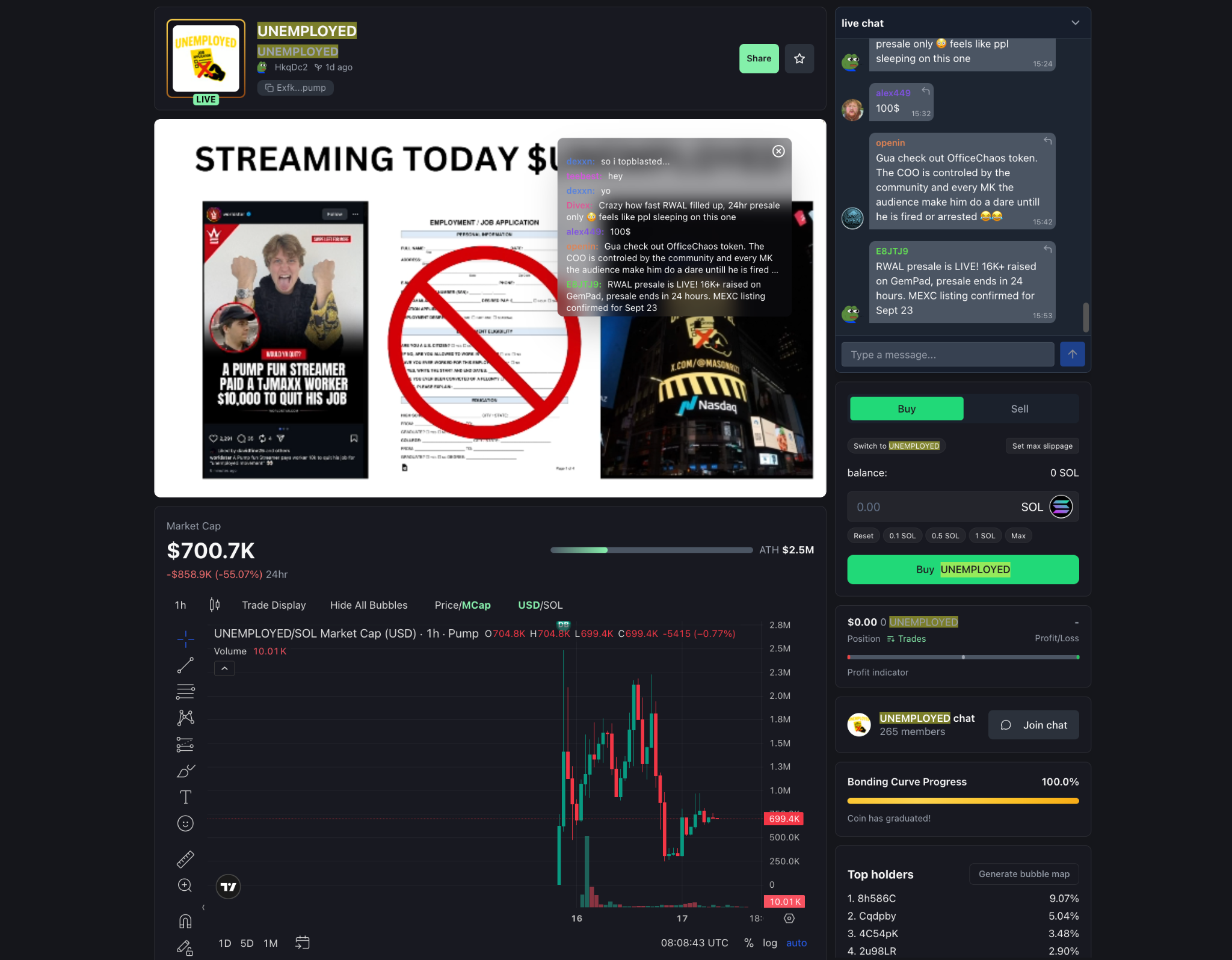

In addition to the cover image, the card also includes key information such as market capitalization, 24-hour fluctuations, and a brief description. By condensing the "hotness + market information" into a single viewable layer, it's easy to read. After a ten-second hesitation, I clicked on the UNEMPLOYED room with the LIVE logo from the homepage. The title line directly stated the narrative: "Turn resignation into a movement." Once inside, the host's screen was in the center, and a full row of trading and chat tools lined up on the right: a chat box, a Buy/Sell panel, a position and profit/loss bar, and a Bonding Curve Progress notification at the bottom: 100% (Coin has graduated) (the gameplay remains the same as before). At the bottom, a scrolling screen displayed real-time updates on who bought how much and when, and who was dumping the market.

The most eye-catching thing on the screen is a long picture of the "program declaration": on the left side it says "A Pump.fun anchor gave a TJ Maxx employee $10,000 to resign" (narration from the room, not independently verified), on the right side is a job application form marked with a red prohibition mark, and on the next page is a photo of the Nasdaq big screen in New York - the dramatic tension of "resignation is content" is vividly displayed on the screen.

Read the disk first, then take action.

I first spent about 30 seconds examining the right-hand side readings: market capitalization approximately $700,000, 24-hour change approximately -55%, and historical high approximately $2.5 million. The 1HK chart fluctuates repeatedly, showing multiple ups and downs. Further down, I examine the top holders: the top few hold approximately 9%, 5%, and 3%+, respectively, representing relatively modest concentrations. These are the readings at the time, merely a snapshot of the market's performance. Risk assessments still require consideration of factors like contract permissions and team history.

Meanwhile, what are the streamers doing?

He clearly understood the flow: first, he'd use a few jokes to get the atmosphere going, then he'd throw in engaging instructions—like, "Ten seconds left, click Buy together," or he'd call out the names of several large buy orders to create a sense of excitement. In between, he'd constantly repeat two things: "This isn't a tip; it's about turning attention into an asset"; and "There are a few more episodes to come today, don't go away" (corresponding to the "Previous streams"/"Next show preview" cards he'd posted below). With each engaging interaction, the candlestick chart's volume surged, and the bottom bar's transaction volume seemed to be fast-forwarded.

Press the buy button.

The process is very short: connect to Phantom → click Buy → enter 0.1 sol → confirm slippage and sign. Within seconds, my purchase appears in the position bar in the lower right corner, and my line of record flashes in the transaction flow. The entire process does not require jumping to other DEX pages—view, think, and place orders all on the same screen. Every joke from the host is almost instantly reflected in the K-line and the transaction flow.

The "noise" and "signal" of barrage.

Danmu comments fall into three categories: the first is slogan-like spamming; the second is cross-room solicitation for unrelated projects (typically phrased like "XX presale is ending soon, raised so much, going to be listed on a certain exchange"); and the last category is a few useful reminders, such as whether a game has "graduated" or whether there is community backup. For first-time players, treating the third category as a signal and the first two as background noise can help reduce misjudgment.

Summary : The LIVE tag ties "live content" and "live trades" onto the same screen. Unlike "off-screen tipping" on Twitch/Kick, this allows for simultaneous on-screen reading and order placement. Livestreams like UNEMPLOYED, which turn their actions into conversational topics, are naturally better at transforming emotions into trading volume—which is why I dared to place a small trial position within two minutes.

Three Acts and Three Principles: Converting "Attention Peaks" into Actionable Rhythms

Over the past few nights, I've been shuttling between multiple livestreams, waiting for the "explosive moment" to appear. The three most common scenarios on the scene: lag, explosive moments, and novice livestreams, all occur in turn almost every night.

First, the live broadcast room is stuck

During peak hours, some rooms experienced delays or frame drops between the video and the ordering panel (local network factors may not be ruled out) . An even more extreme situation occurred two days ago: on September 15th, according to Decrypt , leading influencer Alex Becker stated after the start of his pump.fun broadcast that the platform was under severe pressure and that it was difficult to maintain live streaming. He stated on X that if the platform could not be restored, he would switch to YouTube to continue.

This isn't simply a "slow loading" issue; it's the systemic pressures of front-end live streaming, matchmaking, and on-chain confirmations . For traders, every click during peak trading hours is a race against slippage. On my screen, the conversations and the comments are almost synchronized: once the streamer triggers the "collective action" slogan, the bottom bar refreshes continuously, and the price jumps in a stair-like manner.

Second, the explosion point is driving prices

Livestreaming content with event-like elements or strong interactive mechanisms often results in higher transaction volumes and volatility. On September 15th, Decrypt reported that streamer Bagwork played an unreleased song, allegedly by Drake/Future, during a livestream. The associated meme token's market capitalization surged to approximately $53 million , and the creators received $83,410 in two-day commissions. Bagwork has also recently gained popularity through a series of livestreaming incidents, including storming the field at a Los Angeles Dodgers game.

In the UNEMPLOYED room I entered, this "content → transaction" coupling was equally evident: actions like the "Buy" countdown, the name-calling of large-amount addresses, and the release of the next game preview all left clear ripples on the bottom candlestick chart and the transaction flow . At this point, prices weren't just passively reflecting content; they were driven by it.

Third, the red envelope rain pushed "newbie live broadcast" to the forefront

The platform publicly stated that " over $4 million was distributed to creators yesterday , the majority going to first-time creators ." This aligns with what I observed on the platform: a surge of "first-time streamers" emerged that same night, clearly prioritizing interaction and pacing. This is because streamers have a stronger marginal incentive to turn over content within Project Ascend 's high-percentage, small-cap range . In other words, the more newcomers and the more expensive the shows, the more frequent the turnover .

To make the above three acts executable, I have summarized three principles :

Principle 1: Give yourself an "observation window" and wait for "secondary organization".

Observe the room for 2-3 minutes before entering it, observing three things: whether the peak online volume has subsided, whether the first round of sentiment orders have been fulfilled, and whether the host is organizing a second round of interaction. When a second round of volume surges occurs and the host is still maintaining high-intensity interaction, use small amounts to "take advantage" instead of chasing the initial high.

Principle 2: Change your reward mentality to a position mentality.

In Pump.fun's livestream, this isn't about giving gifts, but rather buying a tradable position. Before entering the market, set a maximum loss limit and a planned reduction trigger level, treating participating funds as a "fun budget." Don't add to your fund beyond the capital pool, and don't let emotions be an excuse.

Principle 3: Read three indicators to understand your opponent’s motivations.

- Creator Fee and Market Cap Range: To maximize the streamer's income, in the small-cap stage with high commissions, streamers are more willing to create frequent turning points to increase turnover;

- Position concentration (e.g., top holders distribution): When concentration is high, there is a greater risk of short-term losses.

- External traffic signals (announcements, cross-platform linkages, topic challenges): They are often the precursors to transaction density.

Combining these three items, it is easier to judge whether a live broadcast room is " making programs to attract traffic " or " exhausting emotions ."

Note: The events and data in this section are based on public information and the author's personal experience. They do not constitute investment advice. Please conduct your own research (DYOR).

Conclusion

This round is not just "more lively", but a superposition of mechanisms and scenarios: live streaming compresses attention into second-level traffic, and Ascend precipitates each transaction into cash flow for creators, forming a closed loop of "content → participation → transaction → distribution".

But the cold water was equally blunt: As of September 17th, according to OKX Wallet data , only nine Pump.fun "live streaming concept" tokens had a market capitalization greater than $1 million; while GMGN's statistics on September 15th showed 39. The leading token, Bagwork, peaked at over $50 million and is now trading at approximately $8 million, a retracement of 80%. The current market capitalization is held by KIND, at approximately $16.8 million.

This may indicate that "converting watchability into settleability" is valid, but the survival curve is extremely steep and there are very few winners: without continuous programs and external traffic, the popularity will still be quickly diluted by time and turnover.