Original title: "9 Hidden Web3 Trends To Watch In 2023 》

Original title: "

Author: Max Yampolsky

A Quick Look at 9 Web3 Development Trends in 2023

A Quick Look at 9 Web3 Development Trends in 2023

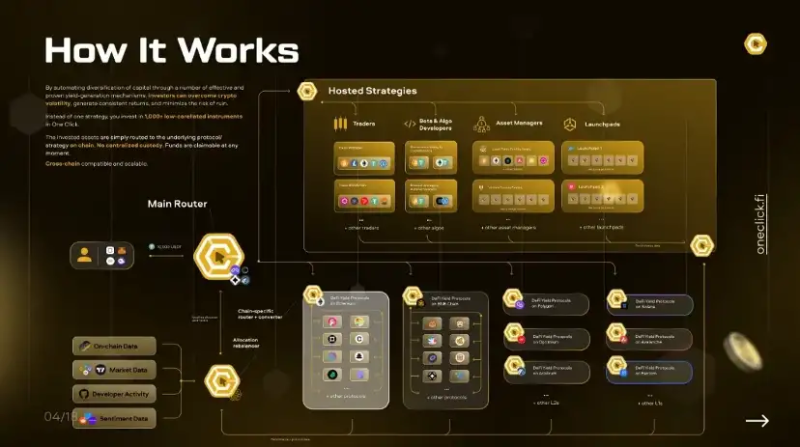

1. Social DeFi

Below I've listed nine Web3 trends that are gaining momentum right now and will be part of the industry's growth in 2023.

A Quick Look at 9 Web3 Development Trends in 2023

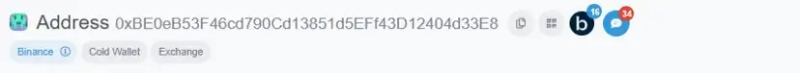

But addresses are often long, complex strings of letters and numbers that humans struggle to remember and associate with a specific person or company.

A quick overview of 9 major Web3 development trends in 2023

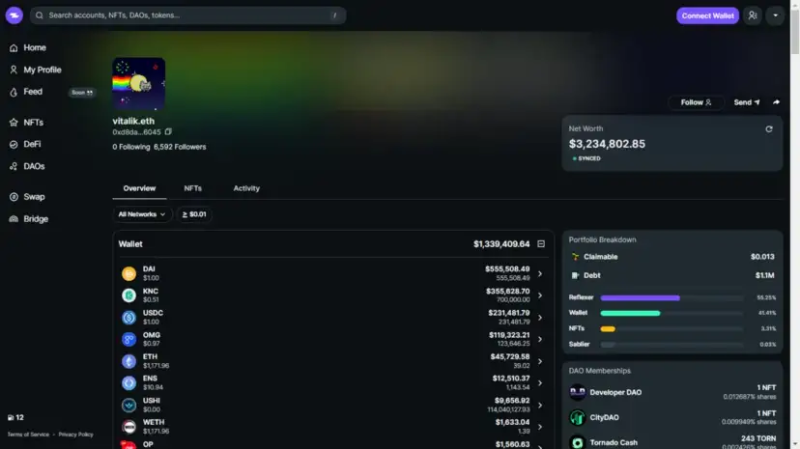

Social DeFi refers to a series of applications and platforms designed to make it easier for people to connect and interact using cryptocurrencies.

Some key characteristics of Social DeFi include:

Personalized 0x addresses: Apps like DeBank and ENS allow users to personalize their 0x addresses into something more human-readable, like a username. This makes it easier for people to identify and remember each other's wallets.

Message Wallet Owner + Wallet Follow: Apps like DeBank allow users to message wallet owners, or follow specific wallets, and get notified about their activity. In my opinion, this is a killer feature that could open up a whole new world of social trading.

Dapp Notifications: Additionally, some B2B solutions have emerged, such as Notifi, which allow cryptocurrency projects to enable notifications for users of their DApps.

Social feeds and communities: Platforms like DeBank provide social feeds and communities related to a particular wallet or project. These platforms allow users to stay updated on the latest developments in the DeFi space and connect with like-minded people.

A quick overview of 9 major Web3 development trends in 2023

username = NFT?

A quick overview of 9 major Web3 development trends in 2023

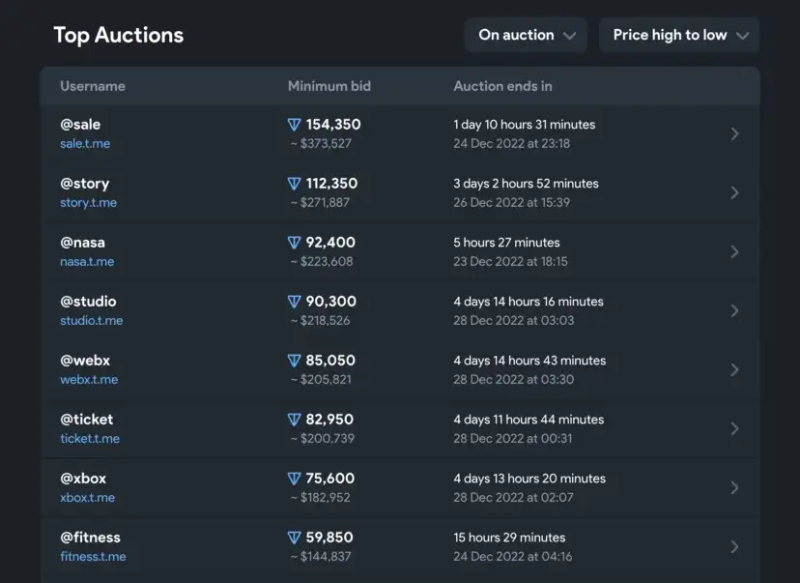

This creates a whole new market for all social media account owners. Instead of being a relatively meaningless thing you set and forget, your username becomes a valuable asset, unique, just like an NFT. While it remains relatively illiquid, platforms like Fragment make it easy to cash out.

Currently, Fragment only offers Telegram usernames, but going forward, you can already see all kinds of things being traded there: from major social networking sites like Twitter/Instagram/Snapchat, to character nicknames for World of Warcraft servers, and maybe even license plate numbers."Elon Musk recently announced that Twitter plans to delete 1.5 billion inactive accounts to free up usernames. this kind"to clean up

This will unleash a wealth of valuable "NFTs" on the platform and create an opportunity to snatch some attractive usernames with the expectation of later reselling them for a tidy profit.

Other Web2 Social Apps Adopting Web3

Twitter was one of the first major social media platforms to integrate NFT-focused Web3 capabilities. In early 2022, they added an NFT set to the profile picture of all Twitter Blue paid subscribers. In a recent update in October 2022, the developers added the ability for users to trade NFTs directly from tweets.

Back in November 2021, Twitter established an internal Web3 development department, and with Binance's recent $500 million investment in Twitter, expect more Web3 functionality to be integrated into the app.

Instagram is expected to follow suit, as the platform is owned by Meta Corporation, which has recently pivoted to building products for the Metaverse. Instagram already allows users to mint and sell NFTs directly through the app, with more features coming in 2023.

Globalization of SocialDeFi in 2023?

A Quick Look at 9 Web3 Development Trends in 2023

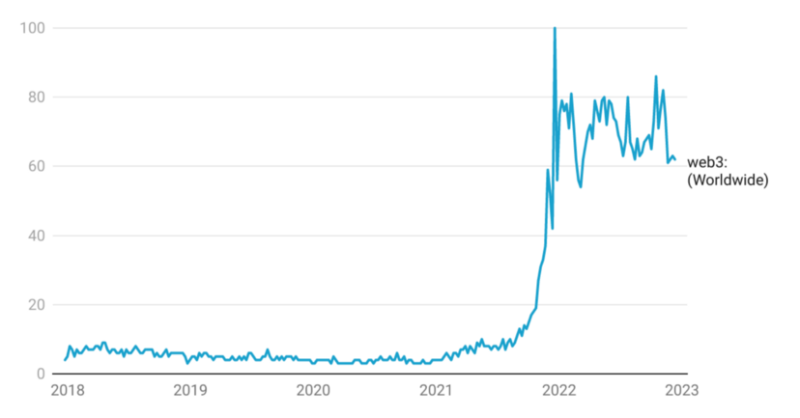

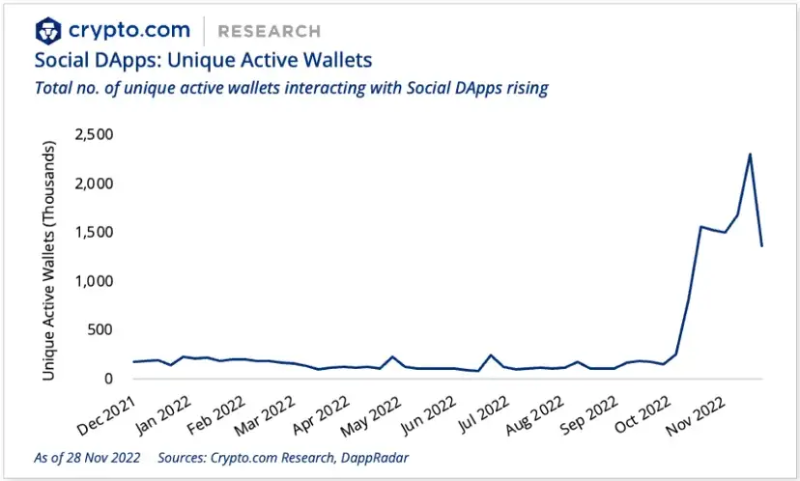

The number of unique active wallets interacting with social dApps increased by over 1250% in 2022 and is expected to continue to increase in 2023 as demand for Web3 identities increases.

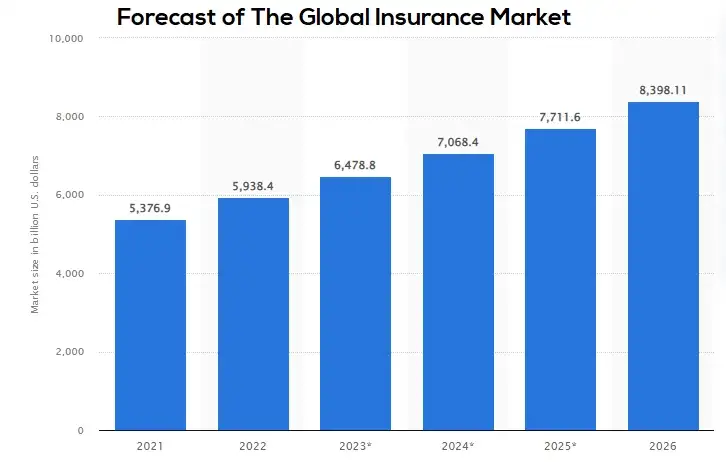

2. DeFi/Cryptocurrency Risk Insurance

A Quick Look at 9 Web3 Development Trends in 2023

A quick overview of 9 major Web3 development trends in 2023

Key facts:

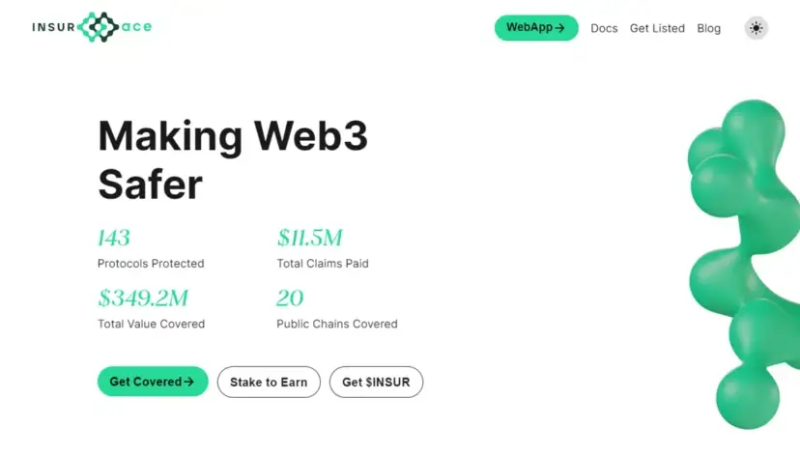

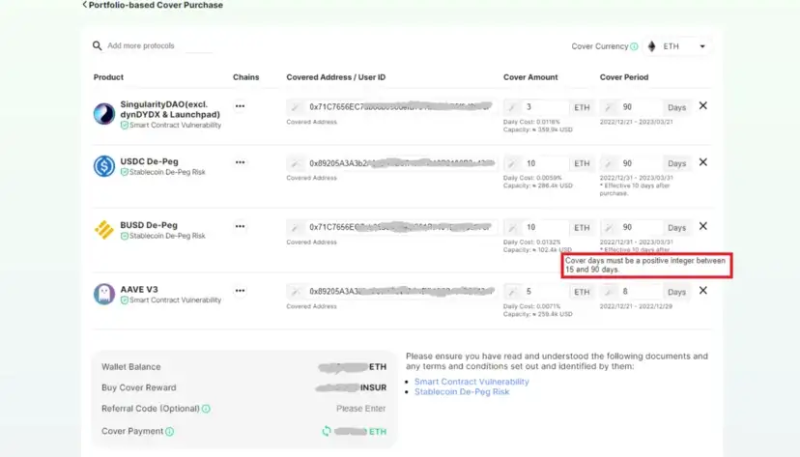

DeFi and cryptocurrency risk insurance provides protection against DeFi-related risks, such as protocol-specific hacks, stablecoin depegging, and CEX bankruptcy.

Premiums for these insurance products range between 0.2-0.9% per month, depending on the product type.

The coverage period for these insurance products currently ranges from 10 to 90 days.

Protection is currently limited and most products are sold out.

From the above points we can see that the cryptocurrency insurance segment is still in its infancy and there are many areas for improvement: liquidity, capital efficiency, product availability and cost, all of which are expected to see more in 2023 progress.

DeFi/Cryptocurrency Insurance Predictions for 2023

A Quick Look at 9 Web3 Development Trends in 2023

Web3 insurance can provide protection against the inherent risks of investing in decentralized finance (DeFi) and cryptocurrencies. As traditional investors continue to embrace DeFi and cryptocurrencies, demand for risk insurance products is expected to increase.

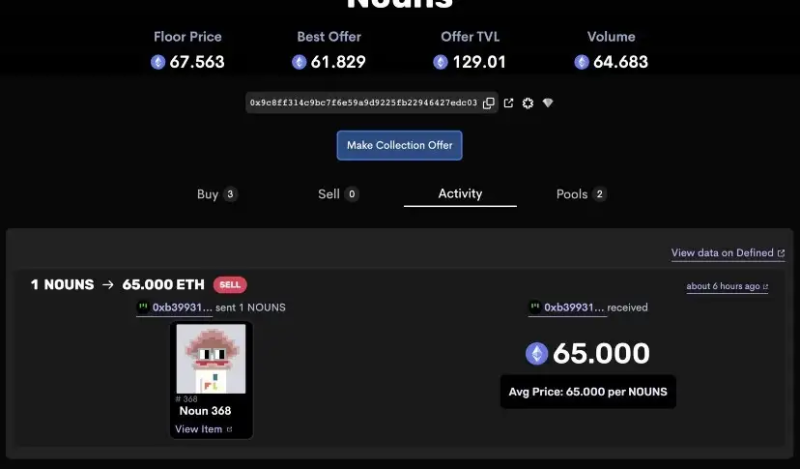

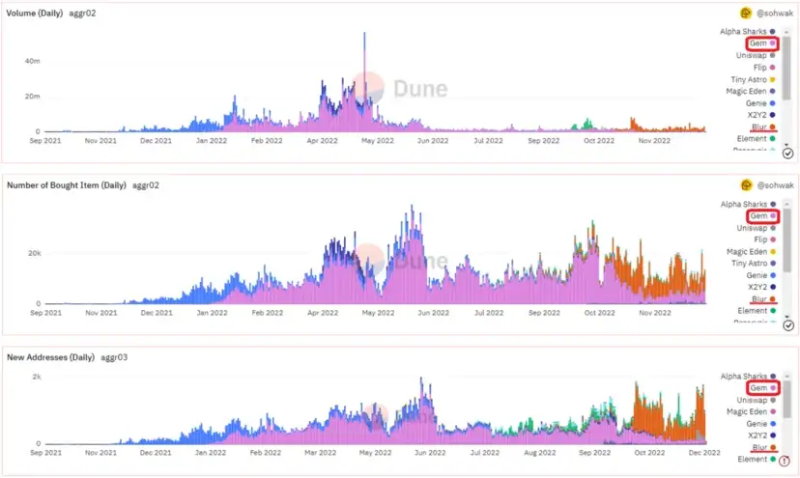

3. NFT Liquidity Tool

Liquidity of NFTs is a perennial problem in the Web3 world. These assets are notoriously illiquid, making it difficult for owners to convert them into cash.

A Quick Look at 9 Web3 Development Trends in 2023

OpenSea and Uniswap, which acquired NFT aggregation services gem.xyz and Genie respectively, plan to leverage Sudoswap's liquidity to facilitate NFT transactions. Efforts to "make it easier to buy and sell NFTs" can increase the liquidity of the NFT market, making it more attractive to investors and collectors. Overall, developing liquidity solutions for NFTs is an important opportunity in Web3.

What's next for NFT liquidity tools in 2023?

A quick overview of 9 major Web3 development trends in 2023

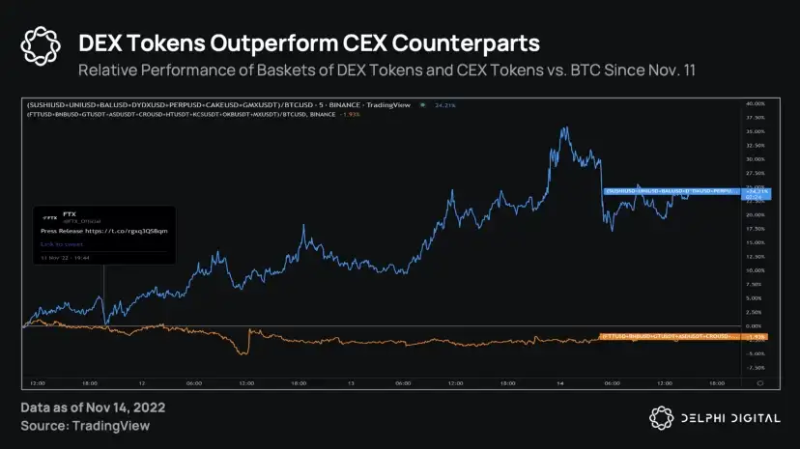

4. Advanced trading tools of DEX

One of the major barriers to widespread adoption of decentralized exchanges (DEXs) is the need for advanced trading tools, such as stop loss functionality. Some protocols are working hard to solve this problem, dYdX is one example.

In addition to the lack of a stop loss feature, liquidity and slippage/front-running have also been issues for traders on DEXs.

A Quick Look at 9 Web3 Development Trends in 2023

Overall, the development of advanced DEX trading tools is an important trend in the Web3 world, as it will help make DEXs more user-friendly and competitive with CEXs.

Upcoming DEX upgrades in 2023

A Quick Look at 9 Web3 Development Trends in 2023

5. Rise of M2E Apps

Move-to-earn, a trend of rewarding users for fitness with cryptocurrencies, non-fungible tokens or points, is expected to continue until 2023.

A Quick Look at 9 Web3 Development Trends in 2023

Other apps with similar mechanisms

More fitness Web3 apps use a similar mechanism, combining NFT, cryptocurrency, GPS, and GameFi technologies. For example:

Money dancing programs like Rapty.app and Dansa.

Workout-track-money apps like MetaGym.

Bike money making programs like BikeN and BikeRush.

...any other movement you can think of probably has a suitable Web3 application.

2023 predictions

A Quick Look at 9 Web3 Development Trends in 2023

6. NFTs of mainstream brands

A quick overview of 9 major Web3 development trends in 2023

An exciting development in the NFT world is the emergence of branded NFTs. These NFTs are created by, or are associated with, well-known brands, companies, or celebrities. Brand NFTs offer fans and collectors the opportunity to own their favorite brands or celebrities, which can be used to promote and engage fans in new and innovative ways.

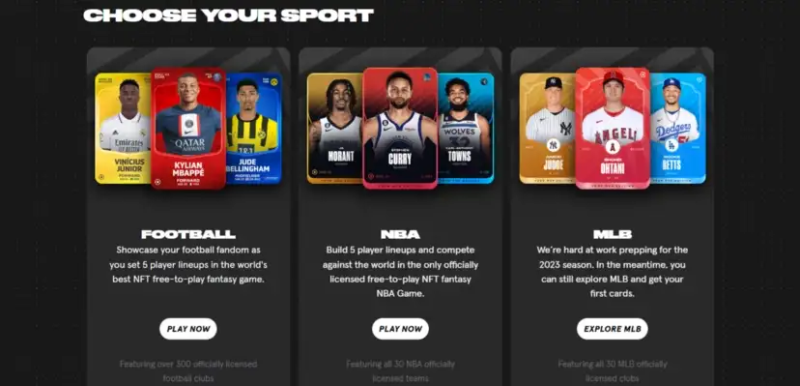

Sports NFT

A Quick Look at 9 Web3 Development Trends in 2023

Sports cards have long been a favorite collectible, with fans collecting physical cards of their favorite players and teams. More recently, digital sports cards in games, such as FIFA's Ultimate Team, have also exploded in popularity. Now, the collectibles industry is turning to NFTs as a new medium for sports card representation and transactions.

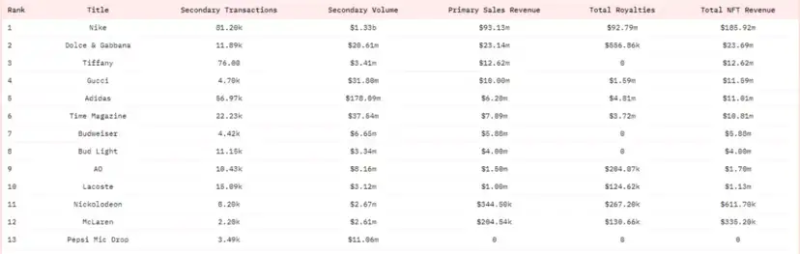

Commercial brand NFT

Top brands are also using NFTs to build awareness. For example, Coca-Cola used NFTs as a marketing tool in July 2021 to sell a collection of collectibles for $575,883.61 in an online auction.

A Quick Look at 9 Web3 Development Trends in 2023

2023 predictions

A Quick Look at 9 Web3 Development Trends in 2023

7. Transparency

A Quick Look at 9 Web3 Development Trends in 2023

As a result, many projects are now taking steps to increase transparency.

The addition of doxxed teams.

More projects disclose all their owned project wallet/treasury addresses.

Some companies organize independent DAOs with community members to manage decisions related to treasury management.

A public roadmap that allows community participation.

More projects publicize product updates and report on their progress.

The founding team openly shares their mistakes (if any) and lessons learned.

The project announces its connection to relevant investors and all project-related stakeholders.

A Quick Look at 9 Web3 Development Trends in 2023

Additionally, publicly available monitoring tools are on the rise:

Proof of Reserve Exchange (Coinmarketcap, DefiLlama).

All data related to dApps and DeFi protocols are public and easily verifiable on-chain (DefiLlama, Dune Analytics), so there is no point in hiding/lying some information.

This trend will accelerate as legitimate projects aim to gain more trust from the community/investors.

A Quick Look at 9 Web3 Development Trends in 2023

This trend towards transparency is accelerating as legitimate projects struggle to gain the trust of communities and investors. At the same time, less transparent projects will raise red flags and be seen as untrustworthy. It is vital that cryptocurrency projects remain transparent to build trust in the community and investors.

In 2023, will the trend towards transparency continue?

A quick overview of 9 major Web3 development trends in 2023

The first step towards transparency is the introduction of Proof of Reserves data. The top-level analytics project has also added tools to make it easier to track these metrics and make projects harder to hide.

8. Market integration (acquisition/partnership)

As the bear market dragged on, industry leaders bought up smaller companies that were struggling to survive. This trend can be observed in the NFT space, with Uniswap acquiring liquidity aggregator Genie and OpenSea acquiring Gem.xyz.

A quick overview of 9 major Web3 development trends in 2023

During a bear market, financing can be tight and the hype surrounding the industry can dissipate. In such cases, smaller projects may turn to partnerships as a free marketing tool to increase their visibility and influence. On the other hand, large projects may be more willing to partner with or acquire smaller projects when there is less hype and competition in the market.

An example of market consolidation in the cryptocurrency industry is the recent partnership between Balancer and Aave for the exchange of governance tokens and the introduction of common pools. Both projects are well-established in the industry, but by joining forces, they can expand their influence and provide more value to users.

Will this trend continue in 2023?

A quick overview of 9 major Web3 development trends in 2023

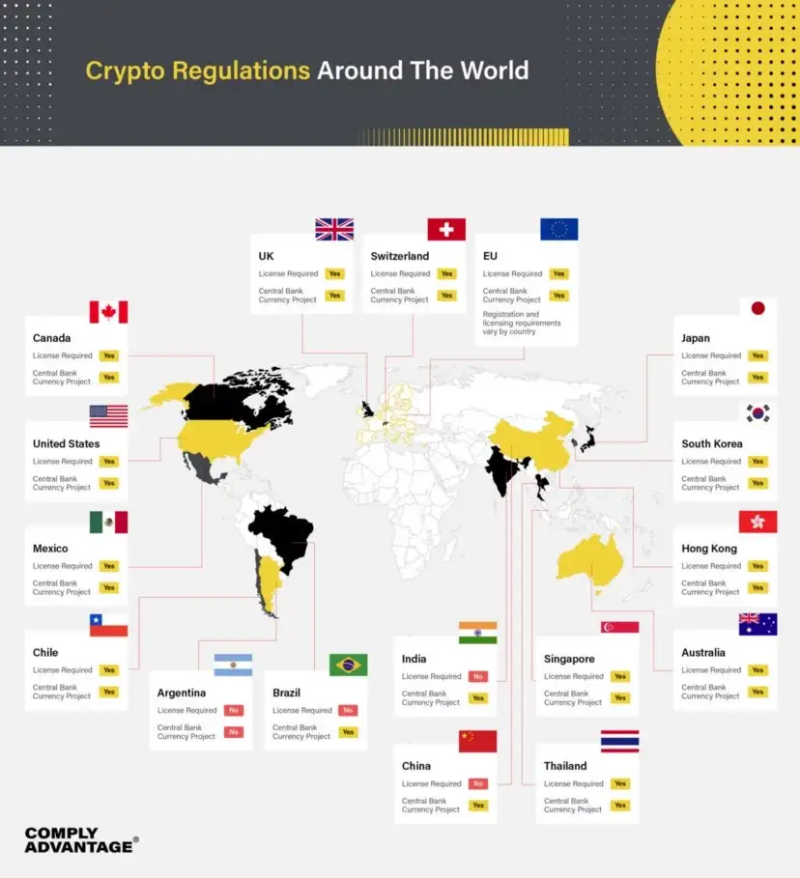

9. Compliance

Regulatory compliance is increasingly critical in cryptocurrencies as governments around the world seek greater oversight and transparency.

In the U.S

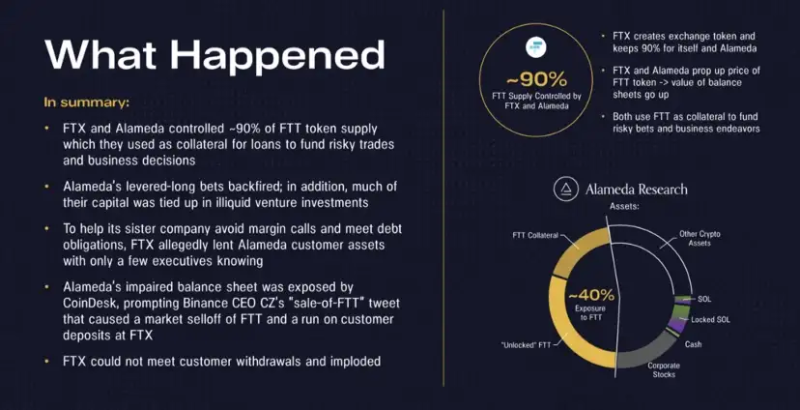

The recent FTX case highlights the need for cryptocurrency projects to prepare for additional scrutiny from regulators. U.S. Commodity Futures Trading Commission (CFTC) Chairman Rostin Behnam has called on lawmakers to create a regulatory framework for digital assets following the collapse of cryptocurrency exchanges.

Behnam told the Senate committee that the CFTC does not have the authority to regulate the spot market and is “handicapped” due to its inability to register spot market exchanges.

A quick overview of 9 major Web3 development trends in 2023

in Europe

MiCA (Markets in Cryptoassets) regulations will be introduced in 2023. On October 10, 2022, the European Parliament's Committee on Economic and Monetary Affairs voted overwhelmingly in favor of the regulation, paving the way for a parliament-wide vote by the end of the year.

If passed, the law would allow providers of digital wallets and other cryptocurrency services to sell their products across the EU, provided they are registered with national authorities and meet minimum guarantees for investor protection and financial stability. The MiCA bill also requires cryptocurrency issuers to publish a white paper presenting information about their projects.

There are some concerns about the limits on stablecoins, and whether the rules apply to non-forgeable tokens (NFTs). In addition, the EU is considering the development of a digital financial strategy, the Digital Operations Resilience Act (DORA), and a DLT pilot regime for wholesale use to strengthen regulatory compliance and ensure the stability and security of the cryptocurrency industry.

What does 2023 mean for cryptocurrency investors?

Summarize

Summarize

With the widespread adoption of blockchain technology, Web3 has become the innovation frontier for entrepreneurs and builders.

The industry is still in its infancy and rapidly evolving, with trends changing every month. Staying ahead and on top of the latest market dynamics has become crucial.

In 2023, we expect to see major developments in SocialFi, insurance protocols, and NFT liquidity tools. Mainstream NFTs, M2E, and DEX advanced trading tools are expected to achieve faster speeds.