Compilation of the original text: Bai Ze Research Institute

Compilation of the original text: Bai Ze Research Institute

Original title: "The State of Crypto Payment Providers in 2022"

Cryptocurrencies have come a long way — from being considered a long-term speculative digital asset to an efficient method of payment. Many consumers and businesses are accepting encrypted payments because of their associated benefits, including convenience, speed, reasonable processing fees, and greater security.

While existing traditional payment mechanisms are effective in these several ways, they have significant drawbacks such as long settlement times, numerous intermediaries, lack of transparency and high commissions. This has led to the emergence of crypto payment providers who use robust payment systems powered by blockchain as an alternative to traditional payment systems.

Last December, we analyzed how crypto payment providers pose a threat to traditional payment service providers. In this article, we examine the key use cases of crypto payments growing in prominence, along with key players in the market, the current market landscape, and room for growth of crypto payment providers.

Where are crypto payment providers targeting?

In order to meet the different needs of consumers, businesses and merchants, crypto payment providers provide different products and services according to the requirements of customers. Let’s take a look at some of the prominent areas that crypto payment providers are targeting.

Consumers pay businesses: In order to facilitate merchants to collect money online and offline, encrypted payment providers provide encrypted checkout solutions that allow merchants to accept cryptocurrency payments from customers. For example, Coinbase offers the Coinbase Commerce solution, which allows merchants to accept payments in 10 cryptocurrencies, including BTC, BCH, USDC, USDT, ApeCoin, Dogecoin, LTC, and Shiba Inu. Currently, Coinbase has more than 8,000 merchants using its solutions around the world.

Business-to-business (B2B) payments: Traditional B2B transactions, especially cross-border transactions, involve multiple intermediaries, and final settlement takes several days. To solve this problem, crypto payment providers offer B2B solutions that reduce the payment process to seconds and at a lower cost. For example, Syro provides B2B payments and invoicing solutions, using the stablecoin USDC and the Celo network to enable instant settlement between businesses.

Non-Fungible Token (NFT) Payments: Buying NFT is one of the main uses of encrypted payments. This is because most NFT marketplaces require payment in cryptocurrencies. Crypto payment providers such as BitPay offer NFT payment solutions that allow businesses to accept payments in 8 different cryptocurrencies and 5 USD-pegged stablecoins from over 100 supported wallets. Payment providers such as NFTpay and MoonPay enable NFT payments via credit cards.

Web3 payment: Crypto payment provider launches Web3 payment solution to support the increasingly popular Web3 ecosystem. DePay's decentralized peer-to-peer payment gateway solution allows merchants to accept payments in any of thousands of different cryptocurrencies across multiple blockchains and receive payments in the asset of their choice.

remittance paymentsecondary title

Major Cryptocurrency Payment Providers

There are many crypto payment providers in the market, including crypto-native payment providers and traditional payment companies. In this article, we’ll discuss popular crypto payment providers that charge transaction fees of 1% or less. Let’s take an in-depth look at these crypto payment providers and the main products and services they offer.

Binance:

Binance offers the Binance Pay service, which enables merchants to accept payments in over 50 cryptocurrencies and stablecoins. It provides various products and services to merchants, including payment API, hosted checkout page, App SDK, applet, payment link. Some of the merchants using Binance’s payment solution include SafePal, Shopping.io, Egycards, Bitrefill, Coinsbee, CryptoRefills, Lost Relics, and Exeno.

BitPay:

BitPay enables merchants to accept payments in 16 different cryptocurrencies from customers in 229 countries and territories. Merchants can accept payments directly on their websites, as well as email customers invoices with cryptocurrency payments embedded. BitPay also enables merchants to accept in-person payments in physical stores using smartphones and tablets. Using the BitPay Send service, merchants can make payments globally, including payroll payments, customer refunds, rewards, and supplier payments. Since its inception in 2011, as of October 2022, BitPay has processed more than 10 million transactions with a total value of over US$5 billion.

CoinsBank:

CoinsBank is an all-in-one crypto service provider offering crypto exchange services, wallet services, crypto credit cards and merchant gateways. It supports 4 cryptocurrencies: BTC, LTC, ETH and XRP.

Coinbase:

Launched in February 2018, Coinbase Commerce is Coinbase's digital payments service. The service enables merchants to accept cryptocurrency payments directly in their crypto wallets. Merchants can integrate the solution with the checkout process, or add it as a payment option on their e-commerce platforms. They can also integrate the solution with their stores through the supported eCommerce platforms Shopify and WooCommerce.

CoinGate:

Founded in 2014, CoinGate enables online and offline merchants to accept payments in more than 70 cryptocurrencies, including BTC, LTC, ETH, and BNB. It also offers an email payment solution that allows merchants to email customers digital invoices and accept encrypted payments. Currently, businesses in more than 70 countries are using CoinGate's services. Some of its partner merchants include Alternative Airlines, Surfshark, NordVPN, and Hostinger.

Coinify:

Coinify is a cryptocurrency exchange and payment processing service provider. Coinify's payment solution allows merchants to let their customers pay with 10 supported cryptocurrencies while getting paid in the fiat currency of their choice. The company operates in more than 180 countries and is serving more than 45,000 merchants.

CoinPayments:

Founded in 2013, CoinPayments is one of the world's leading crypto payment service providers. The company is serving more than 100,000 merchants from more than 190 countries. CoinPayments' payment solutions enable merchants to accept payments in over 175 cryptocurrencies. The company also offers a number of tools for merchants, including a shopping cart plugin, payment buttons, API, invoice generator, and sales tools. As of October 2022, the company has processed over $10 billion worth of encrypted payments.

NOWPayments:

NOWPayments is a crypto payment service provider that allows merchants to accept crypto payments on their websites and brick-and-mortar stores. It supports around 150 cryptocurrencies and allows customers and merchants to accept donations. It also provides merchants with options for bulk payments such as payroll, rewards, and commissions.

SpicePay:

SpicePay's e-commerce, billing and donation tools allow merchants to accept cryptocurrency payments from customers around the world, with payments deposited directly into the merchant's SpicePay wallet. Merchants can also automatically convert cryptocurrency funds to USD, EUR, GBP or CAD and withdraw funds via SEPA or PayPal.

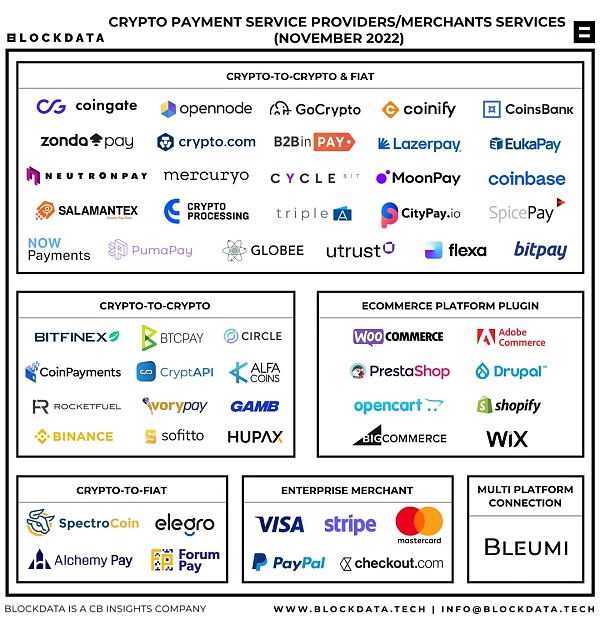

We have created a payments market panorama detailing active cryptocurrency payment providers and categorizing them by the types of payments they support. Cryptocurrency payment providers haven't changed much over the past year.

The State of the Crypto Payment Market in 2022

Crypto Payment Acceptance Is Rising Despite Crypto Market Entering Bear Market

2022 will be a tough year for the crypto market, with the market capitalization of major cryptocurrencies such as Bitcoin and Ethereum falling by more than 50% from their respective all-time highs of $1.3 trillion and $571.7 billion in November 2021.

However, mainstream adoption of cryptocurrencies is on the rise as consumers and merchants become more accustomed to trading digital assets. The average monthly crypto payments processed by crypto payment provider BitPay will increase from 58,000 in 2021 to 67,000 in 2022.

The general decline in the cryptocurrency market has led consumers to prefer cryptocurrencies with more stable prices rather than highly volatile cryptocurrencies such as Bitcoin when paying. According to BitPay, the share of payments using Bitcoin dropped from 57% in March 2022 to 48% in July 2022, while Litecoin's share increased from 14% to 22% during the same period.

Despite the volatility in the cryptocurrency market, merchants around the world are increasingly accepting cryptocurrencies. For example, in August 2022, Italian luxury fashion brand Gucci partnered with BitPay to begin using ApeCoin as a payment method in some of its US stores. Online pet food and supply store Kibbles, fashion brand Charles & Keith and luxury car retailer EuroSports are all enabling cryptocurrency payments at their online stores in Singapore in 2022.

High demand from consumers and merchants has prompted traditional payment companies such as Paypal, Worldpay, Visa, and Mastercard to venture into the crypto payments ecosystem. This will facilitate further growth of the crypto payment market.

Companies around the world are accepting crypto payments

To benefit from the growing demand for crypto payments, many companies are venturing into the space. In November 2022, Gate_io, a US-based cryptocurrency exchange platform, launched Gate Pay, its cryptocurrency payment solution. Initially, it supported 21 cryptocurrencies and later expanded to over 130.

In September 2022, Asia Broadband, a US-based metal resources company, launched its cryptocurrency payment gateway solution, PayAABB, which allows online and offline businesses to accept payments in more than 400 cryptocurrencies. During the same period, cryptocurrency exchange Bitso launched a cryptocurrency payment service in Argentina that can scan QR codes.

In July 2022, Xend Finance, a Nigeria-based cryptocurrency services company, launched XendBridge, a payment API product. In May 2022, IvoryPay announced the launch of its encrypted payment gateway service, enabling merchants to accept payments in stablecoins and IVRY tokens. In February 2022, Solana Labs launched Solana Pay, an encrypted payment solution.

In October 2022, Fireblocks launched Payments Engine, a new set of development tools that allows payment service providers to provide merchants, entrepreneurs and creators with an end-to-end blockchain-based solution that enables them to Accept, manage and settle encrypted payment transactions globally.

The high demand has prompted traditional payment service providers to partner with crypto payment providers to support their merchants in accepting crypto payments. In September 2022, Bahrain-based EazyPay partnered with Binance to integrate cryptocurrency payments at EazyPay's more than 5,000 point-of-sale terminals and its online payment gateway.

In April 2022, Stripe partnered with Circle to enable a new feature for Twitter that allows a certain number of creators on the platform to earn a certain amount of USDC income from its Ticketed Spaces and Super Follows features. During the same period, Nium partnered with BitPay to launch Nium Crypto Accept, a crypto payment solution.

Existing crypto payment providers are further expanding their product portfolios to remain competitive in the market. For example, in November 2022, Bitfinex launched an automatic conversion feature for its crypto payment acceptance solution, Bitfinex Pay. It allows users to automatically convert Bitcoin payments into USDT, thereby reducing the risk posed by price fluctuations. In July 2022, CoinGate added support for Lightning Network payments to its crypto payment solution.

In March 2022, Binance launched Bifinity, a cryptocurrency payments technology company. Bifinity supports over 50 cryptocurrencies and major payment methods including VISA and Mastercard.

Regulators Keen to Push Adoption of Crypto Payments

Singapore is at the forefront of driving the adoption of crypto payments. In November 2022, the Monetary Authority of Singapore (MAS) approved licenses for Circle and Paxos. Circle has a payment institution license that allows it to issue cryptocurrencies and provide domestic and cross-border payment services, while Paxos is authorized to provide digital payment services. In October 2022, MAS authorized Blockchain_com and Coinbase to provide payment services in Singapore. Luno, Digital Treasures Center, Crypto_com, Genesis and Sparrow are the other companies that have been approved by MAS to operate in Singapore in 2022.

In August 2022, Crypto_com received approval from the UK Financial Conduct Authority (FCA) to carry out encrypted asset business in the UK. In January 2022, the FCA granted the encrypted payment company Bottlepay a license to operate as an encrypted asset business.

Countries around the world sanctioned by the U.S. and its allies are keen to embrace encryption for cross-border payments. In September 2022, the Russian Ministry of Finance will allow residents to use cryptocurrencies for cross-border payments. In the same month, the Iranian Ministry of Mines and Trade approved the use of cryptocurrencies as payment methods for imports and exports.

Additionally, in February 2022, Colorado became the first state in the United States to accept cryptocurrencies as a form of tax payment.

The Central African Republic approved bitcoin as the country's legal tender, the second country to do so after El Salvador, which adopted bitcoin as legal tender in September 2021.

What is the future of crypto payments?

Digitization has changed the way merchants and consumers receive and pay money. Cryptocurrencies as a store of value are finally becoming a medium of exchange in mainstream e-commerce.

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.

With the introduction of cryptocurrency-friendly regulations and the adoption of crypto payments by more institutions, crypto payment providers will gain more demand and play a key role in the future development of the crypto payment industry.

risk warning:

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.