It has been more than three months since the aUSD mis-minting incident on August 14. Not long ago, AcalaCommunity LiveThe events and reasons for the incident are described in the During this time, the Acala team has taken various platform recovery steps. So how effective are these recovery measures? What kind of plans does Acala have in terms of products and markets in the future? PolkaWorld interviewed Bette, the co-founder of Acala, to share with us the latest situation and plans of Acala.

PW: Some time ago we saw your first voice after the aUSD incident, and also saw the team share the process and reasons of the entire aUSD incident. After this incident, what experience did Acala gain?

Bette:On this subject, I would like to start by saying that we are very grateful to all of you for your patience and support to help us through this time, and we believe that we will be in a better place after this experience.

During the time when the accident happened, everyone was very humble. During this process, we talked with many partners and other projects that had experienced similar situations. They all gave us very good advice and help, and let us Acala Foundation inFaced with a $3 billion incident, being able to react quickly and leverage around $5 million to cover the gap and turn things around,This is quite a challenge. In addition, in the process, we burst out more initiative to complete the technical optimization and upgrading of each link, and used a lot of work to complete the tracking and processing of incidents.

After this incident, the biggest experience we have gained is that we need to think about how to continuously improve the level of security and awareness, especially in the current blockchain world where cross-chain requirements are magnified. At present, our technical team is also embarking on more security developments to ensure that more tasks and work can be completed safely and stably.

PW: We have seen some measures to restore the platform, how effective are these measures so far?

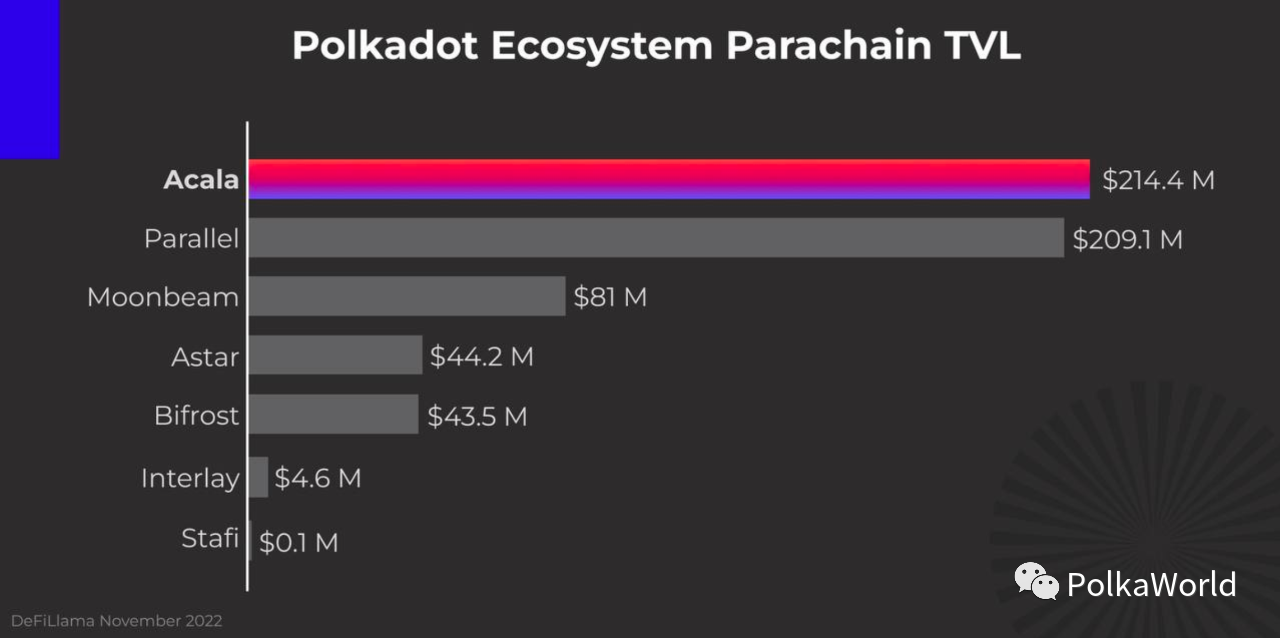

Bette:image description

image description

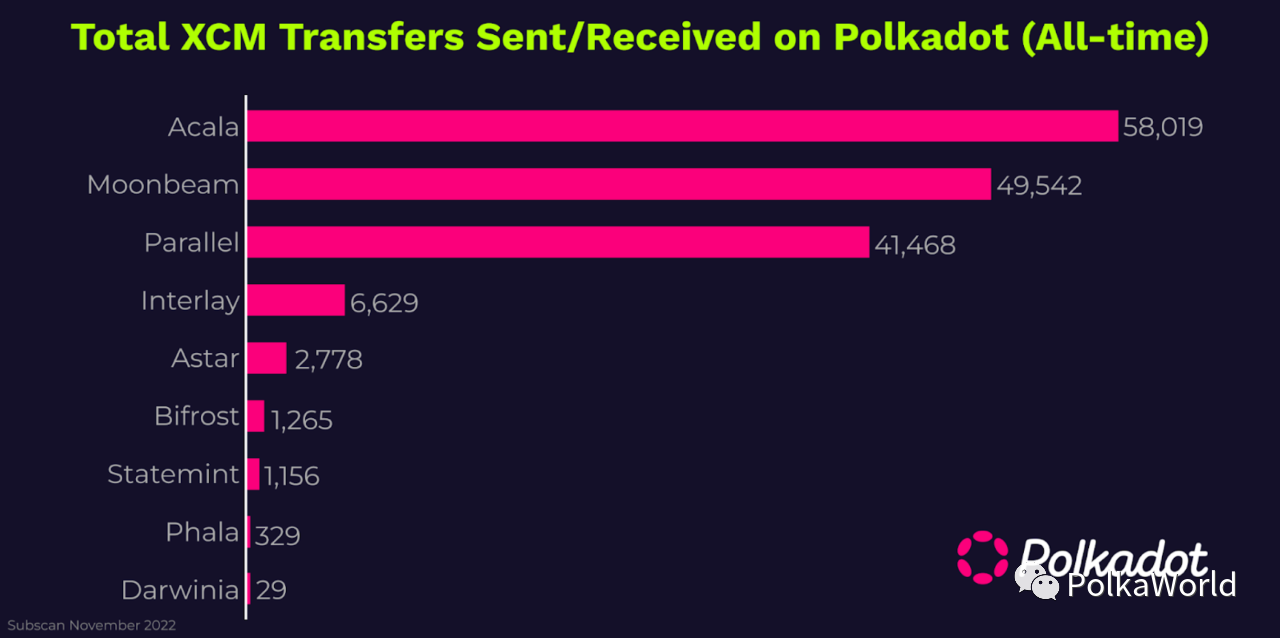

Total XCM send/receive transactions on Polkadot

I have a few things to say about the above data:

first of allXCM transactionsSecondly,

Secondly,Acala's TVL is still No. 1 in the current market environment. I remember that when the Acala platform was restored, it was actually divided into three steps. First, the pool was leveled to the pre-incident level, and then the withdrawal function was turned on, so that everyone could withdraw money from the liquidity pool, which ensured that LPs would not be affected. The effect of price fluctuations during the pause. The second step is to open the aUSD debt warehouse management, which is to allow everyone to manage the debt warehouse, to protect the current assets from the price fluctuations during the suspension period, and to allow those users who are close to liquidation to withdraw their funds to ensure their assets safety. The last step is to enable all functions, such as transactions in DEX and oracle price feeds, etc. After the completion of the three steps, it is true that the TVL has also been reduced to a certain extent due to the squeezed demand during the suspension period. However, as the parachain with the most applications in Polkadot’s ecological native DeFi, and the product is also the most in-demand basic product in DeFi, although the market is down , but Acala's products also meet the needs of Polkadot and Acala users to a certain extent.

The last reason I want to say is thatDecentralized open platforms still have certain advantages over closed-door centralized platforms.You can see the current on-chain status of the entire protocol without us shouting on Twitter that everything is safe, because all data can be checked on the chain, regardless of the mortgage status of aUSD or the status of core assets, you can check it on Subscan. It is not like many centralized platforms that need to prove their innocence, but cannot gain the real trust of users.

PW: I think many people have doubts about aUSD. What is the anchoring logic? Can you talk about the peg between aUSD and $1?

Bette:First of all, I would like to ask everyone, where does the value of aUSD come from? In terms of product design, the value of aUSD is actually determined by the collateral that supports it. Basically, there is sufficient collateral behind every circulating aUSD, which means that if the aUSD debt holder wants to get back 100% or more of the mortgage assets, then he needs to repay every aUSD he borrowed It can only be retrieved after it is given to the debt warehouse. This also provesaUSD is now fully collateralized, is backed by assets and has real value. So aUSD does not generate a risk value similar to a bank run. Of course, our venture partners, experts like Gauntlet, are now more focused on providing parametric advice to balance market volatility risk with capital efficiency. In this sense, aUSD is very different from other types of stablecoins, especially from algorithmic stablecoins.

Second, some people may be very concerned about the peg or market price of aUSD. What is the market price? First of all, there is an over-collateralized collateral behind each aUSD, which is its hard value and guarantee. But aUSD is also traded in the market and will also have fluctuating trading prices. So when trading in a DeX like Acala (of course there are also DeXs on Moonbeam), the market price presented is the current face value of aUSD, which is affected by factors such as market conditions and supply and demand. So as a decentralized stablecoin, its value will fluctuate according to market demand. aUSD was never quite pegged to a point (nor was DAI). So there will always be fluctuations in aUSD depending on supply and demand in the market (especially in a unique situation we are currently in). Under normal circumstances, aUSD may fluctuate in different patterns or at different price levels.

But right now we are in a unique situation in many ways. It includes its own situation, and of course some macro market conditions. So in our example, all the millions of aUSD mis-minted coins in circulation are all mortgaged, which guarantees the value support behind all aUSD. But this also leads toSupply and demand are not completely balanced, and the market needs time to digest and restore balance.And at the same time, the cryptocurrency market and the macro economy are currently in turmoil. Therefore, I believe that reasonable people would think that the process of natural peg in this case will take a certain amount of time, which is reasonable to expect, because every aUSD in circulation is now fully mortgaged.

The fundamentals of aUSD are now stable and verifiable on the chain. Even if you still don’t believe what I said, you can look at the data on the chain and you will know. Also, this could be a good opportunity to get aUSD at low cost to pay off a debt position or arbitrage as aUSD will eventually peg, but of course, this is not financial advice, do your own research. The above is the question about the aUSD peg, it will eventually be pegged naturally, but it will take time, and there is obviously a chance.

PW: Since Luna’s UST algorithm stablecoin stormed, many regions have paid attention to the supervision of stablecoins. Will aUSD face supervision? How prepared is Acala for dealing with regulation?

Bette:Just as the question just explained that there is a fundamental difference between aUSD and UST, aUSD is a decentralized over-collateralized stablecoin, and each aUSD is backed by sufficient collateral. So nothing like a run will happen. Supervision will definitely come, but we have enough preparation and flexibility to adapt to this demand in terms of technical architecture. Our protocol also has the opportunity to integrate with institutional financial systems, so we will continue to explore and upgrade.

Secondly, the Acala team has been working hard on other levels of supervision. Whether it is the cooperation with the American technology bank Current or the cooperation with Coinbase’s Alluvial on institutional staking products, it means that the regulatory level is formal. Agency approved. But the market is always changing, so the regulation will keep pace with the times, so we will work harder on compliance.

PW: How is Acala EVM+ going? Now there is a saying in the community that the emergence of the Move public chain may destroy the existing EVM chain. What do you think of this view?

Bette:Acala EVM+ is already live,But Acala is an Appchain application chain, not a General EVM.It is not on the same track as Polygon and other application chains. Acala EVM+ is more about empowering native protocols and improving user experience.

For example, the Tapio synthetic asset tDOT in the Acala DeFi building block, its protocol and the integration with Acala are all completed at the Substrate layer to achieve unique functions, and then Tapio also deploys the EVM smart contract, in terms of user experience and rewards Further expansion of non-core functions such as distribution, this is a good usage scenario for Acala EVM+.

Therefore, the main purpose of EVM is to serve Acala Appchain. We are also keeping up with the development of Polkadot technology, and will support wasm contracts in the future. For Acala Appchain, no matter what the contract is, as long as it can better empower and optimize the protocol The integrated experience of users and terminals is a good virtual machine, and we will support it.

As for Move destroying EVM, I don't think so, because as a development language that has gone through multiple cycles, EVM is always the first choice for contract developers. Although the current EVM has many defects, no matter what new products are launched, they need certain data and practical operations to judge, so I think it is too early to use "destroy" now. It is better to judge after the Move is widely adopted in the future, and compare it with the EVM chain from multiple actual latitudes.

PW: The recent FTX incident has caused a huge shock to the industry. Is there a connection between Acala and FTX/Alameda? Will the FTX incident affect Acala?

Bette:The FTX incident has no direct impact on Acala,Although Alameda participated in investing in Acala, they only had a very small share and had no influence at all. But what I want to say more is that this incident actually has a profound impact on everyone in our industry.

First of all, compliance will be the trend, and non-compliant centralized platforms will lose the trust of users and the legitimacy of business

Secondly, openness, transparency, decentralization, and on-chain verifiability will once again become the main criteria for everyone to judge value.

In addition, blindly using hype methods such as airdrop and yield farming to create bubbles to show "false" development and prosperity will lose its effectiveness, and more attention will be paid to real value creation and value dissemination

In the end, don’t think that everyone has withdrawn their capital. On the contrary, institutions (Institutions) have become more clear about the next direction, and the preferred track is ready to enter the market. Capital and product applications will follow.

PW: What is the focus of Acala's recent work? Is there any progress in technology and products?

Bette:We have three directions of development work going on.

First of all, through this accident, several technical capabilities of the Acala chain have received a lot of appreciation and recognition, which is why we were able to recover from a major accident, while most projects are the opposite. We willSecurity, especially cross-chain securityIn terms of further innovation and improvement, as well as the enhancement of accident warning, isolation and chain recovery capabilities, this capability will be a watershed in the next Cycle, and it will also be the advantage of Acala as an application chain.

The second direction isInnovation of Native DeFi, to create Polkadot's cross-chain native DeFi products, such as our close cooperation and integration with Tapio, which solved the problems of DOT liquidity differentiation and UX usability and friendliness, and created products such as tDOT. What I want to add here is the Tapio team that launched the tDOT product. Although the market is currently in a downturn, they have recently received a $4 million investment led by Polychain. There are also well-known institutions such as Arrington, Hypersphere, and Spartan. fund. Tapio is a synthetic asset protocol that deeply cultivates the Acala ecology. Their development will bring new impetus to the development of the Acala ecology DeFi.

The third direction isInstitutional DeFi(Institution x DeFi), the era of simply relying on airdrop mining has passed, and the next era will be the era of creating real value and disseminating real value. Then we will turn DeFi innovation into an Institutional Grade solution. Our technology stack can Adding compliance and business-needed components to empower institutions will also be a new starting point for widespread adoption in the future. Individual users of institutions will use compliant and guaranteed applications. The background assets and business logic are provided by Acala, which is not only transparent, open, but also real-time monitorable and supervised. This will be a huge advantage of this type of Institution integrated with us. Especially the FTX incident and the general awareness of the status quo of the black box of the centralized platform. Our Institution liquid Staking solution with partners such as Alluvial x Coinbase x Kraken will be launched in the second quarter of next year, and the LSDOT derivatives generated at that time will also become a new derivative asset in the Polkadot/Acala ecosystem, continuing to provide pure DeFi protocols and User empowerment forms a virtuous circle: DeFi is the output of innovation and products, Institution DeFi (hyfi) is widely adopted empowerment, and the generated liquidity is continuously injected into DeFi.

PW: Finally, can you talk about Acala's future plans?

Bette:we will have nextLaunch and introduction of a series of technical products, There will also be online workshops, including cross-chain UX, substrate multi-chain testing tools, XCM cross-chain asset management and security tools, etc. Developers and students from the technical department are welcome to pay attention and participate.

We have a cross-chain use case cooperation with Talisman and Tapio's tDOT,At that time, a Polkadot native one-click DOT product will be launched, which maximizes real income and provides liquidity for users. There will also be a useful UX and SDK at that time, allowing Polkadot to attract more users and developers. Its strong security and strong decentralization features are exactly what people who have experienced FTX and other baptisms need. We hope that as community contributors, we can do our best to become one of the catalysts for Polkadot to be widely used.

The next thing I want to introduce isWe will also cooperate with Kujira, a small partner of Cosmos,We have improved the liquidation mechanism so that assets can be processed more effectively to protect debt holders, and at the same time allow more users to participate in it and make profits. For example, one-click participation in collateral auctions. Kujira's liquidation pool can democratize ordinary users to participate in collateral liquidation. We are currently working with them on the integration of Substrate and EVM+, as well as the integration testing of their smart contracts, and hope to launch this new product early next year.

The last cooperation I would like to mention isThe Ledger wallet has officially supported the transfer of ACA,And includes assets on other Acala platforms such as aUSD, LDOT and tDOT and assets on the Karura platform such as KAR, aUSD, LKSM and taiKSM. Users can also use Ledger devices to use applications on the Acala and Karura platforms, such as the Liquid Staking function (LDOT) or the DOT synthetic asset developed by Tapio - tDOT. This is a substantial breakthrough for users with high asset security requirements.

Of course, there are still many cooperations and progress that have not been announced. When the details are confirmed, we will announce them on Acala's official Twitter as soon as possible.