Original author:0xLaughingOriginal author:

, Cookie, Rhythm BlockBeats

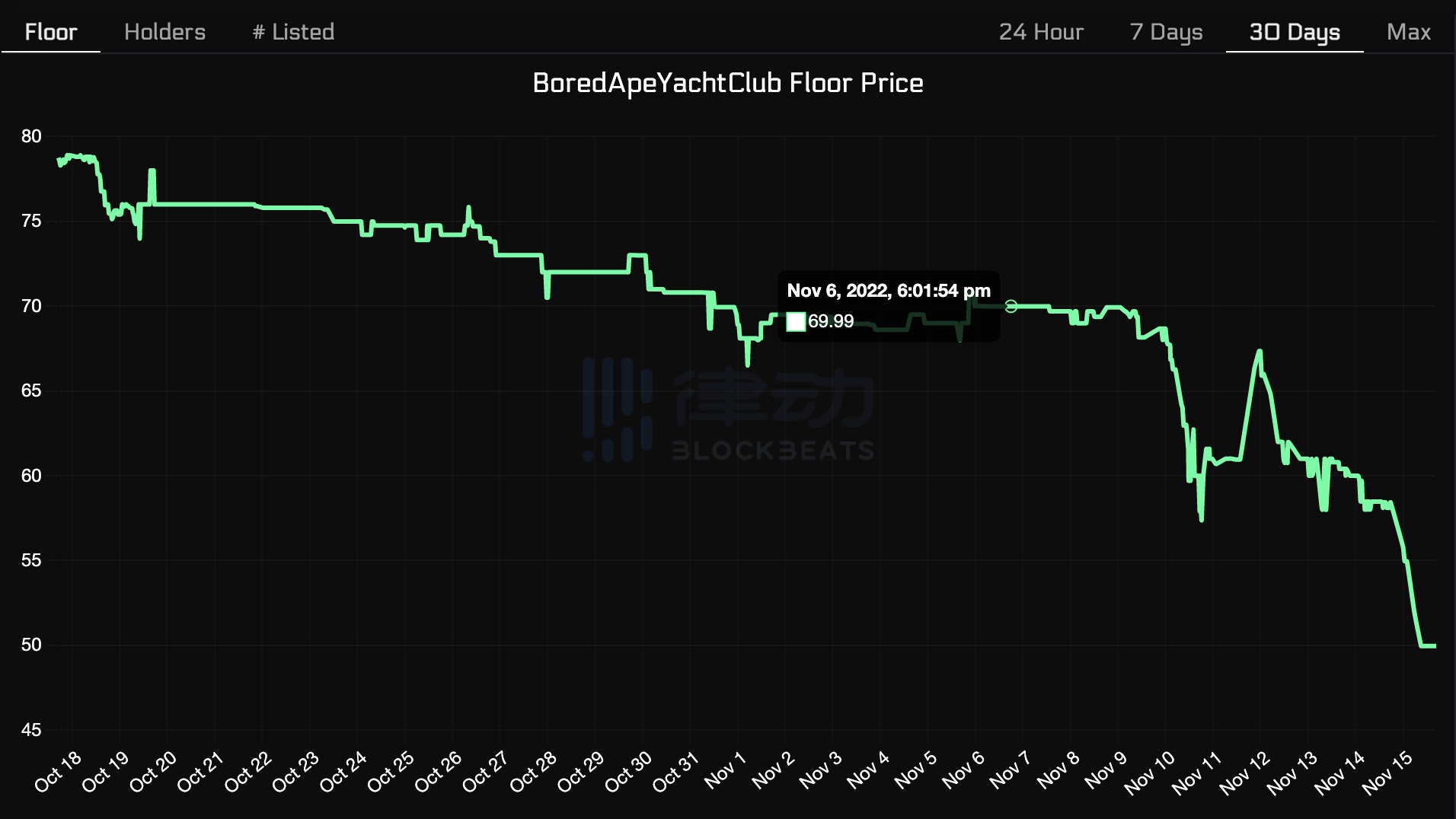

In the past, the crypto bear market came quietly, and then there was the collapse of the Luna Thunder Building. Now the world's second largest FTX exchange has fallen from the industry leader to the altar in just a few days. Every news continues to stir the nerves of the crypto market. The NFT market is no exception, but now a dominant Yuga Labs seems to be unable to sit still.BAYC, owned by Yuga Labs, seems to have been going downhill since the "Monkey Land" sale ended in early May. according toIt shows that the market value of BAYC has dropped from US$4.298 billion at the end of April to US$1.435 billion, a drop of 66.6%, and the floor price has also fallen from the highest point of 145ETH to 48.5ETH a few hours ago. %.

image description

BAYC's floor price and pending orders

However, the transaction data in the last 24 hours is unusual: the floor price fell below 50ETH (a significant drop can be seen from the K-line chart of the floor price above), the 24-hour drop reached 8.55%, and the transaction volume surged by more than 2700ETH.

image description

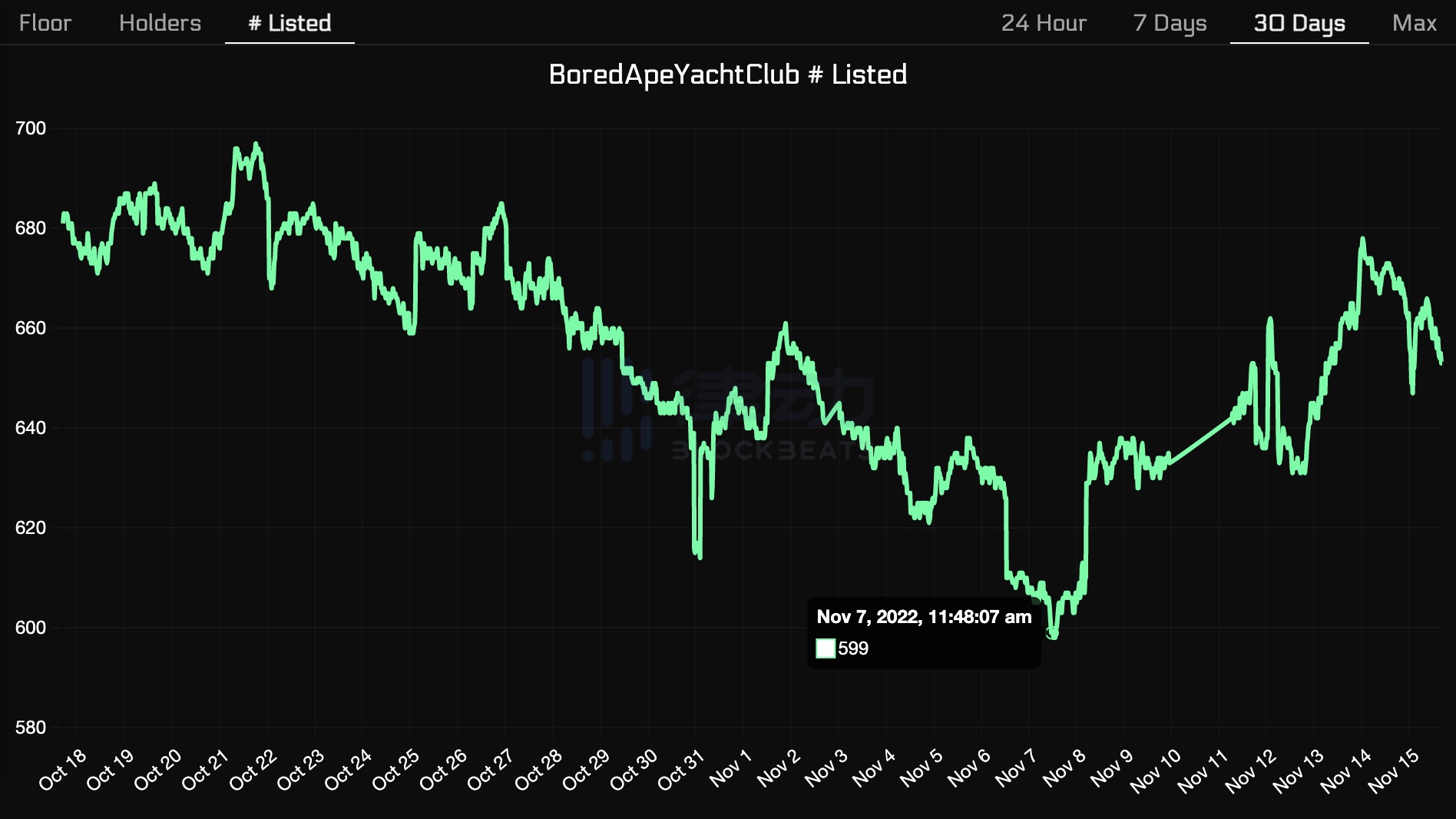

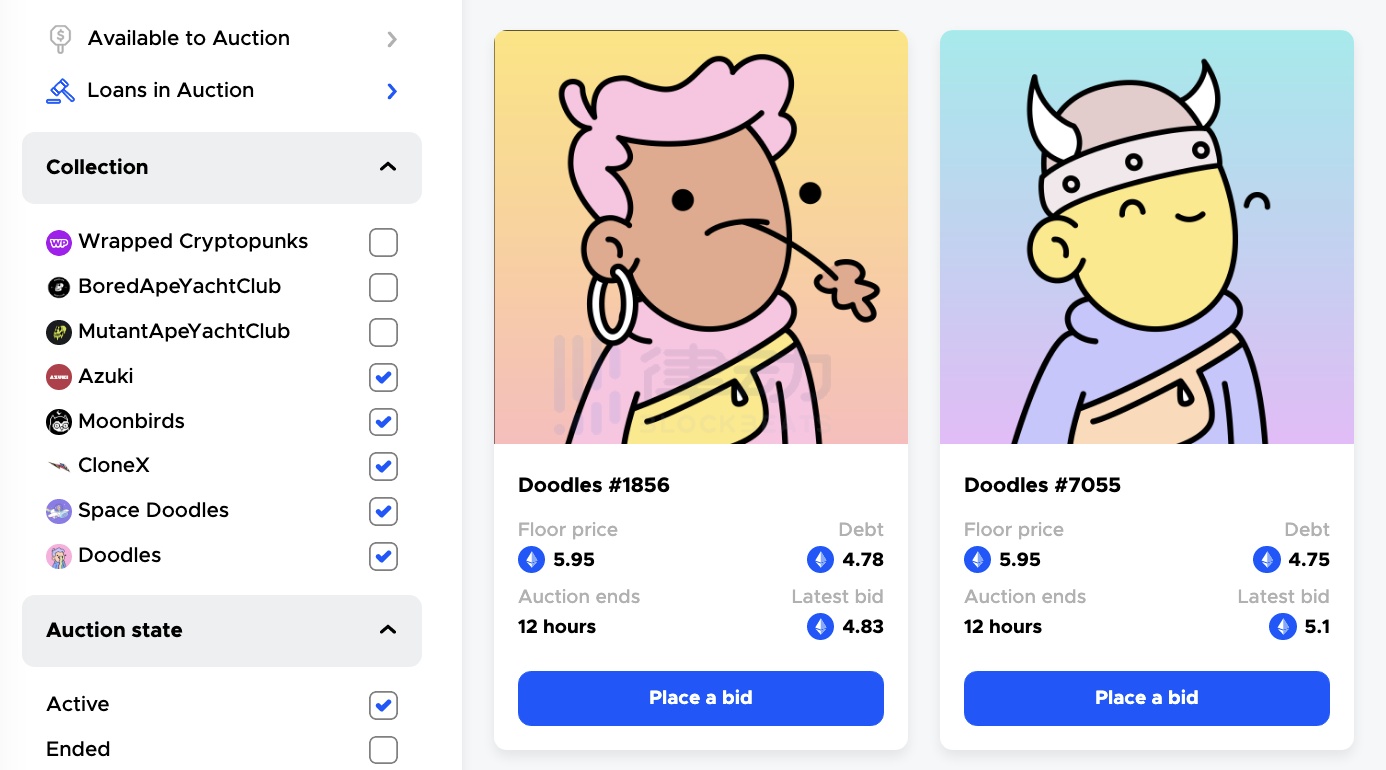

BAYCs liquidating auctions in BendDAO

Due to the drop in the floor price, the BAYC mortgaged in the NFT lending platform BendDAO directly triggered the liquidation auction process, and a large number of BAYC were on the verge of triggering the liquidation auction.Use 1 BAYC to claim 2 airdrops? Detailed explanation of "NFT bank" BendDAOUse 1 BAYC to claim 2 airdrops? Detailed explanation of "NFT bank" BendDAO

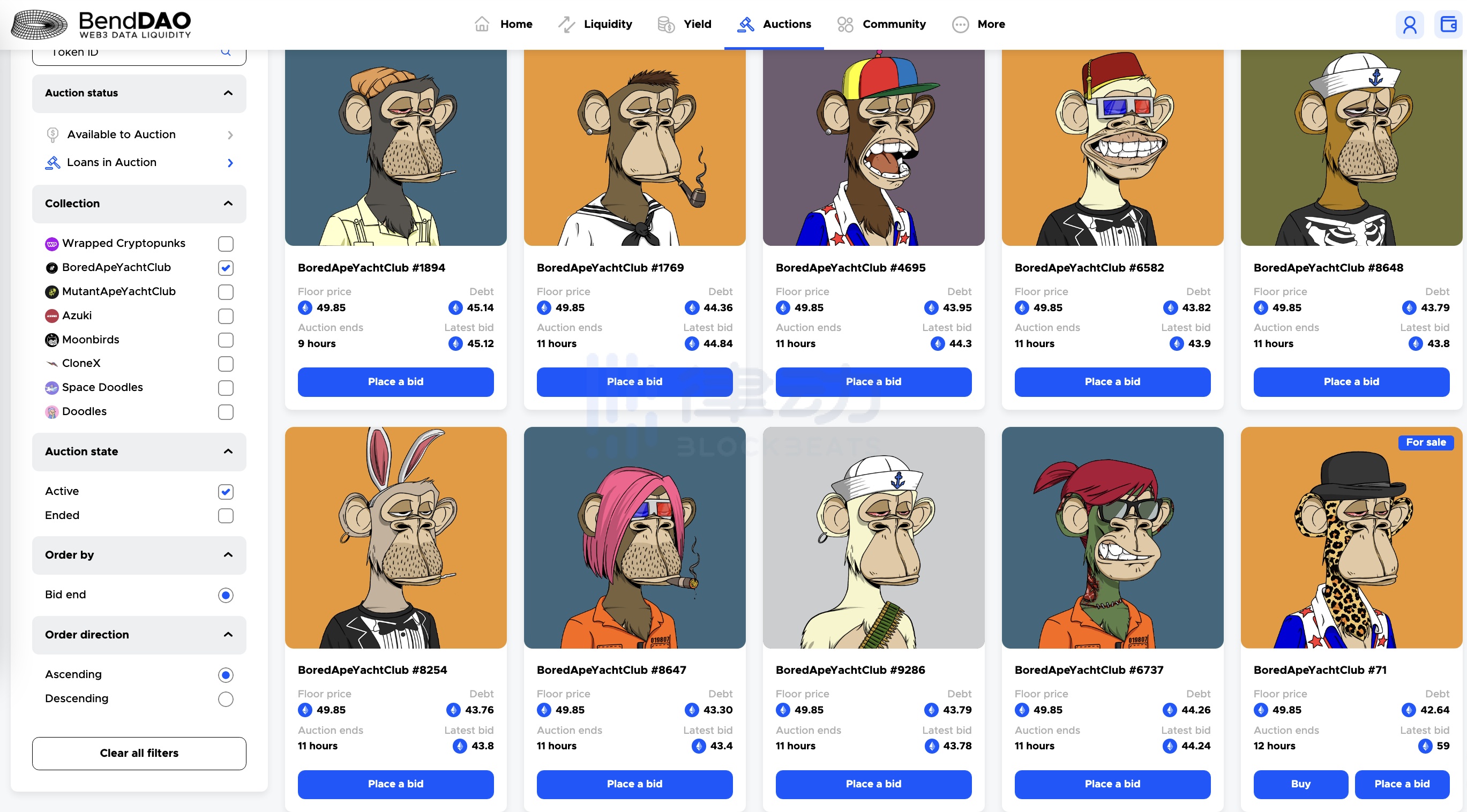

", the current relevant values may be slightly updated)FranklinTable of contents

Table of contents

first level title

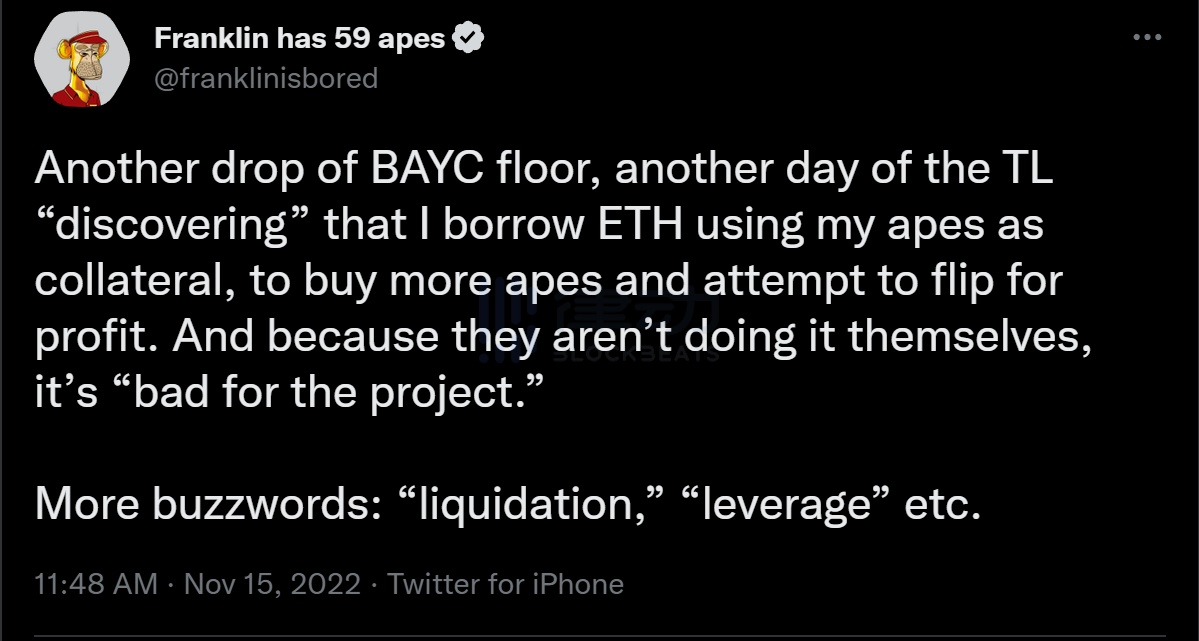

Is Franklin, a big monkey investor, a "smashing arbitrage" or a "clearance sale"?

FranklinHe has been implementing this strategy for a long time. Even when the market of BAYC is not good and falls, he can still obtain very considerable profits. There is no need to be overly FUD, because the fatal point is not "falling" but "no acceptance". At present, neither the transaction of BAYC nor the bidding of liquidation auction of BendDAO has shown any obvious stagnation.

How did he implement the "smashing and arbitrage" strategy?

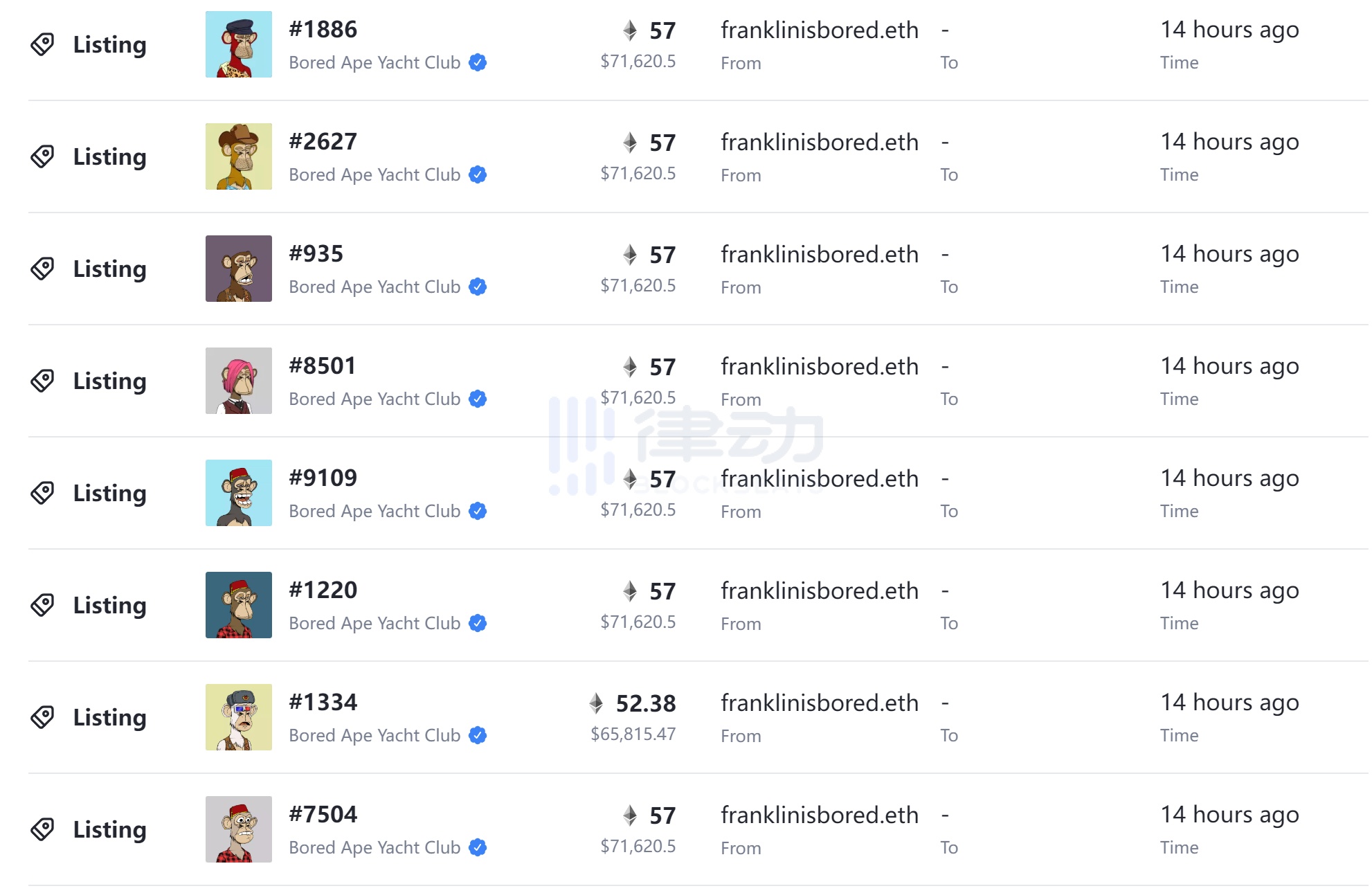

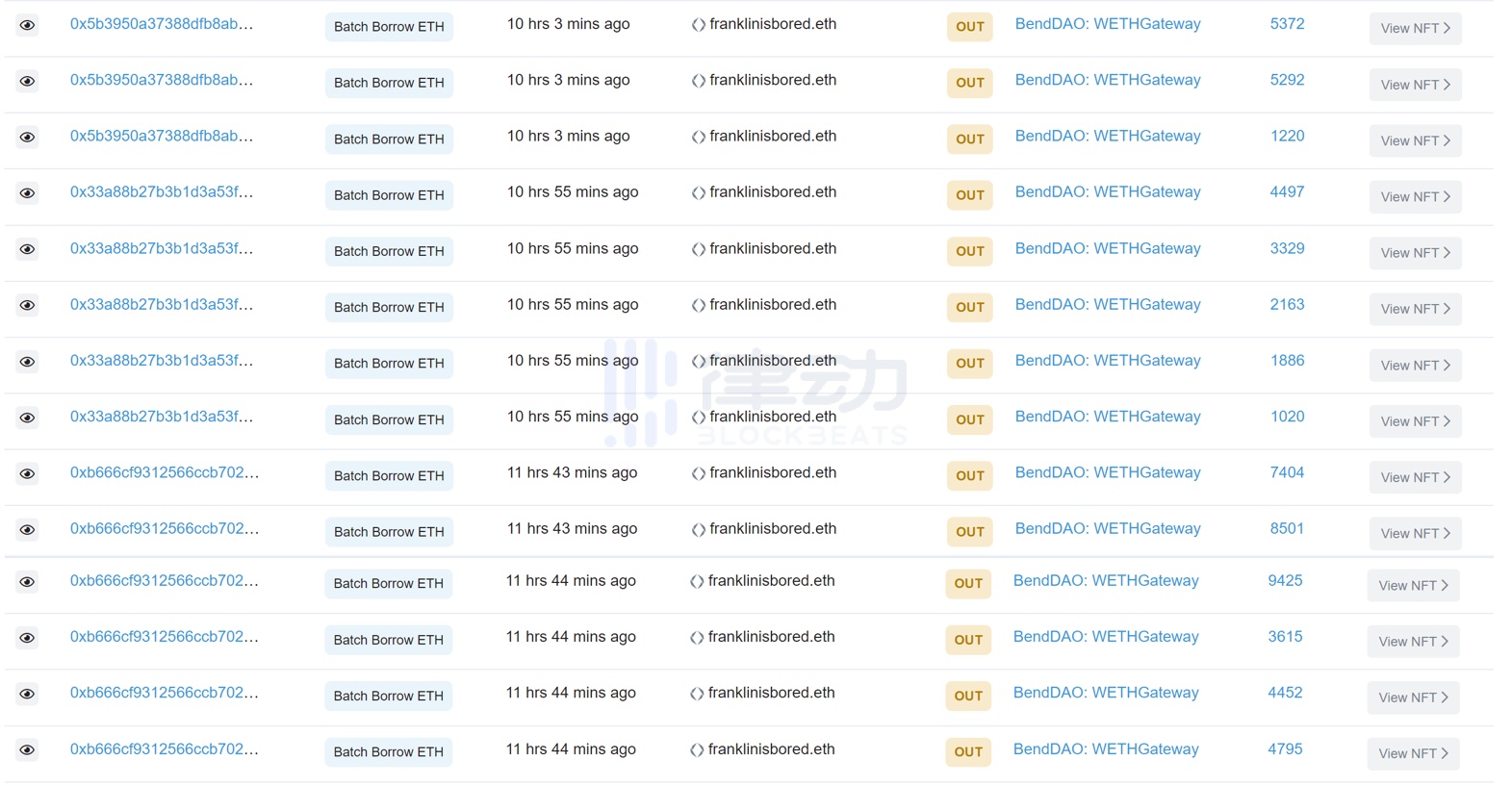

image description

BAYC partially hung out by franklin

First, Franklin listed a bunch of BAYCs at a price close to the floor price, and then received a few lower offers and sold a few of them. In the recent turmoil, this wave of operations looks like a "clearance sale". The surge in pending orders caused panic among other holders, and a lower price than his pending orders appeared, further pushing down the floor price. When BendDAO's oracle feeds the price, the low floor price triggers the liquidation of BendDAO.

image description

In fact, he only sold 4 BAYCs by accepting low-priced Offers, and 14 BAYCs were used for mortgages

Then, he put his 14 BAYC in BendDAO for collateral loan. Taking this loan and the ETH obtained by selling the above 4 BAYCs, he bid on the 7 BAYCs that are being auctioned and liquidated on BendDAO in the price range of 43.8 - 44.3 ETH.Next,

There are three situations that can satisfy him:

• The borrower pays off more than half of the debt within 24 hours after the start of the auction liquidation. At this time, as the first bidder, the borrower can get a reward of 5% of the total debt paid by the borrower. (Based on 45E debt, the reward is 2.25E)

• The borrower failed to pay off the debt, Franklin won the auction and successfully completed buying low and selling high. (That is, the 44E auction is successful, and then go to the secondary market to sell at the floor price of 50E)

• Borrower defaults, Franklin does not win the auction and can either close or keep hitting the floor until Scenario 2 is completed.

If the floor price has fallen below 44E when he wins the auction with 44E, there will be a loss, but the probability of this situation is low.

secondary title

In essence, Franklin’s strategy is short-term short-term but “monkey-oriented” long. He believes that the 4 low-priced Offers he received were sold at a good price. Not only can he get the “first bidding reward” on BendDAO, but also You can participate in liquidation auctions to sell low and buy high. But if the floor price of BAYC cannot rebound back, his strategy will not work.

Will it trigger BAYC's "serial liquidation"?

secondary title

In the short term, it will not trigger the "serial liquidation" of BAYC

In DeFi, it is often caused by bad news that the prices of mainstream digital assets such as Bitcoin and Ethereum have fallen, resulting in the insolvency of mortgage assets in some DeFi ecosystems being liquidated. The liquidation and sell-off process triggered a further decline in mainstream digital assets, which also caused more assets to be liquidated due to insolvency. This reciprocation led to the "serial liquidation" of digital assets, and the price entered a "death spiral."

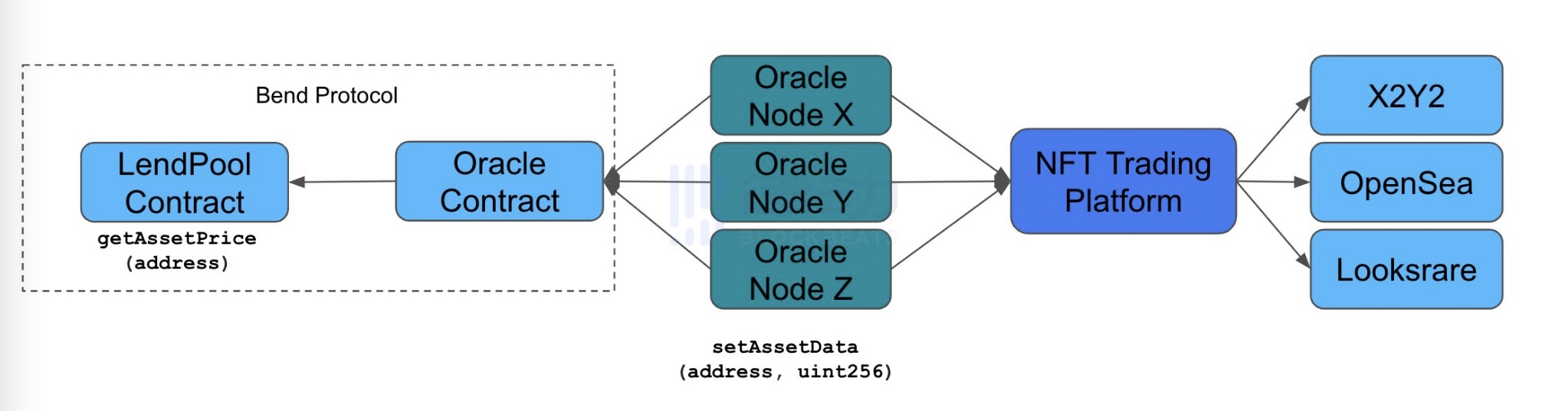

BendDAO’s oracle feed price is the floor price data obtained by off-chain nodes from OpenSea, Looksrare, and X2Y2, and the NFTs that are being auctioned and liquidated are not sold on NFT trading platforms such as OpenSea, so they will not pull down these secondary markets After the floor price is reached, the price data is fed to the oracle machine, causing the mortgaged NFT inside the platform to be further liquidated. In other words, the transaction price of BendDAO's liquidation auction will not be fed to itself.

secondary title

In the long run, if the liquidation auction is not completed in time, it may have an impact on the market outlookThe impact of the Luna thunderstorm is far-reaching, the aftermath of the FTX crash is still unresolved, and the NFT market is in a cold winter. Unlike the last run on BendDAO, the current "first bid reward" will help digest the liquidation auction, which means that no one will come purchase,

However, when a large number of BAYCs trigger liquidation auctions on BendDAO and are sold at a price lower than the floor price in the secondary market, repeated use of the same strategy to "smash the market for arbitrage" may cause a further drop in the floor price and trigger more liquidation auctions.Worse, if the floor price quickly falls below the debt amount of the borrower, there will be no room for arbitrage, which may keep BAYCs in a state of no redemption or auction., reducing the liquidity of other NFT trading platforms, causing the floor price of the secondary market to fall further, entering a vicious circle.

first level title

Will there be a run on BendDAO this time like last time?

BendDAO is insolvent, is NFT finally ushering in the subprime mortgage crisis?BendDAO is insolvent, is NFT finally ushering in the subprime mortgage crisis?BendDAO is insolvent, is NFT finally ushering in the subprime mortgage crisis?

At the same time, the floor price of many NFTs has quickly fallen below its debt price. Restricted by auction rules (requiring bids to be 95% higher than the floor price and higher than the debt price), most of the NFTs in liquidation auctions are either unable to bid Either it is unprofitable, and liquidators who have lost their motivation for arbitrage choose to wait and see, which leads to a large number of NFTs that no one participates in the auction, further exacerbating the liquidity run.

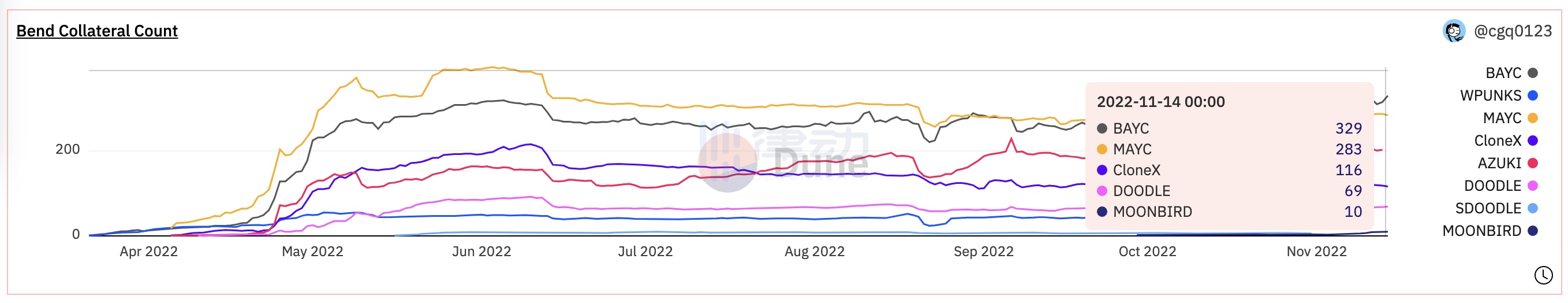

Overview of mortgaged blue-chip NFTs in BendDAO (source:Dune@cgq0123)

image description

At that time, it was the poor performance of the entire NFT market that caused the floor price to fall, which led to the lack of confidence of NFT traders; the small amount of bad debts at the beginning of the crisis were not resolved in time, which caused the panic and stampede of the liquidity providers of the lending pool.

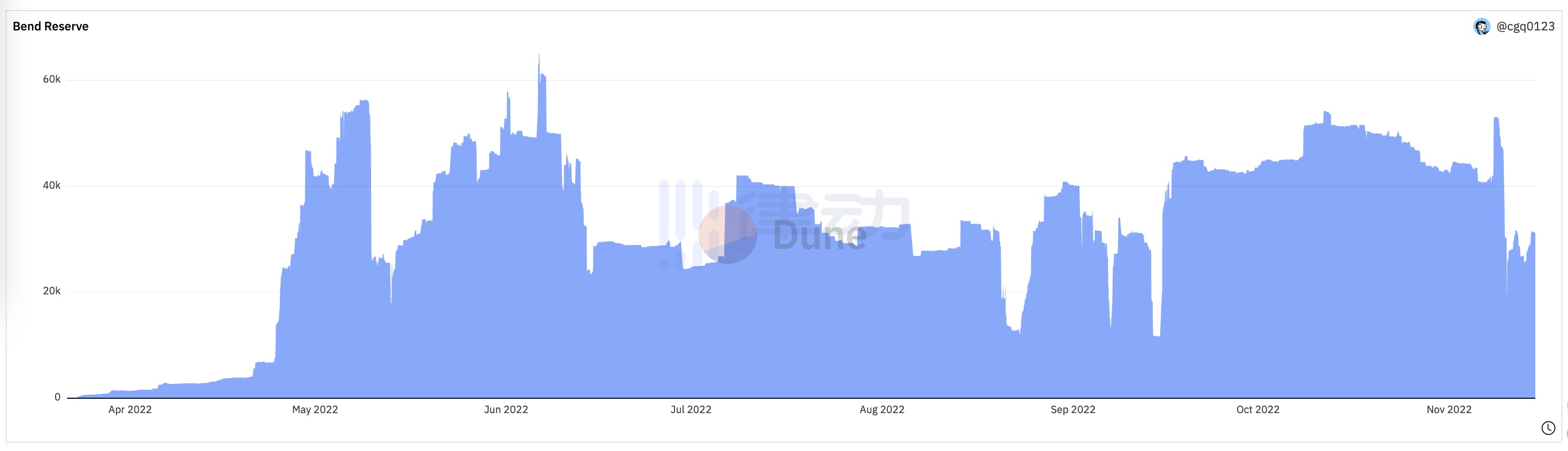

image descriptionDeadline for publication, according toDune data

, there are 31,422 ETH in BendDAO's loan pool, and the reserve is in good condition

But this time, only BAYC had a relatively serious liquidation auction phenomenon, and after that incident, BendDAO made improvements in the mechanism, making adjustments to the liquidation threshold, auction cycle, bidding restrictions, and base interest rates. The display page in the UI interface that may cause misunderstanding and panic has been improved. Now one of the key points of "smashing arbitrage" is "the first bid reward" is also one of the improved measures.

In addition to BAYC, 5 MAYCs are also in the liquidation auction state, and a large number of MAYCs are on the verge of triggering liquidation. Here comes the question again. Behind the liquidation auction of the two flagship projects in the hands of the former champions, why are their holders so panicked? Is there something wrong with Yuga Labs?

first level title

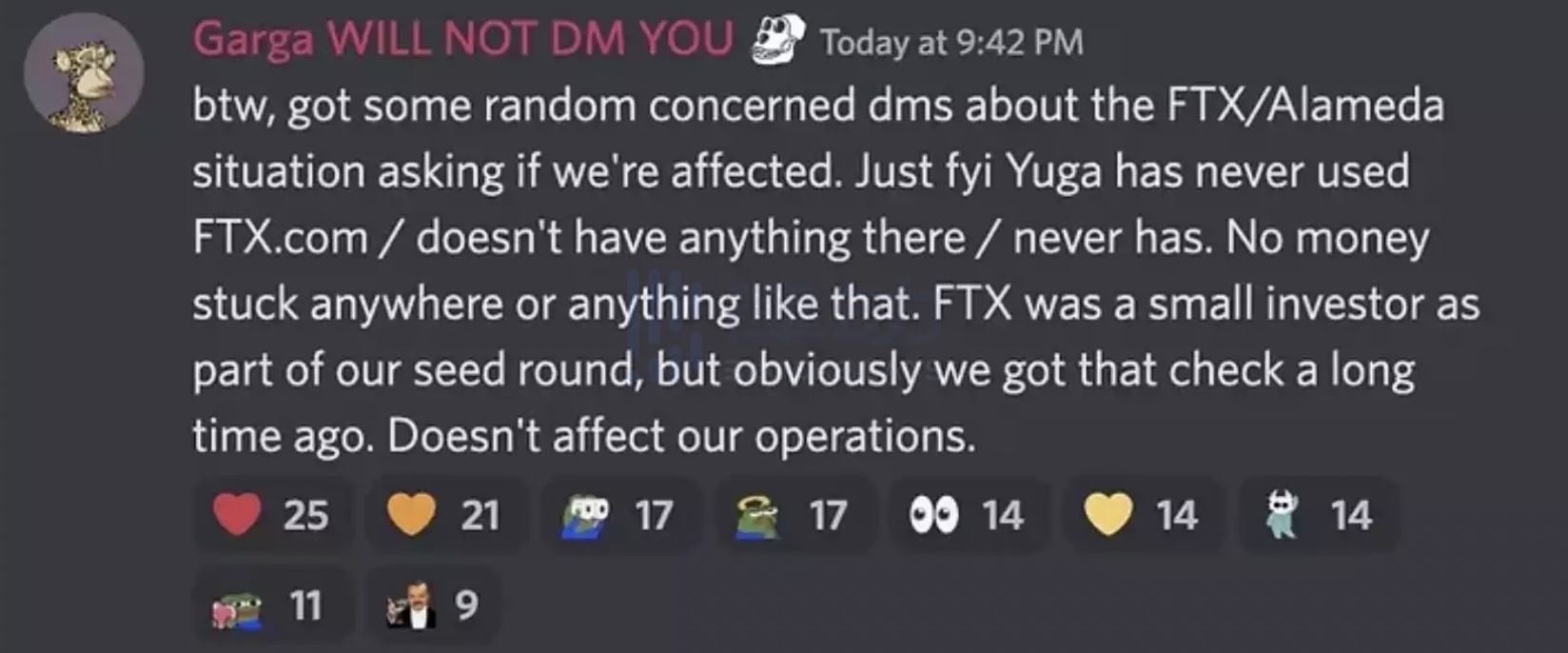

Moment of FUD: Is Yuga Labs' Vault on FTX?

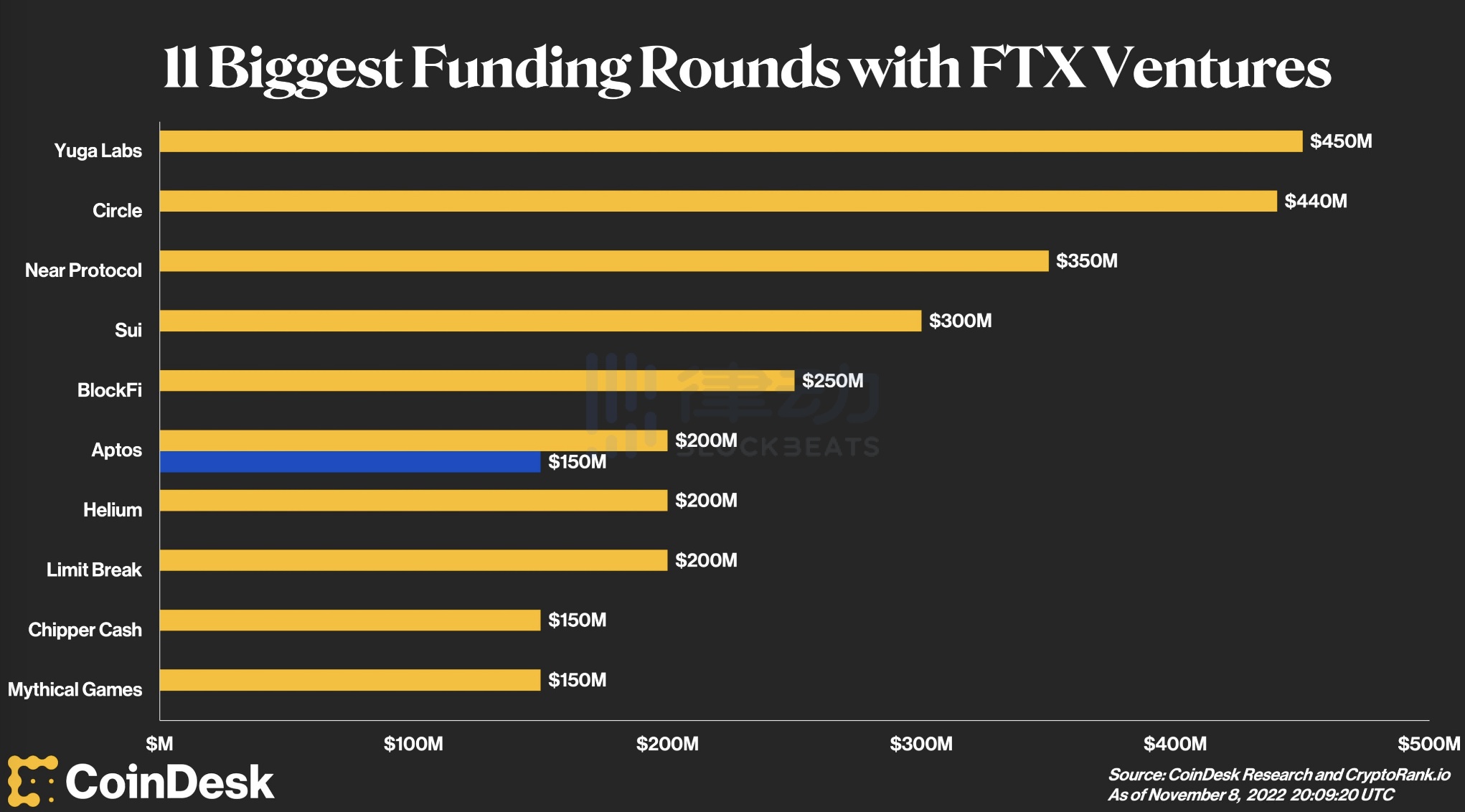

On November 8, CoinDesk summarized and announced the largest investment projects and financing amounts of FTX Ventures, and Yuga Labs ranked first. according toto reportto report

The huge financing shows that it is closely related, so is the money raised by Yuga Labs placed on FTX?

secondary title

18,000 ETH royalties go to FTX

In the face of doubts, Garga, the co-founder of Yuga Labs, spoke in Discord on November 11, saying that the entire encryption market is concerned about the serious consequences of FTX and SBF, but Yuga Labs does not have any funds on FTX. He wrote: "By the way, some people in the market asked us if we were affected by the FTX/Alameda incident. Yuga Labs has never used FTX.com, nor has any funds and assets on it. Although FTX is Yuga Labs Seed round A small investor in the financing, but obviously we received their check long ago and it will not affect our operations.”Just an hour later, Compass, an NFT analysis platform, "struggled": announced the revenue of Yuga Labs' royaltiesAddress Interaction Record

, found that more than 18,000 ETH was sent to FTX, and 57,473 $APE was also sent to FTX.

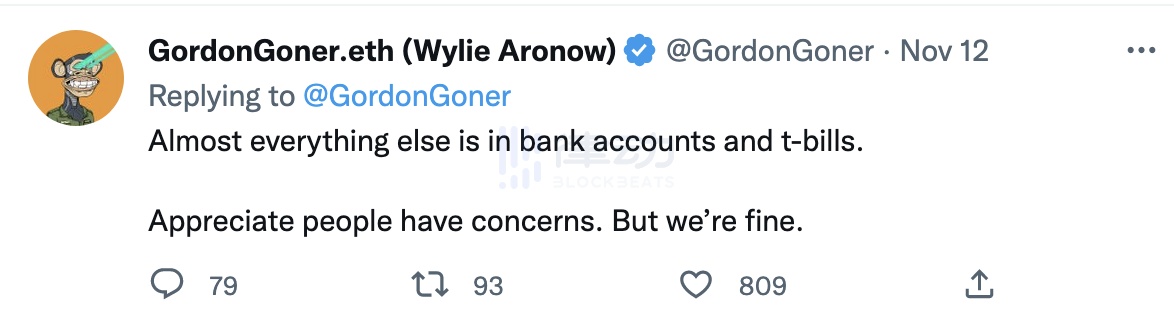

Obviously, Garga's "safety statement" seems to have lied and is not convincing.On November 12, Wylie Aronow, another co-founder of Yuga Labs, stated again on his personal Twitter: "The FTX incident has not affected us. Although some of our partners may have used it, we have never used it. We are in FTX There are some funds on it, but we moved it out earlier this week.” Meanwhile, Wylie Aronow announcedWithdrawal chain recordsFTX.US, found that 19,666 ETH were indeed transferred from

Wylie Aronow meant that OpenSea sent the royalties to the FTX wallet, not Yuga Labs official. He also seems to mock those FUD people as "unhinged" and "amateur etherscan detectives".

CT didn't accept the account, it's only a few dollars, where is the big head?

image description

It's just that "typing certificate is innocent" seems to be unconvincing

In fact, even if the nearly 20,000 ETH transfer records announced by Wylie Aronow are true, its value is only more than 20 million U.S. dollars, which is far from the previous financing of 450 million U.S. dollars. Compared with the entire national treasury, it is only a drop in the bucket, so where did most of the funds go?

"Etherscan detectives" were unable to provide evidence, and Yuga Labs was only "typing proof of innocence". Compared with CEXs who are all raising money to make Merkle trees to prove that the reserves are sufficient, Yuga Labs' statement seems to be less convincing.

What is the truth?

image description

Last night Yuga Labs announced the acquisition of WENEW Labs and its flagship NFT series 10KTF

More radical "rumors" think that Yuga Labs' announcement of the acquisition of 10KTF at this point in time seems to be "bravery": Look, we still have money to buy, stop your FUD.

If Yuga Labs really lost most of its funds in the "FTX Thunderstorm", then the panic of BAYC holders seems understandable. After all, without financial support, even the leader may not survive the crypto winter.