Original author:Original author:

Aunt Aimest.ioThe blockchain currently revolves around two things: 1. Addresses; 2. Transactions. Going to use an interesting tool today

Analyze the wallet addresses of blockchain celebrities to understand their investment situation, as well as the asset status of the bear market, and see what inspiration can be given to ordinary investors.

The celebrities selected are: @Justin Sun @神鱼@SBF @冯波@王峰

Note: Because the Mest product is still in the Alpha stage, there may be some data accuracy issues, this content is for reference only.

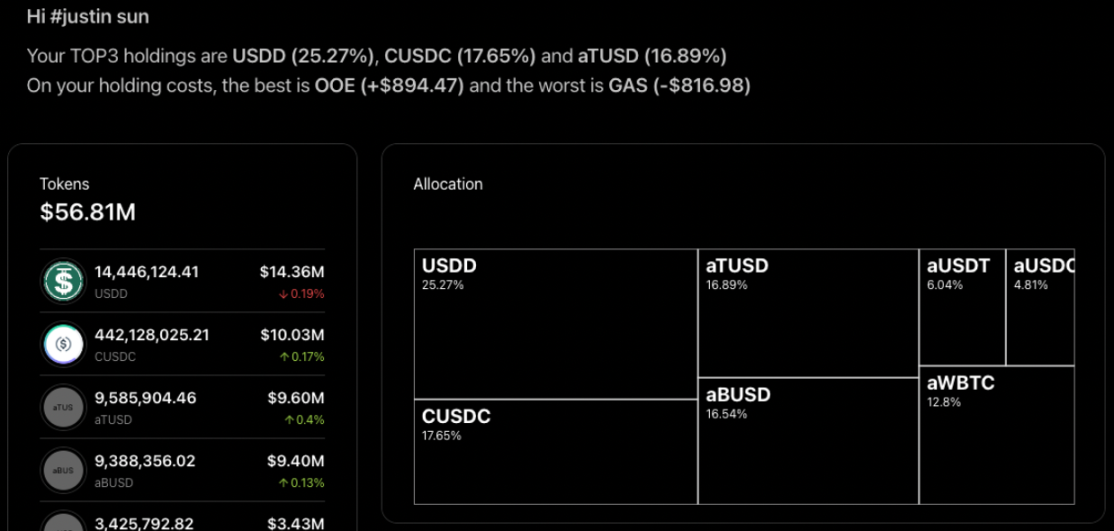

Justin Sun

0x3DdfA8eC3052539b6C9549F12cEA2C295cfF5296

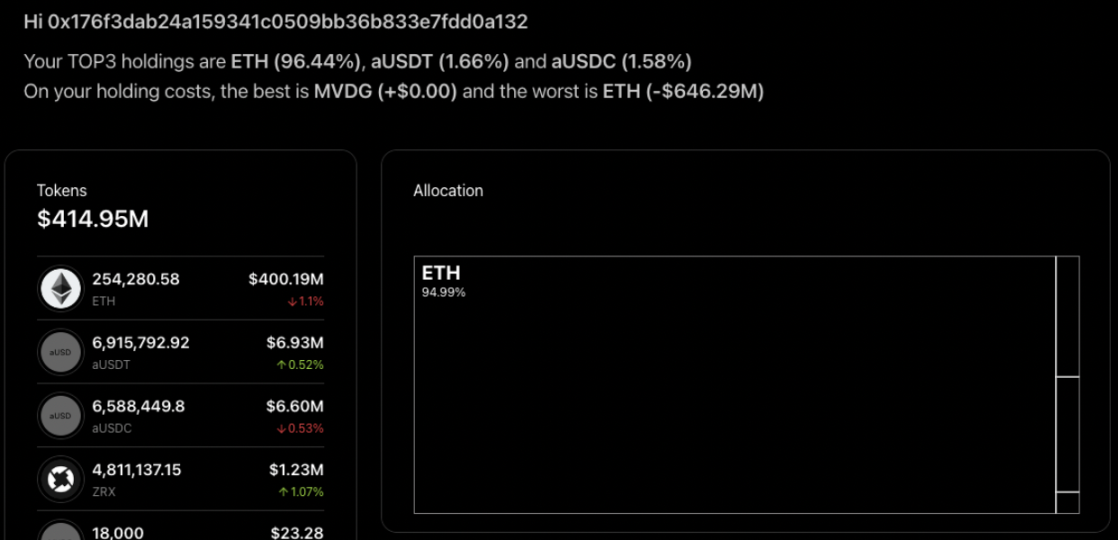

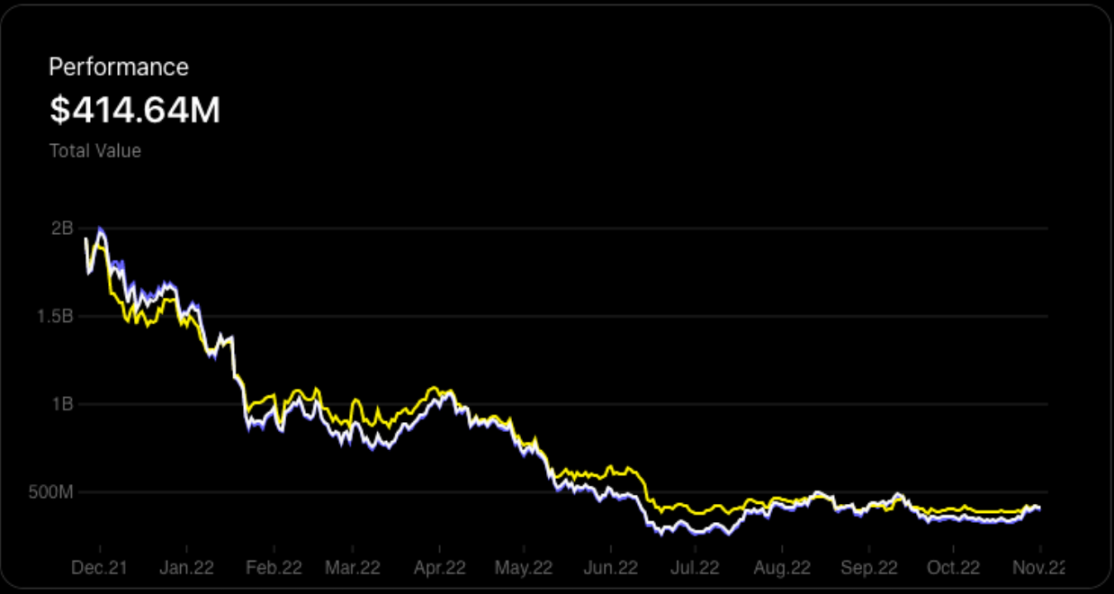

0x176f3dab24a159341c0509bb36b833e7fdd0a132

secondary title

The tokens currently held by 0x3Ddf are mainly stable coins, which is in line with the stable investment under the bear market. The address 0x176f is mainly based on ETH, supplemented by stable coins.

secondary title

When the ETH at address 0x176f was transferred to the wallet, the price was \(4115, the current price is \)1573, down 62%, with a loss of nearly 650 million US dollars, and it became the token with the worst investment performance in this wallet address.

secondary title

Does it outperform BTC or ETH?

Outperform simply investing in BTC or ETH means that when a certain token is transferred in or out of the wallet, it is converted into equivalent BTC or ETH, thereby simulating the investment in BTC and ETH.

Because the address 0x3Ddf holds more stable coins, it is no surprise that it outperformed BTC and ETH investments.

Since the address 0x176f mainly holds ETH, the performance of Performance is basically the same as that of the market.

God fish

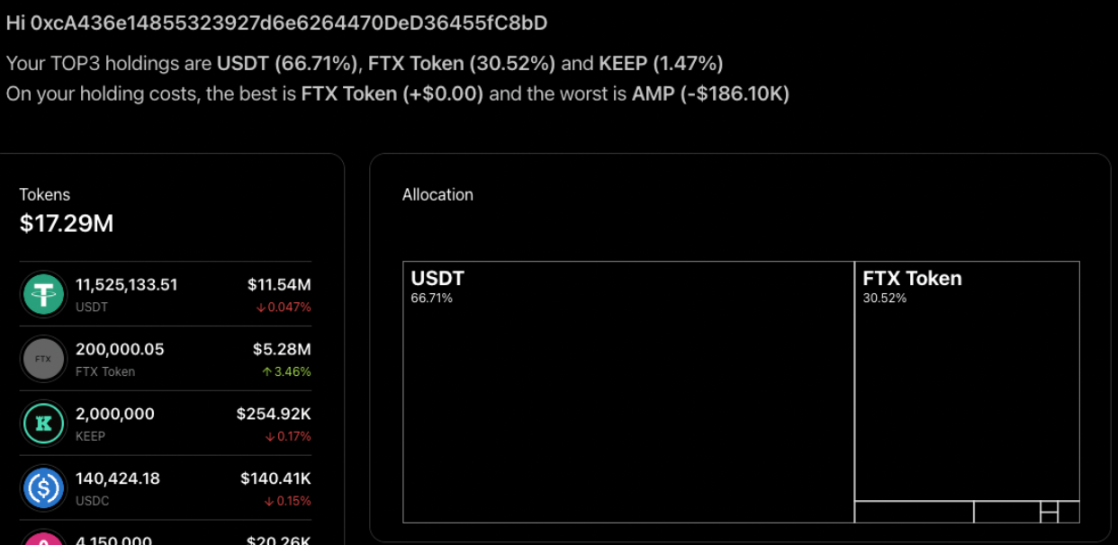

0xcA436e14855323927d6e6264470DeD36455fC8bD

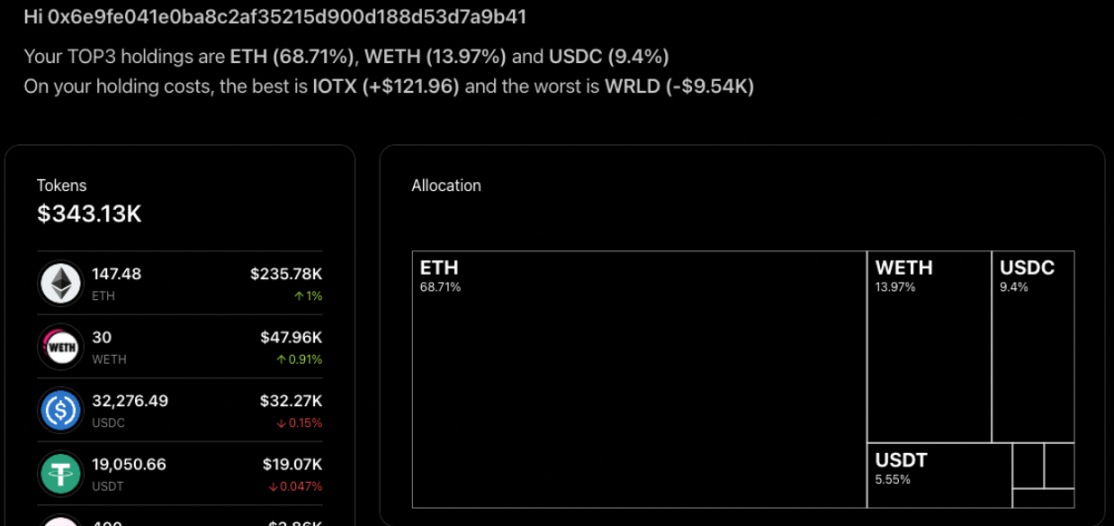

0x6e9fe041e0ba8c2af35215d900d188d53d7a9b41

secondary title

0xcA43 is mainly stable currency and FTX, which is a little more aggressive than Justin Sun, but because USDT accounts for more than 60%, the risk is controllable. The address 0x6e9f is similar to that of Justin Sun, both of which mainly invest in ETH, but the volume is not large, and the others are stable coins.

secondary title

Holding cost

The cost price of the ETH mainly held by the other address 0x6e9f was 2590 when it was transferred in, which was about 40% lower. Price performance here is slightly better than Justin Sun's.

secondary title

Does it outperform BTC or ETH?

Therefore, Shenyu’s overall investment performance is slightly aggressive. Although it holds certain high-risk currencies, the risks are basically controllable because most of the stablecoins and ETH.

SBF

0x84d34f4f83a87596cd3fb6887cff8f17bf5a7b83

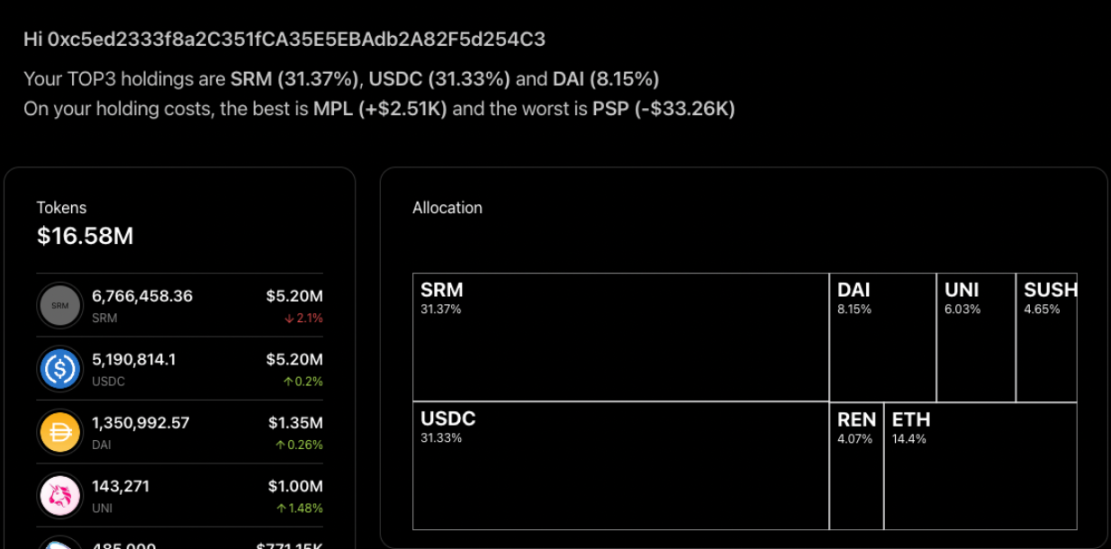

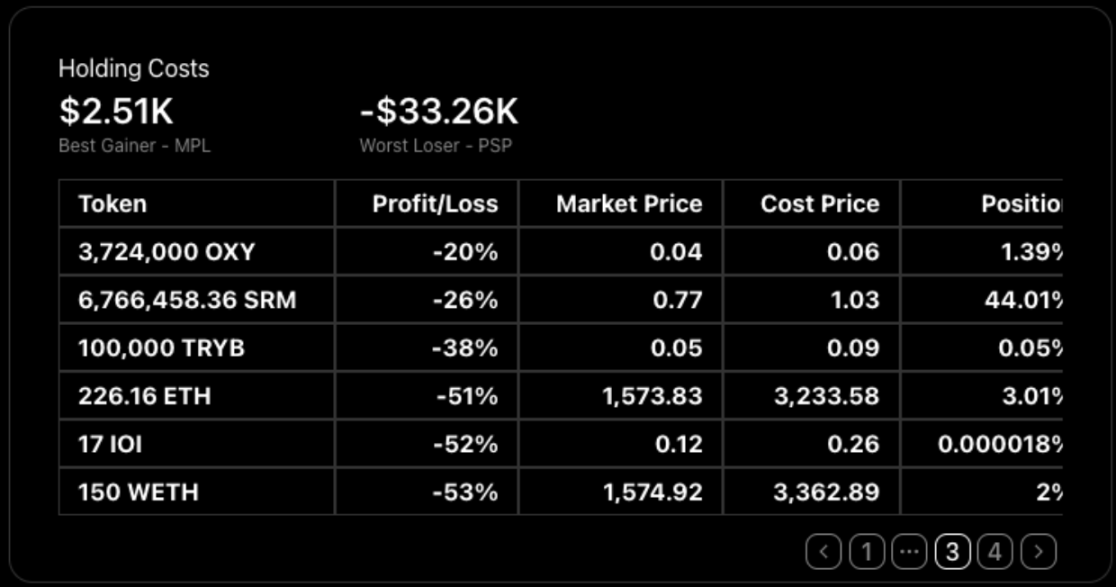

0xc5ed2333f8a2C351fCA35E5EBAdb2A82F5d254C3

secondary title

The address 0x84d3 is only $18.99k, and the volume is not large, so we will not analyze it for now. Mainly look at the address 0xc5ed, the most held are SRM, stable currency and Uni.

secondary title

Mainly look at the cost of SRM and Uni at address 0xc5ed. The holding cost of SRM is \(1.03, the current price is \)0.77, a decrease of 26%, while the holding cost of Uni is \(5.57, the current price is \)6.98, an increase of 25.27. Because of the larger volume of SRM, the overall investment is still in a state of loss.

secondary title

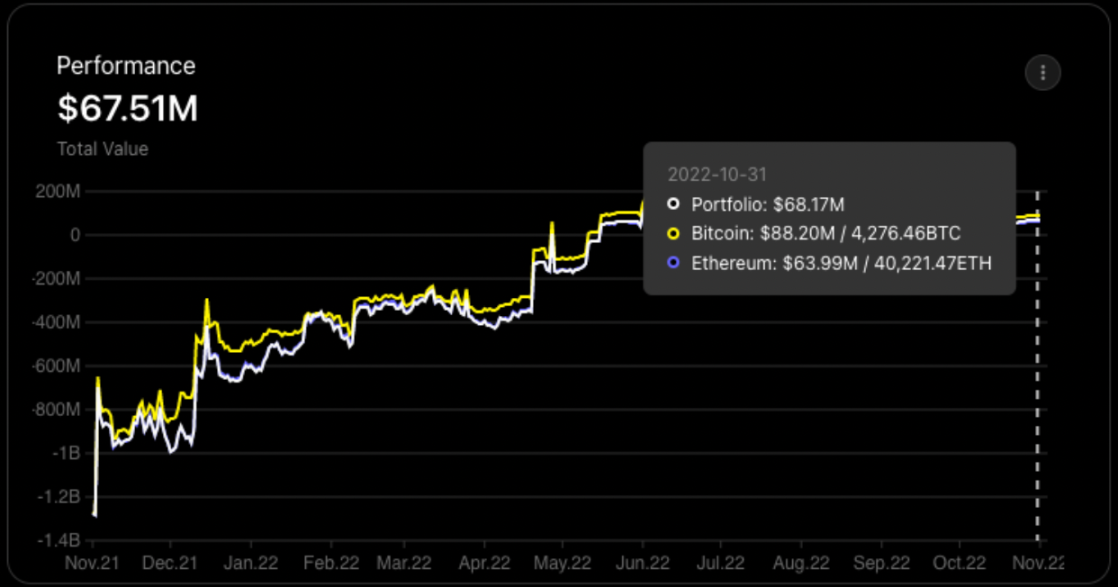

Does it outperform BTC or ETH?

Interestingly, the investment at address 0xc5ed underperformed for BTC, about 30% lower, while the investment for ETH was indeed profitable.

Feng Bo

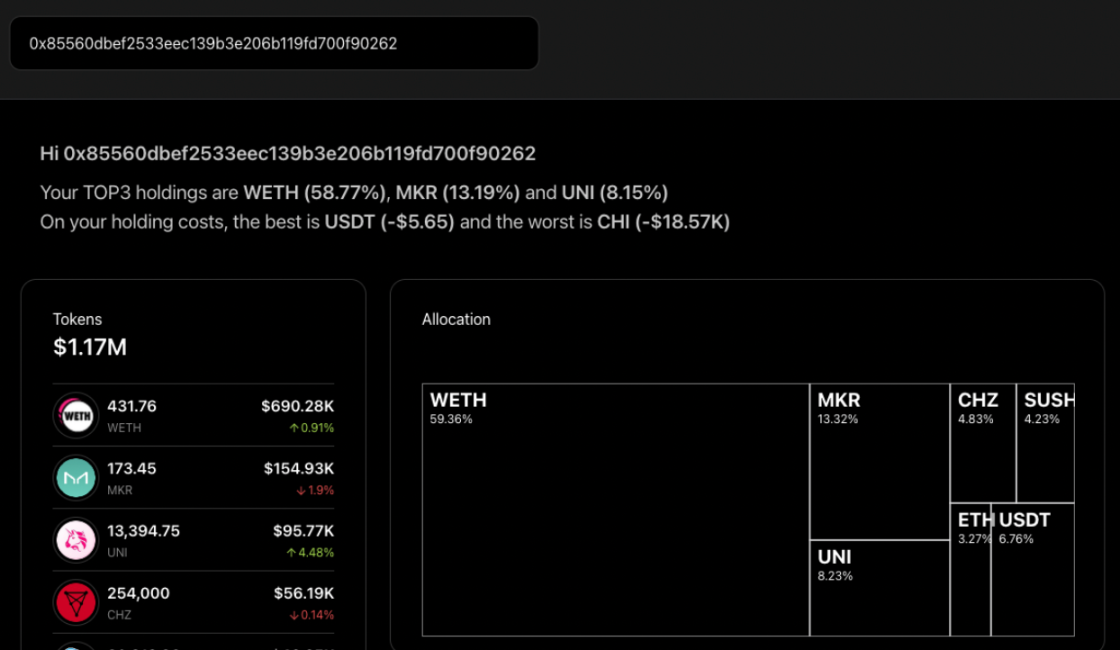

0x85560dbef2533eec139b3e206b119fd700f90262

secondary title

Mainly holding WETH/MKR/Uni/CHZ/SUSHI and some stable coins, it can be seen that Feng Bo's investment is very inclined to DeFi, which is very vertical.

secondary title

The holding cost of WETH is around \(3200, which is 50% lower than the current price. The holding cost of MKR is also very high, more than \)2000. Others like Uni/CHZ/Sushi also have higher holding costs. It can be seen that Feng Bo's current investment strategy is Hodl, because the cost of holding positions is relatively high, so he can only wait for the next bull market.

secondary title

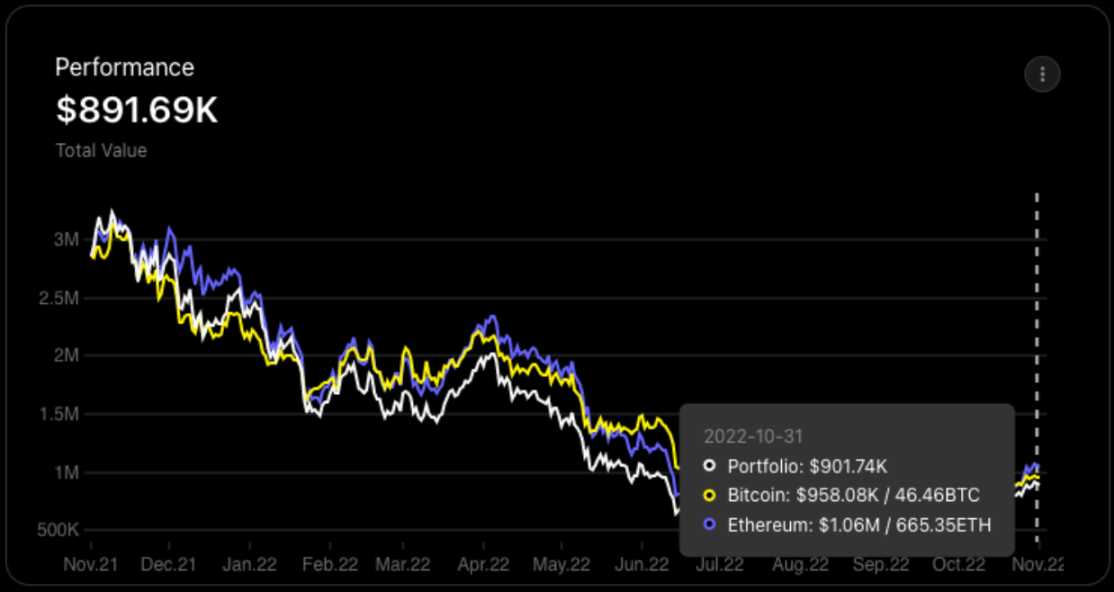

Does it outperform BTC or ETH?

Wang Feng

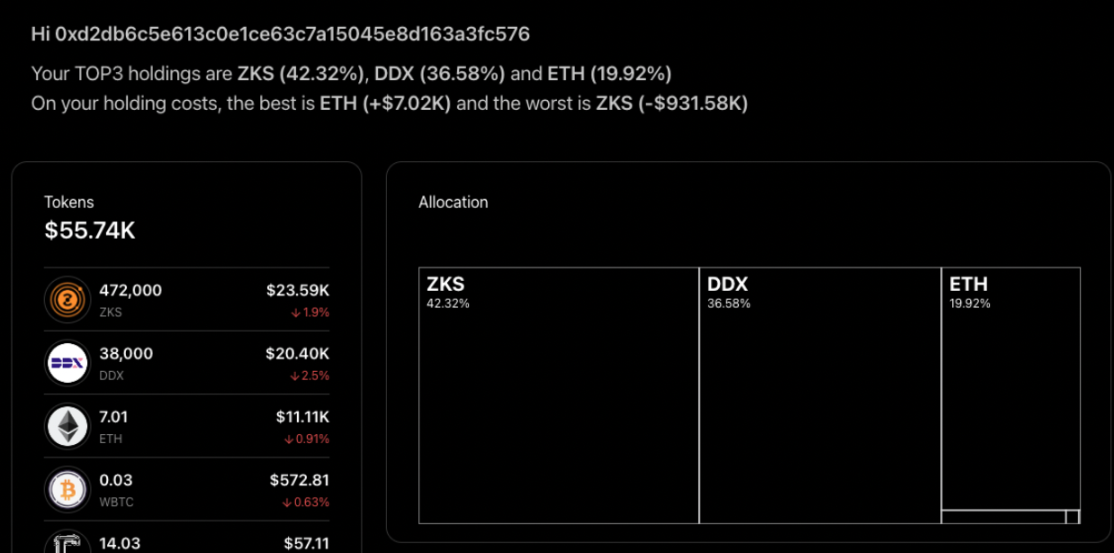

0xd2db6c5e613c0e1ce63c7a15045e8d163a3fc576

secondary title

There are not many assets in this wallet address, and it is not very informative, but we still try to dissect some valid information. The positions are mainly ZKS/DDX/ETH, which seems to be more inclined to the Layer2 zero-knowledge proof solution.

secondary title

From the perspective of ETH holding cost, Wang Feng is indeed a very early investor, with less than \(600, but the performance of ZKS and DDX is too bleak. DDX holding cost is \)5.59, while the current price is only \(0.54, down The performance of ZKS is even worse, the cost of holding positions is \)2.02, and the current price is only $0.05, a drop of more than 40 times.

secondary title

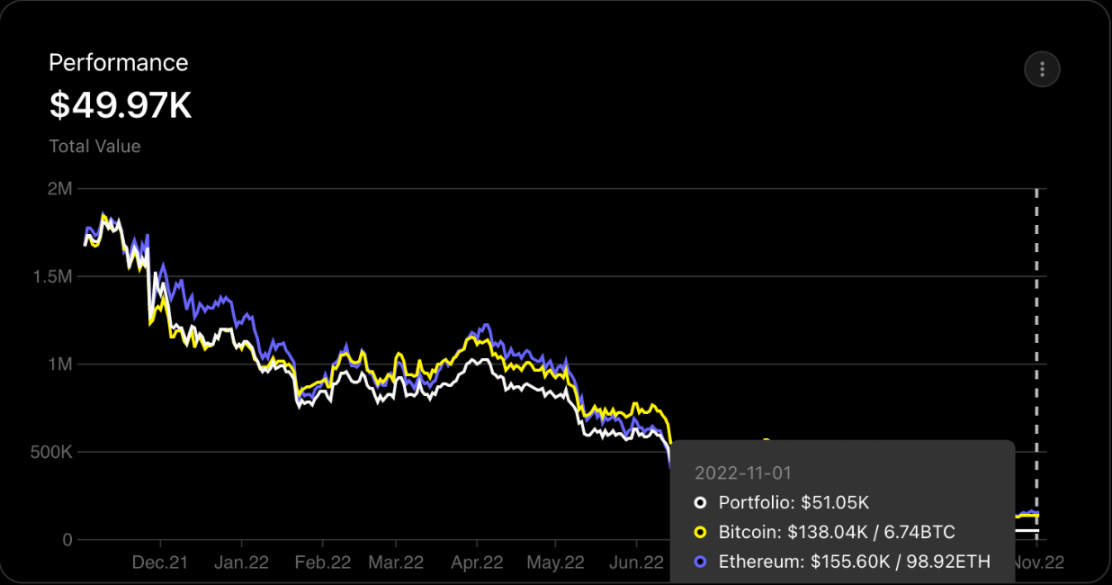

From the above data, the conclusion is already very clear, Wang Feng's investment did not outperform BTC or ETH. Judging from the wallet address, Wang Feng is still a relatively aggressive investment player.

in conclusion

in conclusion

Based on the analysis of the wallets of the above six bigwigs, the following conclusions are drawn:

Bear market investment outperforms BTC or ETH only @Justin Sun;

@Justin Sun also has the largest investment loss, his ETH holding cost is $4115, a loss of $650 million;

The most stable bear market investment is @Justin Sun, because he holds enough stable coins. In fact, Shenyu has performed well in this aspect, holding more than 10 million USDT in USDT;

The most aggressive investment is @王峰, because ZKS and DDX, which he holds the most, have suffered dozens of times of decline;

The DeFi expert is @冯波, and the wallet addresses are almost all DeFi mainstream tokens;

The best performer in ETH investment is @王峰, who insisted on holding ETH when it was $583.

After reading the investment of the big guys, I have summarized some experiences:

The bear market holds stable coins, and if you want to hoard, hoard ETH;

Original link