New Project | Sei: Layer 1 that focuses on trading scenarios

Since Uniswap invented AMM, the core mechanism of DEX, DeFi has developed rapidly, and the transaction volume has also continued to rise, taking food from CEX.

However, unlike the order book of CEX, most DEXs adopt the automatic market maker (AMM) mechanism, which relies on mathematical models to operate. Although it does not need to rely on traditional market makers to provide liquidity, the disadvantages are also obvious. Both slippage and impermanent loss have been criticized by users, and users cannot perform spot price orders like CEX.

From a macro perspective, even for the same trading pair, different LP tokens are issued by different DEX platforms, which further fragments the liquidity of assets. The mechanism of AMM breaks the difficulty from 0 to 1 for DEX and introduces the initial liquidity for the DEX industry. However, this mechanism also restricts the greater liquidity carried by DEX and the further development of DEX.

In fact, as early as the birth of AMM, DEX, an order book mechanism similar to CEX, was born. However, due to various reasons such as the performance of Ethereum, the number of user groups, and liquidity, the order book exchange on the chain has not been further developed.

secondary title

How does CLOB change the core transaction mechanism of Layer 1?

Sei is a Layer 1 blockchain developed based on the Cosmos SDK, and its core is a transaction infrastructure based on the Central Order Book (CLOB). This allows Sei not only to integrate with dApps on its own chain, but also to leverage the liquidity of the entire Cosmos ecosystem and create a trading market for its assets on Sei.

It’s worth noting, though, that Sei is a “permissioned” blockchain. This means that developers cannot freely deploy smart contracts. Smart contracts need to pass the governance process proposal before they can be deployed. Currently Sei provides developers with two different types of smart contracts: CosmWasm contracts that use Sei's DEX module, and general-purpose contracts that do not require the functionality of the DEX module.

As a Layer 1 "born for transactions", Sei did not single-handedly use any of the AMM or traditional order book mechanisms when processing transactions, but chose a set of compromise solutions - the central order book (CLOB). CLOB builds an order matching engine in the lower structure of the chain, and tries to solve this problem by "built-in" the order book in the chain. Through transactions based on the order book mechanism, in addition to realizing pre-orders, high transaction speed and low handling fees also make high-frequency transactions possible.

For the current DEX, they all process transactions through smart contracts. On the hierarchical structure of the chain, the chain itself is not optimized. For DEX developers, if they want to improve the performance of DEX, developers cannot perform any operations on Layer 1.

Sei is different. Sei's dApp is built on top of the Central Limit Order Book (CLOB).At the end of each block, all orders related to CLOB will be processed by the native order matching engine.

As the infrastructure for DeFi products, Sei prioritizes reliability, security, and high throughput, and applications built on it will benefit from dedicated built-in order book infrastructure, fast execution, deep liquidity, and complete decentralization Customized matching service.

secondary title

Born for Trading: A Different Ecological Path

Different from the large and comprehensive development direction of other Layer 1, Sei's professionalism and sense of direction are more clear. Sei's core ecology revolves around transactions. The Sei team has publicly stated, “In the long run, the transaction-focused blockchain hopes to build a better infrastructure for exchanges, thereby gradually improving the infrastructure of DeFi.”

At the protocol level, Sei leverages Twin-Turbo consensus and parallelization to improve performance. This consensus can significantly improve block construction and processing times. Sei Network is also the first Cosmos chain to be parallelized, which allows the chain to process different independent transactions simultaneously, improving overall throughput and latency.

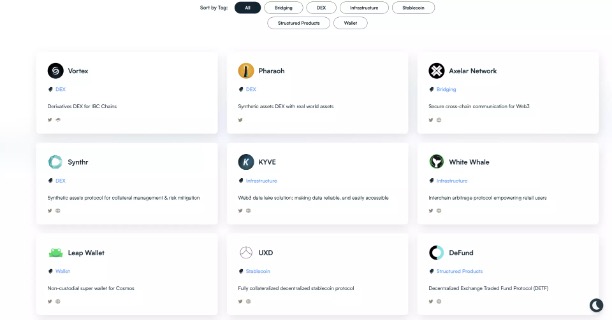

image description

At present, Sei has launched a rich variety of projects

In addition, it is also different from most Layer 1 development strategies that directly target C-end users. Sei's development path pays more attention to pioneering and serving developers well.

From a macro perspective, the change of the narrative layer of Web3 has injected new imagination and more users into the encrypted world. However, when we look at the industry landscape, it is not difficult to find that "transaction" is still the behavior with the most intensive frequency, the most common user groups, and the largest amount of funds in the encryption industry. Therefore, Sei chose such a development route that is not so close to the C-side application layer.

In the current industry landscape, exchanges are still the top priority for funds and users. The current Layer1 infrastructure hinders the development of on-chain transactions, and what Sei has to do is to attract developers and create a better next-generation DeFi application ecosystem.

secondary title

Crypto Nasdaq?

This series of strategies built around transactions also revealed Sei's ambitions-to encrypt Nasdaq. For Sei, if a high-speed, low-cost trading infrastructure can be provided, then developers will develop trading products, and traders and investors will rush in. In the end, just as Nasdaq's high-speed electronic quotations beat the traditional quotations of other exchanges, Sei may also become a huge "next generation" Layer 1 through this approach.

But for now, it's still too early. As the Sei team itself admits, “every Layer 1 is a startup right now except Ethereum.”

The Sei project was co-founded by Jeffrey Feng and Jayendra Jog, and most of its core members come from companies in the Internet and TradFi fields, such as Robinhood, Databricks, Airbnb, Goldman Sachs, etc. In August this year, Sei Labs completed a US$5 million seed round of financing, led by Multicoin Capital, with participation from Coinbase Ventures, GSR, Flow Traders, Hudson River Trading, Delphi Digital, Tangent, etc.

When the development direction of Web3 is still full of uncertainties, Sei did not capture the possible explosive trend of the application layer, but further deepened the large-scale transaction market.For Sei, a trading-focused strategy can build a better infrastructure for trading activities, which will gradually improve the infrastructure of DeFi.

We have no way of knowing where the result of this alternative development route will lead, but what is certain is that DeFi, stablecoins, transactions, these species that have accompanied the encrypted world for a long time will continue to coexist.