Original source:Binance Reseach

Original compilation: PANews

Original source:

Original compilation: PANews

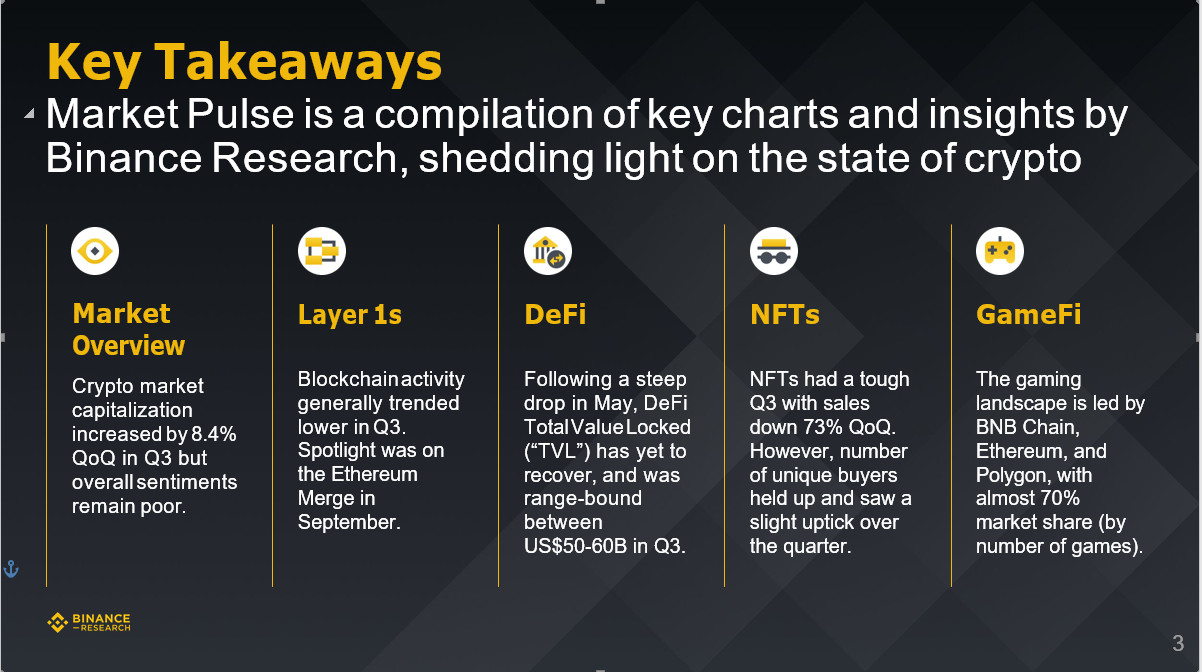

MarketPlus is a research report on the state of the encryption market launched by Binance Research. In the third quarter, the report involved several key vertical fields including the overview of the encryption market, DeFi, NFT, and GameFi. The key data are as follows.

Encrypted market overview: In the third quarter, the market value of encrypted currencies increased by 8.4% month-on-month, but the overall market sentiment is still not good.

Layer 1: Blockchain activity generally declined in the third quarter, but the Ethereum merger in September has aroused widespread concern in the market.

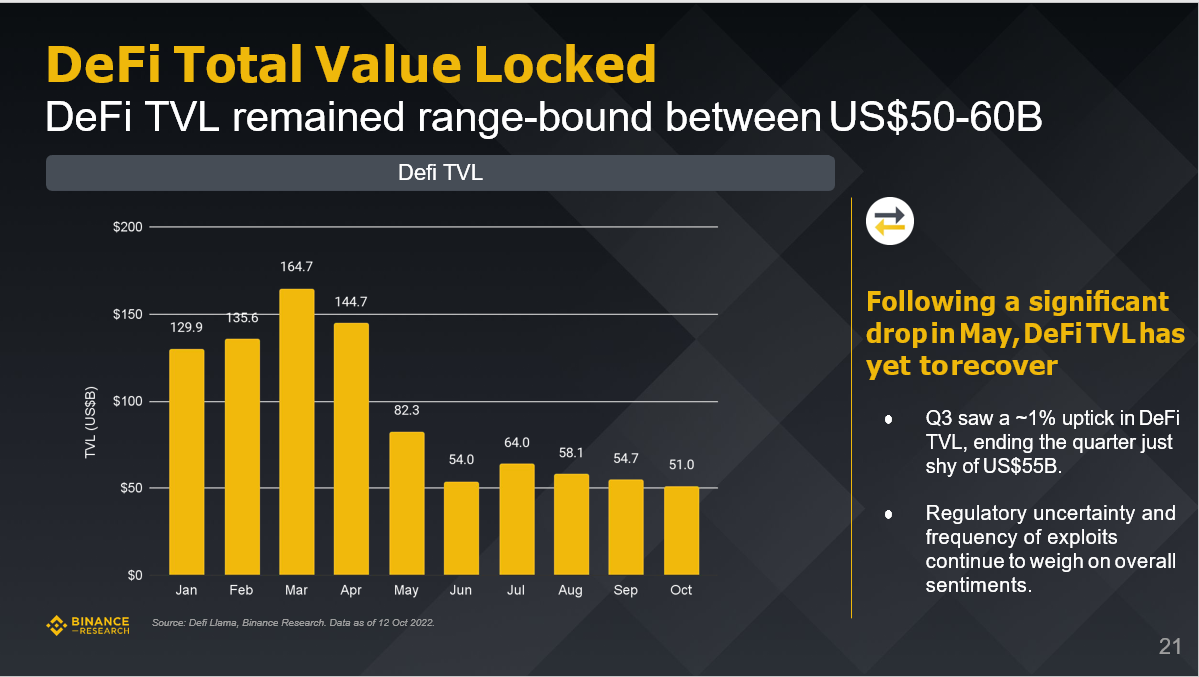

DeFi: Following a sharp drop in May, DeFi Total Value Locked (“TVL”) has yet to recover, largely hovering in the $50-60 billion range in Q3.

Binance Research Institute: Review the market status of the five key tracks in the third quarter

first level title

1. Encryption market overview

According to data from Coinmarketcap and Binance Research as of September 30, 2022, the market value of cryptocurrencies increased slightly in the third quarter, with a quarter-on-quarter increase of 8.4%.

Binance Research Institute: Review the market status of the five key tracks in the third quarter

image description

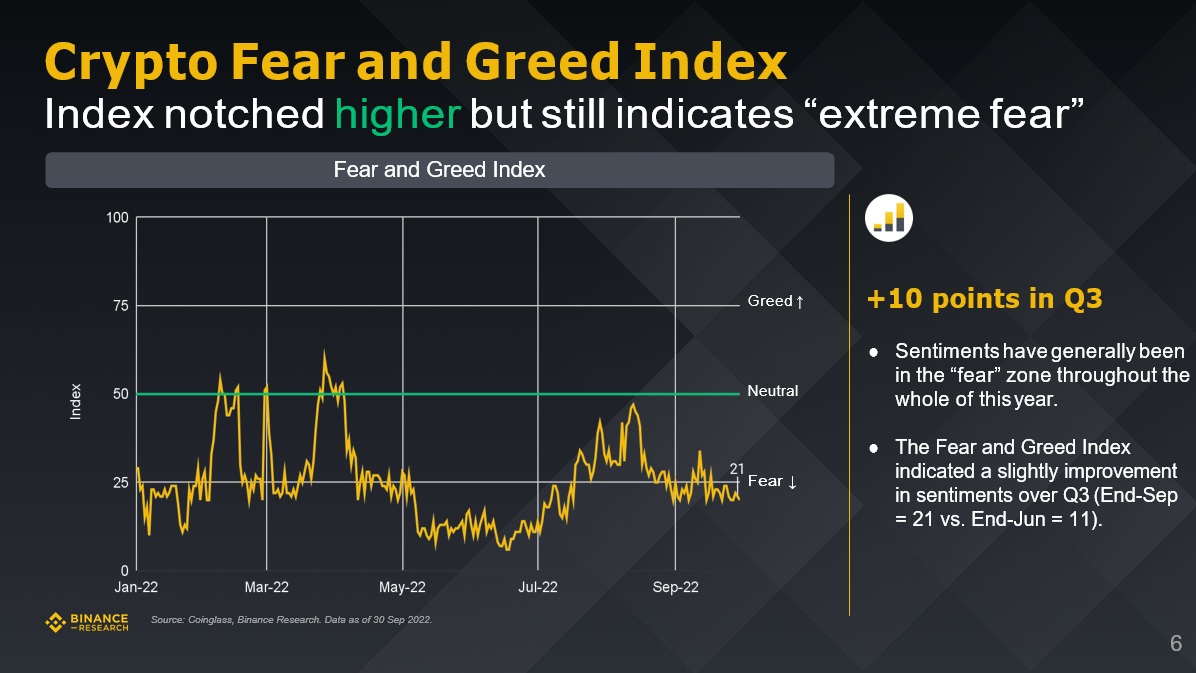

Crypto Fear and Greed Index

The Crypto Fear and Greed Index edged higher and remains in a state of "extreme fear." Crypto Fear and Greed rose 10 points in Q3.

Binance Research Institute: Review the market status of the five key tracks in the third quarter

image description

Crypto Unicorn Index

In the third quarter, the number of cryptocurrencies with a market value of more than $1 billion decreased, down 19.4% from the previous quarter.

Binance Research Institute: Review the market status of the five key tracks in the third quarter

image description

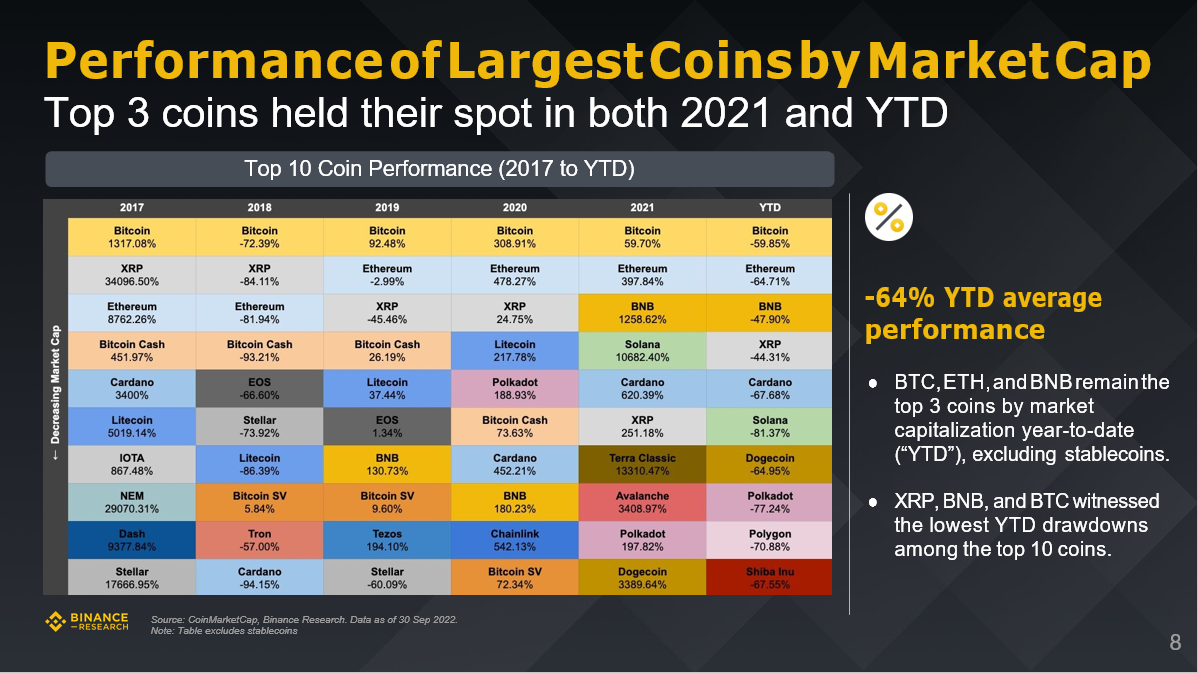

Cryptocurrency performance with the highest market capitalization

For the whole of 2021 and so far in 2022, the top three currencies by market capitalization have not changed, namely: Bitcoin, Ethereum and BNB.

Binance Research Institute: Review the market status of the five key tracks in the third quarter

image description

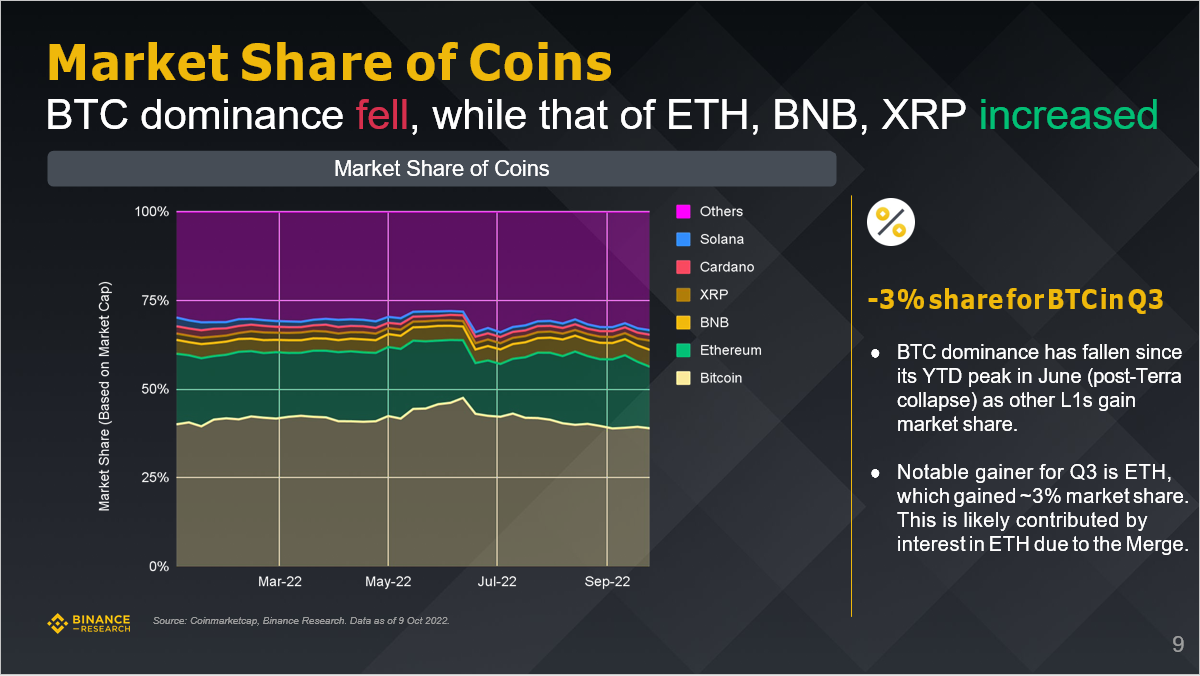

cryptocurrency market share

Bitcoin’s market dominance fell while Ethereum, BNB, and XRP gained market share.

Bitcoin’s market share fell by 3% in the third quarter.

BTC’s market dominance has declined since its year-to-date peak in June (since the Terra crash) as other Layer 1 market shares have increased.

The market share that showed a significant increase in the third quarter was ETH, which increased its market share by about 3%, which may be due to the increased investor interest in ETH due to the merger.

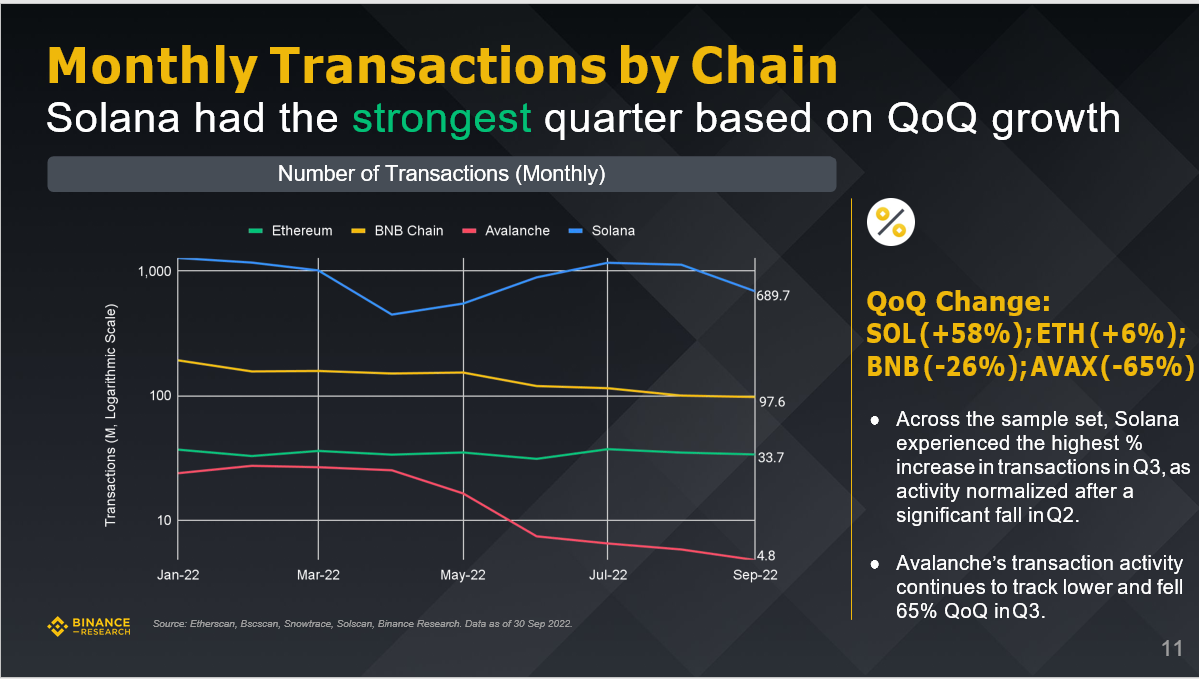

According to data from Etherscan, Bscscan, Snowtrace, Solscan, and Binance Research as of September 30, 2022, Solana had the strongest quarterly performance in terms of blockchain monthly transaction volume.

Binance Research Institute: Review the market status of the five key tracks in the third quarter

Quarter-to-quarter changes: SOL (+58%), Ethereum (+6%), BNB (-26%), AVAX (-65%).

Transaction activity on the Avalanche chain continued to decline, falling 65% quarter-on-quarter in the third quarter.

Binance Research Institute: Review the market status of the five key tracks in the third quarter

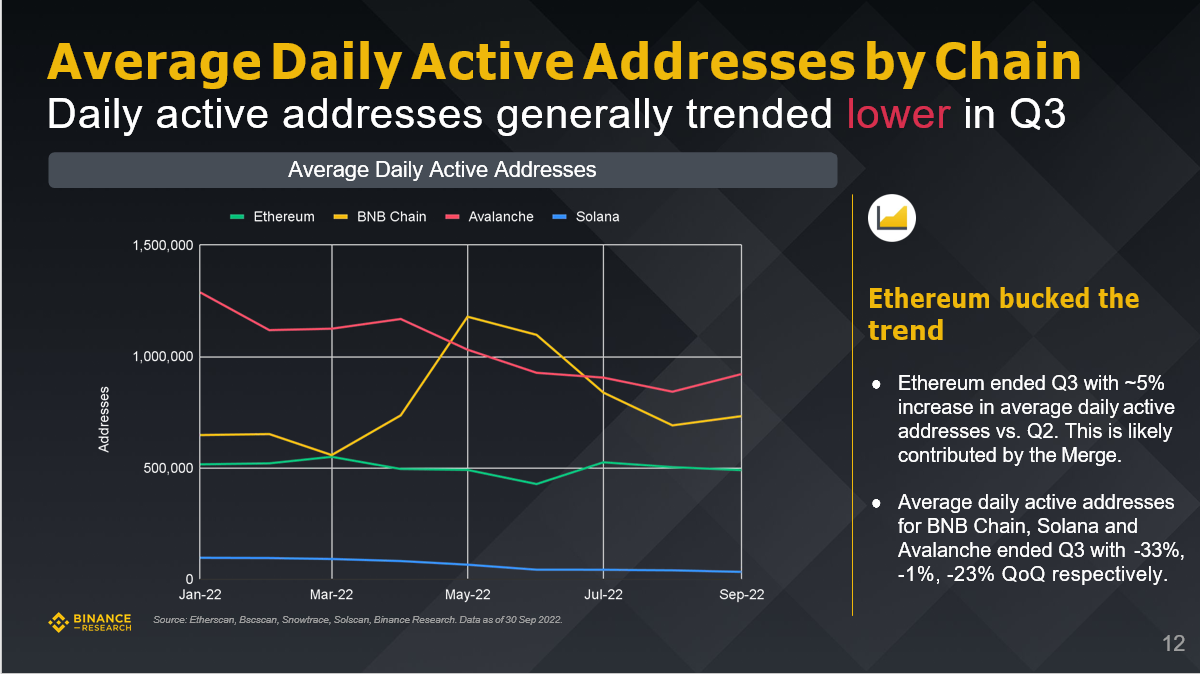

The average daily active address data of the blockchain generally showed a downward trend in the third quarter, but Ethereum bucked the trend.

Binance Research Institute: Review the market status of the five key tracks in the third quarter

image description

twitter follower

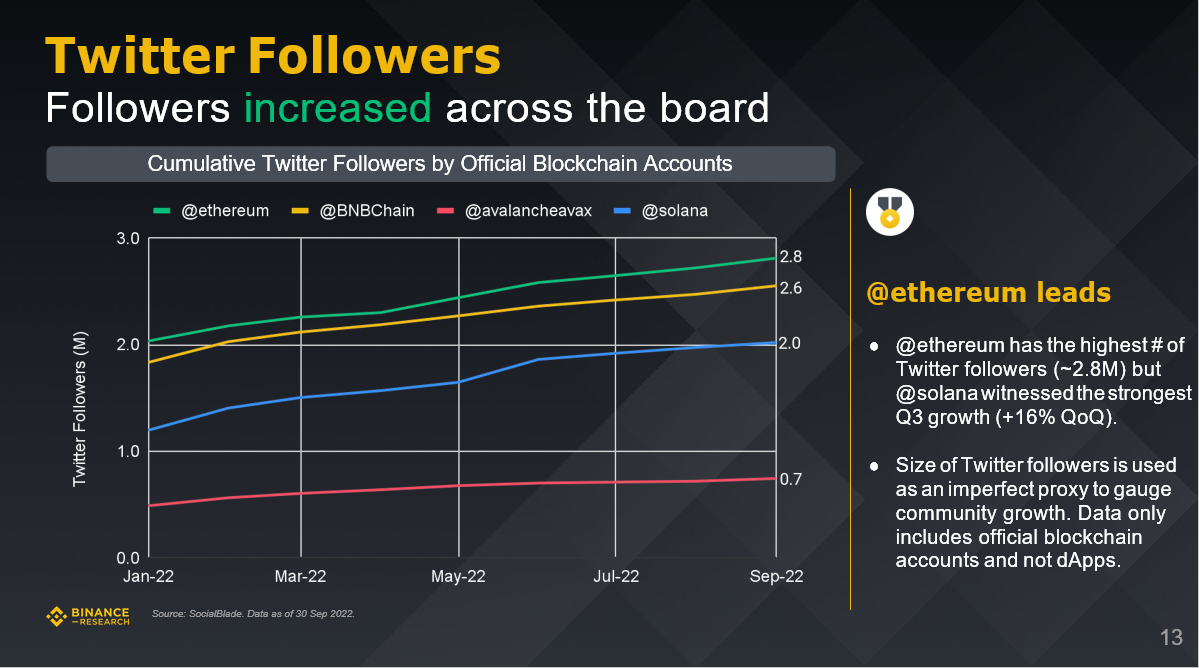

According to SocialBlade data as of September 30, 2022, the number of Twitter fans following the cryptocurrency industry has grown across the board in the third quarter, with the number of fans of the @ethereum account growing the most.

The indicator of the number of Twitter fans is used to measure the growth trend of the community (note: the data only includes official blockchain accounts, excluding dApps).

Binance Research Institute: Review the market status of the five key tracks in the third quarter

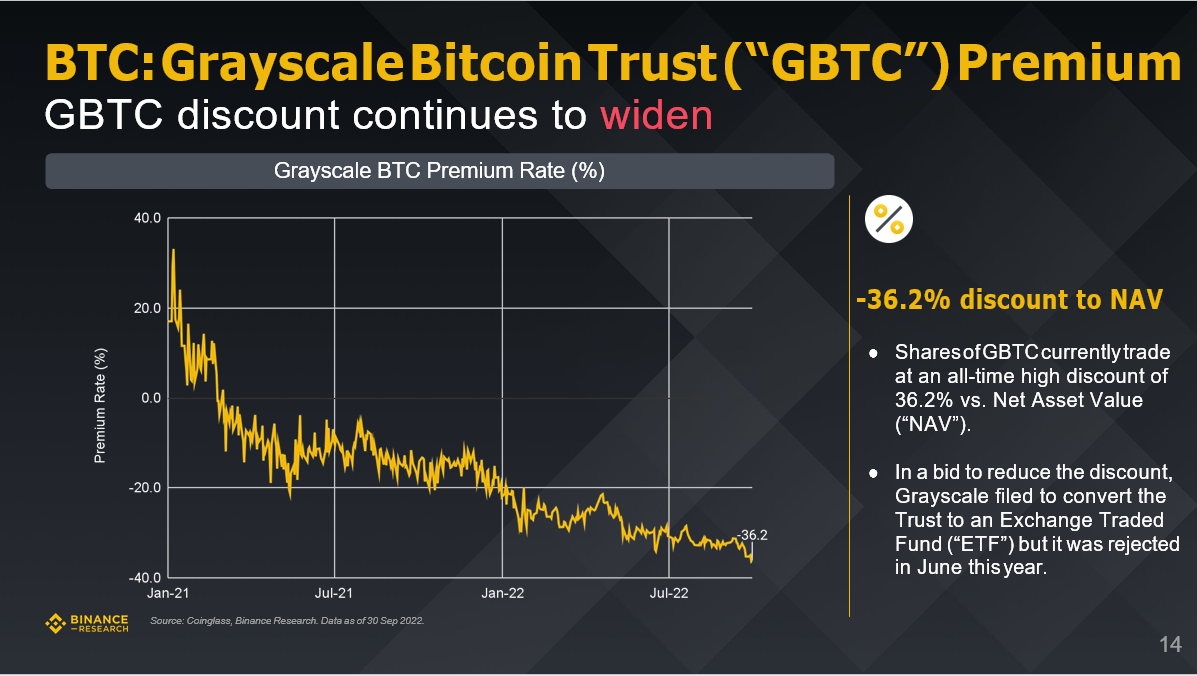

The grayscale Bitcoin Trust (“GBTC”) premium, the GBTC discount range continued to expand, and the net asset value fell by 36.2%.

Binance Research Institute: Review the market status of the five key tracks in the third quarter

image description

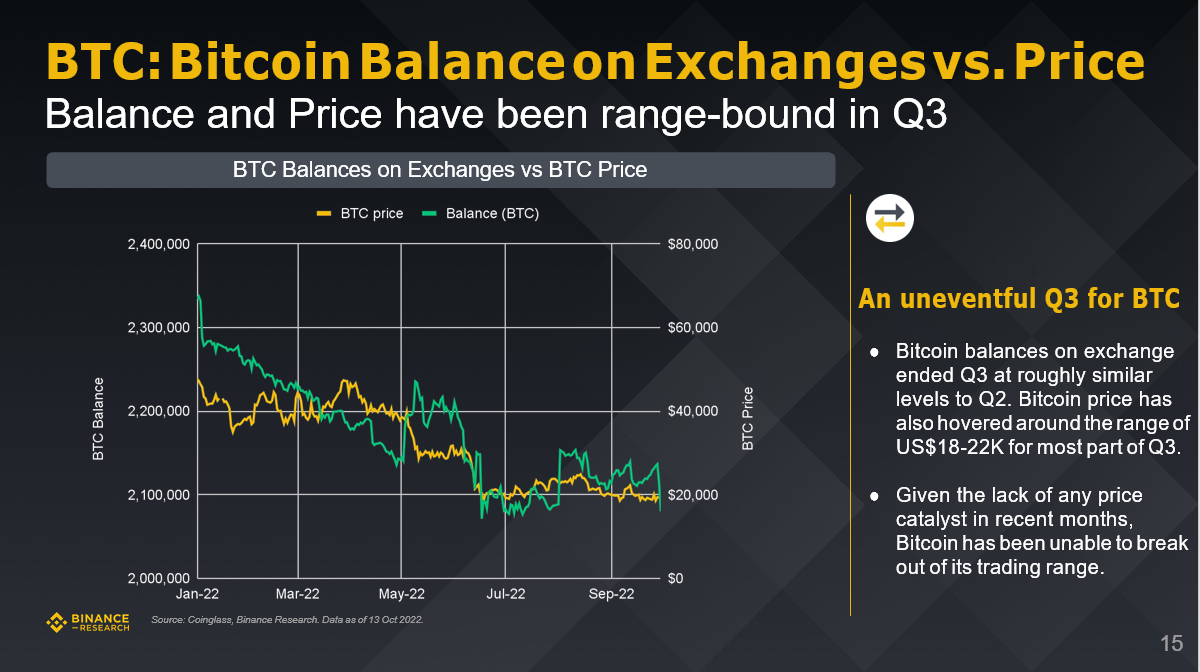

Exchange Bitcoin Balances and Prices

The balance and price of Bitcoin on exchanges fluctuated in a range in the third quarter.

Binance Research Institute: Review the market status of the five key tracks in the third quarter

image description

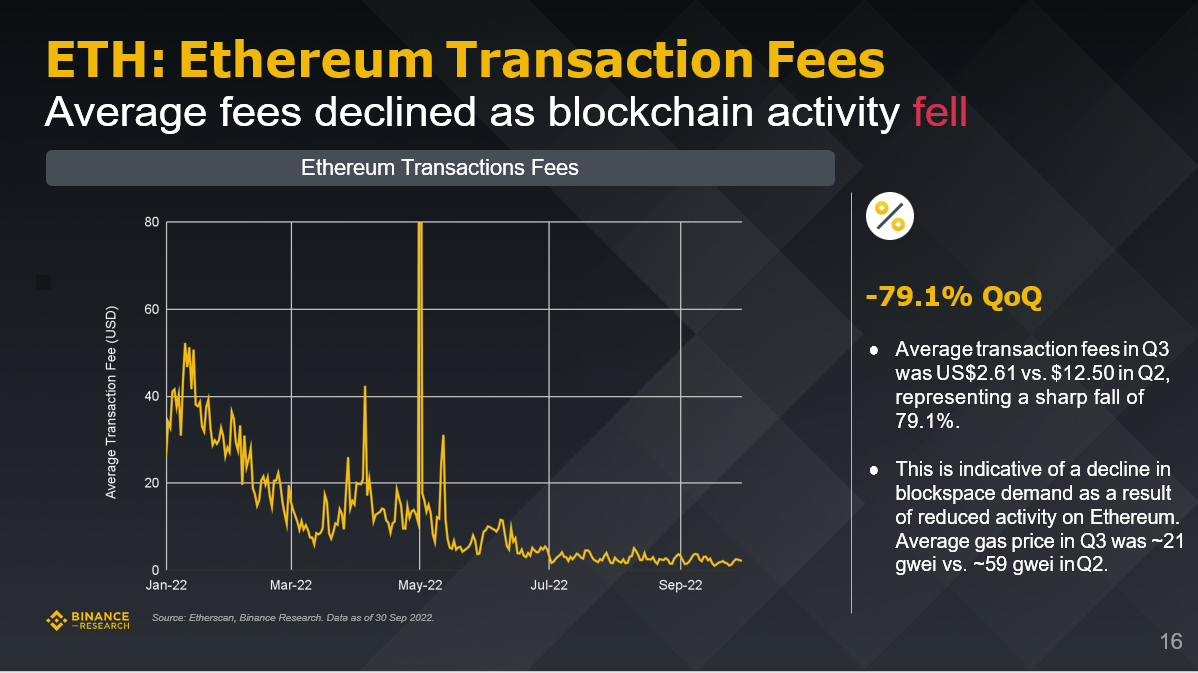

Ethereum transaction fees

According to data from Etherscan and Binance Research as of September 30, 2022, as the activity on the Ethereum chain decreased, the average transaction fee decreased by 79.1% quarter-on-quarter.

Binance Research Institute: Review the market status of the five key tracks in the third quarter

image description

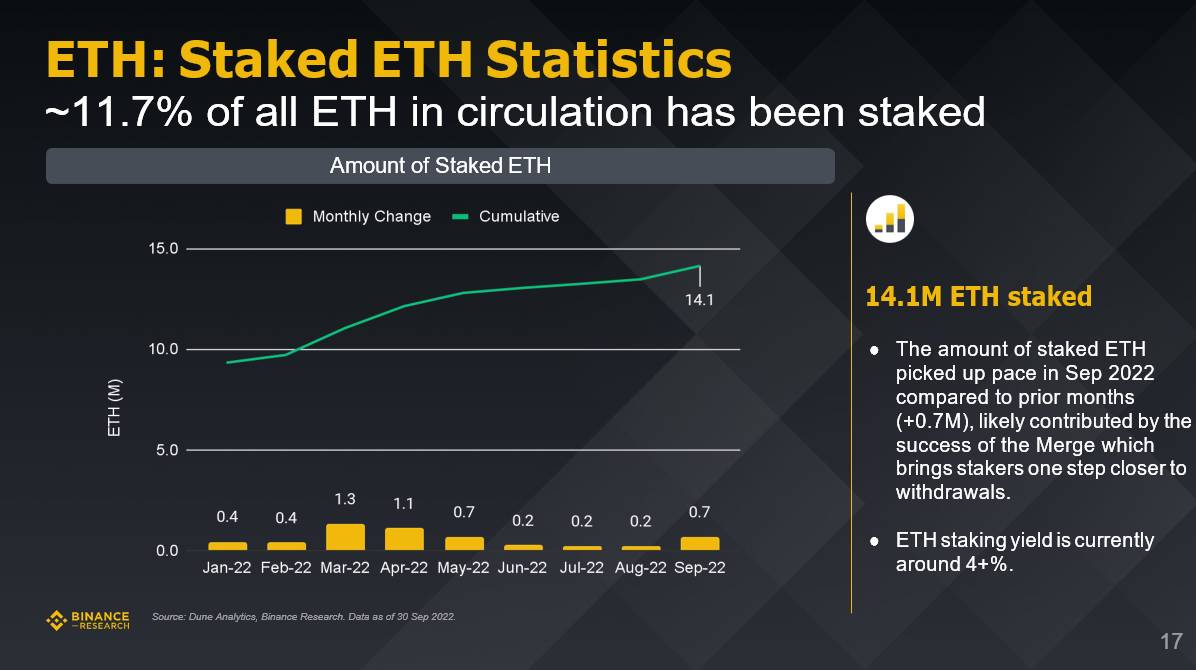

Staking data on the Ethereum chain

According to data from Dune Analytics and Binance Research as of September 30, 2022, about 11.7% of the circulating ETH is currently pledged, with a total of about 14.1 million.

Binance Research Institute: Review the market status of the five key tracks in the third quarter

image description

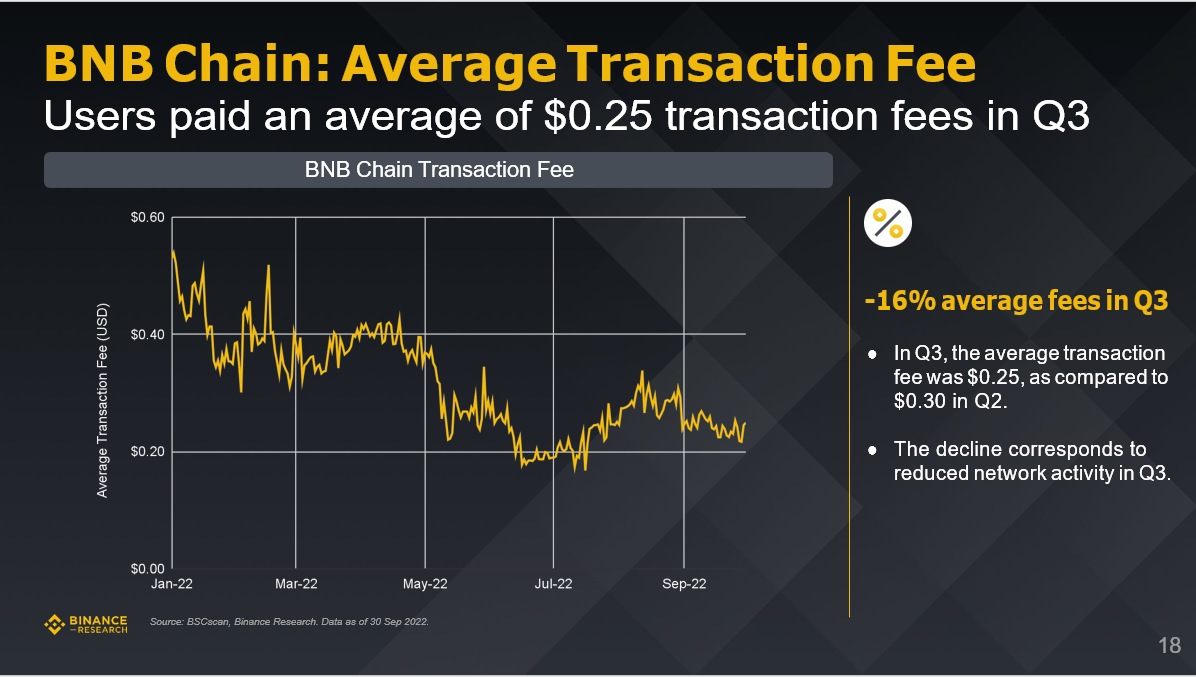

BNB chain average transaction fee

According to data from BSCscan and Binance Research as of September 30, 2022, the average transaction fee on the BNB chain in the third quarter was approximately $0.25, a decrease of 16%.

Binance Research Institute: Review the market status of the five key tracks in the third quarter

image description

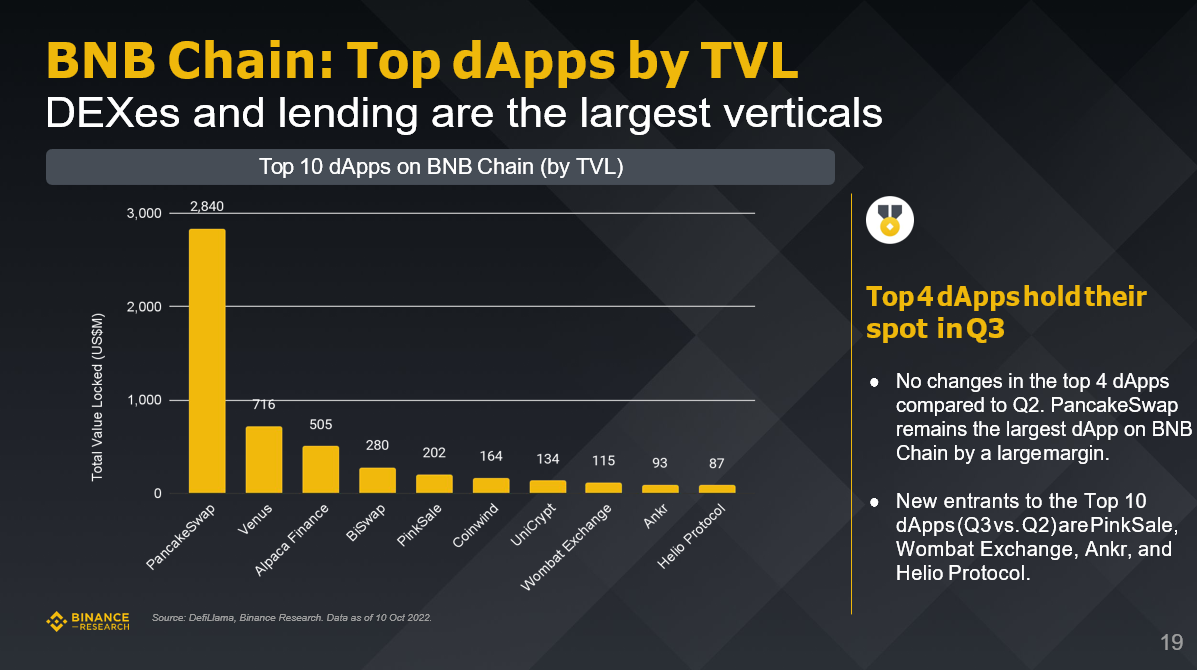

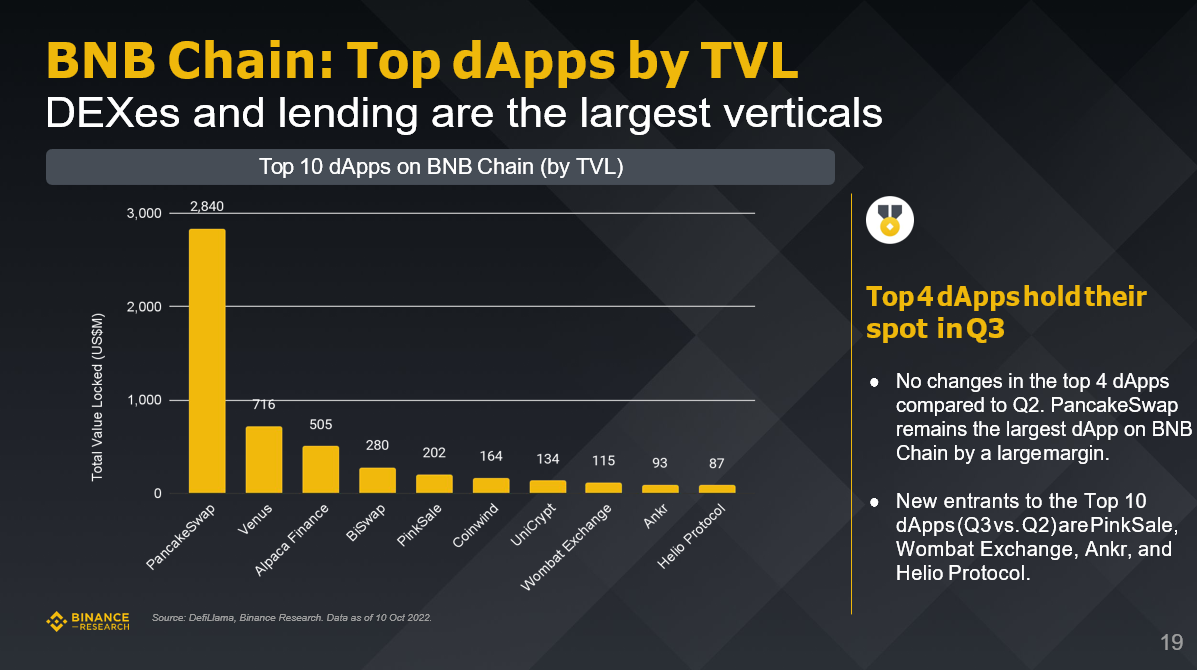

The lock-up amount of the head dApp on the BNB chain

According to data from DefiLlama and Binance Research as of October 10, 2022, DEX and lending applications on the BNB chain are still the largest top dApps.

Binance Research Institute: Review the market status of the five key tracks in the third quarter

first level title

According to data from Defillama and Binance Research as of October 12, 2022, the DeFi market has yet to recover after a sharp drop in May, and the total locked positions of DeFi in the third quarter remained in the range of US$50-60 billion.

Binance Research Institute: Review the market status of the five key tracks in the third quarter

Binance Research Institute: Review the market status of the five key tracks in the third quarter

image description

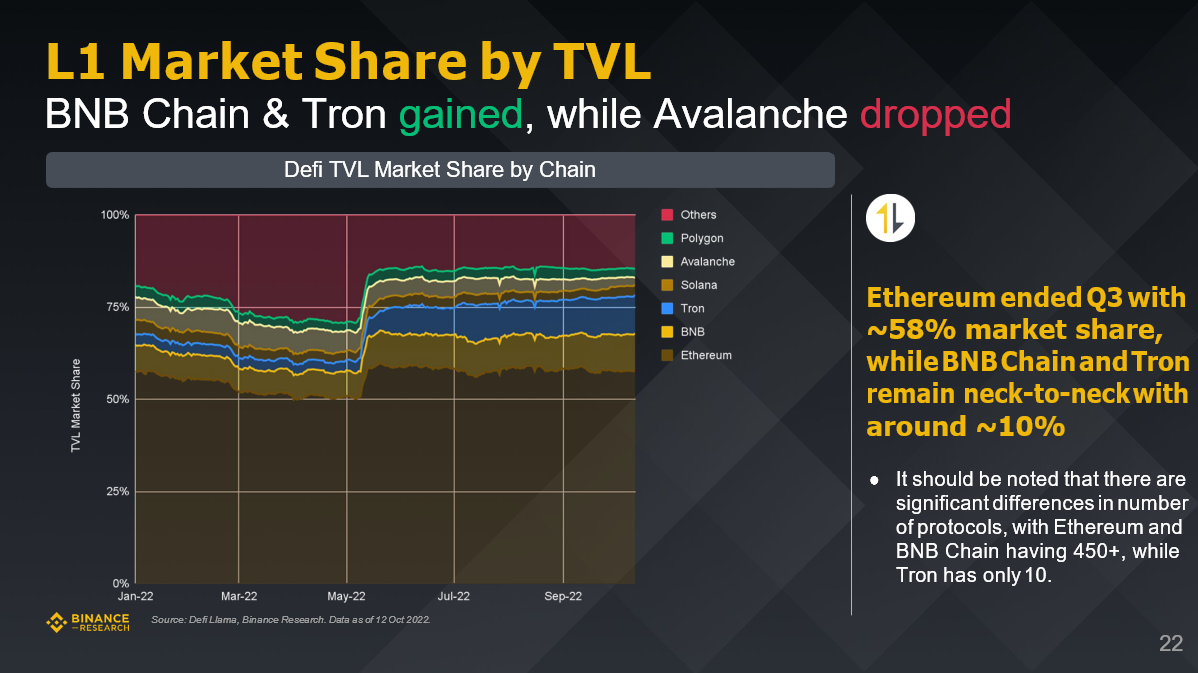

Divide Layer 1 market share by locked amount

The market share of BNB Chain and Tron grew, but Avalanche fell.

Binance Research Institute: Review the market status of the five key tracks in the third quarter

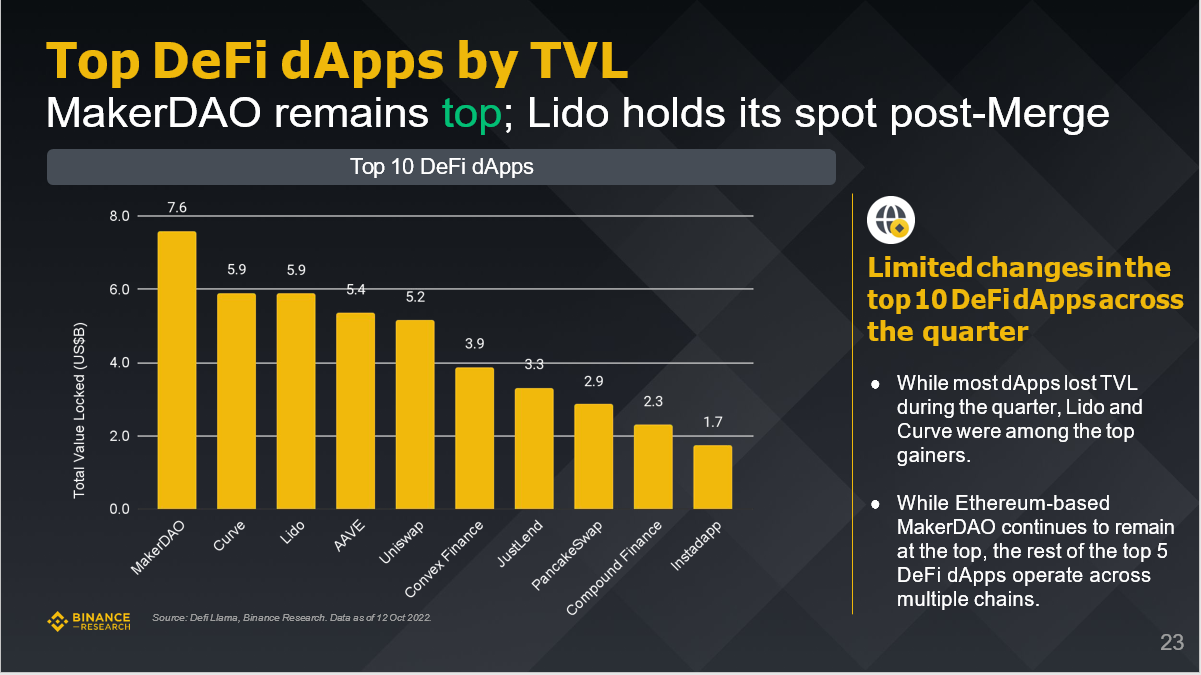

image description

Distinguish top DeFidApps by lockup amount

The top ten DeFidApps did not change much in the third quarter, MakerDAO maintained its lead, and Lido performed well after the merger of Ethereum.

Binance Research Institute: Review the market status of the five key tracks in the third quarter

image description

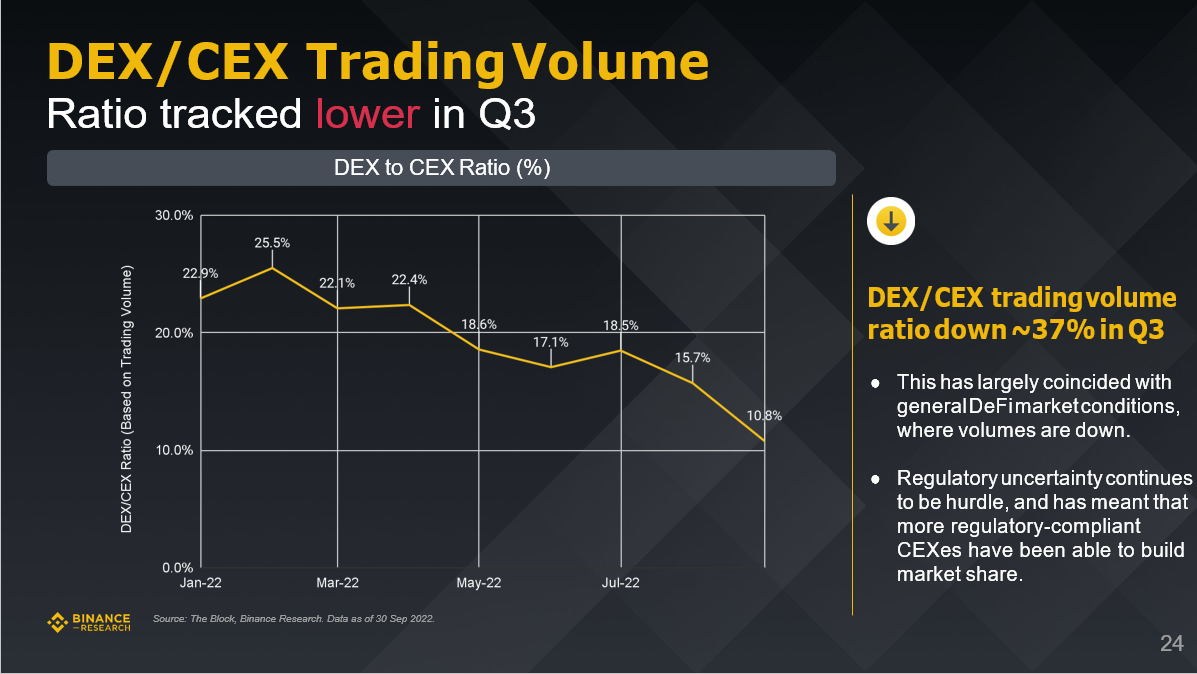

DEX/CEX trading volume

According to data from TheBlock and Binance Research as of September 30, 2022, the trading volume of DEX/CEX in the third quarter decreased by about 37% month-on-month.

Binance Research Institute: Review the market status of the five key tracks in the third quarter

image description

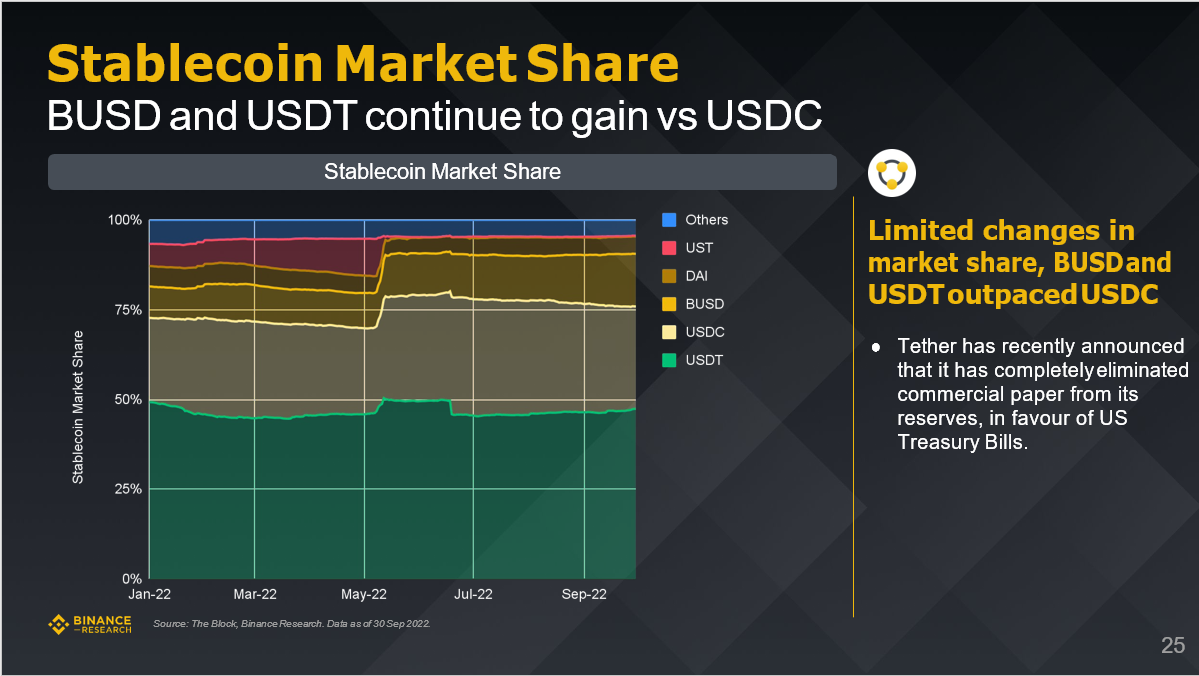

Stablecoin Market Share

The market share of BUSD and USDT increased, while USDC decreased.

Binance Research Institute: Review the market status of the five key tracks in the third quarter

image description

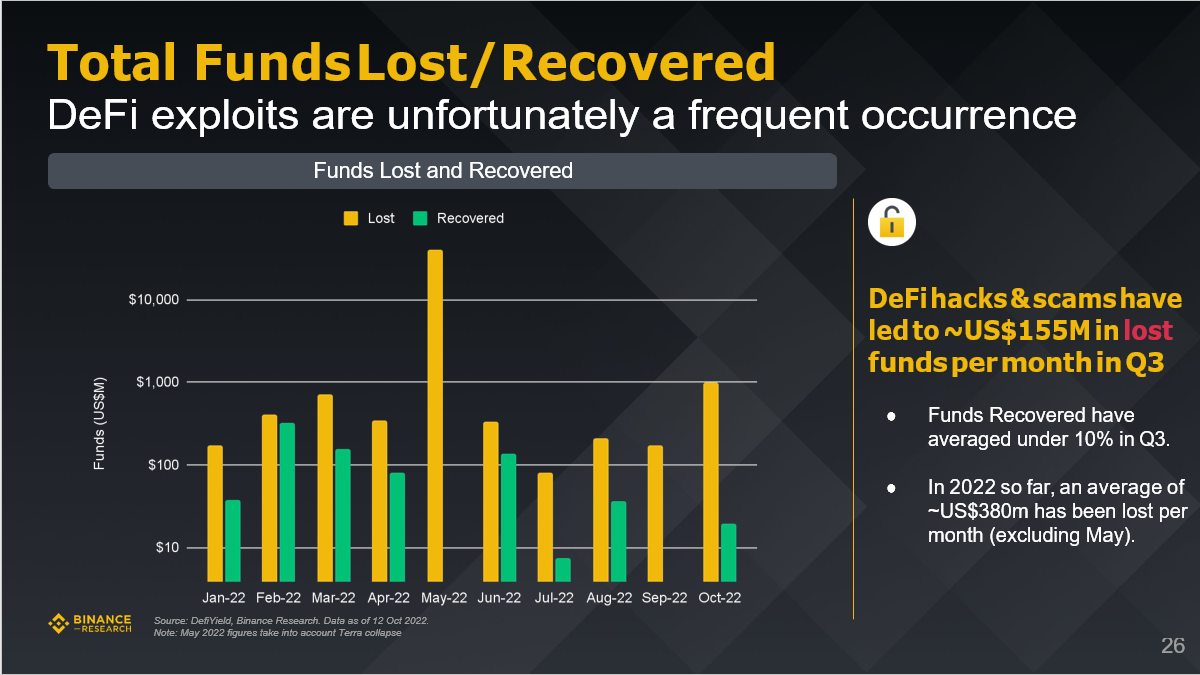

Total funds lost/recovered

According to data from DefiYield and Binance Research as of October 12, 2022, DeFi vulnerabilities occurred frequently in the third quarter, and DeFi hacks and scams resulted in a monthly loss of $155 million in funds in the third quarter.

Binance Research Institute: Review the market status of the five key tracks in the third quarter

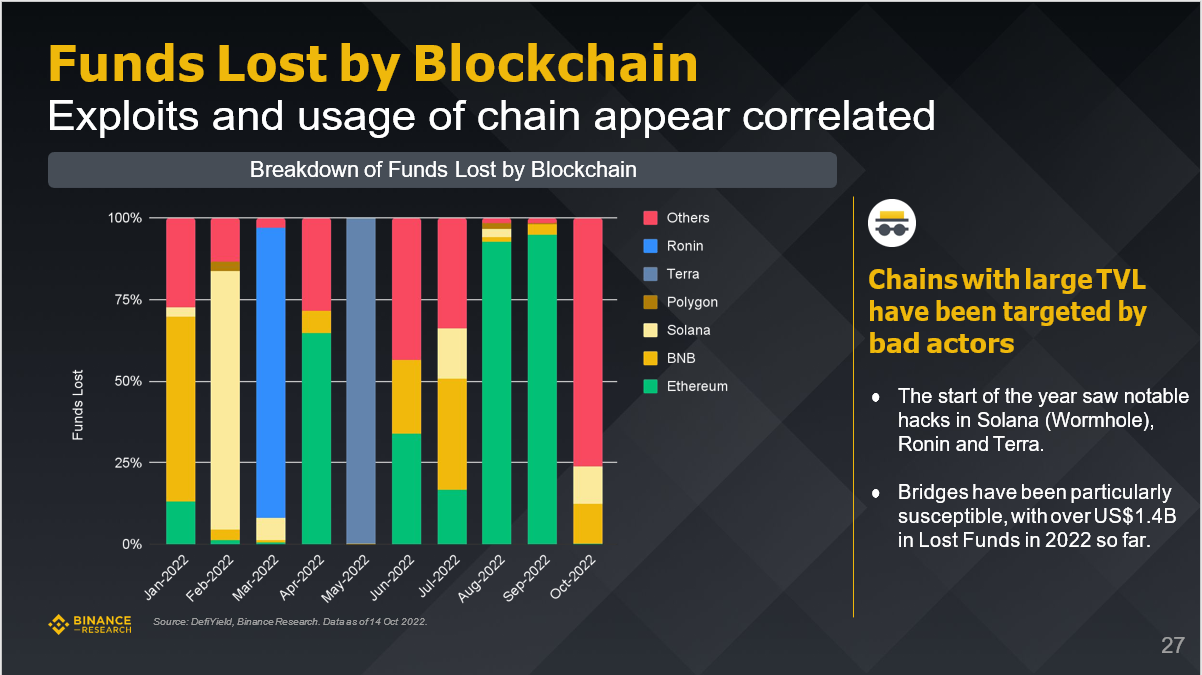

image description

Funds lost on the blockchain

The Solana (Wormhole), Ronin, and Terra blockchains have all seen massive hacks this year.

first level title

4. NFT

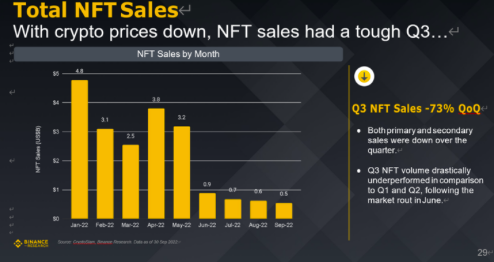

image description

Total NFT sales

According to data from CryptoSlam and BinanceResearch as of September 30, 2022, with the decline in cryptocurrency prices, NFT sales in the third quarter suffered from Waterloo, down 73% from the previous quarter.

Binance Research Institute: Review the market status of the five key tracks in the third quarter

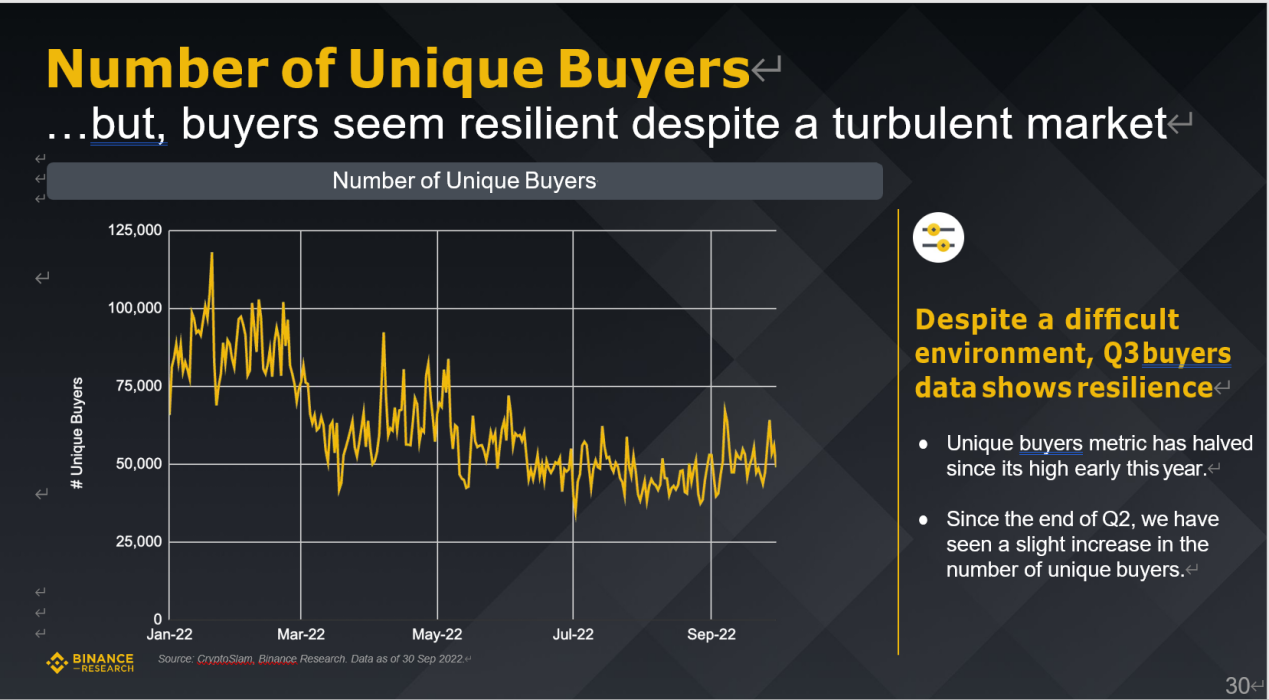

image description

Number of Unique Buyers

According to the data from CryptoSlam and Binance Research as of September 30, 2022, despite market turbulence and a harsh environment, the number of buyers seems to have rebounded, and the number of buyers in the third quarter has rebounded to a certain extent.

Binance Research Institute: Review the market status of the five key tracks in the third quarter

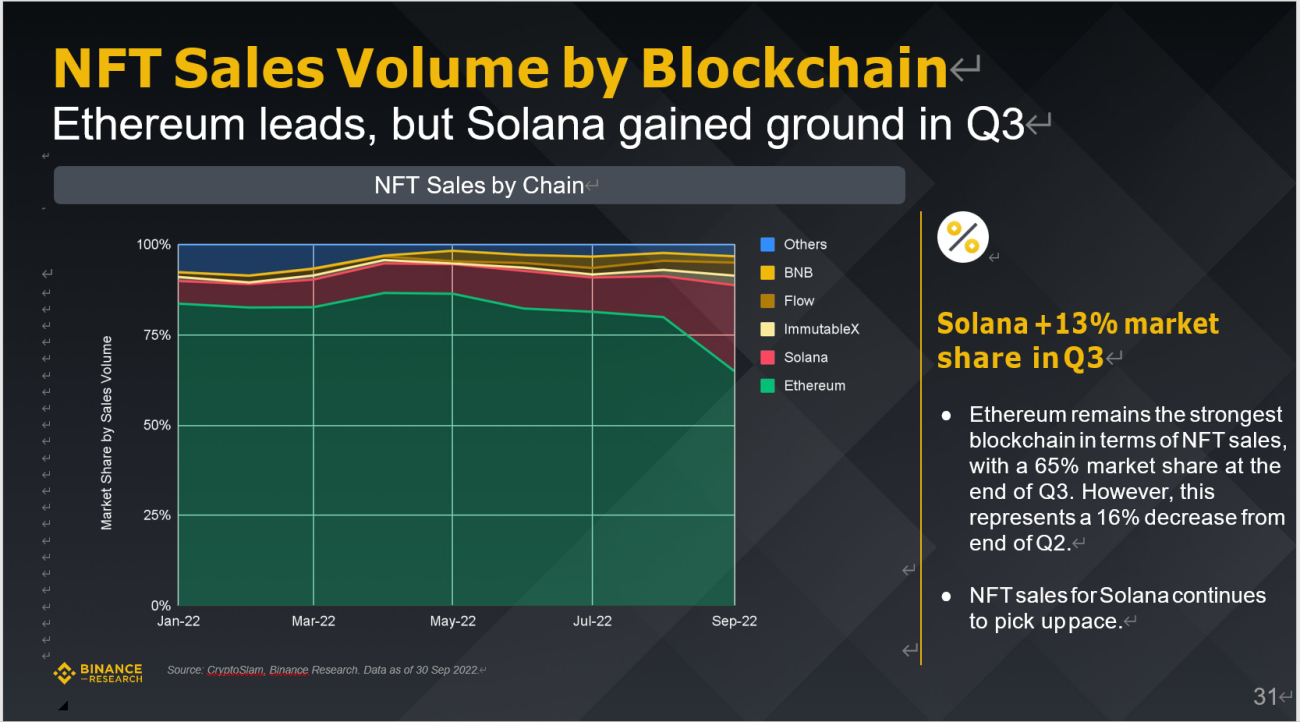

image description

NFT Sales on Major Blockchains

According to data from CryptoSlam and Binance Research as of September 30, 2022, Ethereum is still in the leading position, but Solana has the fastest growth in the third quarter, increasing its market share by 13%.

Binance Research Institute: Review the market status of the five key tracks in the third quarter

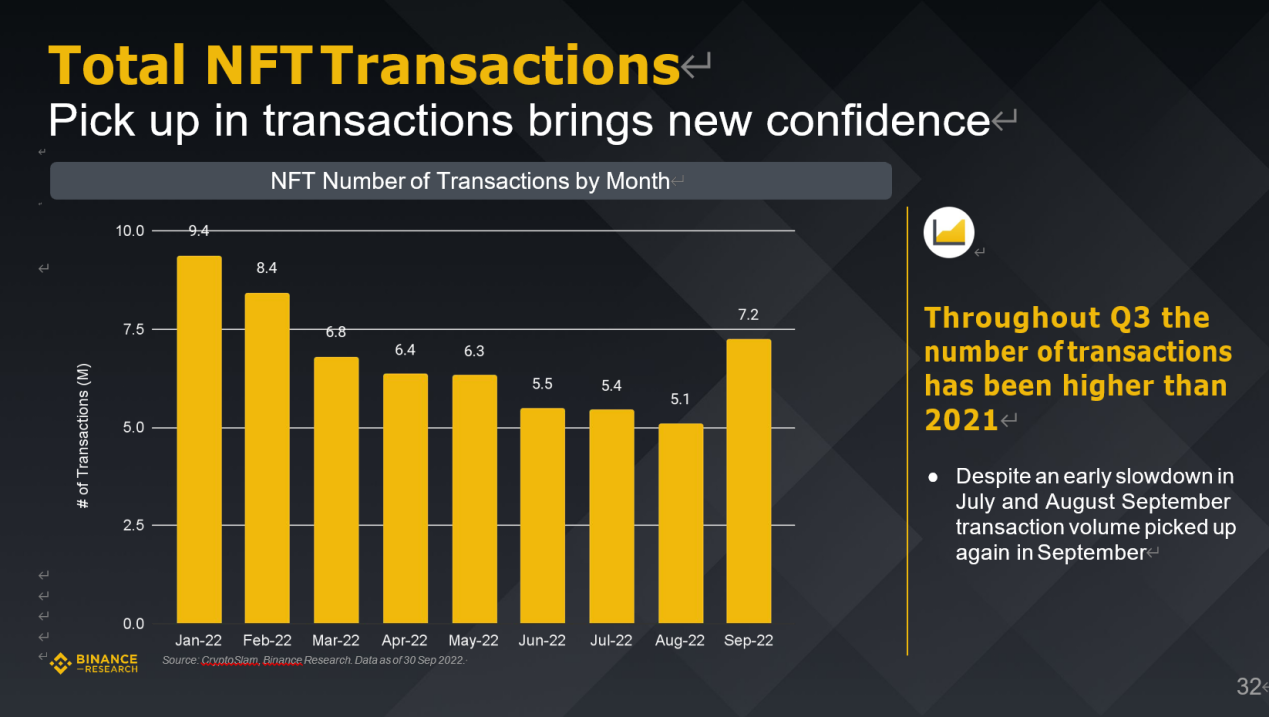

image description

Binance Research Institute: Review the market status of the five key tracks in the third quarter

image description

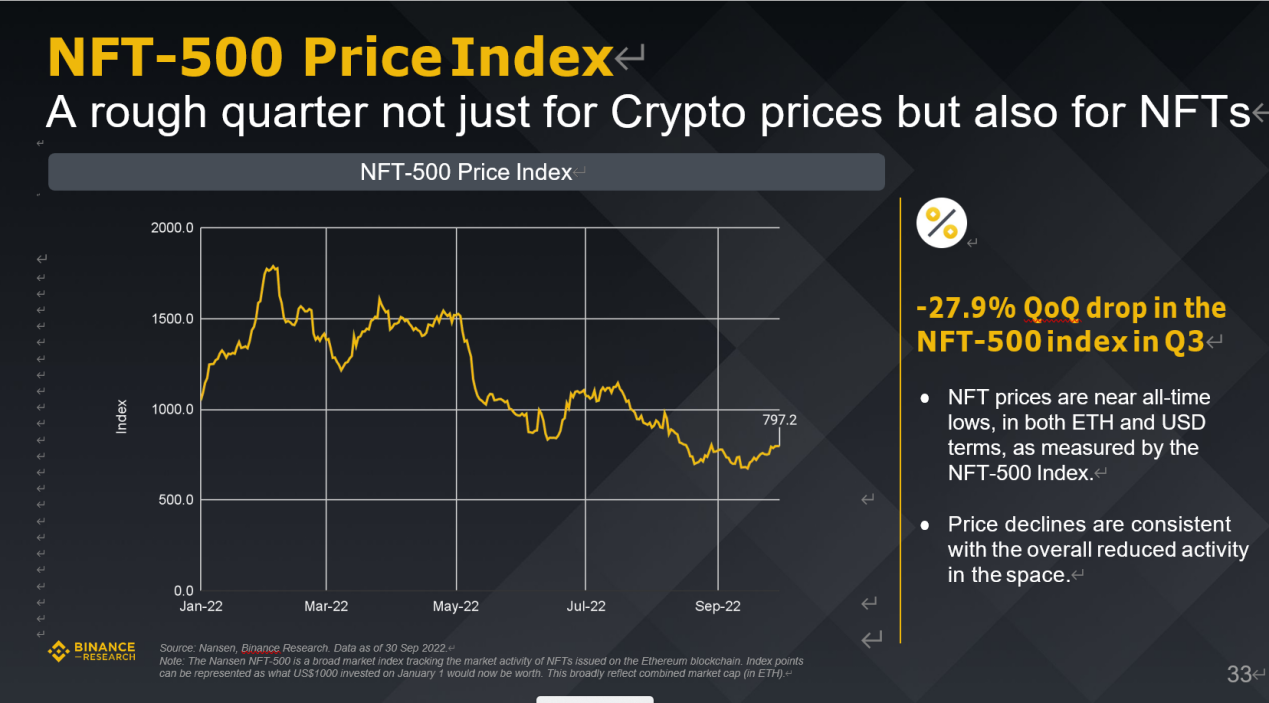

NFT-500 Price Index

According to data from Nansen and Binance Research as of September 30, 2022, the third quarter was very difficult for the entire encryption market. Not only cryptocurrencies, but NFT prices are also very unstable. The NFT-500 index fell by 27.9% month-on-month. (Note: Nansen NFT-500 is an NFT market index to track NFT market activities on the Ethereum blockchain.)

Binance Research Institute: Review the market status of the five key tracks in the third quarter

image description

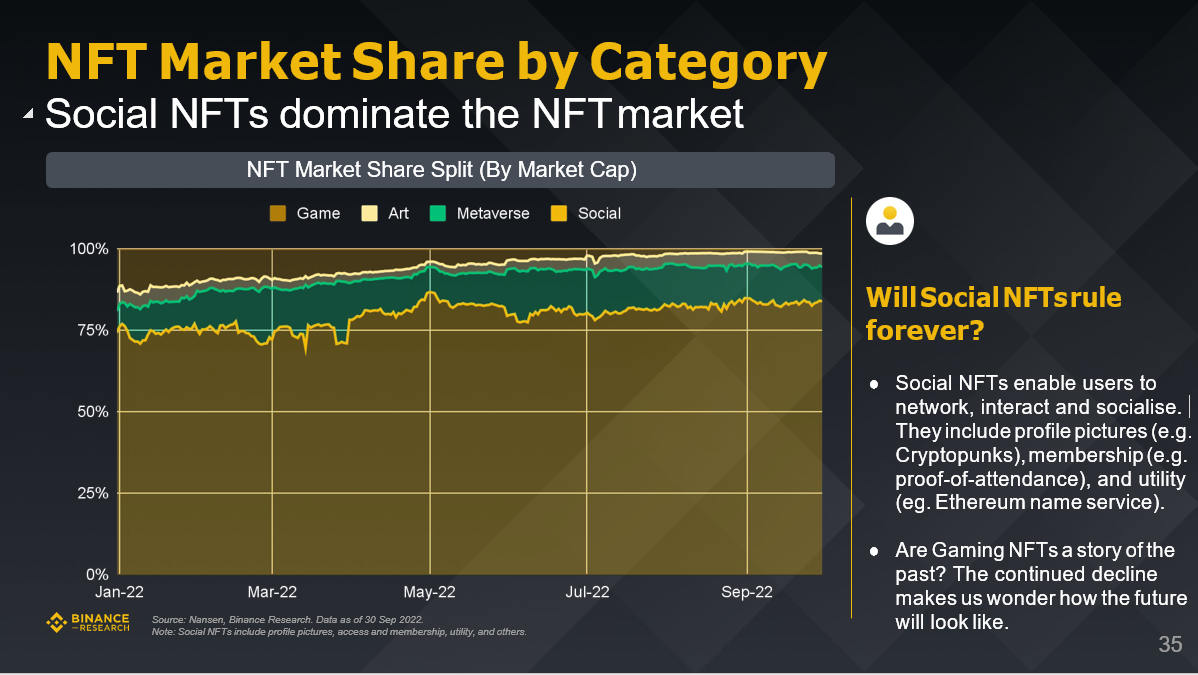

NFT Market Share by Category

According to data from Nansen and Binance Research as of September 30, 2022, social NFT dominates the NFT market (note: social NFT includes types such as PFP pictures, access rights and membership, utilities, etc.).

Binance Research Institute: Review the market status of the five key tracks in the third quarter

image description

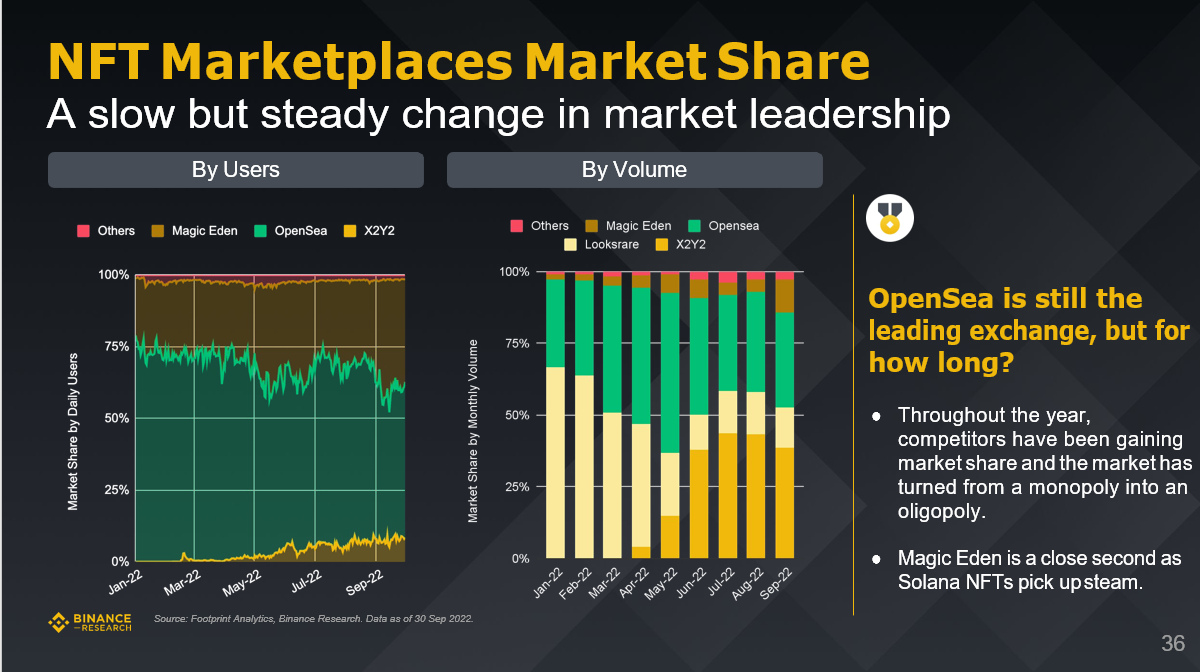

NFT market share

According to the data of Footprint Analytics and Binance Research as of September 30, 2022, the NFT market leadership has undergone slow and steady changes. OpenSea is still the leading NFT trading platform, but how long can this state last?

Binance Research Institute: Review the market status of the five key tracks in the third quarter

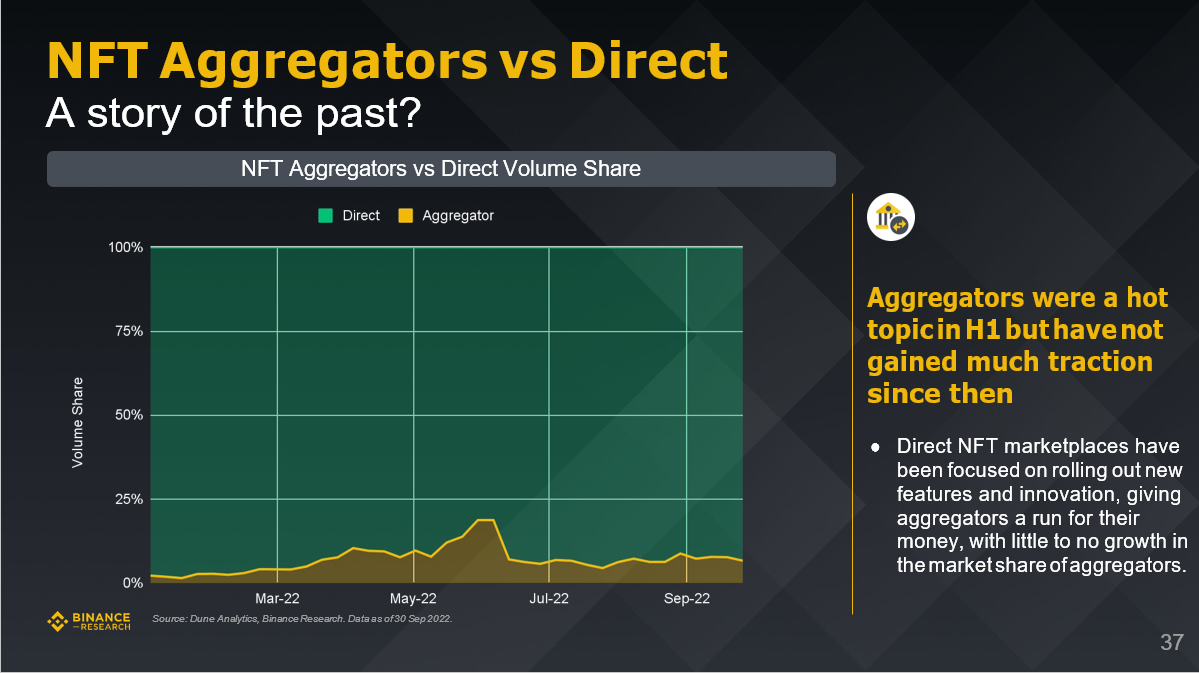

NFT aggregator and direct connection service provider

Aggregators are a hot topic in the NFT market in the first half of 2022, but have not gained much attention since then. In contrast, the direct-to-NFT market has been focused on launching new features and innovations, and in this case, the market share of NFT aggregation service providers has barely increased.

Binance Research Institute: Review the market status of the five key tracks in the third quarter

image description

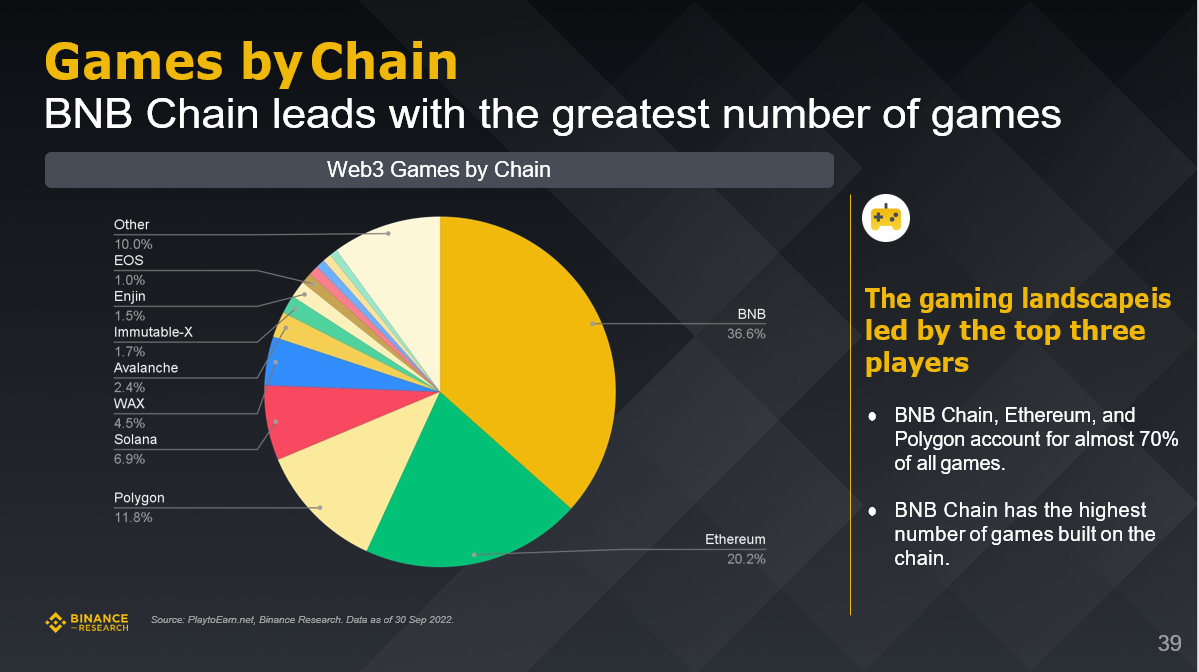

The blockchain chosen by Lianyou

According to data from PlaytoEarn.net and BinanceResearch as of September 30, 2022, the chain game industry is mainly led by BNB Chain, Ethereum, and Polygon.

Binance Research Institute: Review the market status of the five key tracks in the third quarter

image description

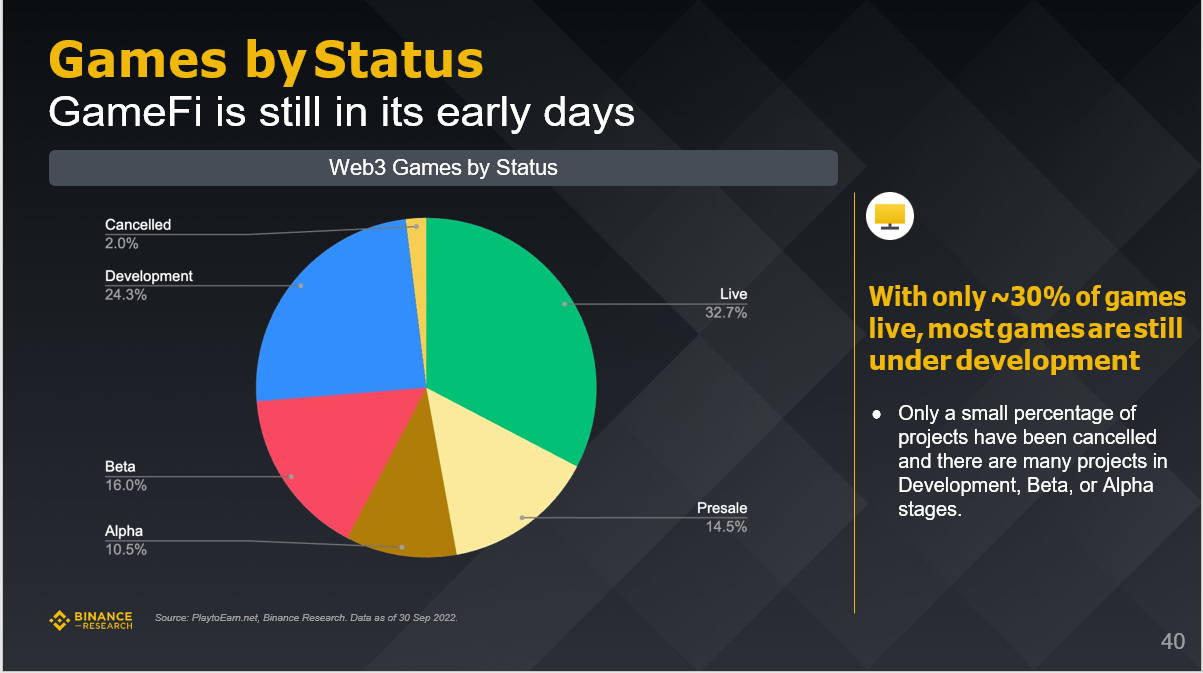

Chain game development status

According to data from PlaytoEarn.net and Binance Research as of September 30, 2022, GameFi is still in its early stages.

Binance Research Institute: Review the market status of the five key tracks in the third quarter

image description

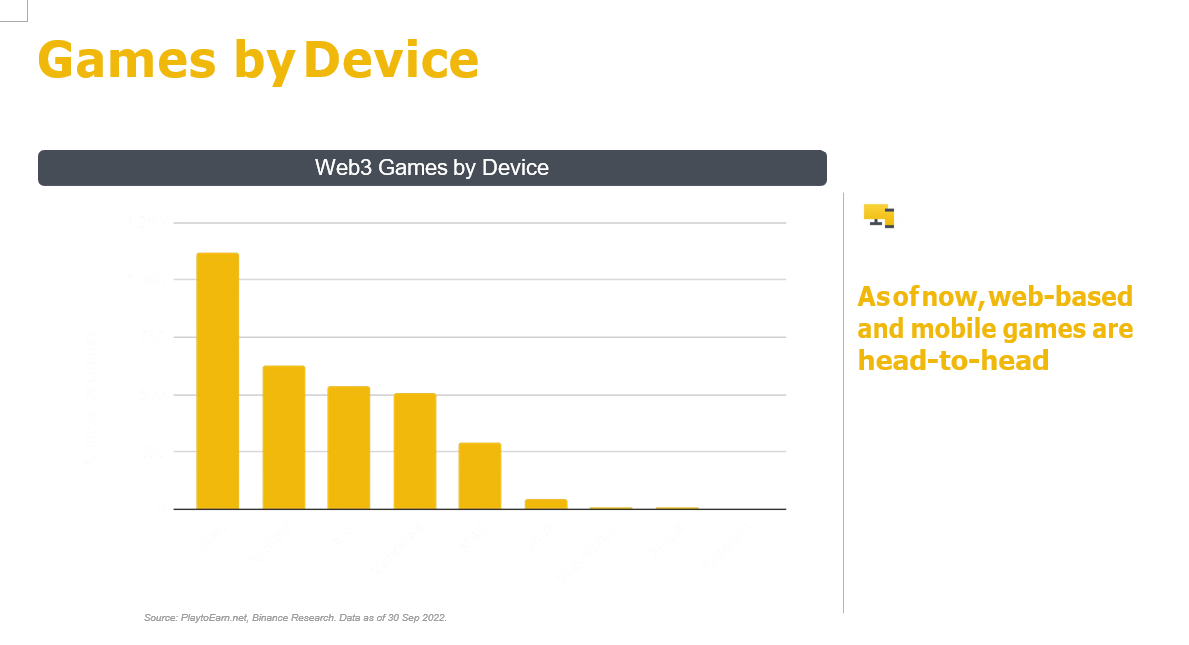

Equipment type

According to data from PlaytoEarn.net and BinanceResearch as of September 30, 2022, players are more willing to choose online games and mobile games.

At this stage, online games and mobile games are beginning to compete head-on.

Binance Research Institute: Review the market status of the five key tracks in the third quarter

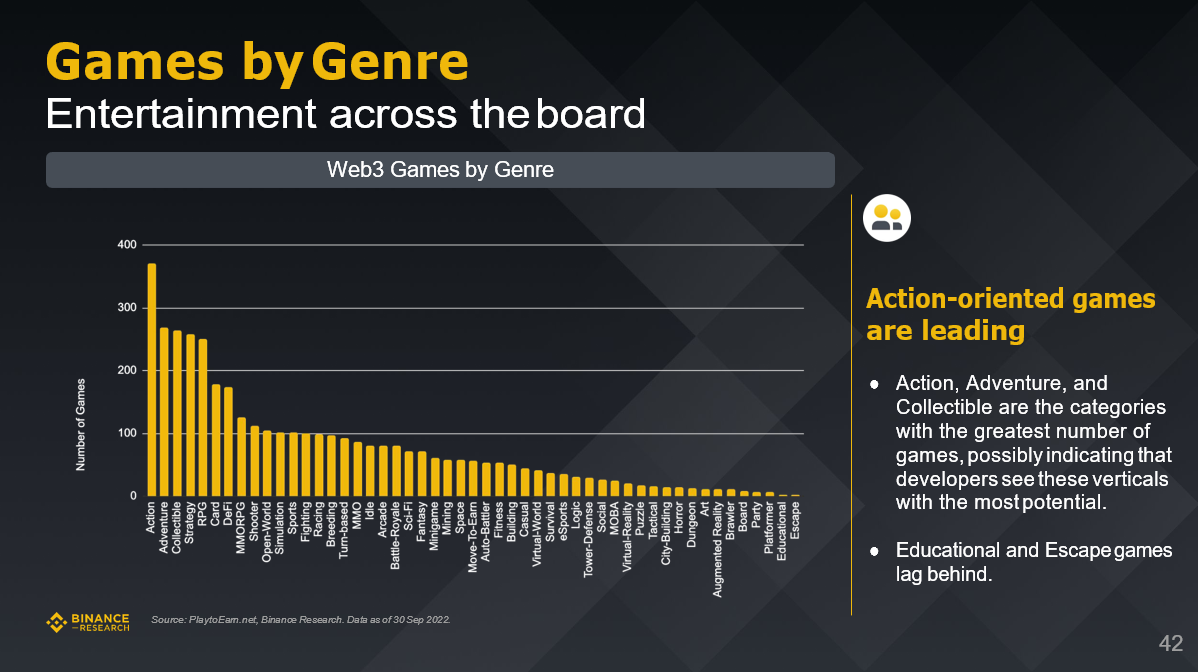

image description

game type

The current action games are in the leading position.

Binance Research Institute: Review the market status of the five key tracks in the third quarter

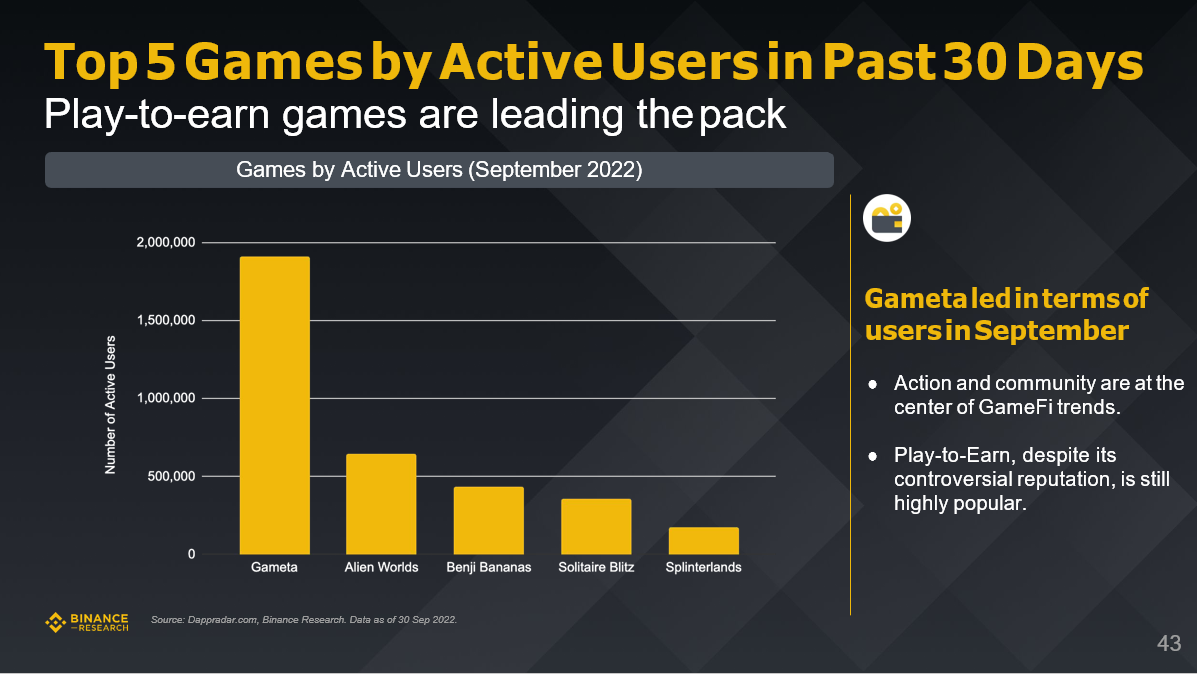

image description

Top 5 games by active users in the past 30 days

According to data from Dappradar.com and Binance Research as of September 30, 2022, "play and earn" P2E games are leading the trend.

Binance Research Institute: Review the market status of the five key tracks in the third quarter

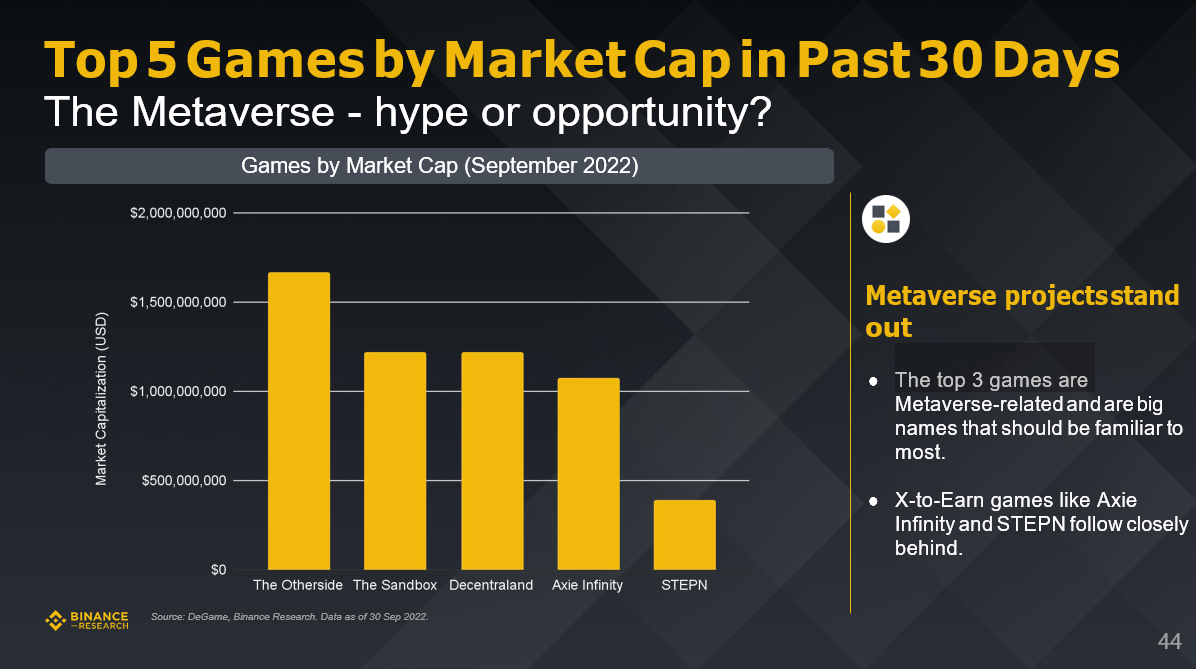

image description

Top 5 games by market capitalization in the past 30 days

The Metaverse – Hype or Opportunity?