Mango から数億の資金を盗んだ後、ハッカーは「無罪を晴らす」ために DAO 提案を開始しました。

北京時間の今朝早く、Solana の環境分散型取引プラットフォームである Mango がハッキングされ、最大 1 億 1,500 万米ドルの損失を被りました。

その後、マンゴー関係者らは、対応策を講じているとツイートし、ハッカーが率先して返済問題(一部は報奨金として保留される可能性がある)について話し合うためにマンゴーに連絡してくれることを期待している、とツイートした。流動性を凍結します。予防措置として、フロントエンドでの入金を無効にし、状況の進展に応じて最新情報を提供します。」

ソラナ生態系アルゴリズムの安定通貨協定であるUXDプロトコルは、マンゴー攻撃で影響を受けた資金の総額は2,000万米ドル近くであると述べ、その保険基金は損失をカバーするのに十分であると述べた。

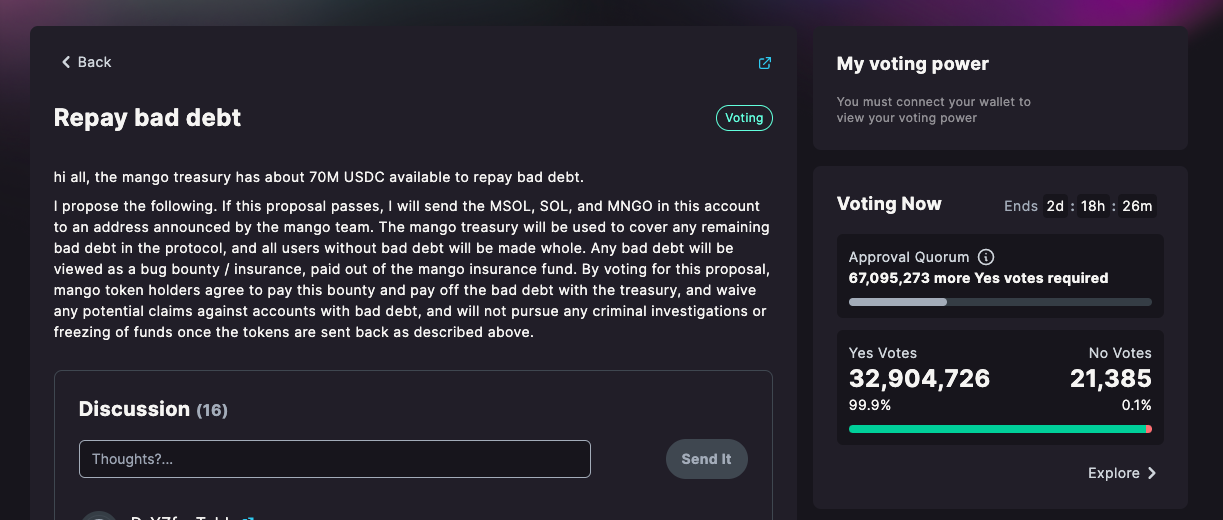

以前の攻撃のプロットの傾向とは異なり、今回のハッカーは「ドラマに非常に夢中」で、レルムに関する新しいガバナンス提案をリリースしました。マンゴーがユーザーの不良債権を返済するために国庫資金(7,000万ドル)を使うことが期待されている;当局者が同意すれば、ハッカーは盗まれた資金の一部を返し、犯罪捜査や資産凍結を避けることを期待している。一部の暗号化愛好家は、Mango ハッカーは DeFi と DAO を理解しているとコメントしました。

今まで、この提案は 3,290 万票の賛成票を獲得し、そのうち 3,241 万票はハッカー自身によって投じられたものです。副題

攻撃のために MNGO 価格を操作する

結合暗号学者@Joshua Lim同様に@Mango公式事故報告書によると、次のように攻撃プロセスを復元します。

ハッカーはまず、Mango Exchange A と B のアドレスに 500 万米ドルをそれぞれ送金します。2 つのアドレスは次のとおりです。

A:CQvKSNnYtPTZfQRQ5jkHq8q2swJyRsdQLcFcj3EmKFfX;

B:4ND8FVPjUGGjx9VuGFuJefDWpg3THb58c277hbVRnjNa;

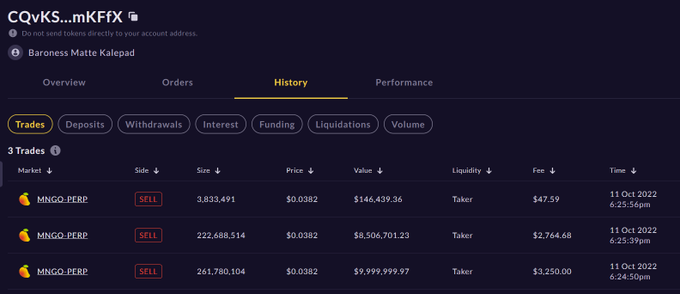

次に、ハッカーは MNGO の無期限契約を使用して、アドレス A を通じて Mango のプラットフォーム通貨 MNGO を空売りし、始値は 0.0382 ドル、売りポジションは 4 億 8,300 万、買いポジションは 4 億 8,300 万でした。画像の説明

(ハッカーはMNGOを略します)

画像の説明

(MNGO価格推移)

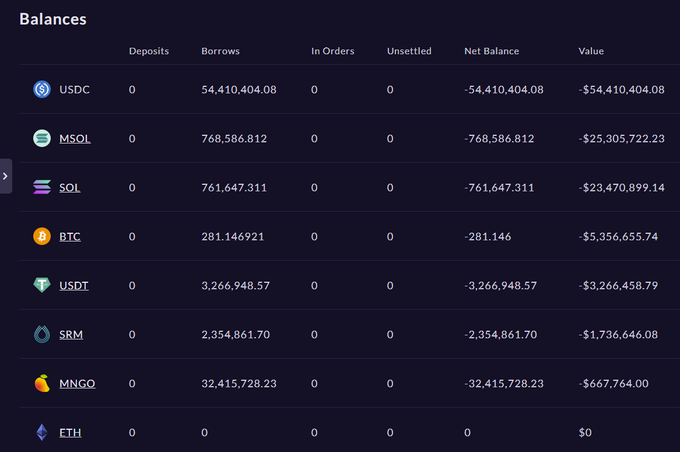

この時点で、ハッカーのロングポジション利益は 4 億 8,300 万 * (0.91 ドル - 0.0382 ドル) = 4 億 2,000 万ドルで、ハッカーはアカウントの純資産を使って Mango から借入しました。幸いなことに、プラットフォームの流動性が不十分であったため、ハッカーは最終的には融資のみを行いました。以下を含む約 115 万の資産:5,441万USDC、768,500 MSOL(2,530万ドル)、761,600 SOL(2,347万ドル)、281 BTC(535万6,000ドル)、326万USDT、235万4,000 SRM(173万ドル)、3,241万MNGO(66万7,000ドル)画像の説明

(盗まれた資金の回収)

実際には、

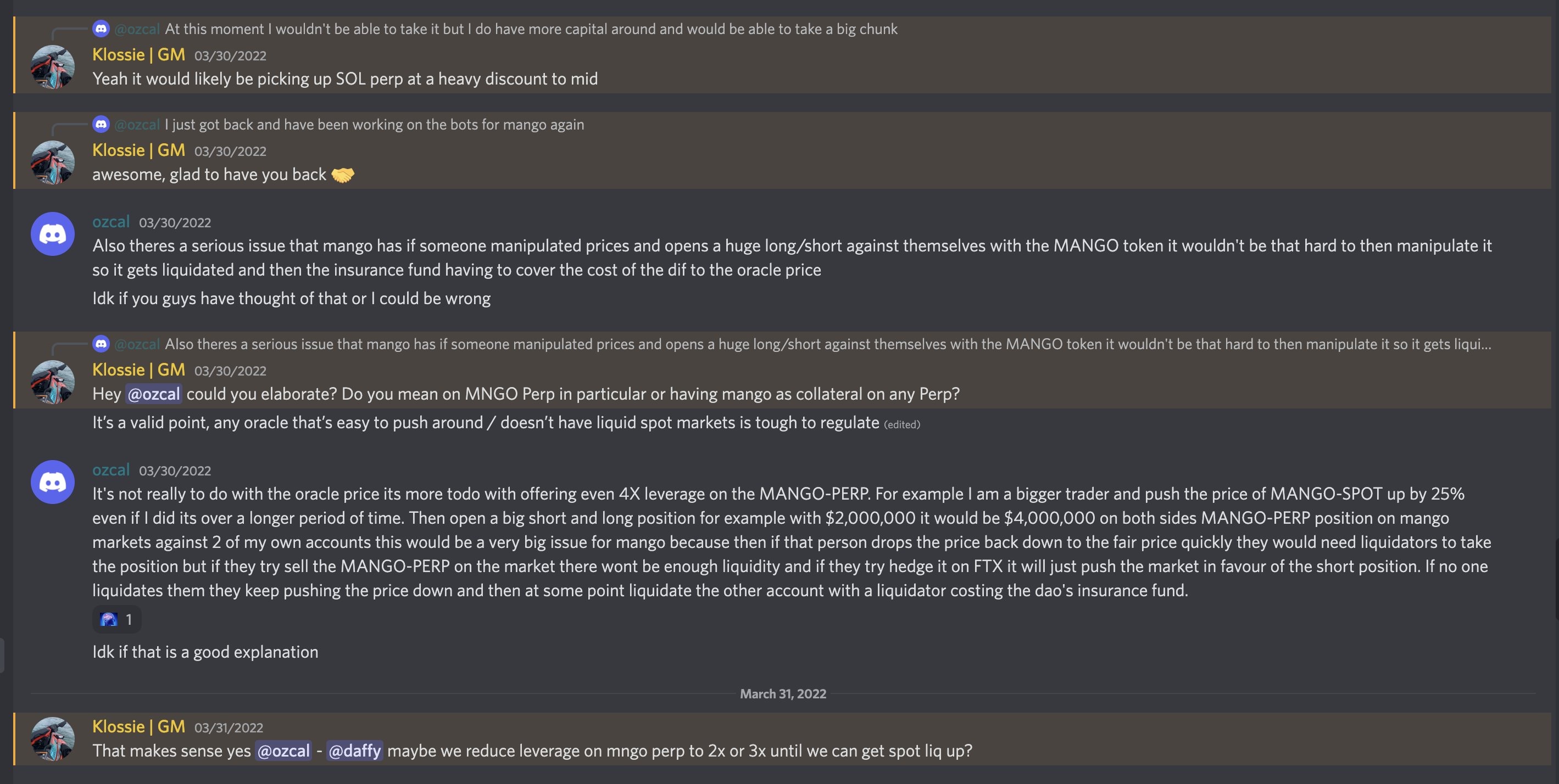

実際には、マンゴーへの攻撃は避けられたかもしれない。画像の説明

(今年3月のMango Discordチャットのスクリーンショット)

副題

プロジェクトの方向性をハッカーが侵害?

新しい提案新しい提案、政府が協定の不良債権を返済するために国庫資金(7,000万ドル)を活用することへの期待を表明した。現在の財務資金は約1億4,400万米ドルで、これには8,850万米ドル相当のMNGOトークンとUSDCの約6,000万米ドルが含まれていることがわかっています。

ハッカーらは、当局がこの計画に同意すれば、盗まれた資金の一部は返還されるとしながらも、犯罪捜査や資金凍結が起こらないことを期待していると述べた。 「この提案が可決されれば、このアカウントのMSOL、SOL、MNGOをMangoチームが発表した住所に送ります。Mangoの財務省は、契約に残っている不良債権と不良債権を抱えたすべてのユーザーをカバーするために使用されます」全額補償されます...上記のように代表コインが返還されれば、犯罪捜査や資金の凍結は行われません。」

以前の統計によると、ハッカーが返送を計画している資産の額は約4,943万米ドルで、これは盗まれた資金の約42%に相当し、盗まれた資産のほぼ半分がハッカーによって残されたことを意味します。この割合は、これまでの攻撃で当局が約束した上限よりもはるかに高い。

Mango関係者は、現時点での最善の解決策は攻撃者と通信することだと述べた。 「Mango DAOの優先事項は、さらなる不必要な損失を防ぐこと、Mangoプロトコルの預金者の資金を確保すること、Mango DAOの価値の一部を回収することです。Mangoは、この問題を解決する最も建設的な方法は、事件への取り組みを続けることであると信じています」そして、問題を友好的に解決しようとするために合意から削除された資金を管理していた人々。」

法律専門家でありLegalDAO創設者のMasterLi氏は、どの国の法律の観点から見ても、そしてこの投票が可決されるか否かに関わらず、ハッカーの犯罪的性質がこのようにして個人の責任を回避しようとしていることに疑いの余地はないと信じています。 . 国の法律では機能しません。

「もう1つのレベルは、DAOガバナンスルールのレベルです。DAOエンティティが存在しない場合、DAOガバナンスルールはDAOメンバー間のある種の契約または契約とみなすことができると思います。ハッカーはトークンを盗み、権利を行使することで契約関係に参加します」提案を行うことは、法的観点からはまったく支持できません。言い換えれば、ハッカーが提案し投票する権利には本質的に欠陥があります。この意味で、「役人」がこの理由で提案を拒否した場合(MangoDAO にそのような提案があるかどうかはわかりません)メカニズム)それは理由がないわけではありませんし、DAOの目的に反するとは思いません。これは、私が民主的な選挙に参加しに行ったのに、誰かが私の票を盗んで私に投票したのであれば、この投票は間違いなく無効であると言っているようなものです。 」

最終的に当局者がこの提案に同意し、実行に移すかどうかは不明だ。本稿執筆時点で、ハッカーの提案には 3,290 万票の賛成票が集まっており、そのうち 3,241 万票がハッカー自身によって投じられたものですが、基準となる 6,709 万票にはまだ程遠いです。