first level title

MakerDAO's Dilemma

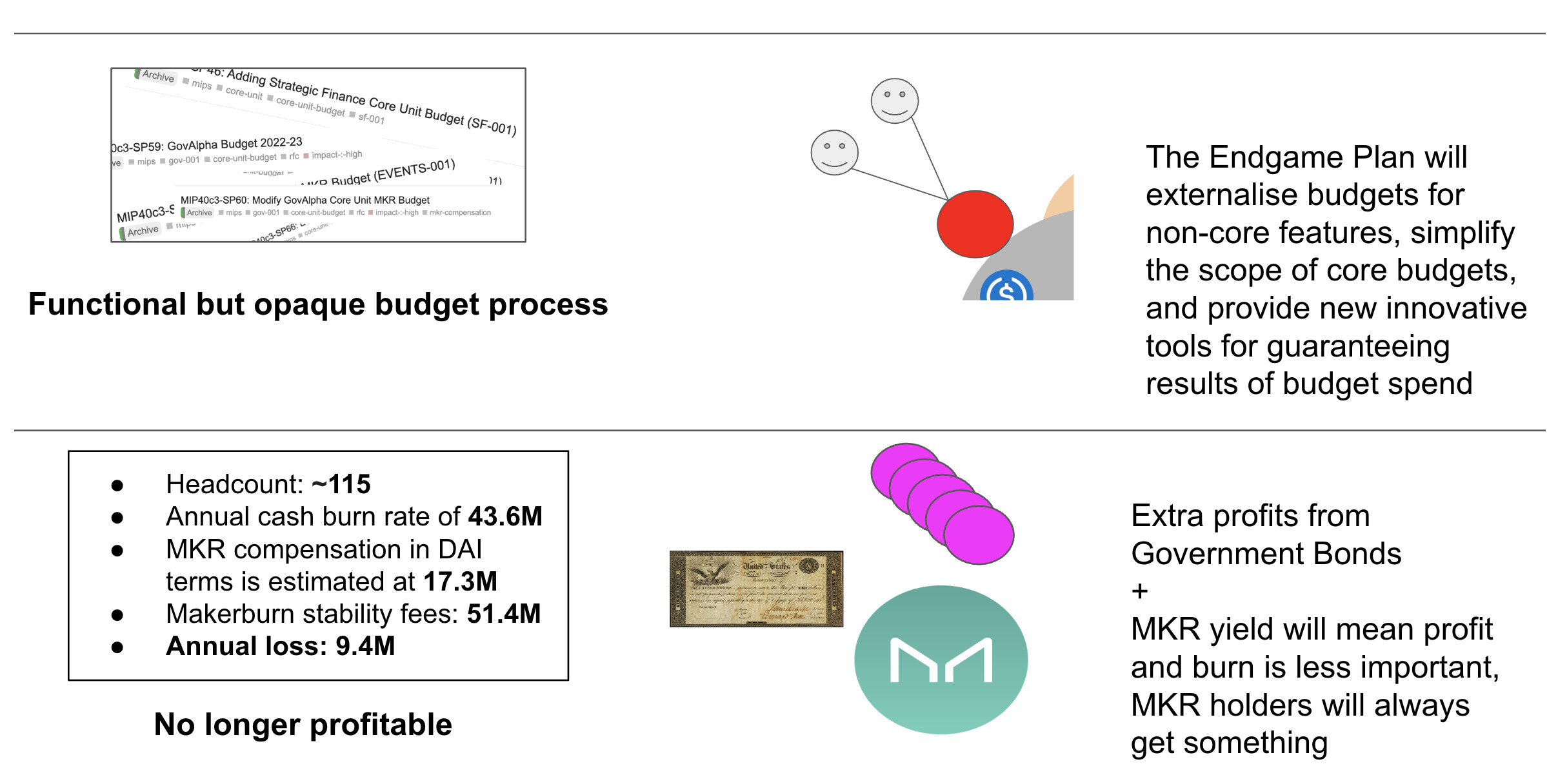

According to MakerDAO’s revenue data, MakerDAO’s annual stability fee income is approximately $51.4 million. But beyond the ostensible income, maintaining this large and complex governance machine requires 115 employees, burns cash at $43.6 million per year, and makes MKR compensation about $17.3 million in DAI. The cost of these payments has exceeded MakerDAO’s stability fee income and caused MakerDAO to lose about $9.4 million per year.

MakerDAO co-founder Rune Christensen was aware of this problem in May this year, and formally proposed an Endgame Plan (The Endgame Plan) in June, hoping to simplify the complexity of governance. Rune's signature has also been changed to "now working on some new projects and contributing to Maker as a community member".

first level title

Governance Reform: MetaDAO

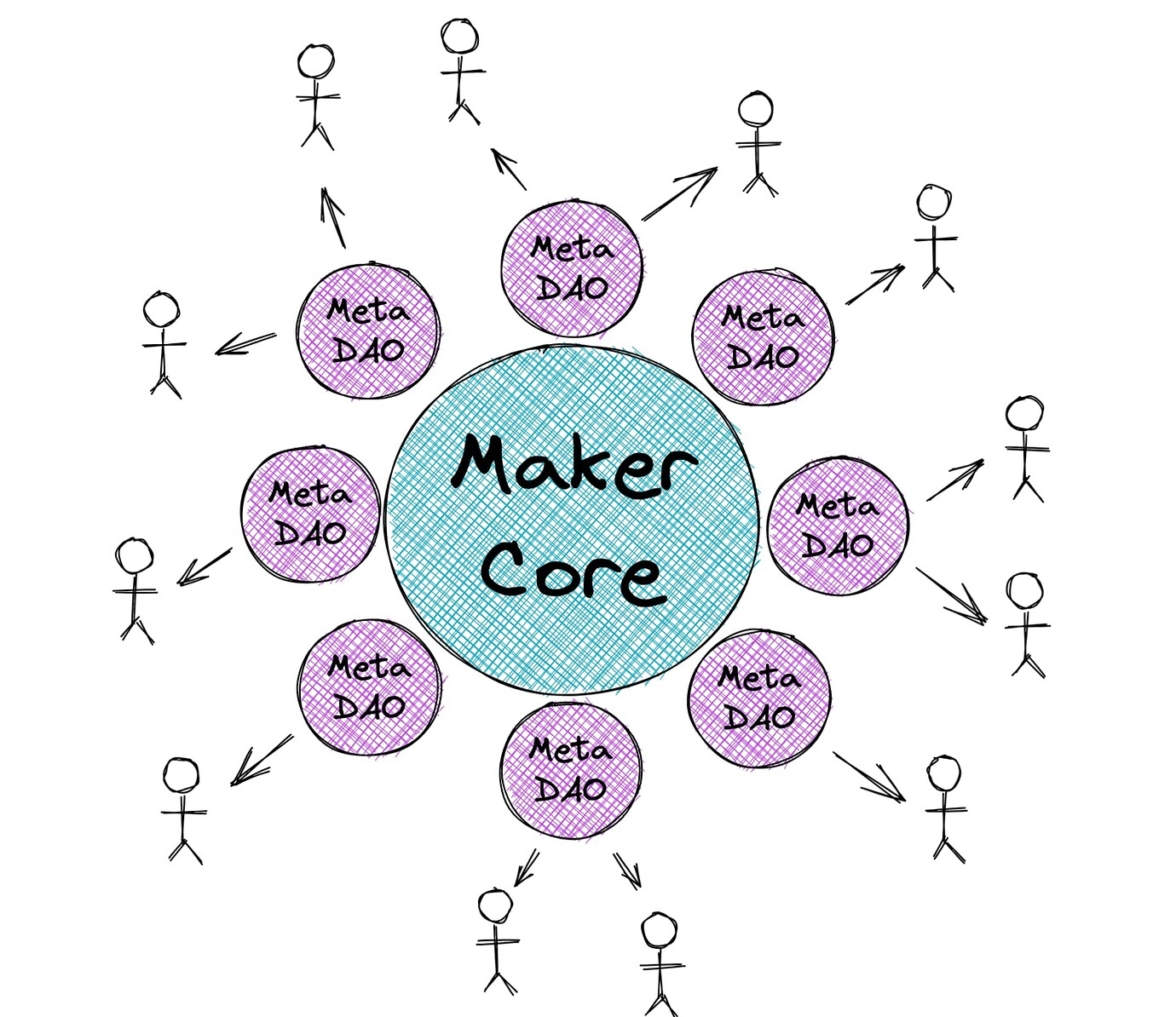

On the one hand, the existing governance process is too complicated, which restricts the speed of MakerDAO's development of new functions; on the other hand, it needs to rely on the participation of a large number of people, which has become the main reason for MakerDAO's losses in the bear market. As an important part of the endgame plan, MetaDAO is committed to speeding up the governance process, reducing MakerDAO's labor costs, isolating risks, and parallelizing highly complex governance processes.

Similar to the current mainstream "modularization" idea of the blockchain, the complex MakerDAO governance is split into small pieces, that is, MetaDAOs one by one. Each MetaDAO can focus on its own tasks without being burdened by other responsibilities. distracted. For example, MetaDAO, which focuses on creation, will recruit developers to build front-end products and on-chain functions; MetaDAO, which focuses on RWA (real world assets), will be responsible for managing RWA Vaults. This can also overcome the single-threaded problem of the current Maker governance process, realize multi-center governance, allow MetaDAO to execute in parallel, and speed up the governance process.

Makers can create new MetaDAOs by deploying new ERC20 tokens. Ideally, Maker Core only needs to support collaborative MetaDAO in the end, and the specific work will be completed by each MetaDAO, reducing the burden on MakerDAO. Some members of Meta Core will also be reorganized into Meta DAO, reducing MakerDAO's labor costs by half.

Comparing MakerDAO and MetaDAO is like the relationship between Layer 1 and Layer 2. Maker governance can be regarded as a slow, expensive but more secure "Governance Layer 1", while MetaDAO is like a fast and flexible "Governance Layer 2". But the final security upgrade comes to Maker governance.

first level title

The path to decentralization

MakerDAO increases decentralization primarily through the following paths, focusing on increasing the use of decentralized collateral and accumulating protocol-owned decentralized assets with protocol revenue.

1. Increase the use of ETH collateral

After Tornado Cash was sanctioned by the U.S. Treasury Department, Maker has adopted a series of measures to reduce its dependence on USDC.

For example, increase the debt ceiling of WSTETH-B Vault and reduce the stability fee to zero, and reduce the stability fee of ETH-A, ETH-B, WSTETH-A, WBTC-A, WBTC-B, RENBTC-A and other Vaults.

Lowering funding rates for other vaults may reduce the need to mint DAI with USDC via PSM.

2. Introduce EtherDai

EtherDai was introduced to own staked ETH under the control of Maker governance, a product that includes ETHD and EtherDai Vaults. ETHD is a wrapper around Lido's Staked ETH (stETH) (similar to wstETH). Users can wrap stETH into ETHD, or redeem ETHD into stETH. The emergence of ETHD and wstETH may be because Lido issues pledge rewards through rebase. If users hold stETH, the balance will continue to increase, but it may be inconvenient to use in some scenarios.

Maker governance will have backdoor access to ETHD collateral, possibly incentivizing liquidity by setting up short-term ETHD/DAI liquidity mining on Uniswap. On the other hand, it is possible to set the stability fee of EtherDai Vault to zero to guide the demand for EtherDai Vault.

3. Adjust the use of real world assets (RWA)

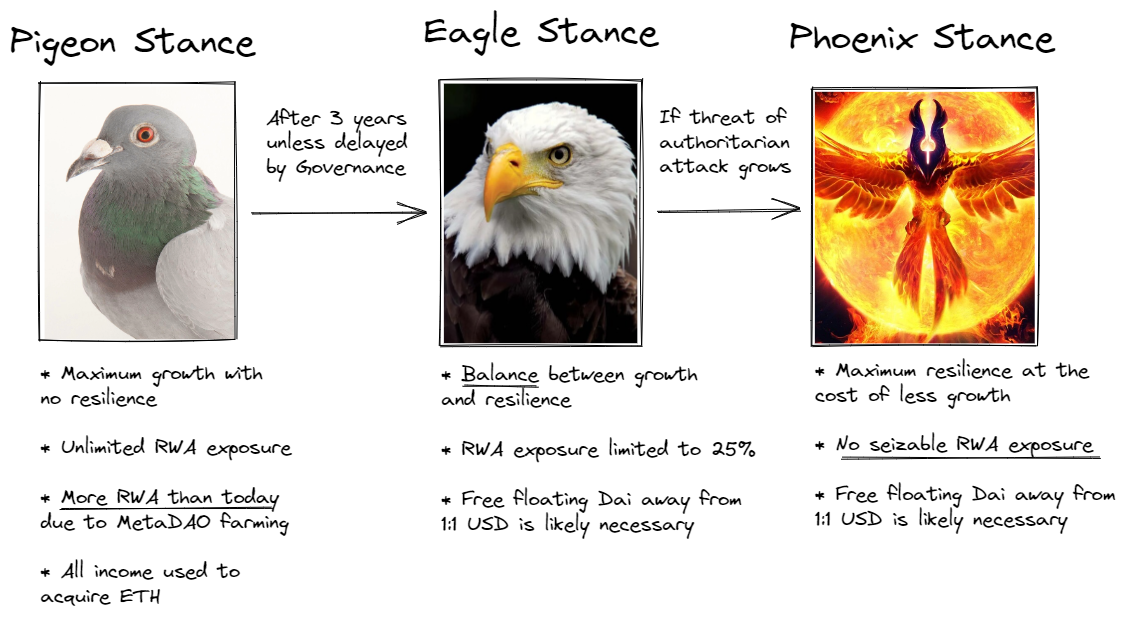

The endgame plan proposes 3 different collateral strategies, which are dove style, eagle style, and phoenix style. They will gradually develop forward with the timeline and gradually advance according to the threat of regulation.

The first is the pigeon strategy. The main task during this period is to increase RWA as much as possible and maintain high-speed growth. Because RWA collateral can bring relatively higher stability fees to Maker, Maker wants to earn as much as possible during this period and exchange it for ETH.

After 3 years, if DAI starts to be attacked by authority and the RWA collateral is at risk of being confiscated, then switch to the eagle strategy and limit the risk exposure to RWA to 25%, in order to seek a balance between performance growth and flexibility .

If there is evidence that an authority attack is imminent or all collateral of RWA has been confiscated, it will transition to the Phoenix strategy of eliminating all RWA risk exposures, and only RWA that cannot be controlled by the authority can be used as collateral.

Starting from the eagle strategy, that is, RWA has the risk of being confiscated, it is necessary to make DAI unpegged from the US dollar and become a free floating asset.

The basis for adopting this development route is that supervision may tend to be stricter, and the degree to which RWA collateral is threatened by authoritative institutions increases over time. And MakerDAO can also use the current time window to expand the market as much as possible and accumulate assets.

4. Vault owned by the agreement

When a user pledges assets in Maker to borrow DAI, a Vault will be generated. The anchor stability module does not distinguish between users, has no stability fee, and will not be liquidated. It can also be regarded as a special vault.

The Vault owned by the protocol will help MakerDAO accumulate more ETH. The first plan is to use the surplus of 40 million DAI to obtain Staked ETH with 2x leverage. This means that $80 million worth of Staked ETH can earn yield, and the surplus will also be put into a Vault owned by the protocol. With the completion of the merger and transfer of Ethereum to PoS, MakerDAO can obtain an additional staking income.

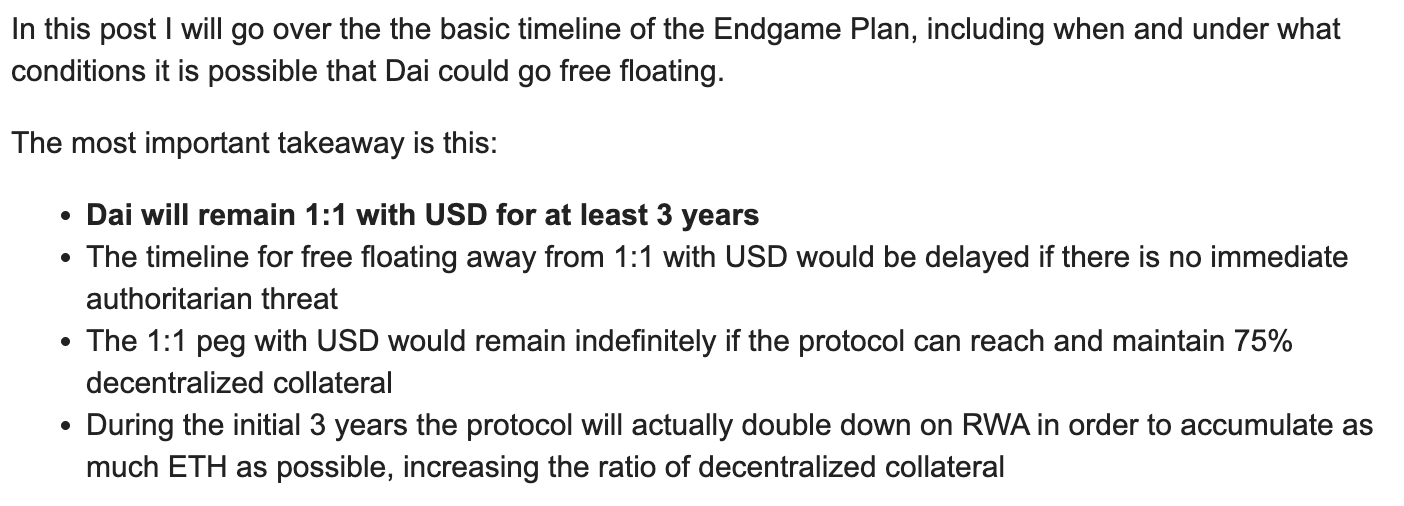

In the short term, DAI will still be anchored to the US dollar

According to the current plan, DAI will still be anchored to the US dollar for quite a long time. Rune also explained on his twitter that "it is a bad idea to exchange all stablecoin collateral for ETH".

MakerDAO is still using the assets in PSM to increase its influence. For example, 1inch and Paraswap, two aggregation DEXs, have already integrated PSM. Transactions between large amounts of USDC and DAI will directly pass through Maker’s PSM, without transaction slippage, and without any Transaction Fees.

Rune’s final plan timetable published in the MakerDAO Governance Forum on August 30 also shows that DAI will remain anchored to the US dollar for at least 3 years, and this time will be extended if there is no direct threat. If collateral decentralization can be increased to 75%, then the peg to the US dollar will be maintained indefinitely.

summary

In the short term, DAI will still be anchored to the US dollar, and Maker's main task at present is to continue to expand its business and accumulate assets. MetaDAO's reform of governance may be mainly to reduce MakerDAO's huge labor costs in the bear market, and to speed up the efficiency of follow-up work.

Regulatory pressure may not come anytime soon, this is a window of time to seize opportunities for development. When the regulatory pressure does come, MakerDAO's plan is to achieve censorship resistance and peg to the US dollar in the medium and long term.