Compilation of the original text: Bai Ze Research Institute

Compilation of the original text: Bai Ze Research Institute

secondary title

What determines Bitcoin's future energy consumption?

Before diving into estimates, we should understand the factors that determine Bitcoin's future energy consumption. The most important variable isbitcoin price、transaction fee、as well asas well asAverage electricity price for miners。

text

bitcoin price

Bitcoin price is the most critical determinant of Bitcoin's future energy consumption.

The bitcoin price multiplied by the block reward determines the industry-wide revenue of bitcoin miners, including their costs and profit margins. The rise in the price of Bitcoin has driven the increase in the income of miners across the industry, increasing the profit margin of miners in the short term. Bitcoin mining is an industry with fierce competition and low barriers to entry. These lucrative profit margins will naturally attract more miners to participate, resulting in increased energy consumption.

transaction fee

Currently, most miners barely consider transaction fees because they represent only a small percentage of the miner's total revenue. So you might be surprised why we think Bitcoin’s transaction fee levels are critical to its future energy consumption.

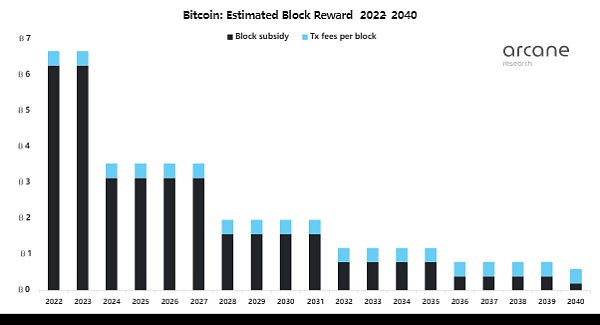

Bitcoin miners produce 52,560 blocks per year, and the first miner to grab a block will receive a block reward. The block reward consists of two parts:andandtransaction fee。

The block subsidy is newly minted bitcoins, while transaction fees are bitcoins paid to miners as a tip by the sender of the transactions included in the block.

According to CoinMetrics, the historical average transaction fee per block is 0.4 BTC, which is a fraction of the current block reward.

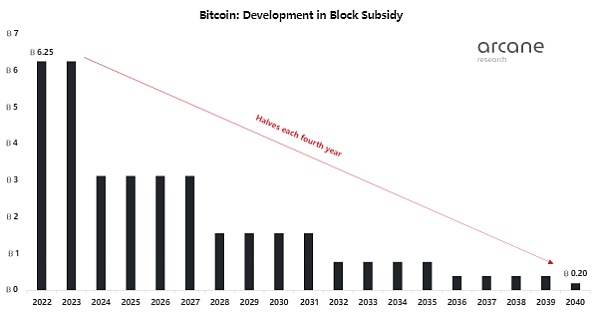

Transaction fees may not appear to be important in the block reward, but since the block subsidy is halved every four years or so, its importance will gradually increase.

We assume that transaction fees per block will remain at 0.4 BTC through 2040. Since transaction fees are constant but the block subsidy is halved every four years, transaction fees will gradually become a larger share of the block reward. By my estimate, transaction fee share will grow to 67% by 2040, with a block subsidy of 0.195 BTC and transaction fees of 0.4 BTC.

While Bitcoin price is the most critical determinant of Bitcoin's future energy consumption, transaction fees are a close second, and their importance will grow further in the future.

Percentage of revenue that miners spend on electricity

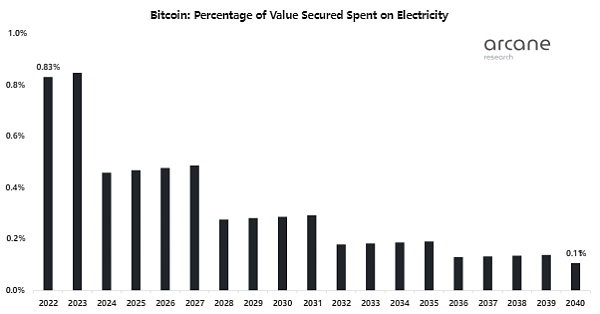

Bitcoin miners spend a certain percentage of their income on energy, and the higher this percentage, the higher the energy consumption of the industry. To estimate where this percentage will go in 2040, we have to look again at the competitive nature of the industry.

In any industry, expenses can be broken down into two main components: CAPEX (capital expenditures) and OPEX (operating expenses). For Bitcoin miners, CAPEX consists of equipment and electrical infrastructure, while OPEX consists mostly of energy. Currently, based on an energy consumption of 88 TWh and an average energy price of $50 per MWh, Bitcoin miners spend approximately 50% of their income on energy.

I believe that as the industry matures, Bitcoin miners' share of energy revenue will grow somewhat from current levels. As the industry matures, it may very well become the most competitive it has ever been. It is a global industry that is difficult to regulate and has low barriers to entry. Competitive forces could wipe out profit margins in the long run, except for miners who have access to unusually cheap electricity.

Also, the CAPEX part will gradually decrease as ASIC improvements are slowing down. To account for these trends, I assume that the percentage of miner revenue spent on electricity increases by 2% per year, implying 71% by 2040.

Average energy prices for the Bitcoin mining industry

As I explained, bitcoin miners will collectively earn a specific annual income, depending on bitcoin price and block rewards. They will spend a certain percentage of this revenue on energy, depending on how the industry competes. To understand how much energy the cost of energy translates into, we must estimate the average energy price for the industry.

We estimate the average electricity price for the Bitcoin mining industry to be $50 per MWh, and I believe it will remain at this level for the foreseeable future. We are already seeing high inflation globally and it is likely to continue. Still, the hyper-competitive nature of Bitcoin mining will incentivize miners to find cheaper energy sources.

Bitcoin mining is a location-independent industry, which means you can set up a mining operation almost anywhere the regulations allow. By 2040, I believe most Bitcoin miners will be using stranded energy that is much cheaper than grid electricity. Some miners may still be connected to the grid, but they will reduce energy costs by providing demand response services or selling the heat output of their equipment.

secondary title

Bitcoin could be a significant energy consumer, but it depends on price

If you've read any headlines about Bitcoin mining, you might think that the industry is currently a huge consumer of energy worldwide.

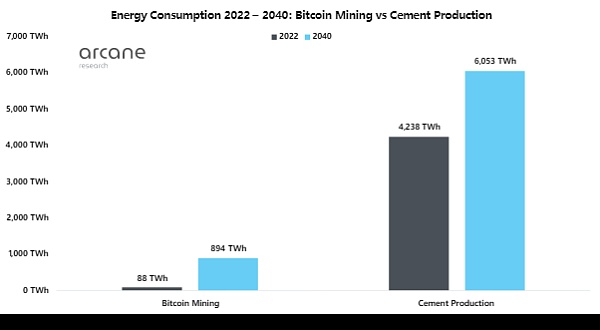

However, Bitcoin mining consumes only 88 TWh per year, which is 0.05% of the global energy consumption of 173,340 TWh. This means that the current energy consumption of Bitcoin mining is only a small number on a global scale.

Bitcoin mining may currently have limited energy consumption, but historically, it has grown rapidly as the price of Bitcoin has risen. If bitcoin prices continue to soar in the coming decades, bitcoin mining could grow into a major global energy consumer.

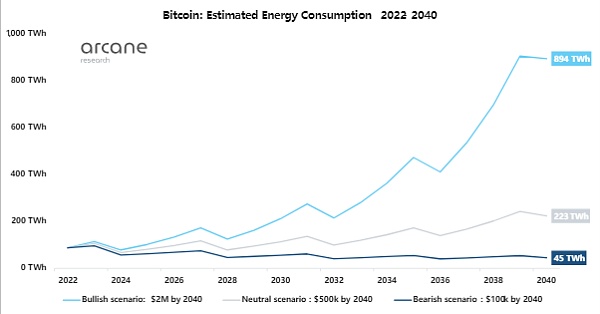

Bitcoin price is the most critical factor in determining the future energy consumption of Bitcoin. Therefore, I simulated three scenarios:

Bullish scenario of Bitcoin price growing linearly to $2M by 2040.

Neutral scenario of Bitcoin price increasing linearly to $500,000 in 2040.

Bearish scenario with linear increase in Bitcoin price to $100,000 by 2040.

As shown in the chart below, Bitcoin's future energy consumption will vary greatly depending on the future Bitcoin price.

If the bitcoin price hits $2 million by 2040, bitcoin could consume 894 TWh per year — a 10-fold increase from today's levels. This energy consumption is estimated to be equivalent to 0.36% of global energy consumption in 2040, a considerable increase from today's share of 0.05%.

Let's look at a more neutral scenario where the Bitcoin price reaches $500,000 by 2040. In this scenario, Bitcoin would consume 223 TWh per year, slightly more than double current levels. This small increase in energy consumption is surprising since a Bitcoin price of $500,000 would represent a 20-fold increase in Bitcoin price. Here we see the impact of the halving, which will be explained later in this article.

secondary title

Scenario Analysis: Bitcoin Price and Transaction Fees

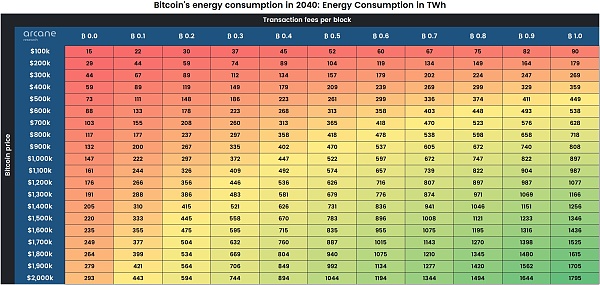

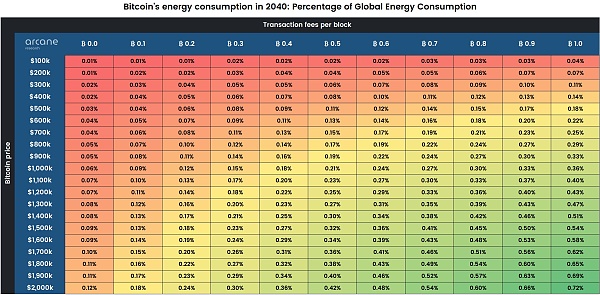

The three scenarios above differ only in price. As mentioned earlier, the level of transaction fees also has a huge impact on Bitcoin’s future energy consumption. Therefore, I included a scenario analysis for how much Bitcoin's energy consumption in 2040 will vary based on Bitcoin price and transaction fees.

In the table above, we see that transaction fees have a huge impact on Bitcoin's energy consumption at a Bitcoin price of $2 million in 2040. For every 0.1 BTC increase in transaction fees per block, Bitcoin’s energy consumption increases by 150 TWh, almost double the current energy consumption of 88 TWh.

Another interesting conclusion from the table is that, based on the historical average transaction fee of 0.4 BTC per block, the Bitcoin price would have to exceed $200,000 in 2040 for its energy consumption to remain at current levels. Here again we see the impact of the halving.

The graph above is the same as the previous one, but instead of showing energy consumption in TWh, it is shown as a percentage of global energy consumption. Here, we assume an annual growth rate of 2% in global energy consumption through 2040.

secondary title

Halving Limits Bitcoin's Energy Consumption Growth

The graph below shows our estimates for the development of Bitcoin's energy consumption between 2022 and 2040. We can see that energy consumption decreases substantially every four years for all price scenarios. The reason is that the block subsidy is halved every 210,000 blocks or every four years.

Since the block subsidy is halved every four years, Bitcoin mining will gradually reduce energy consumption. Over time, the impact of block subsidy halving on Bitcoin mining energy consumption will gradually weaken.

Assuming a transaction fee of 0 BTC per block, Bitcoin's energy consumption will only increase if the price of Bitcoin increases faster than the block subsidy decreases. The block subsidy is halved every four years, and the price of Bitcoin must double every four years to offset this effect. In this case, the bitcoin price would have to be around $650,000 in 2040 for its energy consumption to be higher than it is today.

in conclusion

in conclusion

Bitcoin's future energy consumption is very uncertain and depends on several factors. One thing is for sure, though: Bitcoin will only become a major global consumer of energy when its price hits millions of dollars.

While an increase in Bitcoin's price spurs more mining activity and higher energy consumption, the halving has the opposite effect. Due to the halving, the price of Bitcoin must continue to rise at an alarming rate for Bitcoin's energy consumption to increase in the long term. The mitigating effect of the halving can be offset by future transaction fee increases. This growth will only happen when Bitcoin becomes the dominant global payment system and is in high demand.

This fact leads us to an important conclusion from this paper. That is: Bitcoin's future energy consumption will only grow if people see Bitcoin as a store of value and payment system. Keep in mind that Bitcoin will consume a lot of energy in 2040 if the price grows to millions of dollars and transaction fees are quite high. Bitcoin price is determined by market demand for Bitcoin as a store of value, while transaction fees are driven by demand for usage of the Bitcoin payment system.

We can therefore say that energy consumption will only reach extremely high levels if Bitcoin succeeds as a "money". Even in the bullish price scenario of $2 million in 2040, Bitcoin would consume only 0.36% of global energy consumption. Spending 0.36% of our energy to secure a store of value and facilitate transactions for billions of people around the world is well worth it - and that's not even taking into account the energy needs of Bitcoin miners that incentivize even more energy production.

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.

risk warning:

According to the "Notice on Further Preventing and Dealing with the Risk of Hype in Virtual Currency Transactions" issued by the central bank and other departments, the content of this article is only for information sharing, and does not promote or endorse any operation and investment behavior. Participate in any illegal financial practice.