The trading volume of the leading decentralized exchange Uniswap is close to that of centralized exchanges such as Coinbase, but the proportion of decentralized exchanges in the trading of encrypted derivatives (mainly perpetual contracts) is still relatively low. This may be due to factors such as security, convenience, and mobility. Derivatives DEX usually involves leverage and liquidation process, and funds need to be stored in a specific contract, which is not as safe and convenient as spot DEX; the risk of providing liquidity in AMM derivatives DEX is relatively high, and the order book is difficult To attract traditional market makers, liquidity is relatively limited, and there is still a big gap between the on-chain derivatives trading experience and centralized exchanges.

With the maturity of various expansion plans, multiple decentralized derivatives exchanges have been launched one after another, and decentralized derivatives exchanges have also become a type of protocol that can bring real benefits to users. In a previous series of articles, PANews has discusseddYdX、Perpetual、MCDEX、Synthetix、GMX, this article will introduce some derivative DEXs that have been launched recently or are still popular, and the data statistics are from August 18.

ApolloX

ApolloX is a DEX-CEX mixed encrypted derivatives exchange. DEX is deployed on the BNB chain, and DEX and CEX can share liquidity. According to news on June 7, ApolloX has completed its seed round of financing. Participating investors include Binance Labs, Kronos Research, Lingfeng Capital, SafePal, Token Pocket, 3Commas, and LUX Capital. The specific financing scale has not been announced.

ApolloX can provide perpetual contract trading with a leverage of up to 100 times. Similar to dYdX, it adopts the traditional order book model and is close to a centralized exchange in experience. 50% of APX tokens are also reserved as transaction rewards and liquidity mining rewards during distribution to stimulate transaction volume and liquidity, which can be regarded as a competitor of dYdX.

On June 8, 2022, ApolloX was attacked. Hackers obtained 53 million APX tokens from the contract and converted them to 2.1 million BUSD. User funds were not lost. Afterwards, the team repurchased approximately 12.75 million APX with USD 600,000, and the lost tokens will be made up for by the transaction fees earned.

Stimulated by transaction mining and liquidity incentives, ApolloX has matured. As of August 18, the total transaction volume in the past 30 days exceeded 16 billion US dollars.

Deri Protocol

Deri Protocol can provide perpetual futures, perpetual options and multiplier perpetual contract transactions (Power Perpetual proposed by Paradigm), and has won LD Capital, FBG Capital, Bixin Ventures, Lotus Capital, Black Range, WOO Network, BSC Growth Fund, etc. invest.

The characteristic of Deri is that it combines positions with NFT, and uses NFT to represent the positions of traders and liquidity providers. NFT records the long or short direction of the transaction, funding fees, entry prices, transaction volume, Information such as margin and liquidity provided, which allows Deri and other protocols to have better composability.

The Deri Proactive Market Making (DPMM) adopted by Deri is borrowed from DODO, a decentralized exchange for spot trading. It uses the index price provided by the oracle as the mark price. When a transaction occurs, it will push the mark price to The direction of the transaction moves, and the price change is proportional to the size of the transaction.

Deri has been upgraded to version V3 this year. Deri V3 has upgraded the account structure. Now perpetual futures and options products share a liquidity pool. Users can also trade multiple derivatives of the same underlying asset at the same time, which improves capital efficiency. The introduction of Vault enables user funds to obtain additional income in lending agreements (Aave, Venus, etc.), allowing the agreement to preserve user funds in a more decentralized manner.

Synfutures

Synfutures is a decentralized synthetic asset derivatives trading platform. On June 16, 2021, it announced the completion of a US$14 million Series A financing, led by Polychain Capital, Framework, Pantera Capital, Bybit, Wintermute, CMS, Kronos , IOSG Ventures participated in the investment.

Synfutures is now able to use the V1 version, which is an Ethereum-based futures market that can trade Ethereum native assets, cross-chain assets, and synthetic assets of real assets. It has been deployed on Polygon, BNB chain, and Arbitrum. Its biggest feature is that any user can create a new trading pair through the "factory" contract, as long as the asset is supported by Uniswap or Chainlink's oracle machine, similar to Uniswap in the derivatives trading field.

Synfutures adopts a synthetic automatic market maker (sAMM). Liquidity providers (LP) can directly provide liquidity with quoted assets, synthesize long positions of half of the underlying assets, and then provide liquidity with these two assets. In terms of pricing, Synfutures also adopts the common constant product publicity x*y=k in AMM, and the market price corresponding to this formula is also the fair price. On this basis, Synfutures also introduces index price and mark price, and the index price corresponds to the oracle price. When the market price fluctuates suddenly, the index price can protect the user's position from liquidation.

Currently, Synfutures V1 is mature, and the V2 version is being tested. In the past 24 hours, the trading volume of Synfutures V1 was 37 million US dollars, which is close to the average of the recent daily trading volume.

Mycelium

Rebranded from TracerDAO, this is a perpetual contract exchange on Arbitrum that allows up to 30x leverage. It has received $4.5 million in financing from Framework Ventures, DACM, Maven 11, Apollo Capital, Distributed Global Ventures, Paperclip Fund, Supernova, GSR, and Efficient Frontier.

Mycelium's Perpetual Swaps mechanism is similar to that of GMX. Users bring together a basket of assets and stablecoins to form an MLP pool, which acts as a counterparty for other traders. Liquidity providers deposit whitelisted assets into the MLP pool in exchange for MLP tokens to start providing liquidity. Like GMX, liquidity providers get part of the transaction fee in the form of ETH and get additional esMYC tokens, which can eventually be unlocked into MYC.

The buying and selling fees for Mycelium traders are lower, only 0.03%, and there is no slippage in transactions. 10% of the fees will be rewarded to the top 50% of traders to attract traders and compete with GMX.

The current liquidity in the MLP pool is $11.85 million, and the trading volume in the past 24 hours is $12.37 million.

Vega Protocol

Vega Protocol is built on the Tendermint consensus algorithm and is an application chain for trading derivatives. Vega received a $5 million seed round of financing led by Pantera Capital in 2019. Since Vega was designed before the Inter-Blockchain Communication Protocol (IBC), it does not access the Cosmos Hub, but uses its own cross-chain bridge to cross-chain from Ethereum.

Vega uses the application chain to reduce transaction costs, increase transaction speed, prevent front-running transactions and MEV. Anyone can create a transaction market on any underlying asset and attract liquidity through a liquidity incentive mechanism. The order book model also adopted by Vega, only the price taker (price taker) pays the transaction fee, and LP shares part of the fee.

The liquidity incentive mechanism is a major innovation of Vega. The normal operation of the new trading market requires a certain amount of liquidity. Liquidity providers can make commitments at their own acceptable price levels, starting from the cheapest until reaching the desired level. required liquidity. This liquidity acquisition method is similar to an auction, which encourages liquidity to move to higher-yielding, that is, less liquid markets. The fees obtained by LP will be uniformly allocated after the end of each transaction period. It is not that more funds can be allocated to allocate more fees. The time and importance of liquidity provision also need to be considered. LPs who are willing to take risks and provide early liquidity will get greater returns.

Currently, Vega only allows transactions on the test network, and the restricted main network can only carry out token pledge, delegation and governance voting.

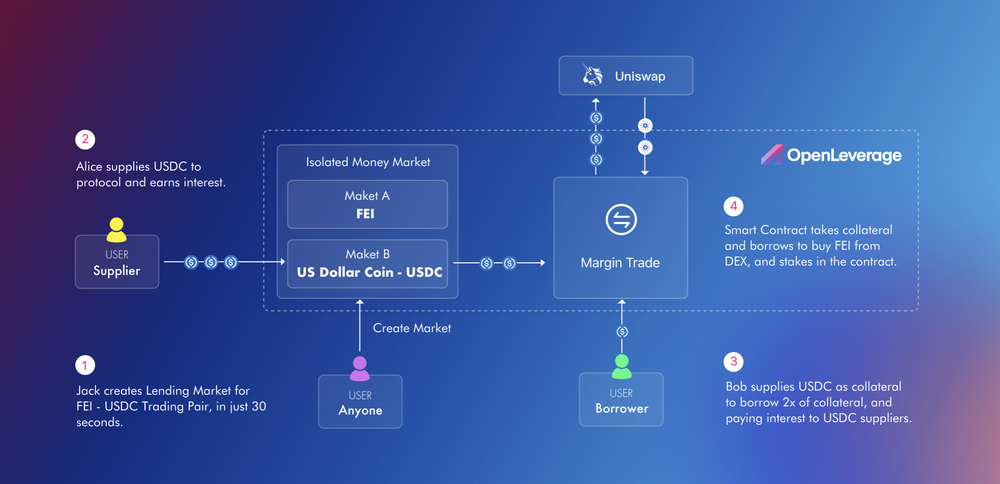

OpenLeverage

OpenLeverage is a license-free lending margin trading platform. The project completed a seed round of financing of US$1.8 million in July 2021. On June 21, 2022, OpenLeverage announced that it has received investment from Binance Labs.

Leveraged transactions on OpenLeverage do not depend on their own liquidity. Traders first borrow on OpenLeverage and then complete transactions on other DEXs. Anyone can create a lending pool for any trading pair available on the DEX, enabling leveraged trading. Each token is an independent lending pool, realizing risk isolation.

Since OpenLeverage’s borrowing and lending occurs on existing liquid trading pairs in DEX, it does not need an oracle machine to obtain off-chain prices, and can provide time-weighted average prices from supported DEXs (Uniswap, SushiSwap, PancakeSwap, BiSwap, etc.) Get prices on .

Users who trade in OpenLeverage need to pay the DEX transaction fee, the 0.22% transaction fee charged by OpenLeverage and the loan interest calculated according to the block.

Currently OpenLeverage supports the BNB chain, Ethereum, and KuCoin Community Chain. On the most active BNB chain, the current TVL is $6.25 million, and the transaction volume in the past 24 hours is $750,000.

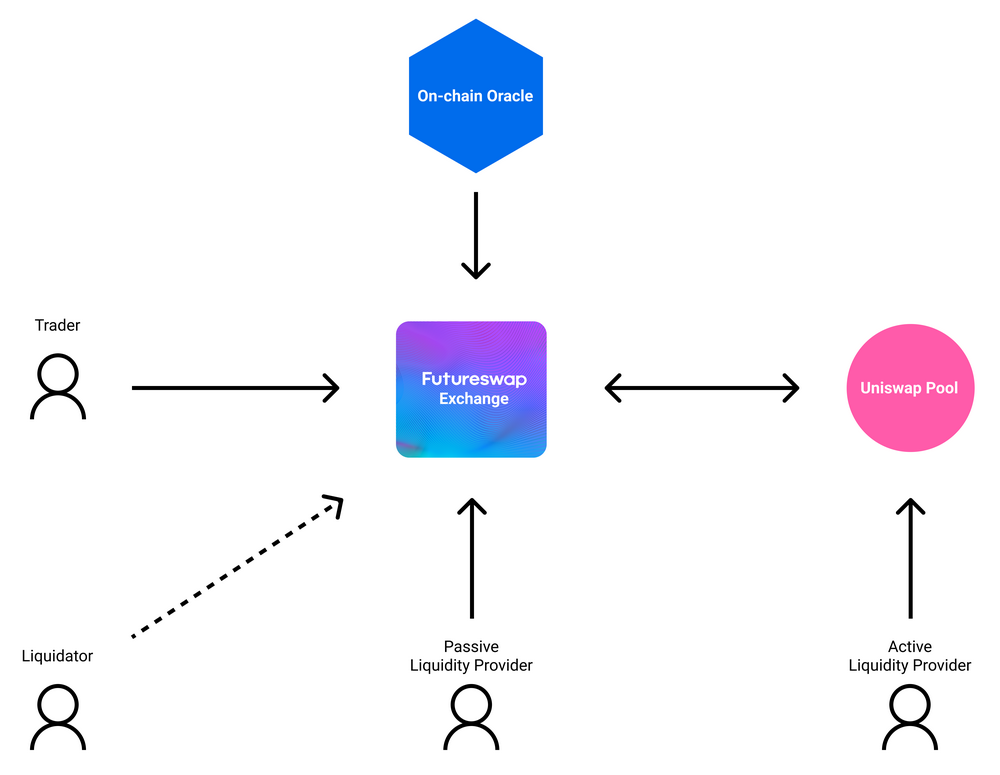

Futureswap

Futureswap is a decentralized leverage trading protocol that can provide up to 30 times leverage. It had announced on October 12, 2021 that it had received $12 million in financing, co-led by Ribbit Capital, Framework Ventures, True Ventures, and Placeholder.

The mechanism of Futureswap is similar to that of OpenLeverage. It can use the existing liquidity of Uniswap V3. It needs to borrow funds first, and then complete transactions on other DEXs. If a user holds 100 USDC and wants to go long ETH with 10 times leverage, he needs to borrow 900 USDC first, and then use 1000 USDC to buy ETH on Uniswap V3.

Futureswap is currently built on Avalanche and Arbitrum. The official website shows that the total trading volume of Futureswap is about 4.2 billion US dollars, but the current own liquidity of Futureswap’s ETH/USDC trading pair on Arbitrum is only 2.43 million US dollars, and the long position of this trading pair is 33.9 million dollars, and the airdrop position is about 34,000 dollars.

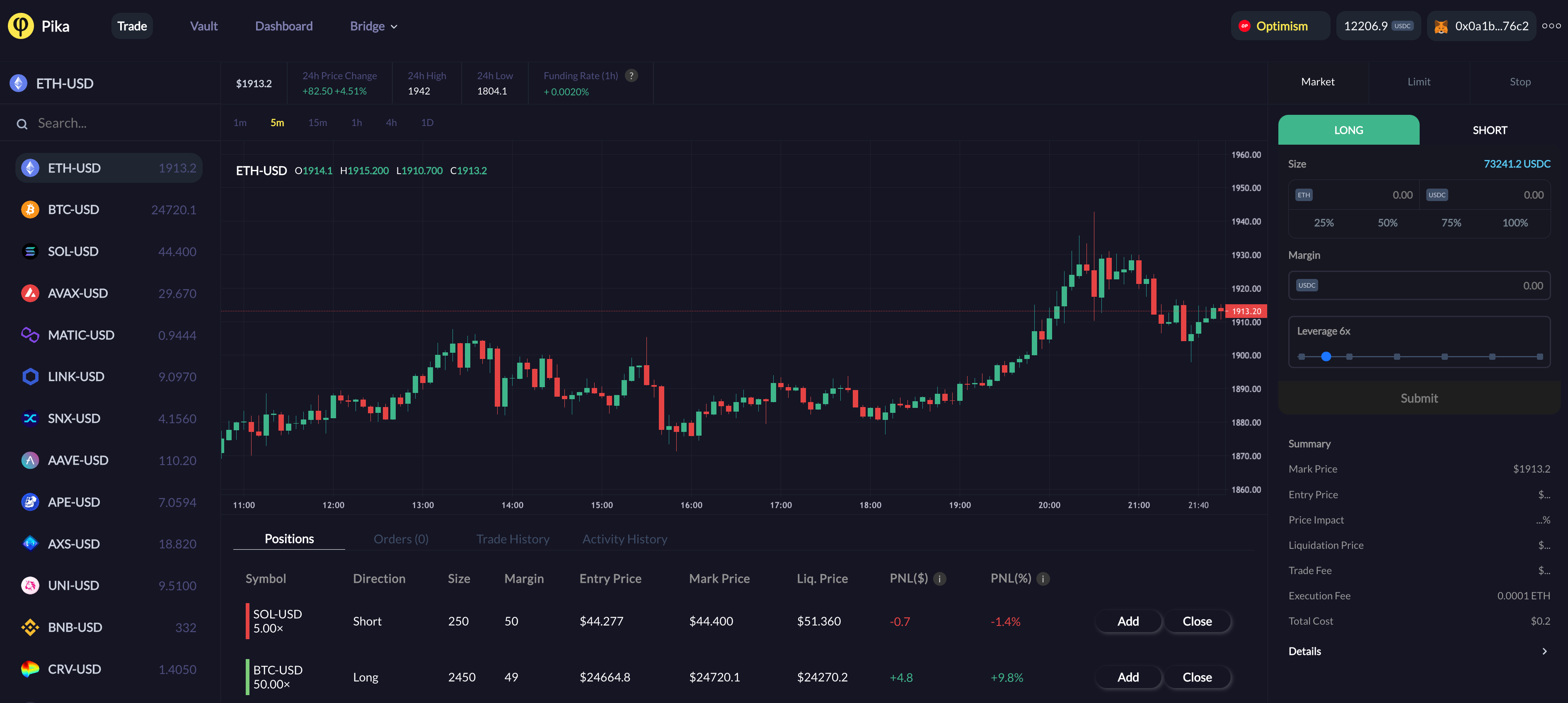

Pika Protocol

A perpetual contract DEX on Optimism, the second layer of Ethereum, supports market orders, limit orders and stop orders, allowing up to 50 times leverage.

Pika uses Chainlink oracles and fast oracles from exchanges to jointly determine transaction prices and concentrate liquidity around oracle prices. The fast oracle machine obtains the middle price from Binance, FTX, and Coinbase. Whenever a user submits an order, the price is obtained as the mark price. If the price of the fast oracle and the price of the Chainlink oracle deviate by more than 2%, then both are used together.

LP deposits USDC into the Vault to provide liquidity. When a user initiates a transaction, the funds in the Vault serve as the counterparty of the user's transaction and share part of the transaction fee (0.1%).

Pika Protocol has been launched on Optimism. The project has been audited but is still in testing mode. The funding limit of Vault is set at 1 million USDC.

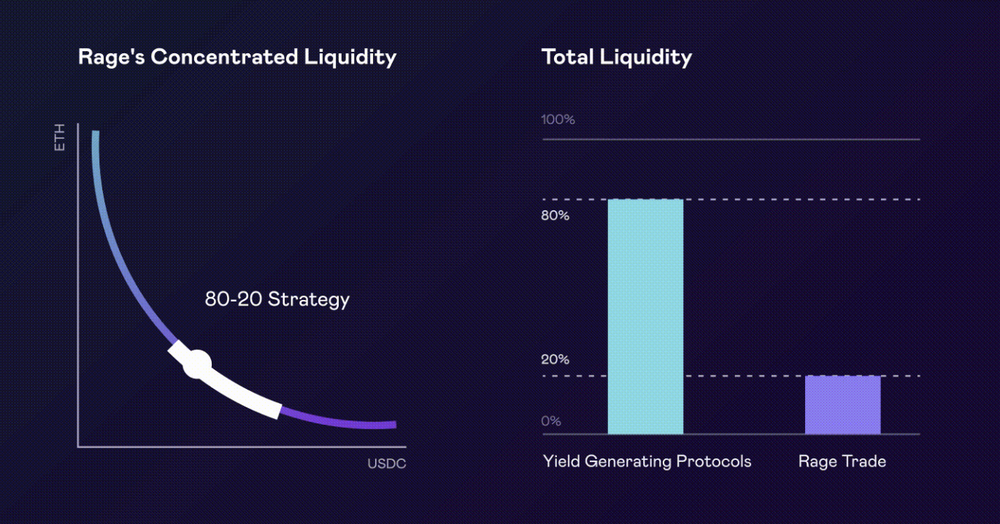

Rage Trade

Rage Trade is an ETH perpetual contract trading agreement, which can carry out perpetual contract transactions with 10 times leverage. It aims to solve the problem of low return rate of liquidity providers in similar agreements. Rage Trade investors include CMS, 3AC, Zee Prime, Not3Lau, MGNR and others.

Rage Trade uses Layer Zero to bring together liquidity on different chains. Users can deposit LP tokens (such as Curve Tri-Crypto) in Curve, Aave, GMX, etc. into Rage Trade's 80-20 Vaults, 80% 20% of the funds are used to provide aggregated liquidity for Rage Trade through Uniswap V3, so that liquidity providers can obtain higher returns. Therefore, Rage Trade also calls itself the most liquid and composable full-chain ETH perpetual contract.

summary

summary

The derivatives track is easy to obtain investment from large institutions, but at present, the trading volume of derivatives DEX is still far behind that of CEX. According to data from CoinMarketCap, in the past 24 hours, only dYdX, Kine Protocol, and GMX had a trading volume of $900 million, $270 million, and GMX, with a trading volume of more than $100 million; while Binance’s derivatives trading volume was 519 million in the past 24 hours. One hundred million U.S. dollars.

AMM, including its improved vAMM, has been difficult to obtain the market, and liquidity providers have high risks and low returns; GMX (GLP), which consists of multiple assets to form an index as a user's counterparty, can bring better benefits to participants The revenue also ushered in the similar product Mycelium; order book-type trading protocols such as dYdX and ApolloX are still the biggest winners.