疑点重重,融资1亿美金的新公链5ire或是骗局

乱世出英雄,熊市多骗局。

7月15日,CoinDesk报道称,一层区块链网络5ire当日从Sram & Mram处筹集了1亿美元的A轮融资,估值15亿美元。在熊市中,这样的融资规模和估值较为震撼,但5ire的融资并没有业内知名机构参与。带着好奇和疑惑,PANews深入了解了5ire的相关内容,发现该项目疑点重重。

融资信息不一致,公链却欲进行IPO?

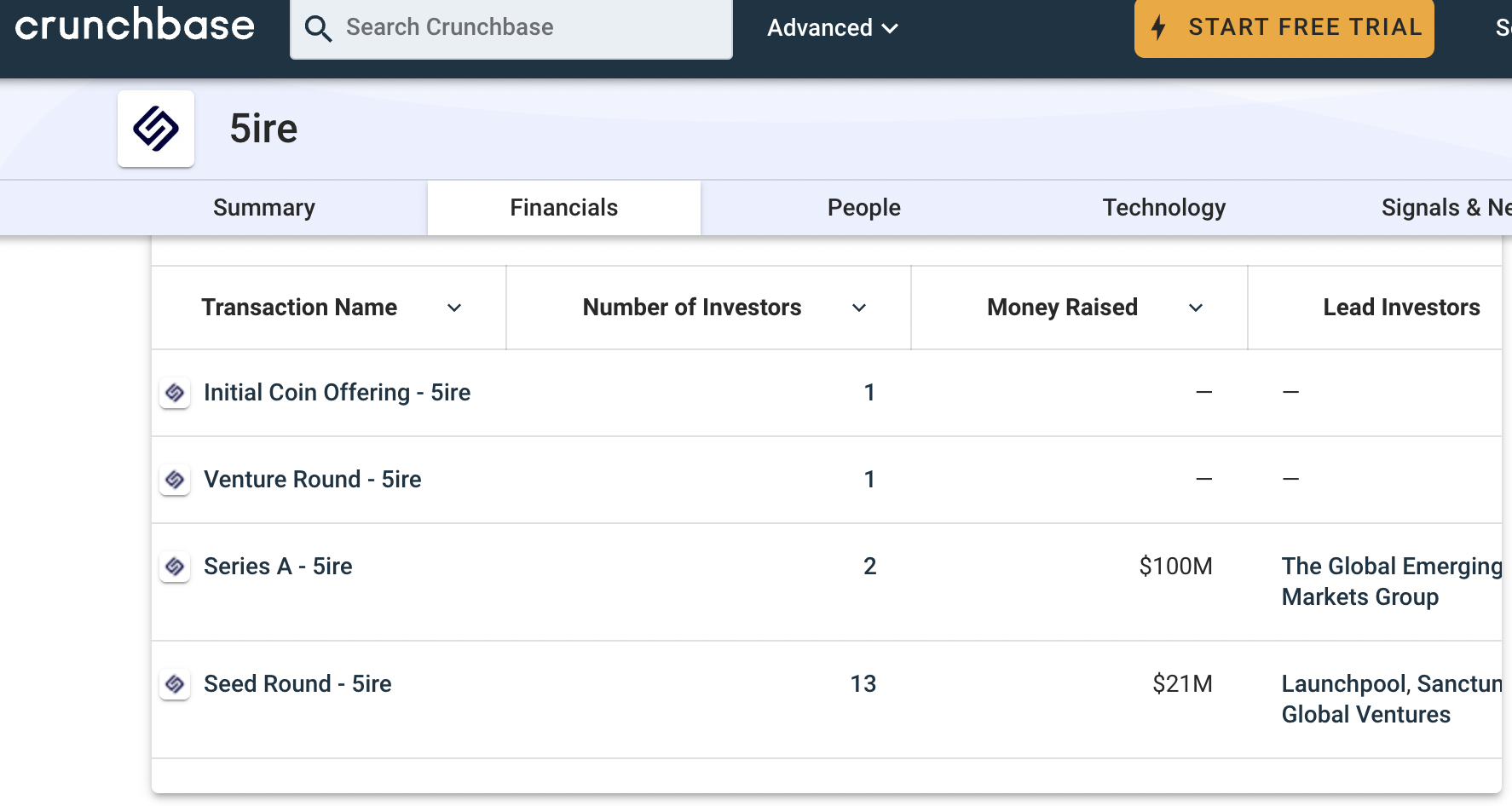

5ire的官方Linkedin中展示了自己的Crunchbase链接,Crunchbase是一个包含创业公司创始人、雇员、融资信息等的数据库。5ireChain的Crunchbase页面显示,5ireChain的A轮融资于2022年2月14日宣布,由The Global Emerging Markets Group(GEM)和MH Ventures投资,融资规模为1亿美元。这一数据与7月15日宣布完成的A轮融资的投资机构与日期并不一致。

继续寻找5ire在今年2月份的融资消息,PANews发现THE ECONOMIC TIMES曾在2月15日的报道中称,5ire当日宣布从GEM Global Yield(即前面的GEM)处获得了1亿美元的“投资承诺”,并计划用这笔资金来寻求IPO。这一说法也在5ire的官方博客上得到验证,2月18日,5ire的官方博客发布了题为“5ire从GEM Global Yield LLC筹集了1亿美元”的文章,文中并未提到这笔投资属于投资承诺。

由此可知,5ire的A轮融资在今年2月份和现在7月份的报道中,显示的投资机构均不相同。而作为一个公链项目,还未正式上线却寻求IPO的说法也显得十分诡异。

问题就出在GEM(GEM Digital和GEM Global Yield)的惯用伎俩“投资承诺”,据链捕手报道,最近半年,GEM投资了最少16个加密项目,其中对 Venice Swap、Naetion、KaJ Labs、Unizen、Unizen、H2O Securities的单笔投资都超过1亿美元。GEM投资的项目大多并没有什么亮点,且基本都是以投资承诺的方式宣布,而不是直接投资,也就是不会直接打款,通过和项目方合作发出利好消息,拉盘后卖出的方式,完成和项目方的利益分配。

GEM最近投资的项目

以上信息说明,5ire可能已经被GEM“鸽”一次,或者进行了一次联合“表演”,且在与GEM的合作中,5ire的官方博客中并未说明这是“投资承诺”,截至7月18日也并未修改,有释放虚假利好消息的嫌疑。

而本次投资5ire 1亿美元的机构Sram & Mram是一个提供解决方案和服务的公司,在其官网、Twitter、Facebook、Instagram、Linkedin等渠道均未对此次投资进行报道。Sram & Mram的官方推特只有120人关注。这是否又是再一次表演呢?

5ire已经将手伸向了散户,PANews每次登录5ire的官网,都会出现申请投资者白名单的弹窗。若1亿美元的融资为真,5ire没有必要这么着急通过这种营销手段从散户处筹集资金。

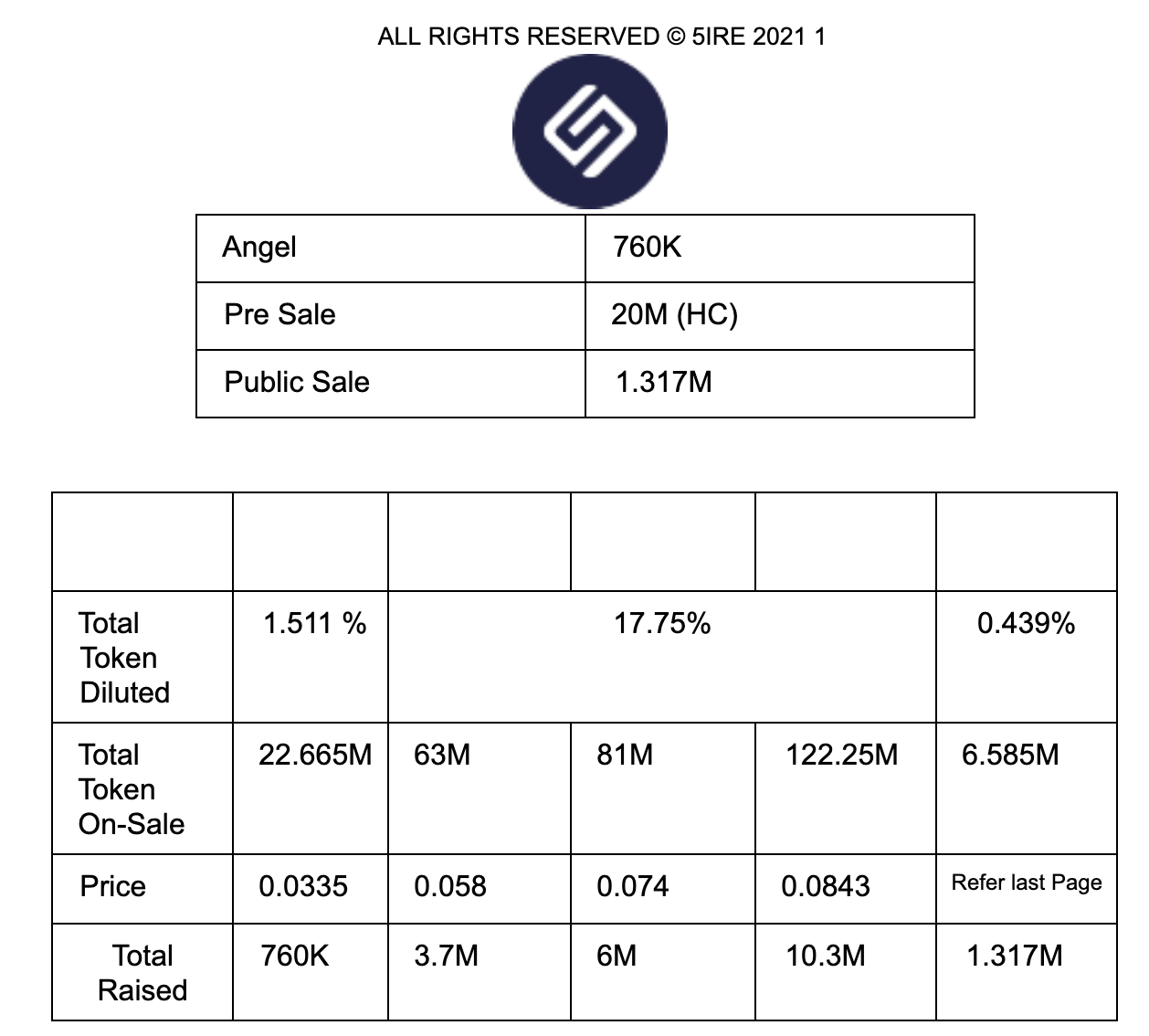

项目官网的白名单申请中仍然保留着代币模型的链接,而里面的内容与公布的融资金额和估值并不一致。如下图所示,根据相关内容,5ire总共计划筹集的资金为2200万美元左右。5ire代币总量为15亿,若按照公募前的最后一轮价格0.0843美元计算,估值约为1.26亿美元;若按第三轮公募价0.3美元计算,估值约为4.5亿美元。与当前媒体所报道的估值完全不同。

5ire的官方资料和媒体报道的融资消息中有诸多矛盾之处,项目的宣传中存在夸大的可能,官网展示内容存在错误之处,融资消息毫无疑问涉嫌虚假宣传。

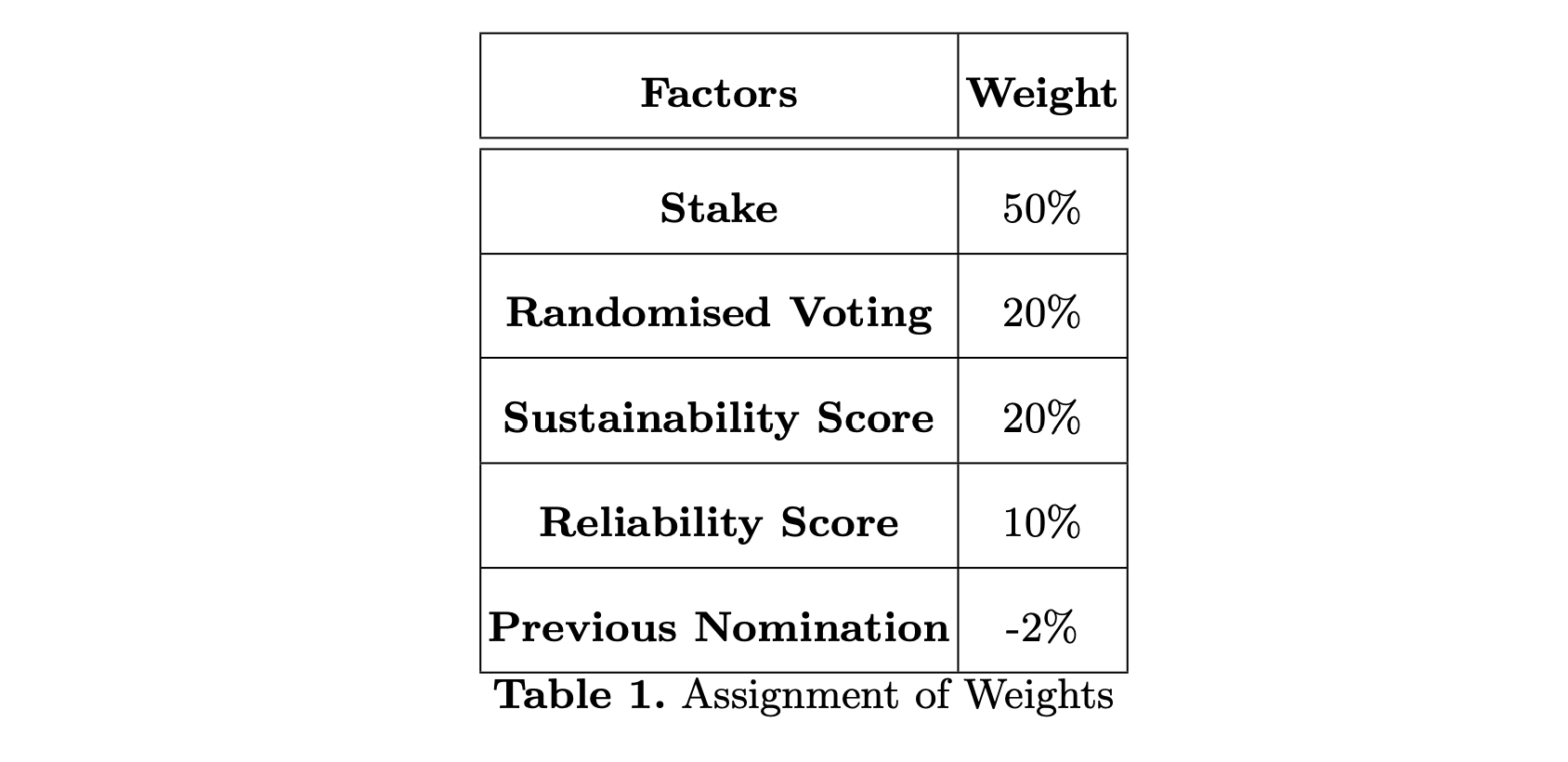

自称“第五代区块链”,却只会写科普内容

继续在官网寻找项目的相关信息。相比于其它区块链,5ire的特点在于可持续性,能够满足联合国可持续发展的目标。5ire的共识机制将可持续性作为最重要的组成部分之一,它的共识被称为SPoS,节点打包区块的权重取决于质押、可靠性、随机投票和可持续性分数这四个因素,获得最大分数的节点将负责后续12小时的区块打包。可以认为这是现有PoS共识机制的一个变种,在其中增加了可持续性分数。那么,5ire的可持续性分数是怎么计算的呢?

按照白皮书中的描述,可持续性分数由环境、社会和治理(ESG)分数组成。最初,这个分数将根据从受信任的机构处获得的数据进行分配。在5ire生态稳定后,将有一个去中心化的机制来分配和更新可持续性分数,让节点定期更新参与者的可持续性分数。下表是ESG的评判因素。

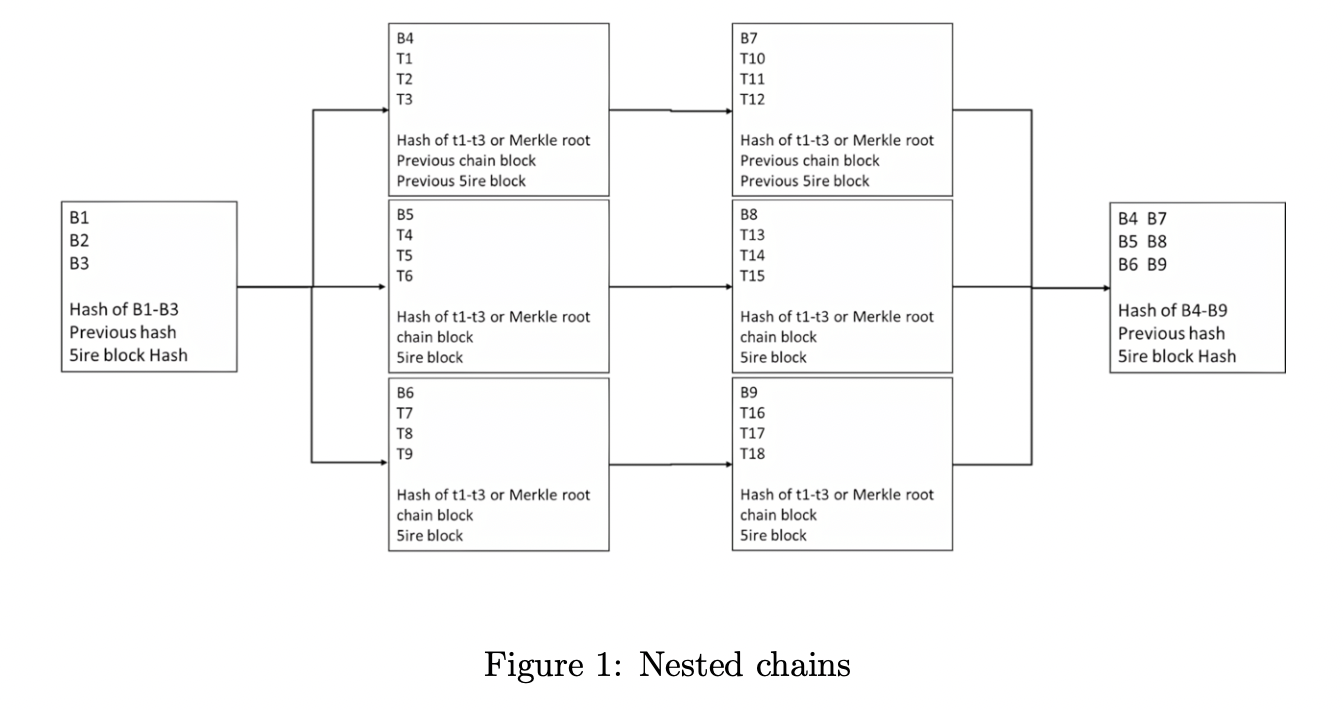

此外,5ire还引入了嵌套链的概念,类似于平行链,以解决可扩展性问题。嵌套链根据网络负载的需求来创建,一旦创建,就将保持在嵌套链上继续出块,直到该链被添加到5irechain的区块中。嵌套链的结构如下图所示。每一条链对应一个交易池,一旦交易池中的交易数量超过阈值,该交易池就会被分成两个池。当交易池中的交易数量下降时,又可以合并为一条链。

因为可持续性的概念,5ire将自己称为“第五代区块链”,对应“第五次工业革命”,认为第五次工业革命的重点是引导技术为人类服务,5ire可以通过解决环境可持续性问题,来构建一个以用户为中心的可持续生态系统。在我们的理解中,工业革命对应的是技术上的突破,并能带来效率的提升。而5ire只是引入可持续性的概念,将自己称为下一次工业革命的说法恐有不妥。

在技术上,平行链的概念已在Polkadot中应用。因为5ire中链的条数是可变的,这种方案的开发难度可能比当前常见的扩容方案更高。

在5ire的官方博客中,有大量文章用于介绍星际文件系统、数据安全、DeFi、默克尔树的工作原理等基础概念,这些文章中完全没有提到5ire相关的内容。

在官网公布的合作伙伴和投资者中包含68个Logo,但并未找到上述融资消息中提到的Sram & Mram、The Global Emerging Markets Group的相关Logo,而DAOStarter、ARDURA等Logo重复出现。这不仅增加了融资消息是虚构的可能性,还显得项目方很不用心。

当潮水退去的时候,没有人还愿意继续裸泳,除非这个人存在问题。加密市场骗局和内幕重重,PANews也将谨慎甄别虚假项目,拨云见日。