Weekly Digest: Bitcoin price continues to fall after CPI release. ERC-721R is released, and NFT buyers can refund money. Can this measure further increase buyers' trust in NFT project parties? The Juno community voted against Proposition 18 and refused to share and confiscate tokens equally with CCN. Is completely decentralized community governance the best solution?

1. Summary of industry dynamics:

major event

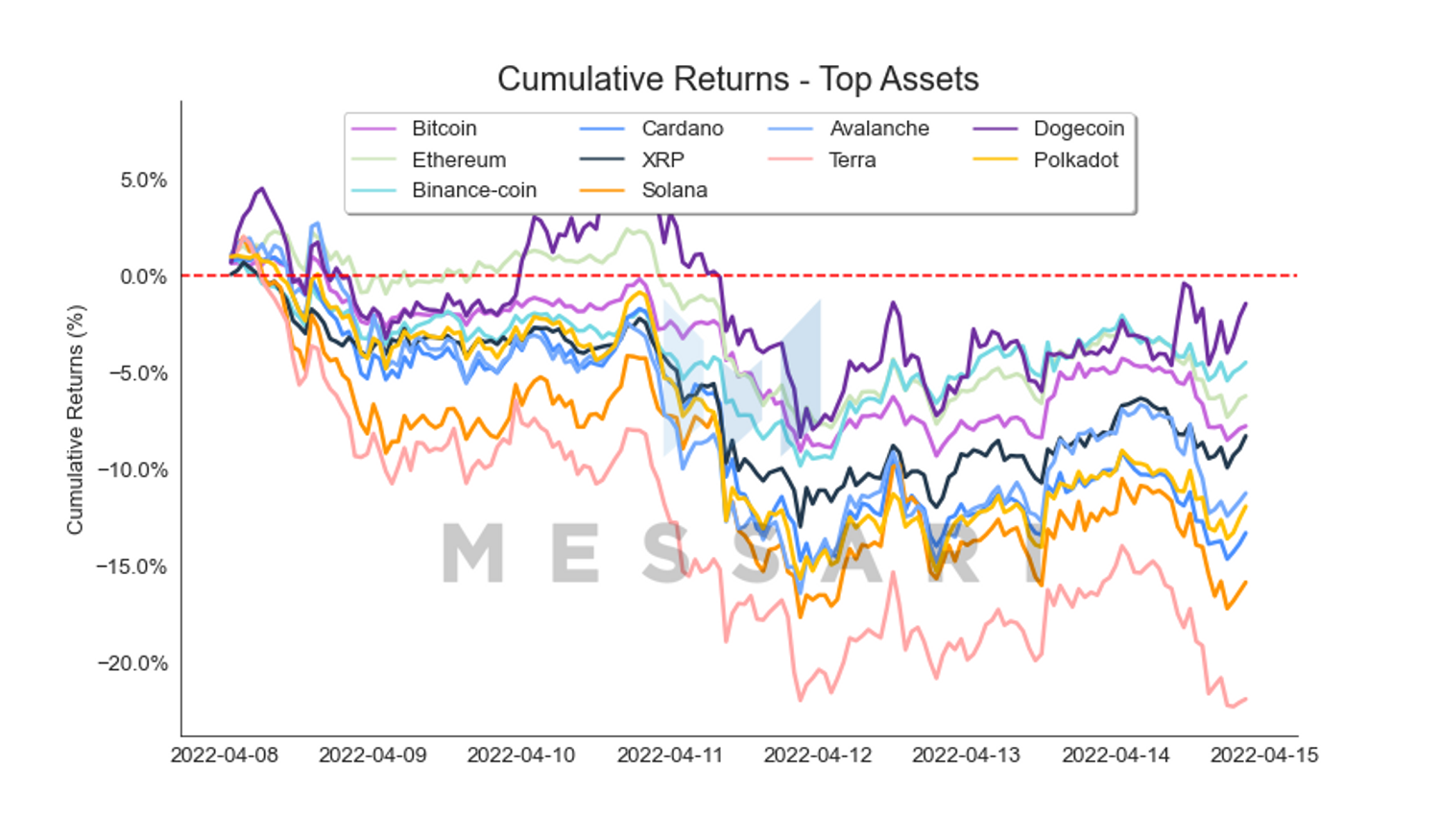

Last week, the encryption market continued to retreat. On the 11th local time in the United States, the White House spokesman said that the CPI index to be announced on the 12th would be "abnormally high". Climbing to 2.75%, the crypto market fell in response, with Bitcoin falling nearly 7% and Ethereum falling nearly 9%. The U.S. stock market was closed on Friday local time on Good Friday, and the trading volume in the crypto market was relatively low. As of writing, the price of Bitcoin closed at $40,400, forming a strong support at the $40,000 mark. Although the overall market conditions of the encryption market are average this week, there are still a few important news that have caused an upsurge in some sectors. Before that, there was the release of the new NFT specification ERC-721R, and after Elon Mask joined Twitter, he announced that he would acquire Twitter. Fire SHIB and DOGE.

On April 11, 2022, a new NFT token standard called "ERC-721R" was officially released. This standard adds a trustless refund function to the NFT contract, allowing minters to freely return within a specific period. The purpose of this function is to combat the occurrence of "Rug-pull". Rug pull is one of the most common frauds in NFT projects, that is, the project party closes the project immediately after starting to sell NFT and runs away with the money. ERC-721R stores the raised funds in a three-party account locked by a smart contract during the NFT minting stage, and the project party sets a "refund cycle". Before the refund cycle is reached, the project party cannot obtain the three-party The funds in the account, and users can return the NFT in their hands at any time, so that NFT participants have more flexible countermeasures.

However, ERC-721R still has flaws in its design. The audit company SlowMist said that because the NFT project party can control the "setRefundAddress" function, Mint an NFT in advance in the Refund Address, and constantly use the Refund Address to call the Refund function to obtain the three-party account. Locked assets to enable Rug Pull.

The token specification of ERC-721R was first promoted by Exodia Labs, the NFT project party, on its Github. Exodia Labs belongs to an unknown team. It currently operates two NFT projects but has not received strong attention. This can not help but make people Reminiscent of the NFT project Moonbirds, which was on fire this weekend, it was sold out within a few hours after it was launched on April 16. The amount raised reached 66 million US dollars, and the current floor price is close to 13ETH. Although the project party is very reliable, it is so fast and effective. Effective financing methods still have great hidden dangers. Although ERC-721R cannot fundamentally effectively constrain NFT project parties, this is a good start. As the NFT market becomes more and more popular, enough temptations will eventually come. It will lead to more fraudulent behaviors. If it cannot be effectively constrained, it will also have a negative impact on the entire market. After that, ERC-721R will be updated more, such as adding Vesting Period, Cliff and other means will make NFT financing more efficient. Perfect and safe.

In addition, Elon Musk tweeted on Thursday that he would acquire Twitter at $54.2 per share, for a total of $43 billion. As soon as this news was released, heated discussions among major KOLs in the traditional and encryption industries started. Some TRON founder Justin Sun memorized the purchase of $60, and CZ Changpeng Zhao tweeted that he was not interested in this. Vitalik also made a statement on this , saying that he does not oppose Musk's acquisition of Twitter, but opposes the hostile acquisition of social media platforms by rich people. Twitter also launched the "poison pill plan" on the 16th to counter Musk's acquisition. "Poison pill plan" is an anti-hostile takeover strategy, which usually makes the acquirer pay a higher price when acquiring the target company's stock, such as the acquired company issuing new shares at a discount to existing shareholders, thereby increasing the acquirer's cost .

Musk, who holds two major Meme Coins (DOGE and SHIB), tweeted hinting whether Twitter could use DOGE as a subscription fee for a certain Twitter service after he became a shareholder of Twitter last week, and then DOGE surged in the short term. Sik really owns Twitter, and the transformation of this social platform from Web 2 to Web 3 may become a reality, or it may turn Twitter to a more private platform. But for DOGE and SHIB holders, recent related news may be an important factor in the trend of these two tokens. DOGE also became the best-performing token in Top Assets this week with news.

2. Major investment

During the reporting period, a total of 39 financing events occurred in the encryption market. The number of projects was significantly higher than that of the previous week. The total disclosed financing exceeded US$1 billion (excluding the US$2 billion financing of Epic Games). Among the subdivided tracks, the Web 3.0 and NFT/Games tracks are more active this week;

This week, there were 3 financings of over US$100 million, namely 1) BlackRock, Fidelity and other institutions invested US$400 million in Circle, an encrypted stable currency USDC issuer; 2) Genies1, an NFT virtual avatar production company led by Silver Lake. US$500 million in Series C financing; and 3) US$210 million in financing from Voyager Innovations, a centralized digital payment solution provider led by SIG Ventures, with participation from Tencent and KKR.

(1) EPNS

On April 14, the EPNS (Ethereum Push Notification Service) project announced the completion of US$10.1 million in Series A financing, led by Jump Crypto, with participation from Tiger Global, ParaFi, A.Capital, Sino Global Capital, Polygon Studios, and Harmony Foundation. The post-money valuation reached $131 million. The project had raised US$600,000 in a seed round in March 2021, with investors including True Ventures and Binance Labs, among others.

The project is a decentralized information push protocol built in the Ethereum ecosystem, allowing users (ie wallet addresses) to receive information notifications from various Dapps, smart contracts and even centralized services. This project enables DeFi users to enjoy services similar to the traditional financial world, such as reminder services such as DeFi loan contract liquidation, liquidation, and gas fee reduction.

The application currently has three versions: Chrome browser plug-in, IOS and Android. Since launching in April 2020, the project has sent over 4 million notifications to over 44,000 subscribers.

(2) Noox

(1) Noox, an on-chain reputation platform, completed a $2 million seed round of financing led by Collab+Currency, with participation from Electric Capital, Sfermion, SamsungNext, POAP and Alphanonce.

(2) The project can cast the user's on-chain behavior/achievements into "NFT medals", turn the user's wallet address into a real on-chain business card and identity authentication, and use the on-chain data to help users establish a reputation and reputation in the Web 3.0 world Social Identity System.

2. Macro and technical analysis:

2. Macro and technical analysis:

BTC fell below 40,000 USD, and the short-term sideways trading is around 40,000 USD. We judge that 38,000 USD will be a follow-up support. In the short term, it is still recommended to be cautious. With the decline, after the overall price-performance ratio has a certain value, it is not too late to add to the market .

The trend of ETH and BTC is basically the same, and the overall support is at $2,800. It is recommended to observe before shrinking the balance sheet.

The Nasdaq index is in a process of falling relay.

1. Technical indicators:

(1) Ahr999: 0.919, falling back to the regular investment range, but the price/performance ratio is still not high for the time being.

(2) MVRV: 1.6459, with a slight drop, the market sentiment is in a safe range.

(3) Changes in the number of BTC addresses: the number of addresses holding less than 1 currency has increased rapidly, and the number of addresses holding more than 100 coins has also risen in the short term.

(4) Changes in the number of ETH addresses: With the number of addresses holding 100 coins as the cut-off point, the number of addresses below 100 increases, and the number of addresses above 100 is basically sideways.

2. Summary:

We believe that the current overall price/performance ratio of BTC has been significantly improved compared to last week, and has a long-term configuration price/performance ratio, and the recent currency holding addresses also reflect this expectation. However, in the short term, macro risk factors are superimposed, and we believe that there is still a certain chance of a downward trend. Observing the market is the best choice at this stage.

3. Encrypted ecological tracking:

Metaverse Metaverse

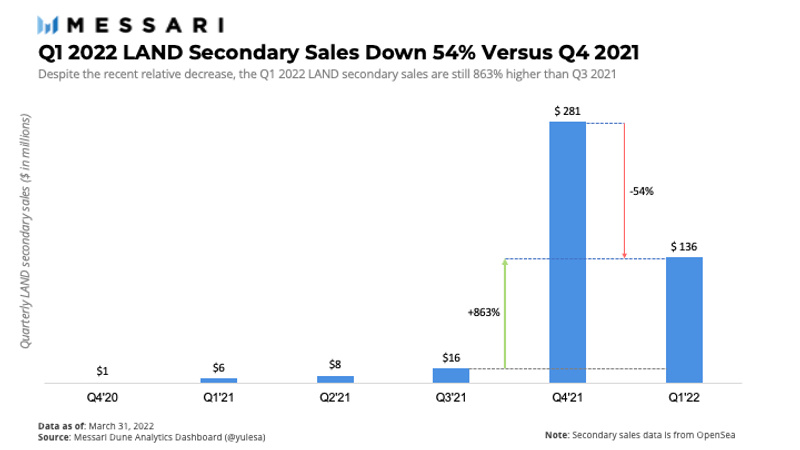

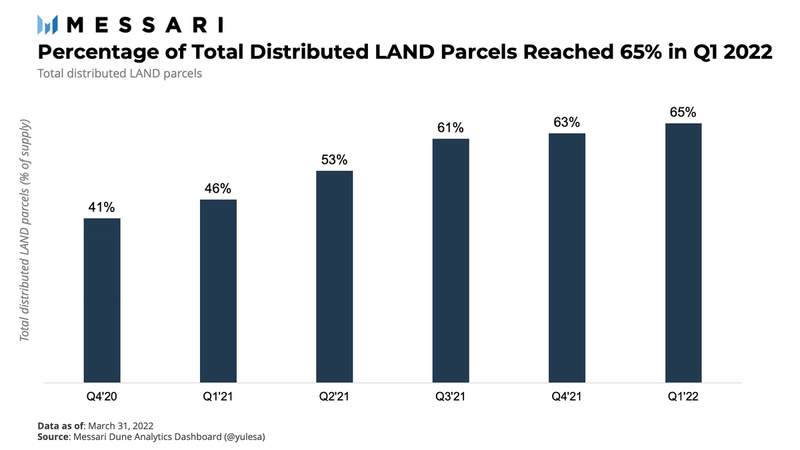

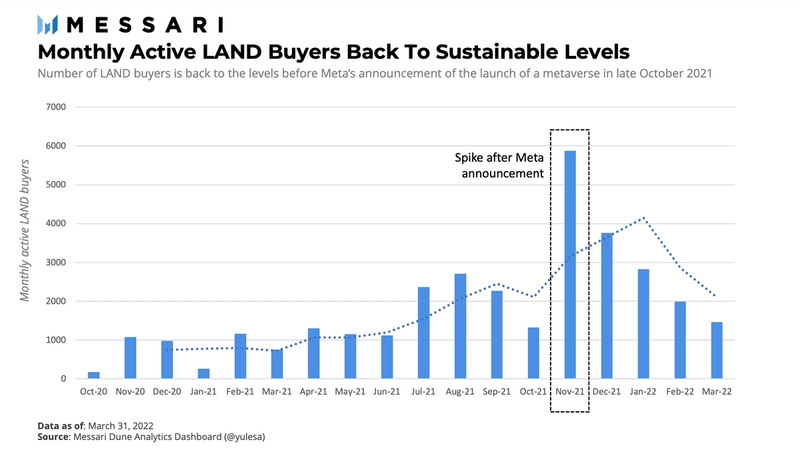

The blockchain data platform Messari announced the financial report of Sandbox Q1, the following is a summary:

(1) The secondary market sales of digital plots decreased by 54% compared to 2021 Q4, but still increased by 865% compared to 2021 Q3, and the market is still looking for a balance point.

(2) The proportion of allocated LAND reached 65%, an increase of 2% compared with 2021 Q4, and the growth rate was slower. The representative team is consciously conducting sales control in the current market.

(3) Sandbox launched Alpha Season 2 in March. During the release period, Sandbox registered users reached 2 million, but the number of monthly active LAND purchasers is gradually returning to the normal value of last year.

(4) Summary: Sandbox is still the Metaverse project with the strongest operation, planning, market popularity, and scalability in the current blockchain ecosystem.

Scalability expansion

(1) According to Jack Niewold, the founder of Crypto Pragmatist, on social networking sites, one of the four major Layer 2 technology providers Arbitrum, Optimism, zkSync and Starknet may issue Tokens next month. Jack said that Arbitrum has always been firmly in the top spot in the Rollup field, so Arbitrum is the one most likely to launch Token. The current TVL of Arbitrum is 3.66 billion US dollars, which is 3.5 times that of the second layer dYdX in Layer 2, but the current four None of the big tech parties responded.

(2) Polygon announced the "Green Declaration", saying that it will achieve negative carbon emissions in 2022, and promised to donate 20 million US dollars of financial support to the environmental protection community. First, Polygon will purchase $400,000 in carbon credits through the carbon credit market on KlimaDAO. After that, Polygon will selectively eliminate some Token projects with high carbon emissions, and strive to achieve negative carbon emissions before Ethereum converts PoS to achieve carbon neutrality.

(3) Cross-chain protocol Anyswap launched their V4 product "anyCall" - a cross-chain information routing protocol, anyCall allows users to transmit any information specifications in any two chains through a transaction, such as NFT, micro-contract, information , tokens, etc.

GameFi blockchain games

(1) Ronin Hacking Event Tracking – The hacker address was sanctioned, and the Axie Infinity ecology was seriously affected

The U.S. government included the Ronin stealing address on the sanctions list, affirming that it is related to the North Korean hacker organization. The U.S. Treasury Department added an Ethereum address to the sanctions list on April 15, noting that the address is controlled by the North Korean hacker group "LAZARUS GROUP", which Nansen has marked as a "Ronin Bridge attack address." The current address still holds 148,000 ETH. Crypto tracker Elliptic estimates that 14% of stolen funds have been laundered so far;

According to Coinmarketcap data, as of April 17, the price of RON was around $1.51, which was nearly 35% lower than the $2.26 on the day the hacker attack was announced (March 30), and continued to fall;

The price of SLP is around $0.016, a drop of nearly 95% from the high of $0.34 in the second half of last year, and a 20% drop from $0.02 on the day the hacker attack was announced (March 30). The decline in SLP prices means that the income that players get from participating in Axie Infinity is constantly decreasing. The decrease in income will definitely affect the price of NFT assets in the game, the transaction volume and the number of players, thus affecting the price of guild tokens that rely heavily on the income of Axie Infinity games to attract players. Such as YGG.

According to Dappradar data, as of April 17, the floor price of the native NFT in the Axie Infinity game dropped to $17.52, a drop of 61.38% within 30 days; the overall transaction volume of NFT in the game dropped to $60.99 million, a drop of 46.87% within 30 days; NFT sales , trading users showed varying degrees of decline.

Remedial and Improvement Measures

Adding verification nodes: On April 6, Ronin announced the addition of five new verification nodes, namely Nansen, Delphi Digital, Stable Node, Animoca Brands, and Dialectic, to strengthen its blockchain security, which is expected to be completed this week. Its goal is to achieve at least 21 independent verification nodes to jointly protect the network within three months;

Financing compensation for damaged customers: On April 6, Sky Mavis, the parent company of Axie Infinity, completed a US$150 million financing led by Binance and participated by existing investors Animoca Brands, a16z, Paradigm and Accel. This financing will be used for compensation Loss of user funds affected by the hacking incident;

Launch of bug bounty program: On April 13, Sky Mavis launched a bug bounty program, covering smart contracts and front-end application interface vulnerabilities. Among them, smart contract vulnerabilities include re-entry attacks, oracle machine attacks, etc., and the rewards range from US$1,000 to US$1 million. If the bonus is US$1 million, it will be released in 6 months; the previous application interface vulnerability rewards range from US$50 to 15,000 USD varies. All winnings are paid out through AXS.

(2) Important project – BreederDAO: BREED public offering will be launched on Copper on April 26

BreederDAO, an asset production platform led by a16z, Hashed and Delphi Digital, officially launched the token BREED;

BreederDAO has established formal partnerships with more than 20 chain games, including Axie Infinity, Pegaxy, Cyball, Crypto Unicorns, Nyan Heroes, etc. The cooperation mode is divided into producing in-game NFT assets and investing in in-game NFT assets.

BreederDAO can be compared to Unilever in the metaverse world, producing game assets on a large scale for players and guilds to purchase;

(3) Important project - Civita

Metaverse game developer Directive Games has completed a $20 million financing led by Delphi Digital and Three Arrows Capital, and investors such as Framework, Bitkraft, and Yield Guild Games. The funds will be used to develop 4X based on blockchain technology. (Exploration, Expansion, Exploitation, and Governance) Strategy game Civitas, where players level up their cities by fighting with other cities either alone or in alliances.

Directive Games is a game studio composed of game industry veterans from LucasArts, Weta Digital, Square Enix, Ubisoft and Tencent. The team has been building online multiplayer games set in large universes since 2014, and Civitas will be the studio's first AAA blockchain game and a key project for future development.

Among them, YGG disclosed in the announcement that it purchased 150,000 US dollars of CITI Token, and CITI can be used for governance, pledge and in-game purchases. Residents can stake Tokens on their own land, and each city manages its own staking mechanism and reward distribution mechanism. In addition, YGG will purchase game assets as the game develops. NFT buildings have different functions and states and can be decorative or functional. Players can also burn buildings along with other resources to upgrade to new buildings.

Civitas will launch the first batch of NFTs in the second quarter of 2022, with a beta launch planned for the first quarter of 2023 and an official launch later in 2023.

(4) Important project – Genies: Silver Lake’s first direct investment in the encryption field

Genies, an NFT virtual avatar production company, has completed a $150 million Series C financing led by Silver Lake. This financing will be used to iterate virtual avatar creation tools, enabling users to create virtual avatars, virtual clothing, virtual houses, etc. Experience; Based on the virtual avatar created by Genies avatar creation tool, the user has full ownership and commercialization rights, and can be used in different commercial application environments without restriction.

Silver Lake is a well-known venture capital institution in Silicon Valley that focuses on the technology field. It once entered the encryption ecosystem indirectly by investing in Digital Currency Gtoup (Silver Lake co-founder Glenn Hutchins became a director of DCG). This is the first time Silver Lake has directly participated in encryption Ecological project investment;

Genies has partnered with Universal Music and Warner Music to become the official virtual avatar and NFT supplier of digital goods for the two companies.

(5) Important investment – Animoca Brands

Chain game guild operator Real Player DAO completed the seed round of financing led by Animoca Brands and participated by institutions such as Momentum6 and Youbi. Deployment and promotion on Harmony and Solana.

Football media platform OneFootball will launch NFT marketplace Aera in partnership with Animoca Brands and Dapper Labs. Based on the Flow network, this NFT marketplace aims to create a new fan experience through blockchain technology, bringing football fandom to Web3. The market will release the first batch of star card NFT series "HATTTRICKS" in April

(6) Important investment – Binance

Binance will invest €100 million in France in a partnership with Paris-based startup incubator StationF. As part of the partnership, the BNB Chain, NFT Labs, and Binance Labs teams will support startups and connect potential collaborations with Binance partners. Binance CEO once stated that "the French government is one of the most "progressive" and "open-minded" governments in the world, and its attitude towards cryptocurrencies is "very positive".

Binance Labs, together with the existing shareholders of Merit Circle, the chain game association, Spartan Group, DCG, YGG and other institutions, jointly completed a new round of financing for Merit Circle with an undisclosed amount. Merit Circle will create an NFT market for in-game assets, and the market will introduce statistical dimensions and tools such as rarity and reserve price scanners to help traders and collectors make the right trading decisions. Merit Circle is currently the second largest game guild after Yield Guild Games in market value. The game assets held by the guild are mainly Axie Infinity, Star Atlas, Illuvium, Big Time, etc.

4. Platform public chain

(1) Dynamic summary of the public chain:

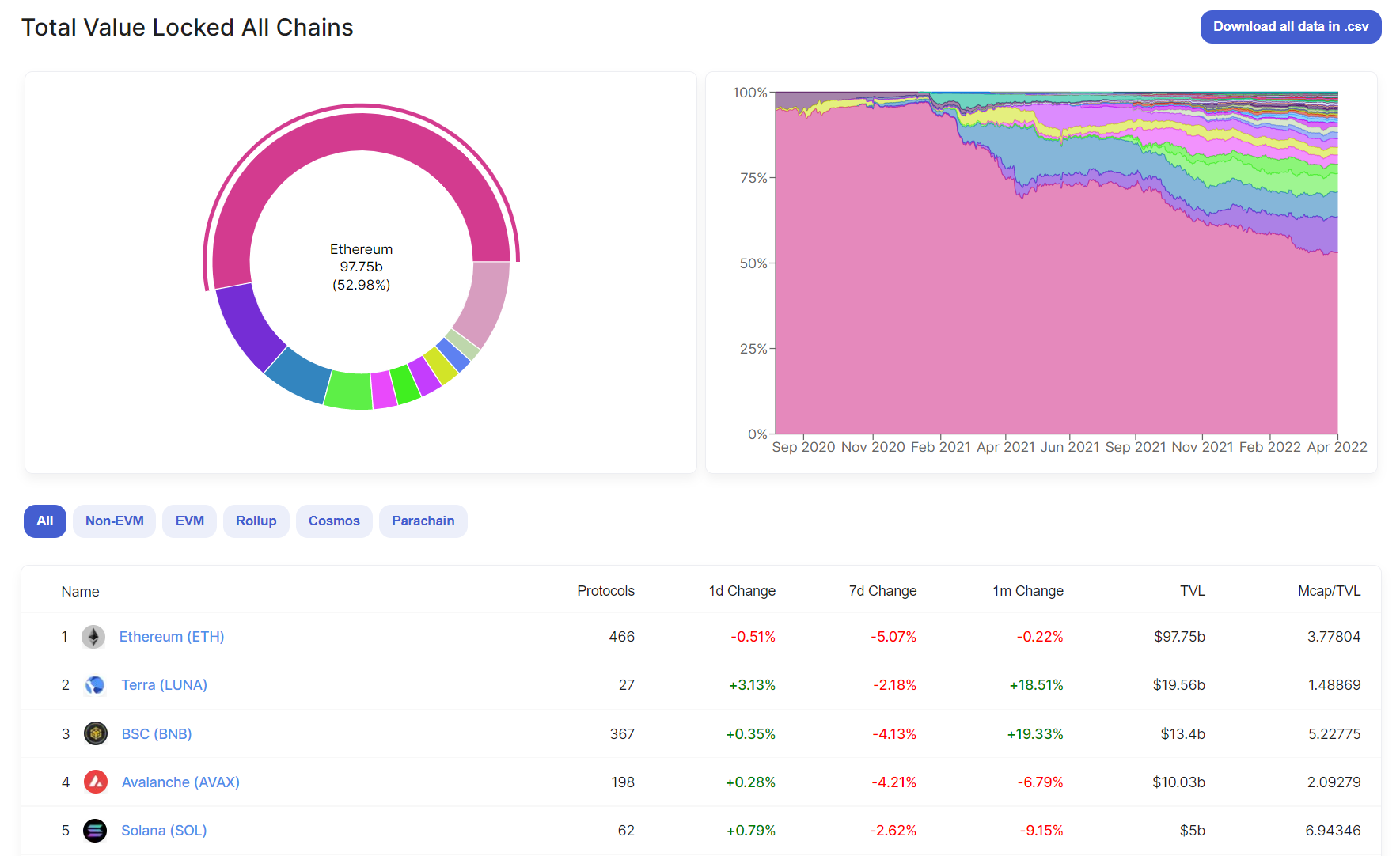

Last week, the overall lock-up volume of the public chain (including staking) dropped from US$192.7 billion to US$184.6 billion, with a change ratio of -4%. Among them, Curve, Lido and Anchor account for the top three in the total market respectively. It can be seen that stable currency, liquidity and pledge will still be the main battlefield and traffic entrance of the encryption market at this stage.

Comparing the lock-up volume of each public chain horizontally, the proportion of Ethereum dropped from 53.43% last week to 52.98%, a slight drop. The top five are still public chain giants and new darlings. Although there is still a big gap between the bottom four and Ethereum, the trend of gradually eroding the market still exists.

In the competition of emerging public chains, Terra, which relies on its own UST stablecoin mechanism, does not have a quantitative advantage in ecology, but its advantages in segmented fields are becoming more and more obvious, and there is a reserve mechanism that binds various public chains one after another. plans, thus establishing a second-place advantage in the market and the reason for Ethereum’s recent major decline. The development of Avalanche's subnet is also gradually booming, and the connection with the multi-chain ecology has laid the foundation for it to become the transformation closest to the mature Layer 0.

In contrast, Solana’s total lock-up volume is gradually shrinking, so it is eager to launch its own stablecoin product Nirvana Finance. Later, we will study and sort out the algorithmic stablecoins of each public chain. Please pay attention to our report at the end of the report column to obtain the latest research results.

Among the top 20 public chains, Waves, Osmosis, and Harmony have seen the largest decline in total lock-up volume, with -12%, -14%, and -14% respectively; and Aurora and Aster, which have risen more against the trend, 9% and 14%, respectively.

Algorithmic stablecoins have always been a recent hot spot, and Waves' recent retracement is also inseparable from stablecoins. At the end of February and the beginning of March, Waves used the "Russian Ethereum" gimmick to drive the first rise in an environment of geo-conflict. Later, using its stable mechanism, the project side continued to raise the price of WAVES through lending-buying operations In exchange for an anchor to its stablecoin USDN. But finally, the decoupling of USDN occurred on April 5, and the USDN currency price once fell to 0.7 US dollars. It can be seen that for the public chain, sustainable growth is more important. Although the price of WAVES has risen by about 6 times compared to the beginning of the year, it has fallen by more than 65% so far, and its TVL has also dropped by 54%.

OSMO is due to the previous increase brought about by the Carbon upgrade at the beginning of this year. At present, there has been a certain degree of deviation between TVL and currency prices recently. Therefore, OSMO has begun to repair its valuation. The high inflation in the early stage has brought selling pressure, and the callback is a reasonable phenomenon. As the largest DEX in the Cosmos ecosystem, there is still promising development in 2022.

The recent development of Harmony is relatively slow compared to other mainstream public chains. Recently, the network speed has also been slow due to the spam transactions of arbitrage robots. The team temporarily lowered the gas limit of each block to 20 million, and plans to make the order of transactions deterministic by time through deployment, so that the spam trading strategies from arbitrageurs will no longer be valid. Therefore, it can be seen that the degree of centralization in the initial stage of the development of emerging public chains is relatively high.

Aurora is an Ethereum-compatible developer platform built on NEAR (Layer 2 EVM on NEAR). Developers can easily deploy smart contracts from Ethereum to NEAR, with fast block generation and confirmation and low cost. feature. Have a development experience similar to "ETH 1.0", while users have the opportunity to use the speed and scalability level promised by "ETH 2.0". The recent growth is mainly due to the $350 million financing of the NEAR ecosystem last week. Developers, users, and investors have expressed their expectations for its later development.

(2) Fundamental layer investment:

Ava Labs, the lead developer of the cryptocurrency Avalanche, is raising a new round of funding. The company will raise $350 million at a valuation of $5.25 billion, according to people familiar with the matter, which would make it the most valuable cryptocurrency startup, although not as close to Polygon and Circle's recent valuations of $20 billion and $9 billion. one. Ava Labs was established in 2018 and received US$6 million in financing in 2019. Investors include fund giants a16z and Polychain.

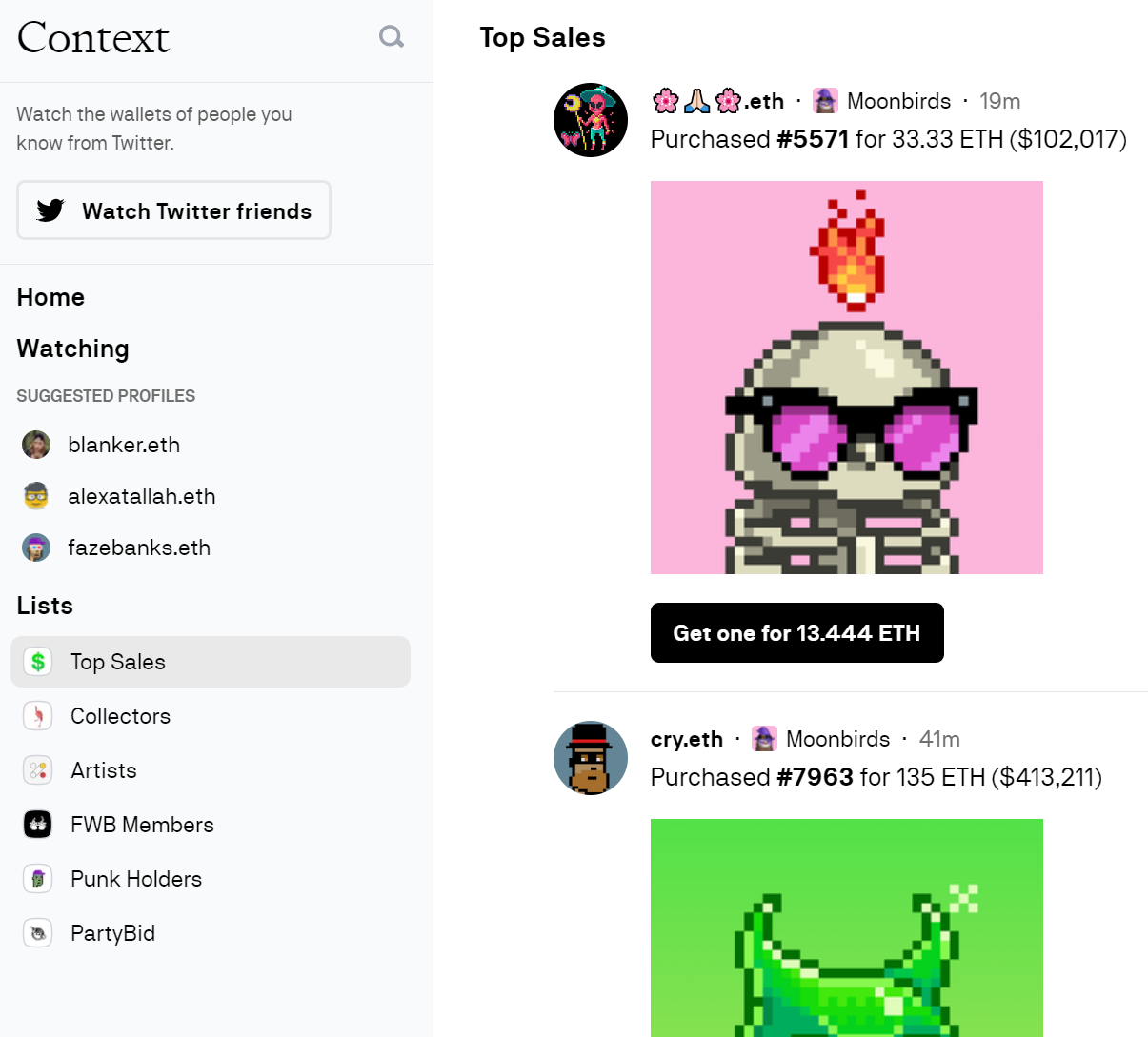

On April 14, Context, a Web3 wallet tracking application, announced the completion of a $19.5 million seed round of financing. This round of financing was led by Variant Fund and OpenAI CEO Sam Altman, with participation from Dragonfly Capital and other investors. Angel investors include Quora CEO Adam D 'Angelo et al. Context is a Web3 wallet tracking application. The new function of this application can help users automatically find and follow the Web3 wallet associated with the celebrity that the user follows on Twitter, and track the chain activity of the wallet address in real time.

Polychain recently led the seed round of Nomad, a cross-chain bridge project, with a financing amount of US$22 million. Participating institutions include Circle Ventures, 1kx, Amber, etc.

Nomad is a cross-chain bridge project that aims to provide security first. By introducing Optimistic technology, a dispute window is set to resolve fraud proofs, aiming to reduce cross-chain costs and improve the security of cross-chain messaging. Currently supporting Ethereum, Moonbeam (Polkadot parallel chain) and Milkomeda (Cardano’s EVM side chain), Nomad also announced in February this year that it will deploy a cross-chain bridge in Evmos in the Cosmos ecosystem to connect Ethereum and Evmos ecology. The current Nomad cross-chain bridge TVL is 47 million US dollars, and will continue to be deployed in more than 10 ecosystems in the future.

(3)Polkadot

The Polkadot network’s 14th parachain slot auction ended, and the Polkadot NFT public chain Unique Network won Polkadot’s 14th parachain slot auction.

Unique Network is an NFT infrastructure deployed on the Polkadot mainnet, which allows Dapps developers to use it to develop NFT applications with high interoperability and scalability. Its leading network, Quartz, won Kusama for the 14th time in November 2021. Auction, but it is worth noting that the Quartz token QTZ is currently close to zero, with a daily trading volume of less than $2,000.

Unique Network received US$11.3 million in financing led by Outlier Ventures in October 2021, with a total financing amount of US$16 million from Animoca Brands. The LAO is also an early investor.

The Polkadot parachain project Acala has reached a cooperation with Anchor Protocol to connect Terra and Polkadot’s Defi ecosystem. Users can borrow UST through staking LDOT and LKSM provided by Acala in Anchor. This not only provides Acala users with more application scenarios, It also provides more staking options for the Terra ecology. The two parties will jointly deploy more applications in the future.

(4)Cosmos

Juno

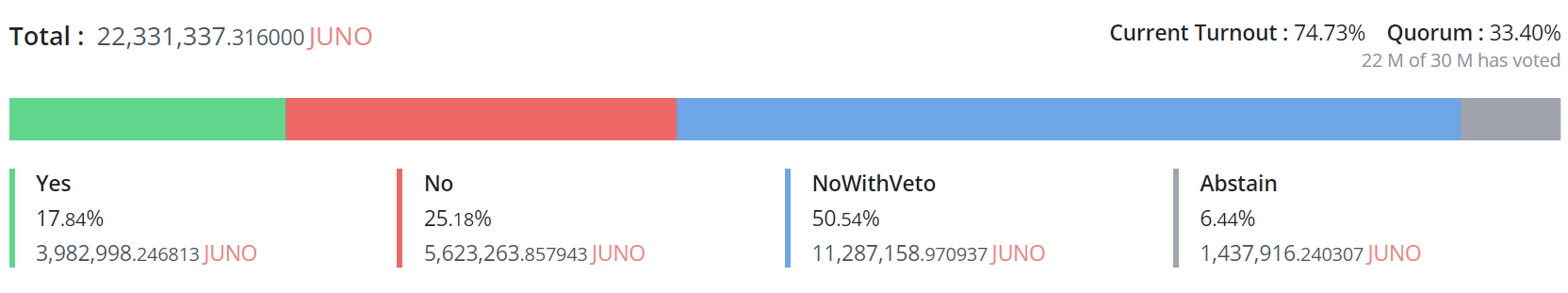

The confiscation of the assets of the giant whale has made new progress. The giant whale published a governance proposal Proposal #18 Harmony Proposal to end FUD in the Juno community, indicating that it is a service organization (called CCN) that manages encrypted assets for customers, before the JUNO stakedrop Managed more than 10 million ATOMs for customers through 53 addresses. It was not intentional to cheat JUNO's pledge airdrops by "sweeping wool". The behavior of merging all JUNOs into one address after receiving the airdrops was out of consideration for reducing operating costs.

In response to the community's previous concerns (giant whales controlling governance, sell-off) and Proposal#16, CCN proposed a compromise plan, and stated that most of its customers supported the plan. The proposal proposes that the 2.5 million JUNOs that are about to be confiscated should be shared equally between Juno community members and CCN customers, and 5% of the CCN customers’ portion will be unlocked every month for 20 months, while the JUNO allocated to community members will be re-issued. Vote for discussion. CCN believes that this solution not only addresses the concerns of the community, but also signals the security of funds to JUNO holders.

The proposal has not been approved by the community. Community members generally believe that this is CCN's sophistry and its assets should be confiscated; however, some members attribute the recent decline of JUNO to the influence of Proposal #16 and believe that CCN should be given a chance. Juno's core development team, Core-1, has yet to comment on the proposal. The voting will end on April 23, but "NoWithVeto veto" has an absolute advantage, that is, the 500 JUNO pledged by the proposer will be confiscated as a punishment.

Proposal #16 was proposed on March 11, aiming to confiscate the JUNO airdrops obtained by the giant whale through what was identified as "sweeping wool" and deceiving the community. The proposal once caused great controversy, and even Core-1 also called on users to vote against the proposal on Twitter, and expressed the hope that new proposals could be made to provide more alternative solutions. But the proposal ultimately passed.

Affected by this incident and the recent failure of the mainnet upgrade, the price of JUNO dropped from about US$40 on March 11 to about US$16 on April 17. Although there was a rebound during the period, it was hard to resist the decline.

As the first smart contract platform public chain in the Cosmos ecosystem, Juno is one of the necessary infrastructures in the ecosystem; at the same time, its "de-institutionalized" governance model and token economy are also useful for decentralized community governance in the Web 3.0 era. great significance for exploration. JZL will continue to follow up the development of this event, welcome to discuss with us the rationality of DAO governance.

Terra

Last week, Luna Foundation Guard continued to increase its holdings of about 2,633 BTCs, and currently holds about 42,530 BTCs, corresponding to a market value of about US$1.8 billion. As of April 17, the TVL on the Terra chain was about 26.79 billion U.S. dollars, a drop from last week's 27.9 billion U.S. dollars. LUNA continued to fall in the past week, falling from nearly $93 to about $81 on April 17.

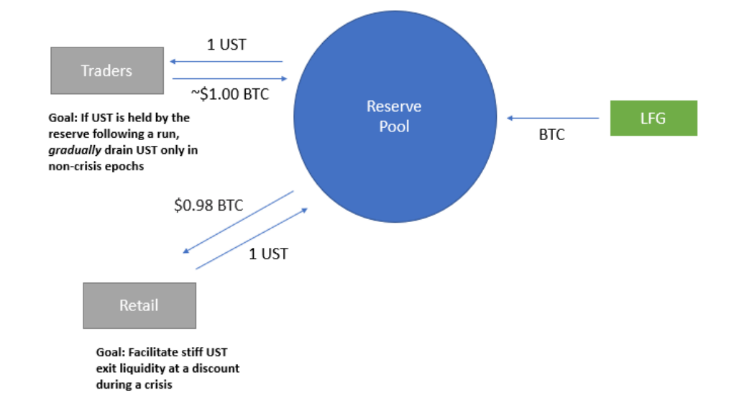

Why does LFG need a large amount to buy BTC?

UST is a decentralized algorithmic stablecoin minted by LUNA (the native token on the Terra chain). The value of UST is fully guaranteed by the algorithm, that is, 1 UST is equivalent to 1 dollar of LUNA, and users can create UST by destroying LUNA, or destroy UST in exchange for equivalent LUNA.

The price of UST is stabilized by the arbitrage mechanism. When the demand for UST increases and the price rises (such as 1.02 US dollars), users can mint 1 UST with LUNA of 1 US dollar and sell it in the market to obtain risk-free income; if the price of UST falls ( Such as 0.98 US dollars), users can exchange 1 UST for LUNA of 1 US dollar, sell and make a profit.

The biggest problem with this mechanism is that when the price of LUNA falls, it may trigger a death spiral, and the introduction of BTC as a foreign exchange reserve can alleviate this problem to a certain extent. According to the governance proposal released by Jump Trading in the Terra community, BTC reserves will be linked to the exchange of UST. When a crisis occurs (such as UST price is lower than 0.98 US dollars), UST holders can use 1 UST to exchange 0.98 US dollars for BTC ( Arbitrage), this mechanism provides support for the price of UST. When the crisis is resolved, the reserve treasury will buy back the UST held by BTC to supplement the reserve. In addition, according to an interview with Do Kown, some of the LUNA that was originally destroyed when UST is minted in the future will be used to purchase BTC or other reserve assets.

Stablecoins are one of the most important infrastructures in blockchain and DeFi applications, and Terra is binding UST and "digital gold" to gradually realize its vision of turning UST into "encrypted world dollars". The current market value of UST has reached 17.4 billion US dollars. Assuming 40% of the BTC reserves, LFG still needs to purchase about 5.2 billion US dollars of BTC reserves. We will continue to pay attention to the dynamics of LFG.

Cosmos Hub

Cosmos Hub completed the Theta upgrade and launched the IBC Interchain Accounts cross-chain account function.

In previous cross-chain interactions, users need to log in to chain A first, transfer assets to chain B through IBC, and then log in to chain B for subsequent operations. But now through the cross-chain account function, users can complete the entire process in the initial interactive interface.

Cross-chain accounts provide composability and interoperability for smart contracts across different blockchains.

We believe that this feature will greatly enhance the user experience in the Cosmos ecosystem and the prosperity and growth of DeFi applications. JZL is optimistic about the development of the Cosmos ecology for a long time. In the second half of the year, Cosmos will also launch the Interchain Security cross-chain security function, and we will continue to pay attention.

Zhou Xiaochuan, president of the China Society for Finance and Banking and former governor of the People's Bank of China, attended the 2022 Tsinghua Wudaokou Global Finance Forum and delivered a keynote speech on "Some Issues and Responses to Digital Currency". He pointed out that SWIFT is not a cross-border international payment system. Its full name is society for Worldwide Interbank Financial Telecommunications. It is actually a communication organization, that is, many communications are required before payment. These communications go through SWIFT, and the final payment and settlement are all It is based on the currency system of each country; and CIPS (Cross-border Interbank Payment System) is designed for RMB cross-border payment, that is, RMB cross-border payment, settlement, and clearing. Although the system also incorporates some communication functions, the communication functions are not used much. There is a significant difference between the two systems.

We think this point of view can be compared to the difference between IBC and other cross-chain payment projects. IBC is essentially Inter-Blockchain Communication. Inter-blockchain communication, payment and asset transfer are only one of its main functions. Its main purpose Or to solve the inter-chain communication problem. This update of the cross-chain account has released part of the potential of IBC. There are more applications to look forward to in the future. This is one of the reasons why we are optimistic about the Cosmos multi-chain ecosystem. IBC is expected to become the SWIFT of the multi-chain world.

5.DAO Decentralized Autonomous Organization

(1) Reputation DAO, a decentralized reputation service project, received USD 4.75 million in financing. Investors include Chainlink, AirTree Ventures, Digital Asset Capital Management, etc.

The goal of Reputation DAO is to build a reputation layer for blockchain. Since most users do not have the ability to personally inspect smart contract code, Reputation DAO aims to help users understand which blockchains, decentralized applications, on-chain counterparties, and oracles are trustworthy. In addition, due to the lack of an on-chain credit rating system, current DeFi applications are mainly based on over-collateralization. The project hopes to build a credit mechanism to solve this problem.

To a certain extent, the project is similar to credit rating agencies in the traditional world. Through the construction of DAO, collective wisdom can be used to continuously drive the evolution of reputation calculation formulas.

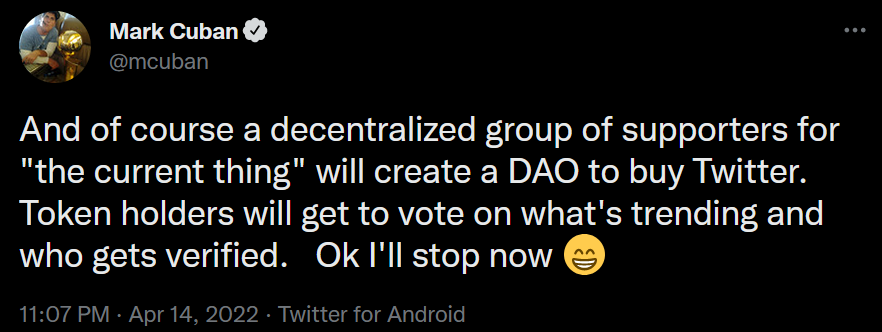

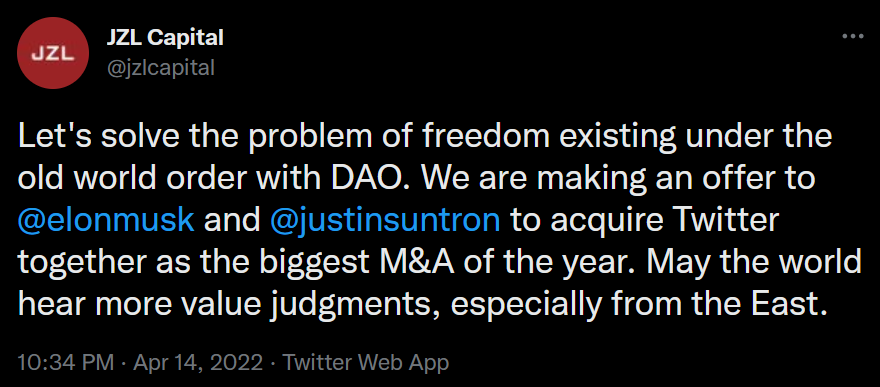

(2) NBA Dallas Mavericks (formerly known as the Dallas Mavericks) owner Mark Cuban said on Twitter that a group of decentralized supporters should create a DAO to acquire Twitter, and token holders will vote on social media What's trending on the Internet and who should be authenticated.

This idea coincides with JZL. Before Mark Cuban proposed the idea, we said on Twitter that we would form a DAO with Justin Sun and Elon Musk to carry out the acquisition.

We are always looking for creative ideas, business and cooperation opportunities, welcome to contact us and subscribe on JZL official website. We also look forward to your reading feedback. If there are obvious facts, understandings or data errors in the above content, please contact us for correction.

about Us

JZL Capital is a professional organization registered overseas, focusing on blockchain ecological research and investment. The founder has rich experience in the industry. He has served as the CEO and executive director of many overseas listed companies, and has led and participated in eToro's global investment.

We are always looking for creative ideas, business and cooperation opportunities, welcome to contact us and subscribe on JZL official website. We also look forward to your reading feedback. If there are obvious facts, understandings or data errors in the above content, please contact us for correction.