Original Author: Delta Fund

2021 will be a remarkable year for blockchain. The cryptocurrency market cap exceeds $3 trillion. NFTs are growing in popularity, with more than $23 billion in transaction volume. The United States launched the first Bitcoin futures ETF. El Salvador accepts Bitcoin as legal tender. Ethereum has changed the way fees are charged. DeFi Total Locked Value (TVL) exceeded $200 billion, a 7-fold increase year-on-year. Many new chains were also born this year, and the number of blockchain wallet users increased to 70 million.

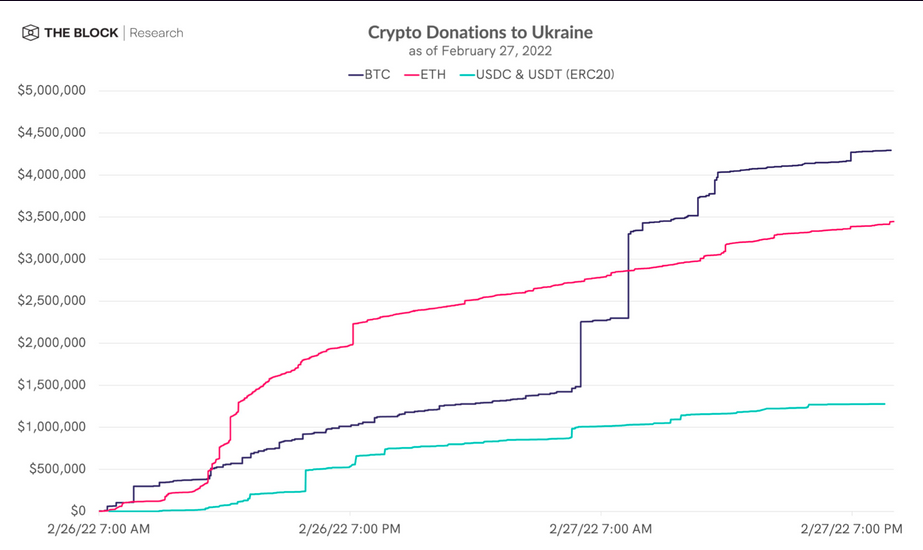

Cryptocurrencies have recently been used as a way to send money across borders against regulation. While the crypto market was initially hit hard after the Ukraine war broke out, it has now rebounded to previous levels. Since the start of the war, the Ukrainian army has received constant cryptocurrency donations. And at the Canadian Truckers protests, protesters received cryptocurrency donations after being blocked from traditional crowdfunding channels like GoFundMe. People can use cryptocurrencies to donate to charitable causes in the future, which is not possible with traditional financial infrastructure.

first level title

Improvements in the blockchain space

secondary title

1. The rise of multi-chain interoperability solutions

Multiple L1 blockchains and L2 solutions will emerge in 2021. On the one hand, the need for cross-chain liquidity has become an obvious bottleneck for the widespread adoption of blockchains, but it also provides important development opportunities.

From 2017 to 2021, several L1 and L2 solutions aimed at increasing transaction speed and reducing costs have been launched. The most well-known blockchains include Polygon, Avalanche, Optimism, Terra, and Solana. These blockchains utilize smart contract capabilities, attracting developers to build several open-source financial applications and games, among other things.

In order to take advantage of the unique characteristics of different blockchains, such as transaction costs and latency, and maximize return on investment, the ability to transfer money across chains becomes critical.

There is currently a trend that decentralized exchange (DEX) aggregators, such as Paraswap, help users get the best price through cross-DEX exchanges, and start to integrate with cross-chain bridges, not only allowing users to exchange on the same blockchain Tokens, which also allow users to exchange tokens across chains. For applications that are not deployed on multiple chains, there are some cross-chain solutions that can solve these problems, such as Symbiosis Finance, Multichain or Atlasdex. Multichain, a cross-chain token transfer protocol, has attracted over $7.7 billion in total lockup across several chains, helping to facilitate cross-chain transfers and native swaps.

secondary title

2. Improvement of DEX user experience and capital allocation efficiency

This year, the user experience of decentralized exchanges (DEXs) has improved in terms of ease of use and capital efficiency.

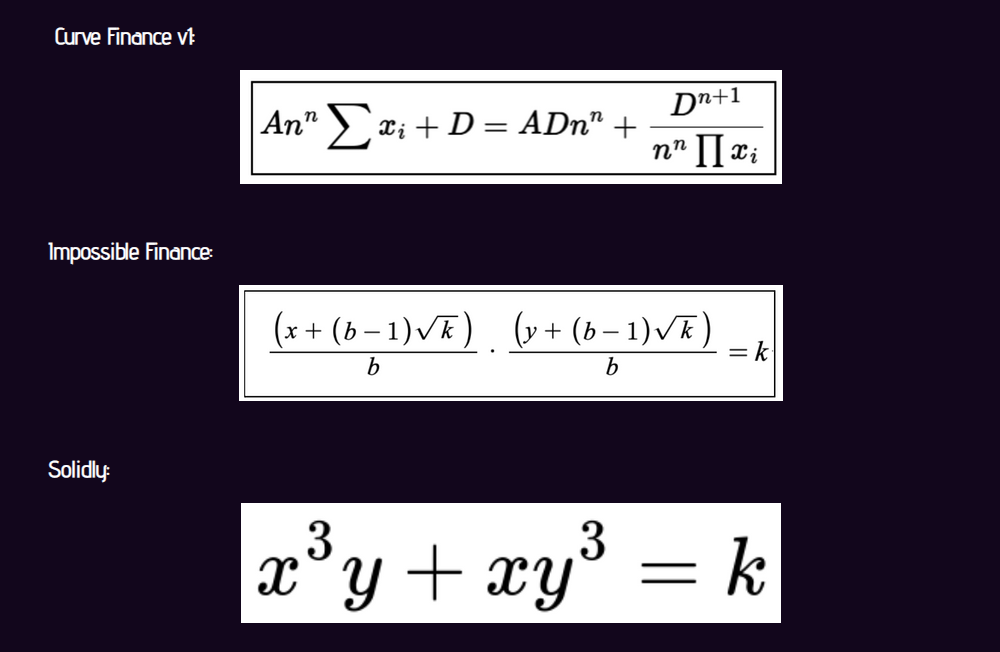

The underlying algorithm of DEX will become more complex. Uniswap follows a simple pricing algorithm x * y = k (constant product formula). where x and y are the respective quantities of the two tokens that make up the liquidity pool. While this is easy to understand, it has a relatively large price impact on trades in similar assets, leading to losses.

Many new DEXs have improved algorithms/curves that are more complex but also more efficient. Some notable examples include:

These algorithms seek to reduce the price impact on transactions, i.e. when a user exchanges one token for another, there is less fluctuation in the value of token X relative to token Y. These new conversion algorithms allow the price of small transactions to remain at a more stable level (around 1), ensuring that the price impact is small, while allowing the creation of smaller liquidity pools.

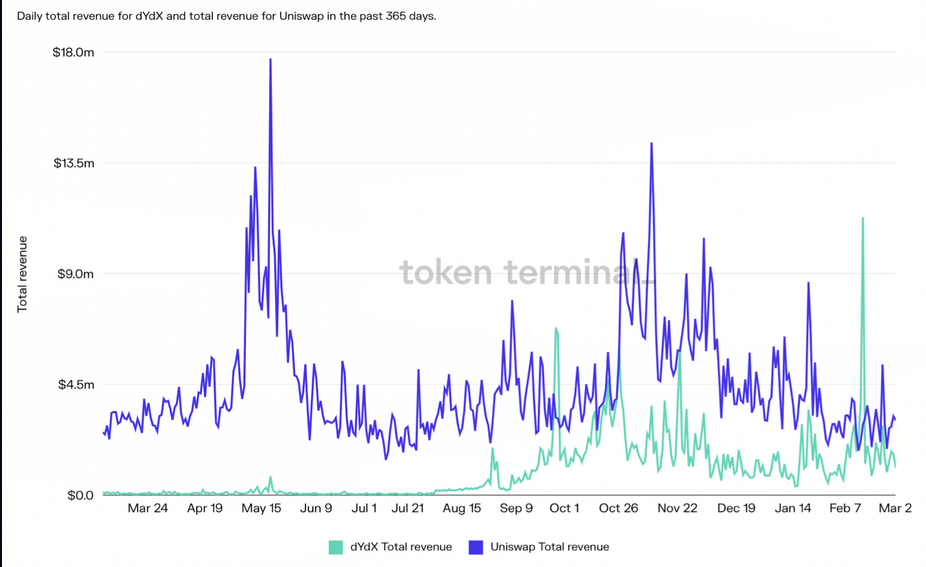

Many DEXs employ an order book model. Uniswap v3 has transformed the classic automated market maker (AMM) model into something closer to an order book, where liquidity providers are able to limit their liquidity to specific price ranges. This is called concentrated liquidity.

dYdX is a new type of DEX with an order book model. The total value locked (TVL) of dYdX is rising rapidly ($1.1 billion in November 2021), and the trading volume is already close to the level of Uniswap (the daily trading volume of Uniswap is about $1.3 billion, while the daily trading volume of dYdX is about at $950 million). However, Uniswap’s revenue is still much higher than that of dYdX, with its intraday peak revenue reaching $17.7 million, while dYdX’s intraday peak revenue was only $6.8 million. Sushiswap plans to launch a similar product in the future, and more DEXs are likely to follow suit.

secondary title

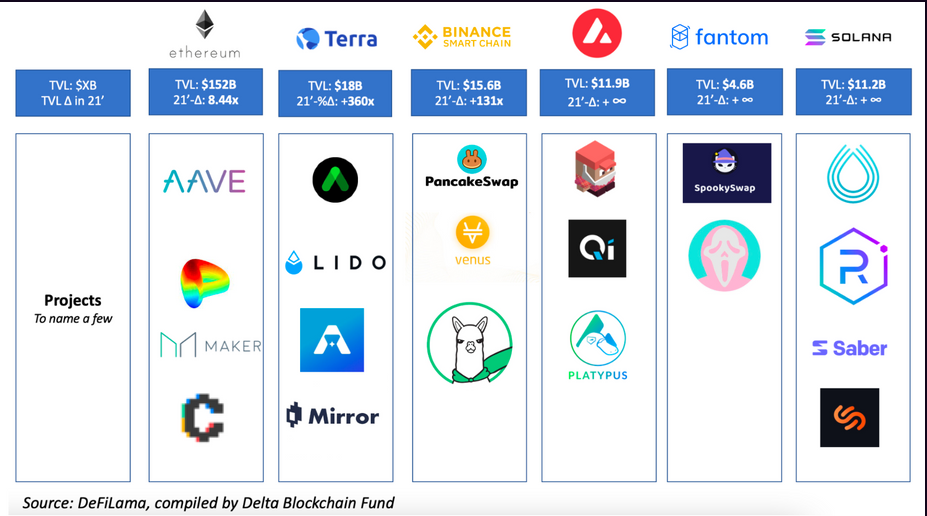

3. Increased adoption of DeFi on L2

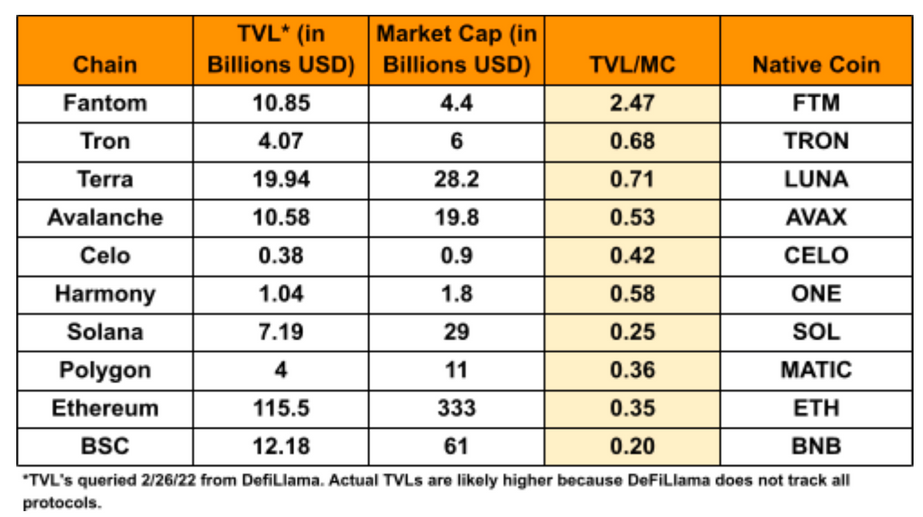

As of December 31, 2021, assets of various decentralized applications (dApps) have exceeded $241 billion. Lending protocols such as MakerDAO, Aave, Curve, and Anchor Protocol lead the way, accounting for about 25% of the total value locked (TVL). As of December 31, 2021, decentralized exchanges such as Uniswap, PancakeSwap, spookswap, Serum, etc. have also created a TVL of US$13 billion.

In addition to the rapid growth of L1 blockchain TVL, thanks to the high yield of liquidity mining, the TVL of L2 solutions has also increased significantly since the first half of 2021. The leader among them is Polygon, whose TVL has rapidly increased from 100 million The dollar rose to a peak of $8 billion. Arbitrum, Optimism, and more L2 solutions are launching in the second half of 2021 and gaining a lot of attention from the DeFi participants and developer community.

As more and more market participants enter the world of digital assets and participate in the development of new applications, the DeFi space is rapidly becoming crowded, resulting in increased transaction costs and reduced transaction speed. These problems will continue to worsen as blockchains get more and more participants, and the main L1 blockchains will quickly saturate. As a result, gas fees will rise for most L1 blockchains.

High fluctuations and delays in Gas fees will lead to transaction slippage, which will also become an eternal problem in Ethereum, so more and more people will transfer a large amount of assets to different layers.

The emergence of L2 solutions and side chains not only improves transaction speed, but also saves gas costs, and the development of the DeFi field will be stronger. By 2022, more DeFi applications are expected to adopt L2 solutions. The increase in TVL of L2 solutions such as Arbitrum, Optimism, and Boba is strong evidence that the community has begun to embrace rollups.

With increased transaction speeds, reduced fees, and innovations such as Optimism V2, the process of deploying L1 smart contracts to L2 will be simplified, so it can be fully believed that in the near future, all major tokens will launch L2 versions, and the bridge will Make sure they can move efficiently between layers.

secondary title

4. "NFT-Fi" will define 2022

NFT transactions across multiple platforms have exceeded $23 billion, with OpenSea taking the lead. The transaction volume of NFT in the third quarter of 2021 exceeded 10 billion US dollars, accounting for almost half of the total transaction volume of NFT in 2021.

Lending/secured NFT technology will dominate the space and will compete with the token swap market. In 2021, NFT entered the public eye, had a major impact on the art world, and gained mainstream recognition. By 2022, NFTs may continue this trend. Companies such as Swap.Kiwi allow the direct exchange of NFTs with other parties in escrow accounts. NFT can not only tokenize assets, but also tokenize positions. For example, large institutions can tokenize their existing positions in liquidity pools, swap them without first closing their positions, and then trade those assets. Additionally, companies such as Taker Protocol are allowing users to borrow money using NFTs as collateral, giving NFT holders access to liquidity.

In 2021, 75% of NFT transactions will be conducted on Ethereum. By 2022, NFT transactions may move to other L1 and L2 chains, including Ronin, Flow, Immutable, and Solana. A multi-chain solution that allows NFTs to be transferred across chains will redefine the field. Since the launch of Solana and its NFT trading marketplace in the second half of 2021, Solana's total NFT transaction volume has exceeded $1.3 billion, with SolanArt leading the way. At the same time, Polygon has completed more than $480 million in NFT transactions, of which $413 million came from OpenSea, mainly due to the fact that users can issue NFTs directly on Polygon through the OpenSea platform.

The application of NFT in games will be another focus. The transaction of game props will lead to a variety of business models, such as on-chain analysis that emphasizes the performance, scarcity and practicality of props.

Some examples of NFTs being used in DeFi include:

Liquidity provider positions in Uniswap V3 are represented by NFTs because they are non-fungible.

NFT platform Ubisoft Quartz allows people to buy scarce digital goods using cryptocurrencies.

UC Berkeley Auctions NFTs of Two Nobel Prize-winning Inventions: CRISPR-Cas9 Gene Editing and Cancer Immunotherapy

NFTs as tickets to exclusive events

secondary title

5. Increased focus on security

In 2021, a total of $14 billion in cryptocurrency was stolen, another record high. A total of $2.2 billion was stolen from DeFi platforms. This figure is worrying and could deter institutions from participating in on-chain protocols.

Centralized marketplaces Crypto.com and Wormhole Protocol have both become the latest targets for hackers. According to Crypto.com, on January 17, 2022, approximately $30 million worth of Bitcoin and Ethereum was stolen, and the accounts of approximately 500 users were attacked. The Wormhole protocol, which allows users to transfer assets between the Ethereum and Solana blockchains, was hacked on February 2, 2022, resulting in a loss of approximately $320 million. These hacks show that digital asset platforms still have a lot of work to do before they can be adopted more widely.

Due to the open source nature of crypto projects, white hat hackers will play an important role in securing the ecosystem. At the ETHDenver 2022 conference, white hat hacker Jay Freeman discovered a key vulnerability in the Optimism code of the L2 solution. He emphasized the importance of bug rewards to motivate white hat hackers and suppress malicious hackers, which is conducive to improving the security of the entire system . White hat hackers are actively involved in finding vulnerabilities, contacting the team publicly, or attacking the platform and returning funds. During Poly Network’s $600 million hack in August 2021, the white hat hacker returned the funds to the project team and subsequently accepted a job offer from the project.

With the popularity of cryptocurrencies, scams will be inevitable. For example, some Boring Ape (BAYC) holders were tricked into selling their BAYC at a low price, so strengthening user education on network security and blockchain operation security becomes crucial.

secondary title

6. Development of innovative DeFi and staking protocols

DeFi

In 2021, Uniswap V3 market makers earned $200 million in commissions and suffered a temporary loss of $260 million, of which a net loss of $60 million accounted for 30% of commission income. Finding solutions to huge temporary losses (losses due to the volatility of tokens) will be the focus of 2022. Managing LP positions in Univ3 is much more complex than UniV2, and the algorithm will adjust the liquidity range based on different data points on-chain and off-chain. The need for precise indexing protocols will also increase. Protocols like Chainlink will also be used more and face more competition. To reduce temporary losses, more settlements will be established.

In 2021 though, NFTs and the metaverse are getting a lot of attention. By 2022, the market's interest in new protocols in the DeFi space will be rekindled. More traditional financial applications such as interest rate swaps, futures, hedge funds and insurance will be launched on the blockchain. Brand new agreements will also emerge.

Many new projects will take inspiration from Curve’s token economy and the way it has helped protocols like Convex and Votium evolve. Curve's token economy allows users to vote on which pools receive CRV rewards (interest).

pledge

pledge

A new liquidity staking protocol will be launched, allowing people to stake tokens across different blockchains and projects, and then use derivatives of those pledged tokens (called liquid staking tokens) to participate in DeFi. These liquid collateralized tokens will be backed by currently held and locked tokens.

secondary title

7. The Rise of DAOs

A decentralized autonomous organization (DAO) is similar to a traditional organization, except that the management rules of the DAO are written and executed by smart contracts, and all transactions of the DAO are publicly visible to anyone on the blockchain. The DAO has garnered huge traction, financing the purchase of big-ticket items like footballs and golf clubs, and even one of the 13 original copies of the U.S. Constitution.

By 2022, DAOs will prove that more business models can be built collectively, such as TreasureDAO. This is a successful NFT marketplace on Arbitrum, focusing on equal distribution of revenue and community ownership. In the new year, with BitDAO holding more than $2.5 billion in liquidity, DAO treasury management will become more important than ever. BitDAO becomes a Master DAO, building communities, buying minority or majority stakes in multiple DAOs around the world. BitDAO cooperates with world-renowned universities to form eduDAO, which is used to promote research, issue project grants and develop new products. DAOs will also be used more broadly for political donations, with UkraineDAO, which aims to support Ukraine, already receiving large donations, and Assange DAO, which aims to fund Julian Assange's legal fees, has raised $7.5 million.

At the same time, more technology companies will turn to decentralized organizations, which will include not only small companies, but also large companies. Companies such as Shapeshift have successfully transformed from a centralized entity to a decentralized entity, tokenizing previous shareholder equity and airdropping it to over 1 million Shapeshift users, the largest airdrop in cryptocurrency history.

DAOs provide an opportunity for protocols and platforms to raise funds quickly, while allowing more community members to participate in the decision-making process. This could lead to ICOs for new and existing protocols, such as L2s (like Boba) and DEXs (like Sushiswap and Uniswap) launching Boba, SUSHI, and UNI tokens.

While DAOs that allow people to pool their investments are growing in popularity, they are not new. "The DAO," one of the first DAOs to allow users to pool their funds for investment, launched in 2016 and has raised $150 million from around 11,000 investors, but due to a bug in its smart contract, The DAO The DAO funds were stolen, an event that led to a hard fork of Ethereum in 2017.

secondary title

8. Large-scale investment in decentralized games/P2E economy and Metaverse

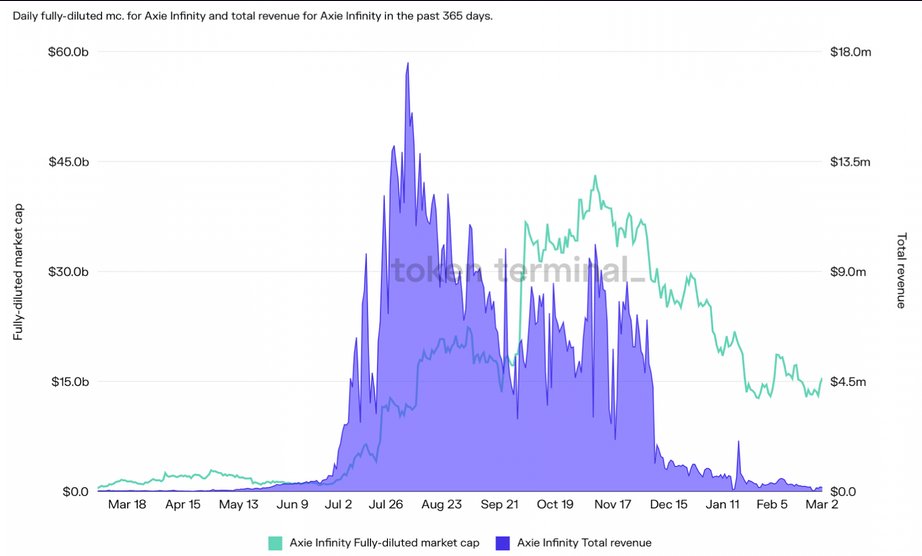

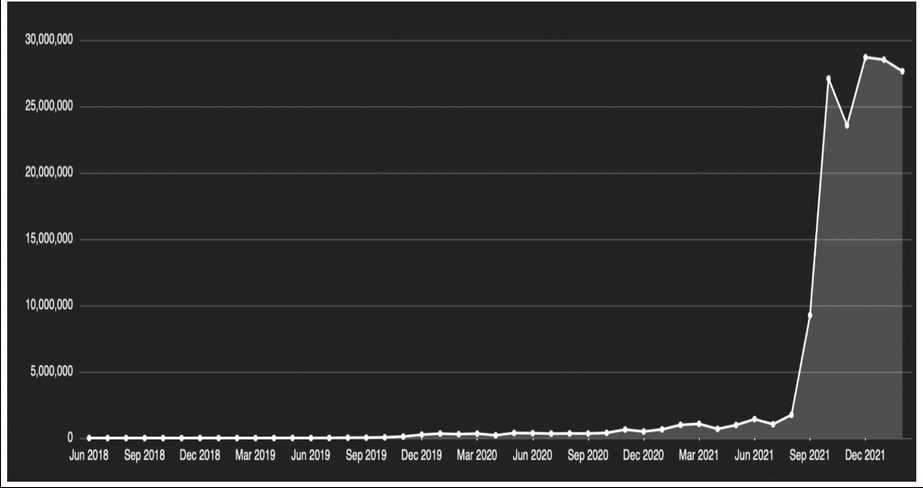

In 2021, there are three major themes in the game field, namely "Earn while Playing" (P2E), game guilds and the token economy of the chain game Axie Infinity. Blockchain Flow has been around for a while, but Axie Infinity has recently created its own ecosystem blockchain for all upcoming games.

Developers choose to develop games on the blockchain, providing players with low-cost transactions, fast execution and settlement, which can attract a large number of users. Currently, only certain elements are deployed directly on-chain, such as tokens and NFTs. Infrastructure companies provide support for these functions, such as Stardust, which outsources NFT management for users. By 2022, more and more traditional games such as chess and backgammon may move to a P2E model and be fully deployed on-chain, including computing and graphics.

In 2022, more games will be directly deployed on the chain, providing permanent storage and supporting different levels of NFT transactions on the game market. Animoca Brands is in the leading position in the field of blockchain games, they currently have 8 blockchain-based games, including virtual world, Sandbox (the game has received a lot of investment from companies such as Softbank, and has partnered with brands such as Adidas and Atari cooperate). Animoca Brands has also partnered with Formula 1 racing cars and well-known football clubs such as Bayern Munich and Manchester City to launch NFT collectible collections. The future will continue to see the rise of blockchain entertainment studios working on games and NFT projects.

In addition, more game developers from traditional game companies (such as EA, Activision Blizzard, etc.) will enter the blockchain game field in 2022. Still, many P2E games in development will have to make trade-offs between time-to-market and game quality.

2022 will show which blockchains are best for game development. Flow has proven its suitability for deploying games, however other blockchains such as Solana (low transaction costs and high throughput) still have a lot of flexibility.

Because blockchain-based games require players to own the game's native NFT and then allow players to earn tokens while playing the game, this has also led to a situation where some players do not have enough funds to purchase the game's native NFT. This has led to scholarship programs where game NFT owners lend them to players, called "scholars." These scholars then invest time in the game and are rewarded. Rewards will then be split between scholars and game NFT owners. This also gave birth to the game guild. A typical example is the Yield Gaming Guild, which was founded in 2018 and has 100,000 members, 18,500 Yield Guild badge holders, 32 scholarship managers, and more than 10,000 Axie Infinity Scholars across Southeast Asia, India, Latin America, Brazil and Europe.

The guild manager needs to ensure a stable number of members in order for the guild to earn more tokens. However, for NFTs whose value changes rapidly, fund management will be very difficult. Software management systems around guild management will be a new topic in 2022.

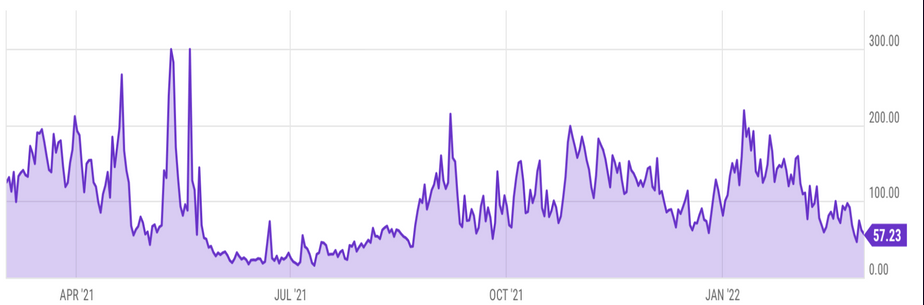

At the same time, how to develop a blockchain game that can attract players' interest for a long time is also worthy of attention. Axie Infinity’s daily revenue has risen from $10,000 in early March 2021 to a peak of $17.5 million, but revenue has since declined, underscoring how quickly interest in the blockchain ecosystem has shifted.

The rapid rise and fall in revenue can be attributed in part to the shift in player interest and the release of new games on the blockchain. A similar situation will still appear in 2022, so the focus will turn to how to make a blockchain-native game with a P2E mechanism to attract long-term interest from players.

In addition, as more funds will be invested in P2E projects, many venture capital funds focusing on investing in blockchain games will also be born. Spartan, for example, raised $50 million for its metaverse and games fund. Recently, FTX announced the establishment of a $2 billion fund focused on investment and mergers and acquisitions in the gaming field, led by Amy Wu.

secondary title

9. Storage will continue to be dominated by centralized companies

From a financial perspective, the cost of data storage has been decreasing over the past few decades, especially decentralized storage. Currently, more than 80 ZB of data are stored globally, which is equivalent to approximately 2.4 trillion 4K movies or 4.8 trillion video games. Let's say Amazon can store all of this data and charge $0.0125/GB per month. That means Amazon could potentially make $100 billion a month just by storing this data. This data is owned by individuals, companies and institutions. The storage business is owned by big tech companies and is a major source of revenue for them, especially Amazon (AWS revenue accounts for 14.5% of its total revenue). Decentralized storage will continue to drive down profit margins for big tech companies and allow people around the world to regain control of their data through solutions like Slik Photos.

From a privacy standpoint, decentralized storage allows people to store data on a distributed network of nodes rather than on a central server. In a distributed network of nodes, people's files are stored on multiple devices. Stored content is only open to the uploader and the users it shares with, similar to Google Drive.

Some well-known decentralized storage protocols include Arweave, Filecoin, and Functionland. These are open-source, community-governed decentralized storage solutions that allow users to store applications and files on the blockchain. There are also companies that don’t have blockchain tokens but still use Web3 applications, such as Filebase, which stores user data in S3-compatible encryption across multiple decentralized storage networks. Expect to develop more business models around storage, indexing, and identity. These will be prerequisites for any blockchain project and help differentiate Web3 projects from blockchain or cryptocurrency projects.

10. Incentives for blockchain developers

In 2021, the flow of talent from Web2 to Web3 will hit a record high. In 2022, how to retain talents and provide developers with clear long-term and short-term profit goals will become the theme.

Good blockchain developers keep jumping from project to project, which leads to a lot of volatility. The 2021 Electric Capital developer report shows that only 25-30% of blockchain developers are still working part-time or full-time on the same project after the third year. Blockchains like Solana, NEAR, and Polkadot are all written using the popular programming language Rust in combination with C++. Among developers, the Rust programming language is more popular than Solidity (the language in which Ethereum is written). This is mainly because Rust has existed longer and has a wider range of applications, and Solana provides high rewards to attract developers. Since Solana launched, it has provided significant funding to support projects built upon it. Solana and NEAR have the fastest developer growth rate of any blockchain in 2021, with more than 4 times the number of full-time developers, but they only have a small number of Web3 developers. Solana, NEAR, and Polkadot have a total of 2,700 developers.

How to retain talents for a long time will attract more attention. While issuing tokens can reduce developer attrition, the rapid launch of tokens and the drop in token prices may lead to a faster brain drain. Hacking will also speed up the process.

As more and more people embrace blockchain and realize its use cases, there will be an influx of developers to Web3. Soon, blockchain will evolve from a buzzword and a product selling point to being fully integrated with the product.

secondary title

11. The call for regulation is growing

To facilitate institutional adoption, more on-chain governance, legal technical frameworks, and identity innovations will need to be provided. The government’s focus will shift to the monitoring of on-chain activity, such as KYC reviews of decentralized applications, allowing regulators to track identities certified on-chain. One of the services that help users create digital identities is the Ethereum Name Service (ENS), which provides names to wallets and websites. It allows users to have their own username and profile and use it on multiple services on the Ethereum blockchain. Instead of long wallet addresses, users can receive cryptocurrencies using custom wallet names.

Additionally, legal tech innovation requires collaboration with government and legal teams, which can slow time-to-market. By resolving legal issues, implementing security measures, and ensuring that transactions can be unaffected in the event of on-chain failures, it is beneficial to promote the increase of on-chain liquidity. There are already some protocols, such as the Astra protocol, that equip smart contracts with a decentralized compliance layer to meet dispute resolution and KYC review needs. Blockchain is expected to integrate third-party applications into smart contracts, making authentication possible. There are already on-chain applications such as Polygon and Terra that use digital identity verification applications such as Synaps to connect users' verification IDs to their wallets and store them in a decentralized manner.

The benefits on-chain are high, but so are the costs. As security and insurance coverage expands, costs for institutional investors may also increase.

Regulation of privacy protocols may not happen until 2022. However, money laundering is a growing concern and needs to be addressed in order for institutions to deploy capital on-chain.

As the adoption of cryptocurrencies increases, more and more countries are introducing regulations specific to this space. On the one hand, countries such as the UAE are looking to attract cryptocurrency businesses by creating virtual asset special zones, including digital assets, products, operators and exchanges. In September 2021, the UAE Securities and Commodities Authority and the Dubai World Trade Center Authority (DWTCA) signed a framework agreement allowing DWTCA to license and authorize financial activities related to crypto assets. In October 2021, DIFC, another free trade zone in Dubai, released the first part of the regulatory framework for digital tokens. Non-citizens and non-residents can easily set up sole proprietorship companies in DIFC and obtain visas and trade licenses. Dubai is home to many crypto companies, with exchanges BitOasis and DWTCA recently signing a memorandum of cooperation with Binance to help establish their regulatory framework.

However, there are also countries and institutions that are taking steps to crack down on cryptocurrencies. From April 1, 2022, India will impose a 30% tax on all virtual digital assets without any exemption, which will make the taxation of cryptocurrency income the same as that of lottery and gambling income. Meanwhile, El Salvador's decision to accept cryptocurrencies as legal tender was opposed by the International Monetary Fund (IMF), and major rating agency Fitch Ratings downgraded the country's credit rating. The U.S. and U.K. have the same tax regime for gains from cryptocurrencies as gains from stocks, while in Germany, sales of cryptocurrencies held for more than a year are tax-free regardless of profits.

U.S. President Joe Biden is expected to issue an executive order directing government agencies at all levels to study cryptocurrencies and central bank digital currencies (CBDCs) and propose a regulatory strategy for digital assets.

secondary title

12. Increased institutional adoption

Friendly regulation could provide clearer guidance for institutions developing crypto products. Coinbase has given up launching USDC lending plans after being threatened with prosecution by regulators, but such plans may be put back on the agenda once regulations are clarified.

There are already encrypted futures ETFs on the market, and encrypted spot ETFs may be introduced in 2022. The U.S. Securities and Exchange Commission (SEC) is studying the launch of a crypto spot ETF on the NYSE subsidiary Arca Exchange. Major investors such as Charles Schwab and Grayscale Investments are also discussing launching cryptocurrency ETFs in 2022.

Increased adoption of cryptocurrencies has also revived interest in central bank digital currencies (CBDCs), but most CBDCs are still in the research phase, with countries such as the UK still evaluating the merits of adopting them. Therefore, a mainstream CBDC is unlikely to be launched before 2025-2026. China plans to increase public adoption of CBDCs this year, which helps shed light on the advantages and challenges associated with CBDC adoption.

As blockchain research matures, blockchain is expected to be applied to other government functions. For example, the Estonian government has used blockchain technology in the tax system and business registration system, and uses blockchain technology to protect residents' electronic health records. Hospitals in the UK are using blockchain to track the storage and supply of COVID-19 vaccines.

secondary title

stable currency

stable currency

2021 is the year of algorithmic stablecoin projects (algorithmically monitoring supply and demand, thereby keeping token prices constant). However, most projects fail. At present, more algorithmic stablecoin projects try to find an optimal balance between collateral and algorithms.

Due to market volatility, UST (Terra stablecoin) has seen two de-pegs in 2021. Eventually, the Terra team got enough liquidity by connecting to blockchains like Solana and Cosmos.

In 2022, more collateralized stablecoins like DAI and MIM will emerge. They will come with some added features, such as free lending. With more interoperability and interconnection between different blockchains, some stablecoins may become obsolete.

China's digital yuan is being adopted by tech giants such as Tencent and Alibaba, and fueling the growth of financial conglomerates. WeChat is also adopting the digital yuan and providing client access. The question is whether and how the digital yuan will be integrated with decentralized applications.

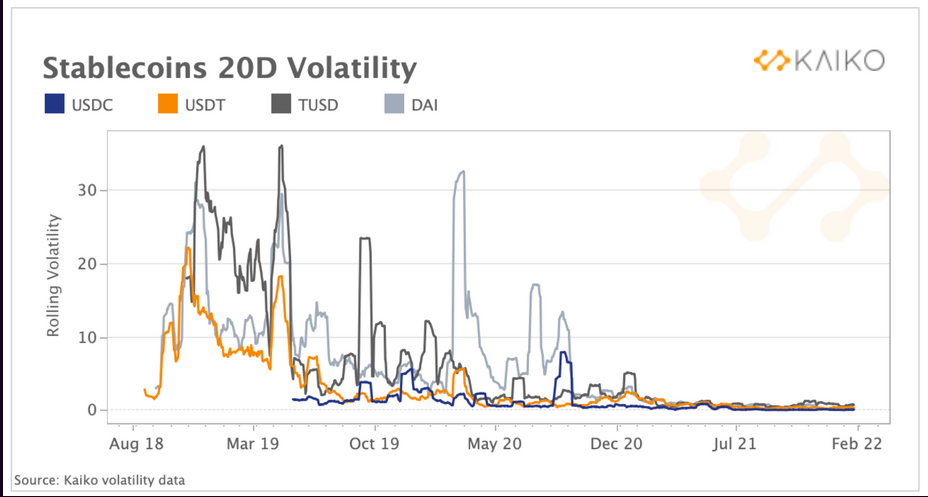

Stablecoins can make cryptocurrencies a mainstream medium of everyday transactions, with applications in other areas such as the exchange of goods and services, the issuance of decentralized insurance solutions, derivatives contracts, and consumer loans, among others. In order to function well, stablecoins must maintain their stability, and the volatility of stablecoins has also declined significantly in recent years.

in conclusion

In summary, Web 3.0 blockchain infrastructure is the key to sustainable growth of on-chain innovation. 2021 sparked the first debate on the difference between Web3 projects and blockchain projects/programs/protocols. A blockchain company should interact with at least one blockchain to be considered a blockchain-native company. However, a Web3 project requires a fully decentralized technical solution as part of the infrastructure, including community-governed open source projects and decentralized storage, identity and privacy solutions. At present, a lot of development work is being carried out around the blockchain infrastructure, and many business models are originated from it. It is expected that the global blockchain infrastructure will grow significantly in the future.