解密红杉资本加密局:Michelle为何选择All in Crypto?

2月18日,红杉资本宣布推出规模为5-6亿美元的加密货币投资基金,这是红杉资本自 1972 年成立以来的首个特定行业基金。

但是这一切是如何发生的?为何红杉资本从一个传统一线美元基金大步跨越,试图引领Web3投资?

答案很简单,有人在推动和Lead,她的名字是MICHELLE BAILHE。

一定程度上,她,改变了红杉资本。

2020年9月,MICHELLE 从从私募股权公司 Hellman & Friedman跳槽到红杉资本后,开始积极主导Crypto方向的投资,并Lead了FIREBLOCKS和FTX的投资。

用红杉资本内部的人的话来说, Michelle Bailhe 才是真正的 ALL IN CRYPTO!

另外一个类似的合伙人是Shaun Maguire,主导了DeSo、ParallelFi、Faraway等项目的投资。

所以,目前红杉资本加密领域的投资主要是 Michelle Bailhe和Shaun Maguire在Lead,其次是 Alfred Lin、Ravi Gupta 和 Konstantine Buhler 也将Crypto作为优先选项。

目前其部分Portfolio以及负责人如下:

Michelle Bailh (FTX, Fireblocks)

Shaun Maguire (DeSo, ParallelFi, Iron Fish, Faraway, Strips, and more seeds in stealth)

Alfred Lin (FTX)

Mike Vernal (Starkware)

Ravi Gupta (Fireblocks)

Roelof Botha (Square now Block)

Andrew Reed (Robinhood)

Stephanie Zhan (stealth seed, Brud acquired by Dapper Labs)

至少在去年下半年,红杉资本并未打算设立专门的加密基金,用Maguire的原话来说是,“We don’t want the lessons of crypto to be siloed just in a crypto team(我们不希望加密货币的课程仅仅被孤立在一个加密货币团队中 )”,但是当时也并未排除这个可能性。

或许是由于a16z的启发,专门的加密基金变得越来越流行,前a16z Crypto负责人Katie Haun认为,如果只是兼任且没有专门的团队,就不可能在加密投资方面取得成功。

我们不关心Maguire的出身背景等,但是好奇她关于Web3/Crypto投资的观点,比如她特别在意公司或者创始人讲故事的能力,以及认为WEB2创业者转型WEB3的潜力被低估了,部分内容来自于过往播客采访。

根据红杉推演的Crypto的周期模型,目前正处于第二阶段。

讲故事的能力

“在大多数公司,尤其是在技术领域,讲故事是一种被低估的艺术。优秀公司和传奇公司之间的区别在于,它们讲述了如何让人们的生活变得更美好的故事。”

在Michelle看来,讲故事的能力是一种核心竞争力,被严重低估。

用她的话说,人类就是一个会讲故事的物种,一个故事比其他信息更有用。

Michelle的父亲是电影制片人,所以她从小明白,光有技术和产品是不够的,还能让人去理解他。

比如说谷歌的成功,在很早期的时候就讲了一个如何让生活变得更美好的故事,而不是单纯讲我们是一家人人都知道的大公司。

谷歌在超级碗的第一个广告大致是,在搜索框中搜索,“如何在法国留学”,“如何与女生约会”,“如何组装一个婴儿床”……

读者脑中是一个美丽的生活故事,而不是枯燥的产品。

目前,主要有两种叙事逻辑:一种是从公司的角度来讲故事,吸引好奇;另外一种是从创始人的角度出发,再来讲公司的故事,比如乔布斯、比尔盖茨和马斯克。

在Crypto领域,Michelle对FTX创始人SBF赞赏有加。

在红杉的会议上,她表示,喜欢SBF的原因之一在于他是一个了不起的讲故事的人,这对于创建真正传奇的公司很重要。

此外,SBF的“时钟速度”令人叹为观止,以及你提出的任何问题,他可能已经从一百个角度思考过,Michelle评价SBF是其“见过的优秀人才”的前三名。

WEB3投资

Michelle表示,红杉资本专注于投资下一个技术时代,接下来,会专注于两件事,一是继续投资和支持 Web 3 和 Crypto领域的伟大创业者,其次,有一件事被大众严重低估,那就是WEB2的创业者转向WEB3,就像从PC桌面端转向移动端,其中会有非常成功转变的案例。

Michelle分享了一个小故事。

在红杉的大本营活动中,所有创始人一起露营过夜,其中三个不同领域的创始人,分别来自游戏、消费和直播购物,都不约而同和她谈起NFT,这让她想到,这些公司或许都将转向Web3,就像他们转向移动端一样,而那些不这样做的公司将被抛在后面。

如何Pitch项目?

Michelle坦言,她的大部分投资是在推特上找到的,然后也会通过推特私信主动联系,比如主动联系过FTX的相关人员。以及她认为她能为帮助过的公司做的最重要的事情是,在正确的时间将他们介绍给正确的人。

对于红杉资本而言,有一个问题在于,WEB3时代的风险投资是否会冲击红杉等传统VC,这似乎是一场自我革命,比如宪法DAO等各种案例提供了一个新的投资范式。

Michelle认为,VC和所有生物系统一样,要么进化,要么死亡,而红杉资本永远偏执(Paranoid)。

红杉资本一直在打造一个长期主义的模型,在这种模式下,不必仅仅因为公司上市就出售股票或代币,这是传统风险投资的一个难点。

LP要获得流动性,那么基金就会出售股票(代币)等,这一定程度上会伤害创始人,特别是在某些关键时刻;以及卖完了股票或者代币,两者的关系可能就结束了,但是创始人其实是需要长期帮助的,作为VC,红杉资本并不是“被动金钱”,而是真正的商业合作伙伴。

(注:2021年10月,红杉资本宣布在美国和欧洲市场设立名为Sequoia Fund的单一、永久基金,改变传统基金的组织模式,不再为其设立存续期。红杉可以在企业IPO后很长时间内持有公开股票,并为LP寻求最佳的长期回报,这些LP中的大多数都是非营利组织和捐赠基金。)

给想要进入这个行业的人什么建议?

Michelle非常真诚地表示,“如果你觉得生活中有一个空间,尽管很多人可能觉得没有,但如果你能感觉到生活中有一个可以冒险的空间,那就去冒险吧”。

此外,Michelle强调快速的执行力很重要,而不是花太多时间浪费在考虑和纠结上,这也是她最欣赏FTX团队的地方,比如有的时候,SBF也会问她一些问题,虽然她在24小时内回复了,但是SBF已经早早解决了,这显得她好像说了一堆废话,这是她从一些强大的创始人那儿学到的经验教训。

最后重点分享以及强烈推荐Michelle在2021年底亲自撰写的一篇文章《Ask Not Wen Moon–Ask Why Moon》,凝聚了她关于WEB3和Crypto投资的思考:

Ask Not Wen Moon–Ask Why Moon

2021 年是加密货币丰收的一年: 数百个项目启动;数千名新的开发人员和超过 1 亿的新用户进入了加密领域;加密货币的总市值增加了 1 万亿美元;DeFi 的总锁定价值也到了2500亿美元;NFT 销售额打破了历史记录并且获得了 SNL 的特写;Tom Brady(职业美式橄榄球运动员)和妻子Gisele对FTX的支持,激发了人们对加密货币的兴趣;PleasrDAO 拯救了 Wu Tang Clan 专辑;ConstitutionDAO 几乎差点就买下了宪法......

然而,仍然有很多刚接触加密领域的人问同样的问题:加密领域到底发生了什么?加密领域的投资到底是投货币还是投资新的互联网?什么是热门的新代币和新NFT?什么时候才能 TO DAO MOON ?

我认为更好的问题实际上是:为什么MOON?为什么加密和Web3会蓬勃发展?为什么是现在这个时候?虽然加密领域作为一个市值上万亿的庞然大物的确值得重视,但是它为什么重要?

虽然回答这些问题可能是一个西西弗斯式的任务,但我们试图在几页纸内做到。这些问题对任何深入该领域的人来说都显得过于简单,但我们希望通过提供加密货币的历史背景和生态系统的思维模式的广泛概述,让更多用户、开发者、运营商和创始人参与进来。

我们还希望它能让人们明白,为什么红杉资本坚信加密货币是我们这个时代最重要的巨大转变之一。

加密世界正在发生什么以及为什么重要

本质上,货币代表着信任。我们这个星球上的许多人喜欢信任他们的货币和金融系统。

我们相信我们的央行不会在一夜之间让我们的货币贬值。我们相信政府能避免恶性通货膨胀,这样我们的货币就能保持购买力。我们相信银行会确保我们的资金安全,不会轻率地放贷,而私营公司会帮助我们安全地将我们的资金用于商业和其他金融服务。

我们为这种信托的特权付出了向金融服务公司(一个价值数万亿美元的行业)缴纳的税收和费用。在过去的几个世纪里,这种信任基础一直是我们经济进步的重要基石。

然而,许多金融系统并不值得这种程度的信任。即使在一些最繁荣和人口最多的国家也是如此。比如说08-09 年的大金融危机,甚至导致了美国的信任也受到了侵蚀。最近几年,各国政府应对 COVID 的全球货币刺激措施再次引发了许多质疑,进一步降低了信任。

引发加密行业的比特币白皮书于2008年10月31日发布,距雷曼兄弟(Lehman Brothers)在金融危机中倒闭仅六周时间,这似乎不是一个巧合。白皮书标题为《比特币:点对点电子现金系统》(Bitcoin: A Peer to Peer Electronic Cash System),文章里描述了密码学中圣杯问题的解决方案:使用分布式网络来验证数字文件的真实性。

这在互联网上引入了一种新问题:可验证的稀缺性,并且如何使价值直接在线转移无需中介。要交换比特币,我们所需要的只是互联网访问和对比特币开源代码的信任。就像现在数十亿人相信互联网可以进行全球信息自由交换一样,2.2 亿人现在相信区块链可以实现全球价值自由交换。

从历史背景来看,“互联网金融”可以被视为我们金融体系的自然演变。金融货币的历史是一个为了方便而逐渐抽象的故事(以物易物经济到金属货币再到纸币等)。

今天,在世界各地发行的大部分货币已经是数字化的,就像我们曾经用纸币替代黄金那样。但是,我们为这种模拟系统的低效率付出了巨大的代价,因为它具有分散的司法管辖区、无数的中介机构和长期的结算延迟。为什么我们不转向互联网原生的金融货币流动方向?这难道不是 PayPal、Stripe、Square 和其他公司应该开始的旅程的下一步吗?

虽然比特币似乎旨在解决支付问题,但通常来说,大多数发明很少按照发明者的计划进行。随着对比特币的需求增长,它的价格和交易费用也在增加,这使得它逐渐作为一种投资工具(或价值存储)而不是支付机制(交换媒介)。

最有趣的是,新发明者以新的方式构建了比特币的概念。比如说,以太坊贡献了分布式账本,不仅用于货币,还可以用于计算。

区块链作为去中心化的计算平台抓住了开发者的想象力,市场前景很大,可以宏观地描述为试图带来更好的金融秩序和更好的互联网。

更好的金融货币:不受任意货币政策、审查和监督的货币,以及更值得信赖、更容易获得、更高效和更便宜的金融系统;

更好的互联网:用户拥有自己的数据,而不是从给定平台租用访问权限的应用程序;创作者获得更好的回报,社区管理自己;流动性更强、可跨平台携带、更适合管理数字版权的数字商品 (NFT)。

这些只是目标,我们还有很长的路要走。有人认为加密货币的整个努力都是骗局,但这没有抓住重点。从历史上看,当技术创新在监管之前导致金融创新时,我们会看到改变世界的创新,然后会看到狂热、欺诈、崩溃、监管框架,然后是缓慢建立持久价值(参见:1600 年代阿姆斯特丹的早期股票市场)。

Crypto似乎没有什么不同,有着虚假的Token,有着一些过度炒作。但与所有其他技术革命一样,在这段时间里也必将产生经久不衰的公司。

大转变

加密技术将改变互联网的价值,也将改变互联网本身的价值。区块链将改写我们拥有、出售、购买、交易、交换和奖励的方式。随着软件渗透到我们的世界,加密货币(软件货币)也将渗透到货币以及我们用它做的一切。

区块链的固有属性,即时价值转移,可核实稀缺和用户所有权,可以在付款,金融,游戏,内容,社交网络等中重组万亿市场上限。

1.数字货币从根本上对 2.2 亿人以及未来不断增加的人有用,无论是作为上限供应通胀对冲、抗审查的价值存储、无国界交换媒介和/或投资工具等用途,这创造了一个新的资产类别。

2.这种新的资产类别正在为中心化和去中心化 (DeFi) 的金融服务创造市场。与任何资产类别一样,所有者希望能够购买、持有、出售、交易、借贷、对冲、掉期、细分、保险等等。使用加密货币,他们还希望 24/7 全天候自由地跨越国界和时区。这可能会扩展当前的金融体系,创造更多的消费者选择。

3.加密的兴起需要一个新的加密堆栈。从核心基础设施到开发人员工具,一些传统堆栈可以转换,而另一些则不会。托管、节点、法定加密货币以及链上和链下数据只是新兴加密堆栈的几个领域。在这个时代,价值可能会累积到新的层次。在传统软件中,应用层产生了更多价值(Google ~ 2T 市值,TCP/IP/SMTP 可以说是 0 美元),而在加密货币中,核心协议可通过代币货币化(BTC+ETH ~$2T 市值)

4.区块链不仅支持数字资产,还支持数字商品 (NFT) 和去中心化应用程序 (Web3)。尽管这些领域的交易量、用户兴趣和开发者精力都在爆炸式增长,但它们仍处于早期阶段。Web3 具有巨大的潜力,可以使用区块链围绕用户所有权、创建者奖励和社区治理(例如 DAO)等原则重塑互联网服务。

5.监管框架仍在塑造之中,因此创始人需要深思熟虑地探索未知领域。

加密的心理模型

沿着两个维度理解加密货币可能会有所帮助:空间和时间。

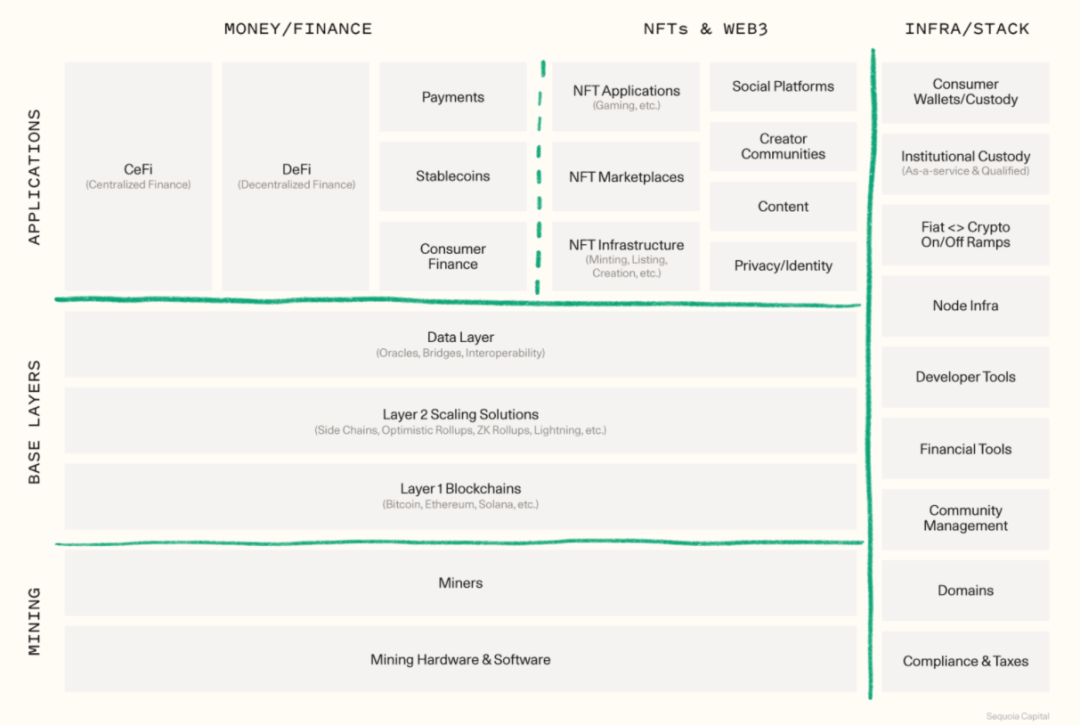

空间:下面是加密生态系统的地图。

它的组织方式就像一个典型的堆栈,从底部的硬件到顶部的应用程序,右侧是构建和访问它的基础设施。目前来说,我们当然知道这是不完美的。其中许多类别重叠。

时间:受典型的新技术采用 S 曲线的启发,这是一个特定领域机会何时成熟的框架。这也是不完美的——建设是同时发生的,阶段是重叠的,并且在反馈循环中相互作用。

但是,这不是过去十年中每个局部最大值和最小值的重演, 相反,这是试图缩小范围并想象我们如何从数百万到数十亿的加密用户的发展过程。

第一阶段:孤立。加密作为一个孤岛,与非加密世界脱节。加密自行构建了核心协议(想想用于互联网的 TCP/IP,以及用于加密的比特币、以太坊和 Solana 等第 1 层区块链)。协议与其原生代币密不可分,各种Token创造了对交易所和额外金融服务的需求,大多数老牌企业缺乏满足这一需求的技术和监管意愿,从而让加密货币原住民填补了这一空白。每种金融服务的加密原生类似物大致按其历史顺序出现:货币、外汇、借贷、衍生品、保险、期权、ETF 等。

第二阶段:连通性。连接加密和非加密世界。非加密世界看到了加密的价值并构建/购买基础设施来访问它。托管/钱包、加密法币开/关通道、数据馈送、特定于区块链的基础设施和开发工具在这段时间呈指数级增长。从 NFT 艺术社区到游戏再到Web3 社交网络的新用例吸引了新用户。随着大众市场开始参与加密市场,竞争压力极大地简化了用户体验并降低了访问障碍。在接下来的十年中,能够访问加密的用户和开发人员数量将增加 10-100 倍。我们认为我们处于才刚刚开始的第二阶段。

第三阶段:成熟。加密世界和非加密世界的融合,因此它们不再是不同的。与移动设备一样,一旦加密访问足够普遍,应用程序将拥有充分发挥其潜力所需的基础。他们将跨越从加密到平常生活的鸿沟。需要明确的是,目前已经有很多人在消费金融、DeFi、NFT、Web3 等领域进行建设,但只有几亿人和机构能够访问它们。随着访问权限的扩展,应用程序的用户参与度将增加一个数量级。

期待

加密货币仍处于早期阶段。尽管它充满了波动性,但它也充满了创新。将加密货币视为纯粹的投机行为是忽视每项金融创新都有其滥用者的历史,并错过了创造更好金融系统的巨大潜力。将加密货币视为太慢、太昂贵或令人困惑而无法使用,就像在拨号阶段拒绝互联网一样。

虽然对加密的用户体验、成本、速度或环境影响的批评都是正确的,但这些并不是这场运动的末日信号,相反,这些批评都是我们入场建设的机会。我们的基本诉求是:数十亿人想要一个更好的金融系统和一个更好的互联网;我们认为新一代的开发者有动力为这个世界来构建这些满足诉求。