Defi Weekly is a column launched by Odaily in conjunction with global DeFi incubator DeFictory, blockchain marketing consulting company WXY, data provider OKLink, and content partner BlockArk. The four sections of market investment and financing information show important changes in the Defi world in the past week.

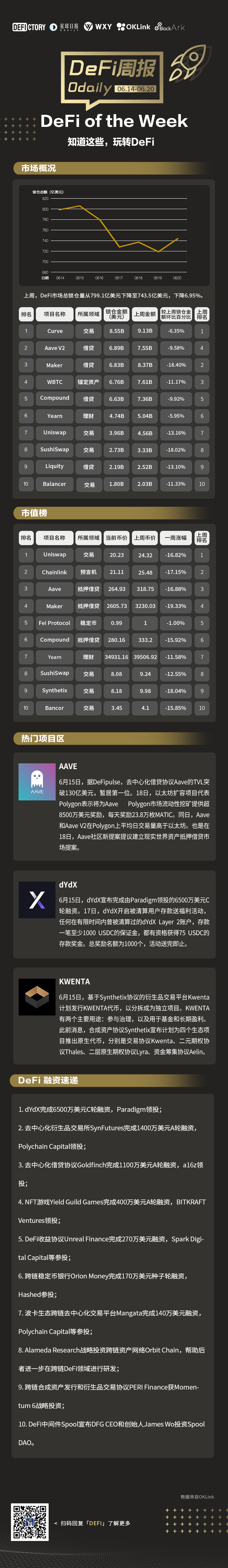

Last week, the total lock-up volume of the DeFi market dropped from US$79.91 billion to US$74.35 billion, a decrease of 6.95%.

popular items

AAVE

secondary title

dYdX

popular items

KWENTA

On June 15, Kwenta, a derivatives trading platform based on the Synthetix protocol, plans to issue KWENTA tokens to spin off into an independent project. KWENTA has two main uses: participation in governance, and for funds and long-term profitability. In previous news, the synthetic asset protocol Synthetix announced plans to launch native tokens for four ecological projects, namely the trading protocol Kwenta, the binary options protocol Thales, the second-tier native options protocol Lyra, and the fundraising protocol Aelin.

financing news

secondary title

financing news

dYdX completes USD 65 million in Series C financing, led by Paradigm;

Decentralized derivatives exchange SynFutures completes $14 million in Series A financing, led by Polychain Capital;

Goldfinch, a decentralized lending protocol, completed its $11 million Series A financing led by a16z;

NFT game Yield Guild Games completes $4 million in Series A financing led by BITKRAFT Ventures;

DeFi revenue agreement Unreal Finance completed a financing of US$2.7 million, with participation from Spark Digital Capital and others;

Orion Money, a cross-chain stable currency bank, completed a seed round of financing of 1.7 million US dollars, and Hashed participated in the investment;

Polkadot's ecological cross-chain decentralized trading platform Mangata completed a financing of 1.4 million US dollars, and Polychain Capital and others participated in the investment;

Alameda Research strategically invests in Orbit Chain, a cross-chain asset network, to help the latter further research and develop in the field of cross-chain DeFi;