"Our examinations over the past century demonstrate that extreme market irrationality periodically erupts—and shows convincingly that investors who want to do well would do well to learn how to deal with the next eruption." - Warren Buffett

Today, a rational market is inevitable. When it comes to retail, fundamentals tend not to drive investments as much as momentum and hype. However, with the introduction of the Internet, retail investors have access to as much information as professional traders. Armed with this information, strong, well-thought-out decisions can be made.

Of course, once those decisions were made, they were posted on Reddit, an internet forum with subforums, including those focused on investing. This may seem simple, but the profound impact on the market is clear. With these new mediums of communication, investors unlocked market manipulation capabilities once only available to Wall Street insiders.

Of course, once retail investors start threatening Wall Street's profit lines, Wall Street's right to return becomes a breeze. Within days of a subreddit-fueled short squeeze that hurt hedge fund bets, platform Robinhood, the leader of effective retail conglomerates, halted trading in several securities, including GameStop, Amc Entertainment Holdings and others. While this has been unfathomable in the past, Robinhood seems to have decided that it knows what's best for investors.

As alarming as this crossing is, it is only a symptom of market fear.

all inFiatdesignated assets andFiatFunds held on the platform are fraudulently controlled

The only money you can control is your cash. Even so, the physical dollars you hold keep losing value. Banks, creditors, money management apps (i.e. CashApp) — they're all the same. Each one requires you to fully trust the escrow entity not only to protect your wealth from outside interests, but also to protect your internal interests.

In fact, Robinhood's actions are a failure.

This can only be avoided entirely by opting out, and buying Bitcoin. By storing one's wealth on the Bitcoin network, one is protected in every way. The money is entirely yours and no one can stop you from using it. It cannot be lent, restricted, held or charged interest. Through effective planning and the persistence of the community, Bitcoin prevailed.

Regardless of the outcome for GameStop or others involving securities, the real lesson is that people don't have control over their money. This is shameful. By buying Bitcoin, you help fix the conditions in favor of grand schemes to manipulate currencies. Buy bitcoins and launch yourself beyond the control of fiat currencies.

Retail investors group together, traditional financial direction markers, new funds enter the game

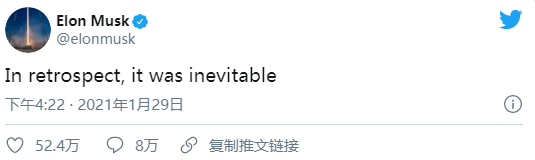

Elon Musk, the CEO of SpaceX and Tesla and the richest man in the world, changed his Twitter profile to "#bitcoin" and tweeted a cryptic message , which has been interpreted by many in the Bitcoin space as advocating the technology, or acknowledging that his tacit approval is certain to happen.

In the minutes following the tweet, the price of bitcoin climbed sharply. It rose from $32,000 at the time of tweeting to $37,500 an hour later, peaking at 14%, per transaction view. The price of BTC eventually reached a 14-day high of $38,300 on the day. According to data aggregator Coinalyze, this price increase led to short-term liquidations worth more than $446 million on several cryptocurrency exchanges.

This momentum has obviously laid a good foundation for this year's bull market. Whether it is the late capital entry or the promotion and use of Bitcoin, it has laid a good and broad foundation. Undoubtedly, this market riot will have a profound impact on the currency circle.