Debunked: Misunderstandings inside the encrypted doomsday machine |

As long-term Bitcoin holders, we are not shocked by the ongoing chaos in the nature of the Bitcoin market. The reality is that unlike other public traditional financial markets, the Bitcoin market has more voices. Price assessments, use case surroundings, data are all different, and even skeptics have different controversies. It is difficult for a novice to enter the Bitcoin market and jump directly into the signal.

This confusion is reflected again in a misleading article circulating on the Internet, "Bit Short: Inside the Encrypted Doomsday Machine."

As with many other articles, the Medium authors seem to fall into some fairly wide-ranging novice pitfalls surrounding Bitcoin exchange data, in terms of Bitcoin transaction data, the nature of Bitcoin as a black market currency, and the settlement around a well-known gray market dollar ( The Fear, Uncertainty, and Doubt (FUD) aspect known as tether, falls into some pretty big novice pitfalls. This article will examine the author's key arguments one by one, and explain these pitfalls, arguing why anyone considering tether or its relationship to bitcoin should not be taken seriously.

At the root of the conspiracy is a basic assumption that the bitcoin market is illegitimate, that there is no legitimate demand for bitcoin, only FOMO created as a by-product of "fraudulent bundle printing". In 2016 or 2017, the tether conspiracy theory was a very powerful narrative. That's right, these tether fears existed before 2020...that's an old story.

In 2021, we know that fiat is devaluing at a tremendous rate, people and institutions flock to anything that is not fiat, and big investors appear on TV to discuss their massive allocations to Bitcoin. The "no legitimate need" argument is much weaker these days. Bitcoin, the hardest and scarcest asset in the world, was created with this express purpose.

While on the surface, Bitshorts: Inside Crypto's Doomsday Machine appears to be raising some very credible concerns around the bitcoin market, those concerns are actually based on a misunderstanding of data visualization, which itself is Based on fake data.

Unfortunately, "bit short" is unfounded FUD.

The author is parodying individuals who have been locked into this bondage narrative for over four years.

We have no intention of defending Tether, iFinex, Bitfinex, or any other private tether-related organization, we have not spoken to them, and they can and do defend themselves. Instead, we're here to debunk the misinformation in "The Bit Short," and provide some context so new investors can avoid the obvious misconceptions that fuel this and other under-researched FUD articles that will Keep spreading.

A brief history of Tether and USD-pegged tokens

Tether, the original "stablecoin," launched in 2014, four years ahead of any competitor. In fact, Tether's massive success and apparent demand in 2017 drove the launch of "regulated alternatives" such as USDC, GUSD, and Paxos.

October 2014: Tether (USDT) origin date

December 2017: Dai stablecoin origin date

September 2018: USDC origination date

September 2018: GUSD origination date

September 2018: Paxos Origin Date

Tether is the largest stable lock both by market cap and usage because it was the first. It does create a stable currency market and has significant network effects years before other players start competing. That's not to say it's without its faults, it's just to explain why it's much bigger than its much younger rivals.

Again, this article is not meant to defend Tether's claims, but rather to help others better understand what Tether is and the role it plays. Tether is a black box with a "rough" design. Tether products are aimed at the banking system. From a regulatory standpoint, this is sketchy in nature. That's why people use it. Tether users do not want to own their value in a legacy compatible system. The main use of Tether is to sell your bitcoins for "dollars" without affecting the banking system. In practice, Tether is analogous to the future purchase demand of Bitcoin. For many, tethering is focused on circumventing regulations when trading bitcoin.

Alerting to how rough Tether is is like jumping into the ocean and alerting of fish swimming. Of course, Tether is not externally "obedient and transparent", which is what Tether is about.

But the authors of “Bit Short” would have you believe that Tether is not only “sketchy” but also serves the gray dollar market, and there is no demand for Bitcoin other than “sketch” Tether manipulation. We're not saying Tether isn't sketchy, but we think Tether is a very delicate place in the larger Bitcoin ecosystem. We will argue with strong evidence that bundling is not like a fundamental problem in Bitcoin investment theory, nor is it a legitimacy in the Bitcoin market. The authors of the book "Bit Short" base their argument on the following points:

1. Daily inflows into Bitcoin exceed $10 billion.

2. Tether accounts for more than 70% of Bitcoin transaction volume.

3. The issuance of Tether must be fraudulent because of how it is issued.

4. Bitcoin insiders are blind to how bundlers are manipulating the Bitcoin market.

5. Legal transactions have nothing to do with Tether.

6. Legal authority is the only way to solve the above problems.

While the author's articles are worth reading, especially for readers with little or no knowledge of the Bitcoin market, upon some inspection it becomes clear that these opinions are based on a misunderstanding of faulty data and general ignorance.

Debunking point 1: "Tether Inflows to Bitcoin Exceed $10 Billion"

The most important point in his article is the first graph it shows in the "Shock" section.

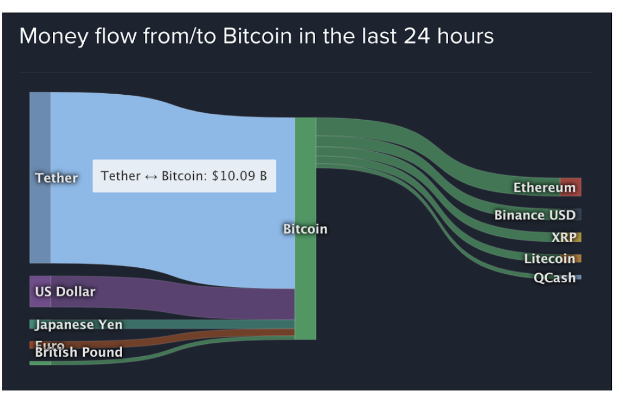

The author took a screenshot from coinlib.io's 24-hour fund flow (representing the flow of funds from Bitcoin to Bitcoin over the past 24 hours), and claims that the chart shows a one-way purchase from Tether to Bitcoin.

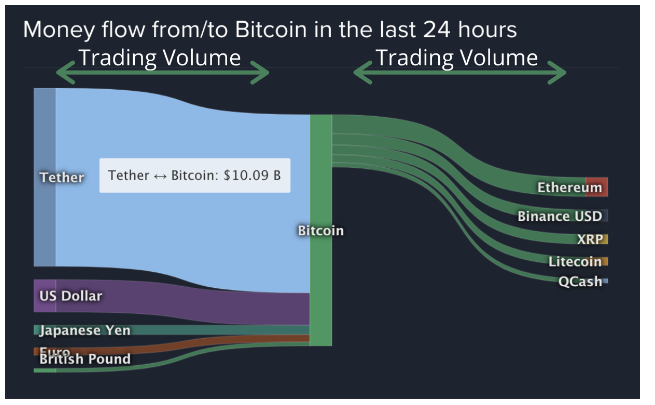

As the data source points out, this does not represent one-way inflows, but volume. Volume is very different from one-way inflows. The authors seem to be confused about how to read the graphs they refer to. The authors claim that the left side of the graph shows the value flowing into Bitcoin, while the right shows the value flow out of Bitcoin. This is a completely incorrect interpretation of the graph.

shocked to discover

On January 8th, I saw this post on HackerNews about Tether manipulating Bitcoin, and it shocked me: I thought Tether had been eliminated from cryptocurrency, but apparently he still exists. But in the cryptocurrency market, how many Tethers are there? I was surprised to find that there are still a lot of them.

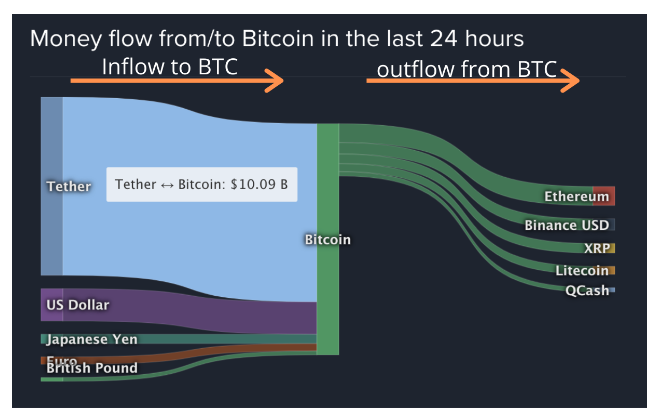

The left side of the graph shows which currencies are flowing into Bitcoin (ie, Bitcoin is being bought) in all encrypted exchanges, and the right side shows which currency is flowing out of Bitcoin (ie, Bitcoin is being used to buy), and the icon shows the beginning of January 2021. typical data.

Here is the graphical meaning suggested by the authors:

But here's what the graph actually means:

Volume is not equal to dollars flowing into the system. This is a fact.

As a result of this apparent misrepresentation, the basis of the author's argument has completely disintegrated because Tether is not flowing $10 billion per day. To be more precise, Tether has about $10 billion in reported trading volume on the exchange.

In this article, the author willingly or unwillingly misrepresents how to interpret the data in these coinlib.io graphs. We will leave it to the reader to determine what they think the author's most likely intention was in this misstatement.

Debunking point 2: "70% of all Bitcoin transaction volume is Tether"

Next, the author claims that Tether constitutes 70% of Bitcoin transaction volume.

Another screenshot from "The Bit Short"

Seventy percent is an interesting number. How does the author come up with this "fact"? Conveniently, if a coinlib.io user scrolls down to/from Bitcoin's Fund Flow in the last 24 hour graph, they will find coinlib.io's Bitcoin volume graph.

Also conveniently, if they add up the total 24-hour bitcoin transaction volume reported on coinlib.io and divide by the 24-hour tether count, they find that roughly 66% of bitcoin transaction volume is tether. Here is the math for the preliminary survey on January 20, 2021:

BTC/USD volume: 1.25 billion

BTC/USDT volume: 6.88 billion

BTC/ETH volume: 1.49 billion

BTC/BUSD trading volume: 440 million

BTC/JPY volume: 360 million

Total BTC transaction volume: about 10.42 billion

Therefore, the USDT transaction volume is 6.88 billion, and the total BTC transaction volume is 10.42 billion, which is approximately equal to 66%.

It may be a coincidence that our numbers coincide with the author's claim of "nearly 70%", however, we have not been able to recreate the exact sum of the total USDT totals with any other resource's BTC volume percentage. Coinmetrics.io, coingeck.com, and coinmarketcap.com are all very well known aggregators that we tried to use to recreate the 70% stats for authors.

Unfortunately for the author's thesis, coinlib.io doesn't have the strongest reputation as a data resource, and many exchanges (especially the one the author points to) have been known to report fake volumes in order to get something like coinlib for free Such marketing of encrypted data aggregators. The author seems to have taken the coinlib.io volume information at face value, when in fact it is almost completely faked.

Breaking down Bitcoin's tethered volume

Let’s break down the tether count highlighted by coinlib.io further:

Coinlib.io shows a 24-hour tethered volume of 6.89 billion (January 20, 2021), but not all exchanges used to report this number are legitimate. In fact. Most of them are not! We highlight in orange all exchanges involved in fake transactions to manipulate their rankings on sites like coinlib.io, coinmarketcap.com, and coinecko.com.

The authors seem to think that HitBTC and Bit-Z are driving more actual Bitcoin demand than Coinbase.

Another screenshot from "TheBit Short"

Bit-Z and HitBTC are not big exchanges at all, not even close to the biggest two. HitBTC in particular has a long history of such unethical behavior. Even Binance, the number one exchange for tether volumes, has taken some shady practices to increase its volume numbers when exchanging. The main point is that the huge tethered volume is not real and definitely does not represent almost 70% of the total transaction volume of Bitcoin. In fact, the actual transaction volume is far smaller than any amount reported by these sites.

US-based Bitwise conducted a groundbreaking study in 2018 that showed 95% of reported Bitcoin volume was fake! itmaintains aA website designed to better display legitimate bitcoin transaction volume.

Bitcointradevolume.com is in a very different situation than coinlib.io or the author of "The Bit Short".

Source: bitcointradevolume.comSource: bitcointradevolume.com

On January 25, 2021, bitcointradevolume.com shows a $2.4 billion bitcoin trading volume of about $2.4 billion, with bitcoin futures trading just over $4 billion. As it turns out, the legitimate 24-hour volume of Bitcoin is around $10 billion, with over 75% of the actual volume coming from U.S. regulators.

At this point, it should be clear that the dramatized story told by the authors of The Bit Short is far from reality. Their claim that Tether is 70% of Bitcoin’s legitimate transaction volume is far from reality — at best it represents only 25% to 35% of real Bitcoin transaction volume in a given 24-hour period.

Debunking point 3: "Issuance must be fraudulent because of the difference in the way it is issued"

Source: "The Bit Short" Source: "The Bit Short"

Tether Limited, the organization behind the earliest stablecoins, only issues new tokens to partners. It makes sense for large over-the-counter desks to receive tether and use it in large blocks. Dan Matuszewski of CMS Holding and Nic Carter of Castle Island Ventures in 2019middlemiddledo thisdiscussed in detail.

Paulo Arduino, CTO of Tether LimitedIn this 2019 podcastmiddlemiddleDifferent business models used.

USDC from Coinbase has a different model than Tether Limited. Anyone can create a Coinbase account and deposit USD and Mint USDC. If you dig a little deeper into the total stablecoin printing across different players, there is actually a substantial amount of correlation between all coins.

The author asserts that Tether prints must be 100% fraudulent based on operational differences between the way Tether Limited issues USDT and the way Coinbase/Circle issues USDC. We asked the authors: Why is stablecoin market cap growth so closely correlated? If you look at the stablecoin market cap growth for all stablecoins on a site like stablecoinindex.com, it's clear that they are growing in tandem.

Are all stablecoin issuers conspiring and coordinating to print at the same time? We seriously doubt that. The distribution of stablecoin market capitalization across all participants suggests that inflows into Tether may be legitimate and in sync with the rest of the market.

Again, Tether Limited is a black box and we can't say for sure how it manages its operations, but the market has so far pegged tether's value at $1.

Debunking Point 4: Bitcoin Insiders Don’t Know How Tether Manipulates the Bitcoin Market

We think, for now, it's clear that Bitcoiners know far more about the Tether market than the authors of Bitshort. We will just provide some examples of Bitcoiners addressing concerns about Tether over the years.

Debunking point 5: Legitimate transactions are not tied to Tether

Bitwise Bitcoin, which offers Bitwise Bitcoin Funds in the U.S. open market, maintains the aforementioned resource bitcointradevolume.com. On the site, it lists only legitimate bitcoin markets and estimates the volume of transactions it deems legitimate.

All of the following exchanges offer tether markets and are listed on Bitwise; Binance, Bitfinex, Kraken, Poloniex, and Bittrex. According to Bitwise, 10 out of 10 legitimate exchanges use USDT. Again, this is another sign that tether is part of the legitimate bitcoin market.

Paxful, the most compliant and largest Bitcoin P2P marketplace, added support for Tether in 2020 and operates in the US. The only two cryptocurrencies it supports are BTC and USDT.

Debunking Point 6: Legal Institutions Are Needed to Regulate Bitcoin

callcallFight against censorship like Robinhood, WeBull, TD Ameritrade, and Nasdaq itself. But these systems are legal...

We believe that this last point is the final conclusion that the author of "The Bit Short" does not understand Bitcoin from first principles. Early Bitcoin investor Tyler Winklevoss on thisin famous quoteNice synthesis of Bitcoin’s value proposition:

"We choose to place our money and our beliefs within a mathematical framework that is free from politics and human error."

The famous Latin word vires in numeris, which means "numerical strength" in English, is another good way to understand Bitcoin's worldview. Bitcoin was never about authority, it was always about an opt-in, permissionless system enabled through mathematics and cryptography. For the people, by the people, by the people's money. Calling for regulation means you don't understand the Bitcoin paradigm shift.

One could argue that if there were no legal institutions war on cash, constant taxation, dystopian financial surveillance and a mysterious banking system, then there would be no need for tethering... if legal institutions were so good at bringing transparency and integrity to our monetary system sex, why didn't they fix their own currency first?

However, there is a more important point here. Bitcoin is already regulated, not by man-made laws, but by natural laws. There is no "buyer of last resort", no one to save investors from their bad choices... burn me once, shame on you, burn me twice, shame on me. If tether is a scam, it will eventually blow itself up. Investors will learn new things, markets will be temporarily stuck, and Bitcoin will continue to clear trades as if nothing happened.

Throughout Bitcoin's 12-year history, it has survived. Gox, OneCoin, etc.