The cryptocurrency market appears to have bounced back from a week of losses, while Wall Street posted its worst day since October.

simply put

simply put

1. Bitcoin and the broader cryptocurrency market appear to have bounced back from several days of losses.

2. With the launch of more complex products and services, DeFi projects continue to flourish.

3. Wall Street had its worst day since October as the GameStop controversy forced short sellers to pay fees to maintain their positions.

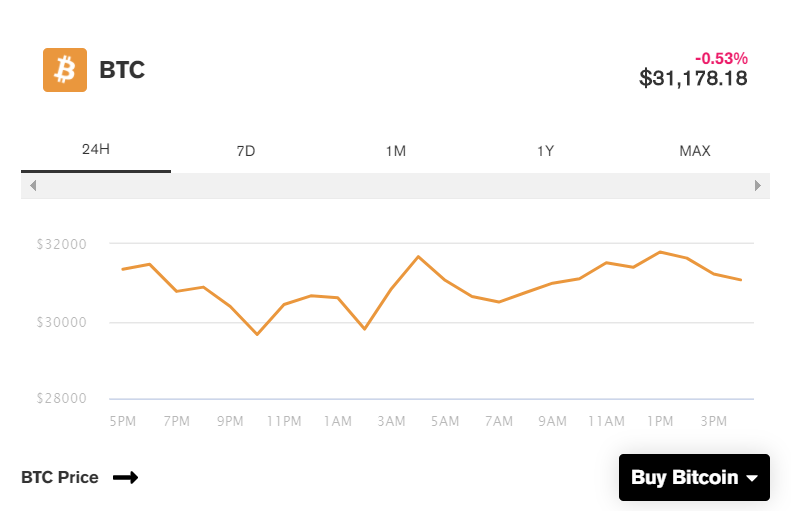

It's been a quiet day for cryptocurrencies (compared to Wall Street) as major cryptocurrencies like Bitcoin and Ethereum appear to have completed their corrections. Bitcoin fell to a low of $30,458 on Jan. 27, bounced confidently above $31,000, and is currently relatively stable.

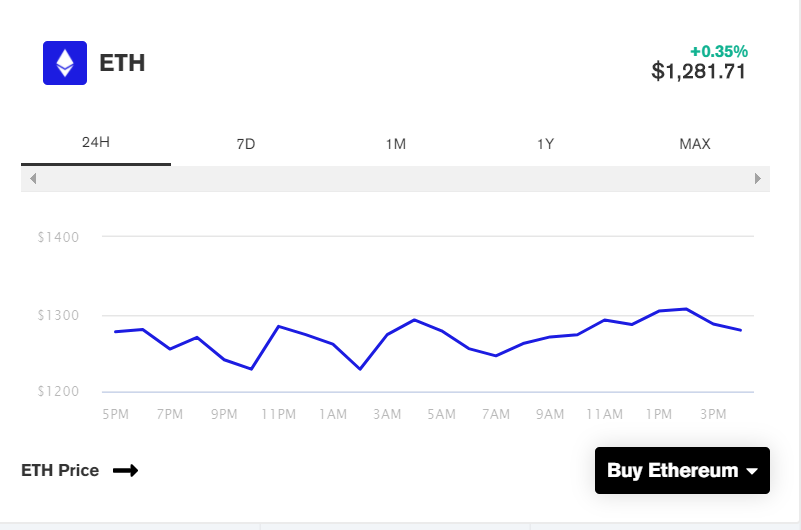

Ethereum’s price followed a similar pattern to Bitcoin’s, reaching its lowest point on Wednesday before bouncing back. Among the top 20 projects, most of them resumed their correction for the first time, among which Chainlink, the most prominent project, increased by 6.6%, Uniswap increased by 7.5%, and AAVE increased by 6.4%. With the continued popularity of DeFi, AAVE and Uniswap have made substantial gains for a week in a row.

The growing sophistication of products and services seems to be what is driving the DeFi recovery. Just yesterday, a report on DeFi trends seemed to indicate that tools of means traditionally used in big banks are now slowly infiltrating the decentralized space.

While these products are still being developed, at a time when the broader cryptocurrency market is being buffeted by volatility, the rates offered in decentralized finance — not to mention the governance tokens of companies offering swaps — are rapidly gaining momentum. Become the most stable way to make money.

secondary title

Dow and S&P 500 perform worst in three months

It's a different day on Wall Street. The Dow, S&P 500 and Nasdaq all posted their biggest losses since October 2020.

On the S&P 500, the communications, services, financials and health care sectors were the biggest losers on the stock market today. Disney, Merck and Boeing were the worst performers on the Dow, with losses of 4% each.

The Nasdaq fell 2.5%, Netflix fell 6.2%, PayPal fell 4.65%, and all other big tech stocks took a hit.

The hot topic on Wall Street is GameStop, and low-priced buyers on Wall Street bets have attracted hedge funds. This story is a modern day scattered David and Goliath. A group on Reddit has found that large hedge funds are shorting GameStop, a company that sells physical computer games in malls across the U.S., to make money.

However, a group of investors on Reddit decided to enter the market only yesterday, forcing up the stock price and forcing the hedge fund to take losses of up to $10 million.

In 2006, when the company was running successfully, the stock was worth just $50. At press time, the company's shares were trading at $347 as the company's stores were all but closed and the digital download space destroyed profit margins.