secondary title

What is the Cantillon Effect?

We saw the Cantillon effect in 2008 and 2020, when banks and other companies were bailed out from bankruptcy. These are real examples of the effectiveness of having a direct link with Wall Street and the Federal Reserve. Only those closest to controlling the money supply benefit greatly from each recession, while many lower and middle class people do not.

Today, this can easily be seen in the recent debate over the stimulus package in the United States. While senators have been wrangling for months over the money citizens will get, beyond the immediate purpose of the bill, the question of how billions of dollars in new funding will be used to support large-scale organizations and interests is anything but bipartisan. Besides, nothing was agreed upon.

secondary title

money is never fair

The non-neutral nature of money means that money is not created and distributed evenly or fairly among the population. Money creation is inherently unfair, and the easier it is to create money, the more unfair it becomes for those without authority and access to certain connections.

Frankly, relying on money to facilitate the advancement of life. When people talk about institutionalization, what they're really referring to is the rules that are closer to the printers of money today.

To the untrained eye, America looks like the land of prosperity, but once the shutters are lifted, reality shows that it is only the closest thing to a money printing press.

The Cantillon effect is not only true for fiat currencies, but also for precious metals.

Precious metals (mainly gold and silver) have historically been the best monetary commodities available to mankind. But unfortunately, the mining, custody, and verification processes required for a functioning precious metals economy create vulnerabilities for opportunistic central operators to benefit from a privileged position.

The mining of newly discovered gold and silver caused by the Spanish price revolution wreaked havoc in the United States and throughout Europe, arguably ending the unprecedented growth of the Renaissance. As people across Europe discovered that the purchasing power of their gold and silver was waning, the Spanish royal family benefited from the new discoveries.

secondary title

entry of bitcoin

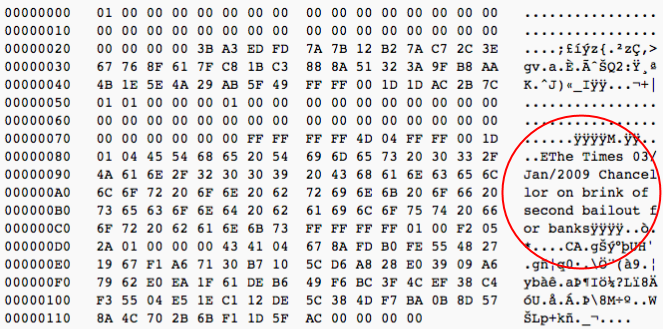

On January 3, 2009, Satoshi Nakamoto mined the first block of the Bitcoin blockchain, and the news was "Times 03/1/2009 Chancellor of the Exchequer to launch second bailout for banks" - London Times that morning headlines. Not only is this a message from Nakamoto about their intention to create a fairer currency, but it effectively time-stamps and proves a fair launch of the Bitcoin currency.

secondary title

Bitcoin Adjustment Incentive Mechanism

The Cantillon Effect 2.0 was introduced to the world by Bitcoin. In the Bitcoin world, rather than being rewarded for privilege, status, and geography, only those who live closer to the truth reap the fruits of value creation.

The transition to the Bitcoin standard is an awakening of truth and reality.

Bitcoin eliminates the ability of institutions to fight the market, because Bitcoin cannot be created out of thin air without excess energy mining it. It is impossible to create more than 210000000 bitcoins because the supply cap of 21000000 is enforced by a distributed network of independent nodes. For the first time in history, Bitcoin provided individuals with a means of precise economic calculation.

Bitcoin makes it much less scalable to use brute force to capture value.

Because Bitcoin makes it easy to custody and verify one's Bitcoins, Bitcoin users no longer need to rely on a central authority to hold their wealth. Due to this distribution of keys, and the fact that coins cannot be moved without getting the Bitcoin private key (to spend the key), the censor or thief must now go from key holder to key holder, And blackmail each individual key.

We see that technology is fundamentally changing the logic of violence. Gone are the days when the government could simply freeze a person's bank account. The increased cost of extorting and controlling the wealth of people is a fundamental shift in the way the world is organized today.

The defensibility Bitcoin brings to individuals and corporations is discussed in depth in a recent Bitcoin Magazine article, “The Sovereign Corporation Thesis.”

A transparent future brings more opportunities

We all know very well what a closed and centralized monetary system can lead to, because we experience it every day. Centralization certainly has its use cases, but not when there is a lack of accountability for the dilution of individual labor. Making money out of nothing has always plagued one's productivity and ability to succeed in life.

In Bitcoin, the responsibility lies with individuals, not institutions, or self-appointed bureaucrats who are out of touch with the reality of the majority. Little is known about how money is created and how officials at the various branches of the Federal Reserve decide on an "acceptable" rate of inflation. How much is too high inflation and how much is too low? Fiat has become more improvised theater than real science. Rules are broken when those in power deem it necessary, and citizens of countries have no say in what is in their monetary interests.

In contrast, Bitcoin’s consensus rules are immutable, and its code upgrades extremely slowly through world-class peer review. Unlike your iPhone, which breaks if not upgraded, Bitcoin upgrades are optional and users choose voluntarily. The consensus of the Bitcoin network is purer than democracy. It does not seek to abstract from productiveness in favor of rent-seeking or parasitism. It continues to incentivize the best outcomes for all involved, especially when it means forcing individuals to be more productive in order to earn more Bitcoin.

In the last 12 years of Bitcoin's existence, you'd be hard-pressed to find someone who hasn't heard of the digital currency. However, until now, there has been an insane amount of curiosity about money, trying to figure out what money is, how it was created, how it was used historically, what makes money or a store of value successful nothing. Today, Bitcoin is the viral orange pill that woke the world up to what our current monetary system is and how it impacts our everyday lives.

In a Bitcoin-based world, rather than a world where benefits are unfairly distributed to those with the right social status and influence, value is accumulated by those who create it, those who are closer to the truth.

Ultimately, Bitcoin enables individuals to opt out and build outside of existing control structures. These benefits are not created equal. The earlier adopters get rewarded the more because it should be within a truly fair system. Bitcoin rewards the curious.

We all discover Bitcoin when it's the best time to own it. There are people who have held bitcoins for a long time but are no longer involved in the bitcoin space. Some had to go on the painful journey of finding Bitcoin very early on, before cashing in on enormous value—not just in the price of Bitcoin, but in unleashing the real power of productive individuals who weren’t in the best possible shape. potential. Bitcoin changed that because anyone with access to the internet could do so. With the introduction of the Internet and access to information, Bitcoin will play a similar role, continuing to expose the opaque practices of central banking networks.

A transparent future allows for more opportunities.