Learn DeFi Lending in 10 Minutes——Uncover the Mystery of DeFi Lending

1. What is a loan

Lending in Chinese means lending. To understand lending, we can start with life. In life, lending often occurs, such as student loans, housing loans, car loans, and business loans that everyone is familiar with. So, what is a loan? The act of a depositor providing funds to a borrower in exchange for deposit interest is a loan. This includes both saving money and borrowing money.

Second, why save money?

It's very simple, because saving money will generate interest, and the interest can be added to the principal and deposited together to generate compound interest. The result is to make money more, and money to make money.

3. Why borrow money?

A very common saying is "because of poverty", which seems to be the truth at first glance, but it is not. Because many companies and individuals who are not short of money currently have or have had loans that need to be repaid. Some people borrow money for investment to obtain a return far exceeding the interest on the loan; some borrow money for early enjoyment; some borrow money for emergency turnover...

In daily life, there are many scenarios for borrowing in fiat currencies: go to the bank to deposit a capital-guaranteed wealth management product; buy a Cailitong on WeChat; go to a provident fund center to buy a house with a loan; spend on Alipay, Huabei, and Taobao to buy a game console...and so on. So, what about cryptocurrencies?

4. Centralized digital currency lending platform

Centralized lending is also an important application of centralized finance (Centralized Finance). Currently, there are many centralized digital currency lending platforms that also provide lending services for individuals or institutions. A simple example is as follows:

BlockFi (U.S., largest holder of Grayscale Bitcoin Trust);

Cred (United States, has filed for bankruptcy protection, internal fraud);

Celsius (UK);

NEXO (Switzerland);

RenrenBit (Singapore).

Just like Cred in the example has filed for bankruptcy protection due to fraud, these centralized digital currency lending platforms also have the following risks that may cause loss of customer deposits: hacker attacks, internal bad operations (misoperation, fraud), bad debts, etc. But the core problem is that these centralized digital currency lending platforms are inconsistent with the main value of cryptocurrencies, that is, they are not self-custodial property. Therefore, a decentralized cryptocurrency lending platform is even more necessary.

5. Decentralized digital currency lending platform

Decentralized lending, that is, the protagonist of the topic DeFi-Lending (Decentralized Finance - Lending), with the help of decentralized lending, anyone can become a depositor or borrower in a way that is completely decentralized and does not require review or approval authority . At present, most lending projects are on the Ethereum public chain, and of course there are projects on other chains, such as HECO's Lendhub and Conflux's Flux.

DeFi-Lending is mainly introduced through the following aspects:

Types of lending

important lending formula

Three elements of DeFi-Lending: depositors

Three elements of DeFi-Lending: Borrowers

Three elements of DeFi-Lending: platform side

1. Classification of loan forms

It can be roughly divided into the following forms:

(1) Point-to-point

ethland (renamed Aave in 2019 iteration) adopted the peer-to-peer form when it went online in 2017. The characteristic of the peer-to-peer form is that there will be a stable interest rate, but the disadvantage is that it cannot be accessed freely.

The Dharma contract locks 90 days of interest. After the borrower borrows money, the repayment on the first day and the 90th day are the same, and the interest for 90 days must be paid.

(2) Point-to-point contracts

Point-to-point contracts are also known as stablecoin types. Take Makerdao as an example. Depositors deposit cryptocurrency into the contract. When borrowing money, they can only lend one asset from the contract—DAI. DAI is a stable currency anchored to the US dollar.

(3) Reserve pool

At present, most decentralized lending adopts the method of reserve pool, such as: Compond, Aave, Flux and so on. The advantage of the loan agreement in the form of a reserve pool is that you can freely deposit, borrow, and repay.

2. Important lending formula

Important formula for decentralized lending:

Deposit Value * Deposit Rate + Fee = Loan Value * Loan Rate

3. Three elements of DeFi-Lending: depositors

As a depositor, there are two issues that I am most concerned about, first, where is the money stored (asset custody), and second, how much money can be earned (deposit interest rate). Let's answer it below.

(1) Asset custody

Asset custody is also a question of where the money is stored. The assets of the decentralized lending agreement are all hosted in the smart contract, and the contract is deployed on the open blockchain, and the smart contract of the decentralized lending agreement is generally audited, and the audited code is mostly open source. Therefore, the contract code is relatively strong and transparent, and naturally avoids the possibility of human error in centralized lending.

(2) Deposit interest rate

How to determine the deposit interest rate is also a question of how much money can be earned. Here we need to introduce a word first, capital utilization rate. The deposit interest rate is related to the utilization rate of funds. The higher the utilization rate of funds, the higher the deposit interest rate; conversely, the lower the utilization rate of funds, the lower the deposit interest rate. The specific calculation formula will be given later (see the example of loan interest rate). Here I would like to remind you that the interest rates of most lending platforms are floating at present, so you need to pay attention to the fluctuation of interest rates at any time in order to suffer unnecessary losses.

4. Three elements of DeFi-Lending: Borrowers

As a borrower, there are four main issues that are most concerned about, firstly, whether the loan needs to be mortgaged, secondly, how much money can be borrowed, thirdly, how much money needs to be repaid (loan interest rate), and fourthly, the risk of liquidation during the borrowing process. Let us solve the above questions one by one.

(1) Whether mortgage is required

Do decentralized lending protocols require collateral? The answer is yes, a mortgage is required. And at present, the cycle loans of all decentralized exchanges need to be over-collateralized. So, why do you need to mortgage? The main reasons are that the cryptocurrency prices fluctuate greatly, the transaction depth of some currencies is insufficient, and the operation delay on the chain.

At present, the cycle lending of the decentralized lending platform basically adopts the method of over-collateralization, which is beneficial for all parties on the platform to control risks. Tokens with poor liquidity and low liquidity will require more collateral; tokens with better liquidity and large liquidity will require less collateral. At present, some platforms are exploring the non-over-collateralization model, which requires the help of KYC on the chain, so we will not discuss it here.

(2) What is the upper limit of the loan amount?

To know the value of the maximum loan amount X that can be borrowed on the platform, a simple calculation is required.

The formula is: X = deposit amount / mortgage factor (different platforms have slightly different names for the mortgage factor).

For example: on the Flux lending platform, the mortgage factor of stable coins such as DAI and USDT is 130%, that is, if the deposit amount is 130 USDT, you can lend a maximum of 100 USDT equivalent cryptocurrencies; the mortgage factor of ETH, BTC, etc. It is 140%, that is, if the deposit amount is 14 ETH, you can lend a maximum of 10 ETH equivalent in cryptocurrency.

(3) Borrowing interest rate

Before explaining the borrowing rate, it is necessary to explain a problem and a concept.

Question: Why is the deposit rate always less than the borrowing rate?

Some people say that according to the formula "deposit value * deposit interest rate + fee = loan value * loan interest rate", because of the existence of handling fees, the deposit interest rate is lower than the loan interest rate. This seems correct at first glance, but even if the fee is 0, the deposit interest rate will still be lower than the loan interest rate. The reason is that in order to meet the depositor’s requirement that they can withdraw money at any time, the lending platform will not lend out all the deposited money, so the deposit interest rate must be lower than the borrowing interest rate. On the other hand, when the borrowing demand increases, it will adjust the market borrowing demand by increasing the borrowing interest rate, and improve the utilization rate of funds.

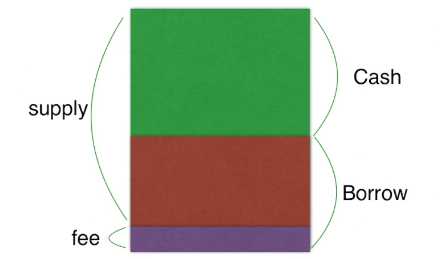

capital utilization

in:

in:

Supply is the deposit account balance (deposit + interest)

Borrow is the loan balance (loan + interest)

fee charges a handling fee for the platform

Cash is the remaining unlented assets

The capital utilization rate (Ua) = Borrow / (Cash + Borrow). At present, the DeFi-Lending market uses the "fund utilization rate" indicator to adjust the borrowing rate, that is, the higher the fund utilization rate, the higher the borrowing rate.

Classification of Market Rate Models

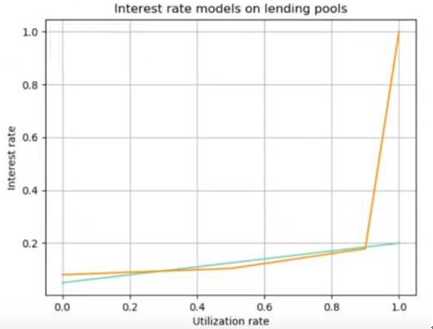

The first type is the linear interest rate model, which represents Compound and Fulcrum. The formula type and function diagram are roughly as follows (X in the formula is the capital utilization rate, the abscissa in the interest rate graph is the capital utilization rate, and the ordinate is the loan interest):

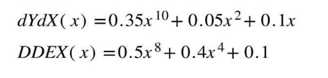

The second type, the polynomial interest rate model, represents dYdX and DDEX. The formula type and function diagram are roughly as follows:

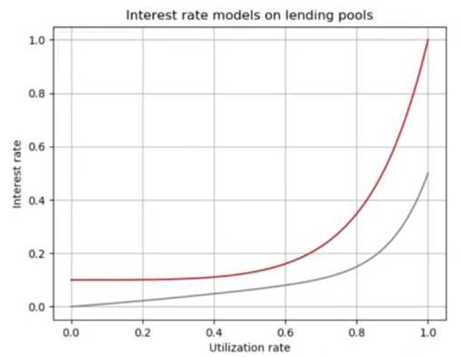

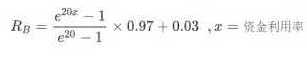

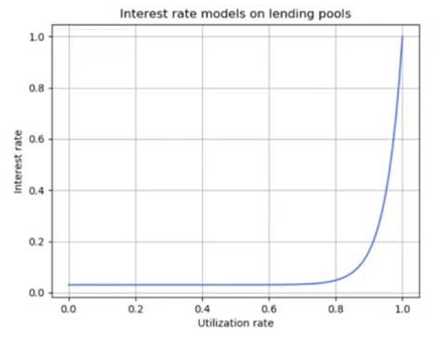

The third type, the index interest rate model, represents Flux, and the formula type and function diagram are roughly as follows:

Here is a note to explain that the interest rate model will seek a balance between the interests of depositors and borrowers according to market conditions and other conditions. Therefore, the interest rate model will be adjusted. The above-mentioned interest rate model is not necessarily the model used by related projects. . In addition, there is no conclusion about which type of interest rate model is necessarily good, but it is just the result of a trade-off between depositors and borrowers.

In addition, most projects modifying the interest rate model need to be voted by the decentralized autonomous organization (DAO) before it can take effect. In the early stage of a general project, the development team will manage the DAO internally. After the agreement is implemented and stabilized, the relevant management authority will be gradually handed over to the community DAO.

Example of Loan Interest Calculation

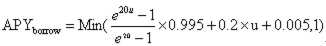

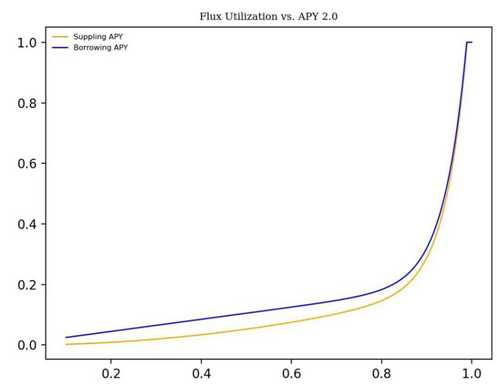

Here we still take the FLUX platform as an example. Its latest interest rate model formula and diagram are as follows:

The picture below is a screenshot of the DAI deposit and loan interface on the Flux platform:

Several data can be obtained from the above figure:

A. The deposit interest rate of DAI on the left is 4.02%;

B. The borrowing rate on the right is 9.22%;

C. The remaining unlented assets of DAI Cash is $158.714;

D. The DAI borrowing balance Borrow is $122.727.

Based on the known information, we use the Flux interest rate model to verify whether the interest rate is accurate.

Step 1: Calculate utilization Ua

Ua=Borrow / (Cash + Borrow)=122.727 / 281.441 = 0.43607

Step 2: Calculate the loan interest rate (e in the interest rate formula is a mathematical constant about 2.71828)

(e20Ua-1)/(e20-1)*0.995+0.2* Ua+0.005

=(6132.722966-1)/ (485158668.4999 - 1) * 0.995 + 0.2 * 0.43607 +0.005

=0.0922

=9.22%

Step 3: Calculate the deposit interest rate (Flux platform fee is 0)

Deposit value * deposit rate + fee = loan value * loan rate

(158.714+122.727)*X+0=122.727*0.0922

X=0.0402

X=4.02%

Through the above calculation steps, the correctness of the deposit interest rate and borrowing interest rate in the picture can be verified. Thus we have completed the explanation of loan interest rate and deposit interest rate.

(4) Liquidation

As a borrower, we must be clear about the liquidation issue. We need to understand the source of the currency price of the borrowing platform, what is the liquidation line of the platform, and how the liquidation is carried out. Let's introduce them one by one.

what is liquidation

In order to reduce the risk of the agreement and protect depositors, when the ratio of the borrower's loan value to the value of the mortgaged asset reaches a certain value, the borrower will be liquidated by other users of the agreement, so that the ratio of the loan value to the value of the mortgaged asset can be restored to a reasonable range . When liquidation occurs, the collateral assets of the account become sellable assets at the current market price. Any person (liquidator) may repay part or all of the outstanding loan on behalf of the borrower. In return, the liquidator can obtain the collateral held by the borrower's loan, which is defined as a liquidation incentive.

Source of currency price

clearing line

clearing line

As the name implies, when the ratio of the borrower's loan value to the mortgage asset value reaches a certain value, the borrower's assets will be liquidated, and this value can be called the liquidation line. There are also differences in the settlement lines of different lending products. Here we take the Flux platform as an example to explore the platform liquidation line and liquidation incentives:

The liquidation mortgage rate in the Flux protocol is a set value, which is currently 110%. When your account loan mortgage rate is lower than the liquidation mortgage rate, your deposit liquidation will be triggered. That is to say, then the asset liquidation line is 100/110 which is about 90.91% (accurate to 0.01).

Without considering the loan interest, if the price of the loaned ETH increases by 1.82 times to a price equal to 182 DAI, then the value of his loan is divided by the value of the mortgage asset, that is, (182 DAI / 200 DAI)*100%= 91%, which exceeds the liquidation line set by Flux at 90.91%. assets may be liquidated.

Assume that the liquidator repays all the loans, that is, the current amount of ETH is 182 DAI (the amount of ETH remains unchanged).

In return, the liquidator can get 200 DAI deposited by Zhang San.

Then the liquidation incentive is 18 DAI (200 DAI – 182 DAI), and the incentive percentage is 18 DAI /200 DAI = 9%.

5. Three elements of DeFi-Lending: platform

Different DeFi-Lending platforms charge different fees. Just to list a few:

Compound: Based on 10% or 5% of the interest rate paid by the lender (depending on the asset);

Lendf.me: 0.05% of the total loan amount will be used as a handling fee;

AAve: 0.25% handling fee is charged for loans, and the handling fee for flash loans is 9/10,000. 80% of the handling fee is used to repurchase Lend, and 20% goes to the team;

Flux: 0 handling fee.

Of course, the main headache at present is not the handling fee, but the gas fee of the Ethereum network, which makes lending platforms on non-Ethereum networks more friendly and friendly, such as the Flux lending platform on the Conflux public chain.

At present, the lock-up volume of DeFi-Lending is stable at around 5 billion US dollars. 2020 is the year when DeFi explodes, and Lending lending is the "real" demand of DeFi, and it will inevitably be known by more and more people in the days to come. DeFi is shining brightly on the way forward.

Copyright belongs to the author. For commercial reprint, please contact the author for authorization, for non-commercial reprint, please indicate the author.